The Macroeconomic Implications of Consumption: State-Of-Art and Prospects for the Heterodox Future Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The National Income Multiplier: Its Theory Its Philosophy Its Utility

University of Montana ScholarWorks at University of Montana Graduate Student Theses, Dissertations, & Professional Papers Graduate School 1959 The national income multiplier: Its theory its philosophy its utility John Colin Jones The University of Montana Follow this and additional works at: https://scholarworks.umt.edu/etd Let us know how access to this document benefits ou.y Recommended Citation Jones, John Colin, "The national income multiplier: Its theory its philosophy its utility" (1959). Graduate Student Theses, Dissertations, & Professional Papers. 8768. https://scholarworks.umt.edu/etd/8768 This Thesis is brought to you for free and open access by the Graduate School at ScholarWorks at University of Montana. It has been accepted for inclusion in Graduate Student Theses, Dissertations, & Professional Papers by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. THE NATIOHAL INCOME MULTIPLIER; ITS THEORY, ITS PHILOSOPHY, ITS UTILITY J» COLIN H. JONES B.A. University of WaJes^ U.C.W., Aberystwyth, 195Ô Presented in partial fulfillment of the requirements for the degree of Master of Arts MONTANA STATE UNIVERSITY 1959 Approved by: , Board of Examiners Dean, Graduate School AUG 6 1959 D a te UMI Number: EP39569 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. UMI Dis»art«t)on Publishsng UMI EP39569 Published by ProQuest LLC (2013). -

AP Macroeconomics: Vocabulary 1. Aggregate Spending (GDP)

AP Macroeconomics: Vocabulary 1. Aggregate Spending (GDP): The sum of all spending from four sectors of the economy. GDP = C+I+G+Xn 2. Aggregate Income (AI) :The sum of all income earned by suppliers of resources in the economy. AI=GDP 3. Nominal GDP: the value of current production at the current prices 4. Real GDP: the value of current production, but using prices from a fixed point in time 5. Base year: the year that serves as a reference point for constructing a price index and comparing real values over time. 6. Price index: a measure of the average level of prices in a market basket for a given year, when compared to the prices in a reference (or base) year. 7. Market Basket: a collection of goods and services used to represent what is consumed in the economy 8. GDP price deflator: the price index that measures the average price level of the goods and services that make up GDP. 9. Real rate of interest: the percentage increase in purchasing power that a borrower pays a lender. 10. Expected (anticipated) inflation: the inflation expected in a future time period. This expected inflation is added to the real interest rate to compensate for lost purchasing power. 11. Nominal rate of interest: the percentage increase in money that the borrower pays the lender and is equal to the real rate plus the expected inflation. 12. Business cycle: the periodic rise and fall (in four phases) of economic activity 13. Expansion: a period where real GDP is growing. 14. Peak: the top of a business cycle where an expansion has ended. -

On the Concept of Nudging: Its Coherence and Applicability?

On the Concept of Nudging: Its Coherence and Applicability? Mads Wistrup Freund September 15, 2017 25-June-1993-xxxx MSc in Business Administration and Philosophy Vejleder: Marius Gudman Høyer 1 Abstract The practice of nudging has attracted attention from researchers, policymakers, and practitioners alike. The contemporary interest in nudging has sparked demands for a clearer examination of the conditions under which nudging and other behavioral methods can be used efficiently and acceptable. There are several unresolved questions which may have contributed to heated political and scientific discussions, especially heated is the ethical discussion of applying nudging in the public policy domain. This thesis concentrate on the philosophical premises nudges are built on. It is argued that the model is philosophically problematic. Different interventions might operate through various logics that threaten not only effectiveness but also representativeness and ethical ends. This thesis aruges that the next step in advancing the acceptability nudging requires a clarification. The thesis investi- gates the internal logic of this practice by exploring the expositions and implications within the literature on nudging in public policy, by specifically exploring its origins in behavioral economics; its impact on welfare policy; and ethical implications. This analysis is guided by Foucaults concept of veridiction and understanding of power. This thesis concludes that nudging would be more acceptable if it clarified that humans, in these models, are treated as defective econs. Choice architects are trying to represent the complex reality of hu- man judgment and decision-making with the inclusion of psychology in a highly simplified normative modeling framework, to increase individuals tendency to act according to neo- classical rational choice models. -

How Do Income and the Debt Position of Households Propagate Public Into Private Spending?

University of Heidelberg Department of Economics Discussion Paper Series No. 676 How Do Income and the Debt Position of Households Propagate Public into Private Spending? Sebastian K. Rüth and Camilla Simon February 2020 How Do Income and the Debt Position of Households Propagate Public into Private Spending? Sebastian K. R¨uth Camilla Simon∗ February 21, 2020 Abstract We study the household sector's post-tax income and debt position as prop- agation mechanisms of public into private spending, in postwar U.S. data. In structural VARs, we obtain the consumption \crowding-in puzzle" for surges in public spending and show this consumption response to be accompanied by a persistent increase in disposable income. Endogenously reacting income, however, is insufficient to rationalize conditional comovement of private and public spending: once we hypothetically force (dis)aggregate measures of in- come to their pre-shock paths, consumption still rises. Corroborating these findings within an external-instruments-identified VAR, which constitutes an adequate laboratory for the simultaneous interplay of financial and macroe- conomic time-series, we provide causal evidence of fiscal stimulus prompting households to take on more credit. This favorable debt cycle is paralleled by dropping interest rates, narrowing credit spreads, and inflating collat- eral prices, e.g., real estate prices, suggesting that softening borrowing con- straints support the accumulation of debt and help rationalizing the absence of crowding-out. Keywords: Government spending shock, household income, household in- debtedness, credit spread, external instrument, fiscal foresight. JEL codes: E30, E62, G51, H31. ∗Respectively: Heidelberg University, Alfred-Weber-Institute for Economics, phone: +49 6221 54 2943, e-mail: [email protected] (corresponding author); University of W¨urzburg,Department of Economics, phone: +49 931 31 85036, e-mail: camilla.simon@uni- wuerzburg.de. -

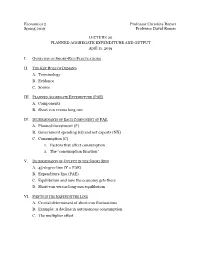

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE and OUTPUT Ap

Economics 2 Professor Christina Romer Spring 2019 Professor David Romer LECTURE 20 PLANNED AGGREGATE EXPENDITURE AND OUTPUT April 11, 2019 I. OVERVIEW OF SHORT-RUN FLUCTUATIONS II. THE KEY ROLE OF DEMAND A. Terminology B. Evidence C. Source III. PLANNED AGGREGATE EXPENDITURE (PAE) A. Components B. Short run versus long run IV. DETERMINANTS OF EACH COMPONENT OF PAE p A. Planned investment (I ) B. Government spending (G) and net exports (NX) C. Consumption (C) 1. Factors that affect consumption 2. The “consumption function” V. DETERMINANTS OF OUTPUT IN THE SHORT RUN A. 45-degree line (Y = PAE) B. Expenditure line (PAE) C. Equilibrium and how the economy gets there D. Short-run versus long-run equilibrium VI. SHIFTS IN THE EXPENDITURE LINE A. Crucial determinant of short-run fluctuations B. Example: A decline in autonomous consumption C. The multiplier effect Economics 2 Christina Romer Spring 2019 David Romer LECTURE 20 Planned Aggregate Expenditure and Output April 11, 2019 Announcements • We have handed out Problem Set 5. • It is due at the start of lecture on Thursday, April 18th. • Problem set work session Monday, April 15th, 6:00–8:00 p.m. in 648 Evans. • Research paper reading for next time. • Romer and Romer, “The Macroeconomic Effects of Tax Changes.” I. OVERVIEW OF SHORT-RUN FLUCTUATIONS Real GDP in the United States, 1948–2018 Source: FRED (Federal Reserve Economic Data); data from Bureau of Economic Analysis. Short-Run Fluctuations • Times when output moves above or below potential (booms and recessions). • Recessions are costly and very painful to the people affected. Deviation of GDP from Potential and the Unemployment Rate Unemployment Rate Percent Deviation of GDP from Potential Source: FRED; data from Bureau of Labor Statistics. -

AGGREGATE DEMAND and ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, Et Al.), 2Nd Edition

Chapter 24 AGGREGATE DEMAND AND ECONOMIC FLUCTUATIONS Principles of Economics in Context (Goodwin, et al.), 2nd Edition Chapter Overview This chapter first introduces the analysis of business cycles, and introduces you to the two stylized facts of the business cycle. The chapter then presents the Classical theory of savings-investment balance through the market for loanable funds. Next, the Keynesian aggregate demand analysis in the form of the traditional "Keynesian Cross" diagram is developed. You will learn what happens when there’s an unexpected fall in spending, and the role of the multiplier in moving to a new equilibrium. Chapter Objectives After reading and reviewing this chapter, you should be able to: 1. Describe how unemployment and inflation are thought to normally behave over the business cycle. 2. Model consumption and investment, the components of aggregate demand in the simple model. 3. Describe the problem that “leakages” present for maintaining aggregate demand, and the classical and Keynesian approaches to leakages. 4. Understand how the equilibrium levels of income, consumption, investment, and savings are determined in the Keynesian model, as presented in equations and graphs. 5. Explain how, in the Keynesian model, the macroeconomy can equilibrate at a less-than-full-employment output level. 6. Describe the workings of “the multiplier,” in words and equations. Key Terms Okun’s “law” behavioral equation “full-employment output” (Y*) marginal propensity to consume aggregate expenditure (AE) marginal propensity to save accounting identity paradox of thrift Chapter 24 – Aggregate Demand and Economic Fluctuations 1 Active Review Fill in the Blank 1. The macroeconomic goal that involves keeping the rate of unemployment and inflation at acceptable levels over the business cycle is the goal of . -

Macro Model Objectives : Understand the Difference Between Desired

Macro Model Objectives : Understand the difference between desired expenditure and actual expenditure. Explain the determinants of desired consumption and desired investment expeditures. Understand the meaning of equilibrium national income. Recognize the difference between movements along and shifts of the aggregate expenditure functions. Desired expenditure Everyone makes expenditure decisions. Fortunately, it is unnecessary for our purposes to look at each of the millions of such individual decisions. Instead, it is sufficient to consider four main groups of decision makers. The sum of their desired expenditures on domestically produced output is called desired aggregate expenditure, or more simply aggregate expenditure (AE). AE = C + I +G +(X-M) Autonomus versus induced expenditure. Components of aggregate expenditure that do not depend on national income are called autonomous expenditures. Components of aggregate expenditure that do change in response to changes in national income are called induced expenditures. Global Economics : macro model 2 Important simplifications Our goal is to develop the simplest possible model of national-income determination. To do so we focus on only two of the four components of desired aggregate expenditure. Consumption and investment Desired consumption expenditure By definition, there are only two possible uses of disposable income–consumption and saving. W hen the household decides how much to put to one use, it has automatically decided how much to put to the other use. The consumption function relates to total desired consumption expenditures of all households. The consumption behaviour of households depends on the income that they actually have to spend, which is called disposable income. Under the assumptions, here, there are no governments, therefore no taxes. -

10Expenditure Multipliers*

Chapter EXPENDITURE 10 MULTIPLIERS* Key Concepts FIGURE 10.1 The Consumption Function Fixed Prices and Expenditure Plans1 5 In the very short run, firms do not change their prices and they sell the amount that is demanded. As a result: 4 ♦ The price level is fixed. ♦ GDP is determined by aggregate demand. 3 Aggregate planned expenditure is the sum of planned consumption expenditure, planned investment, planned Consumption 2 function government purchases, and planned exports minus planned imports. GDP and aggregate planned expenditures have a two- 1 way link: An increase in real GDP increases aggregate planned expenditures, and an increase in aggregate expenditures increases real GDP. 123 45 Consumption expenditure (trillions of 1996 dollars) Consumption expenditure, C, and saving, S, depend on Disposable income (trillions of 1996 dollars) disposable income (disposable income, YD, is income minus taxes plus transfer payments), the real interest ♦ The slope of the consumption function equals the rate, wealth, and expected future income. MPC. The slope of the U.S. consumption function The consumption function is the relationship between is about 0.9. consumption expenditure and disposable income. Fig- ♦ Changes in the real interest rate, wealth, or expected ure 10.1 illustrates a consumption function. future income shift the consumption function. ♦ The amount of consumption when disposable in- Consumption varies when real GDP changes because come is zero ($1 trillion in Figure 10.1) is called changes in real GDP change disposable income. autonomous consumption. Consumption above this The saving function is the relationship between saving amount is called induced consumption. and disposable income. The marginal propensity to ♦ The marginal propensity to consume,,, MPC,,, is save, MPS,,, is the fraction of a change in disposable the fraction of a change in disposable income that is ∆S income that is saved, or MPS = . -

The Wealth Effect in Empirical Life-Cycle Aggregate Consumption Equations

The Wealth Effect in Empirical Life-Cycle Aggregate Consumption Equations Yash P. Mehra his article presents an empirical model of U.S. consumer spending that relates consumption to labor income and household wealth. This specification is consistent with the life-cycle hypothesis of saving first T 1 popularized in the 1960s by Ando, Modigliani, and their cohorts. My anal- ysis here extends the previous research in several directions. First, I examine the dynamic relationship between consumption, income, and wealth using cointegration and error correction methodology. In previous research, the tra- ditional life-cycle model has often been examined using either levels or first differences of these variables. While the use of differences does avoid the pitfall of spurious correlation due to common trending series, it tends to lead to the omission of the long-run equilibrium (cointegrating) relationships that may exist among levels of these variables. In fact, Gali (1990) goes so far as to present a theoretical life-cycle model that generates a common trend in aggregate consumption, labor income, and wealth. Therefore, my empirical work here tests for the presence of a long-run equilibrium (cointegrating) rela- tionship between the level of aggregate consumer spending and its economic determinants such as labor income and wealth. I then examine the short-run dynamic relationship among these variables using an error correction specifi- cation proposed in Davidson et al. (1978). The present article investigates whether wealth has predictive content for future consumption. If it does, then changes in wealth may lead to changes in The author wishes to thank Huberto Ennis, Pierre Sarte, and Roy Webb for many useful suggestions. -

Chapter 4.Pmd

Chapter4 Determination of Income and Employment We have so far talked about the national income, price level, rate of interest etc. in an ad hoc manner – without investigating the forces that govern their values. The basic objective of macroeconomics is to develop theoretical tools, called models, capable of describing the processes which determine the values of these variables. Specifically, the models attempt to provide theoretical explanation to questions such as what causes periods of slow growth or recessions in the economy, or increment in the price level, or a rise in unemployment. It is difficult to account for all the variables at the same time. Thus, when we concentrate on the determination of a particular variable, we must hold the values of all other variables constant. This is a stylisation typical of almost any theoretical exercise and is called the assumption of ceteris paribus, which literally means ‘other things remaining equal’. You can think of the procedure as follows – in order to solve for the values of two variables x and y from two equations, we solve for one variable, say x, in terms of y from one equation first, and then substitute this value into the other equation to obtain the complete solution. We apply the same method in the analysis of the macroeconomic system. In this chapter we deal with the determination of National Income under the assumption of fixed price of final goods and constant rate of interest in the economy. The theoretical model used in this chapter is based on the theory given by John Maynard Keynes. -

The Aggregate Expenditure Model a Stylized Look at Business Cycle Dynamics

The Aggregate Expenditure Model A Stylized Look at Business Cycle Dynamics Elements of Macroeconomics ▪ Johns Hopkins University Outline 1. The Aggregate Expenditure Model 2. An Expanded Aggregate Expenditure Model 3. The Multiplier Effect • Textbook Readings: Ch. 12 Elements of Macroeconomics ▪ Johns Hopkins University From Macro Variables to (Short-Run) Macro Models • The first of three models - The Aggregate Expenditure Model § Solely output variables are in this model • Next class: Aggregate Demand - Aggregate Supply Model § Both output and prices are in this model • Later: Expanded Loanable Funds Model (Monetary Policy) § Output, prices and financial markets are in this model Elements of Macroeconomics ▪ Johns Hopkins University A Quick Review • We have measurements GDP = C + I + G + NX § Consumption: Households purchases of goods and services § Investment: Housing, business investment in equipment, software, buildings plus inventories § Government spending: defense, infrastructure, social security, … § Net exports: Exports minus imports • We need a model § What forces drive the overall economy? Elements of Macroeconomics ▪ Johns Hopkins University What Are We Looking For With This Model? • We acknowledge that boom/bust cycles are regular occurrences • Periodically, we see big imbalances § Millions want jobs, but can’t find them ➞ Unemployment jumps § Millions want to drive cars and trucks ➞ Gasoline prices soar and inflation jumps • We want a model that identifies equilibrium, BUT ALLOWS FOR IMBALANCES Elements of Macroeconomics -

The Sraffian Supermultiplier and the Stylized Facts

Texto para Discussão 005 | 2019 Discussion Paper 005 | 2019 Stagnation and unnaturally low interest rates: a simple critique of the amended New Consensus and the Sraffian supermultiplier alternative Franklin Serrano Instituto de Economia, Universidade Federal do Rio de Janeiro Ricardo Summa Instituto de Economia, Universidade Federal do Rio de Janeiro Vivian Garrido Moreira Universidade Estadual do Centro Oeste - UNICENTRO This paper can be downloaded without charge from http://www.ie.ufrj.br/index.php/index-publicacoes/textos-para-discussao Stagnation and unnaturally low interest rates: a simple critique of the amended New Consensus and the Sraffian supermultiplier alternative1 March. 2019 Franklin Serrano Instituto de Economia, Universidade Federal do Rio de Janeiro Ricardo Summa Instituto de Economia, Universidade Federal do Rio de Janeiro Vivian Garrido Moreira Universidade Estadual do Centro Oeste – UNICENTRO Abstract This paper argues that the amended versions (financial wedge and secular stagnation) of the simple pragmatic New Consensus model are as open to theretical criticism as the original one. We show that: (1) the real natural rate of interest is unlikely to be negative and (2) it (inconsistently) depends on the neoclassical investment function drawn at a position of full employment, in a model which the economy is demand constrained; (3) both investment and full employment saving are induced by the trend of demand in the longer run and this challenges the usefulness of the notion of a natural or neutral rate of interest, which (4) are also subject to the sraffian capital critique. This is then constrasted to an alternative simple Sraffian Supermultiplier model in which the interest rate and the financial wedge are distributive instead of allocative variables, and there is no natural rate of interest since in the longer run there is no trade-off between consumption and investment and also no full employment of labor.