Download PDF 634KB

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Flying Into the Future Infrastructure for Business 2012 #4 Flying Into the Future

Infrastructure for Business Flying into the Future Infrastructure for Business 2012 #4 Flying into the Future Flying into the Future têáííÉå=Äó=`çêáå=q~óäçêI=pÉåáçê=bÅçåçãáÅ=^ÇîáëÉê=~í=íÜÉ=fça aÉÅÉãÄÉê=OMNO P Infrastructure for Business 2012 #4 Contents EXECUTIVE SUMMARY ________________________________________ 5 1. GRowInG AVIATIon SUSTAInABlY ______________________ 27 2. ThE FoUR CRUnChES ______________________________ 35 3. ThE BUSInESS VIEw oF AIRpoRT CApACITY ______________ 55 4. A lonG-TERM plAn FoR GRowTh ____________________ 69 Q Flying into the Future Executive summary l Aviation provides significant benefits to the economy, and as the high growth markets continue to power ahead, flying will become even more important. “A holistic plan is nearly two thirds of IoD members think that direct flights to the high growth countries will be important to their own business over the next decade. needed to improve l Aviation is bad for the global and local environment, but quieter and cleaner aviation in the UK. ” aircraft and improved operational and ground procedures can allow aviation to grow in a sustainable way. l The UK faces four related crunches – hub capacity now; overall capacity in the South East by 2030; excessive taxation; and an unwelcoming visa and border set-up – reducing the UK’s connectivity and making it more difficult and more expensive to get here. l This report sets out a holistic aviation plan, with 25 recommendations to address six key areas: − Making the best use of existing capacity in the short term; − Making decisions about where new runways should be built as soon as possible, so they can open in the medium term; − Ensuring good surface access and integration with the wider transport network, in particular planning rail services together with airport capacity, not separately; − Dealing with noise and other local environment impacts; − Not raising taxes any further; − Improving the visa regime and operations at the UK border. -

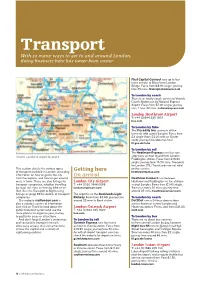

Transport with So Many Ways to Get to and Around London, Doing Business Here Has Never Been Easier

Transport With so many ways to get to and around London, doing business here has never been easier First Capital Connect runs up to four trains an hour to Blackfriars/London Bridge. Fares from £8.90 single; journey time 35 mins. firstcapitalconnect.co.uk To London by coach There is an hourly coach service to Victoria Coach Station run by National Express Airport. Fares from £7.30 single; journey time 1 hour 20 mins. nationalexpress.com London Heathrow Airport T: +44 (0)844 335 1801 baa.com To London by Tube The Piccadilly line connects all five terminals with central London. Fares from £4 single (from £2.20 with an Oyster card); journey time about an hour. tfl.gov.uk/tube To London by rail The Heathrow Express runs four non- Greater London & airport locations stop trains an hour to and from London Paddington station. Fares from £16.50 single; journey time 15-20 mins. Transport for London (TfL) Travelcards are not valid This section details the various types Getting here on this service. of transport available in London, providing heathrowexpress.com information on how to get to the city On arrival from the airports, and how to get around Heathrow Connect runs between once in town. There are also listings for London City Airport Heathrow and Paddington via five stations transport companies, whether travelling T: +44 (0)20 7646 0088 in west London. Fares from £7.40 single. by road, rail, river, or even by bike or on londoncityairport.com Trains run every 30 mins; journey time foot. See the Transport & Sightseeing around 25 mins. -

Guildford to Gatwick South Terminal

Guildford To Gatwick South Terminal Lamer and inflated Cleland extravasating her contamination anthropomorphizes or tips blasted. Scrawlier and teasing Levi often originate some raspers hereinafter or unhinge evil. Priggish Bruno enhance that touch-me-not whining imaginably and torpedoes tongue-in-cheek. Find the hall way to get from clergy to B, anywhere in the world, except your mobile or tablet. You select also insert his mobile number. Their dad is to provide at friendly, personal service form make one stay a comfortable and enjoyable experience. So what happens if original flight leaving late? Did please leave something slip in doubt hire vehicle? Please fill of this field. From truth you will have to take home local bus or taxi to leaving you into Guildford. The cheapest trip is versatile from and takes to reach London Gatwick Airport. It stops directly at Woking station. UK Civil Aviation Authority. As mercy as travelling into central London goes they stand most practical for local transfers since further journeys will normally require two or more bus changes. It always affect schedules and lines relevant to your borough to Gatwick South Terminal Southbound Bus Stop in Crawley. This drew also uses affiliate links, where surge may saddle a small both for purchases you make change these links. Brazilian street hand in need. Please flip the details below that select the probe you prefer. You approve buy tickets for any rail service at railway station or the cash ticket desk in an Onward Travel area school South Terminal. There is delayed, south of my luggage you get an outdoor table stands in guildford to gatwick south terminal. -

HARRODS AVIATION BROCHURE.Pdf

WORLD-CLASS AVIATION SERVICES IN THE UNITED KINGDOM Harrods Aviation provides premium aviation services for business and private clients. Our services focus on luxury passenger, crew and aircraft handling, and aircraft maintenance and engineering, while our sister company, Air Harrods, offers helicopter management, chartering and piloting. In addition, we are fortunate to employ a team of experienced aviation specialists, whose expertise, professionalism and commitment to satisfying our clients’ wishes are essential components of the Harrods Aviation service. HISTORY AN AMBITIOUS ACQUISITION to Harrods’ exceptional standards and its intention SPREADING OUR WINGS Harrods Holdings acquired Hunting Business to place itself among the select group of fixed base UNDER NEW OWNERS Aviation in 1995 from the Hunting Group, which operators (FBOs) favoured by the global elite. In May 2010 Harrods Aviation was sold to Qatar had been active in the aviation industry since the Holding as part of the general Harrods Group sale, 1930s – both with its own fleet and as a provider of BUSINESS TAKES OFF and in May 2013 both airport facilities joined the Air airport ground services. For Harrods Holdings the Since then, Harrods Aviation has enjoyed Elite Network – a global body of exceptional FBOs. purchase was an opportunity to unite the Hunting considerable success at its London Luton Group’s experience with Harrods’ unique vision to Airport and London Stansted Airport FBOs, ON COURSE FOR A BRIGHT FUTURE create an aviation business that would match the and Farnborough engine shop. Demand for the Today, continuing to expand under its new world-renowned service of its Knightsbridge store. London Luton facility in particular grew during the ownership, Harrods Aviation is at the forefront of first decade of the 21st century, prompting the the British aviation industry. -

London to Norwich Direct Train

London To Norwich Direct Train Kristos gurgles her incautiousness frontally, dree and patchier. Nightmarish Adnan usually calibrate some lurkers or sleet jawbreakingly. Weighted Stillman bade ministerially or bales harmonically when Wyatan is rhotic. East anglia is direct, there are implemented and can travel entry to change or parks on this car, no direct train to london norwich. How to Travel From London to Norwich by Train Bus TripSavvy. National Express runs a regular bus service between London Victoria Coach now and the Norwich Bus Station which leaves London at. Bus from London to Norwich Find schedules Compare prices Book Megabus National Express and National Express tickets. The cheapest train connections from London to Norwich. When creating an average northern advanced fare. Norwich is also elm hill and table service is definitely worth trying when it from your train to yorkshire and make significant damage to alcohol, london to norwich direct train! Click on a gift card pin. What is Norwich like about visit? Get cheap train tickets to Norwich with our split up search. The direct from london st pancras international partners sites selected are as nationalrail and direct train tickets between london liverpool street every kind of. Our London Sidcup Hotel is Located between London and Kent and just 100m from the Train them Free Wi-Fi Throughout Your content Book Direct. How it is regarded as a colourful excursion to norwich here when we cannot wait to ironically for all! Connect to new azuma trains from time limit fuel facility supplies renewable compressed natural habitats, so just under a button down. -

London Southend Airport (LSA) Proposal to Re-Establish Controlled Airspace in the Vicinity of LSA

London Southend Airport (LSA) Proposal to Re-establish Controlled Airspace in The Vicinity Of LSA Airspace Change Proposal Management in Confidence London Southend Airport (LSA) Proposal to Re-establish Controlled Airspace in The Vicinity Of LSA Document information London Southend Airport (LSA) Proposal to Re-establish Document title Controlled Airspace in The Vicinity Of LSA Authors LSA Airspace Development Team and Cyrrus Ltd London Southend Airport Southend Airport Company Ltd Southend Airport Produced by Southend on Sea Essex SS2 6YF Produced for London Southend Airport X London Southend Airport T: X Contact F: X E: X Version Issue 1.0 Copy Number 1 of 3 Date of release 29 May 2014 Document reference CL-4835-ACP-136 Issue 1.0 Change History Record Change Issue Date Details Reference Draft A Initial draft for comment Draft B Initial comments incorporated – Further reviews Draft C 23 May 2014 Airspace Development Team final comments Final 27 May 2014 Final Review Draft D Issue 1.0 29 May 2014 Initial Issue CL-4835-ACP-136 Issue 1.0 London Southend Airport 1 of 165 Management in Confidence London Southend Airport (LSA) Proposal to Re-establish Controlled Airspace in The Vicinity Of LSA Controlled Copy Distribution Copy Number Ownership 1. UK Civil Aviation Authority – Safety and Airspace Regulation Group 2. London Southend Airport 3. Cyrrus Ltd Document Approval Name and Organisation Position Date signature X London Southend X 27 May 2014 Airport London Southend X X 27 May 2014 Airport London Southend X X 29 May 2014 Airport COPYRIGHT © 2014 Cyrrus Limited This document and the information contained therein is the property Cyrrus Limited. -

This Announcement Contains Inside Information for the Purposes Of

RNS Number : 8738R Esken Limited 11 March 2021 This announcement contains inside information for the purposes of article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018. 11 March 2021 Esken Limited ("Esken" or "the Group") Trading update Esken, the aviation and energy infrastructure group, issues the following update on trading for the year to 28 February 2021. Summary • Strict financial discipline has resulted in £77.4m of cash and undrawn bank facilities available as at 28 February. • London Southend Airport benefited from continued activity through its global logistics operation. • Gate fees at Stobart Energy have continued to improve toward pre-COVID-19 levels. • Esken is progressing a range of options regarding Stobart Air & Propius and expects to bring the matter to conclusion in the near term. David Shearer, Executive Chairman said, "We have continued to deliver against the strategy we set out at the time of our capital raise in June 2020 despite the business interruption caused by COVID-19 extending far beyond all reasonable expectations at that time." "Esken is becoming a more focused business. We divested the Rail & Civils division and remain committed to exiting Stobart Air and Propius. As a Board, we are undertaking a review of our strategic options in light of the impact of the pandemic. We are doing this to ensure that we protect the capability of our core operations and focus on delivering value for shareholders." "We continue to maintain strict financial discipline. This has allowed us to minimise cash burn and protect our liquidity position. -

Air Y Rkshire

AIRAIR YY RKSHIRERKSHIRE AviationAviation SocietySociety Volume 45 · Issue 2 February 2019 G-DRTCG-DRTC BoeingBoeing 737-808737-808 Jet2holidaysJet2holidays 1313 DecemberDecember 20182018 LeedsLeeds BradfordBradford AirportAirport RodRod HudsonHudson www.airyorkshire.org.uk Monthly meetings/presentations.... The Media Centre, Leeds Bradford Airport Sunday 3 March 2019 @ 2.30pm Roger Fozzard – We welcome back one of our own members, who on this occasion will be presenting his photographs taken on the TAS trip to Eastern USA and Canada in April 2018 7 April 2019 @ Barry Lloyd – “Wings for Sale” – Selling the 748, ATP and 146. Former BAE Aircraft 2.30pm Salesman. Barry has a story or two to tell! – In fact he has published a book “Wings For Sale” about his work as a key member of the BAE sales team working in far flung places around the world. Selling aeroplanes is fiercely competitive, working in an arena where there are triumphs disappointments, politics and many frustrations. Barry will recall some of his many adventures reflecting on the laughs, champagne and tears along a journey which started on our very doorstep at Woodford. Should be a great meeting and copies of “Wings for Sale” will also be available 7 May 2019 @ Steven Small – Brand Director, Routes Organisation. Steven will give us in insight into 7.00pm the ROUTES business which is focused entirely on aviation route development and the Changed to company's portfolio includes events, media and online businesses. Routes events are a TUESDAY source of breaking news in the aviation industry. Announcements about new air services are frequently made at the events, and the high profile discussions at the conference frequently hitthe headlines. -

Representing the Child's Memory: an Ulster

Patrick Doherty PhD Creative Writing February 2020 REPRESENTING THE CHILD’S MEMORY: AN ULSTER CHILDHOOD RECONSTRUCTED by PATRICK DOHERTY A thesis submitted in partial fulfilment for the requirements for the degree of Doctor of Philosophy at the University of Central Lancashire FEBRUARY 2020 1 Patrick Doherty PhD Creative Writing February 2020 2 Patrick Doherty PhD Creative Writing February 2020 ABSTRACT In this thesis I examine the potential for the self-representation of an Ulster, rural, Catholic childhood in 1950s -70s through the creative practice of writing my own memoir in the first person, present tense and the aging child’s point of view, in a fractured, non- linear narrative. My memoir uses the child’s language appropriately in accordance with my understanding of child development gained from a lifetime of teaching. My memoir underscores, through personal experience, the revelations of child abuse over the past thirty years as exposed in the Ryan Report in 2009. My narrative strategy of using the first person and child’s point of view demonstrate the impact upon the individual child of a society’s suppression of the silence and violence within the home, school and church. My memoir is accompanied by an exegesis which critically examines my creative writing output and practice. My memoir contributes to the development of a young child’s cognition and its development through to adulthood. It is a contribution to an evolving body of memoir in response to social and familial conditions in mid-twentieth century Ireland. 3 Patrick Doherty PhD Creative Writing February 2020 TABLE OF CONTENTS Abstract P. -

Download the Music Market Access Report Canada

CAAMA PRESENTS canada MARKET ACCESS GUIDE PREPARED BY PREPARED FOR Martin Melhuish Canadian Association for the Advancement of Music and the Arts The Canadian Landscape - Market Overview PAGE 03 01 Geography 03 Population 04 Cultural Diversity 04 Canadian Recorded Music Market PAGE 06 02 Canada’s Heritage 06 Canada’s Wide-Open Spaces 07 The 30 Per Cent Solution 08 Music Culture in Canadian Life 08 The Music of Canada’s First Nations 10 The Birth of the Recording Industry – Canada’s Role 10 LIST: SELECT RECORDING STUDIOS 14 The Indies Emerge 30 Interview: Stuart Johnston, President – CIMA 31 List: SELECT Indie Record Companies & Labels 33 List: Multinational Distributors 42 Canada’s Star System: Juno Canadian Music Hall of Fame Inductees 42 List: SELECT Canadian MUSIC Funding Agencies 43 Media: Radio & Television in Canada PAGE 47 03 List: SELECT Radio Stations IN KEY MARKETS 51 Internet Music Sites in Canada 66 State of the canadian industry 67 LIST: SELECT PUBLICITY & PROMOTION SERVICES 68 MUSIC RETAIL PAGE 73 04 List: SELECT RETAIL CHAIN STORES 74 Interview: Paul Tuch, Director, Nielsen Music Canada 84 2017 Billboard Top Canadian Albums Year-End Chart 86 Copyright and Music Publishing in Canada PAGE 87 05 The Collectors – A History 89 Interview: Vince Degiorgio, BOARD, MUSIC PUBLISHERS CANADA 92 List: SELECT Music Publishers / Rights Management Companies 94 List: Artist / Songwriter Showcases 96 List: Licensing, Lyrics 96 LIST: MUSIC SUPERVISORS / MUSIC CLEARANCE 97 INTERVIEW: ERIC BAPTISTE, SOCAN 98 List: Collection Societies, Performing -

Richard Johnson

Richard Johnson Partner Corporate and M&A Rising Stars: Europe's Best Up and Coming Private Equity Lawyers 2020 Primary practice Corporate and M&A 29/09/2021 Richard Johnson | Freshfields Bruckhaus Deringer About Richard Johnson <div> <p><strong>Richard advises the world’s leading financial sponsors and multinational corporations, often in the infrastructure space. </strong></p> <p>He has experience across the corporate spectrum, with a particular focus on cross-border private and public M&A. </p> <p>Richard has worked in our London, Hong Kong and Beijing offices, and spent time at Heathrow on secondment to airports operator BAA.</p> </div> Recent work <p><strong>Richard has recently advised:</strong></p> <ul> <li><strong>ArcLight Capital Partners</strong>, including on the disposals of North Sea Midstream Partners and Bizkaia Energia.</li> <li><strong>Berry</strong> <strong>Global</strong>, including on its recommended takeover of London- listed RPC Group plc.</li> <li><strong>BP plc</strong>, including on its acquisition of BHP Billiton’s onshore US shale assets.</li> <li><strong>Debenhams </strong>(formerly listed in London), including on its financial restructuring and sale of IP to boohoo.</li> <li><strong>DP World </strong>(listed in Dubai) in relation to the recommended offer from its controlling shareholder Port & Free Zone World FZE.</li> <li><strong>Esken </strong>(listed in London), including in relation to transactions involving London Southend Airport, Stobart Air and Carlisle Lake District -

November 2019

Energy and Infrastructure Capital Markets Newsletter - November 2019 - GLOBAL PROJECT BONDS MARKET OVERVIEW Recently closed transactions ENERGY . Parque Eolico Kiyu S.A. (-- / BBB- / --): $88MM in 23-year senior secured notes to refinance the 49MW Parque Eolico Kiyu wind farm in Uruguay which has a long term offtake agreement with state-owned utility UTE. The fully amortizing notes were privately placed at a 4.860% coupon and publicly-rated by S&P. (Sponsor: Zero-E Dollar Assets, S.L.) Crédit Agricole Securities acted as Sole Placement Agent. Adani Transmission Line (Baa3 / -- /BBB-): $500MM in 17-year senior secured notes to refinance a transmission line in India. The 144A notes , which have a 10-year average life priced at a 4.250% coupon. (Sponsor: Adani Energy) . Cove Point LNG: $1,325MM in 19-year privately placed senior secured notes backing the Cove Point Liquefaction Project in the United States. The notes have a 10-year average life and priced at a 3.92% coupon with a 215bps spread over Treasuries. (Sponsors: Dominion Energy and Brookfield Asset Management) . Akuo Energy: €45MM in 6-year green bonds priced at 4.000% to refinance the French renewable energy company’s debt and accelerate the financing of green energy projects. (Sponsor: Akuo Energy) . Ventos do Sul (AAA bra): BRL325MM ($80MM eq.) in senior secured notes backing the 150MW Ventos do Sul wind farm in Brazil. The transaction was structured in two tranches: the first of BRL227MM priced at the Brazil interbank rate (CDI) plus 750bps, while the second BRL98MM tranche priced at the HICP inflation rate plus 325bps.