Ap Macro-Mr. Lipman Krugman's Unit 4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Questions and Answers

Intermediate Microeconomics 2nd Year Dr. Eman Gamal El-Din M. Chapter 4 Part 1 Questions and Answers Chapter4 Q1: MCQ Explaining Macroeconomic Trends and Fluctuations 1) The AS/AD model studies the relationship between A) the price level and unemployment. B) the price level and real GDP. C) unemployment and real GDP. D) nominal GDP and inflation. Answer: B 2) By using only the aggregate demand curve, we can determine A) only the price level. B) only the quantity of real GDP. C) both the price level and quantity of real GDP. D) neither the price level nor the quantity of real GDP. Answer: D 3) In short-run macroeconomic equilibrium A) real GDP equals potential GDP and aggregate demand determines the price level. B) the price level is fixed and short-run aggregate supply determines real GDP. C) real GDP and the price level are determined by short-run aggregate supply and aggregate demand. D) real GDP is less than potential GDP. Answer: C 4) The economy is in its short run equilibrium at the point where the A) price level is stable. B) SAS curve intersects the LAS curve. C) AD curve intersects the LAS curve. D) AD curve intersects the SAS curve. Answer: D 9) In the short run, the equilibrium level of real GDP A) is necessarily less than potential GDP. B) is necessarily equal to potential GDP. C) is necessarily greater than potential GDP. D) could be less than, equal to, or greater than potential GDP. Answer: D 10) In the short run, the intersection of the aggregate demand and the short-run aggregate supply curves, A) determines the equilibrium price level. -

AP Macroeconomics: Vocabulary 1. Aggregate Spending (GDP)

AP Macroeconomics: Vocabulary 1. Aggregate Spending (GDP): The sum of all spending from four sectors of the economy. GDP = C+I+G+Xn 2. Aggregate Income (AI) :The sum of all income earned by suppliers of resources in the economy. AI=GDP 3. Nominal GDP: the value of current production at the current prices 4. Real GDP: the value of current production, but using prices from a fixed point in time 5. Base year: the year that serves as a reference point for constructing a price index and comparing real values over time. 6. Price index: a measure of the average level of prices in a market basket for a given year, when compared to the prices in a reference (or base) year. 7. Market Basket: a collection of goods and services used to represent what is consumed in the economy 8. GDP price deflator: the price index that measures the average price level of the goods and services that make up GDP. 9. Real rate of interest: the percentage increase in purchasing power that a borrower pays a lender. 10. Expected (anticipated) inflation: the inflation expected in a future time period. This expected inflation is added to the real interest rate to compensate for lost purchasing power. 11. Nominal rate of interest: the percentage increase in money that the borrower pays the lender and is equal to the real rate plus the expected inflation. 12. Business cycle: the periodic rise and fall (in four phases) of economic activity 13. Expansion: a period where real GDP is growing. 14. Peak: the top of a business cycle where an expansion has ended. -

2012-2 Milton Friedman's Contributions to Macroeconomics and Their Nfluei Nce David Laidler

Western University Scholarship@Western Economic Policy Research Institute. EPRI Working Economics Working Papers Archive Papers 2012 2012-2 Milton Friedman's Contributions to Macroeconomics and Their nflueI nce David Laidler Follow this and additional works at: https://ir.lib.uwo.ca/economicsepri_wp Part of the Economics Commons Citation of this paper: Laidler, David. "2012-2 Milton Friedman's Contributions to Macroeconomics and Their nflueI nce." Economic Policy Research Institute. EPRI Working Papers, 2012-2. London, ON: Department of Economics, University of Western Ontario (2012). Milton Friedman's Contributions to Macroeconomics and Their Influence by David Laidler Working Paper # 2012-2 February 2012 Economic Policy Research Institute EPRI Working Paper Series Department of Economics Department of Political Science Social Science Centre The University of Western Ontario London, Ontario, N6A 5C2 Canada This working paper is available as a downloadable pdf file on our website http://economics.uwo.ca/centres/epri/ Milton Friedman's Contributions to Macroeconomics and their Influence* by David Laidler JEL Classifications: B22, E20, E30, E40, E50 Keywords: Friedman, macroeconomics, Keynes, Keynesianism. monetarism, money, inflation, cycle, depression, monetary policy, consumption. Abstract. Milton Friedman's contributions to and influence on macroeconomics are discussed, beginning with his work on the consumption function and the demand for money, not to mention monetary history, which helped to undermine the post World War II "Keynesian" consensus in the area. His inter-related analyses of the dynamics of monetary policy's transmission mechanism, the case for a money growth rule, and the expectations augmented Phillips curve are then taken up, followed by a discussion of his influence not only directly on the monetarist policy experiments of the early 1980s, but also less directly on the regimes that underlay the "great moderation" that broke down in the crisis of 2007-2008. -

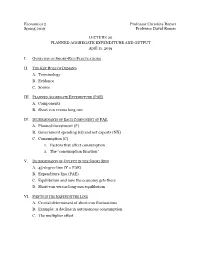

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE and OUTPUT Ap

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE AND OUTPUT April 11, 2019 I. OVERVIEW OF SHORT-RUN FLUCTUATIONS II. THE KEY ROLE OF DEMAND A. Terminology B. Evidence C. Source III. PLANNED AGGREGATE EXPENDITURE (PAE) A. Components B. Short run versus long run IV. DETERMINANTS OF EACH COMPONENT OF PAE p A. Planned investment (I ) B. Government spending (G) and net exports (NX) C. Consumption (C) 1. Factors that affect consumption 2. The “consumption function” V. DETERMINANTS OF OUTPUT IN THE SHORT RUN A. 45-degree line (Y = PAE) B. Expenditure line (PAE) C. Equilibrium and how the economy gets there D. Short-run versus long-run equilibrium VI. SHIFTS IN THE EXPENDITURE LINE A. Crucial determinant of short-run fluctuations B. Example: A decline in autonomous consumption C. The multiplier effect Economics 2 Christina Romer Spring 2019 David Romer LECTURE 20 Planned Aggregate Expenditure and Output April 11, 2019 Announcements • We have handed out Problem Set 5. • It is due at the start of lecture on Thursday, April 18th. • Problem set work session Monday, April 15th, 6:00–8:00 p.m. in 648 Evans. • Research paper reading for next time. • Romer and Romer, “The Macroeconomic Effects of Tax Changes.” I. OVERVIEW OF SHORT-RUN FLUCTUATIONS Real GDP in the United States, 1948–2018 Source: FRED (Federal Reserve Economic Data); data from Bureau of Economic Analysis. Short-Run Fluctuations • Times when output moves above or below potential (booms and recessions). • Recessions are costly and very painful to the people affected. Deviation of GDP from Potential and the Unemployment Rate Unemployment Rate Percent Deviation of GDP from Potential Source: FRED; data from Bureau of Labor Statistics. -

AGGREGATE DEMAND and ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, Et Al.), 2Nd Edition

Chapter 24 AGGREGATE DEMAND AND ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, et al.), 2nd Edition Chapter Overview This chapter first introduces the analysis of business cycles, and introduces you to the two stylized facts of the business cycle. The chapter then presents the Classical theory of savings-investment balance through the market for loanable funds. Next, the Keynesian aggregate demand analysis in the form of the traditional "Keynesian Cross" diagram is developed. You will learn what happens when there’s an unexpected fall in spending, and the role of the multiplier in moving to a new equilibrium. Chapter Objectives After reading and reviewing this chapter, you should be able to: 1. Describe how unemployment and inflation are thought to normally behave over the business cycle. 2. Model consumption and investment, the components of aggregate demand in the simple model. 3. Describe the problem that “leakages” present for maintaining aggregate demand, and the classical and Keynesian approaches to leakages. 4. Understand how the equilibrium levels of income, consumption, investment, and savings are determined in the Keynesian model, as presented in equations and graphs. 5. Explain how, in the Keynesian model, the macroeconomy can equilibrate at a less-than-full-employment output level. 6. Describe the workings of “the multiplier,” in words and equations. Key Terms Okun’s “law” behavioral equation “full-employment output” (Y*) marginal propensity to consume aggregate expenditure (AE) marginal propensity to save accounting identity paradox of thrift Chapter 24 – Aggregate Demand and Economic Fluctuations 1 Active Review Fill in the Blank 1. The macroeconomic goal that involves keeping the rate of unemployment and inflation at acceptable levels over the business cycle is the goal of . -

The Macroeconomic Implications of Consumption: State-Of-Art and Prospects for the Heterodox Future Research

The macroeconomic implications of consumption: state-of-art and prospects for the heterodox future research Lídia Brochier1 and Antonio Carlos Macedo e Silva2 Abstract The recent US economic scenario has motivated a series of heterodox papers concerned with household indebtedness and consumption. Though discussing autonomous consumption, most of the theoretical papers rely on private investment-led growth models. An alternative approach is the so-called Sraffian supermultipler model, which treats long-run investment as induced, allowing for the possibility that other final demand components – including consumption – may lead long-run growth. We suggest that the dialogue between these approaches is not only possible but may prove to be quite fruitful. Keywords: Consumption, household debt, growth theories, autonomous expenditure. JEL classification: B59, E12, E21. 1 PhD Student, University of Campinas (UNICAMP), São Paulo, Brazil. [email protected] 2 Professor at University of Campinas (UNICAMP), São Paulo, Brazil. [email protected] 1 1 Introduction Following Keynes’ famous dictum on investment as the “causa causans” of output and employment levels, macroeconomic literature has tended to depict personal consumption as a well-behaved and rather uninteresting aggregate demand component.3 To be sure, consumption is much less volatile than investment. Does it really mean it is less important? For many Keynesian economists, the answer is – or at least was, until recently – probably positive. At any rate, the American experience has at least demonstrated that consumption is important, and not only because it usually represents more than 60% of GDP. After all, in the U.S., the very ratio between consumption and GDP has been increasing since the 1980s, in spite of the stagnant real labor income and the growing income inequality. -

Some Issues in Monetary Economics January 1970

Some Issues in Monetary Economies* By DAVID I. FAND Public policies are continuously sought which will assist in guiding the economy between the perils of inflation and the dangers of unemployment and under-production. During the last five years the perils of inflation have become increasingly apparent, and during the past year stabilization actions have been taken to reduce the rate of advance of the price level. At the present time there is growing concern that these actions may lead the economy into a recession, What are the vehicles and avenues of stabilization policy which can best restore the econ- oniy to a satisfactory course, that is, a high and rising level of output and employment with a reasonably stable price level? Unfortunately, students of this problem are not in ~ubstan- tial agreement on an answer. Economists have tended to fall into two conflicting schools of thought regarding economic stabilization — the income-expenditure approach and the modern quantity theory of money approach. Until recently, the dominant school has been the modern version of the income-expendi- ture theory which has evolved from the work of John Maynard Keynes in the 1930’s. Policy- makers in the 1950’s and 1960’s generally adopted the theoretical framework of this school for the formulation of economic stabilization actions. Primary emphasis was given to fiscal actions — Federal government spending and taxing programs — in guiding the economy be- tween inflation and unemployment. During the last two decades, proponents of the modern quantity theory of money have increasingly challenged the basic propositions of the income- expenditure school. -

Chapter 4.Pmd

Chapter4 Determination of Income and Employment We have so far talked about the national income, price level, rate of interest etc. in an ad hoc manner – without investigating the forces that govern their values. The basic objective of macroeconomics is to develop theoretical tools, called models, capable of describing the processes which determine the values of these variables. Specifically, the models attempt to provide theoretical explanation to questions such as what causes periods of slow growth or recessions in the economy, or increment in the price level, or a rise in unemployment. It is difficult to account for all the variables at the same time. Thus, when we concentrate on the determination of a particular variable, we must hold the values of all other variables constant. This is a stylisation typical of almost any theoretical exercise and is called the assumption of ceteris paribus, which literally means ‘other things remaining equal’. You can think of the procedure as follows – in order to solve for the values of two variables x and y from two equations, we solve for one variable, say x, in terms of y from one equation first, and then substitute this value into the other equation to obtain the complete solution. We apply the same method in the analysis of the macroeconomic system. In this chapter we deal with the determination of National Income under the assumption of fixed price of final goods and constant rate of interest in the economy. The theoretical model used in this chapter is based on the theory given by John Maynard Keynes. -

Aggregate Or Targeted Demand?

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Tcherneva, Pavlina R. Working Paper Keynes's approach to full employment: aggregate or targeted demand? Working Paper, No. 542 Provided in Cooperation with: Levy Economics Institute of Bard College Suggested Citation: Tcherneva, Pavlina R. (2008) : Keynes's approach to full employment: aggregate or targeted demand?, Working Paper, No. 542, Levy Economics Institute of Bard College, Annandale-on-Hudson, NY This Version is available at: http://hdl.handle.net/10419/31663 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Working Paper No. 542 Keynes’s Approach to Full Employment: Aggregate or Targeted Demand? by Pavlina R. Tcherneva The Levy Economics Institute of Bard College August 2008 The Levy Economics Institute Working Paper Collection presents research in progress by Levy Institute scholars and conference participants. -

The Sraffian Supermultiplier and the Stylized Facts

Texto para Discussão 005 | 2019 Discussion Paper 005 | 2019 Stagnation and unnaturally low interest rates: a simple critique of the amended New Consensus and the Sraffian supermultiplier alternative Franklin Serrano Instituto de Economia, Universidade Federal do Rio de Janeiro Ricardo Summa Instituto de Economia, Universidade Federal do Rio de Janeiro Vivian Garrido Moreira Universidade Estadual do Centro Oeste - UNICENTRO This paper can be downloaded without charge from http://www.ie.ufrj.br/index.php/index-publicacoes/textos-para-discussao Stagnation and unnaturally low interest rates: a simple critique of the amended New Consensus and the Sraffian supermultiplier alternative1 March. 2019 Franklin Serrano Instituto de Economia, Universidade Federal do Rio de Janeiro Ricardo Summa Instituto de Economia, Universidade Federal do Rio de Janeiro Vivian Garrido Moreira Universidade Estadual do Centro Oeste – UNICENTRO Abstract This paper argues that the amended versions (financial wedge and secular stagnation) of the simple pragmatic New Consensus model are as open to theretical criticism as the original one. We show that: (1) the real natural rate of interest is unlikely to be negative and (2) it (inconsistently) depends on the neoclassical investment function drawn at a position of full employment, in a model which the economy is demand constrained; (3) both investment and full employment saving are induced by the trend of demand in the longer run and this challenges the usefulness of the notion of a natural or neutral rate of interest, which (4) are also subject to the sraffian capital critique. This is then constrasted to an alternative simple Sraffian Supermultiplier model in which the interest rate and the financial wedge are distributive instead of allocative variables, and there is no natural rate of interest since in the longer run there is no trade-off between consumption and investment and also no full employment of labor. -

Joana David Avritzer Debt-Led Growth and Its Financial Fragility: An

Joana David Avritzer Debt-led growth and its financial fragility: an investigation into the dynamics of a supermultiplier model March 2021 Working Paper 06/2021 Department of Economics The New School for Social Research The views expressed herein are those of the author(s) and do not necessarily reflect the views of the New School for Social Research. © 2021 by Joana David Avritzer. All rights reserved. Short sections of text may be quoted without explicit permission provided that full credit is given to the source. Debt-led growth and its financial fragility: an investigation into the dynamics of a supermultiplier model Joana David Avritzer1 This paper discusses the financial sustainability of demand-led growth models. We assume a supermultiplier growth model in which household consumption is the autonomous component of demand that drives growth and discuss the financial sustainability of such dynamics of growth from the perspective of the working households. We show that for positive rates of growth the model converges to an equilibrium where worker households are accumulating debt and not wealth. We also show that when the economy is growing at a rate that is positive, and between 2% and 4.4%, the dynamics of the model also implies that households will not be able to service their debt at the point of full long run equilibrium. We then conclude that this household debt-financed consumption pattern of economic growth generates an internal dynamic that leads to financial instability. Keywords: household debt dynamics, debt-financed consumption, growth and financial fragility; JEL Classification: E11, E12, E21, O41. 1 Connecticut College and IRID-UFRJ, email: [email protected]; 1. -

The Way Brands Work: Consumers' Understanding of the Creation and Usage of Brands

The Way Brands Work: Consumers' understanding of the creation and usage of brands Bertilsson, Jon 2009 Link to publication Citation for published version (APA): Bertilsson, J. (2009). The Way Brands Work: Consumers' understanding of the creation and usage of brands. Lund Business Press. Total number of authors: 1 General rights Unless other specific re-use rights are stated the following general rights apply: Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal Read more about Creative commons licenses: https://creativecommons.org/licenses/ Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. LUND UNIVERSITY PO Box 117 221 00 Lund +46 46-222 00 00 Download date: 06. Oct. 2021 The way brands work Consumers’ understanding of the creation and usage of brands Jon Bertilsson Lund Institute of Economic Research School of Economics and Management Lund Business Press Lund Studies in Economics and Management 114 Lund Business Press Lund Institute of Economic Research P.O.