The Only Event Dedicated to Esg, Bonds & Loans

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(As Defined Below) Under Rule 144A Or (2) Non-U.S

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) QIBS (AS DEFINED BELOW) UNDER RULE 144A OR (2) NON-U.S. PERSONS (AS DEFINED IN REGULATION S) OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the Preliminary Offering Memorandum following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Preliminary Offering Memorandum. In accessing the Preliminary Offering Memorandum, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from the Bank as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S (“REGULATION S”) UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THE FOLLOWING PRELIMINARY OFFERING MEMORANDUM MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND IN PARTICULAR MAY NOT BE FORWARDED TO ANY U.S. -

2018 Activity Report

MOST VALUABLE INVESTMENT IS TRUSTING FACES 2018 ACTIVITY REPORT 1 1 TABLE OF CONTENTS Foreword 05 GENERAL INFORMATION 1 Our Bank 07 About Us, Our Vision, Our Mission, Our Strategy 08-11 Capital, Partnership Structure, Shares of the Board Members & Amendments to the Articles of Association 13 Objectives of Nurolbank in 2018 15 Banking Services 16-17 Our Milestones 20-21 Financial Indicators 23 Rating of the Rating Agency 24-33 Sectoral Breakdown of Total Risks 35 Nurolbank’s Activities in 2018 and Its Position in the Sector 36 Key Financial Indicators & Performance Ratios 37 Our Opinions About the World and Turkish Economy 39 Message from Chairman of the Board 40-41 Message from General Manager 42-43 Global Economy 45-47 Turkish Economy 49-51 MANAGEMENT AND CORPORATE MANAGEMENT PRACTICES Yönetim ve Komitelerimiz 52-57 2 Board Members 58-63 Senior Management 64-66 Board Committees 68 Human Resources Practices 71 Corporate Management Codes of Conduct Practices 75 Information on the Bank’s Transactions with the Involved Risk Group Support in Accordance with the Bank’s Regulation on Receiving Support Services 75 FINANCIAL INFORMATION AND ASSESSMENTS ON RISK MANAGEMENT 3 Etik Kurallarımız 76-79 Audit Committee Report 81-83 Risk Management Policies Applied Depending on Risk Types 84-85 Independent Auditor’s Report on Annual Activity Report of the Board Ordinary General Assembly Agenda 86 NUROL INVESMENT BANK INCORPORATED COMPANY INDEPENDENT AUDITOR’S REPORT AS OF DECEMBER 4 31, 2018, CONSOLIDATED FINANCIAL STATEMENTS AND FOOTNOTES ABOUT FINANCIAL STATEMENTS 93 2 3 Most valuable investment is trusting faces Without doubt, finance is more than just the numbers. -

As Defined in Regulation S) Outside of the U.S

IMPORTANT NOTICE OFFERINGS UNDER THE PROGRAMME ARE AVAILABLE ONLY TO INVESTORS WHO ARE PERSONS OTHER THAN U.S. PERSONS (AS DEFINED IN REGULATION S) OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the Base Prospectus following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Base Prospectus. In accessing the Base Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from the Bank as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. SECURITIES OFFERED UNDER THE PROGRAMME HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S (“REGULATION S”) UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THE FOLLOWING BASE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND IN PARTICULAR MAY NOT BE FORWARDED TO ANY U.S. -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

Financial Outlook of the Oic Member Countries 2016

FINANCIAL OUTLOOK OF THE OIC MEMBER COUNTRIES 2016 COMCEC COORDINATION OFFICE October 2016 FINANCIAL OUTLOOK OF THE OIC MEMBER COUNTRIES 2016 COMCEC COORDINATION OFFICE October 2016 For further information please contact: COMCEC Coordination Office Necatibey Caddesi No: 110/A 06100 Yücetepe Ankara/TURKEY Phone: 90 312 294 57 10 Fax: 90 312 294 57 77 Web: www.comcec.org PREFACE The Standing Committee for Economic and Commercial Cooperation of the Organization of the Islamic Cooperation (COMCEC) Financial Outlook is a contribution of the COMCEC Coordination Office to enrich the discussions during the Finance Working Group Meetings being held twice a year. Finance Working Group is established as part of the implementation of the COMCEC Strategy. For developing a common language/understanding, and approximating policies in financial cooperation to address and find solutions to the financial challenges of the OIC Member Countries, the COMCEC Strategy envisages Financial Cooperation Working Group as one of the implementation instruments of the Strategy. In this respect, Finance Working Group Meetings aim to provide a regular platform for the member countries’ experts to elaborate thoroughly financial cooperation issues and share their best practices and experiences. COMCEC Financial Outlook 2015 is prepared by Alper BAKDUR (Chapters 1, 2 and 3) and Okan POLAT (Chapters 4 and 5), with the objective of presenting a general outlook of the financial system of the OIC Member States, highlighting the potential areas for cooperation in this sector and as well as evaluating the recent developments in the global financial structure. Views and opinions expressed in the report are solely those of the author(s) and do not represent the official views of the COMCEC Coordination Office or the Member States of the Organization of Islamic Cooperation. -

IFC Deal Query Based on IFC Investment Services Projects

IFC Deal Query Based on IFC Investment Services Projects Date Disclosed Project Name Project Number Product Line 07/23/2021 DCM UBP Social Bond 44900 Loan 07/07/2021 RATCH Loan 43901 Loan 07/01/2021 HDFC II 44139 Loan 06/30/2021 Erste_CRO_MREL 44745 Loan 06/30/2021 OCB green loan 43733 Loan 06/30/2021 Aspen Pharmacare 45174 Loan 06/29/2021 PSL - Ultratech 45146 Loan 06/28/2021 Banco BV SEF Credit Line 43661 Loan 06/24/2021 CTP Bond 44887 Loan 06/23/2021 WCS COVID NMBTZ 44080 Loan 06/22/2021 NSG RSE FACILITY 45366 Loan 06/15/2021 Axian Togo 44666 Loan Page 1 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Company Name Country Sector UNION BANK OF THE Philippines Financial Institutions PHILIPPINES RH INTERNATIONAL Thailand Infrastructure (SINGAPORE) CORPORATION PTE. LTD. HOUSING DEVELOPMENT India Financial Institutions FINANCE CORPORATION LIMITED ERSTE & Croatia Financial Institutions STEIERMARKISCHE BANK D. D. ORIENT COMMERCIAL Vietnam Financial Institutions JOINT STOCK BANK ASPEN FINANCE South Africa other PROPRIETARY LIMITED PRECIOUS SHIPPING Thailand Infrastructure PUBLIC COMPANY LIMITED BANCO VOTORANTIM S.A. Brazil Financial Institutions CTP N.V. Central Europe Region other NMB BANK PLC Tanzania Financial Institutions NSG UK ENTERPRISES Argentina Manufacturing LIMITED LA SOCIETE HOLDING Togo Telecommunications, Media, and Technology Page 2 of 1315 09/29/2021 IFC Deal Query Based on IFC Investment Services Projects Environmental Category Department Status FI-2 Regional Industry - FIG Asia & Pac Active B Regional -

Istanbul, Turkey March 4, 2020 #GTRTURKEY

Istanbul, Turkey #GTRTURKEY www.gtreview.com March 4, 2020 OVERVIEW Once registered, log-in to GTR Connect to network with fellow delegates, download event The region’s premier industry gathering returns materials and more. to Istanbul in 2020, offering key insights into Turkey’s developing influence on the international trade stage. Last year among other crucial talking points, discussions centred As the world’s leading trade, commodity and export around new horizons for Turkish exporters, plus financial support finance publisher and event organiser,GTR offers mechanisms for aiding Turkish exports in 2020. With over 300 sponsors and advertisers unrivalled exposure and delegates from international and regional companies expected profiling among their peer and client groups.GTR can to be in attendance, this event is not to be missed for those offer various appealing options that would strategically wanting to extend their global reach and industry knowledge in and effectively help raise the profile of the partner, this exciting market. and offer a highly effective platform with which to showcase its capabilities and mission. “It is a unique opportunity where all stakeholders of the trade finance industry meet.” K Sirdar, Borcelik Sponsorship opportunities Beatrice Boldini Head of Business Development [email protected] “Excellent event. The roundtable discussions were a +44 (0)20 8772 3009 great initiative to foster networking, making this year’s event even better!” Speaking opportunities B Şahin, Taraboru Matt Hines Conference Producer -

As Defined in Regulation S) Outside of the U.S

IMPORTANT NOTICE OFFERINGS UNDER THE PROGRAMME ARE AVAILABLE ONLY TO INVESTORS WHO ARE PERSONS OTHER THAN U.S. PERSONS (AS DEFINED IN REGULATION S) OUTSIDE OF THE U.S. IMPORTANT: You must read the following before continuing. The following applies to the Base Prospectus following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Base Prospectus. In accessing the Base Prospectus, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from the Bank as a result of such access. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. SECURITIES OFFERED UNDER THE PROGRAMME HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE U.S. OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE U.S. OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (AS DEFINED IN REGULATION S (“REGULATION S”) UNDER THE SECURITIES ACT), EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND APPLICABLE STATE OR LOCAL SECURITIES LAWS. THE FOLLOWING BASE PROSPECTUS MAY NOT BE FORWARDED OR DISTRIBUTED TO ANY OTHER PERSON AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER AND IN PARTICULAR MAY NOT BE FORWARDED TO ANY U.S. -

Offering Memorandum Dated October 26, 2012

IMPORTANT NOTICE THIS OFFERING IS AVAILABLE ONLY TO INVESTORS WHO ARE EITHER (1) QIBs (AS DEFINED BELOW) UNDER RULE 144A OR (2) NON-U.S. PERSONS (AS DEFINED BELOW) OUTSIDE OF THE UNITED STATES IMPORTANT: You must read the following before continuing. The following applies to the Offering Memorandum following this page, and you are therefore advised to read this carefully before reading, accessing or making any other use of the Offering Memorandum. In accessing the Offering Memorandum, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from the Bank (as defined in the Offering Memorandum) as a result of such access. THE OFFERING MEMORANDUM IS NOT AN OFFER TO SELL SECURITIES AND THE BANK IS NOT SOLICITING OFFERS TO BUY SECURITIES IN ANY JURISDICTION WHERE SUCH OFFER OR SALE IS NOT PERMITTED. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN THE UNITED STATES OR ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. THE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE ‘‘SECURITIES ACT’’), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES OR OTHER JURISDICTION AND THE SECURITIES MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES OR TO, OR FOR THE ACCOUNT OR BENEFIT OF, U.S. PERSONS (‘‘U.S. PERSONS’’) AS DEFINED IN REGULATION S (‘‘REGULATION S’’) UNDER THE SECURITIES ACT, EXCEPT PURSUANT TO AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN COMPLIANCE WITH ANY APPLICABLE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES. -

Printmgr File

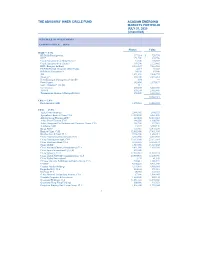

THE ADVISORS’ INNER CIRCLE FUND ACADIAN EMERGING MARKETS PORTFOLIO JULY 31, 2020 (Unaudited) SCHEDULE OF INVESTMENTS COMMON STOCK — 98.4% Shares Value Brazil — 3.7% BR Malls Participacoes 377,114 $ 720,750 BRF* 151,500 603,206 Cia de Saneamento de Minas Gerais* 33,300 348,669 Cia de Saneamento do Parana* 397,200 2,323,862 EDP - Energias do Brasil 2,093,847 7,413,588 FII BTG Pactual Corporate Office Fund‡ 4,317 75,382 IRB Brasil Resseguros S 54,338 83,540 JBS 1,831,876 7,609,772 Minerva* 868,100 2,263,212 Nova Embrapar Participacoes* (A) (B) 854 — Porto Seguro 345,400 3,570,832 Seara Alimentos* (A) (B) 911 — Sul America 638,288 6,225,588 TOTVS 639,294 3,165,495 Transmissora Alianca de Energia Eletrica 650,249 3,618,623 38,022,519 Chile — 1.4% Enel Americas ADR 1,850,041 14,004,810 China — 43.0% Agile Group Holdings 2,496,592 3,166,523 Agricultural Bank of China, Cl H 17,084,000 6,061,830 Alibaba Group Holding ADR* 210,408 52,816,616 Anhui Conch Cement, Cl H 146,500 1,106,741 Anhui Hengyuan Coal Industry and Electricity Power, Cl Aˆ200GnmxPMGpKe6Lo+Š 185,200 137,981 Autohome ADR 43,187 3,785,341200GnmxPMGpKe6Lo+ LSWP64RS10 SEI INVESTMENTS Baidu ADR* Donnelley Financial14.3.14.0 LSWpf_rend 15-Sep-2020 07:22107,816 EST 12,873,230 948527 TX 1 11* Bank of China, Cl H 52,052,000 17,461,930 AIC ACADIAN - NPORT-Baoshan Iron & NoneSteel, Cl ALNF 2,106,500 1,484,917 HTM ESS 0C China Communications Services, Cl H 3,116,900 2,018,869 Page 1 of 1 China Construction Bank, Cl H 37,544,000 27,515,054 China Merchants Bank, Cl A 2,738,325 13,653,372 China -

Araştirma Bilgi Notu - Imkb100-50-30

ARAŞTIRMA BİLGİ NOTU - IMKB100-50-30 01 OCAK 2012 – 31 MART 2012 İTİBARI İLE ENDEKSLERİN KAPSAMINDAKİ HİSSELER IMKB 100 IMKB 100 IMKB 50 IMKB 30 ADANA ÇİMENTO(C) İPEK DOĞAL ENERJİ ADVANSA SASA AKBANK ADVANSA SASA İŞ BANKASI (C) AFYON ÇİMENTO AKSA AKRİLİK KİMYA AFYON ÇİMENTO İŞ FİNANSAL KİRALAMA AK ENERJİ ARÇELİK AK ENERJİİŞ GAYRİMENKUL Y.O. AKBANK ASYA KATILIM BANKASI AKBANK İTTİFAK HOLDİNG AKSA AKRİLİK KİMYA BİM MAĞAZALAR AKFEN HOLDİNG İZMİR DEMİR ÇELİK ANADOLU EFES DOĞAN HOLDİNG AKSA AKRİLİK KİMYA KARDEMİR (D) ARÇELİK EMLAK KONUT GMYO AKSA ENERJİ KARSAN OTOMOTİVASELSANENKA İNŞAAT AKSİGORTA KARTONSAN ASYA KATILIM BANKASI EREĞLİ DEMİR ÇELİK ALARKO HOLDİNG KİLER GIDA BAGFAŞ GARANTİ BANKASI ANADOLU EFES KİLER GMYO BİM MAĞAZALAR İHLAS HOLDİNG ANADOLU SİGORTA KOÇ HOLDİNG BİZİM MAĞAZALARI İŞ BANKASI (C) ARÇELİKKONYA ÇİMENTO DOĞAN HOLDİNG KARDEMİR ( D ) ASELSAN KOZA ALTIN DOĞAN YAYIN HOLDİNG KOÇ HOLDİNG ASYA KATILIM BANKASI KOZA MADENCİLİKECZACIBAŞI İLAÇ KOZA ALTIN AYGAZ MENDERES TEKSTİL EMLAK KONUT GMYO MİGROS TİCARET BAGFAŞ METRO HOLDİNG ENKA İNŞAAT PETKİM BANVİTMİGROS TİCARET EREĞLİ DEMİR ÇELİK SABANCI HOLDİNG BEŞİKTAŞ FUTBOL YAT. MONDİ TİRE KUTSAN FENERBAHÇE SPORTİFSİNPAŞ GMYO BİM MAĞAZALAR MUTLU AKÜ FORD OTOSAN ŞİŞE CAM BİZİM MAĞAZALARI NET HOLDİNG GALATASARAY SPORTİF T. HALK BANKASI BORUSAN MANNESMANN NET TURİZM GARANTİ BANKASI TEKFEN HOLDİNG BOYNER MAĞAZACILIK NETAŞ TELEKOM GOOD-YEAR TOFAŞ OTOMOBİL FAB. BRİSA OTOKAR İHLAS HOLDİNG TURKCELL DEVA HOLDİNG PARK ELEKT. MADENCİLİK İŞ BANKASI (C) TÜPRAŞ DO-CO RESTAURANTS PETKİM İZMİR DEMİR ÇELİKTÜRK HAVA YOLLARI DOĞAN HOLDİNG RHEA GİRİŞİMKARDEMİR (D) TÜRK TELEKOM DOĞAN YAYIN HOLDİNG SABANCI HOLDİNG KOÇ HOLDİNG TÜRK TRAKTÖR DOĞUŞ OTOMOTİVSİNPAŞ GMYO KONYA ÇİMENTO VAKIFLAR BANKASI ECZACIBAŞI İLAÇ ŞEKERBANK KOZA ALTIN YAPI VE KREDİ BANKASI ECZACIBAŞI YATIRIM ŞİŞE CAM KOZA MADENCİLİK EGE GÜBRE T. -

Turquoise Equities

Technical Notice 16 October 2014 Turquoise Equities Turkish Securities Available on Customer Development Service (CDS) Turquoise is pleased to announce that Borsa Istanbul BIST 30 Index constituents are available on the CDS environment for testing. Details of available instruments are listed below: Symbol Name ISIN CCY MIC AKBNKy AKBANK T.A.S. TRAAKBNK91N6 TRY XIST ARCLKy ARCELIK AS TRAARCLK91H5 TRY XIST ASELSy ASELSAN ELEKTRONIK SANAYI TRAASELS91H2 TRY XIST BIMASy BIM BIRLESIK MAGAZALAR AS TREBIMM00018 TRY XIST EKGYOy EMLAK KONUT GAYRIMENKUL YATI TREEGYO00017 TRY XIST ENKAIy ENKA INSAAT VE SANAYI AS TREENKA00011 TRY XIST EREGLy EREGLI DEMIR VE CELIK FABRIK TRAEREGL91G3 TRY XIST FROTOy FORD OTOMOTIV SANAYI AS TRAOTOSN91H6 TRY XIST SAHOLy HACI OMER SABANCI HOLDING TRASAHOL91Q5 TRY XIST KRDMDy KARDEMIR KARABUK DEMIR-CL D TRAKRDMR91G7 TRY XIST KCHOLy KOC HOLDING AS TRAKCHOL91Q8 TRY XIST KOZALy KOZA ALTIN ISLETMELERI AS TREKOAL00014 TRY XIST KOZAAy KOZA ANADOLU METAL MADENCILI TREKOZA00014 TRY XIST MGROSy MIGROS TICARET A.S TREMGTI00012 TRY XIST PGSUSy PEGASUS HAVA TASIMACILIGI AS TREPEGS00016 TRY XIST 1 Technical Notice 25 November 2013 PETKMy PETKIM PETROKIMYA HOLDING AS TRAPETKM91E0 TRY XIST TAVHLy TAV HAVALIMANLARI HOLDING AS TRETAVH00018 TRY XIST TKFENy TEKFEN HOLDING AS TRETKHO00012 TRY XIST TOASOy TOFAS TURK OTOMOBIL FABRIKA TRATOASO91H3 TRY XIST TUPRSy TUPRAS-TURKIYE PETROL RAFINE TRATUPRS91E8 TRY XIST THYAOy TURK HAVA YOLLARI AO TRATHYAO91M5 TRY XIST SISEy TURK SISE VE CAM FABRIKALARI TRASISEW91Q3 TRY XIST TTKOMy TURK TELEKOMUNIKASYON AS TRETTLK00013 TRY XIST TCELLy TURKCELL ILETISIM HIZMET AS TRATCELL91M1 TRY XIST GARANy TURKIYE GARANTI BANKASI TRAGARAN91N1 TRY XIST HALKBy TURKIYE HALK BANKASI TRETHAL00019 TRY XIST ISCTRy TURKIYE IS BANKASI-C TRAISCTR91N2 TRY XIST VAKBNy TURKIYE VAKIFLAR BANKASI T-D TREVKFB00019 TRY XIST ULKERy ULKER BISKUVI SANAYI TREULKR00015 TRY XIST YKBNKy YAPI VE KREDI BANKASI TRAYKBNK91N6 TRY XIST Details of the production dates will be announced in due course.