Public M&A Trends for 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inception 9 February 2005 Investment Universe ASX Listed No. Of

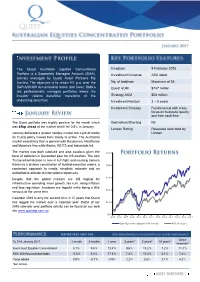

The Quest Australian Equities Concentrated Inception 9 February 2005 Portfolio is a Separately Managed Account (SMA), Investment Universe ASX listed actively managed by Quest Asset Partners Pty Limited. The objective is to return 4% p.a. over the No. of holdings Maximum of 35 S&P/ASX300 Accumulation Index (pre fees). SMA’s Quest AUM $747 million are professionally managed portfolios where the investor retains beneficial ownership of the Strategy AUM $58 million underlying securities. Investment Horizon 3 – 5 years Investment Strategy Fundamental with a key focus on business quality and free cash flow The Quest portfolio was slightly positive for the month which Derivatives/Shorting Nil was 85bp ahead of the market which fell 0.8% in January. Lonsec Rating Reviewed and rated by January delivered a quieter holiday market but a jolt of reality Lonsec as Trump policy moved from theory to active. The Australian market eased less than a percent with Resources, Healthcare and Materials firm while Banks, REITS and Industrials fell. The market was both subdued and also cautious given the $330 burst of optimism in December post the US election. The new Trump administration is now in full flight and causing tremors thanks to a divisive combination of hurried executive orders, a $280 combatant approach to media, simplistic rationale and an authoritative attitude to international diplomacy. Despite that the global markets are still hoping for $230 infrastructure spending, more growth, tax cuts, rising inflation and less regulation. Investors are hopeful while being a little $180 nervous at the same time. Calendar 2016 is only the second time in 12 years that Quest has lagged the market over a calendar year. -

Consolidated Financial Statements of Asa Newco Gmbh for the Stub Period from April 1, 2014 to December 31, 2014

Asa NewCo GmbH Consolidated financial statements of Asa NewCo GmbH for the stub period from April 1, 2014 to December 31, 2014 Asa NewCo GmbH Consolidated Financial Statements 1. Consolidated income statement ............................................................. 1 2. Consolidated statement of comprehensive income .................................... 3 3. Consolidated balance sheet ................................................................... 4 4. Consolidated statement of changes in equity ........................................... 5 5. Consolidated cash flow statement .......................................................... 6 6. Notes to the consolidated financial statements ......................................... 7 6.1. General information and summary of significant accounting policies . 7 6.1.1 General information ................................................................... 7 6.1.2 Basis of preparation .................................................................. 8 6.1.3 Published standards, interpretations and amendments applicable as of April 1, 2014 as well those adopted early on a voluntary basis ......... 9 6.1.4 Issued but not yet applied standards, interpretations and amendments ............................................................................ 9 6.1.5 Scope of consolidation ............................................................. 11 6.1.6 Consolidation principles ............................................................ 11 6.1.7 Presentation and functional currency......................................... -

Initial Public Offerings

November 2017 Initial Public Offerings An Issuer’s Guide (US Edition) Contents INTRODUCTION 1 What Are the Potential Benefits of Conducting an IPO? 1 What Are the Potential Costs and Other Potential Downsides of Conducting an IPO? 1 Is Your Company Ready for an IPO? 2 GETTING READY 3 Are Changes Needed in the Company’s Capital Structure or Relationships with Its Key Stockholders or Other Related Parties? 3 What Is the Right Corporate Governance Structure for the Company Post-IPO? 5 Are the Company’s Existing Financial Statements Suitable? 6 Are the Company’s Pre-IPO Equity Awards Problematic? 6 How Should Investor Relations Be Handled? 7 Which Securities Exchange to List On? 8 OFFER STRUCTURE 9 Offer Size 9 Primary vs. Secondary Shares 9 Allocation—Institutional vs. Retail 9 KEY DOCUMENTS 11 Registration Statement 11 Form 8-A – Exchange Act Registration Statement 19 Underwriting Agreement 20 Lock-Up Agreements 21 Legal Opinions and Negative Assurance Letters 22 Comfort Letters 22 Engagement Letter with the Underwriters 23 KEY PARTIES 24 Issuer 24 Selling Stockholders 24 Management of the Issuer 24 Auditors 24 Underwriters 24 Legal Advisers 25 Other Parties 25 i Initial Public Offerings THE IPO PROCESS 26 Organizational or “Kick-Off” Meeting 26 The Due Diligence Review 26 Drafting Responsibility and Drafting Sessions 27 Filing with the SEC, FINRA, a Securities Exchange and the State Securities Commissions 27 SEC Review 29 Book-Building and Roadshow 30 Price Determination 30 Allocation and Settlement or Closing 31 Publicity Considerations -

Ellerston Global Equity Managers Fund PERFORMANCE REPORT January 2018

Ellerston Global Equity Managers Fund PERFORMANCE REPORT January 2018 Fund performance^ Investment Objective 1 3 1 3 Yr 5 Yr Strategy Since Month Months Yr p.a p.a Inception p.a The investment objective is to generate superior returns for Unitholders with a focus on risk and capital preservation. GEMS A Net 0.95% 11.13% 22.51% 20.46% 17.51% 13.90% GEMS B Net 0.95% 11.13% 22.51% 20.45% 17.33% 13.72% Investment Strategy Global long/short equity Overlays fundamental stock selection with macroeconomic outlook Bias toward Australia Commentary In January, equity markets continued their upward charge, taking their lead from the US. The Dow Jones and S&P 500 drove the rally in developed equity markets, delivering their tenth consecutive month of positive returns, maintaining their stellar performances and hitting new record high levels as the month Key Information progressed. The major Eurozone and Asian equity markets were all in positive territory, buoyed by strong earnings delivered by corporates and positive Strategy Inception 1 January economic outlooks reinforced by central bankers, politicians and business Date 2002 leaders at the gathering at Davos. However, the month ended with markets trading off their intra-month highs, as US bond yields backed up sharply, Fund Net Asset A$195.6M Value signalling inflationary concerns and potentially highlighting stretched equity valuations. Liquidity Quarterly USA: Equity markets in the US continued their explosive rally, with the broader Class A Redemption A$ 1.7548 S&P 500 index logging its strongest start to a year since 1987. -

Annual Report 2006

Annual Report 2006 Minding our business Building your investment Our Vision To liberate and empower businesses MYOB is a global provider of solutions that liberate business owners and accountants from the burden of day to day administration, empowering them to achieve business success. Our Clients China - Finding the right solution MYOB BusinessBasics Mr Zheng originally came across provides more time BusinessBasics by chance. After seeing what it could do, he investigated further and for creativity realised that BusinessBasics offered exactly the functions that Pioneer Times needed. Since its establishment seven years ago, Chinese company Pioneer Times has Advice for other clients evolved from a creative design organisation “After implementing BusinessBasics, I providing traditional brand promotion went in to discuss a contract with a client. services, to an organisation working with the newly emerging fields of digital and Beforehand, I had a look at the client’s online design and production. historical project records in the new system. During the meeting, my client The key challenge was astonished to hear me quoting every expenditure item from our working history “Our business is still small so we don’t – and of course we won the business!” have the budget to recruit a professional “It makes me feel good that everything is accountant. However, the company’s back under my control.” financial management is crucial to our success. I have a team full of creative ideas but no-one who is passionate “I never thought software like this could about accounting!” change our company’s business operations beyond my wildest imagination.” The owner of Pioneer Times, Wei Zheng, often found it difficult to track projects, – Wei Zheng, outcomes or spend per project. -

Gender Equity: Big Companies Better on Boards, but Below ASX Average on Management Positions

Media Release 8 March 2016 Gender equity: big companies better on boards, but below ASX average on management positions New Catalyst research, released for International Women’s Day, reveals the best and worst points of women’s participation in corporate Australia. The report covers female participation on boards and in management as well as assessing policies to help women in the workplace. While some companies in the ASX have real equality on their boards, overall the ASX has a long way to go. ASX50 companies have 27% female board members while the ASX200 has just 22%. Top and bottom companies, women on boards, ASX100: # women board Company Industry members # board members % women on board Medibank Private Insurance 5 8 63% Mirvac Group Property 4 8 50% DUET Group Utilities 4 9 44% Spark Infrastructure Utilities 3 7 43% Woolworths Retail 3 7 43% Oil Search Oil & Gas 1 9 11% Westfield Property 1 12 8% Qube Holdings Logistics 0 8 0% Domino's Pizza Hospitality 0 6 0% TPG Telecom Teleco 0 5 0% Women’s participation in management positions is stronger across the ASX200 (37%) than the larger companies in the ASX50 (29%). Health care companies performed best in the ASX100: Company Industry Female managers worldwide Healthscope Health Care 80% Primary Health Care Health Care 60% Ramsay Health Care Health Care 53% Sonic Healthcare Health Care 53% For media enquiries, please contact: Tom Burmester 0468 926 833 www.tai.org.au Flight Centre Travel 49% JB Hi-Fi Specialty Retail 8% Iluka Resources Metals & Mining 8% Sirtex Medical Biotechnology 8% Downer EDI Infrastructure 7% Alumina Limited Metals & Mining 0% “The ASX50 has 5 CEOs named Andrew, 4 named Michael but only three who are women: Alison Watkins (Coca Cola Amatil), Susan Lloyd-Horwitz (Mirvac Group) and Kerrie Mather (Sydney Airport).” said report author Martijn Boersma. -

Appointment of Two Non-Executive Directors

News Release 11 December 2019 Appointment of two Non-executive Directors The Board of GrainCorp (ASX:GNC) (GrainCorp or the Company) is pleased to announce the appointment of Ms Jane McAloon and Ms Kathy Grigg as Non-executive Directors of GrainCorp, effective today. GrainCorp Chairman, Mr Graham Bradley AM, said Ms McAloon and Ms Grigg’s extensive experience across a range of industries, both as executives and non-executive directors, would be a strong fit for the Board. “We are delighted to welcome Jane and Kathy to the GrainCorp Board. They each bring diverse perspectives and different skill-sets, which are valuable to the Company as we refresh our director cohort in anticipation of the planned demerger of our Malt business in early 2020.” Ms Jane McAloon: Ms McAloon has over 25 years’ experience in the natural resources, energy, infrastructure and utility industries in corporate and public sector leadership positions, including senior executive roles with BHP Billiton and AGL. Ms McAloon is a Non-executive Director of Viva Energy, Energy Australia and Home Consortium. She is a Board member of Allens and represents the Future Fund on the Port of Melbourne. She is a Director of Monash University Foundation and Bravery Trust. Previous directorships include Healthscope, Civil Aviation Safety Authority, Cogstate and Australian War Memorial. She was also previously Chairman of the Defence Reserves Support Council and a Member of the Referendum Council on Constitutional Recognition for Aboriginal and Torres Strait Islander Peoples. Ms McAloon holds a Bachelor of Laws and Bachelor of Economics (Hons) from Monash University and a Graduate Diploma in Corporate Governance. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

Pengana Emerging Companies Fund

QUARTERLY REVIEW PENGANA EMERGING COMPANIES FUND December 2018 Quarterly Review DECEMBER 2018 FUND PERFORMANCE Net performance for periods ending 31 December 20181 Since 1 mth 3 mths 1 yr 3 yrs p.a. 5 yrs p.a. 10 yrs p.a. Inception p.a.2 Pengana Emerging Companies Fund -6.2% -18.6% -9.9% 5.2% 9.4% 15.4% 12.6% S&P/ASX Small Ordinaries Index -4.2% -13.7% -8.7% 7.4% 5.6% 6.9% 4.0% Outperformance -2.0% -4.9% -1.2% -2.2% 3.8% 8.5% 8.6% S&P/ASX Small Industrials Index3 -3.9% -13.4% -6.5% 4.7% 6.3% 9.8% 4.9% Outperformance -2.3% -5.2% -3.4% 0.5% 3.1% 5.6% 7.7% FUND COMMENTARY The Fund fell 18.6%1 over the December quarter, underperforming the Small Industrials Index by 5.2% and the Small Ordinaries Index by 4.9%. For the 12 months to December, the Fund was down 9.9%1, underperforming the Small Industrials Index by 3.4% and the Small Ordinaries Index by 1.2%. The Australian share market had the worst close to a year since 2011, with the ASX 200 index closing the quarter 8.5% lower. Global markets generally fared worse with the S&P 500 in the US down 14.3%, the technology heavy US Nasdaq index down 17% and the Nikkei in Japan down over 17%. The nervousness largely centred around concerns over global economic growth pending a US-China trade war, rising US interest rates and sluggish economic growth from China. -

A Roadmap to Initial Public Offerings

A Roadmap to Initial Public Offerings 2019 The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, PO Box 5116, Norwalk, CT 06856-5116, and is reproduced with permission. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. As used in this document, “Deloitte” means Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and Deloitte Financial Advisory Services LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting. Copyright © 2019 Deloitte Development LLC. All rights reserved. Other Publications in Deloitte’s Roadmap Series Business Combinations Business Combinations — SEC Reporting Considerations Carve-Out Transactions Consolidation — Identifying a Controlling Financial Interest Contracts on an Entity’s Own Equity -

Flexshares 2018 Semiannual Report

FlexShares® Trust Semiannual Report April 30, 2018 FlexShares® Morningstar US Market Factor Tilt Index Fund FlexShares® Morningstar Developed Markets ex-US Factor Tilt Index Fund FlexShares® Morningstar Emerging Markets Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar DM ex-US Factor Tilt Index Fund FlexShares® Currency Hedged Morningstar EM Factor Tilt Index Fund FlexShares® US Quality Large Cap Index Fund FlexShares® STOXX® US ESG Impact Index Fund FlexShares® STOXX® Global ESG Impact Index Fund FlexShares® Morningstar Global Upstream Natural Resources Index Fund FlexShares® STOXX® Global Broad Infrastructure Index Fund FlexShares® Global Quality Real Estate Index Fund FlexShares® Real Assets Allocation Index Fund FlexShares® Quality Dividend Index Fund FlexShares® Quality Dividend Defensive Index Fund FlexShares® Quality Dividend Dynamic Index Fund FlexShares® International Quality Dividend Index Fund FlexShares® International Quality Dividend Defensive Index Fund FlexShares® International Quality Dividend Dynamic Index Fund FlexShares® iBoxx 3-Year Target Duration TIPS Index Fund FlexShares® iBoxx 5-Year Target Duration TIPS Index Fund FlexShares® Disciplined Duration MBS Index Fund FlexShares® Credit-Scored US Corporate Bond Index Fund FlexShares® Credit-Scored US Long Corporate Bond Index Fund FlexShares® Ready Access Variable Income Fund FlexShares® Core Select Bond Fund Table of Contents Statements of Assets and Liabilities ................................................ 2 Statements of Operations................................................................