Australian Investment Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2013 Annual Report

Transforming business, making life simple Technology One Limited Technology 2013 Annual Report Technology One Limited 2013 Annual Report cus & Fo t Po et men we rk it r a m of M m O o n C e n o i s i V e s i One One One r p r e t vision. vendor. experience. n E n n S io o i t t m lu C pl o o ici Ev m ty, of ple er xity Pow y t P i o x w e e l r p o , y f t m i E c o i v l C o p t l u m i o t S n i o n TechnologyOne is a leading supplier of powerful, integrated enterprise software solutions. We are also Australia’s largest publicly listed software company. Market focus Our core An enterprise vision and commitment Transforming business, beliefs The power of a single, Preconfi gured enterprise making life simple integrated enterprise solution software solutions reduce time, cost and risk Experience the power of a single, A deep understanding and integrated enterprise solution engagement with our seven key built on a single modern markets means we can deliver platform with a consistent to our customers integrated, look and feel. preconfi gured solutions that provide proven practice, streamline implementations and reduce time, cost and risk. 1 Technology One Limited 2013 Annual Report 2013 full year highlights $m Compound Growth 13% $m Compound Growth 20% 40 80 35 70 30 60 25 50 20 40 15 30 10 20 5 10 0 FY FY 0 04 05 06 07 08 09 10 11 12 13 04 05 06 07 08 09 10 11 12 13 0 FY 04 05 06 07 08 09 10 11 12 13 0 FY 04 05 06 07 08 09 10 11 12 13 5 Net Profi t Before Tax 10 Annual Licence Fees 10 up 16%, $35.1m 20 up 14%, $9.1m 15 30 Every day, more than 1,000 leading corporations, government departments and statutory authorities in Australia, New Zealand, Asia, the South Pacifi c and United Kingdom use our world class enterprise software solutions, which we develop, market, sell, implement, support and run. -

The State of the Deal and Deloitte Queensland Index

The State of the Deal and Deloitte Queensland Index March 2021 – Queensland Index Exceeds $100 billion THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Contents Executive Summary 1 Then & Now – Investment Landscape 3 Then & Now – Deloitte Queensland Index 4 Queensland Economic Update 7 The Deloitte Queensland Index Q1 2021 8 Contacts 11 Sources 12 ii THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Executive Summary Following the significant rebound in the second half of 2020, companies in the Deloitte Queensland Index exceeded $100 billion at 31 March 2021, the highest month end market capitalisation on record for the State. Deloitte Queensland Index S&P/ASX All Ordinaries Companies in the Deloitte return in Q1 2021 return in Q1 2021 Queensland Index 3.5% 2.4% 169 at 31 March 2021 10.6% in Q4 2020 14.0% in Q4 2020 173 at 31 December 2020 90 companies increased Market capitalisation as at Mar-21 market capitalisation (53%) 66 companies decreased market $101.6b capitalisation (39%) 12 no movement (7%) $97.2b as at Dec-20 $18.5b as at Sep-02 5 delistings 1 listing (1%) Announced QLD M&A Disclosed value of announced transactions in Q1 2021 QLD M&A transactions in Q1 2021 64 $1.9b 92 in Q4 2020 $3.3b in Q4 2020 1 THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion The Deloitte Queensland Index increased by 3.5% in Q1 2021 Queensland M&A more broadly remains strong with with total market capitalisation increasing to $101.6b at 64 transactions announced in Q1 2021 including: Mar-21, the highest month end value on record for the State. -

Annual Report for the YEAR 1 JULY 2013 to 30 JUNE 2014

1 JULY 2013 TO 30 JUNE 2014 NEXTDC Limited ABN 35 143 582 521 Annual Report FOR THE YEAR 1 JULY 2013 TO 30 JUNE 2014 2 4 6 16 24 57 58 72 122 124 126 129 FY14 1 JULY 2013 TO 30 JUNE 2014 NEXTDC Limited ABN 35 143 582 521 1 NEXTDC LIMITED ANNUAL REPORT 30 JUNE 2014 Letter from the Chairman Operational performance and cost management are a key focus to ensure the Company is strongly positioned for growth and to deliver the financial performance and shareholder value that investors require. Douglas Flynn, Chairman On behalf of the Board of Directors and NEXTDC Limited, it The completion of our capital recycling program with the I was honoured to take over as Chairman of the Board We believe the Company’s new Board has the strength, is my pleasure to present NEXTDC Limited’s fourth Annual Asia Pacific Data Centre Group raised approximately $140 from Mr Ted Pretty in April 2014. Ted has remained on the independence and breadth of experience required to Report. million across the 2013 and 2014 financial years. The investor Board as a Non-executive Director and I’d like to take this build long term shareholder value. Your Directors and response to NEXTDC’s five-year senior unsecured notes opportunity to thank him for guiding the Company during management team look forward to a period of stability as The past financial year has been transformational with offering in June 2014, which raised $60 million of debt what was a key period of change. -

June 2019 42

y 4 6 Equit 2019 June High Conviction High Quarterly NewsletterQuarterly No. Selector Fund In this quarterly edition, we review performance and attribution for the quarter. We highlight the importance of innovation and culture within organisations and profile ResMed and Cochlear, two leading healthcare businesses. We visit Fisher & Paykel Healthcare in New Zealand and look at one of the biggest growth industries in the world today, cyber security. Photo. Selector analyst trekking through the Atlas Mountains and local Berber kids. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 8, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au P Selector is a boutique fund manager. Our team, combined, have over 150 years of experience in financial markets. We believe in long-term wealth creation and building lasting relationships with our investors. We focus on stock selection, the funds are high conviction, concentrated and index unaware. As a result, the portfolios have low turnover and produce tax effective returns. Selector has a 15-year track record of outperformance and we continue to seek businesses with leadership qualities, run by competent management teams, underpinned by strong balance sheets and with a focus on capital management. Selector High Conviction Equity Fund Quarterly Newsletter #64 CONTENTS IN BRIEF – JUNE QUARTER 3 PORTFOLIO OVERVIEW 5 PORTFOLIO CONTRIBUTORS 7 MARKET INSIGHTS AND OBSERVATIONS 13 INNOVATION + CULTURE = SUCCESS 17 RESMED INC. 20 WAKE-UP CALL 31 FISHER & PAYKEL HEALTHCARE – JUNE 2019 42 RISK OUT…UPFRONT 45 COMPANY VISIT DIARY – JUNE 2019 QUARTER 57 2 Selector Funds Management IN BRIEF – JUNE QUARTER Dear Investor, Looking back on 2019, it would be fair to say that few identify the businesses we want to own on a case by case foresaw how the events of the financial year would basis, understand them to the best of our abilities and unfold. -

Ethical Trans-Tasman Fund Fact Sheet – August 2021

Ethical Trans-Tasman Fund Fact Sheet – August 2021 Investment Objective Fund Performance (after fees, before tax) Ethical investing in Australasian equities to achieve above average long-term risk adjusted returns. Performance 1 6 1 Inception month months year p.a. The Fund invests directly in Australasian equities, listed property companies and other assets that satisfy Pathfinder’s ethical investment 1 criteria. This is a high-conviction fund of top investment ideas and Fund Return 5.3% 8.9% 18.3% 23.3% targets a portfolio of 10 to 40 holdings. Benchmark 3.1% 9.9% 16.0% 8.1% Investing Ethically Return 2 1. UN Sustainable Development Goals: Aspiring for investment Outperformance 2.2% -1.0% 2.3% 15.2% decisions to contribute to UN Sustainable Development Goals. 2. Environmental, social and governance focus: Focusing investment 1 Performance as of 31 August 2021. Trading started: October 2019. into companies that rate higher on environmental, social and 2 50/50 composite of NZX 50 and ASX 200 Index governance criteria. 3. Climate change awareness: Companies with a lower carbon intensity Actual Investment Mix and a plan for managing the transition to a low carbon economy make better long-term investments. Health Care: 29.7% 4. Aware, Fair, Care: Avoiding investment in companies engaged in industries or activities seen as harmful. Utilities: 13.3% 5. Engagement and shareholder voting: Engaging and voting as a Information Technology: 13.3% shareholder can bring about positive change. Consumer Staples: 12.5% Please refer to our Ethical Investment Policy for more details. Financials: 11.2% Investor Suitability Communication Services: 10.2% Industrials: 5.8% The Ethical Trans-Tasman Fund is suited to an investor with a high tolerance to risk and a minimum investment timeframe of 5+ years. -

NEXTDC FY17 Appendix 4E and Annual Report

NEXTDC Limited Appendix 4E Preliminary Final Report Results for announcement to the market For the year ended 30 June 2017 (Previous corresponding period: to 30 June 2016) Summary of Financial Information 2017 2016 Change Change Note $’000 $’000 $’000 % Revenue from ordinary activities 123,550 92,837 30,713 33% Profit/(loss) from ordinary activities after income tax for the period attributable to 1 22,999 1,756 21,243 NMF1 members Profit/(loss) after income tax attributable to 1 22,999 1,756 21,243 NMF members 1. Included in profit after income tax is an income tax benefit of $10.2 million which is primarily due to the recognition of accumulated tax losses as deferred tax assets. Dividends No dividend has been proposed or declared in respect of the year ended 30 June 2017. Net tangible assets 2017 2016 Basic net tangible asset backing per ordinary share $1.75 $1.36 Refer to the attached audited Financial Report for additional disclosures. 1 NMF = Not meaningful NEXTDC Limited and controlled entities | FY17 Annual Report Page 1 of 100 ANNUAL REPORT FOR THE YEAR 1 JULY 2016 TO 30 JUNE 2017 Letter from the Chairman and CEO 3 About NEXTDC 6 Directors’ Report 12 Remuneration Report 22 Auditor’s Independence Declaration 46 Corporate Governance 47 Financial Report 48 Directors’ Declaration 91 Independent Auditor’s Report to the Members 92 Shareholder Information 98 Corporate Directory 100 NEXTDC Limited and controlled entities | FY17 Annual Report Page 2 of 100 Letter from Chairman and CEO We welcome our shareholders to this year’s Annual Report, which marks the end of the financial year to 30 June 2017 (“FY17”) and another period of significant growth and strategic achievements. -

Smallco Investment Fund

Smallco Investment Fund Quarterly Update 30 September 2014 SIF Portfolio Commentary SIF Performance Smallco Investment Fund (SIF) delivered 6.8% during the Return to 30 September 2014 September quarter and for the 12 months was up a solid 12.3%. During the quarter Iress, Isentia Group and Sirtex 3 months 6.8% Medical performed positively, while Carsales.com, Ozforex 1 year 12.3% Group and Macquarie Atlas Roads were negative 3 year p.a. 36.4% contributors. 5 year p.a. 22.5% For the September quarter the Small Ordinaries index was 10 year p.a. 13.6% modestly positive at 1.5% while for the year to 30 Since inception (31.10.00) p.a. 14.2% September it was down -0.1%. Value of $100,000 invested at inception $631,173 In general the Australian market had a solid reporting Fund returns calculated after all fees and expenses and based season and that was reflected in share prices during upon exit price and reinvestment of distributions. August, particularly for Industrial companies. However, towards the end of the quarter, the Australian and international markets became concerned about global political tensions – Ukraine, Iraq and Hong Kong – with a falling iron ore price having a significant negative impact on the Australian resources index. SIF Structure: by sector (look through) One of our major holdings is IRESS (IRE). SIF originally invested in IRE in 2002 when it had a market capitalisation of $260m. At the time we invested it was already the dominant provider of information systems to the professional equity market in Australia and New Zealand (ANZ). -

Content/Dam/Mercer/Attachments/Asia

Participant profile List of contributors The following 370 organisations contributed to the 2020 Australian Benefits Review. 3M Australia Aquila Resources 7-Eleven Aristocrat Technologies Australia A. Menarini Australia Arrow Electronics Australia Abbott Australasia ARTC AbbVie Ascender Accenture Australia* Aspen Australia Acrux DDS Astellas Pharma Australia ADCO Constructions Astrazeneca Adelaide Brighton AT&T Global Network Services Australia* Adobe Systems Australia* ATCO Australia AECOM Australia Aurizon Holdings Agilent Technologies Ausenco AGL AusGroup AIA Australia Australian Premium Iron Management Akamai Technologies Netherlands Australian Turf Club Alliance Mineral Asset Autodesk* Alliance Mining Commodities AVJennings Amazon* B. Braun Australia AMD Australia* B. Braun Avitum Amdocs Australia* Baker McKenzie Amgen Australia Bausch and Lomb Amway Of Australia Baxter Healthcare APA Group Bayer Apple* Bechtel Australia 2.14 Australian Benefits Review © 2020 Mercer Consulting (Australia) Pty Ltd Participant profile Becton Dickinson Celine Australia* beIN Media Group CenturyLink Technology Australia Besins Healthcare Christian Dior Australia* Biogen Church & Dwight BIS Industries Cipla Bluewaters Power 2 Cisco Systems Australia* Bluewaters Power Services Citrix* Boehringer Ingelheim Clean TeQ Bolton Clarke Cleanaway Boston Scientific Clough Projects Bouygues Construction Australia CNH Industrial Bowen and Pomeroy Cochlear BP Australia Colgate-Palmolive* Brisbane City Council Collins Foods Bristol-Myers Squibb Computershare British -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

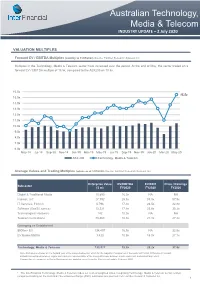

Australian Technology, Media & Telecom

Australian Technology, Media & Telecom INDUSTRY UPDATE – 2 July 2020 VALUATION MULTIPLES Forward EV / EBITDA Multiples (monthly to 31/05/2020) Source: FactSet Research Systems Inc. Multiples in the Technology, Media & Telecom sector have increased over the period. At the end of May, the sector traded on a forward EV / EBITDA multiple of 15.5x, compared to the ASX200 on 10.5x. 16.0x 15.5x 15.0x 14.0x 13.0x 12.0x 11.0x 10.0x 9.0x 8.0x 7.0x 6.0x May-18 Jul-18 Sep-18 Nov-18 Jan-19 Mar-19 May-19 Jul-19 Sep-19 Nov-19 Jan-20 Mar-20 May-20 ASX 200 Technology, Media & Telecom Average Values and Trading Multiples (values as at 1/07/2020) Source: FactSet Research Systems Inc. Enterprise Value EV/EBITDA EV/EBIT Price / Earnings Subsector ($ m) FY2020 FY2020 FY2020 Digital & Traditional Media 10,890 16.9x NA NA Internet, IoT 27,792 25.3x 33.3x 57.9x IT Services, Fintech 5,796 17.3x 24.5x 32.8x Software (SaaS/Licence) 13,221 17.9x 23.9x 35.2x Technological Hardware 142 10.0x NA NA Telecommunications 73,468 10.3x 21.1x 27.2x Emerging vs Established $500m+ EV 134,497 16.9x NA 32.9x EV Below $500m 1,420 10.9x 15.0x 27.7x Technology, Media & Telecom 135,917 15.5x 29.2x 31.8x Note: Multiples are based on the forward year of the unreported period, which for the majority of companies in the sector is FY2020. Difference in forward EV/EBITDA multiples between Figure and Table are representative of the timing difference between month-end result, and current day result. -

Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612

2 2 nd nd Fu No.3 201 Ex 50 50 Ex Aust Equities Aust Quarterly Newsletter Quarterly December Selector In this quarterly edition we review performance and attribution. We review and share some of our macro thoughts on energy, interest rates and bank regulation. Finally we focus on health insurance specialist NIB. Photo: An ACT Fire and Rescue team. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au About Selector We are a boutique fund manager and we have a combined experience of over 60 years. We believe in long term wealth creation and building lasting relationships with our investors. Our focus is stock selection. Our funds are high conviction, concentrated and index unaware. As a result we have low turnover and produce tax effective returns. First we identify the best business franchises with the best management teams. Then we focus on valuations. When we arrive at work each day we are reminded that; “The art of successful investment is the patient investor taking money from the impatient investor”. Our fund is open to new subscriptions. Please forward to us contact details if you would like future newsletters to be emailed to family, friends or business colleagues. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000, Australia Telephone 612 8090 3612 Web www.selectorfund.com.au December 2012 Selector Australian Equities Fund Quarterly Newsletter #32 Dear Investor, This time last year the world was in turmoil.