Sks Microfinance Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seagate Crystal Reports Activex

Format of holding of specified securities 1.0 Name of Listed Entity: SIGNET INDUSTRIES LTD 2.0 Scrip Code/Name of Scrip/Class of Security :- 512131 3.0 Share Holding Pattern Filed under: Reg. 31(1)(a)/Reg. 31(1)(b)/Reg.31(1)(c) a. If under 31(1)(b) then indicate the report for Quarter ending 30/03/2019 b. If under 31(1)(c) then indicate date of allotment/extinguishment 4.0 Declaration: The Listed entity is required to submit the following declaration to the extent of submission of information:- Particulars Yes No 1 Whether the Listed Entity has issued any partly paid up shares? NO 2 Whether the Listed Entity has issued any Convertible Securities or Warrants? NO 3 Whether the Listed Entity has any shares against which depository receipts are issued? NO 4 Whether the Listed Entity has any shares in locked-in? YES 5 Whether any shares held by promoters are pledge or otherwise encumbered? NO * If the Listed Entity selects the option ‘No’ for the questions above, the columns for the partly paid up shares, Outstanding Convertible Securities/Warrants, depository receipts, locked-in shares, No of shares pledged or otherwise encumbered by promoters, as applicable, shall not be displayed at the time of dissemination on the Stock Exchange website. Also wherever there is ‘No’ declared by Listed Entity in above table the values will be considered as ‘Zero’ by default on submission of the format of holding of specified securities. 5.0 The tabular format for disclosure of holding of specified securities is as follows:- SIGNET INDUSTRIES LTD Table I - Summary Statement holding of specified securities 30/03/2019 Categ Category of Nos. -

NSDL Honours Sharekhan for Achieving 10 Lakh Demat Accounts

The January-March 2016 Times AN IN-HOUSE MAGAZINE OF SHAREKHAN VOL. 7 No.01 | PUBLISHED FROM MUMBAI TigerTiger roarsroars atat thethe NSDLNSDL awardsawards ceremonyceremony Sharekhan turns Goregaon branch Heart-to-heart with 16 in style! bullish on 2016 Sheru Ajith Rao Dear Sherus, The March 2016 Times AN IN-HOUSE MAGAZINE OF SHAREKHAN VOL. 7 No.01 | PUBLISHED FROM MUMBAI Hi, hello and namaste! It is good to talk to you again. I am sure you used the long weekend to recharge your batteries and are now ready to take on the new financial year! Well, financial year 2017 is going to be crucial for us. Our company is poised at the threshold of a very defining moment and all set to embrace the promising future that is about to unfold. We are looking forward to scaling new heights of success and taking the opportunities presented to us in the coming days. We will, among other things, have more resources and a wider product range at our disposal to ensure the tiger roars and rises to the top. Tiger roars at the NSDL Meanwhile, what else is cooking? Well, Sharekhan is collecting awards for one. On awards ceremony pages 3-5 our cover story talks of Sharekhan’s superlative performance at the NSDL Sharekhan turns Goregaon branch Heart-to-heart with 16 in style! bullish on 2016 Sheru Ajith Rao Star Performer Awards 2015 in December last year. Then, in keeping with our focus on educating clients, our Goregaon branch organised a seminar on market outlook for its clients recently. -

Complete Book of Banking & Computer Awareness by Debarati

IBPS Examinations Banking Awareness tips for recruitment as clerks and officers in banks e-book (Banking Awareness) PART: 01 Prepared by Debarati Mukherjee meetdebaratimukherjee.wordpress.com Follow in Facebook https://www.facebook.com/bforbureaucracy 1 BULLET POINTS - PART: 001 Reserve Bank of India 01. Central bank is a bank which acts as a banker to the government; has monopoly of note issue and controls the entire banking system 02. RBI is the central bank in India 03. RBI was established by an act of Parliament in 1934 04. The initial share capital for RBI was Rs. 5 crores 05. RBI was nationalized under (transfer of public ownership) act 1948 06. Its affairs are regulated by central board of directors 07. It has four regional centres at Mumbai, Kolkatta, Chennai and Delhi 08. The central office of the bank is at Mumbai 09. RBI is note issuing authority; banker, agent and financial adviser to the government; custodian of cash reserves of banks; custodian of nation's reserves of foreign exchange; lender of the last resort; controller of credit etc. 10. Currency notes other than one rupee notes are issued by RBI 11. RBI has credit control ± regulation of cash reserves of commercial banks, regulating the flow of credit, qualitative control and open market operations 12. Handles all government transactions 13. It is a banker's bank 14. It maintains the exchange rate for the Indian rupee; hold the country's reserves in foreign currencies and administration of the exchange management regulations Scheduled commercial banks 15. They are included in the second schedule to the RBI act, 1934 16. -

Secondary Or Stock Market in India

By Dr. Snigdha Mishra Assistant Professor The stock exchange is an organised and centralised market for the purchase and sale of industrial and financial securities of all descriptions, viz., Stocks, Shares, Debentures etc. It is a market for transactions in old securities. Practically, it is a place where the buyer of a security may find a seller who is ready to sell his holdings at a fair and reasonable price provided the security has been listed. According to the Securities Contracts (Regulations) Act of 1956, a stock exchange is „an association, organisation or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities‟. The stock exchange was established by “East India company” in 18th century . In India it was established in 1850 with 22 stock brokers opposite to town hall Bombay .This stock exchange is known as oldest stock exchange of Asia. In 1975, it was renamed as Bombay Stock Exchange (BSE). There are 23 stock exchanges in the India. Mumbai's (earlier known as Bombay), Bombay Stock Exchange is the largest, with over 6,000 stocks listed. The BSE accounts for over two thirds of the total trading volume in the country. Established in 1875, the exchange is also the oldest in Asia. Among the twenty- two Stock Exchanges recognised by the Government of India under the Securities Contracts (Regulation) Act, 1956, it was the first one to be recognised and it is the only one that had the privilege of getting permanent recognition ab-initio. -

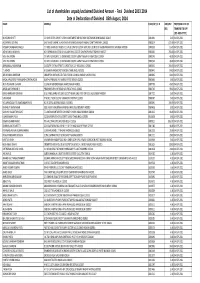

Final Dividend 2013-2014

List of shareholders unpaid/unclaimed Dividend Amount - Final Dividend 2013 -2014 Date of Declaration of Dividend : 05th August, 2014 NAME ADDRESS FOLIO/DP_CL ID AMOUNT PROPOSED DATE OF (RS) TRANSFER TO IEPF ( DD-MON-YYYY) MUKESH B BHATT C O SHRI DEVEN JOSHI 7 SURBHI APARTMENT NEHRU PARK VASTRAPUR AHMEDABAD 380015 0001091 8.0004-SEP-2021 AGGARWAL DEV RAJ SHIV SHAKTI SADAN 14 ASHOK VIHAR MAHESH NAGAR AMBALA CANTT HARYANA 134003 0000014 672.0004-SEP-2021 ROSHAN DADIBA ARSIWALLA C O MISS SHIRIN OF CHOKSI F 2 DALAL ESTATE F BLOCK GROUND FLOOR DR D BHADKAMKAR ROAD MUMBAI 400008 0000158 16.0004-SEP-2021 ACHAR MAYA MADHAV NO 9 BRINDAVAN 353 B 10 VALLABH BHAG ESTATE GHATKOPAR EAST BOMBAY 400077 0000030 256.0004-SEP-2021 YASH PAL ARORA C O MR K L MADAN C 19 DAYANAND COLONY LAJPAT NAGAR IV NEW DELHI 110024 0000343 48.8004-SEP-2021 YASH PAL ARORA C O MR K L MADAN C 19 DAYANAND COLONY LAJPAT NAGAR IV NEW DELHI 110024 0000344 48.8004-SEP-2021 ANNAMALAL RABINDRAN 24 SOUTH CHITRAI STREET C O POST BOX 127 MADURAI 1 625001 0000041 256.0004-SEP-2021 T J ASHOK M 51 ANNA NAGAR EAST MADRAS TAMIL NADU 600102 0000441 84.0004-SEP-2021 ARUN BABAN AMBEKAR CROMPTON GREAVES LTD TOOL ROOM A 3 MIDC AMBAD NASIK 422010 0000445 40.0004-SEP-2021 MAZHUVANCHERY PARAMBATH KORATHJACOB ILLATHU PARAMBU AYYAMPILLY PORT KERALA 682501 0005464 8.0004-SEP-2021 ALKA TUKARAM CHAVAN 51 5 NEW MUKUNDNAGAR AHMEDNAGAR 414001 0000709 40.0004-SEP-2021 ANGOLKAR SHRIKANT B PRABHU KRUPA M F ROAD NOUPADA THANE 400602 0000740 98.0004-SEP-2021 MIRZA NAWSHIR HOSHANG D 52 PANDURANG HOUSING SOCIETY -

Capital Markets in India: a Conceptual Framework

SHANLAX International Journal of Economics s han lax # S I N C E 1 9 9 0 Capital Markets in India: A Conceptual Framework OPEN ACCESS Harish Tigari Assistant Professor & Co-ordinator, Davan PG Studies, Davangere, Karanataka, India Volume: 8 R.Aishwarya Issue: 1 Davan PG Studies, Davangere, Karanataka, India Month: December Abstract The history of the Indian capital market goes back to the 18th century when the securities of East Indian companies were traded. The contribution of the Indian capital market for the sustainability Year: 2019 of the Indian economy is considerable since the year 1890s. The capital market plays a role in terms of wealth distribution and the economic development of a country like India. The capital market acts as a transformer of savings into capital investment. The capital market has witnessed P-ISSN: 2319-961X major reforms since the implementation of New Economic Policy 1991 and after that. The Indian government and SEBI have adopted various reforms to enhance the performance of Indian stock E-ISSN: 2582-0192 exchanges. The present study tries to analyze the recent reforms in the Indian capital market from the year 2010 onwards. The present research is largely based on secondary data. The statistical facts and figures regarding the growth and development of the capital market were available from Received: 09.10.2019 various journals, publications, and websites. Keywords: Capital market reforms, New economic policy 1991, Indian economy, Stock Accepted: 15.11.2019 exchanges & Indian government. Published: 01.12.2019 Introduction The capital market plays a vital role in the growth and development of a Citation: country’s economy. -

Adtech Power Systems Limited) (Hereinafter Referred to As “ASL” Or “The Company”) Was Incorporated on 05Th February 1990 in Chennai, Tamilnadu

ADTECH SYSTEMS LIMITED Annual Report 2012-13 Company information Board of Directors M.R.Subramonian M.R.Narayanan N.Suresh Managing Director Director Director M.R.Krishnan Executive Director Company Secretary and CFO S.Balamurali Auditors M.R.RAMACHANDRAN & Co Chartered Accountants 9/1, Lynwood Avenue Mahalingapuram, Chennai-34 Bankers STATE BANK OF INDIA SIB Branch, Trivandrum 695 001 Share Transfer Agents M/s Integrated Enterprises (India) Limited 2nd Floor, Kences Towers, North Usman Road T.Nagar, Chennai 600 017 Registered Office No.18,III Floor,R.M.S. Appartments 12, Gopalakrishna Street, T.Nagar Chennai-600 017 Phone 91 44 28150967/28155137 Corporate Office 5/2523, Golf Links Road, Kowdiar P.O Trivandrum – 695 003 Phone 91 471 2433805/569 Website www.adtechindia.com Shares Listed with Madras Stock Exchange Ltd Cochin Stock Exchange Ltd Ahmedabad Stock Exchange Assoc.Ltd ADTECH SYSTEMS LIMITED Annual Report 2012-13 NOTICE Notice is hereby given that the Twenty Second Annual General Meeting of the Members of ADTECH SYSTEMS LIMITED will be held on Monday, the 30th September 2013 at 4.00 P.M at No.18, III Floor, R.M.S.Apartments, 12, Gopalakrishna Street, T.Nagar, Chennai 600 017 to transact the following business. ORDINARY BUSINESS 1. To consider and adopt the Audited Balance Sheet as at 31st March 2013, the Statement of Profit and Loss and the Cash Flow Statement for the financial year ended on that date, and the reports of the Auditors and the Board of Directors thereon. 2. To declare a dividend on equity shares 3. To appoint a Director in place of Shri. -

Today's View DNA-Based Personalization

© 2017 Bank of Baroda. All rights reserved NEWS HIGHLIGHTS Sebi may soon issue norms mandating foreign brokers to store data locally Innoviti bets on same-day fund transfer to shopkeepers Kochi gets one of India's biggest startup ecosystem Paytm to get into content space, launch OTT service Today’s View Akhil Handa +91 22 6759 2873 [email protected] DNA-based personalization Aparna Anand According to a Cisco blog, the IoT and data statistics are staggering, to the +91 22 6759 2873 point of appearing fantastical: 5 quintillion bytes of data produced every day [email protected] and by the year 2020, it is estimated that the IoT will comprise of more than iPhone shipments halve as 30 billion connected devices. high prices hit sales A barrage of personal data such as individuals’ nutrition, sleep, activity etc. is Apple’s iPhone shipments in already being collected by wearable devices and connected fitness platforms India last year are estimated to like MapMyFitness, Endomondo and MyFitnessPal that have more than 220 have shrunk by as much as half million members globally. With such personalised data, platforms can provide from the 2017 level, its worst buying recommendations much beyond purchase history, imagine the ultra- performance since 2014 in the personalisation that can happen with our DNA data! world’s fastest-growing smartphone market, adding to global woes that have forced With science evolving and at-home genetic testing becomes more affordable, the company to cut its revenue it has opened new possibilities for companies to utilise DNA data. The outlook. company most responsible for revolutionizing access to DNA is Illumina which has sequenced some 90% of all the DNA data ever processed. -

Stock Exchanges – the More the Merrier?

Institutional EYE Stock exchanges – the more the merrier? It is hard to argue against SEBI’s intent to foster competition for stock exchanges and depositories. However, it is unclear if adding more stock exchanges will accomplish the desired outcome. While ownership regulations are being eased to lower entry barriers, SEBI needs to ensure this be done with stronger guardrails. Source: morguefile.com Competition is essential for continuous improvement to products and services, and to this extent, the intent of fostering greater competition for stock exchanges and depositories is in the right direction. Increasing use of technology, breakdown of trading platforms, co-location issues, have all laced the ‘equity’ exchanges. Commodity exchanges too have seen their fair share of scams. While the regulator can provide an enabling 05 February 2021 iiasadvisory.com 1 Institutional EYE environment, it cannot run the exchange. Therefore, the most enduring solution to customer delight is market-driven competition. Will having more stock exchanges and depositories achieve that objective? SEBI, in its January 2021 discussion paper on “Review of Ownership and Governance norms for facilitating new entrants to set up Stock Exchange / Depository” believes it will1. SEBI has argued that newer technologies of block chain and distributed ledgers will bring an innovative element to trading and price discovery, and perhaps that will. If nothing else, it will increase the technology intensity of trading from its current levels. Yet, India had over 20 stock exchanges in the past – most of them being local / territorial2. Although the Calcutta Stock Exchange continues (largely in name only), none of the other local / territorial exchanges survived against the size and liquidity of NSE and BSE (Exhibit 1). -

A Project Report On

A Project Report on ONLINE TRADING DERIVATIVES Project submitted in partial fulfillment for the award of Degree of MASTER OF BUSINESS ADMINISTRATION 1 DECLARATION I hereby declare that this Project Report titled “ONLINE TRADING DERIVARIVES” submitted by me to the Department of Business Management, XXXX, is a bonafide work undertaken by me and it is not submitted to any other University or Institution for the award of any degree diploma / certificate or published any time before. Name of the Student Signature of the Student 2 ACKNOWLEDGEMENT I would like to give special acknowledgement to XXX, director, XXXX for his consistent support and motivation. I am grateful to Mr.V.Raghunadh, Associate professor in finance, Vivekananda School of Post Graduate Studies for his technical expertise, advice and excellent guidance. He not only gave my project a scrupulous critical reading, but added many examples and ideas to improve it. I am indebted to my other faculty members who gave time and again reviewed portions of this project and provide many valuable comments. I would like to express my appreciation towards my friends for their encouragement and support throughout this project. XXXX 3 ONLINE TRADING IN DERIVATIVES CONTENTS Chapter –I Introduction Need for the study Objectives of the study Methodology Limitations Chapter –II Stock markets in India Financial Markets Money Markets Capital Markets Stock Markets Derivative Markets Chapter -III Theoretical framework of derivative market. Chapter -IV Practical aspects of derivative market. Chapter –V Summary & Suggestions ANNEXURE Questionnaire Bibliography 4 CHAPTER-I • INTRODUCTION • NEED FOR STUDY • OBJECTIVES • METHODOLOGY • LIMITATIONS 5 Introduction : In our present day economy, finance is defined as the provision of money at the time when it is required. -

CSBL Ind. Clint. Book June 2020.Pmd

ACKNOWLEDGMENT I / We acknowledge the receipt of copies of all the documents executed by me including the following : 1) Account opening form 2) Tariff sheet ( DP and Trading ) and all other documents including voluntary (POA ) executed by me / us. 3) Proof of Address, Bank and PAN and Aadhar Card 4) Policies and procedures for Trading account, Financial details, FATCA declaration, Risk disclosure document. 5.) Received and read the rights and obligation documents ( DP and Trading ) Signature of the client :............................................................................................................... Name of the Client :............................................................................................................................ BO ID :..1..2..0..2..3..9.0..0.......................................Client Code :............................................... Date :.............................................. Signature Card Account No. 120 23900 (To be filled by the CSBL) First Authorised Second Authorised Third Authorised Signatory Signatory Signatory Name X1- A X1- B X1- C Signature Specimen All proof should be self attested self be should proof All One passport size photograph of each Account Holder. Account each of photograph size passport One Copy of RBI Apporval for NRIs. for Apporval RBI of Copy Proof of NRI Status. NRI of Proof Date of Birth Certificate in case of Minors. of case in Certificate Birth of Date The following documents are to be submitted by the Investors :- Investors the by submitted be to are documents following The 4. 3. Signatures should be preferably in black ink. black in preferably be should 3. Signatures 2. Strike off whichever is not applicable. not is whichever off 2. Strike 1. All correspondence / queries shall be addressed to the First / Sole Applicant only. Applicant Sole / First the to addressed be shall queries / correspondence 1. All Instructions for Applicants for Instructions 7.8 wt. -

A Study on Risk and Return Analysis of Selected Stocks in BSE Sensex by ABHISHEK.V (1AZ16MBA04)

A Project report (16MBAPR407) A Study on Risk and Return analysis of Selected Stocks in BSE Sensex BY ABHISHEK.V (1AZ16MBA04) Submitted to VISVESVARAYA TECHNOLOGICAL UNIVERSITY, BELGAUM In partial fulfilment of the requirements for the award of the degree of MASTER OF BUSINESS ADMINISTRATION Under the guidance of INTERNAL GUIDE EXTERNAL GUIDE Dr.Prakash B Yargol Meghesh.M Professor Business Head Acharya Institute of Technology J WINGS Department of MBA Acharya Institute of Technology Soladevanahalli, Bangalore-560 107 May 2018 CERTIFICATE TO WHOl\l SO EVER IT MAY CONCERN I. This is to certify that Mr. Abhishek.\", a student of Acharya Institute of Technology - th Bangal01:e, Pursued 03 (Three) months of Internship with us from 15 January 2018 to 24'h March 2018 2. During the Summer Internship. he has successfully completed the project titled "A ~tudy on Risk and Re-turn analysis of selected stocks in BSE Sensex" under the guidance of Mr. Megesh. M. 3. The Students performance during the Internship and comments on his project work are as under:- Mr. Abhishek.V completes ass1gnmcnls in a timely manner. performs quality work that is accurate and thorough, and manages time effectively. Student is responsible, punctual. ha~ good attendance. Student expresses thoughts clearly and is professional in dealing with both co-workers and the clients. Initiative asks for work if not assigned and is able to work independently. We wish him all the very best in foturt' endeavors (Signature of the Autl10rized Company Official) Name Me~esh. M Designation: Business I lead Date 2-l-03 -2018 No.