Directors Report 2004 18.8.041

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inception 9 February 2005 Investment Universe ASX Listed No. Of

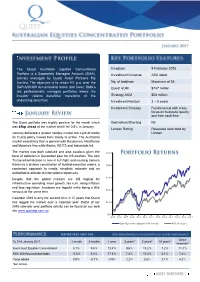

The Quest Australian Equities Concentrated Inception 9 February 2005 Portfolio is a Separately Managed Account (SMA), Investment Universe ASX listed actively managed by Quest Asset Partners Pty Limited. The objective is to return 4% p.a. over the No. of holdings Maximum of 35 S&P/ASX300 Accumulation Index (pre fees). SMA’s Quest AUM $747 million are professionally managed portfolios where the investor retains beneficial ownership of the Strategy AUM $58 million underlying securities. Investment Horizon 3 – 5 years Investment Strategy Fundamental with a key focus on business quality and free cash flow The Quest portfolio was slightly positive for the month which Derivatives/Shorting Nil was 85bp ahead of the market which fell 0.8% in January. Lonsec Rating Reviewed and rated by January delivered a quieter holiday market but a jolt of reality Lonsec as Trump policy moved from theory to active. The Australian market eased less than a percent with Resources, Healthcare and Materials firm while Banks, REITS and Industrials fell. The market was both subdued and also cautious given the $330 burst of optimism in December post the US election. The new Trump administration is now in full flight and causing tremors thanks to a divisive combination of hurried executive orders, a $280 combatant approach to media, simplistic rationale and an authoritative attitude to international diplomacy. Despite that the global markets are still hoping for $230 infrastructure spending, more growth, tax cuts, rising inflation and less regulation. Investors are hopeful while being a little $180 nervous at the same time. Calendar 2016 is only the second time in 12 years that Quest has lagged the market over a calendar year. -

Blasting Without Wires in Surface and Underground

DRILLING AND BLASTING Blasting without wires in surface and underground A WebGen™ unit is encoded at CMOC Northparkes mine by an Orica engineer, ready for loading. ince the launch of WebGen™, the ENABLING NEW MINING METHODS UNDERGROUND world’s first wireless initiating system WebGen™ has demonstrated its success in various in early 2017, Orica has executed underground mines and led to the development of several more than 500 blasts fired using the new mining techniques that would have otherwise been wireless technology in both surface deemed impossible to execute without wireless blasting S and underground mines around the technology. world. At Musselwhite mine, an underground mine owned and WebGen™ is one of the most exciting blasting technologies operated by Newmont, located on the southern shore of to be developed since the introduction of electronic blasting Lake Opapimiskan in Canada uses a Temporary Rib Pillar systems in the early 2000’s. This revolutionary system (TRP) method enabled by WebGen™ to extract ore pillars allows for groups of in-hole primers to be wirelessly that previously could not be recovered in underground initiated by a firing command that communicates through operations. rock, air and water. This eliminates the need for down- wires and surface connecting wires, enabling new mining Using the WebGen™ enabled TRP method, the main ore methods and blasting techniques that are safe and reliable of the panel were blasted and extracted while the TRP held – removing people from harm’s way, reducing operating back the waste rock backfill. For Newmont, this delivered costs, and at the same time increasing productivity benefits. -

Australian Investment Strategy

2 November 2016 Asia Pacific/Australia Equity Research Investment Strategy Australian Investment Strategy Research Analysts STRATEGY Hasan Tevfik ,CFA 61 2 8205 4284 [email protected] Aussie darlings Peter Liu 61 2 8205 4071 ■ Aussies love their darlings: Australia currently has the most expensive [email protected] equity market "Darlings" in the world. Our darlings trade on a forward P/E Damien Boey of 38x. The other commodity-focused market, Canada, has the second 61 2 8205 4615 [email protected] most expensive darlings. Darlings in Australia have been more expensive only during the Nasdaq bubble when they touched 45x. ■ Darling derating: Buying Australian darlings at these valuations has been a poor strategy in the past. Also, the current high valuation for Australia's darlings suggest they are especially vulnerable to rising bond yields and the coming end of the Australian profits recession. A rising discount rate and a lower premium for growth suggest investors should focus on stocks that could be future darlings. ■ Hello Daaarling: Future market darlings have shared many similar characteristics over the last 20 years. They are generally well managed, have strong balance sheets and operate on high margins. Our "Hello Daaarling" strategy highlights potential future darlings and they currently trade on just 17x P/E and include Caltex, Eclipx, Mayne Pharma, Nufarm, Star Entertainment and South 32. We add Eclipx to our long Portfolio. Figure 1: Australia has the most expensive darlings in the world Median 12-month forward P/E of "market darlings" around the world* 40 35 30 25 20 15 10 Australia Canada Cont. -

Ellerston Global Equity Managers Fund PERFORMANCE REPORT January 2018

Ellerston Global Equity Managers Fund PERFORMANCE REPORT January 2018 Fund performance^ Investment Objective 1 3 1 3 Yr 5 Yr Strategy Since Month Months Yr p.a p.a Inception p.a The investment objective is to generate superior returns for Unitholders with a focus on risk and capital preservation. GEMS A Net 0.95% 11.13% 22.51% 20.46% 17.51% 13.90% GEMS B Net 0.95% 11.13% 22.51% 20.45% 17.33% 13.72% Investment Strategy Global long/short equity Overlays fundamental stock selection with macroeconomic outlook Bias toward Australia Commentary In January, equity markets continued their upward charge, taking their lead from the US. The Dow Jones and S&P 500 drove the rally in developed equity markets, delivering their tenth consecutive month of positive returns, maintaining their stellar performances and hitting new record high levels as the month Key Information progressed. The major Eurozone and Asian equity markets were all in positive territory, buoyed by strong earnings delivered by corporates and positive Strategy Inception 1 January economic outlooks reinforced by central bankers, politicians and business Date 2002 leaders at the gathering at Davos. However, the month ended with markets trading off their intra-month highs, as US bond yields backed up sharply, Fund Net Asset A$195.6M Value signalling inflationary concerns and potentially highlighting stretched equity valuations. Liquidity Quarterly USA: Equity markets in the US continued their explosive rally, with the broader Class A Redemption A$ 1.7548 S&P 500 index logging its strongest start to a year since 1987. -

2019 Voting Record As at 30 June 2019

2019 Voting Record as at 30 June 2019 Solaris Core Australian Equity Fund Solaris High Alpha Australian Equity Fund Solaris Core Australian Equity Fund (Total Return) Stock Company Name Meeting Date Item Resolutions Solaris Resolution Management/ Decision Type Shareholder Proposal MQG Macquarie Group Limited 26/07/2018 2a Elect Peter H Warne as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2b Elect Gordon M Cairns as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2c Elect Glenn R Stevens as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 3 Approve the Remuneration Report For Ordinary Management MQG Macquarie Group Limited 26/07/2018 4 Approve Participation of Nicholas Moore in the Macquarie Group Employee Retained Equity Plan For Ordinary Management MQG Macquarie Group Limited 26/07/2018 5 Approve Issuance of Macquarie Group Capital Notes For Ordinary Management JHX James Hardie Industries plc 10/08/2018 1 Accept Financial Statements and Statutory Reports For Ordinary Management JHX James Hardie Industries plc 10/08/2018 2 Approve the Remuneration Report For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3a Elect Persio Lisboa as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3b Elect Andrea Gisle Joosen as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3c Elect Michael Hammes as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3d Elect Alison Littley as Director -

Content/Dam/Mercer/Attachments/Asia

Participant profile List of contributors The following 370 organisations contributed to the 2020 Australian Benefits Review. 3M Australia Aquila Resources 7-Eleven Aristocrat Technologies Australia A. Menarini Australia Arrow Electronics Australia Abbott Australasia ARTC AbbVie Ascender Accenture Australia* Aspen Australia Acrux DDS Astellas Pharma Australia ADCO Constructions Astrazeneca Adelaide Brighton AT&T Global Network Services Australia* Adobe Systems Australia* ATCO Australia AECOM Australia Aurizon Holdings Agilent Technologies Ausenco AGL AusGroup AIA Australia Australian Premium Iron Management Akamai Technologies Netherlands Australian Turf Club Alliance Mineral Asset Autodesk* Alliance Mining Commodities AVJennings Amazon* B. Braun Australia AMD Australia* B. Braun Avitum Amdocs Australia* Baker McKenzie Amgen Australia Bausch and Lomb Amway Of Australia Baxter Healthcare APA Group Bayer Apple* Bechtel Australia 2.14 Australian Benefits Review © 2020 Mercer Consulting (Australia) Pty Ltd Participant profile Becton Dickinson Celine Australia* beIN Media Group CenturyLink Technology Australia Besins Healthcare Christian Dior Australia* Biogen Church & Dwight BIS Industries Cipla Bluewaters Power 2 Cisco Systems Australia* Bluewaters Power Services Citrix* Boehringer Ingelheim Clean TeQ Bolton Clarke Cleanaway Boston Scientific Clough Projects Bouygues Construction Australia CNH Industrial Bowen and Pomeroy Cochlear BP Australia Colgate-Palmolive* Brisbane City Council Collins Foods Bristol-Myers Squibb Computershare British -

Gender Equity: Big Companies Better on Boards, but Below ASX Average on Management Positions

Media Release 8 March 2016 Gender equity: big companies better on boards, but below ASX average on management positions New Catalyst research, released for International Women’s Day, reveals the best and worst points of women’s participation in corporate Australia. The report covers female participation on boards and in management as well as assessing policies to help women in the workplace. While some companies in the ASX have real equality on their boards, overall the ASX has a long way to go. ASX50 companies have 27% female board members while the ASX200 has just 22%. Top and bottom companies, women on boards, ASX100: # women board Company Industry members # board members % women on board Medibank Private Insurance 5 8 63% Mirvac Group Property 4 8 50% DUET Group Utilities 4 9 44% Spark Infrastructure Utilities 3 7 43% Woolworths Retail 3 7 43% Oil Search Oil & Gas 1 9 11% Westfield Property 1 12 8% Qube Holdings Logistics 0 8 0% Domino's Pizza Hospitality 0 6 0% TPG Telecom Teleco 0 5 0% Women’s participation in management positions is stronger across the ASX200 (37%) than the larger companies in the ASX50 (29%). Health care companies performed best in the ASX100: Company Industry Female managers worldwide Healthscope Health Care 80% Primary Health Care Health Care 60% Ramsay Health Care Health Care 53% Sonic Healthcare Health Care 53% For media enquiries, please contact: Tom Burmester 0468 926 833 www.tai.org.au Flight Centre Travel 49% JB Hi-Fi Specialty Retail 8% Iluka Resources Metals & Mining 8% Sirtex Medical Biotechnology 8% Downer EDI Infrastructure 7% Alumina Limited Metals & Mining 0% “The ASX50 has 5 CEOs named Andrew, 4 named Michael but only three who are women: Alison Watkins (Coca Cola Amatil), Susan Lloyd-Horwitz (Mirvac Group) and Kerrie Mather (Sydney Airport).” said report author Martijn Boersma. -

Appointment of Two Non-Executive Directors

News Release 11 December 2019 Appointment of two Non-executive Directors The Board of GrainCorp (ASX:GNC) (GrainCorp or the Company) is pleased to announce the appointment of Ms Jane McAloon and Ms Kathy Grigg as Non-executive Directors of GrainCorp, effective today. GrainCorp Chairman, Mr Graham Bradley AM, said Ms McAloon and Ms Grigg’s extensive experience across a range of industries, both as executives and non-executive directors, would be a strong fit for the Board. “We are delighted to welcome Jane and Kathy to the GrainCorp Board. They each bring diverse perspectives and different skill-sets, which are valuable to the Company as we refresh our director cohort in anticipation of the planned demerger of our Malt business in early 2020.” Ms Jane McAloon: Ms McAloon has over 25 years’ experience in the natural resources, energy, infrastructure and utility industries in corporate and public sector leadership positions, including senior executive roles with BHP Billiton and AGL. Ms McAloon is a Non-executive Director of Viva Energy, Energy Australia and Home Consortium. She is a Board member of Allens and represents the Future Fund on the Port of Melbourne. She is a Director of Monash University Foundation and Bravery Trust. Previous directorships include Healthscope, Civil Aviation Safety Authority, Cogstate and Australian War Memorial. She was also previously Chairman of the Defence Reserves Support Council and a Member of the Referendum Council on Constitutional Recognition for Aboriginal and Torres Strait Islander Peoples. Ms McAloon holds a Bachelor of Laws and Bachelor of Economics (Hons) from Monash University and a Graduate Diploma in Corporate Governance. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612

2 2 nd nd Fu No.3 201 Ex 50 50 Ex Aust Equities Aust Quarterly Newsletter Quarterly December Selector In this quarterly edition we review performance and attribution. We review and share some of our macro thoughts on energy, interest rates and bank regulation. Finally we focus on health insurance specialist NIB. Photo: An ACT Fire and Rescue team. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000 Australia Tel 612 8090 3612 www.selectorfund.com.au About Selector We are a boutique fund manager and we have a combined experience of over 60 years. We believe in long term wealth creation and building lasting relationships with our investors. Our focus is stock selection. Our funds are high conviction, concentrated and index unaware. As a result we have low turnover and produce tax effective returns. First we identify the best business franchises with the best management teams. Then we focus on valuations. When we arrive at work each day we are reminded that; “The art of successful investment is the patient investor taking money from the impatient investor”. Our fund is open to new subscriptions. Please forward to us contact details if you would like future newsletters to be emailed to family, friends or business colleagues. Selector Funds Management Limited ACN 102756347 AFSL 225316 Level 3, 10 Bridge Street Sydney NSW 2000, Australia Telephone 612 8090 3612 Web www.selectorfund.com.au December 2012 Selector Australian Equities Fund Quarterly Newsletter #32 Dear Investor, This time last year the world was in turmoil. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Sustainability at Orica Chemicals

Beating Competition With Clever Solutions Indra Adhikari Purujittam Yadav May 2014 0 Table of Content 1. Executive Summary ............................................................................................. 2 2. Introduction to Orica .......................................................................................... 3 3. Stakeholders Analysis ......................................................................................... 5 Figure 3.1: Original Stakeholder model by Freeman (1984) .......................................................... 5 Figure 3.2: Adopted version of stakeholder model by Freeman (2003) ..................................... 6 Table 3.1: Stakeholder model refined ........................................................................................................ 7 4. Engagement with Stakeholders: .......................................................................... 7 4.1 Employees & Contractors ........................................................................................................................ 7 4.2 Customers ....................................................................................................................................................... 8 4.3 Suppliers & Business Partners ............................................................................................................... 8 4.4 Shareholders and the Investment Community ............................................................................... 8 4.5 Community and Local Partners