Ellerston Global Equity Managers Fund PERFORMANCE REPORT January 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

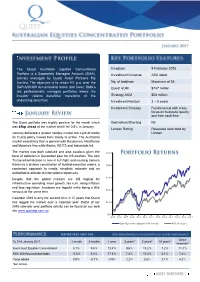

Inception 9 February 2005 Investment Universe ASX Listed No. Of

The Quest Australian Equities Concentrated Inception 9 February 2005 Portfolio is a Separately Managed Account (SMA), Investment Universe ASX listed actively managed by Quest Asset Partners Pty Limited. The objective is to return 4% p.a. over the No. of holdings Maximum of 35 S&P/ASX300 Accumulation Index (pre fees). SMA’s Quest AUM $747 million are professionally managed portfolios where the investor retains beneficial ownership of the Strategy AUM $58 million underlying securities. Investment Horizon 3 – 5 years Investment Strategy Fundamental with a key focus on business quality and free cash flow The Quest portfolio was slightly positive for the month which Derivatives/Shorting Nil was 85bp ahead of the market which fell 0.8% in January. Lonsec Rating Reviewed and rated by January delivered a quieter holiday market but a jolt of reality Lonsec as Trump policy moved from theory to active. The Australian market eased less than a percent with Resources, Healthcare and Materials firm while Banks, REITS and Industrials fell. The market was both subdued and also cautious given the $330 burst of optimism in December post the US election. The new Trump administration is now in full flight and causing tremors thanks to a divisive combination of hurried executive orders, a $280 combatant approach to media, simplistic rationale and an authoritative attitude to international diplomacy. Despite that the global markets are still hoping for $230 infrastructure spending, more growth, tax cuts, rising inflation and less regulation. Investors are hopeful while being a little $180 nervous at the same time. Calendar 2016 is only the second time in 12 years that Quest has lagged the market over a calendar year. -

Gender Equity: Big Companies Better on Boards, but Below ASX Average on Management Positions

Media Release 8 March 2016 Gender equity: big companies better on boards, but below ASX average on management positions New Catalyst research, released for International Women’s Day, reveals the best and worst points of women’s participation in corporate Australia. The report covers female participation on boards and in management as well as assessing policies to help women in the workplace. While some companies in the ASX have real equality on their boards, overall the ASX has a long way to go. ASX50 companies have 27% female board members while the ASX200 has just 22%. Top and bottom companies, women on boards, ASX100: # women board Company Industry members # board members % women on board Medibank Private Insurance 5 8 63% Mirvac Group Property 4 8 50% DUET Group Utilities 4 9 44% Spark Infrastructure Utilities 3 7 43% Woolworths Retail 3 7 43% Oil Search Oil & Gas 1 9 11% Westfield Property 1 12 8% Qube Holdings Logistics 0 8 0% Domino's Pizza Hospitality 0 6 0% TPG Telecom Teleco 0 5 0% Women’s participation in management positions is stronger across the ASX200 (37%) than the larger companies in the ASX50 (29%). Health care companies performed best in the ASX100: Company Industry Female managers worldwide Healthscope Health Care 80% Primary Health Care Health Care 60% Ramsay Health Care Health Care 53% Sonic Healthcare Health Care 53% For media enquiries, please contact: Tom Burmester 0468 926 833 www.tai.org.au Flight Centre Travel 49% JB Hi-Fi Specialty Retail 8% Iluka Resources Metals & Mining 8% Sirtex Medical Biotechnology 8% Downer EDI Infrastructure 7% Alumina Limited Metals & Mining 0% “The ASX50 has 5 CEOs named Andrew, 4 named Michael but only three who are women: Alison Watkins (Coca Cola Amatil), Susan Lloyd-Horwitz (Mirvac Group) and Kerrie Mather (Sydney Airport).” said report author Martijn Boersma. -

Appointment of Two Non-Executive Directors

News Release 11 December 2019 Appointment of two Non-executive Directors The Board of GrainCorp (ASX:GNC) (GrainCorp or the Company) is pleased to announce the appointment of Ms Jane McAloon and Ms Kathy Grigg as Non-executive Directors of GrainCorp, effective today. GrainCorp Chairman, Mr Graham Bradley AM, said Ms McAloon and Ms Grigg’s extensive experience across a range of industries, both as executives and non-executive directors, would be a strong fit for the Board. “We are delighted to welcome Jane and Kathy to the GrainCorp Board. They each bring diverse perspectives and different skill-sets, which are valuable to the Company as we refresh our director cohort in anticipation of the planned demerger of our Malt business in early 2020.” Ms Jane McAloon: Ms McAloon has over 25 years’ experience in the natural resources, energy, infrastructure and utility industries in corporate and public sector leadership positions, including senior executive roles with BHP Billiton and AGL. Ms McAloon is a Non-executive Director of Viva Energy, Energy Australia and Home Consortium. She is a Board member of Allens and represents the Future Fund on the Port of Melbourne. She is a Director of Monash University Foundation and Bravery Trust. Previous directorships include Healthscope, Civil Aviation Safety Authority, Cogstate and Australian War Memorial. She was also previously Chairman of the Defence Reserves Support Council and a Member of the Referendum Council on Constitutional Recognition for Aboriginal and Torres Strait Islander Peoples. Ms McAloon holds a Bachelor of Laws and Bachelor of Economics (Hons) from Monash University and a Graduate Diploma in Corporate Governance. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Directors' Report FY2008

BlueScope Steel Limited Directors’ Report BlueScope Steel Limited ABN 16 000 011 058 Directors’ Report for the Financial Year Ended 30 June 2008 Contents Page Corporate Directory 2 Directors’ Report 3 Directors’ Biographies 6 Remuneration Report 10 Corporate Governance Statement 33 BlueScope Steel Limited Directors’ Report CORPORATE DIRECTORY Directors G J Kraehe AO Chairman R J McNeilly Deputy Chairman P F O’Malley Managing Director and Chief Executive Officer D J Grady H K McCann AM P J Rizzo Y P Tan D B Grollo Secretary M G Barron Executive Leadership Team P F O’Malley Managing Director and Chief Executive Officer M G Barron Chief Legal Officer and Company Secretary N H Cornish Chief Executive, Australian and New Zealand Steel Manufacturing Businesses I R Cummin Executive General Manager, People and Organisation Performance S R Elias Chief Financial Officer B G Kruger Outgoing President, North America and Corporate Strategy and Innovation P E O’Keefe Chief Executive, Australian Coated and Industrial Markets M R Vassella Chief Executive, Australian Distribution and Solutions Notice of Annual General The Annual General Meeting of BlueScope Steel Limited will be held Meeting at Wesley Conference Centre, 220 Pitt Street, Sydney NSW 2000 at 2.00 pm, Thursday 13 November 2008 Registered Office Level 11, 120 Collins Street, Melbourne, Victoria 3000 Telephone: +61 3 9666 4000 Fax: +61 3 9666 4111 Email: [email protected] Postal Address: PO Box 18207, Collins Street East, Melbourne, Victoria 8003 Share Registrar Link -

For Personal Use Only Use Personal for Prospectus Joint Lead Managers Healthscope Limited Initial Public Offering of Ordinary Shares Important Notes

Healthscope Limited Healthscope Prospectus Joint Global Co-ordinators For personal use only Prospectus Joint Lead Managers Healthscope Limited Initial Public Offering of Ordinary Shares Important Notes Offer No person named in this Prospectus, If the securities are able to be traded on The Offer contained in this Prospectus is nor any other person, guarantees the a securities market and you wish to trade an invitation to acquire fully paid ordinary performance of Healthscope, the the securities through that market, you shares in Healthscope Hospitals Holdings repayment of capital by Healthscope will have to make arrangements for a Pty Ltd to be renamed Healthscope Limited. or the payment of a return on the Shares. participant in that market to sell the All references to Healthscope Limited in No person is authorised to give any securities on your behalf. If the securities this Prospectus are to this entity (ABN 65 information or make any representation market does not operate in New Zealand, 144 840 639) (“Healthscope”) (“Shares”). in connection with the Offer which is the way in which the market operates, the This Prospectus is issued by Healthscope not contained in this Prospectus. Any regulation of participants in that market, and Healthscope SaleCo Limited information or representation not so and the information available to you about ACN 169 924 396 (“SaleCo”). contained may not be relied on as having the securities and trading may differ from been authorised by Healthscope, SaleCo securities markets that operate in Lodgement and listing or their Directors. You should rely only New Zealand. This Prospectus is dated 30 June 2014 on information in this Prospectus. -

Takeovers + Schemes Review

TAKEOVERS + SCHEMES REVIEW 2020 GTLAW.COM.AU 1 THE GILBERT + TOBIN 2020 TAKEOVERS + SCHEMES REVIEW After a seven-year high in 2018, public M&A involving ASX-listed companies softened in 2019. Some key themes from 2019 were: + 41 transactions valued over $50 million were announced in 2019, down from 49 transactions in 2018. The aggregate transaction value decreased significantly from $48.7 billion in 2018 to approximately $24 billion in 2019. + The healthcare sector made the greatest contribution to announced public M&A by value, followed closely by retail & consumer services and industrial products. + Cashed up private equity firms sought out public M&A targets in a significant way, willing to deploy approximately $10.3 billion on a range of targets in 2019, equivalent to 44% of the aggregate transaction value. + While the number of transactions involving a foreign bidder was broadly the same as recent years, the aggregate deal value attributable to foreign bids fell by more than half from $42 billion in 2018 to $19 billion in 2019. Bidders from North America were the most active, while interest from China was more subdued. + 89% of the total number of announced M&A transactions over $50 million were successful in 2019, despite the slight drop in average final premium paid by bidders. + The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry ignited increased scrutiny and action by corporate regulators. The number of ASIC enforcement actions increased by 20% and the Takeovers Panel heard 38 applications, the second highest in its 20-year history. This Review, which was released on 12 March 2020, examines 2019’s public M&A transactions valued over $50 million and provides our perspective on the trends for Australian public M&A in 2019. -

STOXX Pacific 100 Last Updated: 01.08.2017

STOXX Pacific 100 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 98.1 1 1 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 72.3 2 2 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 58.9 3 3 AU000000BHP4 6144690 BHP.AX 614469 BHP Billiton Ltd. AU AUD Y 56.2 4 5 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.3 5 4 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 38.8 6 6 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 33.0 7 7 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 31.3 8 8 AU000000WOW2 6981239 WOW.AX 698123 Woolworths Ltd. AU AUD Y 23.4 9 9 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 18.9 10 11 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 18.6 11 10 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 15.9 12 12 AU000000SCG8 BLZH0Z7 SCG.AX AU01Z4 SCENTRE GROUP AU AUD Y 14.9 13 14 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. AU AUD Y 14.4 14 13 AU000000SUN6 6585084 SUN.AX 658508 SUNCORP GROUP LTD. AU AUD Y 12.5 15 15 AU000000AMC4 6066608 AMC.AX 606660 Amcor Ltd. AU AUD Y 12.0 16 16 AU000000QBE9 6715740 QBE.AX 671574 QBE Insurance Group Ltd. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Directors Report 2004 18.8.041

BlueScope Steel Limited Directors’ Report BlueScope Steel Limited ABN 16 000 011 058 Directors’ Report - 30 June 2004 Contents Page Corporate directory 2 Directors’ report 4 Corporate governance statement 17 Directors biographies 30 Page 1 of 31 BlueScope Steel Limited Directors’ Report Directors G J Kraehe AO Chairman R J McNeilly Deputy Chairman K C Adams Managing Director and Chief Executive Officer D J Grady H K McCann P J Rizzo Y P Tan J Crabb resigned 28 July 2004 Secretary M G Barron Executive Leadership Team Managing Director and Chief Executive Officer K C Adams President Australian Building and Manufacturing Markets N Cornish President Asian Building and Manufacturing Markets M Courtnall Executive Vice President Human Resources I Cummin (appointed 1 September 2003) President Market and Logistics Solutions K Fagg President Industrial Markets L Hockridge Chief Financial Officer B Kruger Notice of Annual General Meeting The annual general meeting of BlueScope Steel Limited Will be held at The Westin 1 Martin Place, Sydney Date 2 pm, 19 October 2004 Registered Office Level 11, 120 Collins Street (BlueScope Steel Centre) Melbourne, Victoria 3000 (03) 9666 4000 Share Registrar ASX Perpetual Registrars Limited Level 4, 333 Collins Street Melbourne, Victoria 3000 +61 3 9615 9130 or 1300 855 998 Page 2 of 31 BlueScope Steel Limited Directors’ Report Auditor Ernst & Young Chartered Accountants Level 33, 120 Collins Street Melbourne, Victoria 3000 Stock Exchange BlueScope Steel Limited shares are quoted on the Australian Stock Exchange Website Address www.bluescopesteel.com Page 3 of 31 BlueScope Steel Limited Directors’ Report Directors’ Report for the year ended 30 June 2004 The directors of BlueScope Steel Limited ("BlueScope Steel") present their report on the consolidated entity ("BlueScope Steel Group") consisting of BlueScope Steel Limited and its controlled entities for the financial year ended 30 June 2004. -

Public M&A Trends for 2020

Public M&A Trends for 2020 www.corrs.com.au Deal predictions based on real data We look beyond statistics to consider what strategies and drivers really matter to bidders, targets and shareholders undertaking a public M&A deal in 2020. This report is based on the most recent data taken from our proprietary database and in-depth research for the 12-month period ended 30 September 2019. Contents 1 2 3 Introduction Key trends and What happened? predictions for 2020 A snapshot of public What we expect we will M&A activity, including see next year deal structure, bidders and targets 4 5 6 How did they pay? How did it get done? What did the Consideration Execution of deals, regulators say? structures, control including pre-bid Key FIRB, ACCC, ASX, premia and funding strategy, conditionality, Takeovers Panel and competition and deal ASIC developments protection 7 8 Corrs Deal Review Contacts Database PAGE 1 Whenever there is change, and whenever there is uncertainty, there is opportunity. Mark Cuban, American businessman and investor PAGE 2 1 Introduction In the current global market, very few things While low interest rates and the hunt for yield mean that are certain, other than that volatility and equity markets will continue to move upwards, making change are ever-present. What then does this some deals harder to do in the short term, we believe that bidders will ultimately end up getting deals done at mean for the short to medium-term outlook a higher price, both because of the level of competition for public M&A? for good opportunities and because the low interest rate environment will become the 'new normal'.