AI, ML & Automation: the Future of Energy, Mining & Utilities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Australian Investment Strategy

2 November 2016 Asia Pacific/Australia Equity Research Investment Strategy Australian Investment Strategy Research Analysts STRATEGY Hasan Tevfik ,CFA 61 2 8205 4284 [email protected] Aussie darlings Peter Liu 61 2 8205 4071 ■ Aussies love their darlings: Australia currently has the most expensive [email protected] equity market "Darlings" in the world. Our darlings trade on a forward P/E Damien Boey of 38x. The other commodity-focused market, Canada, has the second 61 2 8205 4615 [email protected] most expensive darlings. Darlings in Australia have been more expensive only during the Nasdaq bubble when they touched 45x. ■ Darling derating: Buying Australian darlings at these valuations has been a poor strategy in the past. Also, the current high valuation for Australia's darlings suggest they are especially vulnerable to rising bond yields and the coming end of the Australian profits recession. A rising discount rate and a lower premium for growth suggest investors should focus on stocks that could be future darlings. ■ Hello Daaarling: Future market darlings have shared many similar characteristics over the last 20 years. They are generally well managed, have strong balance sheets and operate on high margins. Our "Hello Daaarling" strategy highlights potential future darlings and they currently trade on just 17x P/E and include Caltex, Eclipx, Mayne Pharma, Nufarm, Star Entertainment and South 32. We add Eclipx to our long Portfolio. Figure 1: Australia has the most expensive darlings in the world Median 12-month forward P/E of "market darlings" around the world* 40 35 30 25 20 15 10 Australia Canada Cont. -

Content/Dam/Mercer/Attachments/Asia

Participant profile List of contributors The following 370 organisations contributed to the 2020 Australian Benefits Review. 3M Australia Aquila Resources 7-Eleven Aristocrat Technologies Australia A. Menarini Australia Arrow Electronics Australia Abbott Australasia ARTC AbbVie Ascender Accenture Australia* Aspen Australia Acrux DDS Astellas Pharma Australia ADCO Constructions Astrazeneca Adelaide Brighton AT&T Global Network Services Australia* Adobe Systems Australia* ATCO Australia AECOM Australia Aurizon Holdings Agilent Technologies Ausenco AGL AusGroup AIA Australia Australian Premium Iron Management Akamai Technologies Netherlands Australian Turf Club Alliance Mineral Asset Autodesk* Alliance Mining Commodities AVJennings Amazon* B. Braun Australia AMD Australia* B. Braun Avitum Amdocs Australia* Baker McKenzie Amgen Australia Bausch and Lomb Amway Of Australia Baxter Healthcare APA Group Bayer Apple* Bechtel Australia 2.14 Australian Benefits Review © 2020 Mercer Consulting (Australia) Pty Ltd Participant profile Becton Dickinson Celine Australia* beIN Media Group CenturyLink Technology Australia Besins Healthcare Christian Dior Australia* Biogen Church & Dwight BIS Industries Cipla Bluewaters Power 2 Cisco Systems Australia* Bluewaters Power Services Citrix* Boehringer Ingelheim Clean TeQ Bolton Clarke Cleanaway Boston Scientific Clough Projects Bouygues Construction Australia CNH Industrial Bowen and Pomeroy Cochlear BP Australia Colgate-Palmolive* Brisbane City Council Collins Foods Bristol-Myers Squibb Computershare British -

Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612

2 2 nd nd Fu No.3 201 Ex 50 50 Ex Aust Equities Aust Quarterly Newsletter Quarterly December Selector In this quarterly edition we review performance and attribution. We review and share some of our macro thoughts on energy, interest rates and bank regulation. Finally we focus on health insurance specialist NIB. Photo: An ACT Fire and Rescue team. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au About Selector We are a boutique fund manager and we have a combined experience of over 60 years. We believe in long term wealth creation and building lasting relationships with our investors. Our focus is stock selection. Our funds are high conviction, concentrated and index unaware. As a result we have low turnover and produce tax effective returns. First we identify the best business franchises with the best management teams. Then we focus on valuations. When we arrive at work each day we are reminded that; “The art of successful investment is the patient investor taking money from the impatient investor”. Our fund is open to new subscriptions. Please forward to us contact details if you would like future newsletters to be emailed to family, friends or business colleagues. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000, Australia Telephone 612 8090 3612 Web www.selectorfund.com.au December 2012 Selector Australian Equities Fund Quarterly Newsletter #32 Dear Investor, This time last year the world was in turmoil. -

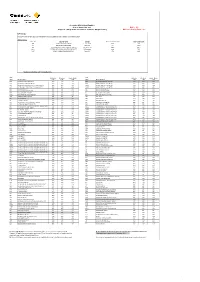

Participating Organisations | June 2021 Aon Rewards Solutions Proprietary and Confidential

Aon Rewards Solutions Proprietary and Confidential Participating organisations | June 2021 Aon Rewards Solutions Proprietary and Confidential Participating organisations 1. .au Domain Administration 44. Alexion Pharmaceuticals Limited Australasia Pty Ltd 2. [24]7.ai 45. Alfa Financial Software 3. 10X Genomics* Limited 4. 4 Pines Brewing Company 46. Alibaba Group Inc 5. 8X8 47. Alida* 6. A.F. Gason Pty Ltd* 48. Align Technology Inc. 7. A10 Networks 49. Alkane Resources Limited 8. Abacus DX 50. Allianz Australia Ltd 9. AbbVie Pty Ltd 51. Allscripts 10. Ability Options Ltd 52. Alteryx 11. Abiomed* 53. Altium Ltd 12. AC3 54. Amazon.com 55. AMEC Foster Wheeler 13. ACCELA* Australia Pty Ltd 14. Accenture Australia Ltd 56. Amgen Australia Pty Ltd 15. AccorHotels 57. AMP Services Limited 16. Acer Computer Australia Pty Ltd* 58. AMSC 17. Achieve Australia Limited* 59. Analog Devices 18. Achmea Australia 60. Anaplan 19. ACI Worldwide 61. Ancestry.com 62. Anglo American Metallurgical 20. Acquia Coal Pty Ltd 21. Actian Corporation 63. AngloGold Ashanti Australia 22. Activision Blizzard Limited* 23. Adaman Resources 64. ANZ Banking Group Ltd 24. Adcolony 65. Aon Corporation Australia 25. A-dec Australia 66. APA Group 26. ADG Engineers* 67. Apollo Endosurgery Inc. 27. Adherium Limited 68. APPEN LTD 28. Administrative Services 69. Appian* 29. Adobe Systems Inc 70. Apple and Pear Australia Ltd* 30. ADP 71. Apple Pty Ltd 31. Adtran 72. Apptio 32. Advanced Micro Devices 73. APRA AMCOS 33. Advanced Sterlization 74. Aptean Products* 75. Aptos* 34. AECOM* 76. Apttus 35. AEMO 77. Aquila Resources 36. Aeris Resources Limited 78. Arcadis 37. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

Introduction

INTRODUCTION CONTRIBUTNG ORGANISATIONS CONTRIBUTORS LISTED ALPHABETICALLY 7-Eleven Stores Amgen Australia ABB Australia AMT GROUP Abigroup Amway of Australia Accolade Wines Anglican Retirement Villages Diocese of Sydney Actavis Australia AP Moller-Maersk A/S Actelion Pharmaceuticals APL Adelaide Brighton APT Management Services (APA Group) Adidas Australia Arch Wood Protection (Aust) AECOM Australia Arrow Electronics Australia Afton Chemical Asia Pacific LLC Ashland Hercules Water Technologies (Australia) AGC Aspen Pharmacare Australia Aggreko Australia AstraZeneca AGL Energy ATCO Australia Aimia Atlassian Air Liquide Australia Aurecon Group Alcon Laboratories Australia Ausenco Alfa Laval Australia Ausgrid (formerly EnergyAustralia) Allergan Australia Aussie Home Loans Allied Mills Australand Property Group Alpha Flight Services Australia Post Alphapharm Australian Agricultural Company Alstom Australian Catholic University Altium Australian Institute of Company Directors Amadeus IT Pacific Australian Pharmaceutical Industries (Priceline, Soul Pattinson Chemist) Ambulance Victoria Australian Prudential Regulation Authority Amcor Australian Timken Propriety AMEC Mining & Metals Australian Turf Club © 2012 Mercer Consulting (Australia) Pty Ltd Top Management Remuneration Report 1.7 INTRODUCTION Avant Mutual Group BMW MELBOURNE Avery Dennison BMW Sydney AVJennings Boart Longyear Avon Cosmetics BOC Baptist Community Services NSW & ACT Boehringer Ingelheim Barbeques Galore Boeing Defense Australia BASF Australia Bombardier Transportation Australia -

1. Shareholdings in Public and Private Companies (Including Holding

Form A 3 March 2020 Surname: Mclachlan Other names: Andrew State/Territory: SA Date: 3/03/2020 1. Shareholdings in public and private companies (including holding companies) indicating the name of the company or companies (Note: It is NOT necessary to declare the size or value of the shareholding) Name of company – (including holding and subsidiary companies if applicable) OATMILL HOLDINGS PTY LTD AUSTOFIX GROUP LTD VITRO SOFTWARE HOLDINGS (Designated Activity Company) ALUMINA LIMITED ANTIPODES GLOBAL INVESTMENT COMPANY LTD ANZ BANKING GROUP LIMITED AP EAGERS LIMITED ARISTOCRAT LEISURE LIMITED BHP GROUP LIMITED BORAL LIMITED CLEANAWAY WASTE MANAGEMENT LTD COMMONWEALTH BANK OF AUSTRALIA CORPORATE TRAVEL MANAGEMENT LIMITED COSTA GROUP HOLDINGS LIMITED GRAINCORP LIMITED ILUKA RESOURCES LIMITED LI LONG SHORT FUND LIMITED MACQUARIE GROUP LIMITED MINERAL RESOURCES LIMITED Form A NAOS EMERG OPP CO LTD NINE ENTERTAINMENT co HLDGS LTD OOH!MEDIA LIMITED ORIGIN ENERGY LIMITED ORORA LIMITED QBE INSURANCE GROUP LIMITED QUBE HOLDINGS LIMITED RELIANCE WORLDWIDE CORPORATION LIMITED SIMS LIMITED SONIC HEALTHCARE LIMITED SOUTH32 LIMITED S32 THE STAR ENTERTAINMENT GROUP LTD TPG TELECOM LIMITED TPM WAM LEADERS LIMITED WAM MICROCAP LIMITED WESFARMERS LIMITED WESTPAC BANKING CORPORATION WOODSIDE PETROLEUM LIMITED WORLEY LIMITED NATIONAL STORAGE REIT STPLD SEC AMCOR PLC JANUS HENDERSON GROUP PLC SPARK NEW ZEALAND LIMITED VIRGIN MONEY UK PLC ANZ BANK UNSEC NON-CUM PARADICE GLOBAL SMALL CAP FUND PLATINUM EUROPEAN FUND WESTPAC CAPITAL NOTES 2. Family and business -

Australian Capital Territory Listed Company Shareholdings As at 31 March 2021

? i Australian Capital Territory Listed Company Shareholdings at 31 March 2021 Publication Date: April 2021 Page | 1 10X Genomics Inc Airbus SE 3i Group PLC Aisin Corp 3M Co Ajinomoto Co Inc A O Smith Corp Akamai Technologies Inc a2 Milk Co Ltd/The Akzo Nobel NV ABB Ltd Albemarle Corp Abbott Laboratories Alcon Inc AbbVie Inc Alexandria Real Estate Equities Inc ABC-Mart Inc Alexion Pharmaceuticals Inc ABIOMED Inc Alfa Laval AB Accent Group Ltd Algonquin Power & Utilities Corp Accenture PLC Align Technology Inc Accor SA Alimentation Couche-Tard Inc Acom Co Ltd Alkane Resources Ltd ACS Actividades de Construccion y Servic Alleghany Corp Activision Blizzard Inc Allegion plc Adbri Ltd Allianz SE Adecco Group AG Allstate Corp/The adidas AG Ally Financial Inc Admiral Group PLC Alnylam Pharmaceuticals Inc Adobe Inc Alphabet Inc Advance Auto Parts Inc ALS Ltd Advanced Micro Devices Inc Alstom SA Advantest Corp AltaGas Ltd Adyen NV Altice USA Inc Aegon NV Altium Ltd Aeon Co Ltd Alumina Ltd Aflac Inc Amada Co Ltd Afterpay Ltd Amadeus IT Group SA AGC Inc Amazon.com Inc Ageas SA/NV Ambu A/S Agilent Technologies Inc Amcor PLC Agnaten SE AMERCO AGNC Investment Corp American Express Co Agnico Eagle Mines Ltd American Financial Group Inc/OH AIA Group Ltd American International Group Inc Air Canada American Tower Corp Air Liquide SA American Water Works Co Inc Air Products and Chemicals Inc Ameriprise Financial Inc Air Water Inc AmerisourceBergen Corp Airbnb Inc AMETEK Inc Page | 2 Amgen Inc Assicurazioni Generali SpA AMP Ltd Assurant Inc Amphenol Corp -

Directors Report 2004 18.8.041

BlueScope Steel Limited Directors’ Report BlueScope Steel Limited ABN 16 000 011 058 Directors’ Report - 30 June 2004 Contents Page Corporate directory 2 Directors’ report 4 Corporate governance statement 17 Directors biographies 30 Page 1 of 31 BlueScope Steel Limited Directors’ Report Directors G J Kraehe AO Chairman R J McNeilly Deputy Chairman K C Adams Managing Director and Chief Executive Officer D J Grady H K McCann P J Rizzo Y P Tan J Crabb resigned 28 July 2004 Secretary M G Barron Executive Leadership Team Managing Director and Chief Executive Officer K C Adams President Australian Building and Manufacturing Markets N Cornish President Asian Building and Manufacturing Markets M Courtnall Executive Vice President Human Resources I Cummin (appointed 1 September 2003) President Market and Logistics Solutions K Fagg President Industrial Markets L Hockridge Chief Financial Officer B Kruger Notice of Annual General Meeting The annual general meeting of BlueScope Steel Limited Will be held at The Westin 1 Martin Place, Sydney Date 2 pm, 19 October 2004 Registered Office Level 11, 120 Collins Street (BlueScope Steel Centre) Melbourne, Victoria 3000 (03) 9666 4000 Share Registrar ASX Perpetual Registrars Limited Level 4, 333 Collins Street Melbourne, Victoria 3000 +61 3 9615 9130 or 1300 855 998 Page 2 of 31 BlueScope Steel Limited Directors’ Report Auditor Ernst & Young Chartered Accountants Level 33, 120 Collins Street Melbourne, Victoria 3000 Stock Exchange BlueScope Steel Limited shares are quoted on the Australian Stock Exchange Website Address www.bluescopesteel.com Page 3 of 31 BlueScope Steel Limited Directors’ Report Directors’ Report for the year ended 30 June 2004 The directors of BlueScope Steel Limited ("BlueScope Steel") present their report on the consolidated entity ("BlueScope Steel Group") consisting of BlueScope Steel Limited and its controlled entities for the financial year ended 30 June 2004. -

Martin Currie Australia and Are Disclosed Where the Vote Instruction Is Consistent Across All Such Clients

Voting records are for clients who have delegated voting authority to Martin Currie Australia and are disclosed where the vote instruction is consistent across all such clients. Individual voting records are available to clients on request. MARTIN CURRIE AUSTRALIA VOTING DISCLOSURE FROM 1 OCT TO 31 DEC 2020 Company Meeting Vote Meeting Date Proponent Item Number Proposal Name Type Instruction Meridian 01/10/2020 Annual 1 Elect Mark Verbiest as Mgmt For Energy Limited Director Saracen 06/10/2020 Annual 1 Elect Sally Langer as Mgmt For Mineral Director Holdings Limited Saracen 06/10/2020 Annual 2 Elect Roric Smith as Mgmt For Mineral Director Holdings Limited Saracen 06/10/2020 Annual 3 Elect Samantha Tough Mgmt For Mineral as Director Holdings Limited Saracen 06/10/2020 Annual 4 Approve Remuneration Mgmt For Mineral Report Holdings Limited Saracen 06/10/2020 Annual 5 Approve Long Term Mgmt For Mineral Incentive Plan Holdings Limited Saracen 06/10/2020 Annual 6 Approve Issuance of Mgmt For Mineral Performance Rights to Holdings Raleigh Finlayson Limited Saracen 06/10/2020 Annual 7 Approve Issuance of Mgmt For Mineral Share Rights to Sally Holdings Langer Limited Saracen 06/10/2020 Annual 8 Approve Termination Mgmt For Mineral Benefits Holdings Limited AGL Energy 07/10/2020 Annual 2 Approve Remuneration Mgmt Against Limited Report AGL Energy 07/10/2020 Annual 3a Elect Peter Botten as Mgmt For Limited Director AGL Energy 07/10/2020 Annual 3b Elect Mark Bloom as Mgmt For Limited Director AGL Energy 07/10/2020 Annual 4 Approve Grant of Mgmt Against Limited Performance Rights under the AGL Long Term Incentive Plan to Brett Redman AGL Energy 07/10/2020 Annual 5 Approve Termination Mgmt For Limited Benefits for Eligible Senior Executives Martin Currie Australia Voting Disclosure Report 2020 Q4 Martin Currie Australia is a division of Legg Mason Asset Management Australia Limited. -

Commsec Margin Lending Approved Securities List

Accepted ASX Listed Equities as at 21 September 2021 Buffer - 5% Subject to change at the discretion of CommSec Margin Lending Maximum Gearing Ratio - 90% LVR Changes Changes since the last Approved Securities List was published are outlined in the below table: ASX Securities ASX Code Security Name Change Previous Portfolio LVR New Portfolio LVR AST AUSNET SERVICES LIMITED Capped LVR 75% 75% BGL BELLEVUE GOLD LIMITED New LVR 0% 40%* SXL SOUTHERN CROSS MEDIA GROUP LIMITED Uncapped LVR 40%* 40%* QLTY BETASHARES GLOBAL QUALITY LEADERS ETF LVR Increase 65% 70% CLNE VANECK GLOBAL CLEAN ENERGY ETF New LVR 0% 65% *Available via facilities with PLVR enabled only ASX Portfolio Standard Single Stock ASX Portfolio Standard Single Stock Code Security Name LVR LVR LVR Code Security Name LVR LVR LVR A200 BETASHARES AUSTRALIA 200 ETF 80% 75% 70% BNKS BETASHARES GLOBAL BANKS ETF 70% 65% 60% A2M THE A2 MILK COMPANY LIMITED 55% 50% 45% BOQ BANK OF QUEENSLAND LIMITED 70% 65% 60% AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF 90% 85% 80% BOQPE BANK OF QUEENSLAND LIMITED 70% 65% 60% AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED 50% 45% 40% BOQPF BANK OF QUEENSLAND LIMITED 70% 65% 60% ABA AUSWIDE BANK LTD 50% 45% 40% BPT BEACH ENERGY LIMITED 50% 45% 40% ABC ADELAIDE BRIGHTON LIMITED 60% 55% 50% BRG BREVILLE GROUP LIMITED 65% 60% 55% ABP ABACUS PROPERTY GROUP 65% 60% 55% BSL BLUESCOPE STEEL LIMITED 70% 65% 60% ACDC ETFS BATTERY TECH & LITHIUM ETF 60% 55% 50% BVS BRAVURA SOLUTIONS LIMITED 45% 40% 35% AD8 AUDINATE GROUP LIMITED 40% 0% 0% BWP BWP TRUST 70% 65% 60% ADH ADAIRS LIMITED 45% 40% 35% BWX BWX LIMITED 45% 40% 35% ADI APN INDUSTRIA REIT 60% 55% 50% BXB BRAMBLES LIMITED 80% 75% 70% AEF AUSTRALIAN ETHICAL INVESTMENT LIMITED 40% 35% 30% CAJ CAPITOL HEALTH LIMITED 40% 0% 0% AFG AUSTRALIAN FINANCE GROUP LTD 40% 35% 30% CAR CARSALES.COM LIMITED. -

Ellerston Australian Small Companies Fund (SCF) Performance Report | November 18

Ellerston Australian Small Companies Fund (SCF) Performance Report | November 18 PERFORMANCE SUMMARY Investment Objective Strategy The Investment objective for the 1 3 1 3 5 Net % Since Ellerston Australian Small Month Months Yr p.a. Yr p.a. Yr p.a Inception p.a. Companies Fund is to outperform the S&P/ASX Small Ordinaries Accumulation Index (Benchmark). SCF -3.84 -11.15 2.60 9.35 8.99 8.86 Investment Strategy Benchmark -0.37 -10.25 -1.63 10.40 7.07 6.76 The Fund’s active, research-driven approach seeks to identify a Source: Ellerston Capital Limited concentrated portfolio of smaller MARKET COMMENTARY companies with sound businesses, attractive earnings profiles and The Ellerston Small Companies Fund fell 3.84% Net in November, underperforming the ASX Small Ordinaries supportive industries, which are Accumulation Index which fell 0.37%. During the month, the Small Industrials Accumulation Index rose 0.81% trading at a discount. whilst the Small Resources Accumulation Index fell 4.07%. Key Information The largest contributors to positive attribution were G8 Education (GEM), Worley Parsons (WOR) and Beach Strategy Inception 10 October 2013 Energy (BPT). G8 rallied after management re-affirmed CY18 guidance and outlined their plans to return to Date occupancy growth at the 2018 Investor Day. After undertaking the acquisition of Jacobs Engineering in October, Worley Parsons share price remained weak in November due to the continued fall of the oil price. Fund Net Asset $0.9771 The Portfolio does not hold Worley. Like most oil sector stocks, Beach Energy fell in November on the back Value of the fall in the oil price.