Notice of 2021 Annual Meeting and Proxy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

It Doesn't Have to Be This Way: Obamacare's Troubling Reality

It Doesn’t Have to be This Way: Obamacare’s Troubling Reality Every day Americans are confronted with more bad news about Obamacare. Insurers are leaving the ACA marketplaces, premiums continue to increase, and fewer people are enrolling, which will likely lead to more premium increases. Lawmakers must act because the American people deserve better. Insurers Dropping Out CNBC: Anthem will drop out of Ohio's Obamacare market; 18 counties could be left with no ACA plan Alleigh Marré, spokeswoman for the U.S. Department of Health and Human Services, said “This news is heartbreaking for the millions of Ohioans who depend on access to affordable, high-quality healthcare, and this is a stark reminder that Obamacare is collapsing.” Times Free Press: Most of Tennessee will have only one insurer under Obamacare in 2018 Tennessee Insurance Commissioner Julie Mix McPeak said … "the market remains challenged as most Tennessee consumers will still face limited options and increasing premium prices. WTHR: Anthem, MDwise Pulling Out of Indiana’s Obamacare Exchange in 2018 Both companies cited a “volatile” marketplace filled with “growing uncertainty.” So what’s causing this uncertainty? In one word, Obamacare. The flawed design of Obamacare itself, particularly the flawed individual mandate and the instability of the Cost Sharing Reduction subsidies, written and implemented by Democrats, are causing the volatile marketplace. Declining Enrollment Politico: Nearly 2M Fell Off Obamacare Coverage Rolls Through Mid-March CMS said high costs and lack of affordability were the most common factors individuals cited when asked why they didn't keep their coverage. Obamacare’s actual enrollment has failed to meet projections every single year. -

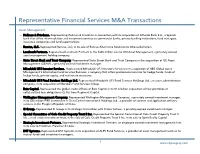

Representative Financial Services M&A Transactions

Representative Financial Services M&A Transactions Asset Management • Hellman & Friedman. Representing Hellman & Friedman in connection with its acquisition of Allfunds Bank S.A., a Spanish bank that offers intermediation and investment services to commercial banks, private banking institutions, fund managers, insurance companies and fund supermarkets. • Ramius, LLC. Represented Ramius, LLC, in its sale of Ramius Alternative Solutions to AllianceBernstein. • Landmark Partners. Represented Landmark Partners in the $465 million sale to OM Asset Management, a privately owned asset management holding company. • State Street Bank and Trust Company. Represented State Street Bank and Trust Company in the acquisition of GE Asset Management (GEAM), a privately owned investment manager. • Mitsubishi UFJ Investor Services. Represented Mitsubishi UFJ Investors Services in its acquisition of UBS Global Asset Management’s Alternative Fund Services Business, a company that offers professional services for hedge funds, funds of hedge funds, private equity, and real estate structures. • Mitsubishi UFJ Fund Services Holdings Ltd. Represented Mitsubishi UFJ Fund Services Holdings Ltd., an asset administration company, in its acquisition of Meridian Fund Services Group. • Bain Capital. Represented the global credit affiliate of Bain Capital in its $1.6 billion acquisition of four portfolios of collateralized loan obligations (CLOs) from Regiment Capital. • Wellington Management Company. Represented Wellington Management Company, a privately owned investment manager, in its $85 million PIPE investment in ChinaCache International Holdings Ltd., a provider of content and application delivery services in the People’s Republic of China. • 3i Group. Represented 3i Group in its strategic transaction with Fraser Sullivan, a privately owned investment manager. • Special Committee of Cole Credit Property Trust II Inc. -

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Fact Sheet:State Street Aggregate Bond Index Fund, Jun2021

State Street Aggregate Bond Index Fund - Class K Fixed Income 30 June 2021 Fund Objective Total Return The State Street Aggregate Bond Index Fund (the "Fund") seeks to provide Bloomberg Barclays investment results that, before fees and expenses, correspond generally U.S. Aggregate to the price and yield performance of an index that tracks the U.S. dollar Cumulative Fund at NAV Bond Index denominated investment grade bond market over the long term. QTD 1.80% 1.83% Process YTD -1.77 -1.60 The Fund seeks to achieve its investment objective by investing Annualized substantially all of its investable assets in the Aggregate Bond Index 1 Year -0.56 -0.33 Portfolio, which has substantially similar investment policies to the Fund 3 Year 5.31 5.34 when the Fund invests in this “master-feeder” structure, the Fund’s only 5 Year 2.88 3.03 investments are shares of the Portfolio and it participates in the investment returns achieved by the Portfolio. Under normal circumstances, at least Since Fund Inception 3.27 3.40 80% of the Fund's net assets will be invested (either on its own or as a part of a master/feeder structure) in securities comprising the Bloomberg Barclays U.S. Aggregate Bond Index (the "Index") or in securities that Gross Expense Ratio 0.215% SSGA Funds Management, Inc. (the “Adviser”) determines have economic Net Expense Ratio^ 0.025% characteristics that are comparable to the economic characteristics of 30 Day SEC Yield 2.04% securities that comprise the Index. The Fund is not managed according 30 Day SEC Yield (Unsubsidized) 1.94% to traditional methods of "active" investment management, which involve the buying and selling of securities based upon economic, financial Maximum Sales Charge - and market analysis and investment judgment. -

Stewardship Activity Report: Q2 2017

Stewardship Activity Report Q2 2017 Figure 1: Vote Summary H1 2017 This report provides an overview of the 2017 proxy seasons Number of Meetings Voted 12,608 in the US, UK and Japan markets and highlights SSGA’s stewardship activities, proxy voting and engagement, on Number of Countries 81 material environmental, social and governance (ESG) topics. Management Proposals 123,572 Votes For (%) 87.3 Votes Against (%) 12.7 Thematic Focus — Cross Shareholder Proposals 3,446 Regional Engagements 92.7 With Management (%) Gender Diversity — Fearless Girl 1 Against Management (%) 7.3 In March 2017, SSGA launched its Fearless Girl campaign that 1 Votes Against Management are calculated as For + Abstain. All proposal statistics was supported by our call to action on companies to improve exclude Do Not Vote instructions. board quality by enhancing diversity on boards. In Q2 2017, we sent letters to over 600 companies in the US, UK and Figure 2: Breakdown of Voting by Region H1 2017 Australia that we identified as lacking a single woman on the board. In the letter we informed companies of our expectations Australia with regards to diversity on boards and offered to engage with 1% RW 37% companies on this matter. We made clear that our preferred United Kingdom 4% approach to drive greater board diversity is through an active dialogue and engagement with companies. However, we Japan 12% clarified that in the event that companies fails to take action to increase the number of women on their boards, we will use Europe North America our proxy voting power to effect change — voting against the 13% 33% Chair of the board’s nominating and/or governance committee if necessary. -

Drilling the Monterey Shale

A New California Oil Boom? Drilling the Monterey Shale By Robert Collier December 2013 Table of Contents Table of Contents 2 Part 1: Distracted by Fracking? 3 Part 2: The Most dangerous chemical you’ve never heard of 6 Part 3: The Climate conundrum 9 Part 4: Monterey Shale: Twice as polluting as Keystone XL? 13 Part 5: Is California really like North Dakota? 18 Part 6: Keeping the story straight: industry reports at odds on California oil 24 Notes 27 Page 2 | Drilling the Monterey Shale Part 1: Distracted by Fracking? Over the past few years, the United States has found the more likely candidate for tapping the Monterey itself in the midst of a major boom in oil and gas Shale: A technique, already widely in use in the oil production. Rapid expansion in the use of a drilling industry, known as “acidizing.” technique called hydraulic fracturing, or “fracking,” has opened up previously unreachable pockets of oil It’s not widely discussed in publicly, but for some and gas, and returned the U.S. to its historic position time oil companies have found acidizing more as a major global producer of these fossil fuels. effective in the Monterey Shale than fracking. And it seems the boom may be coming to Acidizing typically involves the injection of high California. Once a leading producer of oil in the U.S., volumes of hydrofluoric acid, a powerful solvent, California’s production has fallen off dramatically (abbreviated as “HF”) into the oil well to dissolve over the years as oil fields age and are depleted. -

Repsol's Green Bond Framework

ALL RIGHTS ARE RESERVED © REPSOL, S.A. 2017 1 Repsol, S.A. (“Repsol”) is the exclusive owner of this document. No part of this document may be reproduced (including photocopying), stored, duplicated, copied, distributed or introduced into a retrieval system of any nature or transmitted in any form or by any means without the prior written permission of Repsol This document is for information purposes only. This document is not a legally binding document and does not have the effect of creating, recognizing, amending or extinguishing any existing legal or contractual rights or obligations. This document is not a registration document or a prospectus. This document does not constitute an offer or invitation to purchase or subscribe shares or securities, in accordance with the provisions of the Spanish Law on the Securities Market (Royal Legislative Decree 4/2015 of the 23rd of October) or any other legislation. In addition, this document does not constitute an offer of purchase, sale or exchange, nor a request for an offer of purchase, sale or exchange of securities in any other jurisdiction. This document contains statements that Repsol believes constitute forward-looking statements which may include statements regarding the intent, belief, or current expectations of Repsol and its management, including statements with respect to trends affecting Repsol’s financial condition, financial ratios, results of operations, business, strategy, geographic concentration, production volume and reserves, capital expenditures, costs savings, investments and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates and are generally identified by the words “expects”, “anticipates”, “forecasts”, “believes”, estimates”, “notices” and similar expressions. -

EXXONMOBIL DEVELOPMENT § COMPANY; and EXXONMOBIL § OIL CORPORATION, § § Plaintiffs, § § V

Case 3:17-cv-01930-B Document 110 Filed 12/31/19 Page 1 of 35 PageID <pageID> UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF TEXAS DALLAS DIVISION EXXON MOBIL CORPORATION; § EXXONMOBIL DEVELOPMENT § COMPANY; and EXXONMOBIL § OIL CORPORATION, § § Plaintiffs, § § v. § CIVIL ACTION NO. 3:17-CV-1930-B § STEVEN MNUCHIN, in his official § capacity as Secretary of the U.S. § Department of the Treasury; § ANDREA M. GACKI, in her official § capacity as the Director of the U.S. § Department of the Treasury’s Office § of Foreign Assets Control; and the U.S. § DEPARTMENT OF THE TREASURY’S § OFFICE OF FOREIGN ASSETS § CONTROL, § § Defendants. § MEMORANDUM OPINION AND ORDER Before the Court is Plaintiffs Exxon Mobil Corporation, ExxonMobil Development Company, and ExxonMobil Oil Corporation’s Motion for Summary Judgment (Doc. 92), as well as Defendants Steven Mnuchin, Andrea Gacki, and the Office of Foreign Assets Control’s Cross-Motion for Summary Judgment (Doc. 95). The parties dispute whether the Office of Foreign Assets Control’s imposition of a two-million-dollar fine upon Plaintiffs for alleged violations of Ukraine-related sanctions regulations was lawful. Because the Court concludes that Plaintiffs lacked fair notice that their conduct was prohibited, the Court GRANTS Plaintiffs’ motion (Doc. 92) and DENIES Defendants’ cross-motion (Doc. 95). Further, the Court VACATES the Office of Foreign Asset - 1 - Case 3:17-cv-01930-B Document 110 Filed 12/31/19 Page 2 of 35 PageID <pageID> Control’s Penalty Notice. I. BACKGROUND1 This is an administrative case prompting the Court to determine which party receives the benefit of having its cake and eating it, too—the regulating agency that failed to clarify, or the regulated party that failed to ask. -

Leading Energy Companies Announce Transition Principles

Leading energy companies announce transition principles December 17, 2020 • Eight leading energy companies have jointly developed and agreed Principles as a collaborative platform for energy transition. • Joint collaborative approach welcomed by investors leading engagement with companies across sector through Climate Action 100+. • Principles support collective industry acceleration to contribute to the Paris Agreement objectives by delivering progress on reducing GHG emissions, the role of carbon sinks, and the importance of transparency and alignment on climate change with trade associations. • Companies are building further on this collaboration to drive more consistency and transparency in Greenhouse Gas reporting, and in measurement of the emissions which may occur at different points in the value chain. Leading energy companies, bp, Eni, Equinor, Galp, Occidental, Repsol, Royal Dutch Shell and Total today announced they have agreed to apply six Energy Transition Principles as they play their part in the energy transition. The six Principles, agreed and embraced by the companies, are to: 1. PUBLIC SUPPORT FOR THE GOALS OF THE PARIS AGREEMENT: publicly support the goals of the Paris Agreement, including international cooperation as a vehicle to ensure these goals can be achieved at the lowest overall cost to the economy. 2. INDUSTRY DECARBONISATION: In line with each company's individual strategy, ambitions and aims, work to reduce emissions from their own operations and strive to reduce emissions from use of energy, together with customers and society. Companies may measure their contributions using carbon intensity and/or absolute metrics at different points in the value chain as determined by their approach. 3. ENERGY SYSTEM COLLABORATION: collaborate with interested stakeholders, including energy users, investors and governments, to develop and promote approaches to reduce emissions from use of energy, in support of countries delivering their Nationally Determined Contributions (NDCs) towards achieving the goals of the Paris Agreement. -

Exxonmobil Indonesia at a Glance Country Fact Sheet

ExxonMobil Indonesia at a glance Country fact sheet KEY FACTS 1898 Standard Oil Company of New York (Socony) opens a marketing office in Java. 1968 Mobil Oil Indonesia Inc. (MOI) is formed and becomes one of the first contractors to be involved in the country’s newly established “Production Sharing Contract (PSC)” approach for B block in North Aceh. MOI is later renamed ExxonMobil Oil Indonesia (EMOI) in 2000. 2001 A discovery of over 450 million barrels of oil at Banyu Urip oil field, East Java. 2005 ExxonMobil Cepu Limited (EMCL) assigned as operator for the Cepu block under PSC. 2006 Banyu Urip Plan of Development (POD) approved by the government of Indonesia. 2009 Cepu block commenced commercial production through Early Production Facility (EPF). 2011 EMCL awards five major Banyu Urip project Engineering, Procurement and Construction (EPC) contracts to five Indonesian-led consortiums. 2015 In October, ExxonMobil assigned its interest in the North Sumatra Block Offshore (NSO) and B Block PSC to Pertamina. The start-up of Banyu Urip’s onshore Central Processiong Facility (CPF) commenced in December. 2016 POD production of 165,000 barrels of oil per day is achieved at Banyu Urip field. NOW Approximately 570 employees at ExxonMobil Indonesia. Nearly 90 percent are Indonesians, many of whom are senior managers and engineers. Increasing energy supply for Indonesia. The FSO vessel, Gagak Rimang, connected to the mooring tower. UPSTREAM Cepu block East Natuna block • The Cepu Block PSC was signed on 17 September 2005 • Located in the South China Sea. covering the Cepu Contract Area in Central and East Java. -

Open PDF File, 8.71 MB, for February 01, 2017 Appendix In

Case 4:16-cv-00469-K Document 175 Filed 02/01/17 Page 1 of 10 PageID 5923 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF TEXAS FORT WORTH DIVISION EXXON MOBIL CORPORATION, § § Plaintiff, § v. § No. 4:16-CV-469-K § ERIC TRADD SCHNEIDERMAN, § Attorney General of New York, in his § official capacity, and MAURA TRACY § HEALEY, Attorney General of § Massachusetts, in her official capacity, § § Defendants. § APPENDIX IN SUPPORT OF EXXON MOBIL CORPORATION’S BRIEF IN SUPPORT OF THIS COURT’S PERSONAL JURISDICTION OVER THE DEFENDANTS Exhibit Description Page(s) N/A Declaration of Justin Anderson (Feb. 1, 2017) v – ix A Transcript of the AGs United for Clean Power App. 1 –App. 21 Press Conference, held on March 29, 2016, which was prepared by counsel based on a video recording of the event. The video recording is available at http://www.ag.ny.gov/press- release/ag-schneiderman-former-vice-president- al-gore-and-coalition-attorneys-general-across B E-mail from Wendy Morgan, Chief of Public App. 22 – App. 32 Protection, Office of the Vermont Attorney General to Michael Meade, Director, Intergovernmental Affairs Bureau, Office of the New York Attorney General (Mar. 18, 2016, 6:06 PM) C Union of Concerned Scientists, Peter Frumhoff, App. 33 – App. 37 http://www.ucsusa.org/about/staff/staff/peter- frumhoff.html#.WI-OaVMrLcs (last visited Jan. 20, 2017, 2:05 PM) Case 4:16-cv-00469-K Document 175 Filed 02/01/17 Page 2 of 10 PageID 5924 Exhibit Description Page(s) D Union of Concerned Scientists, Smoke, Mirrors & App. -

Overview of Available Benefits - Supplemental 2

Overview of Available Benefits - Supplemental 2 BIBM benefits Your health. Your wealth. Our partnership: The benefits of working at IBM IBM offers a competitive benefits program, designed to help employees build a solid financial foundation for meeting a diverse array of needs — health care, income protection, retirement security, and personal interests. Supplemental 2 employees are eligible for the following plans and programs which address health care and savings and are described briefly below: Medical, dental, vision, flexible spending accounts, IBM 401(k) Plus Plan and Employees Stock Purchase Plan. Supplemental 2 employees are also eligible for time off and other benefits and services as outlined below. Please contact the IBM Benefits Center-Provided by Fidelity to obtain estimated annual cost for the medical options available in your zip code. BYou are eligible ...for these benefit programs, with the exception of the IBM Employees Stock Purchase Plan, beginning with your first day of employment. Health care coverage (medical, dental and vision) is available for you, your spouse/partner (some health plans may not offer coverage for partners), and eligible children and other dependents (documentation supporting eligibility is required). IBM provides a range of options, to allow employees to design a personalized program that meets their personal or family circumstances. You are covered for pre-existing conditions under IBM's health plans. Medical Benefits options IBM's medical options include the IBM Preferred Provider Organization (PPO), IBM PPO Plus, IBM PPO with Health Savings Account (HSA), IBM Enhanced PPO with Health Savings Account (HSA), the IBM Exclusive Provider Organization (EPO), and health maintenance organizations (HMOs), where available.