Spring 2005 CSR in the Cross-Hairs a Broad Counter-Attack Against Corporate Reform Is Growing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Open PDF File, 8.71 MB, for February 01, 2017 Appendix In

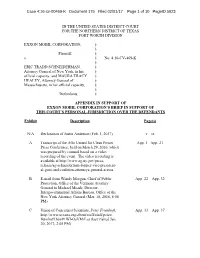

Case 4:16-cv-00469-K Document 175 Filed 02/01/17 Page 1 of 10 PageID 5923 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF TEXAS FORT WORTH DIVISION EXXON MOBIL CORPORATION, § § Plaintiff, § v. § No. 4:16-CV-469-K § ERIC TRADD SCHNEIDERMAN, § Attorney General of New York, in his § official capacity, and MAURA TRACY § HEALEY, Attorney General of § Massachusetts, in her official capacity, § § Defendants. § APPENDIX IN SUPPORT OF EXXON MOBIL CORPORATION’S BRIEF IN SUPPORT OF THIS COURT’S PERSONAL JURISDICTION OVER THE DEFENDANTS Exhibit Description Page(s) N/A Declaration of Justin Anderson (Feb. 1, 2017) v – ix A Transcript of the AGs United for Clean Power App. 1 –App. 21 Press Conference, held on March 29, 2016, which was prepared by counsel based on a video recording of the event. The video recording is available at http://www.ag.ny.gov/press- release/ag-schneiderman-former-vice-president- al-gore-and-coalition-attorneys-general-across B E-mail from Wendy Morgan, Chief of Public App. 22 – App. 32 Protection, Office of the Vermont Attorney General to Michael Meade, Director, Intergovernmental Affairs Bureau, Office of the New York Attorney General (Mar. 18, 2016, 6:06 PM) C Union of Concerned Scientists, Peter Frumhoff, App. 33 – App. 37 http://www.ucsusa.org/about/staff/staff/peter- frumhoff.html#.WI-OaVMrLcs (last visited Jan. 20, 2017, 2:05 PM) Case 4:16-cv-00469-K Document 175 Filed 02/01/17 Page 2 of 10 PageID 5924 Exhibit Description Page(s) D Union of Concerned Scientists, Smoke, Mirrors & App. -

The Fear Profiteers

THE FEAR PROFITEERS: Do ‘Socially Responsible’ Businesses Sow Health Scares to Reap Monetary Rewards? Edited by Bonner Cohen, Ph.D. John Carlisle Michael Fumento Michael Gough, Ph.D. Henry Miller, M.D. Steven Milloy Kenneth Smith Elizabeth Whelan, Sc.D., M.P.H. Hundreds of thousands of deaths a year from smoking is old hat, but possible death by toxic waste, now that’s exciting. The problem is, such presentations distort the ability of viewers to engage in accurate risk assessment. The average viewer who watches story after story on the latest alleged environmental terror can hardly be blamed for coming to the conclusion that cigarettes are a small problem compared with the hazards of parts per quadrillion of dioxin in the air, or for concluding that the drinking of alcohol, a known cause of birth weight and cancer, is a small problem compared with the possibility of eating quantities of Alar almost too small to measure. This in turn results in pressure on the bureaucrats and politicians to wage war against tiny or nonexistent threats. The “war” gets more coverage as these politicians and bureaucrats thunder that the planet could not possibly survive without their intervention, and the vicious cycle goes on. ––Michael Fumento, Science Under Siege CONTENTS EXECUTIVE SUMMARY ..................................................................................... i-iii PREFACE.................................................................................................................I-III ACCIDENTALLY POISONOUS APPLES: Does Everything Cause -

Big Tobacco Helped Create “The Junkman”

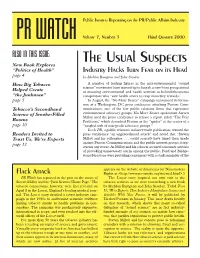

Public Interest Reporting on the PR/Public Affairs Industry PR WATCH Volume 7, Number 3 Third Quarter 2000 ALSO IN THIS ISSUE: The Usual Suspects New Book Explores “Politics of Health” Industry Hacks Turn Fear on its Head page 4 by Sheldon Rampton and John Stauber How Big Tobacco A number of leading figures in the anti-environmental “sound science” movement have teamed up to launch a new front group aimed Helped Create at smearing environmental and health activists as behind-the-scenes “the Junkman” conspirators who “sow health scares to reap monetary rewards.” page 5 In August, the “No More Scares” campaign announced its forma- tion at a Washington, DC press conference attacking Fenton Com- Tobacco’s Secondhand munications, one of the few public relations firms that represents Science of Smoke-Filled environmental advocacy groups. No More Scares spokesman Steven Milloy used the press conference to release a report titled “The Fear Rooms Profiteers,” which described Fenton as the “spider” at the center of a page 10 “tangled web of non-profit advocacy groups.” Inside PR, a public relations industry trade publication, termed the Readers Invited to press conference “an unprecedented attack” and noted that “Steven Trust Us, We’re Experts Milloy and his colleagues . could scarcely have timed their tirade page 12 against Fenton Communications and the public interest groups it rep- resents any worse. As Milloy and his cohorts accused consumer activists of provoking unnecessary alarm among the public, Ford and Bridge- stone/Firestone were providing consumers with a stark reminder of the appears on the website of Americans for Nonsmokers Flack Attack Rights at <http://www.no-smoke.org/internal.html>.) PR Watch has reported in the past on the antics of The Lancet story inspired our own visit to the Steven Milloy and his “Junk Science Home Page.” His tobacco archives as we were researching a new book tobacco connections, however, were first revealed on by Sheldon Rampton and John Stauber. -

Steve Milloy | Polluterwatch 11/24/16, 4�04 PM

steve milloy | PolluterWatch 11/24/16, 404 PM Search HOME BLOG POLLUTERS RESEARCH ABOUT CONTACT STEVE MILLOY GREENPEACE REPORT: CLIMATE CHANGE DENIAL MACHINE VS. SCIENTISTS Posted on: 10 September 2013 By: Connor Gibson Written by Cindy Baxter, crossposted from Greenpeace: Dealing in Doubt. Who likes being lied to by people paid by the oil industry who pose as “experts” on climate change? Did you know it’s been going on for 25 years? In a couple of weeks, the UN’s official advisors on climate change science, the Intergovernmental Panel on Climate Change (IPCC) will update its global assessment on the issue. Yet in the background, more attacks on the climate science are underway For the last quarter century, the climate science denial machine, its cogs oiled by fossil fuel money, has been attacking climate science, climate scientists and every official US report on climate change, along with State and local efforts – with the aim of undermining action on climate change. Our new report, Dealing in Doubt, sets out the history of these attacks going back to the early 90s. These are attacks http://polluterwatch.com/category/freetagging/steve-milloy Page 1 of 11 steve milloy | PolluterWatch 11/24/16, 404 PM based on anti-regulatory, so called “free market” ideology, not legitimate scientific debate, using a wide range of dirty tricks: from faked science, attacks on scientists, fake credentials, cherry-picking scientific conclusions: a campaign based on the old tobacco industry mantra: “doubt is our product”. We give special attention to perhaps today’s poster child of the climate denial machine’s free market think tanks, the Heartland Institute, which is about to launch a new version of its “NIPCC” or “climate change reconsidered” report next week in Chicago. -

Converging Discourses on the Use and Abuse of Science in Massachusetts V

Volume 18 Issue 2 Article 1 2007 Images of Expertise: Converging Discourses on the Use and Abuse of Science in Massachusetts v. EPA David S. Caudill Follow this and additional works at: https://digitalcommons.law.villanova.edu/elj Part of the Environmental Law Commons, and the Evidence Commons Recommended Citation David S. Caudill, Images of Expertise: Converging Discourses on the Use and Abuse of Science in Massachusetts v. EPA, 18 Vill. Envtl. L.J. 185 (2007). Available at: https://digitalcommons.law.villanova.edu/elj/vol18/iss2/1 This Symposia is brought to you for free and open access by Villanova University Charles Widger School of Law Digital Repository. It has been accepted for inclusion in Villanova Environmental Law Journal by an authorized editor of Villanova University Charles Widger School of Law Digital Repository. Caudill: Images of Expertise: Converging Discourses on the Use and Abuse o 2007] IMAGES OF EXPERTISE: CONVERGING DISCOURSES ON THE USE AND ABUSE OF SCIENCE IN MASSACHUSETTS v. EPA DAVID S. CAUDILL* While climate change is an interesting issue, it's not a legal issue .... The Supreme Court only takes a few limited cases every year, and this is just a vanilla exercise in statu- tory interpretation .... 1 The reality is, a case is not going to be about - shouldn't be about - science. If I was working for one side or the other in [Massachusetts v. EPA], I'd be concerned about presenting certain legal questions properly a lot more than I'd be worried about what science is before the 2 Court. In October 1999, several organizations petitioned the Environ- mental Protection Agency (EPA) to regulate, under the Clean Air Act (CAA), carbon dioxide and other greenhouse gases from new motor vehicles. -

Notice of 2020 Annual Meeting and Proxy Statement

Notice of 2020 Annual Meeting and Proxy Statement April 9, 2020 Dear Shareholder: We invite you to attend the annual meeting of shareholders currently scheduled on Wednesday, May 27, 2020, at the Renaissance Dallas Hotel Conference Center, 2222 North Stemmons Freeway, Dallas, Texas 75207. The meeting will begin promptly at 9:30 a.m. Central Time. With the evolving concerns of COVID-19 and public health authority recommendations, these plans are subject to change and could evolve to a virtual meeting. We will notify you of any changes prior to the event and provide the latest status on the Investor Relations section of our website at exxonmobil.com/investor. As always, our first priority remains the health and safety of our shareholders, employees, and communities. At the meeting, you will hear a report on our business and vote on the following items: ‰ Election of directors; ‰ Ratification of PricewaterhouseCoopers LLP as independent auditors; ‰ Advisory vote to approve executive compensation; ‰ Six shareholder proposals contained in this proxy statement; and ‰ Other matters if properly raised. Only shareholders of record on April 2, 2020, or their valid proxy holders may vote at the meeting. Attendance at the meeting is limited to shareholders or their proxy holders and ExxonMobil guests. Only shareholders or their proxy holders may address the meeting. This booklet includes the formal notice of the meeting and proxy statement. The proxy statement tells you about the agenda, procedures, and rules of conduct for the meeting. It also describes how the Board operates, gives information about our director candidates, and provides information about the other items of business to be conducted at the meeting. -

N His Final Column of the Year, Foxnews.Com Science Columnist

TNR Online | Smoked Out (print) Page 1 of 4 PUNDIT FOR HIRE. Smoked Out by Paul D. Thacker Post date: 01.26.06 Issue date: 02.06.06 n his final column of the year, FoxNews.com science columnist Steven Milloy listed "THE TOP 10 JUNK SCIENCE CLAIMS OF 2005." For number nine, Milloy attacked the research of Michael Mann, a Penn State scientist who, in 1999, published research showing a dramatic rise in global temperatures during the twentieth century, after hundreds of years with little climate change. Calling Mann's science "dubious," Milloy praised Representative Joe Barton of Texas, whose calls for an investigation into Mann's methodology last June were cut short when the scientific community and members of Congress protested it as a witch hunt. Representative Sherwood Boehlert, the chairman of the House Committee on Science, wrote to Barton, "The only conceivable explanation for the investigation is to attempt to intimidate a prominent scientist and to have Congress put its thumbs on the scales of a scientific debate." Another conceivable explanation for the investigation is that Barton, as chairman of the House Committee on Energy and Commerce, is swimming in donations from oil companies. But that probably didn't bother Milloy, because he receives his own sponsorship from ExxonMobil. As revealed in Mother Jones last spring, between 2000 and 2003, ExxonMobil donated $90,000 to two nonprofits Milloy operates out of his house in Potomac, Maryland. Milloy's defense of Barton--and excoriation of Mann--is typical of his corporate-subsidized science reporting, in which he has attacked not only global warming, but also secondhand smoke studies and clean air regulations. -

Smoke, Mirrors & Hot

Smoke, Mirrors & Hot Air How ExxonMobil Uses Big Tobacco’s Tactics to Manufacture Uncertainty on Climate Science Union of Concerned Scientists January 2007 © 2007 Union of Concerned Scientists All rights reserved The Union of Concerned Scientists is the leading science-based nonprofit working for a healthy environment and a safer world. UCS combines independent scientific research and citizen action to develop innovative, practical solutions and secure responsible changes in government policy, corporate practices, and consumer choices. Union of Concerned Scientists Two Brattle Square Cambridge, MA 02238-9105 Phone: 617-547-5552 Fax: 617-864-9405 Email: [email protected] Contents Executive Summary 1 Introduction 3 Background: The Facts about ExxonMobil 4 The Origins of a Strategy 6 ExxonMobil’s Disinformation Campaign 9 Putting the Brakes on ExxonMobil’s Disinformation Campaign 25 Appendices A. The Scientific Consensus on Global Warming 29 B. Groups and Individuals Associated with ExxonMobil’s Disinformation Campaign 31 C. Key Internal Documents 37 • 1998 "Global Climate Science Team" memo 38 • APCO memo to Philip Morris regarding the creation of TASCC 44 • Dobriansky talking points 49 • Randy Randol's February 6, 2001, fax to the Bush team calling for Watson's dismissal 51 • Sample mark up of Draft Strategic Plan for the Climate Change Science Program by Philip Cooney 56 • Email from Mryon Ebell, Competitive Enterprise Institute, to Phil Cooney 57 Endnotes 58 Acknowledgments Seth Shulman was the lead investigator and primary author of this report. Kate Abend and Alden Meyer contributed the final chapter. Kate Abend, Brenda Ekwurzel, Monica La, Katherine Moxhet, Suzanne Shaw, and Anita Spiess assisted with research, fact checking, and editing. -

Scientific Consensus on Manmade Global Warming: Think Tank Influence on Public Opinion Through News Media

Rowan University Rowan Digital Works Theses and Dissertations 10-28-2008 Scientific consensus on manmade global warming: think tank influence on public opinion through news media Greg Howe Rowan University Follow this and additional works at: https://rdw.rowan.edu/etd Part of the Public Relations and Advertising Commons Recommended Citation Howe, Greg, "Scientific consensus on manmade global warming: think tank influence on public opinion through news media" (2008). Theses and Dissertations. 695. https://rdw.rowan.edu/etd/695 This Thesis is brought to you for free and open access by Rowan Digital Works. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of Rowan Digital Works. For more information, please contact [email protected]. SCIENTIFIC CONSENSUS ON MANMADE GLOBAL WARMING: THINK TANK INFLUENCE ON PUBLIC OPINION THROUGH NEWS MEDIA by Greg Howe A THESIS Submitted in partial fulfillment of the requirements of the Master of Arts Degree of The Graduate School at Rowan University October 28, 2008 Approved by____ ____ D ate approved © 2008 Greg Howe ABSTRACT Greg Howe Scientific Consensus on Manmade Global Warming: Think Tank Influence on Public Opinion through News Media 2008 Advisor: Joseph Basso, J.D., Ph. D., APR Public Relations Graduate Program This study examined the influence of think tanks, in the news media, on public opinion of what most scientists believe about the cause of global warming. The researcher performed a content analysis on two national newspapers spanning May through July, 2006, the three months surrounding the U.S. release of An Inconvenient Truth, to determine whether papers of differing political ideology provided different amounts of context concerning the global warming scientific consensus. -

2020 Annual Corporate Governance Review PART II

2020 Annual Corporate Governance Review Parts I & II A Review of Results for: > Shareholder Proposals > Director Elections > Say-on-Pay > M&A and Activism Trends View Part I > View Part II > Contents Executive Summary and Acknowledgements ......................................................................................................................................................................................................................... 4 Methodology .................................................................................................................................................................................................................................................................................. 6 PART I Section 1 The Impact of COVID-19 on the 2020 Proxy Season ................................................................................................................................................................................. 9 Section 2 Shareholder Sponsored Proposals ..............................................................................................................................................................................................................12 Section 2A Governance Shareholder Sponsored Proposals ........................................................................................................................................................................................13 Figure 1 S&P 1500 Shareholder Proposal Activity, 2017-2020 (Chart) ............................................................................................................................................................................ -

Annual Report Dated December 31, 2005

The Fund seeks long-term capital appreciation through investments and advocacy that promote the American system of free enterprise. Annual Report Dated December 31, 2005 FREE ENTERPRISE ACTION FUND TABLE OF CONTENTS Page Letter to Shareholders***************************************************************** 3 Schedule of Portfolio Investments******************************************************* 8 Statement of Assets and Liabilities ****************************************************** 16 Statement of Operations *************************************************************** 17 Statement of Changes in Net Assets ***************************************************** 18 Financial Highlights ******************************************************************* 19 Notes to Financial Statements ********************************************************** 20 Report of Independent Registered Public Accounting Firm ********************************* 23 Supplemental Information ************************************************************* 24 This report must be preceded or accompanied by a prospectus of the Fund. The prospectus contains more complete information, including investment objective, risks, fees and expenses and should be read carefully before investing or sending any money. A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to the portfolio securities and information regarding how the Fund voted proxies relating to the portfolio securities during the most recent 12-month period ended -

Exxon Mobil Corporation; Rule 14A-8 No-Action Letter

UNITED STATES SECURITIES A ND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 DIVISION OF CORPORATION FINANCE March 28, 2019 Louis L. Goldberg Davis Polk & Wardwell LLP [email protected] Re: Exxon Mobil Corporation Incoming letter dated January 21, 2019 Dear Mr. Goldberg: This letter is in response to your correspondence dated January 21, 2019 and February 6, 2019 concerning the shareholder proposal (the “Proposal”) submitted to Exxon Mobil Corporation (the “Company”) by Steven J. Milloy (the “Proponent”) for inclusion in the Company’s proxy materials for its upcoming annual meeting of security holders. We also have received correspondence from the Proponent dated January 25, 2019 and February 7, 2019. Copies of all of the correspondence on which this response is based will be made available on our website at http://www.sec.gov/divisions/corpfin/cf-noaction/14a-8.shtml. For your reference, a brief discussion of the Division’s informal procedures regarding shareholder proposals is also available at the same website address. Sincerely, M. Hughes Bates Special Counsel Enclosure cc: Steven J. Milloy [email protected] *** FISMA & OMB Memorandum M-07-16 March 28, 2019 Response of the Office of Chief Counsel Division of Corporation Finance Re: Exxon Mobil Corporation Incoming letter dated January 21, 2019 The Proposal relates to a report. There appears to be some basis for your view that the Company may exclude the Proposal under rule 14a-8(f). We note that the Proponent appears to have failed to supply, within 14 days of receipt of the Company’s request, documentary support sufficiently evidencing that he satisfied the minimum ownership requirement for the one-year period as required by rule 14a-8(b).