VIOP Single Stock Futures and Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

I, No:40 Sayılı Tebliği'nin 8'Nci Maddesi Gereğince, Hisse Senetleri

Sermaye Piyasas Kurulu’nun Seri :I, No:40 say l Teblii’nin 8’nci maddesi gereince, hisse senetleri Borsada i"lem gören ortakl klar n Kurul kayd nda olan ancak Borsada i"lem görmeyen statüde hisse senetlerinin Borsada sat "a konu edilebilmesi amac yla Merkezi Kay t Kurulu"u’na yap lan ba"vurulara ait bilgiler a"a da yer almaktad r. Hisse Kodu S ra Sat "a Konu Hisse Ünvan Grubu Yat r mc n n Ad -Soyad Nominal Tutar Tsp Sat " No Ünvan (TL)* 5"lemi K s t ** ** ADANA 1 ADANA Ç5MENTO E TANER BUGAY SANAY55 A.;. A GRUBU 2.235,720 ALTIN 2 ALTINYILDIZ MENSUCAT E 5SMA5L AYÇ5N VE KONFEKS5YON 0,066 FABR5KALARI A.;. ARCLK 3 ARÇEL5K A.;. E C5HAT YÜKSEKEL 31,344 ARCLK 4 ARÇEL5K A.;. E ERSAN OYMAN 19,736 ARCLK 5 ARÇEL5K A.;. E FER5DE SEZ5K 0,214 ARCLK 6 ARÇEL5K A.;. E F5L5Z EYÜPOHLU 209,141 ARCLK 7 ARÇEL5K A.;. E HANDE YED5DAL 28,180 ARCLK 8 ARÇEL5K A.;. E HAYRETT5N YAVUZ 0,206 ARCLK 9 ARÇEL5K A.;. E 5HSAN ERSEN 1.259,571 ARCLK 10 ARÇEL5K A.;. E 5RFAN ATALAY 195,262 ARCLK 11 ARÇEL5K A.;. E KEZ5BAN ONBE; 984,120 ARCLK 12 ARÇEL5K A.;. E RAFET SALTIK 23,514 ARCLK 13 ARÇEL5K A.;. E SELEN TUNÇKAYA 29,110 ARCLK 14 ARÇEL5K A.;. E YA;AR EMEK 1,142 ARCLK 15 ARÇEL5K A.;. E ZEYNEP ÖZDE GÖRKEY 2,351 ARCLK 16 ARÇEL5K A.;. E ZEYNEP SEDEF ELDEM 2.090,880 ASELS 17 ASELSAN ELEKTRON5K E ALAETT5N ÖZKÜLAHLI SANAY5 VE T5CARET A.;. -

TÜRKİYE İŞ BANKASI A.Ş. U.S.$5,000,000,000 Global Medium

TÜRKİYE İŞ BANKASI A.Ş. U.S.$5,000,000,000 Global Medium Term Note Program Under this U.S.$5,000,000,000 Global Medium Term Note Program (the "Program"), Türkiye İş Bankası A.Ş., a Turkish banking institution organized as a public joint stock company registered with the Istanbul Trade Registry under number 431112 (the "Bank" or the "Issuer"), may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). Notes may be issued in bearer or registered form (respectively "Bearer Notes" and "Registered Notes"). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Program will not exceed U.S.$5,000,000,000 (or its equivalent in other currencies calculated as described in the Program Agreement described herein), subject to increase as described herein. The Notes may be issued on a continuing basis to: (a) one or more of the Dealers specified under "Overview of the Group and the Program" and any additional Dealer appointed under the Program from time to time by the Issuer (each a "Dealer" and together the "Dealers"), which appointment may be for a specific issue or on an ongoing basis, and/or (b) one or more investors purchasing Notes directly from the Issuer. References in this Base Prospectus to the "relevant Dealer" shall, in the case of an issue of Notes being (or intended to be) subscribed by more than one Dealer, be to all Dealers agreeing to subscribe such Notes. An investment in Notes issued under the Program involves certain risks. -

Market Watch Monday, March 01, 2021 Agenda

Market Watch Monday, March 01, 2021 www.sekeryatirim.com.tr Agenda 01 M onday 02 Tuesday 03 Wednesday 04 Thursday 05 Friday Turkstat, 4Q20 GDP Growth Germany, January TurkStat, February inflation CBRT, February Germany, Janu- retail sales inflation assess- ary factory orders China, February Caixin non-mfg. China, February Caixin mfg. PMI ment Germany, February PMI U.S., February Germany and Eurozone, Febru- unemployment data U.S., jobless non-farm payrolls ary Markit mfg. PMI Germany and Eurozone, Febru- ary Markit non-mfg. PMI claims and unemploy- Eurozone, February ment rate Germany, February CPI CPI Eurozone, February PPI U.S., January factory orders U.S., February U.S., February Markit mfg. PMI U.S., February ADP employment average hourly change earnings U.S., February ISM manufactur- ing index U.S., February Markit non-mfg. PMI U.S., January construction U.S., February ISM non- spending manufacturing index Outlook Major global stock markets closed lower on Friday, amid the rise in US Treasury yields, which has increased concerns over rising inflation and the Fed derailing its currently accommodative policy. Global risk appetite has Volume (mn TRY) BIST 100 relatively weakened, despite Fed Chair Powell’s statements suggesting that inflation was likely to remain below the targeted value, and that the 1.551 major central bank would maintain its current policy. Having moved in 1.518 1.488 parallel to the course of major international stock markets, the BIST100 48.000 1.483 1.471 1.600 also shed 1.13% to close at 1,471.39 on Friday, after a volatile day in 40.000 1.500 trading. -

2Ç2021 Kar Tahminleri

ARAŞTIRMA BÖLÜMÜ 16 Temmuz 2021 2Ç2021 KAR TAHMİNLERİ BANKACILIK SEKTÖRÜ 2Ç21T/ 2Ç21T/ 6A21T/ Bilanço Net Dönem Karı *Kesin/ 2Ç21T 1Ç21 4Ç20T 3Ç20 2Ç20 1Ç20 2Ç20 1Ç20 6A21T 6A20 6A20 Açıklama (Mn TL) Tahmini Değ.% Değ.% Değ.% Tarihi Finans Akbank 2.036 2.027 1.848 1.523 1.586 1.310 28,3% 0,4% 4.063 2.896 40,3% 28.07.2021 K Garanti Bankası 2.596 2.529 1.111 1.896 1.600 1.631 62,2% 2,6% 5.124 3.231 58,6% 29.07.2021 K İş Bankası (C) 1.739 1.854 1.627 2.149 1.579 1.456 10,2% -6,2% 3.593 3.035 18,4% 6.08.2021 T T. Halk Bankası 65 59 510 315 950 825 -93,1% 10,7% 124 1.775 -93,0% 13.08.2021 T Vakıflar Bankası 635 750 669 1.100 1.525 1.716 -58,3% -15,3% 1.385 3.241 -57,3% 9.08.2021 K Yapı ve Kredi Bank. 1.844 1.453 765 1.854 1.331 1.129 38,5% 26,9% 3.296 2.461 34,0% 30.07.2021 K TSKB 233 226 207 204 168 154 38,2% 3,0% 459 322 42,4% 4.08.2021 T Finans Toplam 9.148 8.897 6.736 9.040 8.740 8.222 4,7% 2,8% 18.045 16.962 6,4% Kaynak: Ziraat Yatırım, Banka Finansalları, T: Tahmini, a.d.: Anlamlı Değil Tahminlerimizde Etkili Olan Faktörler BDDK’nın açıklamış olduğu aylık verilere göre Bankacılık sektörü karı 2021 yılının Nisan-Mayıs döneminde, bir önceki yılın aynı dönemine göre %30,3, bir önceki çeyreğin ilk iki ayına göre de %9,4 oranında düşüş kaydetmiş ve 8,4 milyar TL seviyesinde gerçekleşmiştir. -

We're Taking Petkim to the Summit

WE’RE TAKING PETKİM TO THE SUMMIT 2015 ANNUAL REPORT M NY CONTENTS PRESENTATION 2 PETKİM IN BRIEF 6 SOCAR TURKEY 8 “VALUE-SITE” 2023 VISION 12 KEY PARAMETERS AND FINANCIAL HIGHLIGHTS 14 PETKİM PLANTS 16 A SOLID TRACK RECORD OF 50 YEARS 20 CAPACITIES OF PETKİM’S PLANTS 24 MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS 26 BOARD OF DIRECTORS 30 MESSAGE FROM THE GENERAL MANAGER 32 EXECUTIVE MANAGEMENT IN 2015 36 PRODUCTION 38 INVESTMENTS 40 LOGISTICS 42 SALES AND MARKETING 44 R&D and TECHNOLOGY 48 SUSTAINABILITY CORPORATE GOVERNANCE 54 INVESTOR RELATIONS 56 AGENDA 57 DECLARATION OF INDEPENDENCE 60 CORPORATE GOVERNANCE PRINCIPLES COMPLIANCE REPORT 77 PROFIT DISTRIBUTION POLICY 78 STATEMENT OF RESPONSIBILITY 80 AUDIT COMMITTEE REPORTS 82 INDEPENDENT AUDITOR’S REPORT ON THE ANNUAL REPORT OFTHE BOARD OF DIRECTORS FINANCIAL INFORMATION 84 CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD BETWEEN JANUARY 1 - DECEMBER 31, 2015 TOGETHER WITH REPORT OF INDEPENDENT AUDITORS 86 INDEPENDENT AUDITORS’ REPORT ON THE CONSOLIDATED FINANCIALS STATEMENTS A PETROCHEMICAL GIANT TURKEY’S SOLE INTEGRATED PETROCHEMICAL PLANT, Presentation PETKİM, REPRESENTS A GIANT PRODUCTION POWER WITH STRATEGIC IMPORTANCE FOR OUR COUNTRY’S INDUSTRY. WITH AROUND 60 PETROCHEMICAL PRODUCTS IN ITS PRODUCT RANGE, PETKİM IS THE INDISPENSABLE RAW- MATERIAL SUPPLIER OF THE PETROCHEMICAL INDUSTRY, PROVIDING RAW AND INTERMEDIATE MATERIALS TO In 2015 VARIOUS INDUSTRIES INCLUDING PLASTICS, CHEMISTRY, PACKAGING, PIPE, PAINT, CONSTRUCTION, AGRICULTURE, AUTOMOTIVE, ELECTRICITY, ELECTRONICS, TEXTILES, AS WELL AS PHARMACEUTICALS, DETERGENTS AND COSMETICS SECTORS THROUGH THE HIGH VALUE ADDED PRODUCTS SUCH AS THERMOPLASTICS, FIBERS AND RAW MATERIALS Corporate Governance FOR PAINTS. PETKİM LEAVES BEHIND 50 SUCCESSFUL YEARS, WHERE IT HAS UNWAVERINGLY CONTRIBUTED TO THE ECONOMY. -

1Ç2021 Kar Tahminleri

ARAŞTIRMA BÖLÜMÜ 21 Nisan 2021 1Ç2021 KAR TAHMİNLERİ BANKACILIK SEKTÖRÜ 1Ç21T/ 1Ç21T/ Bilanço Net Dönem Karı *Kesin/ 1Ç21T 4Ç20T 3Ç20 2Ç20 1Ç20 4Ç19 3Ç19 2Ç19 1Ç19 1Ç20 4Ç20 Açıklama (Mn TL) Tahmini Değ.% Değ.% Tarihi Finans Akbank 1.826 1.848 1.523 1.586 1.310 1.330 1.397 1.278 1.413 39,4% -1,2% 28.04.2021 K Garanti Bankası 1.876 1.111 1.896 1.600 1.631 1.222 1.304 1.911 1.722 15,0% 68,9% 29.04.2021 K İş Bankası (C) 1.682 1.627 2.149 1.579 1.456 2.310 1.348 951 1.458 15,5% 3,4% 07.05.2021 T T. Halk Bankası 45 510 315 950 825 797 308 310 305 -94,5% -91,1% 10.05.2021 T Vakıflar Bankası 703 669 1.100 1.525 1.716 1.280 503 368 651 -59,0% 5,1% 07.05.2021 T Yapı ve Kredi Bank. 1.315 765 1.854 1.331 1.129 263 976 1.120 1.241 16,5% 71,9% 30.04.2021 K TSKB 205 207 204 168 154 204 187 200 185 33,1% -1,0% 30.04.2021 T Finans Toplam 7.652 6.736 9.040 8.740 8.222 7.406 6.023 6.138 6.975 -6,9% 13,6% Kaynak: Ziraat Yatırım, Banka Finansalları, T: Tahmini, a.d.: Anlamlı Değil Tahminlerimizde Etkili Olan Faktörler Bankacılık sektörü karı 2021 yılının Ocak-Şubat döneminde, bir önceki yılın aynı dönemine göre %39, bir önceki çeyreğin ilk iki ayına göre de %16,5 oranında düşüş kaydetmiş ve 9,2 milyar TL seviyesinde gerçekleşmiştir. -

The Only Event Dedicated to Esg, Bonds & Loans

THE ONLY EVENT DEDICATED TO ESG, BONDS & LOANS BECOME A SPONSOR Places sell out fast - call Rebecca Mead on +44 (0)207 045 0929 Clients we work with TO FIND OUT MORE ABOUT SPONSORING contact REBECCA MEAD on +44 (0)207 045 0929 or email [email protected] 2 How borrowers, issuers and investors can implement ESG funding strategies and frameworks Environmental, sustainable and governance has always been a criteria that most companies and investors have considered and factored into their funding and investment strategies for many years. So what’s changed? As general sentiment, the media and a generational shift on topics such as climate change and sustainable development continues to garner more traction, so to has it catapulted ESG and sustainable investment up the priority list for investors. The ESG Capital Markets Summit looks to bring together investors, issuers, regulators and financiers to better understand investors’ ESG investment strategies and criteria, assess the viability of all debt instruments available to issuers and understand what challenges and hurdles must be overcome to implement them. 250+ 60% 100% ATTENDEES INVESTORS AND DIRECTOR LEVEL ISSUERS AND ABOVE Audience breakdown by sector Audience breakdown by job function 30% 40% 30% 20% CEO/CFO Heads of/ 10% Issuers Vice President/ Partner 15% Managing Director Advisors and Director regulators 25% Banks 30% Investors 3 Become a sponsor Position yourself as a specialist in the sector Showcase your expertise by joining a panel discussion or presenting a case study -

Semi-Annual Report and Unaudited Financial Statements for the Period from 1 January 2016 to 30 June 2016

Semi-annual Report and Unaudited Financial Statements for the period from 1 January 2016 to 30 June 2016 AKBANK TURKISH SICAV AKBANK TURKISH SICAV (the "SICAV") is an investment company which offers investors a choice between several classes of shares (each a "Class") in a number of sub-funds (each a "Sub-Fund"). The Fund is organised as an investment company under Part I of the amended Luxembourg Law of 17 December 2010 relating to undertakings for collective investment. No subscription can be accepted on the basis of financial reports. Subscriptions are only valid if they are made on the basis of the last prospectus accompanied by the subscription form, the latest annual report and the latest semi-annual report if published thereafter. R.C.S. Luxembourg B 138.732 AKBANK TURKISH SICAV TABLE OF CONTENTS ORGANISATION OF THE SICAV 2 GENERAL INFORMATION 3 FINANCIAL STATEMENTS Statement of Net Assets 5 Statement of Operations and Changes in Net Assets 6 Net Assets Information 7 SCHEDULE OF INVESTMENTS AND OTHER NET ASSETS AKBANK TURKISH SICAV – Equities 8 AKBANK TURKISH SICAV – Fixed Income 10 INDUSTRIAL CLASSIFICATION AKBANK TURKISH SICAV – Equities 11 AKBANK TURKISH SICAV – Fixed Income 11 NOTES TO THE FINANCIAL STATEMENTS 12 1 AKBANK TURKISH SICAV ORGANISATION OF THE SICAV AKBANK TURKISH SICAV Investment Manager R.C.S. Luxembourg B 138.732 AK Asset Management Inc. Sabancı Center Akbank T.A.Ş. Registered Office Hazine Binası Kat:1 34330 4. Levent 31, Z.A. Bourmicht Beşiktaş İstanbul, Turkey L-8070 Bertrange, Grand Duchy of Luxembourg Independent Auditor Board of Directors Ernst & Young S.A. -

Financial Instruments for Which Brokercreditservice (Cyprus) Ltd Is Systematic Internaliser

Financial Instruments for which BrokerCreditService (Cyprus) Ltd is Systematic Internaliser Period: 18 November 2019 – 14 February 2020 Shares and Equity-Like financial Instruments ISIN Instrument Description US00206R1023 AT&T INC US02079K1079 Alphabet Inc-CL C US0222761092 Aluminium Corporation of China - ADR US3364331070 First Solar Inc US3453708600 Ford Motor Co US50186V1026 LG Display Co LTD - ADR US5949181045 Microsoft Corp US5951121038 Micron Technology INC US6549022043 Nokia - ADR US87238U2033 TCS Group Holding PLC - GDR US8765685024 TATA Motors LTD -SPON ADR US92763W1036 Vipshop Holdings Ltd - ADR US9485961018 Weibo Corp - ADR Non-equity financial Instruments (Bonds) For the financial instruments listed herebelow, BrokerCreditService (Cyprus) Limited is considered to be Systematic Internaliser in respect of all bonds belonging to a class of bonds issued by the same entity or by any entity within the same group. ISIN Instrument Description RU000A0JXTS9 Russia, 4.25% 23jun2027, USD RU000A0ZYYN4 Russia, 4.375% 21mar2029, USD RU000A0ZZVE6 Russia, 2.875% 4dec2025, EUR RU000A0ZZXP8 Credit Europe Bank, 001P-02 Systematic Internaliser financial instruments Page 1 of 3 ISIN Instrument Description RU000A1005L6 AFK Sistema, 001P-09 US706451BG56 Pemex, 6.625% 15jun2035, USD US81180WAN11 Seagate Technology, 5.75% 1dec2034 US900123AL40 Turkey, 11.875% 15jan2030, USD US900123BH29 Turkey, 5.625% 30mar2021, USD USC3314PAB25 Eldorado Gold Corp, 6.125% 15dec2020, USD USG50027AE42 Jaguar Land Rover, 5.625% 1feb2023, USD USL00849AA47 Adecoagro, 6% -

Together Towards a Better Future…

TOGETHER TOWARDS A BETTER FUTURE… PETKİM 2016 ANNUAL REPORT CONTENTS 14 GENERAL INFORMATION 56 COMPANY ACTIVITIES AND MAJOR DEVELOPMENTS 84 FINANCIAL STATUS 14 Our Vision, Our Mission, Our Values IN ACTIVITIES 84 An Assessment of the Financial Standing by the 16 Petkim in Brief 57 Main Developments in the Market in 2016 Management 18 SOCAR 58 Petkim in 2016 85 Profit Distribution Policy 20 SOCAR Turkey 58 Production 23 The Socar Turkey “Value-Site” 2023 Vision 60 Logistics 86 RISKS AND AN ASSESSMENT BY THE GOVERNING BODY 26 Key Parameters and Financial Highlights 64 Sales and Marketing 28 Petkim Plants 66 Technology 88 OTHER MATTERS AND FINANCIAL STATEMENTS 30 Milestones from Petkim’s History 68 Information on the Company’s Investments 88 Corporate Governance Principles Compliance Report 34 Message from the Chairman of the Board of Directors 70 Sustainability 106 Amendments to the Articles of Association 36 Message from the General Manager 80 Investor Relations 108 Agenda 39 Organization, Capital and Shareholding Structure of 82 Internal Audit Systems the Company 82 Internal Control System and an Assessment by the 109 Profit Distribution Table 39 Organizational Structure Governing Body 110 Statement of Responsibility 39 Information on Privileged Shares and Voting Rights of 83 Information on Associates 112 Audit Committee Reports Shares 83 Repurchased Own Shares by the Company 114 Independent Auditor’s Report on the Annual Report of 40 Information on the Governing Body, Executives and 83 Disclosure on Special Audit and Public Audit the -

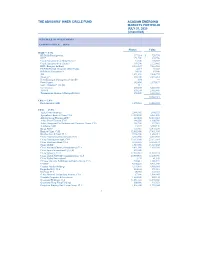

Printmgr File

THE ADVISORS’ INNER CIRCLE FUND ACADIAN EMERGING MARKETS PORTFOLIO JULY 31, 2020 (Unaudited) SCHEDULE OF INVESTMENTS COMMON STOCK — 98.4% Shares Value Brazil — 3.7% BR Malls Participacoes 377,114 $ 720,750 BRF* 151,500 603,206 Cia de Saneamento de Minas Gerais* 33,300 348,669 Cia de Saneamento do Parana* 397,200 2,323,862 EDP - Energias do Brasil 2,093,847 7,413,588 FII BTG Pactual Corporate Office Fund‡ 4,317 75,382 IRB Brasil Resseguros S 54,338 83,540 JBS 1,831,876 7,609,772 Minerva* 868,100 2,263,212 Nova Embrapar Participacoes* (A) (B) 854 — Porto Seguro 345,400 3,570,832 Seara Alimentos* (A) (B) 911 — Sul America 638,288 6,225,588 TOTVS 639,294 3,165,495 Transmissora Alianca de Energia Eletrica 650,249 3,618,623 38,022,519 Chile — 1.4% Enel Americas ADR 1,850,041 14,004,810 China — 43.0% Agile Group Holdings 2,496,592 3,166,523 Agricultural Bank of China, Cl H 17,084,000 6,061,830 Alibaba Group Holding ADR* 210,408 52,816,616 Anhui Conch Cement, Cl H 146,500 1,106,741 Anhui Hengyuan Coal Industry and Electricity Power, Cl Aˆ200GnmxPMGpKe6Lo+Š 185,200 137,981 Autohome ADR 43,187 3,785,341200GnmxPMGpKe6Lo+ LSWP64RS10 SEI INVESTMENTS Baidu ADR* Donnelley Financial14.3.14.0 LSWpf_rend 15-Sep-2020 07:22107,816 EST 12,873,230 948527 TX 1 11* Bank of China, Cl H 52,052,000 17,461,930 AIC ACADIAN - NPORT-Baoshan Iron & NoneSteel, Cl ALNF 2,106,500 1,484,917 HTM ESS 0C China Communications Services, Cl H 3,116,900 2,018,869 Page 1 of 1 China Construction Bank, Cl H 37,544,000 27,515,054 China Merchants Bank, Cl A 2,738,325 13,653,372 China -

Araştirma Bilgi Notu - Imkb100-50-30

ARAŞTIRMA BİLGİ NOTU - IMKB100-50-30 01 OCAK 2012 – 31 MART 2012 İTİBARI İLE ENDEKSLERİN KAPSAMINDAKİ HİSSELER IMKB 100 IMKB 100 IMKB 50 IMKB 30 ADANA ÇİMENTO(C) İPEK DOĞAL ENERJİ ADVANSA SASA AKBANK ADVANSA SASA İŞ BANKASI (C) AFYON ÇİMENTO AKSA AKRİLİK KİMYA AFYON ÇİMENTO İŞ FİNANSAL KİRALAMA AK ENERJİ ARÇELİK AK ENERJİİŞ GAYRİMENKUL Y.O. AKBANK ASYA KATILIM BANKASI AKBANK İTTİFAK HOLDİNG AKSA AKRİLİK KİMYA BİM MAĞAZALAR AKFEN HOLDİNG İZMİR DEMİR ÇELİK ANADOLU EFES DOĞAN HOLDİNG AKSA AKRİLİK KİMYA KARDEMİR (D) ARÇELİK EMLAK KONUT GMYO AKSA ENERJİ KARSAN OTOMOTİVASELSANENKA İNŞAAT AKSİGORTA KARTONSAN ASYA KATILIM BANKASI EREĞLİ DEMİR ÇELİK ALARKO HOLDİNG KİLER GIDA BAGFAŞ GARANTİ BANKASI ANADOLU EFES KİLER GMYO BİM MAĞAZALAR İHLAS HOLDİNG ANADOLU SİGORTA KOÇ HOLDİNG BİZİM MAĞAZALARI İŞ BANKASI (C) ARÇELİKKONYA ÇİMENTO DOĞAN HOLDİNG KARDEMİR ( D ) ASELSAN KOZA ALTIN DOĞAN YAYIN HOLDİNG KOÇ HOLDİNG ASYA KATILIM BANKASI KOZA MADENCİLİKECZACIBAŞI İLAÇ KOZA ALTIN AYGAZ MENDERES TEKSTİL EMLAK KONUT GMYO MİGROS TİCARET BAGFAŞ METRO HOLDİNG ENKA İNŞAAT PETKİM BANVİTMİGROS TİCARET EREĞLİ DEMİR ÇELİK SABANCI HOLDİNG BEŞİKTAŞ FUTBOL YAT. MONDİ TİRE KUTSAN FENERBAHÇE SPORTİFSİNPAŞ GMYO BİM MAĞAZALAR MUTLU AKÜ FORD OTOSAN ŞİŞE CAM BİZİM MAĞAZALARI NET HOLDİNG GALATASARAY SPORTİF T. HALK BANKASI BORUSAN MANNESMANN NET TURİZM GARANTİ BANKASI TEKFEN HOLDİNG BOYNER MAĞAZACILIK NETAŞ TELEKOM GOOD-YEAR TOFAŞ OTOMOBİL FAB. BRİSA OTOKAR İHLAS HOLDİNG TURKCELL DEVA HOLDİNG PARK ELEKT. MADENCİLİK İŞ BANKASI (C) TÜPRAŞ DO-CO RESTAURANTS PETKİM İZMİR DEMİR ÇELİKTÜRK HAVA YOLLARI DOĞAN HOLDİNG RHEA GİRİŞİMKARDEMİR (D) TÜRK TELEKOM DOĞAN YAYIN HOLDİNG SABANCI HOLDİNG KOÇ HOLDİNG TÜRK TRAKTÖR DOĞUŞ OTOMOTİVSİNPAŞ GMYO KONYA ÇİMENTO VAKIFLAR BANKASI ECZACIBAŞI İLAÇ ŞEKERBANK KOZA ALTIN YAPI VE KREDİ BANKASI ECZACIBAŞI YATIRIM ŞİŞE CAM KOZA MADENCİLİK EGE GÜBRE T.