EMLAK KONUT REIT HOLD (Prev

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Only Event Dedicated to Esg, Bonds & Loans

THE ONLY EVENT DEDICATED TO ESG, BONDS & LOANS BECOME A SPONSOR Places sell out fast - call Rebecca Mead on +44 (0)207 045 0929 Clients we work with TO FIND OUT MORE ABOUT SPONSORING contact REBECCA MEAD on +44 (0)207 045 0929 or email [email protected] 2 How borrowers, issuers and investors can implement ESG funding strategies and frameworks Environmental, sustainable and governance has always been a criteria that most companies and investors have considered and factored into their funding and investment strategies for many years. So what’s changed? As general sentiment, the media and a generational shift on topics such as climate change and sustainable development continues to garner more traction, so to has it catapulted ESG and sustainable investment up the priority list for investors. The ESG Capital Markets Summit looks to bring together investors, issuers, regulators and financiers to better understand investors’ ESG investment strategies and criteria, assess the viability of all debt instruments available to issuers and understand what challenges and hurdles must be overcome to implement them. 250+ 60% 100% ATTENDEES INVESTORS AND DIRECTOR LEVEL ISSUERS AND ABOVE Audience breakdown by sector Audience breakdown by job function 30% 40% 30% 20% CEO/CFO Heads of/ 10% Issuers Vice President/ Partner 15% Managing Director Advisors and Director regulators 25% Banks 30% Investors 3 Become a sponsor Position yourself as a specialist in the sector Showcase your expertise by joining a panel discussion or presenting a case study -

Printmgr File

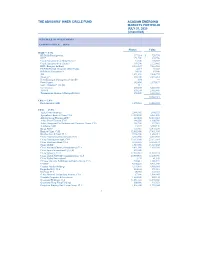

THE ADVISORS’ INNER CIRCLE FUND ACADIAN EMERGING MARKETS PORTFOLIO JULY 31, 2020 (Unaudited) SCHEDULE OF INVESTMENTS COMMON STOCK — 98.4% Shares Value Brazil — 3.7% BR Malls Participacoes 377,114 $ 720,750 BRF* 151,500 603,206 Cia de Saneamento de Minas Gerais* 33,300 348,669 Cia de Saneamento do Parana* 397,200 2,323,862 EDP - Energias do Brasil 2,093,847 7,413,588 FII BTG Pactual Corporate Office Fund‡ 4,317 75,382 IRB Brasil Resseguros S 54,338 83,540 JBS 1,831,876 7,609,772 Minerva* 868,100 2,263,212 Nova Embrapar Participacoes* (A) (B) 854 — Porto Seguro 345,400 3,570,832 Seara Alimentos* (A) (B) 911 — Sul America 638,288 6,225,588 TOTVS 639,294 3,165,495 Transmissora Alianca de Energia Eletrica 650,249 3,618,623 38,022,519 Chile — 1.4% Enel Americas ADR 1,850,041 14,004,810 China — 43.0% Agile Group Holdings 2,496,592 3,166,523 Agricultural Bank of China, Cl H 17,084,000 6,061,830 Alibaba Group Holding ADR* 210,408 52,816,616 Anhui Conch Cement, Cl H 146,500 1,106,741 Anhui Hengyuan Coal Industry and Electricity Power, Cl Aˆ200GnmxPMGpKe6Lo+Š 185,200 137,981 Autohome ADR 43,187 3,785,341200GnmxPMGpKe6Lo+ LSWP64RS10 SEI INVESTMENTS Baidu ADR* Donnelley Financial14.3.14.0 LSWpf_rend 15-Sep-2020 07:22107,816 EST 12,873,230 948527 TX 1 11* Bank of China, Cl H 52,052,000 17,461,930 AIC ACADIAN - NPORT-Baoshan Iron & NoneSteel, Cl ALNF 2,106,500 1,484,917 HTM ESS 0C China Communications Services, Cl H 3,116,900 2,018,869 Page 1 of 1 China Construction Bank, Cl H 37,544,000 27,515,054 China Merchants Bank, Cl A 2,738,325 13,653,372 China -

Araştirma Bilgi Notu - Imkb100-50-30

ARAŞTIRMA BİLGİ NOTU - IMKB100-50-30 01 OCAK 2012 – 31 MART 2012 İTİBARI İLE ENDEKSLERİN KAPSAMINDAKİ HİSSELER IMKB 100 IMKB 100 IMKB 50 IMKB 30 ADANA ÇİMENTO(C) İPEK DOĞAL ENERJİ ADVANSA SASA AKBANK ADVANSA SASA İŞ BANKASI (C) AFYON ÇİMENTO AKSA AKRİLİK KİMYA AFYON ÇİMENTO İŞ FİNANSAL KİRALAMA AK ENERJİ ARÇELİK AK ENERJİİŞ GAYRİMENKUL Y.O. AKBANK ASYA KATILIM BANKASI AKBANK İTTİFAK HOLDİNG AKSA AKRİLİK KİMYA BİM MAĞAZALAR AKFEN HOLDİNG İZMİR DEMİR ÇELİK ANADOLU EFES DOĞAN HOLDİNG AKSA AKRİLİK KİMYA KARDEMİR (D) ARÇELİK EMLAK KONUT GMYO AKSA ENERJİ KARSAN OTOMOTİVASELSANENKA İNŞAAT AKSİGORTA KARTONSAN ASYA KATILIM BANKASI EREĞLİ DEMİR ÇELİK ALARKO HOLDİNG KİLER GIDA BAGFAŞ GARANTİ BANKASI ANADOLU EFES KİLER GMYO BİM MAĞAZALAR İHLAS HOLDİNG ANADOLU SİGORTA KOÇ HOLDİNG BİZİM MAĞAZALARI İŞ BANKASI (C) ARÇELİKKONYA ÇİMENTO DOĞAN HOLDİNG KARDEMİR ( D ) ASELSAN KOZA ALTIN DOĞAN YAYIN HOLDİNG KOÇ HOLDİNG ASYA KATILIM BANKASI KOZA MADENCİLİKECZACIBAŞI İLAÇ KOZA ALTIN AYGAZ MENDERES TEKSTİL EMLAK KONUT GMYO MİGROS TİCARET BAGFAŞ METRO HOLDİNG ENKA İNŞAAT PETKİM BANVİTMİGROS TİCARET EREĞLİ DEMİR ÇELİK SABANCI HOLDİNG BEŞİKTAŞ FUTBOL YAT. MONDİ TİRE KUTSAN FENERBAHÇE SPORTİFSİNPAŞ GMYO BİM MAĞAZALAR MUTLU AKÜ FORD OTOSAN ŞİŞE CAM BİZİM MAĞAZALARI NET HOLDİNG GALATASARAY SPORTİF T. HALK BANKASI BORUSAN MANNESMANN NET TURİZM GARANTİ BANKASI TEKFEN HOLDİNG BOYNER MAĞAZACILIK NETAŞ TELEKOM GOOD-YEAR TOFAŞ OTOMOBİL FAB. BRİSA OTOKAR İHLAS HOLDİNG TURKCELL DEVA HOLDİNG PARK ELEKT. MADENCİLİK İŞ BANKASI (C) TÜPRAŞ DO-CO RESTAURANTS PETKİM İZMİR DEMİR ÇELİKTÜRK HAVA YOLLARI DOĞAN HOLDİNG RHEA GİRİŞİMKARDEMİR (D) TÜRK TELEKOM DOĞAN YAYIN HOLDİNG SABANCI HOLDİNG KOÇ HOLDİNG TÜRK TRAKTÖR DOĞUŞ OTOMOTİVSİNPAŞ GMYO KONYA ÇİMENTO VAKIFLAR BANKASI ECZACIBAŞI İLAÇ ŞEKERBANK KOZA ALTIN YAPI VE KREDİ BANKASI ECZACIBAŞI YATIRIM ŞİŞE CAM KOZA MADENCİLİK EGE GÜBRE T. -

Turquoise Equities

Technical Notice 16 October 2014 Turquoise Equities Turkish Securities Available on Customer Development Service (CDS) Turquoise is pleased to announce that Borsa Istanbul BIST 30 Index constituents are available on the CDS environment for testing. Details of available instruments are listed below: Symbol Name ISIN CCY MIC AKBNKy AKBANK T.A.S. TRAAKBNK91N6 TRY XIST ARCLKy ARCELIK AS TRAARCLK91H5 TRY XIST ASELSy ASELSAN ELEKTRONIK SANAYI TRAASELS91H2 TRY XIST BIMASy BIM BIRLESIK MAGAZALAR AS TREBIMM00018 TRY XIST EKGYOy EMLAK KONUT GAYRIMENKUL YATI TREEGYO00017 TRY XIST ENKAIy ENKA INSAAT VE SANAYI AS TREENKA00011 TRY XIST EREGLy EREGLI DEMIR VE CELIK FABRIK TRAEREGL91G3 TRY XIST FROTOy FORD OTOMOTIV SANAYI AS TRAOTOSN91H6 TRY XIST SAHOLy HACI OMER SABANCI HOLDING TRASAHOL91Q5 TRY XIST KRDMDy KARDEMIR KARABUK DEMIR-CL D TRAKRDMR91G7 TRY XIST KCHOLy KOC HOLDING AS TRAKCHOL91Q8 TRY XIST KOZALy KOZA ALTIN ISLETMELERI AS TREKOAL00014 TRY XIST KOZAAy KOZA ANADOLU METAL MADENCILI TREKOZA00014 TRY XIST MGROSy MIGROS TICARET A.S TREMGTI00012 TRY XIST PGSUSy PEGASUS HAVA TASIMACILIGI AS TREPEGS00016 TRY XIST 1 Technical Notice 25 November 2013 PETKMy PETKIM PETROKIMYA HOLDING AS TRAPETKM91E0 TRY XIST TAVHLy TAV HAVALIMANLARI HOLDING AS TRETAVH00018 TRY XIST TKFENy TEKFEN HOLDING AS TRETKHO00012 TRY XIST TOASOy TOFAS TURK OTOMOBIL FABRIKA TRATOASO91H3 TRY XIST TUPRSy TUPRAS-TURKIYE PETROL RAFINE TRATUPRS91E8 TRY XIST THYAOy TURK HAVA YOLLARI AO TRATHYAO91M5 TRY XIST SISEy TURK SISE VE CAM FABRIKALARI TRASISEW91Q3 TRY XIST TTKOMy TURK TELEKOMUNIKASYON AS TRETTLK00013 TRY XIST TCELLy TURKCELL ILETISIM HIZMET AS TRATCELL91M1 TRY XIST GARANy TURKIYE GARANTI BANKASI TRAGARAN91N1 TRY XIST HALKBy TURKIYE HALK BANKASI TRETHAL00019 TRY XIST ISCTRy TURKIYE IS BANKASI-C TRAISCTR91N2 TRY XIST VAKBNy TURKIYE VAKIFLAR BANKASI T-D TREVKFB00019 TRY XIST ULKERy ULKER BISKUVI SANAYI TREULKR00015 TRY XIST YKBNKy YAPI VE KREDI BANKASI TRAYKBNK91N6 TRY XIST Details of the production dates will be announced in due course. -

Market Watch Thursday, February 19, 2015 Agenda

Market Watch Thursday, February 19, 2015 www.sekeryatirim.com.tr Agenda 16 Monday 17 Tuesday 18 Wednesday 19 Thursday 20 Friday TurkStat, labor statistics Germany, ZEW survey U.S., January housing starts U.S., jobless claims Eurozone, February PMI MoF, January budget Treasury bond auctions U.S., January industrial U.S., Philadelphia Fed survey U.S., February PPI realizations rpoduction Eurozone, February consumer CBRT, January U.S., January PPI confidence expectations survey U.S., Fed - FOMC meeting TAVHL is to announce 4Q14 minutes results (Seker E: € 30mn, Consensus: € 26mn) Outlook: Volume (mn TRY) BIST 100 The BIST 100 closed higher yesterday at par with global markets thanks to speculation that Greece and Euro zone officials would reach a deal 8.000 86.083 85.809 86.041 granting Athens an extension on its loans. Accordingly, the BIST 100 85.442 closed 1.20% higher at 85,442 on a turnover of TRY 3.4bn. Today, we 86.000 may see a positive opening as the TRY is trading stronger against the USD 6.000 84.425 at USD 2.4420, and Brent is also significantly lower at USD 59.44 as of 84.000 print-perhaps helping to lift the grounded airline companies due to massive 4.000 snow in Istanbul. Yesterday's FOMC minutes were also EM friendly, hinting 5.412 at sustained close-to-0% interest rates. Resistance Levels: 86,000–86,600. 2.000 82.000 Support Levels: 84,900–83,700. 4.224 3.980 3.381 0 3.022 80.000 Money Market: 12-Feb 13-Feb 16-Feb 17-Feb 18-Feb The Lira was negative yesterday as the local currency weakened 0.37% against the USD to close at the day low of 2.4595. -

Turkey's Leading Virtual Credit Markets Conference 20+ 70+ 40+ 400+ 250+

SUBSCRIBE TO ATTEND & JOIN THE CORPORATE & INVESTMENT BANKING COMMUNITY ONLINE AT: www.BondsLoans.com TURKEY’S LEADING VIRTUAL CREDIT MARKETS CONFERENCE 400+ 40+ 250+ 70+ 20+ ATTENDEES WORLD CLASS SOVEREIGN, CORPORATE INVESTORS COUNTRIES SPEAKERS & FI BORROWERS Multilateral Sponsor: Bronze Sponsors: Islamic Corporation for the Development of the Private Sector Bonds, Loans & Sukuk Turkey is an important international event which provides networking, informs about the latest developments and gives the chance to debate with market participants. Highly qualified speakers, high profiled participants and relevant topics are the key factors that contribute to the success of this event. Every year we are excited to attend. Esra Ada, Nuve Capital www.BondsLoans.com BRINGING TURKEY’S BUYERS AND SELLERS TOGETHER TO CONDUCT BUSINESS Meet senior decision-makers from Turkish sovereigns, corporates and banks; share knowledge; debate; network; and move your business forward in the current economic climate without having to travel. 400+ 40+ 250+ ATTENDEES WORLD CLASS SOVEREIGN, CORPORATE 70+ SPEAKERS & FI BORROWERS INVESTORS Access top market practitioners Industry leading speakers will share Hear first-hand how local and international Leverage our concierge from across the globe who are “on-the-ground” market intelligence industry leaders are navigating Turkey’s 1-2-1 meeting service to active in Turkey’s markets, including: and updates on Turkey’s economic current economic climate/what they expect efficiently host meetings senior borrowers, investors, -

2018 Turkey Spencer Stuart Board Index

2018 Turkey Spencer Stuart Board Index 2018 turkey spencer stuart board index 1 header (section title) — (remove when section header present) About Spencer StuArt At Spencer Stuart, we know how much leadership matters. We are trusted by organizations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results through the collaborative efforts of a team of experts — now spanning 57 offices, 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organizational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2018 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 2 spencer stuart Contents 3 foreword 4 In the SpotlIght: professionAlISIng the boArd 8 HighlIghtS 11 Our Survey ApproAch 12 BoArd size And compositIon 20 boArd governAnce 24 RemunerAtIon 25 compArAtIve dAtA tAbleS 25 International Comparison 31 Board Composition 32 Board Statistics, Meetings and Committees 2018 turkey spencer stuart board index 1 2 spencer stuart Foreword The 2018 Turkey Spencer Stuart Board Index is an annual study that analyses aspects of board governance among major listed companies, including composition, committees, and remuneration. -

Linklaters Has a Market-Leading Practice, Advising Across Our Core Practice Areas Since the Mid-1980S

> A leading bank on the investment in > ING on the €600m financing granted > The lenders on the project financing of İzmir port project. to Sibirskiy Cement for the acquisition a new terminal at Antalya Airport. > Lenders on the financing of the of Set Group Holding, Set Beton and > Akenerji on the US$75m loans European Nickel metal mine in Turkey. Afyon Çimento. provided by the IFC to finance equity > Akenerji, CEZ and the project company > RWE on the US$12bn development of contributions and shareholder loans to on the US$1bn development and project the Nabucco gas pipeline. its subsidiaries for the support of five financing of a 900MW gas-fired power > Çalık Enerji on its consortium small scale hydropower projects (total plant at Erzin, Hatay Province. arrangements with the Indian Oil 160MW) in Adana. > The lead managers on the US$2bn Corporation. The consortium submitted SACE-backed financing of the project a bid to acquire a stake in Tüpraş as financing of the Blue Stream gas pipeline part of the government of Turkey’s from Russia to Turkey. privatisation process. > The sponsors on the US$325m refinancing of the acquisition financing Our Turkey practice originally used by Akcez (borrower) to purchase SEDAS electricity “ ... [Turkey] desk provides a strong platform distribution company. for the firm’s vast activity on Turkey-related > DP World on the €500m project contracts mandates, advising many leading international and finance documents for project investors from sectors including infrastructure financing of Yarimca Container Terminal. > The lenders on the US$630m financing and the financial services.” and construction of a coal-fired Chambers Global 2016, Corporate/M&A: Turkey (expertise based abroad) merchant power plant with a capacity of 625MW in Iskanderen. -

TUPRAS BUY (Prev

EARNINGS REVIEW Equity TURKEY / Oil&Gas Research 15 February 2016 TUPRAS BUY (Prev. BUY) Hedging gains more than offset inventory losses; strong 2016 guidance Earnings broadly in line, EBITDA beats. Tupras reported Stock Data 12 February 2016 TRY815mn profit for 4Q15, broadly in line with consensus (TRY853mn), but above our estimate (TRY756mn) thanks to robust Current price TRY68.85 EBITDA of TRY1,189mn (YKYe:TRY993mn, consensus:TRY960mn) Target price TRY81.7 on higher sales volume with limited sacrifice at refinery margin. DPS TRY5.37 Deviation on earnings would have been more remarkable if the Total return 26% effective tax rate were lower. The management has also revealed a Current Mcap TRY17,241mn/ US$5899mn strong 2016 outlook, but refrained from any numerical hint for 2015 DPS. Given good operational results and strong 2016 guidance, we Bloomberg Ticker TUPRS TI expect positive impact on the stock following the latest weakness. Number of outstanding shares (mn) 250 High / Low Price Range (12M) 78.45/50.35 Strong sales volume at satisfactory refinery margin. CUR 3-m Average Daily Turnover ($ mn) 35.8 was again above 100% in 4Q15 (106%) to take advantage of strong domestic demand (diesel up 16% and gasoline by 9% yoy in 11M15) Price Performance (%) 1M 3M 6M YtD and refinery margins. Accordingly, sales volume soared by a Return -8.3 -10.6 -7.9 -1.1 whopping 45% yoy, which offset the sharp fall in oil prices largely Relative to BIST100 -7.3 3.2 0.4 0.0 and topline contracted by only 2% yoy coupled with weak TRY. -

Renasset Select Funds Plc (An Umbrella Fund with Segregated Liability Between Sub-Funds)

RenAsset Select Funds plc (an umbrella fund with segregated liability between sub-funds) Open-ended umbrella investment company with variable capital RENASSET EASTERN EUROPEAN FUND RENASSET OTTOMAN FUND RENASSET NIGERIA FUND RENASSET AFRICA EX S.A. FUND Interim Report and Unaudited Financial Statements for the six months ended 31 March 2015 Registration Number: 282792 RenAsset Select Funds plc is an umbrella fund with segregated liability between sub-funds Contents General Information………………………………………………………………………………………………………………………… 1 Report of the Investment Manager………………………………………………………………………………………………………… 4 Balance Sheet……………………………………………………………………………………………………………………………… 8 Comparative Balance Sheet………………………………………………………………………………………………………………… 9 Income Statement……………………………………………………………………………………………………………………………10 Comparative Income Statement……………………………………………………………………………………………………………11 Statement of Changes in Net Assets Attributable to the Holders of Redeemable Shares………………………………………… 13 Comparative Statement of Changes in Net Assets Attributable to the Holders of Redeemable Shares………………………… 14 Statement of Cash Flows……………………………………………………………………………………………………………………15 Comparative Statement of Cash Flows……………………………………………………………………………………………………16 Notes to the Financial Statements…………………………………………………………………………………………………………17 Portfolio Statements………………………………………………………………………………………………………………………… 30 Significant Portfolio Changes……………………………………………………………………………………………………………… 43 Financial Information………………………………………………………………………………………………………………………. 48 Other Information…………………………………………………………………………………………………………………………… -

VIOP Single Stock Futures and Options

February 2018 VIOP SINGLE STOCK FUTURES Reşitpaşa Mahallesi T +90 212 298 21 00 AND OPTIONS Borsa İstanbul Caddesi No:4 F +90 212 298 25 00 Sarıyer 34467 İstanbul www.borsaistanbul.com Single Stock Futures Single Stock Options T. Garanti Bankası A.Ş. GARAN Türk Hava Yolları A.O. THYAO T. Garanti Bankası A.Ş. GARAN Türk Hava Yolları A.O. THYAO T. İş Bankası A.Ş. ISCTR Ereğli Demir ve Çelik Fabrikaları T.A.Ş EREGL T. İş Bankası A.Ş. ISCTR Ereğli Demir ve Çelik Fabrikaları T.A.Ş EREGL H.Ö. Sabancı Holding A.Ş. SAHOL Akbank T.A.Ş. AKBNK H.Ö. Sabancı Holding A.Ş. SAHOL Akbank T.A.Ş. AKBNK Türkiye Vakıflar Bankası T.A.O. VAKBN Turkcell İletişim Hizmetleri A.Ş. TCELL Türkiye Vakıflar Bankası T.A.O. VAKBN Turkcell İletişim Hizmetleri A.Ş. TCELL Yapı Kredi Bankası YKBNK Tüpraş – Türkiye Petrol Rafinerileri A.Ş. TUPRS Yapı Kredi Bankası YKBNK Tüpraş – Türkiye Petrol Rafinerileri A.Ş. TUPRS Derivatives Market (VIOP) Underlying Securities Arçelik A.Ş. ARCLK Petkim Petrokimya Holding A.Ş. PETKM Underlying Securities Arçelik A.Ş. ARCLK Petkim Petrokimya Holding A.Ş. PETKM Emlak Konut Gayrimenkul EKGYO Türkiye Şise ve Cam Fabrikalari A.Ş. SISE Yatirim Ortak A.Ş. Tofaş Turk Otomobil Fabrikasi A.Ş. TOASO VIOP is designed as a market for trading futures and options contracts based on economic or Emlak Konut Gayrimenkul EKGYO Türkiye Şise ve Cam Fabrikalari A.Ş. SISE Yatirim Ortak A.Ş. Türkiye Halk Bankası A.Ş. HALKB Türk Telekomunikasyon A.Ş. TTKOM Tofaş Turk Otomobil Fabrikasi A.Ş. -

December | 2008

DENIZ YATIRIM ARAŞTIRMA TÜRKİYE | POLİTİKA 25 HAZİRAN 2018 Orkun Gödek +90 212 348 5160 çim Sonrası [email protected] Selim Kunter +90 212 348 9078 [email protected] Erdoğan ve Cumhur İttifakı seçimi Sadrettin Bağcı +90 212 348 9088 [email protected] kazandı Cumhurbaşkanlığı* 24 Haziran Cumhurbaşkanlığı ve 27. Dönem milletvekili seçimleri Tayyip Recep Tayyip Erdoğan 52.39% Erdoğan’ın ilk turda Cumhurbaşkanlığı seçimini kazanması ve Cumhur Muharrem İnce 30.79% Selahattin Demirtaş 8.29% İttifakı’nın meclisteki çoğunluğu elde etmesiyle tamamlandı. Erken seçim Meral Akşener 7.42% riskinin masadan kalkmış olması ve Cumhurbaşkanlığı seçimlerinin ikinci tura Temel Karamollaoğlu 0.89% Doğu Perinçek 0.19% kalmamış olması 8 Temmuz tarihine dek muhtemel seçim belirsizliği Genel seçim* fiyatlamasını ortadan kaldıracaktır. Bu nedenle kısa vadeli işlemlerde Türk Lirası cinsinden varlıkların pozitif yönde etkilenebileceğini değerlendiriyoruz. Adalet ve Kalkınma Partisi 42.45% Milliyetçi Hareket Partisi 11.14% USDTRY’de 4.50 bölgesinde, 10Y vadeli gösterge faizde %14-15 aralığında Cumhuriyet Halk Partisi 22.70% dengelenme görülebilir. Hisse senetlerinde ise ilk tepkinin genel olarak olumlu İYİ Parti 10.03% Saadet Partisi 1.35% olmasını bekliyoruz. Halkların Demokratik Partisi 11.57% Diğer 2.11% Cumhurbaşkanlığı yarışını Tayyip Erdoğan ilk turda kazandı. TSİ 02.00’da resmi Genel seçim milletvekili sayısı* olmayan seçim sonuçlarına göre Cumhurbaşkanlığı seçiminde Recep Tayyip Adalet ve Kalkınma Partisi 293 Erdoğan oyların %52.4’ünü alarak ilk sırada yer aldı. En yakın rakibi Muharrem Milliyetçi Hareket Partisi 49 İnce ise %30.8 ile ikinci sırada yer aldı. Selahattin Demirtaş %8.3, Meral Akşener Cumhuriyet Halk Partisi 147 İYİ Parti 44 %7.4, Temel Karamollaoğlu %0.9 ve Doğu Perinçek %0.2.