Influence of Loss Aversion Bias on Investments at the Rwanda Stock Exchange

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RSE | Listing Energicotel on The

PRESS RELEASE: ENERGICOTEL ‘ECTL’ PLC CORPORATE BOND LISTING ON THE RWANDA STOCK EXCHANGE. TODAY, ENERGICOTEL PLC or ‘ECTL’ by trading name officially listed its First Tranche of the FRW 6,500,000,000 Long-term Fixed Rate Corporate Bond amounting to FRW 3,500,000,000 on the Rwanda Stock Exchange Bond Market. Rwanda’s Ministry of Infrastructure, Honorable Ambassador Claver Gatete, rang the bell to grace the occasion and mark commencement of ECTL trading on the RSE.The listing event marked yet another milestone especially this time as the Exchange celebrates its 10 years of operations. ECTL listing is particularly significant as ENERGICOTEL PLC becomes the first company among 12 SMEs under the 1st cohort of the capital market investment clinic project to raise funds and list its securities on the the stock exchange. By the same token, the company also becomes the first company in the energy sector to join the stock market. Presiding over the launch of the listing and trading of ENERGICOTEL PLC’s Corporate Bond, the Minister of Infrastructure Amb. Claver Gatete came back on the role of the Government of Rwanda in the development of the capital market where it uses the market for issuances. “By issuing treasury bonds to the public and privatizing a few of its own companies through the market, the Government has shown a good example to the private sector to follow suit”. The Minister also commended ENERGICOTEL PLC for taking the bold decision to be a pioneer in the energy sector to use capital market in issuing its maiden corporate bond. -

A Behavioural Perspective Choice and Force – the Former Always Being More Resilient, Truthful and Apt for a Democratic System Like Ours

216 Somasekhar Sundaresan The central bank, which is the regulator, placed itself in the shoes of the regulated, taking decisions that they ought to take. Such a policy change led to undermining the sovereignty of the governance mechanisms of the bank – with the supervisor and regulator taking the 27 decisions for the supervised and the regulated. The actions were still those of the bank, but the actual decision was being taken outside the bank. Lessons in regulation of conduct have been learnt and this has presented a great opportunity to learn about the core difference between The Code: A Behavioural Perspective choice and force – the former always being more resilient, truthful and apt for a democratic system like ours. Anuradha Guru1 Finally, there is still one question that remains at large – does the Code have any preference between liquidation and resolution? Many legal and judicial minds tend to take an approach that liquidation is avoidable and that one must do the most to make resolution work. There is nothing in the Code to make any expression of such a preference. The choice between “Law is defined as a task of social engineering designed to eliminate friction and waste in the resolution and liquidation is a sovereign right of the CoC. They can choose in their wisdom to satisfaction of unlimited human interests and demands out of a limited store of goods in existence.” liquidate a company once they form a view that the CD is a basket case. The SC has upheld such Roscoe Pound2 sovereignty of the CoC. ccording to Marxist theory,3 the legal system of a society constitutes one of the However, in cases where the resolution plan does go through, obviating liquidation, components of its 'superstructure' being influenced and in-turn influencing the base when there is a challenge to the terms of the resolution, the question rears its head again. -

Running Head: SELF-SERVING ATTRIBUTIONS in SPORT

This article is downloaded from http://researchoutput.csu.edu.au It is the paper published as: Author: L. J. Aldridge and M. Rabiul Islam Title: Cultural differences in athlete attributions for success and failure: The sports pages revisited. Journal: International Journal of Psychology ISSN: 0020-7594 Year: 2012 Volume: 47 Issue: 1 Pages: 67-75 Abstract: Self-serving biases in attribution, while found with relative consistency in research with Western samples, have rarely been found in Japanese samples typically recruited for research. However, research conducted with Japanese participants to date has tended to use forced choice and/or reactive paradigms, with school or university students, focusing mainly on academic performance or arbitrary and/or researcher-selected tasks. This archival study explored whether self-serving attributional biases would be shown in the real-life attributions for sporting performance made by elite Olympic athletes from Japan and Australia. Attributions (N = 216) were extracted from the sports pages of Japanese and Australian newspapers and rated by Australian judges for locus and controllability. It was hypothesised that Australian, but not Japanese, athletes would show self-serving biases such that they attributed wins to causes more internal and controllable than the causes to which they attributed losses. Contrary to predictions, self-serving biases were shown to at least some extent by athletes of both nationalities. Both Australian and Japanese men attributed wins to causes more internal than those to which they attributed losses. Women, however, attributed wins and losses to causes that did not differ significantly in terms of locus. All athletes tended to attribute wins to causes that were more controllable than the causes to which losses were attributed. -

The Challenges of Emerging Stock Markets in Africa, a Case of Rwanda

East African Journal of Science and Technology, Vol.5, Issue 1, 2015 THE CHALLENGES OF EMERGING STOCK MARKETS IN AFRICA, A CASE OF RWANDA STOCK EXCHANGE Wilson KAZARWA The Independent Institute of Lay Adventists of Kigali, Box 6392, Kigali Rwanda E-mail: , Abstract A number of studies previously carried out indicate that capital market development of any economy is synonymous with the growth and economic development, and almost every African country has put an effort to establish a stock market, including Rwanda. This study focuses on the challenges faced by emerging stock markets in Africa, a case study of Rwanda Stock Exchange. The main objectives of this study include establishing the types of securities traded, rules governing the market, challenges facing the market and the suggested recommendations to counter these challenges. A population comprising of five listed companies and the Capital Market Authority were considered and in each case, one respondent was selected using purposive sampling technique. Although this research used more of secondary data that was obtained through literature review, primary data was also collected using an interview guide. The study has found that currently, the types of securities traded include three government bonds and one corporate bond, and stocks from five companies that have listed and cross-listed on the market. The study established that rules are provided and well adhered to and challenges facing the market include among others the general public which is not fully knowledgeable about trading in stocks, coupled with less skilled investment experts and lacking long-term credit, all this reduce profitability and thus limit the chances of listing stocks onto the stock market. -

Topic: Share Price Change and Investment Decision On

COLLEGE OF BUSINESS AND ECONOMICS (CBE) TOPIC: SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE (2011 – 2016) Thesis submitted in partial fulfillment of the requirements for the award of the Degree of Masters of Business Administration specialized in Finance. Submitted by: KANSIIME Gloria Supervisor: Dr. BARAYANDEMA Jonas June, 2018 I DECLARATION I declare that an evaluation of SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE IN RWANDA is my own work and that all the sources that I have used or quoted have been indicated and acknowledged by means of complete references. KANSIIME Gloria Reg. No: 214003207 MBA-Finance Signature: ……………………………………Date:……../……/2018 I certify that this project entitled “Share price change and investment decision on RSE” was carried out under my supervision. Supervisor name: Dr. BARAYANDEMA Jonas Signature………………………Date:……../………/2018 i COLLEGE OF BUSINESS AND ECONOMICS (CBE) Approval Sheet This thesis entitled SHARE PRICE CHANGE AND INVESTMENT DECISION ON THE RWANDA STOCK EXCHANGE IN RWANDA written and submitted by KANSIIME Gloria In partial fulfillment of the requirements for the degree of Master of finance is hereby accepted and approved. Supervisor Dr. BARAYANDEMA Jonas …………………………………… Date: ……………………… Member of the Jury Member of the Jury Dr. MUSEKURA Celestine Dr. BUSORO R. Theodore …………………………… …………………………… Date: ……………………… Date: ………………… Director of Graduate Studies Dr. NDIKUMANA Philippe ………………………………… Date ………………………… ii DEDICATION First and foremost, I dedicate my work to my beloved Aunt who toiled for my education and sacrificed the descent life they deserved to make sure I attained a bachelor’s degree without which I could not have enrolled for this Master’s Degree program. -

The Republic of Rwanda Us$620000000

THE REPUBLIC OF RWANDA U.S.$620,000,000 5.500 per cent. Notes due 2031 Issue Price: 100 per cent. The issue price of the U.S.$620,000,000 5.500 per cent. Notes due 2031 (the “Notes”) of the Republic of Rwanda (“Rwanda”, the “Republic” or the “Issuer”) is 100 per cent. of their principal amount. Unless previously redeemed or purchased and cancelled the Notes will be redeemed at their principal amount on 9 August 2031 (the “Maturity Date”). The Notes will bear interest from 9 August 2021 at the rate of 5.500 per cent. per annum payable semi-annually in arrear on 9 February and 9 August in each year commencing on 9 February 2022. Payments on the Notes will be made in US dollars without deduction for or on account of taxes imposed or levied by the Republic of Rwanda to the extent described under “Terms and Conditions of the Notes–Taxation”. This Offering Circular does not comprise a prospectus for the purposes of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). Application has been made to the United Kingdom Financial Conduct Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 (as amended) (the “FCA”) for the Notes to be admitted to a listing on the Official List of the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for such Notes to be admitted to trading on the London Stock Exchange’s main market (the “Main Market”). -

The Self-Serving Bias in Children

THE SELF-SERVING BIAS IN CHILDREN Rhonda Darlene Snow B .A. (Hons .), Simon Fraser University, 1982 M.A., Simon Fraser University, 1986 THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY in the Department of Psychology O Rhonda Darlene Snow 1993 SIMON FRASER UNIVERSITY August 1993 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL Name: Rhonda Darlene Snow Degree: Doctor of Philosophy (Psychology) Title of thesis: The Self-serving Bias in Children Examining Committee: Chair: Dr. K. Bartholomew - ~r.m Associate Professor of Psychology - - - Dr. M. M& Associate Professor of Psychology Dr. E. ~6es Internal External Examiner Associate Professor of Psychology - Dr. B. Earn External Examiner Professor of Psychology University of Guelph / Date Approved: b PM 99 PARTIAL COPYRIGHT LICENSE I hereby grant to Simon Fraser University the right to lend my thesis, project or extended essay (the title of which is shown below) to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. I further agree that permission for multiple copying of this work for scholarly purposes may be granted by me or the Dean of Graduate Studies. It is understood that copying or publication of this work for financial gain shall not be allowed without my written permission. TitIe of Thesis/Project/Extended Essay Theself-serving Bias in Children Author: - (signadye) Rhonda Darlene Snow (name) ABSTRACT This study examined the self-serving bias in elementary school-aged children. -

Emotions and Learning from Terminated R&D Projects–A Multiple

TECHNISCHE UNIVERSITÄT MÜNCHEN Lehrstuhl für Betriebswirtschaftslehre – Entrepreneurship Emotions and learning from terminated R&D projects – A multiple-case study research Dennis Warnecke Vollständiger Abdruck der von der Fakultät für Wirtschaftswissenschaften der Technischen Universität München zur Erlangung des akademischen Grades eines Doktors der Wirtschaftswissenschaften (Dr. rer. pol.) genehmigten Dissertation. Vorsitzende: Univ.-Prof. Hana Milanov, PhD Prüfer der Dissertation: 1. Univ.-Prof. Dr. Dr. Holger Patzelt 2. Univ.-Prof. Dr. Frank-Martin Belz Die Dissertation wurde am 23. Oktober 2012 bei der Technischen Universität München eingereicht und durch die Fakultät für Wirtschaftswissenschaften am 15.02.2013 angenommen. Only those who dare to fail greatly can ever achieve greatly. Robert F. Kennedy (1925-1968) II Important note This dissertation contains statements and quotes from engineers and managers from a large multinational cooperation. The usage of these statements in quotes serves exclusively to prove cognitive effects in corporate practice in a scientific manner. The used evidence and statements represent in no way a judging or assessing comparison of the subsidiaries themselves, their processes, their methodologies or practices. Assessments, especially on emotions and level of learning, have been derived by the author and thus include a certain level of subjectivity based on the personal interpretation of the author and a second, independent researcher. The objective of this research is to examine cognitive effects, whose existence and impact is acknowledged by psychology and has been proven in the scientific community, in corporate practice. The author dissociates himself from any judging or valuing conclusions on the quality of any actions or management practices of the respective subsidiaries as this is not the purpose of this dissertation and the interviews have not been evaluated based on this perspective. -

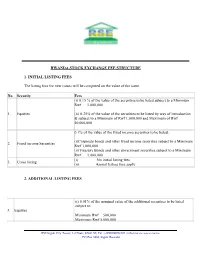

Rwanda Stock Exchange Fee Structure 1. Initial Listing

RWANDA STOCK EXCHANGE FEE STRUCTURE 1. INITIAL LISTING FEES The listing fees for new issues will be computed on the value of the issue. No. Security Fees (i) 0.15 % of the value of the securities to be listed subject to a Minimum Rwf 1,000,000 1. Equities (ii) 0.25% of the value of the securities to be listed by way of introduction & subject to a Minimum of Rwf 1,000,000 and Maximum of Rwf 50,000,000 0.1% of the value of the fixed income securities to be listed: (i)Corporate bonds and other fixed income securities subject to a Minimum 2. Fixed income Securities Rwf 1,000,000 (ii)Treasury Bonds and other government securities subject to a Minimum Rwf 1,000,000 (i) No initial listing fees 3. Cross listing (ii) Annual listing fees apply 2. ADDITIONAL LISTING FEES (i) 0.01% of the nominal value of the additional securities to be listed subject to: 3. Equities Minimum Rwf 500,000 Maximum Rwf 5,000,000 RSE Kigali City Tower, 1st Floor, KN81 ST, Tel : +(250)788516021 ; [email protected] www.rse.rw P O Box 3882, Kigali Rwanda (ii)0.05% of the value of the fixed income securities to be listed: (iii)Corporate bonds and other fixed income securities subject to a Minimum Rwf 1,000,000 4. Fixed income securities (iv) Treasury Bonds and other government securities subject to: Minimum Rwf 1,000,000 Maximum Rwf 10,000,000 The computation of the value of additional listings shall be based on the first date the securities trade ex entitlement after the additional offer. -

E Ect of Entrepreneurial Orientation on Firm Performance and Failure

Durham E-Theses Eect of Entrepreneurial Orientation on Firm Performance and Failure: A Longitudinal Analysis GALI, NAZHA,KAMEL How to cite: GALI, NAZHA,KAMEL (2018) Eect of Entrepreneurial Orientation on Firm Performance and Failure: A Longitudinal Analysis, Durham theses, Durham University. Available at Durham E-Theses Online: http://etheses.dur.ac.uk/12618/ Use policy The full-text may be used and/or reproduced, and given to third parties in any format or medium, without prior permission or charge, for personal research or study, educational, or not-for-prot purposes provided that: • a full bibliographic reference is made to the original source • a link is made to the metadata record in Durham E-Theses • the full-text is not changed in any way The full-text must not be sold in any format or medium without the formal permission of the copyright holders. Please consult the full Durham E-Theses policy for further details. Academic Support Oce, Durham University, University Oce, Old Elvet, Durham DH1 3HP e-mail: [email protected] Tel: +44 0191 334 6107 http://etheses.dur.ac.uk 2 Effect of Entrepreneurial Orientation on Firm Performance and Failure: A Longitudinal Analysis Nazha Kamel Gali A Thesis Submitted in Fulfillment of the Requirements for the Degree of Doctor of Philosophy in Entrepreneurship at Durham University Business School Durham University Business School Durham University United Kingdom 2017 1 Effect of Entrepreneurial Orientation on Firm Performance and Failure: A Longitudinal Analysis Nazha Kamel Gali Abstract This thesis aimed to examine the longitudinal effects of entrepreneurial orientation (EO) and each of its dimensions, innovativeness, proactiveness, and risk taking, on firm performance, among surviving and failed firms, as well as on the risk of firm failure. -

Adaptable History Biases in Human Perceptual Decisions

Adaptable history biases in human perceptual decisions Arman Abrahamyana,b,1, Laura Luz Silvac,2, Steven C. Dakinc,3, Matteo Carandinic, and Justin L. Gardnera,b aDepartment of Psychology and Neurosciences Institute, Stanford University, Stanford, CA 94305; bLaboratory for Human Systems Neuroscience, RIKEN Brain Science Institute, Wako-shi, Saitama 351-0198, Japan; and cUCL Institute of Ophthalmology, University College London, London EC1V 9EL, United Kingdom Edited by J. Anthony Movshon, New York University, New York, NY, and approved May 9, 2016 (received for review September 21, 2015) When making choices under conditions of perceptual uncertainty, based solely on the present sensory evidence (21) and to use success past experience can play a vital role. However, it can also lead to or failure feedback only to optimize their use of such sensory in- biases that worsen decisions. Consistent with previous observations, formation (22). However, both mice (14) and humans (15, 17, 18) we found that human choices are influenced by the success or failure make choices that are biased by their recent history of successes and of past choices even in a standard two-alternative detection task, failures and are thus suboptimal. Such biases, where prior beliefs where choice history is irrelevant. The typical bias was one that made rather than evidence guide behavior, are a form of fallacy, similar to the subject switch choices after a failure. These choice history biases the gambler’s fallacy or hot-hand fallacy (23, cf. 24). led to poorer performance and were similar for observers in different Why might choice history biases remain despite degrading countries. -

The Role of Stock Market on Economic Development of Rwanda; a Case Study of Rwanda Stock Exchange

International Journal of Science and Research (IJSR) ISSN: 2319-7064 Index Copernicus Value (2016): 79.57 | Impact Factor (2017): 7.296 The Role of Stock Market on Economic Development of Rwanda; A Case Study of Rwanda Stock Exchange Jerome Ndagijimana1, Dr. Patrick Mulyungi2 1Student, Jomo Kenyatta University of Agriculture and Technology 2Lecturer, Jomo Kenyatta University of Agriculture and Technology Abstract: In Rwanda there is need to provide funds to start new businesses and to expand existing businesses and industries. The stock market provides companies and the government with an avenue to raise Stock through the sale of shares and bonds to the public. The stock markets bring together those with surplus funds and those with a deficit and facilitate the exchange of the monies. This has however not gotten to its optimal level due to the following challenges facing the Rwanda stock market. First, in RSE there are a limited number of companies listed in the Rwanda Stock Exchange, the investors in Rwanda have limited investment portfolio and another challenge is the limited access to long term securities. The general objective of this study examined the role of stock market on economic development of Rwanda. This study was adopted descriptive research design. The target population of this study is 12 employees of Rwanda Stock Exchange. The researcher was used an open ended questionnaire as data collection. This means that that researcher collected the data through questionnaire. Researcher was used primary data. The Rwanda economic development has an overall correlation with stock market products of 0.776 which is strong and positive.