Pricol Limited-Application Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Importers S.N

LIST OF IMPORTERS S.N. IEC Importer 1 888015356 20 MICRONS LTD. 2 793012112 3M INDIA LIMITED 3 388038047 ABB INDIA LIMITED. 4 3892000662 ABI SNOWATECH 5 2503001335 ABIRAMI SOAP WORKS 6 799008966 ACER INDIA (PRIVATE) LTD 7 713020253 ADVICS SOUTH INDIA PRIVATE LIMITED 8 711002207 AGRIPLAST TECH INDIA PVT LTD 9 799008966 AGRITRADE INDIA SERVICES PVT LTD 10 312019882 AGT FOODS INDIA PRIVATE LIMITED 11 712023836 AISIN AUTOMOTIVE KARNATAKA PRIVATE LIMITED 12 288002822 AKZO NOBEL INDIA LIMITED 13 799009091 ALCON LABORATORIES (INDIA) PVT LTD., 14 503082058 ALOK MASTERBATCHES PRIVATE LIMITED 15 288007735 ALSTOM T & D INDIA LIMITED 16 711017956 ALSTOM TRANSPORT INDIA LIMITED 17 497016061 AMALGAMATIONS VALEO CLUTCH PRIVATE LIMITED 18 988006723 AMARA RAJA BATTERIES LTD 19 3306001414 AMAZON WOOD PVT. LTD. 20 488016207 AMBATTUR CLOTHING PRIVATE LIMITED 21 311009174 AMCOL MINERALS & MATERIALS INDIA PVT LTD 22 407034293 AMPHENOL OMNICONNECT INDIA PVT LTD 23 415900018 ANANDA VIKATAN 24 907000657 APARNA ENTERPRISES LIMITED 25 1088000720 APOLLO TYRES LIMITED 26 988001292 AQUAMALL WATER SOLUTIONS LIMITED 27 402017986 ARISTON AGENCY PRIVATE LIMITED 28 300022964 ARKEMA CHEMICALS 29 300062401 ARMSTRONG 30 588169340 ARO GRANITE INDUSTRIES LTD 31 588130311 ASAHI INDIA GLASS LTD 32 798014911 ASHIRVAD PIPES PVT LTD 33 488014336 ASHOK LEYLAND LIMITED 34 388010789 ASIAN PAINTS LTD 35 412001951 ASIAN TRADING COMPANY 36 796005532 AT & S INDIA PRIVATE LIMITED 37 707010462 ATS ELGI LIMITED 38 2588000011 AUROBINDO PHARMA LIMITED 39 507039807 AUTOLIV INDIA PVT. LTD. 40 903006499 AVANTI FEEDS LTD. 41 497016753 BASF CATALYSTS INDIA PVT LTD., 42 388007257 BASF INDIA LIMITED 43 288012101 BATA INDIA LIMITED 44 596004729 BECTON DICKINSON INDIA PRIVATE LIMITED 45 788013441 BEML LIMITED, 46 388167084 BENNETT COLEMAN & CO LTD 47 288019539 BERGER PAINTS INDIA LIMITED 48 788001027 BHARAT ELECTRONICS LTD. -

Logistics Management in Indian Automotive Component Industry

Logistics Management in Indian Automotive Component Industry Dr. W. K. SARWADE M.com, M.B.A. Ph.D. Professor Department of commerce Dr. Babasaheb Ambedkar Marathwada University, Aurangabad-431004 1 Logistics Management in Indian Automotive Component Industry Abstract Many of the leading firms in the Indian automotive component industry have an efficient logistics management system. Having an efficient logistics management system is no longer a choice but a necessarily for these firms considering the global opportunities that have opened for this industry. The Indian automotive component industry has shown tremendous growth over the last decade. Today it has 480 companies, employees more than 2,50,000 people and has an estimated turnover of approximately Rs 45,000 crore (US$ 10 billion). On export front also, the industry has grown by leaps and bounds, generating an overseas sales of to Rs. 8,190 Crores (US$ 1.8 billion) in 2005-06, which is nearly three times of what it exported in 2001-02 (US$ 578 million)1. Keywords:- logistics, employees, automotive, management, employees 2 Introduction: The Indian automotive component industry has shown tremendous growth over the last decade. Today it has 480 companies, employees more than 2,50,000 people and has an estimated turnover of approximately Rs 45,000 crore (US$ 10 billion). On export front also, the industry has grown by leaps and bounds, generating an overseas sales of to Rs. 8,190 Crores (US$ 1.8 billion) in 2005-06, which is nearly three times of what it exported in 2001-02 (US$ 578 million)1. The tremendous growth in the automotive component sector over the last few years is shown in table 1: Table 1: Growth in Production and Exports in the Indian Automotive Component Industry (Rs. -

Minda Corp Kotak

The Research Report is only for reference purposes for residents in India, but not for the purposes of advising or recommending on any investment. Kotak Securities Limited or its affiliates are not seeking any business relationship with any viewer of this report nor does Kotak Securities or its affiliates assume any liability for acting on this report nor does it take any responsibility to update information provided in this report. Company Report Minda Corp. (MDA) BUY Automobiles December 07, 2015 INITIATING COVERAGE Sector view: Attractive Harness the potential. Minda Corporation is one of the leading suppliers of locksets, Price (`): 89 wiring harness and instrument clusters in the Indian automotive market. Our positive view on the stock is underpinned by (1) Minda’s technology tie-ups with global Target price (`): 110 suppliers that give it access to MNC OEMs, (2) its ability to gain market share across BSE-30: 25,530 segments and (3) robust growth potential from new products such as steering roll connectors and sensors. We expect 25% EPS CAGR over FY2016-20E and initiate coverage with a BUY rating; our TP of `110 is based on 15X September 2017E EPS. Technology tie-ups and strong relationship with OEMs to drive market share gains Minda Corporation is well-placed to deliver 20% revenue CAGR over the next five years led by INSIDE (1) market share gains across segments, (2) expansion of product offerings with existing Key technology customers and (3) new products. We expect Minda Furukawa’s market share in wiring harness partners and their to increase to 16% by FY2020 (from 7% currently) led by market share gains with Maruti. -

Flash Report Indian Truck & Bus Market 3Rd Quarter, October – December 2017 Published on February 2018

Special edition 003 Flash Report Indian Truck & Bus Market 3rd Quarter, October – December 2017 Published on February 2018 Published by RACE Innovations Pvt ltd, Chennai © 2018 RACE Innovations Pvt ltd. All rights reserved www.raceinnovations.in Contents Foreword 3 Key Highlights of the Indian Commercial Vehicle Industry 4 Statistics Bus Market 10 Market Share Buses 11 Statistics Trucks 14 Market Share Trucks 16 Statistics Haulage Tractor (Tractor-Semi Trailer/Trailer) 18 Forecasted Q4 (Jan-Mar) of 2017-18 20 RACE Product Offerings 21 Excon 2017 show a brief 22 2 www.raceinnovations.in © 2018 RACE Innovations Pvt ltd. All rights reserved Foreword Post Demonetization discords, GST (Goods and Service Tax) nearing stabilization impacting spurt in truck sales numbers during the third quarter FY2017/18(Oct-Dec) reflecting 54% growth compared to the previous year quarter FY2016/17 (Oct-Dec). It is being observed that more Foreign direct investments (FDI) is been attracted towards this sector paving way to several foreign companies to form partnership with Indian players in turn steepening demand for high performance trucks. On the contrary the seasonal bus sales continues to witness 20% drop in sales compared to previous year quarter FY2016/17(Oct-Dec), mainly owing to weaker market demands. Weaker demands are due to pre-bookings done in the previous years aimed to negate the upsurge in bus & coach price owing to various factors like the bus body code, emission change over, other regulatory fitments getting mandated. We expect the situation to continue in the next quarters until we have new purchase mandates from government like the JnNURM schemes of the last season. -

Pricol Limited(Erstwhile Pricol Pune Limited)

Pricol Limited(erstwhile Pricol Pune Limited) April 12, 2019 Summary of rated instruments Previously Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) Term loans 31.66 148.26 [ICRA]BBB(Negative); revised Long-term fund-based 145.00 145.00 from [ICRA]BBB+ (Stable) Long-term unallocated 77.34 0.74 Short-term non-fund based 21.00 21.00 [ICRA]A3+; revised from Short-term non-fund based (sublimit) (105.00) (105.00) [ICRA]A2 Total 275.00 315.00 *Instrument details in Annexure – I Rationale The revision in ratings considers the deterioration in Pricol’s consolidated financial profile during 9M FY2019 because of weak performance of the Brazil subsidiary, the recently acquired wiping systems business and the standalone entity in India. The company’s consolidated operating margins stood at 1.2% for 9M FY2019 (1.7% for FY2018), significantly weaker than the company’s and ICRA’s earlier estimates. At the net level, Pricol’s consolidated losses widened to 5.5% during 9M FY2019 from 3.0% in FY2018, as against a net turnaround expected earlier for FY2019. The margins were predominantly impacted by a) increase in input/raw material costs in the standalone business due to higher commodity prices, surge in prices of electronic components with global shortage, and adverse forex movement; b) lower-than- anticipated revenues in the Brazil subsidiary and consequent weak absorption of fixed costs; and c) weak performance of the Czech wiping systems business with slowdown in European PV sales in the recent months and Pricol’s inability to improve the entity’s cost structure, among others. -

Y ™Pnco/ Passion to Excel

PR/COL LIMITED (Formerly Pricol Pune Limited] Y ™pnco/ Passion to Excel 109, Race Course, Coimbatore 641018 , India '- +91 422 4336000 ltm +91 422 4336299 ~ [email protected] e pricol . com CIN : L34200TZ2011 PLC02219 4 • CUSTOMERS • EMPLOYEES • SHAREHOLDERS ;..._ SUPPLIERS PL/SEC/TGT/2018-19/100 Thursday,August23, 2018 Corporate Relationship Department The Manager BSE Limited Listing Department 1st Floor, New Trading Ring National Stock Exchange of India Limited Rotunda Building, P J Towers, "Exchange Plaza' , C-1 , Block G Dalal Street, Fort Bandra-Kurla Complex, Mumbai 400 001 Sandra (E), Mumbai - 400051 Scrip Code: 540293 Scrip Code : PRICOLLTD Dear Sir, Sub: 7thAnnual General Meeting - (1) AGM Proceedings (2) Presentation made at the Meeting We wish to inform you that the 7thAnnual General Meeting of the Company held on August 22, 2018 at Chamber Hall, Chamber Towers, 8/732, Avinashi Road, Coimbatore-641 018 and the business(es) mentioned in the notice of the 7th AGM dated 26th June, 2018 were transacted. In this regard we are enclosing the following : 1) Proceedings of AGM as required under Regulation 30, Part-A of Schedule-I II of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. 2) Presentation made at the Annual General Meeting We request you to kindly take the same on record and acknowledge receipt. Thanking you, Yours faithfully, For Pricol Limited- i.~.Thamizhanban Company Secretary 1cs1· M.No: F7897 Encl: as above ISO14001 ISO/TS16949 OHSAS18001 BUREAU VERIT AS BUREAU VERITAS Certification Certification· Proceedings of the 7th Annual General Meeting of Pricol Limited held on Wednesday, the 22nd August 2018 at 4.30 p.m. -

Pointer Telocation and Pricol Sign a Letter of Intent (LOI) to Form a Joint Venture for Telematics Solutions in India and South East Asia

Pointer Telocation and Pricol sign a Letter of Intent (LOI) to form a Joint Venture for Telematics Solutions in India and South East Asia Rosh HaAyin (Israel) and Coimbatore (India) December 12, 2018. Pointer Telocation Ltd. (Nasdaq: PNTR; TASE: PNTR) – a leading developer, manufacturer and operator of Mobile Resource Management (MRM) and Pricol Limited (NSE: PRICOLLTD; BSE: 540293), a leading manufacturer of automotive components for the global automotive market announced today that they intend to enter into a joint venture to provide advanced telematics and IoT solutions in India and other countries in South East Asia. By way of background, under India's Ministry of Road Transport and Highway’s (MoRTH) AIS 140 standard for Intelligent Transport Systems, Vehicle Tracking Systems will become a mandatory feature for all public transport vehicles and commercial vehicles requiring national permit beginning January 2019. This Joint Venture will further enable Pointer and Pricol to be the leaders in the Indian telematics market. Through the joint venture, Pointer and Pricol will provide a variety of telematics solutions to the customers for both the OEM and the aftermarket segments. Pricol will bring its robust manufacturing capabilities as well as strong sales and distribution network in OEM and aftermarket segment. Pointer will provide its capabilities in design and development of telematics solutions, and its strong sales network of telematics service providers, system integrators and mobile operators. Pointer will control 51% interest and Pricol will control 49% interest in this proposed joint venture. Mr. Vikram Mohan, Managing Director, Pricol, commented, “With this partnership, we will be the one stop provider for telematics solutions to our customers. -

Pricol Ltd (PRILI)

ano Direct Instinct I ivesh I-Direct Instinct ICICI Direct Research Key risks to investing in I-direct Instinct • It is a quick pitch note, which captures the essence of an idea in brief • Instinct idea may be based on management interaction or some immediate triggers that may have a positive impact on the future of the company • Target price is based on forward estimates, which will be published along with Detailed Coverage Report or Nano Nivesh report as the case may be • The intent is to capture price action by coming out with a gist, which may or may not be an interim report between management interaction and publication of the final report • The fair value of I-direct Instinct stocks is subject to expected growth potential in the future. Though due diligence has been done to a fair extent, the actualisation of growth still has a degree of uncertainty attached to it. Customers are advised to allocate a small proportion of their investible income to these stocks and diversify well ICICI Securities Ltd | Retail Equity Research Pricol Ltd (PRILI) CMP: | 70 Target: | 95 (36%) Target Period: 12 months BUY April 1, 2021 Loss making entities sold, clean slate growth ahead… Pricol Ltd (Pricol), established in 1974, is a Coimbatore based supplier of diversified auto components like instrument clusters, sensors & switches, pumps and mechanical products, telematics solutions and wiping systems. Particulars In Q3FY21, the company derived ~65% sales from 2-W, 3-W segment, ~4% Particulars Amount from PV, ~8% from CV space, ~9% from off road vehicles & tractors and Market capitalisation (₹ crore) 853 ~13% from aftermarket & exports. -

Pricol Engineering Industries Limited: Ratings Reaffirmed; Outlook on the Long-Term Rating Revised to Stable from Positive Summary of Rating Action

June 08, 2020 Pricol Engineering Industries Limited: Ratings reaffirmed; outlook on the long-term rating revised to Stable from Positive Summary of rating action Previous Rated Current Rated Instrument* Amount Amount Rating Action (Rs. crore) (Rs. crore) [ICRA]BB+ reaffirmed; Outlook on Long-term - Term Loan 10.00 6.00 long-term rating revised to Stable from Positive [ICRA]BB+ reaffirmed; Outlook on Long-term fund-based 5.00 5.00 long-term rating revised to Stable from Positive [ICRA]BB+ reaffirmed; Outlook on Long-term fund-based (sublimit)# (USD 1.54 million) (USD 0.75 million) long-term rating revised to Stable from Positive Short-term non-fund based 7.50 7.50 [ICRA]A4+; reaffirmed [ICRA]BB+/ [ICRA]A4+ reaffirmed; Long-term/ Short-term fund- (2.50) (2.50) Outlook on long-term rating revised to based facilities (sublimit) Stable from Positive [ICRA]BB+/ [ICRA]A4+ reaffirmed; Long-term/ Short-term non-fund (7.50) (7.50) Outlook on long-term rating revised to based facilities (sublimit) Stable from Positive [ICRA]BB+/ [ICRA]A4+ reaffirmed; Long-term/ Short-term 17.50 21.50 Outlook on long-term rating revised to unallocated facilities Stable from Positive Total 40.00 40.00 *Instrument details are provided in Annexure-1 # Although the facility is denominated in foreign currency, ICRA’s rating for the same is on national scale as distinct from international rating scale. Rationale The revision in outlook on the long-term rating considers the moderation in Pricol Engineering Industries Limited’s (PEIL) operating income (OI) and margins in FY2020 and the muted performance expected in FY2021. -

Investors Presentation AGM 2019

Welcome to Pricol Limited’s 8th Annual General Meeting 29 August 2019 Slide 1 Agenda Financial Performance FY 18‐19 & FY 19‐20 (Q1) New Business Wins Company Outlook FY 19‐20 Key Investments & New Plant Key Partnerships Slide 2 Financial Performance FY 18‐19 & FY 19‐20 (Q1) Slide 3 Standalone Financial Performance FY 18‐19: Operations . Pricol’s standalone revenue from operations grew by 10.30% and stood at INR 1297.90 crores in FY 18‐19 . However, Increase in raw material cost on account of electronics price surge, forex impact due to rupee weakening, fuel price surge and additional cost incurred for stock building for new plants as well as managing labour issues resulted in decrease in profit. Cash generation through operations is INR 73.99 crores in FY 18‐19 as against INR 74.46 crores in FY 17‐18. (In INR crores) Particulars FY 18‐19 FY 17‐18 FY 19‐20 Q1 Revenue from operations 1297.90 1176.71 303.06 (excluding excise duty) Profit / (Loss) before Tax 3.90 74.22 (4.40) (before exceptional item) EBITDA 91.22 107.46 25.16 % of Revenue 7.03% 9.13% 8.30% Slide 4 Standalone Financial Performance FY 18‐19: Total Revenue . Total revenue is INR 1383.91 crores in FY 18‐19, which includes the following: . Sale of land held as stock in trade to the tune of INR 11.84 crores . Sale of traded goods to the tune of INR 67.06 crores . Other income is to the tune of INR 5.93 crores . -

APPROVED VENDOR LIST (AVL) As on 01.04.2017

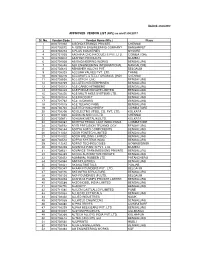

Updated - 01/04/2017 APPROVED VENDOR LIST (AVL) as on 01.04.2017 Sl. No. Vendor Code Vendor Name (M/s.) Place 1 0000701002 A BOND STRANDS PRIVATE CHENNAI 2 0000702572 A JOSEPH ENGINEERING COMPANY BANGARPET 3 0000703274 A PLUS INDUSTRIES MYSORE 4 0000751005 AADHIRA CNC PRODUCTS PVT. LTD. COIMBATORE 5 0000702812 AASHISH PRODUCTS MUMBAI 6 0000701005 AB ENGINEERING WORKS BENGALURU 7 0000703348 ABF ENGINEERING INTERNATIONAL MANGALORE 8 0000702615 ABHISHEK ALLOYS PVT. BELGAUM 9 0000703323 ACCURA VALVES PVT. LTD. THANE 10 0000703216 ACCURATE STEEL FORGINGS [INDI CHENNAI 11 0000703558 ACCUTECH CNC BENGALURU 12 0000702729 ACCUTECH ENTERPRISES BENGALURU 13 0000701013 ACE CARBO NITRIDERS BENGALURU 14 0000703339 ACE FORGE PRIVATE LIMITED BENGALURU 15 0000703256 ACE MULTI AXES SYSTEMS LTD.. BENGALURU 16 0000701014 ACE PRODUCT BENGALURU 17 0000701762 ACE TECHNIKS BENGALURU 18 0000701015 ACE TECHNO FABS BENGALURU 19 0000702704 ACETECH MACHINERY COIMBATORE 20 0000703306 AD ELECTRO STEEL CO. PVT. LTD. KOLKATA 21 0000711020 ADDISON AND CO LTD CHENNAI 22 0000702871 ADHUNIK METALIKS LTD. KOLKATA 23 0000703067 ADITHYA FERRO CAST INDIA PRIVA COIMBATORE 24 0000703593 ADITI PRECISION TECHNOLOGY BENGALURU 25 0000703144 ADITYA AUTO COMPONENTS BENGALURU 26 0000711022 ADOR FONTECH LIMITED BENGALURU 27 0000701022 ADOR WELDING LIMITED BENGALURU 28 0000702542 ADPRO SYSTEMS INDIA BENGALURU 29 0000712542 ADPRO TECHNOLOGIES GOWRIBIDNUR 30 0000703328 ADVANCE PAINTS PVT. LTD. MUMBAI 31 0000703631 ADVANCE TRANSMISSIONS PRIVATE BENGALURU 32 0000703389 AEQUS AUTOMOTIVE PRIVATE -

Pricol Limited(Erstwhile Pricol Pune Limited): Ratings Reaffirmed; Removed from Watch with Developing Implications and Stable Outlook Assigned on Long-Term Rating

September 15, 2020 Pricol Limited(erstwhile Pricol Pune Limited): Ratings reaffirmed; removed from watch with developing implications and Stable outlook assigned on long-term rating Summary of rating action Instrument* Previous Rated Amount Current Rated Amount Rating Action (Rs. crore) (Rs. crore) Term Loans 148.26 179.50 [ICRA]BB+ reaffirmed; Long-term fund-based 145.00 110.00 removed from watch with Long-term unallocated 0.74 4.50 developing implications and Stable outlook assigned Short-term non-fund based 21.00 21.00 [ICRA]A4+ reaffirmed; Short-term non-fund based (sublimit) (105.00) (75.00) removed from watch with developing implications Total 315.00 315.00 *Instrument details are provided in Annexure-1 Rationale The removal of the rating watch (which was placed in June 2019 following the news of the impending divestment of the loss-making subsidiaries) factors in the successful completion of the same in two tranches—in February 2020 and August 2020. The company sold its step-down subsidiaries in Brazil and Mexico in February 2020 for a consideration of $2,000 (~Rs. 1.4 lakh) over and above the takeover of its debt and other liabilities, and its subsidiary in Spain and step-down subsidiary in Czech in August 2020 for a consideration of EUR 50,000 (~Rs. 0.44 crore) net of takeover of all debt and other liabilities. The company’s debt level has reduced post this sale to Rs. 392.8 crore as on August 31, 2020 from Rs. 550.3 crore as on March 31, 2019 and its profitability is expected to improve going forward with sale of sub-par return yielding investments.