International Tax Policy for the 21St Century

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BEYOND PUBLIC CHOICE and PUBLIC INTEREST: a STUDY of the LEGISLATIVE PROCESS AS ILLUSTRATED by TAX LEGISLATION in the 1980S

University of Pennsylvania Law Review FOUNDED 1852 Formerly American Law Register VOL. 139 NOVEMBER 1990 No. 1 ARTICLES BEYOND PUBLIC CHOICE AND PUBLIC INTEREST: A STUDY OF THE LEGISLATIVE PROCESS AS ILLUSTRATED BY TAX LEGISLATION IN THE 1980s DANIEL SHAVIRO" TABLE OF CONTENTS I. INTRODUCTION ................................. 3 II. HISTORICAL OVERVIEW OF CYCLICAL TAX LEGISLATION ... 11 A. Legislation From the Beginning of the Income Tax Through the 1970s: The Evolution of Tax Instrumentalism and Tax Reform ..................................... 11 t Assistant Professor, University of Chicago Law School. The author was a Legislation Attorney with theJoint Committee of Taxation during the enactment of the 1986 tax bill discussed in this Article. He is grateful to Walter Blum, Richard Posner, Cass Sunstein, and the participants in a Harvard Law School seminar on Current Research in Taxation, held in Chatham, Massachusetts on August 23-26, 1990, for helpful comments on earlier drafts, to Joanne Fay and Michael Bonarti for research assistance, and to the WalterJ. Blum Faculty Research Fund and the Kirkland & Ellis Faculty Fund for financial support. 2 UNIVERSITY OF PENNSYLVANIA LAW REVIEW [Vol. 139: 1 B. The 1981 Act and Its Aftermath ................... 19 C. The 1986 Act ............................... 23 D. Aftermath of the 198.6 Act ......................... 29 E. Summary .................................. 30 III. THE PUBLIC INTEREST THEORY OF LEGISLATION ........ 31 A. The Various Strands of Public Interest Theory .......... 31 1. Public Interest Theory in Economics ............ 31 2. The Pluralist School in Political Science .......... 33 3. Ideological Views of the Public Interest .......... 35 B. Criticisms of PublicInterest Theory .................. 36 1. (Largely Theoretical) Criticisms by Economists ... 36 a. When Everyone "Wins," Everyone May Lose .. -

Mayo Clinic, a Minnesota Corporation

United States Court of Appeals For the Eighth Circuit ___________________________ No. 19-3189 ___________________________ Mayo Clinic, a Minnesota Corporation lllllllllllllllllllllPlaintiff - Appellee v. United States of America lllllllllllllllllllllDefendant - Appellant ____________ Appeal from United States District Court for the District of Minnesota ____________ Submitted: October 20, 2020 Filed: May 13, 2021 ____________ Before SMITH, Chief Judge, LOKEN and GRUENDER, Circuit Judges. ____________ LOKEN, Circuit Judge. Mayo Clinic (“Mayo”), a Minnesota nonprofit corporation, oversees healthcare system subsidiaries and operates the Mayo Clinic College of Medicine and Science (“Mayo College”). Mayo is a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code (IRC), 26 U.S.C. § 501(c)(3).1 After an audit in 2009, the Internal Revenue Service concluded that Mayo owed unrelated business income tax (“UBIT”) on certain investment income it received from the investment pool it manages for its subsidiaries. The IRS issued a Notice of Proposed Adjustment and reaffirmed its position in a 2013 Technical Advice Memorandum. At issue is $11,501,621 in UBIT for tax years 2003, 2005-2007, and 2010-2012. Mayo2 paid the tax and brought this refund action. The issue, briefly stated, is whether Mayo is a “qualified organization” exempted from paying UBIT on “unrelated debt-financed income” under IRC § 514(c)(9)(C)(i). Qualified organizations include “an organization described in section 170(b)(1)(A)(ii) . .” Section 170(b)(1)(A)(ii) describes “an educational organization which normally maintains a regular faculty and curriculum and normally has a regularly enrolled body of pupils or students in attendance at the place where its educational activities are regularly carried on.” The IRS denied Mayo the exemption because it is not an “educational organization” as defined in 26 C.F.R. -

RESTORING the LOST ANTI-INJUNCTION ACT Kristin E

COPYRIGHT © 2017 VIRGINIA LAW REVIEW ASSOCIATION RESTORING THE LOST ANTI-INJUNCTION ACT Kristin E. Hickman* & Gerald Kerska† Should Treasury regulations and IRS guidance documents be eligible for pre-enforcement judicial review? The D.C. Circuit’s 2015 decision in Florida Bankers Ass’n v. U.S. Department of the Treasury puts its interpretation of the Anti-Injunction Act at odds with both general administrative law norms in favor of pre-enforcement review of final agency action and also the Supreme Court’s interpretation of the nearly identical Tax Injunction Act. A 2017 federal district court decision in Chamber of Commerce v. IRS, appealable to the Fifth Circuit, interprets the Anti-Injunction Act differently and could lead to a circuit split regarding pre-enforcement judicial review of Treasury regulations and IRS guidance documents. Other cases interpreting the Anti-Injunction Act more generally are fragmented and inconsistent. In an effort to gain greater understanding of the Anti-Injunction Act and its role in tax administration, this Article looks back to the Anti- Injunction Act’s origin in 1867 as part of Civil War–era revenue legislation and the evolution of both tax administrative practices and Anti-Injunction Act jurisprudence since that time. INTRODUCTION .................................................................................... 1684 I. A JURISPRUDENTIAL MESS, AND WHY IT MATTERS ...................... 1688 A. Exploring the Doctrinal Tensions.......................................... 1690 1. Confused Anti-Injunction Act Jurisprudence .................. 1691 2. The Administrative Procedure Act’s Presumption of Reviewability ................................................................... 1704 3. The Tax Injunction Act .................................................... 1707 B. Why the Conflict Matters ....................................................... 1712 * Distinguished McKnight University Professor and Harlan Albert Rogers Professor in Law, University of Minnesota Law School. -

The Joint Committee on Taxation and Codification of the Tax Laws

The Joint Committee on Taxation and Codification of the Tax Laws George K. Yin Edwin S. Cohen Distinguished Professor of Law and Taxation University of Virginia Former Chief of Staff, Joint Committee on Taxation February 2016 Draft prepared for the United States Capitol Historical Society’s program on The History and Role of the Joint Committee: the Joint Committee and Tax History Comments welcome. THE UNITED STATES CAPITOL HISTORICAL SOCIETY THE JCT@90 WASHINGTON, DC FEBRUARY 25, 2016 The Joint Committee on Taxation and Codification of the Tax Laws George K. Yin* February 11, 2016 preliminary draft [Note to conference attendees and other readers: This paper describes the work of the staff of the Joint Committee on Internal Revenue Taxation (JCT)1 that led to codification of the tax laws in 1939. I hope eventually to incorporate this material into a larger project involving the “early years” of the JCT, roughly the period spanning the committee’s creation in 1926 and the retirement of Colin Stam in 1964. Stam served on the staff for virtually this entire period; he was first hired (on a temporary basis) in 1927 as assistant counsel, became staff counsel in 1929, and then served as Chief of Staff from 1938 until 1964. He is by far the longest‐serving Chief of Staff the committee has ever had. The conclusions in this draft are still preliminary as I have not yet completed my research. I welcome any comments or questions.] Possibly the most significant accomplishment of the JCT and its staff during the committee’s “early years” was the enactment of the Internal Revenue Code of 1939. -

Note on Taxation System

Note on Taxation system Introduction Today an important problem against each government is that how to get income temporarily by debt also, but they have to return it after some time. Some government income is received from government enterprises, administrative and judicial tasks and other such sources, but a big part of government income is received from taxation. Taxes: - Taxes are those compulsory payments which are used without any such hope towards government by tax payers that they will get direct benefit in return of them. According to Prof. Seligman, ‘’ Tax is that compulsory contribution given to Government by individuals which is paid in the payment of expenses in all general favours and no special benefit is given in lieu of that.’’ According to Trussing, ‘’The special thing is that in regard of tax in comparison to all amounts taken by government, quid pro quo is not found directly between taxpayer and government administration in it.’’ Characteristics of a Tax It is clear by above mentioned definitions that some specialties are found in tax which are as follows: - (1) Compulsory Contribution—Tax is a contribution given to state by people living within the premises of country due to residence and property etc. or by citizens and this contribution is given for general use only. Though it is a compulsory contribution, therefore, no individual can deny from the payment of tax. For example, no person can say that he is not getting benefit from some services provided by that state or he didn’t get the right to vote, therefore, he is not bound to pay tax. -

Report No. 82-156 Gov Major Acts of Congress And

REPORT NO. 82-156 GOV MAJOR ACTS OF CONGRESS AND TREATIES APPROVED BY THE SENATE 1789-1980 Christopher Dell Stephen W. Stathis Analysts in American National Governent Government Division September 1982 CONmGHnItNA^l JK 1000 B RE filmH C SE HVICA^^ ABSTRACT During the nearly two centuries since the framing of the Constitution, more than 41,000 public bills have been approved by Congress, submitted to the President for his approval and become law. The seven hundred or so acts summarized in this compilation represent the major acts approved by Congress in its efforts to determine national policies to be carried out by the executive branch, to authorize appropriations to carry out these policies, and to fulfill its responsibility of assuring that such actions are being carried out in accordance with congressional intent. Also included are those treaties considered to be of similar importance. An extensive index allows each entry in this work to be located with relative ease. The authors wish to credit Daphine Lee, Larry Nunley, and Lenora Pruitt for the secretarial production of this report. CONTENTS ABSTRACT.................................................................. 111 CONGRESSES: 1st (March 4, 1789-March 3, 1791)..................................... 3 2nd (October 24, 1791-March 2, 1793)................................... 7 3rd (December 2, 1793-March 3, 1795).................................. 8 4th (December 7, 1795-March 3, 1797).................................. 9 5th (May 15, 1797-March 3, 1799)....................................... 11 6th (December 2, 1799-March 3, 1801)................................... 13 7th (December 7, 1801-Marh 3, 1803)................................... 14 8th (October 17, 1803-March 3, 1805)....... ........................... 15 9th (December 2, 1805-March 3, 1807)................................... 16 10th (October 26, 1807-March 3, 1809).................................. -

Vol. 6, No. 2: Full Issue

Denver Journal of International Law & Policy Volume 6 Number 2 Spring Article 11 May 2020 Vol. 6, no. 2: Full Issue Denver Journal International Law & Policy Follow this and additional works at: https://digitalcommons.du.edu/djilp Recommended Citation 6 Denv. J. Int'l L. & Pol'y This Full Issue is brought to you for free and open access by the University of Denver Sturm College of Law at Digital Commons @ DU. It has been accepted for inclusion in Denver Journal of International Law & Policy by an authorized editor of Digital Commons @ DU. For more information, please contact [email protected],dig- [email protected]. DENVER JOURNAL OF INTERNATIONAL LAW AND POLICY VOLUME 6 1976-1977 Denver Journal OF INTERNATIONAL LAW AND POLICY VOLUME 6 NUMBER 2 SPRING 1977 INTERNATIONAL ASPECTS OF THE TAX REFORM ACT OF 1976 TAXING BoYcorrs AND BRIBES ........................................... G. C . Hufbauer J. G. Taylor 589 The authors examine the tax penalty provisions of the Tax Reform Act of 1976 and the Export Administration Act Amendments of 1977 in relation to U.S. persons who "participate in or cooperate with" international boycotts or bribery. The article discusses the various types of international boycotts and the penalty, computational, and reporting requirements imposed on participants as clarified by the Treasury Guidelines and Revenue Proce- dures. The authors conclude with a discussion of the novelty, complexity, and potential impact of the legislation. TAKING SIDES: AN OVERVIEW OF THE U.S. LEGISLATIVE RESPONSE TO THE ARAB BOYCOTT ............................................ John M . Tate Ralph B. Lake 613 The current legislative scheme in opposition to the Arab boycott is generally directed against the Arab League countries' secondary and tertiary, indirect forms of boycott. -

Real Property Like-Kind Exchanges Since 1921, the Internal Revenue

Real Property Like-kind Exchanges Since 1921, the Internal Revenue Code has recognized that the exchange of one property held for investment or business use for another property of a like-kind results in no change in the economic position of the taxpayer and therefore should not result in the imposition of tax. This concept is codified today in section 1031 of the Internal Revenue Code with respect to the exchange of real and personal property, and it is one of many nonrecognition provisions in the Code that provide for deferral of gains. The Obama Administration’s fiscal year 2015 budget targets section 1031 by substantially repealing the provision with respect to real property by limiting the amount of gain that may be deferred to $1 million annually. This proposal could have a significant negative impact on the real estate sector with real implications for the broader economy. Background The original like-kind exchange rule goes all the way back to the Revenue Act of 1921 when Congress created section 202(c), which allowed investors to exchange securities and property that did not have a “readily realized market value.” This rather broad rule was eliminated in 1924 and replaced with section 112(b) in the Revenue Act of 1928, which permitted the deferral of gain on the like-kind exchange of similar property. With limited exceptions, generally related to narrowing the provision, Congress has largely left the like-kind rule unchanged since 1928.1 Section 1031 permits taxpayers to exchange assets used for investment or business purposes for other like-kind assets without the recognition of gain. -

America's Economic Way Of

|America’s Economic Way of War How did economic and financial factors determine how America waged war in the twentieth century? This important new book exposes the influence of economics and finance on the questions of whether the nation should go to war, how wars would be fought, how resources would be mobilized, and the long-term consequences for the American economy. Ranging from the Spanish–American War to the Gulf War, Hugh Rockoff explores the ways in which war can provide unique opportunities for understanding the basic principles of economics as wars produce immense changes in monetary and fiscal policy and so provide a wealth of infor- mation about how these policies actually work. He shows that wars have been more costly to the United States than most Americans realize as a substantial reliance on borrowing from the public, money creation, and other strategies to finance America’s war efforts have hidden the true cost of war. hugh rockoff is a professor of Economics at Rutgers, the State University of New Jersey, and a research associate of the National Bureau of Economic Research. His publications include numerous papers in professional journals, The Free Banking Era: A Re-examination (1975), Drastic Measures: A History of Wage and Price Controls in the United States (1984), and a textbook, History of the American Economy (2010, with Gary Walton). NEW APPROACHES TO ECONOMIC AND SOCIAL HISTORY series editors Nigel Goose, University of Hertfordshire Larry Neal, University of Illinois, Urbana-Champaign New Approaches to Economic and Social History is an important new textbook series published in association with the Economic History Society. -

Summary of the Tax Reform Act of 1976, H.R. 10612, 94Th Congress

^/i I O I M T C M \ ENACTEi:: q4.T^ JOIN'- SUMMARY OF THE TAX REFORM ACT OF 1976 (H.R. 10612, 94TH CONGRESS, PUBLIC LAW 94-455) PREPARED BY THE STAFF OF THE JOINT COMMITTEE ON TAXATION OCTOBER 4, 1976 U.S. GOVERNMENT PRINTING OFFICE 77-889 O WASHINGTON : 1976 JC8-31-76 For sale by the Superintendent of Documents, U.S. Government Printing Office Washington, D.C. 20402 - Price $1.65 CONGRESS OF THE UNITED STATES (94th Cong., 2d sess.) Joint Committee on Taxation Senate House RUSSELL B. LONG, Louisiana, Cliainnan AL ULLMAN, Oregon, Vice Chairman HERMAN E. TALMADGE, Georgia JAMES A. BURKE, Massaciiusetts VANCE R. HARTKE, Indiana DAN ROSTENKOWSKI, IlUnois CARL T. CURTIS, Nebraska HERMAN T. SCHNEEBELI, Pennsylvania PAUL J. FANNIN, Arizona BARBER B. CONABLE, Jr., New York Laurence N. Woodworth, Chief of Staff Herbert L. Cuabot, Assistant Chief of Staff Bernard M. Shatiro, Assistant Chief of Staff (n) LETTER OF TRANSMITTAL October 4, 1976. Hon. Russell B. Long, Chairman, Hon. Al Ullman, Vice Chairman, Joint Committee on Taxation, U.S. Congress, Washington, D.C Dear Messrs. Chairmen: Immediately following the passage of the conference report by the House and the Senate on the Tax Reform Act of 1976 (H.R. 10612), the House and Senate also passed a House Concurrent Resolution (H. Con. Res. 751), rearranging the section numbers of the bill in a more logical sequence. In addition, the House Concurrent Resolution made corrections of printing, clerical, and technical errors. Primarily because of the rearrangement of the section numbers, the Public Law (P.L. -

Legal Status of Capital Gains

LEGAL STATUS OF CAPITAL GAINS PREPARED BY THE STAFF OF THE JOINT COMMITTEE ON INTERNAL REVENUE TAXATION DECEMBER 4, 1959 UNITED STATES GOVERNMENT PRINTING OFFICE 48572 WASHINGTON : 1959 J0810-59 LEGAL STATUS OF CAPITAL GAINS HISTORICAL PERIOD PRIOR TO THE 16TH AMENDMENT The power of the CQngress to subject capital gains to an income tax is now fully established by decisions of the Suprenle Court. Even in our first inconle tax statute (act of 1861, 12 Stat. 292) Congress used language broad enough to warrant the taxation of "annual cap ital gains." This first act levied on income tax to be paid upon the "annual income" deriyecl fronl certain sources, including income "deriyed from an:r kind of property" and contained a catchall provi sion s,,~eeping in "income derived fronl any other source whatever" with certain exceptions having no relation to capital gains. This act was neYer put into effect and was superseded by- the act of 1862 (12 Stat. 432), ,,~hich was similar in this respect to the 1861 act except that the basis of the tax was changed fronl "annual income" to the longer nhrase "annual gains, profits, or income." It \vas not until the act of 1864 (13 Stat. 223) that income derived fronl sales of prop erty was specifically mentioned. This last act contained the same general definition of income referred to in the prior acts, with an additional proviso- that net profits realized by sales of real estate purchased within the year for which income is estimated, shall be chargeable as income; and losses on sales of real estate purchased within the year for which income is estimated, shall be deducted from the income of such year. -

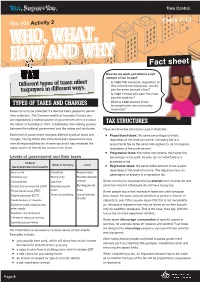

WHO, WHAT, HOW and WHY Fact Sheet

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income.