[PCGG] 100 Day Report and Plan of Action

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emindanao Library an Annotated Bibliography (Preliminary Edition)

eMindanao Library An Annotated Bibliography (Preliminary Edition) Published online by Center for Philippine Studies University of Hawai’i at Mānoa Honolulu, Hawaii July 25, 2014 TABLE OF CONTENTS Preface iii I. Articles/Books 1 II. Bibliographies 236 III. Videos/Images 240 IV. Websites 242 V. Others (Interviews/biographies/dictionaries) 248 PREFACE This project is part of eMindanao Library, an electronic, digitized collection of materials being established by the Center for Philippine Studies, University of Hawai’i at Mānoa. At present, this annotated bibliography is a work in progress envisioned to be published online in full, with its own internal search mechanism. The list is drawn from web-based resources, mostly articles and a few books that are available or published on the internet. Some of them are born-digital with no known analog equivalent. Later, the bibliography will include printed materials such as books and journal articles, and other textual materials, images and audio-visual items. eMindanao will play host as a depository of such materials in digital form in a dedicated website. Please note that some resources listed here may have links that are “broken” at the time users search for them online. They may have been discontinued for some reason, hence are not accessible any longer. Materials are broadly categorized into the following: Articles/Books Bibliographies Videos/Images Websites, and Others (Interviews/ Biographies/ Dictionaries) Updated: July 25, 2014 Notes: This annotated bibliography has been originally published at http://www.hawaii.edu/cps/emindanao.html, and re-posted at http://www.emindanao.com. All Rights Reserved. For comments and feedbacks, write to: Center for Philippine Studies University of Hawai’i at Mānoa 1890 East-West Road, Moore 416 Honolulu, Hawaii 96822 Email: [email protected] Phone: (808) 956-6086 Fax: (808) 956-2682 Suggested format for citation of this resource: Center for Philippine Studies, University of Hawai’i at Mānoa. -

Stories Captured by Word of Mouth Cultural Heritage Building Through Oral History

STORIES CAPTURED BY WORD OF MOUTH CULTURAL HERITAGE BUILDING THROUGH ORAL HISTORY Christine M. Abrigo Karen Cecille V. Natividad De La Salle University Libraries Oral History, still relevant? (Santiago, 2017) • Addresses limitations of documents • Gathers insights and sentiments • More personal approach to recording history Oral History in the Philippines (Foronda, 1978) There is a scarcity of studies and literatures on the status and beginning of oral history in the country. DLSU Libraries as repository of institutional and national memory Collects archival materials and special collections as they are vital sources of information and carry pertinent evidences of culture and history. Oral history is one of these archival materials. Purpose of this paper This paper intends to document the oral history archival collection of the De La Salle University (DLSU) Libraries; its initiatives to capture, preserve and promote intangible cultural heritage and collective memory to its users through this collection, and the planned initiatives to further build the collection as a significant contribution to Philippine society. ORAL HISTORY COLLECTION (OHC) OF THE DLSU LIBRARIES Provenance The core OHC came from the family of Dr. Marcelino A. Foronda, Jr., a notable Filipino historian and from the Center for Oral and Local History of the university, which was later named in his honor, hence, the Marcelino A. Foronda Jr. Center for Local and Oral History (MAFCLOH). Collection Profile FORMAT Print transcript Audio cassette tape Collection Source (in -

Audio Production Techniques (206) Unit 1

Audio Production Techniques (206) Unit 1 Characteristics of Audio Medium Digital audio is technology that can be used to record, store, generate, manipulate, and reproduce sound using audio signals that have been encoded in digital form. Following significant advances in digital audio technology during the 1970s, it gradually replaced analog audio technology in many areas of sound production, sound recording (tape systems were replaced with digital recording systems), sound engineering and telecommunications in the 1990s and 2000s. A microphone converts sound (a singer's voice or the sound of an instrument playing) to an analog electrical signal, then an analog-to-digital converter (ADC)—typically using pulse-code modulation—converts the analog signal into a digital signal. This digital signal can then be recorded, edited and modified using digital audio tools. When the sound engineer wishes to listen to the recording on headphones or loudspeakers (or when a consumer wishes to listen to a digital sound file of a song), a digital-to-analog converter performs the reverse process, converting a digital signal back into an analog signal, which analog circuits amplify and send to aloudspeaker. Digital audio systems may include compression, storage, processing and transmission components. Conversion to a digital format allows convenient manipulation, storage, transmission and retrieval of an audio signal. Unlike analog audio, in which making copies of a recording leads to degradation of the signal quality, when using digital audio, an infinite number of copies can be made without any degradation of signal quality. Development and expansion of radio network in India FM broadcasting began on 23 July 1977 in Chennai, then Madras, and was expanded during the 1990s, nearly 50 years after it mushroomed in the US.[1] In the mid-nineties, when India first experimented with private FM broadcasts, the small tourist destination ofGoa was the fifth place in this country of one billion where private players got FM slots. -

Martial Law and the Realignment of Political Parties in the Philippines (September 1972-February 1986): with a Case in the Province of Batangas

Southeast Asian Studies, Vol. 29, No.2, September 1991 Martial Law and the Realignment of Political Parties in the Philippines (September 1972-February 1986): With a Case in the Province of Batangas Masataka KIMURA* The imposition of martial lawS) by President Marcos In September 1972 I Introduction shattered Philippine democracy. The Since its independence, the Philippines country was placed under Marcos' au had been called the showcase of democracy thoritarian control until the revolution of in Asia, having acquired American political February 1986 which restored democracy. institutions. Similar to the United States, At the same time, the two-party system it had a two-party system. The two collapsed. The traditional political forces major parties, namely, the N acionalista lay dormant in the early years of martial Party (NP) and the Liberal Party (LP),1) rule when no elections were held. When had alternately captured state power elections were resumed in 1978, a single through elections, while other political dominant party called Kilusang Bagong parties had hardly played significant roles Lipunan (KBL) emerged as an admin in shaping the political course of the istration party under Marcos, while the country. 2) traditional opposition was fragmented which saw the proliferation of regional parties. * *MI§;q:, Asian Center, University of the Meantime, different non-traditional forces Philippines, Diliman, Quezon City, Metro Manila, such as those that operated underground the Philippines 1) The leadership of the two parties was composed and those that joined the protest movement, mainly of wealthy politicians from traditional which later snowballed after the Aquino elite families that had been entrenched in assassination in August 1983, emerged as provinces. -

Women and Politics

WOMEN AND POLITICS Speech of former Senator Leticia Ramos Shahani at the Eminent Women in Politics Lecture Series of Miriam College Women and Gender Institute, Claro M. Recto Hall, Philippine Senate, Thursday, 26 April 2007 I should like to thank the Women and Gender Institute of Miriam College for inviting me to open this series of lectures entitled “Eminent Women in Politics”. The College, true to its pioneering tradition, is to be congratulated for daring to enter a controversial and complicated field of endeavor for women. It is certainly an honor to share the podium today with one of our respected Senators of the land – Senate President Manuel Villar – who is a shining example of what we expect our Senators to be – honest, experienced, dedicated to the progress of our people and country and it should be mentioned, a gender advocate. But Senator Villar does not really need this election plug from me since it looks certain that, with three weeks away from voting time, he will be one of the topnotchers in the coming election for Senators. It is also fitting that Miriam College uses this occasion to commemorate the 70 th anniversary of the Filipino women’s right to vote and be voted upon, a victory of those dynamic and patriotic women of the suffragette movement who enabled Filipino women to enter the mainstream of our nation’s political life not only to cast their vote but to stand for elective office. I do not forget that it is they who enabled me to run for public office when my own time came. -

April 2, 2016 Hawaii Filipino Chronicle 1

ApriL 2, 2016 hAwAii FiLipino ChroniCLe 1 ♦ APRIL 2, 2016 ♦ LEGAL NOTES Q & A TAX TIME F-1 STem Ayonon To LeAd KAuAi one Thing STudenTS CAn now FiLipino ChAmber oF iS CerTAin - STAy Longer CommerCe TAxeS PRESORTED HAWAII FILIPINO CHRONICLE STANDARD 94-356 WAIPAHU DEPOT RD., 2ND FLR. U.S. POSTAGE WAIPAHU, HI 96797 PAID HONOLULU, HI PERMIT NO. 9661 2 hAwAii FiLipino ChroniCLe ApriL 2, 2016 EDITORIALS FROM THE PUBLISHER Publisher & Executive Editor re you living on the financial Charlie Y. Sonido, M.D. Pinoy Cinema on edge? According to a recent poll Publisher & Managing Editor conducted by the Hawaii Apple- Chona A. Montesines-Sonido Display at Filipino seed Center for Law and Eco- Associate Editors Dennis Galolo | Edwin Quinabo nomic Justice, nearly half of A Contributing Editor Film Fest Hawaii residents are living pay- Belinda Aquino, Ph.D. veryone loves a good movie, whether it is science check to paycheck. What is alarming is that Creative Designer fiction, an action-packed thriller or romantic com- when broken down by ethnicity, the poll Junggoi Peralta shows that Filipinos comprise a whopping 78 percent of those Photography edy. Simply kill the lights, snuggle up next to your Tim Llena favorite person or persons, grab a bag of popcorn who live month to month! It just shows how financially pre- Administrative Assistant E and blissfully enjoy the next few hours. carious it is to live in Hawaii, especially when large unexpected Shalimar Pagulayan For those movie goers who prefer a night out, expenses hit. Columnists Carlota Hufana Ader attending a local film festival is a good venue to see a range of On a more positive note, Kauai residents are celebrating Emil Guillermo different movies with a certain theme. -

1991 Edition / Bdition 1991

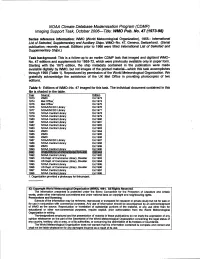

NOAA Climate Database Modernization Program (CDMP) Imaging Support Task, October 20OtL77tle: WOPub. No. 47 (1973-98) Series reference information: WMO (World Meteorological Organization), 195% lntemational List of Selected, Supplementary and Auxiliary Ships. WO-No. 47, Geneva, Switzerland. (Serial publication; recently annual. Editions prior to 1966 were titled lntemational List of Selected and Supplementary Ships.) Task background: This is a follow-up to an earlier CDMP task that imaged and digitized WMO- No. 47 editions and supplements for 1955-72, which were previously available only in paper form. Starting with the 1973 edition, the ship metadata contained in the 'publication were made available digitally by WMO, but not images of the printed material-which this task accomplishes through 1998 (Table 1). Reproduced by permission of the World Meteorological Organization. We .' gratefully acknowledge the assistance of the UK Met Office in providing photocopies of two editions. Table 1: Editions of WMO-No. 47 imaged- for this task. The individual document contained in this file is shaded in the table. -Year Source' Edition 1973 WMO Ed. 1973 1974 Met Office' Ed.1974 1975 Met Offii' Ed. 1975 1976 NOANNCDC Library Ed. 1976 1977 NOWNCDC Library Ed. 1977 1978 NOMCentral Library Ed. 1978 1979 NOAA Central Library Ed. I979 1980 NOMCentral Library Ed.1980 1981 NOAA Central Library Ed.1981 I. 1982 NOMCentral Library Ed. I982 1983 NOMCentral Library Ed.1983 I984 WMO Ed. 1984 1985 WMO Ed. 1985 I986 WMO Ed. 1986 1987 NOWNCDC Library Ed. 1987 1988 NOAA Central Library Ed.1988 1989 WMO Ed.1989 1990 NOAA Central Library Ed.1990 @gji ~~~~~~~~ L!aB-Ba 1992 NOAA Central Library Ed. -

Title Martial Law and Realignment of Political Parties in the Philippines

Martial Law and Realignment of Political Parties in the Title Philippines(September 1972-February 1986): With a Case in the Province of Batangas Author(s) Kimura, Masataka Citation 東南アジア研究 (1991), 29(2): 205-226 Issue Date 1991-09 URL http://hdl.handle.net/2433/56443 Right Type Departmental Bulletin Paper Textversion publisher Kyoto University Southeast Asian Studies, Vol. 29, No.2, September 1991 Martial Law and the Realignment of Political Parties in the Philippines (September 1972-February 1986): With a Case in the Province of Batangas Masataka KIMURA* The imposition of martial lawS) by President Marcos In September 1972 I Introduction shattered Philippine democracy. The Since its independence, the Philippines country was placed under Marcos' au had been called the showcase of democracy thoritarian control until the revolution of in Asia, having acquired American political February 1986 which restored democracy. institutions. Similar to the United States, At the same time, the two-party system it had a two-party system. The two collapsed. The traditional political forces major parties, namely, the N acionalista lay dormant in the early years of martial Party (NP) and the Liberal Party (LP),1) rule when no elections were held. When had alternately captured state power elections were resumed in 1978, a single through elections, while other political dominant party called Kilusang Bagong parties had hardly played significant roles Lipunan (KBL) emerged as an admin in shaping the political course of the istration party under Marcos, -

Jose Wright Diokno

Written by: NACIONAL, KATHERINE E. MANALO, RUBY THEZ D. TABILOG, LEX D. 3-H JOSE WRIGHT DIOKNO “Do not forget: We Filipinos are the first Asian people who revolted against a western imperial power, Spain; the first who adopted a democratic republican constitution in Asia, the Malolos Constitution; the first to fight the first major war of the twentieth century against another western imperial power, the United States of America. There is no insurmountable barrier that could stop us from becoming what we want to be.” Jose W. Diokno Jose “Pepe” Diokno was one of the advocates of human rights, Philippine sovereignty and nationalism together with some of the well-known battle-scarred fighters for freedom like Ninoy Aquino, Gasty Ortigas, Chino Roces, Tanny Tañada, Jovy Salonga, and few more. His life was that of a lover of books, education, and legal philosophy. He never refused to march on streets nor ague in courts. He never showcases his principles to get attention except when he intends to pursue or prove a point. He is fluent in several languages, and used some when arguing in courts, including English and Spanish. He became a Secretary of Justice when appointed by then President Diosdado Macapagal, and he was elected as a Senator of the Republic, who won the elections by campaigning alone. And during his entire political life, he never travelled with bodyguards nor kept a gun or used one. By the time he died, he was with his family, one of the things he held precious to his heart. FAMILY BACKGROUD The grandfather of Jose was Ananias Diokno, a general of the Philippine Revolutionary Army who served under Emilio Aguinaldo and who was later on imprisoned by American military forces in Fort Santiago together with Servillano Aquino, another Filipino General. -

Radio Bygones Indexes

INDEX MUSEUM PIECES Broadcast Receivers 78 C2-C4 Radio Bygones, Issues Nos 73-78 Command Sets 73 C1-C4 ARTICLES & FEATURES Crystal Sets from Bill Journeaux’s Collection 74 C4 K. P. Barnsdale’s ZC-1 77 C2 AERONAUTICAL ISSUE PAGE Keith Bentley Collection 75 C2-C4 The Command Set by Trevor Sanderson Michael O’Beirne’s MI TF1417 77 C4 Part 1 73 4 National Wireless Museum, Isle of Wight 74 C3 Part 2 74 28 Replica Lancaster at Pitstone Green Museum 76 C1-C4 Letter 75 32 Russian Volna-K 74 C1-C2 Firing up a WWII Night Fighter Radar AI Mk.4 Tony Thompson’s Ekco PB505 77 C3 by Norman Groom 76 6 NEWS & EVENTS AMATEUR AirWaves (On the Air Ltd) 76 2 Amateur Radio in the 1920s 73 27 Amberley Working Museum 74 2 Maintaining the HRO by Gerald Stancey 76 27 Antique Radio Classified 75 3 77 3 BOOKS 78 3 Tickling the Crystal 75 15 ARI Surplus Team 73 3 Classic Book Review by Richard Q. Marris BBC History Lives! (Website) 76 2 Modern Practical Radio and Television 76 10 BVWS and 405-Alive Merge! 74 3 CHiDE Conservation 74 3 CIRCUITRY Club Antique Radio Magazine 73 2 Invention of the Superhet by Ian Poole 76 22 HMS Collingwood Museum 74 3 Mallory ‘Inductuner’ by Michael O’Beirne 76 28 Confucius He Say Loudly! 74 2 Duxford Radio Society 78 3 CLANDESTINE Eddystone User Group Lighthouse 74 3 Clandestine Radio in the Pacific by Peter Lankshear 73 16 77 3 Spying Mystery by Ben Nock 74 18 78 3 Letter 75 32 Felix Crystalised (BVWS) 77 2 Talking to Mosquitoes by Brian Cannon 77 10 Hallo Hallo 75 3 Letter 78 38 77 3 Jackson Capacitors 76 2 COMMENT Medium Wave Circle -

Novel Data Transmission Wireless Based Technology for Frontier Applications R

Novel Data Transmission wireless based technology for Frontier Applications R. Brenner With recent material from colleges at Dept. of Physics and Astronomy, Uppsala Universiy and Physikalisches Institut, University of Heidelberg Richard Brenner ± Uppsala University 1/(54) INFIERI, Paris July 22, 2014 OUTLINE Motivation (personal context) Short historical background Wireless technology with mm-waves Application in trackers (HEP) Application in non-HEP detectors Summary and outlook Richard Brenner ± Uppsala University 2/(54) INFIERI, Paris July 22, 2014 (MY) MOTIVATION FOR WIRELESS DATA TRANSFER IN PARTICLE PHYSICS Richard Brenner ± Uppsala University 3/(54) INFIERI, Paris July 22, 2014 Topology Physics events propagate from the collision point radially outwards in - CMS ATLAS Physics events are triggered in RoI that are conical Example: CMS Crystal Calorimeter is tiled to match regions radial from the interaction point in and Event topology The first trigger decision in the LHC detectors is done within 3ms Fast signal transfer Fast extraction of trigger/physics objects Efficient to partition detector in topological regions (Region-of-Interest) Combination of objects from several sub-detectors Richard Brenner ± Uppsala University 4/(54) INFIERI, Paris July 22, 2014 Silicon tracking detectors Readout ALICE Axial tracker readout resulting in long paths, Long latency etc. CMS Silicon tracking detectors are built for convenience with a axial central part (Barrel) with disks in forward-backward direction. Several drawbacks: Short radiation length because of massive services in region between Barrel and Disks Long data path Not segmented in ROI Richard Brenner ± Uppsala University 5/(54) INFIERI, Paris July 22, 2014 Pile-up and data rates at HL-LHC current ~2018 ~2023 H → tt → mmnn The only sub-detector currently not used for fast trigger are the tracking detectors. -

The Miseducation of the People's Power Generation

THE MISEDUCATION OF THE PEOPLE’S POWER GENERATION Those who belong to the People’s Power generationi may still recall the popular article entitled “The Miseducation of the Filipino” by the late Renato Constantino. Although Constantino addressed his grievances against the American colonial government, I think his approach in analyzing the deep-seated problems of society remains valid until today. I do not necessarily agree with some of the assertions he made in his essay,ii but I do agree with his critical observations and emphasis on education. I agree with the letter and spirit of his statements that: 1. “Education is a vital weapon of a people striving for economic emancipation, political independence and cultural renaissance.” However, I would like to add that it is not only a “weapon” (that implies violence), but also a “tool” (that implies non-violence). 2. Nationalism is about the “correction of iniquitous relations,” pursuit of “economic emancipation,” and “appreciation for our own culture.” However, I would like to caution that nationalism is not necessarily anti-foreign, but only against “iniquitous relations.” Nationalism does not absolutely rule out alliances with foreign states, if such alliance supports the national interest. 3. “The most effective means of subjugating a people is to capture their minds. Military victory does not necessarily signify conquest. As long as feelings of resistance remain in the hearts of the vanquished, no conqueror is secure… The moulding of men’s minds is the best means of conquest. Education, therefore, serves as a weapon in wars of colonial conquest… The American military authorities had a job to do.