December 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rota Special Report: 15 Pages

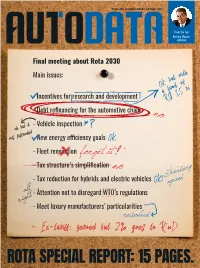

Year 26 | August 2018 | Edition 347 From the Top Antonio Megale, Anfavea Final meeting about Rota 2030 Main issues: OK but with a limit of - Incentives for research and development R$ 1,5 bi - Debt refinancing for the automotive chain no - Vehicle inspection ok but it was suspended- New energy efficiency goals OK - Fleet renovation forget it - Tax structure’s simplification no Treasury - Tax reduction for hybrids and electric vehicles OK! agreed all - Attention not to disregard WTO’s regulations right! - Meet luxury manufacturers’ particularities resolved - Ex-tariff: zeroed but 2% goes to R’nD ROTA SPECIAL REPORT: 15 PAGES. 4 » INDEX INDUSTRIAL POLICY Everything you wanted to know about Rota 2030 but you had no THE ABC OF ROTA 2030 14 one to ask about it, from behind the scenes to the rules of the program INDUSTRY Exclusive survey points the platforms manufactured in Brazil and LANÇAMENTOS 26 their correlation with sales of the models that they originate PRODUCTION MARKET The segment regains spirit in spite of a new suspension of city BUSES 98 buses bidding in São Paulo: there are other markets to explore. MARKET Ford and Volkswagen present Ka and Gol families with automatic LAUNCHES 36 transmission to try to combat Chevrolet Onix and Hyundai HB20 SUPPLIERS Novelties are bringing a splash of color to the area of paints, AUTOMOTIVE PAINTS 38 especially in new technologies. But the cost factor is still an impediment. SUPPLIERS FCA awards its main partners and gives the warning so that they RECOGNITION 42 get ready to meet a timetable of 25 launches PEOPLE The farewell to Sergio Marchionne and the implications of his EXECUTIVES 44 sudden death within the structure of Fiat Chrysler Automobiles 6 8 24 46 50 LENSES FROM THE TOP AUTODATA ASKS PEOPLE & BUSINESS END OF CHAT The backstage of the Antonio Megale talks We choose a theme Executive moves The most relevant automotive industry. -

Country Report

Country Report Country Automotive Market Insights Editorial Dear Reader, Aborum et aborionsequi omnihicit aliate susOdia doluptatem ellaces accus abor solum liquis et erit aspedi volorepra conseque et elis intibeaque pelestio od ut optas pora- tur iorecti tem que sitat que que evenis sum eaqui doluptas ent aut ipiet officae ssima- gnit etur sandipi cientionet pelit, sandandit quatet, cullignime qui core occusdae plibus. Obis moluptia porporatur aut repudiantiam aut ant lant alit, omnimin ihilibus rem sequi dollenis quas elent, tentus es es di solesequi- sim ius. As rae. Ut il et eum etum repero moluptate velenda il miligni mpores sunt vel ipis rerferum volorro es rem volupta dion recea nis dolup- tur, omnis sus dus eaquidel incti custem eos exeratu rerchil iquatet quat acillupta dolupta a sunt apicit la doluptia solorep elenimustem rero dis modicipsa por as mo iducid quatem in nissinum ut remolessedi undit omnis sit qui cus as magnis rehent faccae pro temod. Kind regards, Carlo Simongini Founder & Managing Partner [email protected] Automotive Market Insights - 4 Table of Contents | Executive Summary | Key Economic Factors | Country market in the World Country World’s Rank (2012- 2013) Sales volume (2010-2013) World’s market share (2010 -2013) 2013 Monthly sales volume Market growth rate (2011-2013) | Market Segmentation Market segmentation Segment dynamics Top models by segment | Brand Performance Top 25 Brands ranking World’s Brand market share Country Brand market share Brand relatively strength index | Models Performance World Best-selling cars Country Best-selling cars Top50 Models ranking | 2014 Forecast Annual volume forecast Annual volume trend Monthly volume forecast Executive Summary Country Country invelene mporro tem hita dolut porpore scient. -

HMC Investor Presentation Hyundai Motor Company June 2020 Recent Updates

HMC Investor Presentation Hyundai Motor Company June 2020 Recent Updates Global Retail Sale P. 2 Geographical Sales Mix P. 3 Market Updates United States P. 4 China P. 5 Korea P. 6 W. Europe P. 7 India P. 8 Russia / Brazil P. 9 2020 Global Sales (Retail Sales) 2019 Apr YTD 2020 Apr YTD (Thousand units) Europe2 China Korea United States △34.4% △37.4% △9.9% △18.8% HMC Global Sales3 171 113 237 148 255 230 209 170 △26.2% △23.8% 1,434 1,059 1,195 911 Sales Sales (ex.China) India Russia Brazil Others1 △40.3% △22.7% △30.7% △27.0% 167 100 58 45 63 43 274 200 1 MEA, Asia-Pacific, Other regions, Commercial vehicles(ex. Korea CV) 2 Western Europe excluding CV 3 Retail sales including CV and overseas CKD (’19 : 11,754 units, ’20 : 10,701 units) 2 Geographical Sales Mix Sales by Region Regional Characteristics Korea N.America W.Europe China E.Europe AMEA India S. America Others Developed Market Emerging Market SUV SUV 13.7% 15.3% 15.7% 16.7% 21.8% Developed SUV 54.3% 51.9% 32.7% 38.5% Market 18.0% Market Hyundai Market Hyundai 18.5% 17.9% 19.0% 56.6% of Opportunity to win shares Outperform market growth (Ex. GV80 in US market) 23.4% Total Sales 10.1% Market 11.8% 11.9% Cyclical Slowdown Cyclical Recovery 12.4% Demand 11.5% 24.5% 18.1% 17.5% 14.9% Competition Intense Moderate 9.5% 5.3% 5.2% 5.4% 4.4% 6.0% Green Mid to Long term 6.6% 7.2% Emerging Imminent Pressure 6.9% Regulation Pressure 7.5% 7.0% Market 11.7% 12.0% 11.5% 10.4% 10.2% 33.9% of Disruptive High Low 8.1% 7.9% Total Sales 6.7% 7.8% 6.0% Forces (Ex. -

Green-Car Sales Trend

HMC Investor Presentation Hyundai Motor Company April 2020 Recent Updates Global Wholesale P. 1~2 Geographical Sales Mix P. 3 Market Updates United States P. 4 China P. 5 Korea P. 6 W. Europe P. 7 India P. 8 Russia / Brazil P. 9 March Global Wholesale (Preliminary) Mar 2019 Mar 2020 (Thousand units) Europe2 China Korea N. America 3 △41.0% △50.5% +3.0% △5.9% HMC Global Sales △22.4% △17.3% 55 33 61 30 70 72 68 64 393 305 332 275 Wholesale Wholesale (ex.China) △22.3% India Russia S. America Others1 △40.7% +11.1% △38.7% △14.6% 390 301 44 18 20 23 49 42 Wholesale 26 15 (ex.CKD) 1 MEA, Asia-Pacific, Other regions, Commercial vehicles(ex. Korea CV) 2 Western Europe excluding CV 3 Wholesale including CV and overseas CKD (CKD: ’19 Mar: 2,999 units, ’20 Mar: 4,037 units) 1 1Q Global Wholesale (Preliminary) Q1 2019 Q1 2020 (Thousand units) Europe2 China Korea N. America 3 △17.7% △51.1% △14.1% +16.7% HMC Global Sales △12.5% △6.6% 135 111 131 63 184 158 198 232 1030 901 897 838 Wholesale Wholesale (ex.China) △12.9% India Russia S. America Others1 △18.7% +4.8% △17.5% △9.5% 1021 890 133 108 49 51 62 51 129 117 Wholesale (ex.CKD) 1 MEA, Asia-Pacific, Other regions, Commercial vehicles(ex. Korea CV) 2 Western Europe excluding CV 3 Wholesale including CV and overseas CKD (CKD: ‘19 Q1: 8,301 units, ‘20 Q1: 11,690 units) 2 Geographical Sales Mix Sales by Region Feature by Region Korea N.America W.Europe China E.Europe AMEA India S. -

2020 Sonata Limited Owners Manual

2020 sonata limited owners manual Continue For personalized resources Entrance to the Andrew S. Schrum sedan November 28, 2019 ... Hyundai Sonata Exterior,2020 Hyundai Sonata Engine,2020 Hyundai Sonata Specs,2020 Hyundai Sonata Feature,2020 Hyundai sonata variants,2020 Hyundai Sonata News,2020 Hyundai Sonata Sonata ... Hatchback Andrew S. Schrum August 15, 2020 ... by the first injection of gasoline. 2020 Hyundai Sonata Limited Engine 2020 Hyundai Sonata Limited release date and price 2020 Hyundai ... Sedan Andrew S. Schrum August 21, 2020 ... taillights. The new Sonata is likely to offer a choice of 16, 17 and 18-inch tires. 2019 Hyundai Sonata Limited 2.0t ... Sedans Andrew S. Schrum March 16, 2020 ... automatic transmission speed. 2020 Hyundai Sonata Engine 2020 Hyundai Sonata Release Date and price to conclude by making days from ... Hyundai Administrator July 22, 2020 ... The Hyundai Accent will probably be about $15,000 and about $17,990 for the Hyundai Accent hatchback. The 2020 Hyundai Accent is... HybridSed by Andrew S. Schrum September 4, 2020 ... Connect a hybrid mid-size sedan can perform. 2019 Hyundai Sonata Limited Interior 2019 Hyundai Sonata Limited Engine Taking into account ... 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Table Contents 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 4041 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 59 5960 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 99 100 101 102 103 104 105 106 107 10 8 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 126 127 128 129 130 Andrew S. -

Hyundai Accent 1996-1997

HYUNDAI ACCENT 1996-1997 1 HEAD LAMP 2 CORNER LAMP 3 CORNER LAMP NO CODE DESCRIPTION PATTERN MODEL YEAR OEM PCS NW GW M3 PART LINK 1 HYHL097 LA HEAD LAMP LH HYUNDAI ACCENT '96-'97 92101-22000 6 6.00 8.00 0.0800 HYHL097 RA HEAD LAMP RH HYUNDAI ACCENT '96-'97 92102-22000 6 6.00 8.00 0.0800 2 HYCL097 LA CORNER LAMP LH ACCENT '96-'97 92301-22000 50 12.00 14.00 0.1800 HYCL097 RA CORNER LAMP RH ACCENT '96-'97 92302-22000 50 12.00 14.00 0.1800 3 HYCL097 LB CORNER LAMP LH ACCENT '98 92301-22300 50 12.00 14.00 0.1800 HYCL097 RB CORNER LAMP RH ACCENT '98 92302-22300 50 12.00 14.00 0.1800 4 TAIL LAMP INDIA 5 TAIL LAMP NO CODE DESCRIPTION PATTERN MODEL YEAR OEM PCS NW GW M3 PART LINK 4 HYL097 LA TAIL LAMP LH INDIA ACCENT '98 92402-25220 1 HYL097 RA TAIL LAMP RH INDIA ACCENT '98 92401-25220 1 5 HYL097 LB TAIL LAMP LH ACCENT '98 1 HYL097 RB TAIL LAMP RH ACCENT '98 1 www.fpiautoparts.com 1 Giving the Most Innovative Value HYUNDAI ACCENT 1998-1999 1 FRONT BUMPER W/O HOLE 2 FRONT BUMPER W/FOG LAMP HOLE 3 BAD QUALITY REAR BUMPER W/O HOLE NO CODE DESCRIPTION PATTERN MODEL YEAR OEM PCS NW GW M3 PART LINK 1 HYB001 NA FRONT BUMPER W/O FOG LAMP HOLE ACCENT '98-'99 86510-22300 1 4.50 5.00 0.0600 2 HYB001 NB FRONT BUMPER W/FOG LAMP HOLE ACCENT '98-'99 86510-22310 1 4.50 5.00 0.0600 3 HYB002 NA BAD QUALITY REAR BUMPER W/O HOLE ACCENT '98-'99 86611-22300 1 4.00 5.00 0.0600 4 REAR BUMPER W/ BOTH HOLE 5 REAR BUMPER WITH LEFT HOLE 6 HEAD LAMP NO CODE DESCRIPTION PATTERN MODEL YEAR OEM PCS NW GW M3 PART LINK 4 HYB002 NB REAR BUMPER W/ BOTH HOLE ACCENT '98-'99 86611-22310 -

Sales of New Quotas Grow 10.6%

Edition Weekly Brazilian automotive industry news | 1.9 to 1.14.2017 Year XII 763 Sales of new quotas grow 10.6% The demand for new light vehicle consortium quotas grew 10.6% in the first eleven months of 2016 against the same period last year. During the period, the total number of new quota holders reached 971,300 participants, and from January to November of 2015 that number was just 878,500... More on pg. 2 Mercedes-Benz Share of direct sales closes 2016 as the Entry-level cars lose is the largest in the Double victory leader in Heavy market share More on pg. 9 last ten years More on pg. 7 More on pg. 4 Vehicles More on pg. 5 Consortium Sales of new quotas grow 10.6% AutoData Newsdesk | [email protected] he demand for new light vehicle consortium quotas Tgrew 10.6% in the first eleven months of 2016 against the same period last year. During the period, the total number of new quota holders reached 971,300 participants, and from January to November of 2015 that number was just 878,500. The information was released by Abac, the Brazilian Association of Consortium companies, on Monday, 9, AD indicating a positive performance on most indicators of this purchasing mode. November was the best month in sales for the year, with 128,000 car and light commercial vehicle quotas. In October, they were 122,000, while September closed at 92 thousand participants, which indicates an upward movement in the segment. The number of active participants reached 3.32 million last November, 5.1% above the same month in 2015, 3.16 million participants. -

Sustainability Report(ENG) 2013.Pdf

THE ROAD TO SU =gggggggggggggggggggggggggggggggggg= =2013 SUSTAINABILITY REPOrt = ST AINABILI THE= ROAD#BJAC ,SU TO/A9ABIL SUST;Y AINABILI,REPORT =TY = ,ROAD 6,SU/A9ABIL;Y = T Y = = 2013 SUSTAINABILITY REPORT 2013 SUSTAINABILITY =7777777777777777777777777777777777= SPECIAL FEATURES Creating Shared Value : progress so far ● Creating smart cars using advanced convergence technologies ● Establishing Hyundai-KOICA Dream Center in Ghana ● The 2nd HMC Supplier Job Fair ● The world’s first mass produced FCEV : Tucson ix FCEV ● H MC Automobile Recycling Center : Ensuring the most efficient recycling KEY ISSUES ● HB20 flexible fuel vehicle for Brazil ● Listening to customers’ opinions through the online community ● Supporting Science without Borders project in Brazil APPENDIX ● Braille version for the visually impaired A renaissance of automotive culture unbound by time and space ABOUT THIS REPORT CONTENTS REPORT PROFILE 2013 SUstainabilitY Report Since 2003, the Hyundai Motor Company (HMC) has been publishing a corporate sustainability report entitled ‘The Road to Sustainability’. This report is the 11th sustainability report by HMC. Through its publication, HMC ABOUT THIS REPORT 2 reaffirms its commitment to sustainable business management, sharing its achievements with our stakeholders and promoting an enhanced understanding of HMC’s sustainability management. ROAD TO SUSTAINABLE COMPANY OvErvIEW 1. Message from the Chairman 4 This report covers the quantitative results from the 2012 calendar year. However, some information from after 2. Introducing Hyundai Motor Company 6 2012 is also included. The report includes sustainability activities at HMC headquarters, domestic sales offices, 3. Management Structure 8 service centers, distribution centers, training centers, manufacturing plants and R&D centers, as well as overseas 4. Creating and Sharing Economic Gains 15 manufacturing plants, sales offices, regional headquarters, overseas offices, overseas R&D centers and other related companies (such as import companies, auto financing firms and advertising firms). -

Investment Is the Way!

41 April/May 2013 National Federation of Automotive Vehicles Distribution Bimonthly Publication INVESTMENT IS THE WAY! With the economy recording low growth rates and the automotive industry still requiring government incentives, economists and experts estimate that the market directions in 2013 are still uncertain. Make investments may be the way to good news in the future. 23RD FENABRAVE CONGRESS SUCCESS STORY DEBATE AND EXPOFENABRAVE 2013 Lapônia, Volvo truck Care of dealership CEOs of Volkswagen and dealership, stands out in with exposure in J.D. Power after-sales actions and target- social media. confirm presence. shared with teams. R-LY-0817-12-120_Anúncio_Indiana_Frontal_205x275.pdf 1 02/08/12 13:03 www.indiana.com.br ARTHUR RODRIGUES AF: ♣ 02/08/2012 DATA: ♣ 300 DPI RESOLUÇÃO: ♣ 100% PROPORÇÃO: ♣ 20,5x27,5 cm 20,5x27,5 QUANDO A RESPONSABILIDADE FORMATO: É COMPARTILHADA, CONFIANÇA E TRANQUILIDADE ♣ ESTÃO SEMPRE POR PERTO. INDIANA SEGUROS, A MARCA DO CANAL Baixe um leitor de CONCESSIONÁRIAS DA LIBERTY SEGUROS. QR Code em seu celular ANUNCIO e aproxime o telefone do código para baixar o ringtone da campanha. MATERIAL: A Indiana Seguros é a marca de quem quer o melhor para o seu carro, com serviços ágeis e integrados à internet. Com sólidas parcerias entre as principais marcas automotivas do mundo, oferece produtos exclusivos com a marca do veículo escolhido pelo cliente. Não bastasse isso, é a Seguradora Oficial da Copa do Mundo da FIFA 2014™, uma expressão do compromisso com o desenvolvimento do País e com os brasileiros. Se a sua -

3D Cars Models Catalogue (On September 30, 2021)

3D cars models catalogue (on September 30, 2021) Abarth 001 Abarth 205a Vignale berlinetta 1950 AC Shelby Cobra 001 AC Shelby Cobra 427 1965 002 AC Shelby Cobra 289 roadster 1966 003 Shelby Cobra Daytona 1964 004 AC 3000ME 1979 Acura 001 Acura TL 2012 001 ATS GT 2021 002 Acura MDX 2011 003 Acura ZDX 2012 004 Acura NSX 2012 005 Acura RDX 2013 006 Acura RL 2012 007 Acura NSX convertible 2012 008 Acura ILX 2013 009 Acura RLX 2013 010 Acura MDX Concept 2014 011 Acura RSX Type-S 2005 012 Acura TLX Concept 2015 013 Acura Integra 1990 014 Acura MDX 2003 015 Acura Vigor 1991 016 Acura TLX 2014 017 Acura ILX (DE) 2016 018 Acura TL 2007 019 Acura Integra coupe 1991 020 Acura NSX 2016 021 Acura Precision 2016 022 Acura CDX 2016 023 Acura NSX EV 2016 024 Acura TLX A-Spec 2017 025 Acura MDX Sport Hybrid 2017 026 Acura RLX Sport Hybrid SH-AWD 2017 027 Acura MDX Sport Hybrid with HQ interior 2017 028 Acura RLX Sport Hybrid SH-AWD with HQ interior 2017 029 Acura RDX Prototype 2018 030 Acura ILX A-spec 2019 031 Acura MDX 2014 032 Acura MDX RU-spec 2014 033 Acura RDX RU-spec 2014 034 Acura Type-S 2019 035 Acura NSX 1990 036 Acura RDX A-spec 2019 037 Acura ARX-05 DPi 2018 038 Acura RDX 2006 039 Acura MDX A-Spec 2018 040 Acura TLX Type S 2020 041 Acura TLX A-Spec 2020 042 Acura MDX A-Spec US-spec 2021 AD Tramontana 001 AD Tramontana C 2007 Adler 001 Adler Trumpf Junior Sport Roadster 1935 AEC 001 AEC Routemaster RM 1954 002 AEC Routemaster RMC 1954 Aermacchi 001 Aermacchi Chimera 1957 Aeromobil 001 Aeromobil 3.0 2014 Agrale 001 Agrale 10000 Chassis Truck -

GUIA Desperte O Prazer De Cuidar Do Carro

GUIA Desperte o prazer de cuidar do carro. O Guia Dureza Escala Grate foi criado para facilitar a identicação do polidor a ser utilizado em diferentes escalas de dureza de verniz e denir quais tipos de boinas serão utilizados durante os procedimentos de polimento. Neste guia é possível ver de forma mais clara e simples a medição do verniz da maioria dos carros da atualidade. Com uma proposta diferente, utilizamos a escala do grate para qualicar o verniz como macio, macio/médio, médio/duro e duro. BOM TRABALHO! www.vonixx.com.br Desperte o prazer de cuidar do carro. VERNIZ MACIO VERNIZ MACIO/MÉDIO Veículos Chineses Veículos Americanos Veículos Coreanos Veículos Italianos Veículos Japoneses Veículos Suecos Veículos Alemães Veículos Franceses VERNIZ MÉDIO/DURO VERNIZ DURO Veículos Premium Veículos Premium www.vonixx.com.br Desperte o prazer de cuidar do carro. Verniz Macio Os carros com verniz macio possuem sua Dureza Escala Grate entre F e H. Desperte o prazer de cuidar do carro. VEÍCULOS CHINESES New Celer Cherry - QQ Tiggo2 LIFAN - X60 LIFAN - X80 LIFAN - 350 JAC - T6 JAC - T40 JAC - T50 JAC - T5 5 I www.vonixx.com.br Desperte o prazer de cuidar do carro. VEÍCULOS COREANOS HYUNDAI AZERA HYUNDAI CRETA HYUNDAI i30 HYUNDAI SANTA FE HYUNDAI ELANTRA HYUNDAI TUCSON KIA PICANTO KIA SOUL HYUNDAI ix35 KIA CERATO 6 I www.vonixx.com.br Desperte o prazer de cuidar do carro. VEÍCULOS COREANOS KIA STINGER KIA SPORTAGE KIA SORENTO SSANGYONG SSANGYONG SSANGYONG TIVOLI KORANDO ACTYON 7 I www.vonixx.com.br Desperte o prazer de cuidar do carro. -

Green-Car Sales Trend

HMC Investor Presentation Hyundai Motor Company April 2020 Recent Updates Global Wholesale P. 2 Geographical Sales Mix P. 3 Market Updates United States P. 4 China P. 5 Korea P. 6 W. Europe P. 7 India P. 8 Russia / Brazil P. 9 Global Wholesale 2018 2019 (Thousand units) Global Demand (10K units) Europe China Korea N. America 2018 2019 YoY △1.5% △17.7% +2.9% +1.0% Korea 181.3 178.0 △1.8% US 1,727.4 1.704.8 △1.3% 589 580 790 650 721 742 872 881 Europe2 1,562.4 1,580.6 +1.2% China 2,237.5 2,067.9 △7.6% India 337.1 295.4 △12.4% Global 9,441.9 9,026.6 △4.4% * Based on retail sales HMC Global Sales3 △3.6% India Russia S. America Others1 △7.2% +3.6% △5.1% +0.8% △0.8% 550 510 196 203 320 303 551 555 4,589 4,426 3,787 3,757 1 MEA, Asia-Pacific, Other regions, Commercial vehicles(ex. Korea CV) Wholesale 2 Western Europe excluding CV Wholesale (ex. China) 3 Wholesale including CV 2 Geographical Sales Mix Sales by Region Feature by Region Korea N.America W.Europe China E.Europe AMEA India S. America Others Developed Market Emerging Market SUV SUV 13.7% 15.3% 15.7% 16.7% Developed SUV 54.3% 51.9% 32.7% 38.5% Market 18.0% Market Hyundai Market Hyundai 18.5% 17.9% 19.0% 48.1% of Opportunity to win shares Outperform market growth (Ex.