Metropolitan Washington Airports Authority

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MWAA AE Series 2010AB

NEW ISSUE /BOOK-ENTRY ONLY In the respective opinions of Co‑Bond Counsel to the Airports Authority to be delivered upon the issuance of the Series 2010A-B Bonds, under existing law and assuming compliance by the Airports Authority with certain requirements of the Internal Revenue Code of 1986, as amended (the “Code”), that must be met subsequent to the issuance of the Series 2010A-B Bonds, with which the Airports Authority has certified, represented and covenanted its compliance: (i) interest on the Series 2010A-B Bonds is excluded from gross income for federal income tax purposes, except for any period during which such Series 2010A-B Bonds are held by a person who is a “substantial user” of the facilities financed or a “related” person, as those terms are used in Section 147(a) of the Code; (ii) interest on the Series 2010A Bonds is not a specific preference item or included in a corporation’s adjusted current earnings for purposes of the federal alternative minimum tax; and (iii) interest on the Series 2010B Bonds is an item of tax preference for purposes of the federal alternative minimum tax imposed on individuals, trusts, estates and corporations. Also, in the respective opinions of Co‑Bond Counsel to be delivered upon the issuance of the Series 2010A-B Bonds, under existing law, interest on the Series 2010A-B Bonds is exempt from income taxation by the Commonwealth of Virginia and is exempt from all taxation of the District of Columbia except estate, inheritance and gift taxes. See “TAX MATTERS” for a more detailed discussion. -

Airport Passenger Screening: Background and Issues for Congress

= .75479= &88*3,*7=(7**3.3,a=&(0,74:3)=&3)= 88:*8=+47=43,7*88= &79=1.&8= 5*(.&1.89=.3= ;.&9.43=41.(>= 57.1=,-`=,**3= 43,7*88.43&1= *8*&7(-=*7;.(*= 18/1**= <<<_(78_,4;= .*/.-= =*5479=+47=43,7*88 Prepared for Members and Committees of Congress .75479=&88*3,*7=(7**3.3,a=&(0,74:3)=&3)=88:*8=+47=43,7*88= = :22&7>= Over the next several years, the Transportation Security Administration (TSA) will likely face continuing challenges to address projected growth in passenger airline travel while maintaining and improving upon the efficiency and effectiveness of passenger screening operations. New initiatives to expand the role of TSA personnel beyond screening operations, as well as initiatives to improve screening efficiency and effectiveness through the deployment of new technologies, will likely require additional investment. In addition to annual appropriations of $250 million in FY2008 and FY2009, a portion of the $1 billion identified for aviation security in the stimulus measure (P.L. 111-5) has been designated for acquiring and deploying technologies to screen passengers for explosives. However, policymakers and aviation security planners have not yet agreed upon a well-defined strategy and plan for evolving airline passenger and baggage screening functions to incorporate new technologies, capabilities, and procedures to more effectively and efficiently detect potential threats to aviation security. Ongoing challenges to maintaining and improving upon screening functions include: addressing the potential impacts of projected airline passenger traffic growth on screening operations; optimizing screening efficiency and minimizing passenger wait times; addressing potential airport space constraints for screening checkpoints and equipment; improving the capability to detect explosives at passenger checkpoints; optimizing inline explosives detection systems for checked baggage; developing strategic plans for addressing screening technology and human factors needs; and defining the funding requirements to implement these strategic plans. -

WASHINGTON AVIATION SUMMARY September 2010 EDITION

WASHINGTON AVIATION SUMMARY September 2010 EDITION CONTENTS I. REGULATORY NEWS................................................................................................ 1 II. AIRPORTS.................................................................................................................. 5 III. SECURITY AND DATA PRIVACY ……………………… ……………………….……...7 IV. E-COMMERCE AND TECHNOLOGY......................................................................... 9 V. ENERGY AND ENVIRONMENT............................................................................... 10 VI. U.S. CONGRESS...................................................................................................... 11 VII. BILATERAL AND STATE DEPARTMENT NEWS .................................................... 13 VIII. EUROPE/AFRICA..................................................................................................... 14 IX. ASIA/PACIFIC/MIDDLE EAST .................................................................................16 X. AMERICAS ............................................................................................................... 18 For further information, including documents referenced, contact: Joanne W. Young Kirstein & Young PLLC 1750 K Street NW Suite 200 Washington, D.C. 20006 Telephone: (202) 331-3348 Fax: (202) 331-3933 Email: [email protected] http://www.yklaw.com The Kirstein & Young law firm specializes in representing U.S. and foreign airlines, airports, leasing companies, financial institutions and aviation-related -

Secure Flight and Registered Traveler Hearing

S. HRG. 109–461 THE TRANSPORTATION SECURITY ADMINISTRATION’S AVIATION PASSENGER PRESCREENING PROGRAMS: SECURE FLIGHT AND REGISTERED TRAVELER HEARING BEFORE THE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION UNITED STATES SENATE ONE HUNDRED NINTH CONGRESS SECOND SESSION FEBRUARY 9, 2006 Printed for the use of the Committee on Commerce, Science, and Transportation ( U.S. GOVERNMENT PRINTING OFFICE 27–562 PDF WASHINGTON : 2006 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2250 Mail: Stop SSOP, Washington, DC 20402–0001 VerDate 0ct 09 2002 14:24 Jul 11, 2006 Jkt 027562 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 S:\WPSHR\GPO\DOCS\27562.TXT JACKF PsN: JACKF SENATE COMMITTEE ON COMMERCE, SCIENCE, AND TRANSPORTATION ONE HUNDRED NINTH CONGRESS SECOND SESSION TED STEVENS, Alaska, Chairman JOHN MCCAIN, Arizona DANIEL K. INOUYE, Hawaii, Co-Chairman CONRAD BURNS, Montana JOHN D. ROCKEFELLER IV, West Virginia TRENT LOTT, Mississippi JOHN F. KERRY, Massachusetts KAY BAILEY HUTCHISON, Texas BYRON L. DORGAN, North Dakota OLYMPIA J. SNOWE, Maine BARBARA BOXER, California GORDON H. SMITH, Oregon BILL NELSON, Florida JOHN ENSIGN, Nevada MARIA CANTWELL, Washington GEORGE ALLEN, Virginia FRANK R. LAUTENBERG, New Jersey JOHN E. SUNUNU, New Hampshire E. BENJAMIN NELSON, Nebraska JIM DEMINT, South Carolina MARK PRYOR, Arkansas DAVID VITTER, Louisiana LISA J. SUTHERLAND, Republican Staff Director CHRISTINE DRAGER KURTH, Republican Deputy Staff Director KENNETH R. NAHIGIAN, Republican Chief Counsel MARGARET L. CUMMISKY, Democratic Staff Director and Chief Counsel SAMUEL E. WHITEHORN, Democratic Deputy Staff Director and General Counsel LILA HARPER HELMS, Democratic Policy Director (II) VerDate 0ct 09 2002 14:24 Jul 11, 2006 Jkt 027562 PO 00000 Frm 00002 Fmt 5904 Sfmt 5904 S:\WPSHR\GPO\DOCS\27562.TXT JACKF PsN: JACKF C O N T E N T S Page Hearing held on February 9, 2006 ........................................................................ -

1-31 Dec Jan 06

MAGAZINE www.aaae.org/magazine | December/January 2007 terminal design’s NEW ORDER parking update weather science EDS Integration Has Never Been This Easy. STANDALONE TAKE-AWAY SIMPLE IN-LINE INTEGRATED IN-LINE Certified for Security, Next Generation EDS Designed for Flexibility. • Smallest, Lightest EDS in Production Small, portable and TSA certified, the Reveal • Rolls into Terminal CT-80 improves airport operations and passenger security by bringing EDS to any location. Upgrade your • Operational in Hours, Not Months security to explosives detection at the check-in counter, on • Minimal or No Facility Modification Required the take-away belt, as part of the baggage handling system • Easily Moved to Other Locations in Airport or in any other location with Reveal’s plug and play EDS. www.revealimaging.com 100% Check-In Protection Volume 18/ Number 7 | December/January 2007 MAGAZINE features cover: architecture EDITORIAL BOARD WILLIAM G. BARKHAUER A New Order In Terminal Design | 24 Morristown, New Jersey The focus of airport design is shifting away from the ticket hall and toward the BRYAN ELLIOTT 24 Charlottesville, Virginia concourses, with security issues and technology dominating trends. BILL HOGAN Reynolds, Smith, & Hills JAMES E. JOHNSON Construction On The Fly | 32 Odessa, Florida Okaloosa Regional was planning a new passenger terminal when 9/11 struck. RANDY D. POPE The redesigned, award-winning project opened under budget and ahead Burns & McDonnell 38 of schedule. AAAE BOARD OF DIRECTORS parking update CHAIR ELAINE ROBERTS, Columbus, Ohio Parking’s Possibilities | 38 FIRST VICE CHAIR Technology, novel approaches, and time-tested efforts are helping airports profit KRYS T. -

Request ID Received Date Requester Name Request Description Requested Date

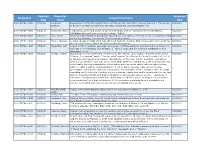

Received Requester Requested Request ID Request Description Date Name Date 2020-TSFO-00391 4/3/2020 Longfield, Requesting the TSA Throughput Data for February 23, 2020 thru February 29, 2020. This seems 4/2/2020 Gregory to be the only week missing from the https://www.tsa.gov/foia/readingroom. 2020-TSFO-00392 4/3/2020 Simansky, Aaron I request access to and copies of any and all emails sent or received by the email address 4/2/2020 "[email protected]" that includes the phrase "iFOIA". 2020-TSFO-00393 4/3/2020 Bier, David Please provide records or documents showing for each DAY of 2019 and 2020, the number of TSA 4/2/2020 air checkpoint travel numbers by TSA checkpoint location. 2020-TSFO-00394 4/7/2020 Munro, Stephen 1. Daily checkpoint data at US airports going back five years 2. Ongoing access to all records “as 4/6/2020 they are filed” by the TSA of the daily checkpoint numbers. 2020-TSFO-00395 4/7/2020 Hargarten, Jeff Copies of TSA checkpoint passenger throughput for Minneapolis-St. Paul International Airport for 4/5/2020 each day in the timespan of both March 1 - April 5, 2020 and the matching weekdays for this timespan in 2019. 2020-TSFO-00396 4/8/2020 Phillips, Joshua Any and all records mentioning or referring to the “Wuhan virus” and/or “Kung flu virus” and/or 4/8/2020 “Chinese Coronavirus” and/or “Chinese virus” and/or “the Chinese flu” from December 31, 2019 to the date this request is processed. -

2017 Annual Airport Traffic Report

- - COVER Table of Contents LETTER FROM AVIATION DEPARTMENT 1 FACT SHEETS John F. Kennedy International Airport 3 Newark Liberty International Airport 5 LaGuardia Airport 7 Stewart International Airport 9 Teterboro Airport 11 AIRCRAFT MOVEMENTS Commercial and Non-Commercial Aircraft Movements 1.1.1 Annual Total 2004-2017, by Airport and Region 13 1.1.2 Monthly Totals 2017, by Airport and Region 19 Aircraft Movements By Market 1.2.1 Annual Totals 2004-2017, by Airport and Region 25 PASSENGER TRAFFIC Top 50 Airport Comparisons 2.1.1 Number of Passengers, Domestic 2017 27 2.1.2 Number of Passengers, Worldwide 2017 28 Commercial Passenger Traffic 2.2.1 Annual Totals 2004-2017, by Airport and Region 29 2.2.2 Monthly Totals 2017, by Airport and Region 34 Passenger Traffic By Market 2.3.1 Annual Totals 2004-2017, by Airport and Region 39 Passenger Traffic By Airline 2.4.1 Top 20 Carriers, 2017 Passengers, by Airport and Region 41 Passenger Traffic By Terminal 2.5.1 2017 Passengers, Domestic and International by Airport 43 Passenger Demographics 2.6.1 Profile of Departing Passengers, by Airport and Region 44 CARGO TRANSPORT Top 50 Airport Comparisons 3.1.1 Revenue Cargo in Short Tons, Top 50 Domestic (ACI) – 2017 51 3.1.2 Revenue Cargo in Short Tons, Top 50 Worldwide (ACI) – 2017 52 Revenue Freight In Short Tons 3.2.1 Annual Totals 2004-2017, by Airport and Region 53 3.2.2 Monthly Totals 2017, by Airport and Region 54 Regional Freight In Short Tons 3.3.1 By International Market, Annual Totals 2004-2017, for Region (US Customs) 55 3.3.2 U.S. -

Is Airline Passenger Profiling Necessary?

University of Miami Law Review Volume 62 Number 1 Volume 62 Number 1 (October 2007) Article 2 10-1-2007 Is Airline Passenger Profiling Necessary? Timothy M. Ravich Follow this and additional works at: https://repository.law.miami.edu/umlr Part of the Law Commons Recommended Citation Timothy M. Ravich, Is Airline Passenger Profiling Necessary?, 62 U. Miami L. Rev. 1 (2007) Available at: https://repository.law.miami.edu/umlr/vol62/iss1/2 This Article is brought to you for free and open access by the Journals at University of Miami School of Law Institutional Repository. It has been accepted for inclusion in University of Miami Law Review by an authorized editor of University of Miami School of Law Institutional Repository. For more information, please contact [email protected]. University of Miami Law Review VOLUME 62 OCTOBER 2007 NUMBER 1 ARTICLES Is Airline Passenger Profiling Necessary? TIMOTHY M. RAVICH* I. INTRODUCTION ...................................................... 1 II. PROFILING INITIATIVES ................................................ 5 A. Computer Assisted Passenger Prescreening System (CAPPS) ............ 9 B . CA PPS II ....................................................... 16 C . Secure Flight.................................................... 19 D. Biometrics and the Registered Traveler Program ...................... 25 III. DISCUSSION .. ....................................................... 29 A. Identifying the Enemy ............................................. 31 B. Is Airline PassengerProfiling Rational -

MWAA AE Series 2010F1

NEW ISSUE /BOOK-ENTRY ONLY In the respective opinions of Co‑Bond Counsel to the Airports Authority to be delivered upon the issuance of the Series 2010F-1 Bonds, under existing law and assuming compliance by the Airports Authority with certain requirements of the Internal Revenue Code of 1986, as amended (the “Code”), that must be met subsequent to the issuance of the Series 2010F-1 Bonds, with which the Airports Authority has certified, represented and covenanted its compliance, interest on the Series 2010F-1 Bonds is excluded from gross income for federal income tax purposes, except for any period during which such Series 2010F-1 Bonds are held by a person who is a “substantial user” of the facilities financed or a “related” person, as those terms are used in Section 147(a) of the Code, and is not a specific preference item or included in a corporation’s adjusted current earnings for purposes of the federal alternative minimum tax. Also, in the respective opinions of Co‑Bond Counsel to be delivered upon the issuance of the Series 2010F-1 Bonds, under existing law, interest on the Series 2010F-1 Bonds is exempt from income taxation by the Commonwealth of Virginia and is exempt from all taxation of the District of Columbia except estate, inheritance and gift taxes. See “TAX MATTERS” for a more detailed discussion. $61,820,000 Airport System Revenue Refunding Bonds Series 2010F-1 (Non-AMT) Dated: Date of Delivery Due: October 1, in the years as shown herein Interest on the Metropolitan Washington Airports Authority’s (the “Airports Authority”) Airport System Revenue Refunding Bonds, Series 2010F-1, in the principal amount of $61,820,000 (the “Series 2010F-1 Bonds”) will be payable on April 1, 2011, and semiannually thereafter on each April 1 and October 1. -

Issue 34CDEF Official Statement (PDF)

34C/D/E/F Official Statement Airport Commission City and County of San Francisco San Francisco International Airport Second Series Revenue Refunding Bonds Issue ISSUE 34C/D/E/F – REFUNDING Rental Car Facility Boarding Area “G” International Terminal International Garage “G” Bart Station Boarding Area “A” AirTrain System International Garage “A” Elevated Roadways Highway 101 _________________________________NEW ISSUES-BOOK-ENTRY ONLY __________Moody’s _________ S&P ________ Fitch Assured Guaranty Insured Ratings: Aaa AAA AAA Financial Security Insured Ratings: Aaa AAA AAA Underlying Ratings: A1 A A (See “RATINGS” herein) In the opinion of Orrick, Herrington & Sutcliffe LLP and Ronald E. Lee, Esq., Co-Bond Counsel to the Commission, based upon an analysis of existing laws, regulations, rulings and court decisions, and assuming, among other matters, the accuracy of certain representations and compliance with certain covenants, interest on the Issue 34C/D/E/F Bonds is excluded from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986 and is exempt from State of California personal income taxes, except that no opinion is expressed as to the status of interest on any Issue 34C Bond, Issue 34E Bond or Issue 34F Bond, for any period that such Issue 34C Bond, Issue 34E Bond or Issue 34F Bond is held by a “substantial user” of the facilities financed or refinanced by the Issue 34C Bonds, the Issue 34E Bonds or the Issue 34F Bonds, or by a “related person” within the meaning of Section 147(a) of the Code. Co-Bond Counsel observe, however, that interest on the Issue 34C Bonds and the Issue 34E Bonds is a specific preference item for purposes of the federal individual and corporate alternative minimum taxes. -

US Customs and Border Protection

U.S. Customs and Border Protection ◆ Docket No. USCBP-2010–0033 UTILIZATION OF GLOBAL ENTRY KIOSKS BY NEXUS AND SENTRI PARTICIPANTS AGENCY: U.S. Customs and Border Protection; Department of Homeland Security. ACTION: General notice and request for comments. SUMMARY: U.S. Customs and Border Protection (CBP) operates several international trusted traveler programs to provide expedited entry into the United States at designated ports of entry for pre- approved travelers. Through the utilization of automated kiosks, the Global Entry pilot program allows CBP to expedite clearance of pre- approved, low-risk air travelers arriving in the United States. In this notice, CBP is announcing that it is expanding two other trusted traveler programs, NEXUS and the Secure Electronic Network for Travelers Rapid Inspection (SENTRI), to permit participants of these programs currently in good standing to utilize Global Entry kiosks as part of their NEXUS or SENTRI membership. CBP also is describing the terms and conditions for such use. NEXUS is a program jointly administered by the United States and Canada that allows certain pre-approved, low-risk travelers expedited processing for travel be- tween the United States and Canada. The SENTRI trusted traveler program allows certain pre-approved, low-risk travelers expedited entry at specified land border ports along the U.S.-Mexico border. EFFECTIVE DATE: Eligible NEXUS or SENTRI participants may begin to utilize the Global Entry kiosks immediately upon notification of eligibility from CBP. Comments concerning this notice and all aspects of the announced Global Entry pilot may be submitted throughout the duration of the pilot. ADDRESSES: You may submit comments, identified by “USCBP- 2010–0033,” by one of the following methods: • Federal eRulemaking Portal: http://www.regulations.gov. -

Request ID Date Received by TSA FOIA Requester Name Request Description Date on Request 2017-TSFO-00001 10/5/2016 Jespersen

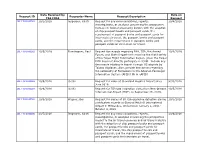

Date Received by Date on Request ID Requester Name Request Description TSA FOIA Request 2017-TSFO-00001 10/5/2016 Jespersen, Kirsti Request for any communications, reports, 10/4/2016 investigations, or analyses concerning the prospective increase in federal processing burden with the adoption of chip passport books and passport cards, the requirement of passport books and passport cards for inter-state air travel, the passport books and passport cards, and the requirement of passport books and passport cards for inter-state air travel. 2017-TSFO-00002 10/5/2016 Risenhoover, Paul Request for records regarding FAA, TSA, the Armed 10/4/2016 Forces, and State Department ensuring the flight safety of the Taipei Flight Information Region, given the Taipei FLIR does not directly participate in ICAO. Include any documents relating to transit through US airports by Taiwan airplanes. Also, provide documents regarding the nationality of Formosans in the Advance Passenger Information System (APIS)? Or in eAPIS? 2017-TSFO-00003 10/6/2016 (b)(6) Request for video at Cleveland Hopkins Airport since 9/30/2016 June 2016. 2017-TSFO-00004 10/6/2016 (b)(6) Request for TSA bag inspection video from New Orleans 10/5/2016 International Airport (MSY) on September 26, 2016. 2017-TSFO-00005 10/6/2016 Wagner, Ben Request for copies of all TSA explosive detection canine 10/5/2016 certification records at General Mitchell International Airport in Milwaukee, WI between January 1, 2011- October 4, 2016. 2017-TSFO-00006 10/7/2016 Jespersen, Kirsti Request for any communications, reports, 10/6/2016 investigations, or analyses concerning the prospective impact to the air travel economy and air travel industry with the adoption of chip passport books and passport cards, the passport books and passport cards for interstate air travel, the chip passport books and passport cards, and the requirement of passport books and passport cards for interstate air travel.