Women-On-Board-Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commerzbank German Investment Seminar Christian Bruch, President and CEO Siemens Energy January 13, 2021

Commerzbank German Investment Seminar Christian Bruch, President and CEO Siemens Energy January 13, 2021 Siemens Energy is a registered trademark licensed by Siemens AG. © Siemens Energy, 2021 Disclaimer INFORMATION AND FORWARD-LOOKING STATEMENTS This document contains statements related to our future business and financial performance, and future events or developments involving Siemens Energy that may constitute forward-looking statements. These statements may be identified by words such as “expect,” “look forward to,” “anticipate” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project,” or words of similar meaning. We may also make forward-looking statements in other reports, prospectuses, in presentations, in material delivered to shareholders, and in press releases. In addition, our representatives may from time to time make oral forward-looking statements. Such statements are based on the current expectations and certain assumptions of Siemens Energy´s management, of which many are beyond Siemens Energy´s control. These are subject to a number of risks, uncertainties, and other factors, including, but not limited to, those described in disclosures, in particular in the chapter “Report on expected developments and associated material opportunities and risks” in the Annual Report. Should one or more of these risks or uncertainties materialize, should acts of force majeure, such as pandemics, occur, or should underlying expectations including future events occur at a later date or not at all, or should assumptions prove incorrect, Siemens Energy´s actual results, performance, or achievements may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. Siemens Energy neither intends, nor assumes any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated. -

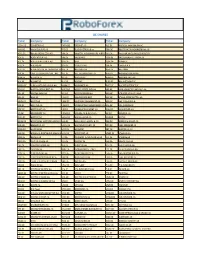

Women-On-Board-Index

WOMENONBOARDINDEX III Aufsichtsräte (Stand 14.01.2012) powered by FidAR Zahl Anteil WoB-Index Posit Zahl AR- Unternehmen Notierung Frauen Frauen nur ion Mitgl. AR AR Aufsichtsräte 1 Douglas Holding AG MDAX 16 8 50% 50,00% 2 Kabel Deutschland Holding AG MDAX 12 5 42% 41,67% 3 Deutsche Bank AG DAX 20 8 40% 40,00% 4 Amadeus Fire AG SDAX 11 4 36% 36,36% 5 Bechtle AG TecDAX 12 4 33% 33,33% 5 Beiersdorf AG DAX 12 4 33% 33,33% 5 Bertrandt AG SDAX 6 2 33% 33,33% 5 Biotest AG SDAX 6 2 33% 33,33% 5 centrotherm photovoltaics AG TecDAX 3 1 33% 33,33% 5 comdirect bank AG SDAX 6 2 33% 33,33% 5 HAMBORNER REIT SDAX 9 3 33% 33,33% 5 TAG Immobilien AG SDAX 6 2 33% 33,33% 13 Deutsche Post AG DAX 20 6 30% 30,00% 13 GfK SE SDAX 10 3 30% 30,00% 15 Sky Deutschland AG MDAX 7 2 29% 28,57% 16 Commerzbank AG DAX 20 5 25% 25,00% 16 Fielmann AG MDAX 16 4 25% 25,00% 16 Fraport AG MDAX 20 5 25% 25,00% 16 Henkel AG & Co. KGaA DAX 16 4 25% 25,00% 16 Merck KGaA DAX 16 4 25% 25,00% 16 Q-CELLS SE TecDAX 8 2 25% 25,00% 16 Software AG TecDAX 12 3 25% 25,00% 16 Symrise AG MDAX 12 3 25% 25,00% 24 Axel Springer AG MDAX 9 2 22% 22,22% 24 STADA Arzneimittel AG MDAX 9 2 22% 22,22% 26 ADVA AG Optical Networking TecDAX 5 1 20% 20,00% 26 Deutsche Telekom AG DAX 20 4 20% 20,00% 26 Hawesko Holding AG SDAX 5 1 20% 20,00% 26 Münchener Rück AG DAX 20 4 20% 20,00% 26 RHÖN-KLINIKUM AG MDAX 20 4 20% 20,00% 26 Siemens AG DAX 20 4 20% 20,00% 26 ThyssenKrupp AG DAX 20 4 20% 20,00% 33 Praktiker Bau- und Heimwerkermärkte SDAX 16 3 19% 18,75% 33 TUI AG MDAX 16 3 19% 18,75% 35 adidas AG DAX 12 -

R Trader Instruments Cfds and Stocks

DE SHARES Ticker Company Ticker Company Ticker Company 1COV.DE COVESTRO AG FNTN.DE FREENET AG P1Z.DE PATRIZIA IMMOBILIEN AG AAD.DE AMADEUS FIRE AG FPE.DE FUCHS PETROLUB vz PBB.DE DEUTSCHE PFANDBRIEFBANK AG ACX1.DE BET-AT-HOME.COM AG FRA.DE FRAPORT AG FRANKFURT AIRPORTPFV.DE PFEIFFER VACUUM TECHNOLOGY ADJ.DE ADO PROPERTIES FRE.DE FRESENIUS PSM.DE PROSIEBENSAT.1 MEDIA SE ADL.DE ADLER REAL ESTATE AG G1A.DE GEA PUM.DE PUMA SE ADS.DE ADIDAS AG G24.DE SCOUT24 AG QIA.DE QIAGEN N.V. ADV.DE ADVA OPTICAL NETWORKING SE GBF.DE BILFINGER SE RAA.DE RATIONAL AFX.DE CARL ZEISS MEDITEC AG - BR GFT.DE GFT TECHNOLOGIES SE RHK.DE RHOEN-KLINIKUM AG AIXA.DE AIXTRON SE GIL.DE DMG MORI RHM.DE RHEINMETALL AG ALV.DE ALLIANZ SE GLJ.DE GRENKE RIB1.DE RIB SOFTWARE SE AM3D.DE SLM SOLUTIONS GROUP AG GMM.DE GRAMMER AG RKET.DE ROCKET INTERNET SE AOX.DE ALSTRIA OFFICE REIT-AG GWI1.DE GERRY WEBER INTL AG S92.DE SMA SOLAR TECHNOLOGY AG ARL.DE AAREAL BANK AG GXI.DE GERRESHEIMER AG SAX.DE STROEER SE & CO KGAA BAS.DE BASF SE HAB.DE HAMBORNER REIT SAZ.DE STADA ARZNEIMITTEL AG BAYN.DE BAYER AG HBM.DE HORNBACH BAUMARKT AG SFQ.DE SAF HOLLAND S.A. BC8.DE BECHTLE AG HDD.DE HEIDELBERGER DRUCKMASCHINENSGL.DE SGL CARBON SE BDT.DE BERTRANDT AG HEI.DE HEIDELBERGCEMENT AG SHA.DE SCHAEFFLER AG BEI.DE BEIERSDORF AG HEN3.DE HENKEL AG & CO KGAA SIE.DE SIEMENS AG BIO4.DE BIOTEST AG HLAG.DE HAPAG-LLOYD AG SIX2.DE SIXT SE BMW.DE BAYERISCHE MOTOREN WERKE AGHLE.DE HELLA KGAA HUECK & CO SKB.DE KOENIG & BAUER AG BNR.DE BRENNTAG AG HNR1.DE HANNOVER RUECK SE SPR.DE AXEL SPRINGER SE BOSS.DE HUGO BOSS -

Lyxor German Mid-Cap MDAX UCITS ETF - Dist

LYXOR ETF MONTHLY REPORT 31st August 2021 Lyxor German Mid-Cap MDAX UCITS ETF - Dist 1. FUND INFORMATION Ticker: MD4X GY Description Ticker MD4X GY Lyxor Asset Management Group ("Lyxor") was founded in 1998 and comprises two subsidiaries (1) (2) of Société Générale group. Lyxor benefits from the Fund Type SICAV expertise of 600 professionals across the wealth management world, advising EUR 117.6 billion* in assets. Lyxor offers bespoke asset management services, UCITS compliant Yes capitalising on its know-how in ETFs and indexing, Alternative and Multi Management, and Absolute Performance and Solutions. As one of the most ISIN FR0011857234 experienced players on the market, Lyxor ETF is Europe's number three provider of ETFs (number two in terms of liquidity (3)), with AuM of more than EUR UKFRS Yes 49.8 billion*. With 220 ETFs listed on 13 financial marketplaces, Lyxor ETF provides investors with varied investment solutions enabling them to diversify their allocation across the entire spectrum of asset classes (equities, bonds, money market instruments and commodities via forward financial instruments). Replication method Indirect (Swap Based) Demonstrating its commitment to high-quality ETFs, in 2011, Lyxor ETF implemented an ETF quality charter with the aim of ensuring that each ETF it offers Full ownership of fund assets Yes complies with the strictest requirements in terms of replication quality, risk monitoring, liquidity and transparency. www.lyxoretf.com Share Class Currency EUR Investment objective Inception Date 15/05/2014 Nav per share at inception (EUR) 100 The Lyxor German Mid-Cap MDAX UCITS ETF - Dist is a UCITS compliant exchange traded fund that aims to track the benchmark index MDAX PERF INDEX. -

In This Issue

FI.News June 2019 In this issue: Island stopping: The importance of digital standards Supply chain finance: Making it more inclusive The Belt and Road Initiative: Bridging east and west Post-trade services: Delivering on new expectations Clearing the decks 10 Bridging east and west Making supply chain finance more inclusive 12 08 Contents Editorial welcome 03 Eye on the industry: Delivering on new 14 expectations in post-trade Big Interview: Island stopping 05 Regional spotlight: Are trade opportunities 16 in Africa shifting south? Innovation focus: Making supply chain 08 Regional focus: Seizing opportunities in 18 finance more inclusive central America Eye on the industry: Clearing the 10 News & awards 20 decks Expert view: Bridging east and west 12 Commerzbank in the press 22 2 Editorial welcome Never standing still Nikolaus Giesbert Divisional Board Member, Trade Finance & Cash Management While Commerzbank takes pride in its history, • Moving towards end-to-end, front-to-back, we are not a bank content to stand still. Having digital solutions; financed trade since 1870, we are accustomed to change. And today, technology, regulation • Being at the forefront of exploring how and changing client preferences stand to emerging technologies can transform fundamentally alter transaction banking, the landscape for trade finance and cash bringing new services, business models and management, and; competition. It’s a dynamic we are embracing. • Recognising permanent changes in the banking So rather than take a short-sighted view and sector and understanding the possibilities. focus simply on the automation of processes, we have invested resources and energy into Of course, extensive transformation must be digital transformation. -

MDAX—2019 Supervisory Board Study Key Insights from This Year’S Analysis by Russell Reynolds Associates

MDAX—2019 Supervisory Board Study Key insights from this year’s analysis by Russell Reynolds Associates Summary Over the past year, Germany's MDAX companies have experienced significant change. The number of companies in the index increased by 10, bringing the overall total to 60. Moreover, 11 "old economy" firms, including Jungheinrich, Krones, Leoni, Salzgitter and Schaeffler, were ousted by pharma, med and biotech risers, such as Evotec, Morphosys, Qiagen, Sartorius and Siemens Healthineers, as well as "new economy" powerhouses like Dialog, Nemetschek, Software AG, Telefonica D, and United Internet. This was also an exceptional election year, with 106 shareholder representative positions expiring. All positions were filled. A total of 67 board members were re-elected, while 36 were replaced. The three remaining roles were absorbed by changes to board sizes. Female shareholder representation surpasses 30 percent For the first time, the share of female shareholder representatives surpassed the required quota, reaching 30.6 percent. Including employee representatives, women now make up 32 percent of supervisory board members. A total of three boards are now chaired by women. However, there is still a major gender discrepancy concerning positions of power when comparing chairpersonships and especially executive board positions. Only four companies can boast more than 30 percent of female executives, while 40 MDAX companies do not have a single woman in a leadership role. Accelerated increase in digital directors The number of digital directors on MDAX supervisory boards showed a significant 30 percent year- on-year increase. However, digital expertise is still unevenly spread in the MDAX. Seven companies have three or more digital directors, while 57 percent of boards completely lack digital expertise. -

Eurex Information

eurex information Date: Frankfurt, April 10, 2003 Recipients: All Eurex Clearing members and vendors Authorized by: Daniel Gisler Central Counterparty – CCP Circulars 57/03 and 58/03 Contact: Functional Member Readiness: Tel. +49-69-21 01-17 00 Content may be most important for: Attachments: Ü Central Counterparty Coordinators CCP Circular 57/03 (English/Deutsch) CCP Circular 58/03 (English/Deutsch) Attachment: 2nd Step CCP Instruments Please find attached a copy of Central Counterparty Circulars 57/03 and 58/03 sent to Frankfurter Wertpapierbörse members and vendors recently. Circular 57/03 provides information on some adjustments that have been made recently to the software in the CCP simulation environment. Circular 58/03 gives important details relating to the second stage of introduction of CCP production and outlines the procedures to be followed, and helpdesk availability, in the initial days. An attachment gives the list of instruments to be introduced on April 10, 2003. All important CCP documents, including those referenced above, can be accessed via the CCP web-site under ‘Documentation’. Access to the CCP site from the Eurex web-site “www.eurexchange.com ” is via the ‘Member Section’ (Eurex login required) > ccp (login ‘ccp’ and password ’go’). Eurex Clearing AG Functional Member Readiness Alternative Management Board: D-60485 Frankfurt am Main Tel. +49-69-2101-1700 Tel. +49-69-9770-1700 Rudolf Ferscha (CEO), Daniel Gisler, www.eurexchange.com Fax +49-69-2101-1701 Fax +49-69-9770-1701 Thomas Lenz, Peter Reitz, Jürg Spillmann, -

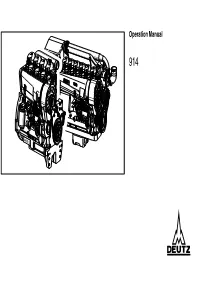

DEUTZ Pose Also Implies Compliance with the Con- Original Parts Is Prescribed

Operation Manual 914 Safety guidelines / Accident prevention ● Please read and observe the information given in this Operation Manual. This will ● Unauthorized engine modifications will in- enable you to avoid accidents, preserve the validate any liability claims against the manu- manufacturer’s warranty and maintain the facturer for resultant damage. engine in peak operating condition. Manipulations of the injection and regulating system may also influence the performance ● This engine has been built exclusively for of the engine, and its emissions. Adherence the application specified in the scope of to legislation on pollution cannot be guaran- supply, as described by the equipment manu- teed under such conditions. facturer and is to be used only for the intended purpose. Any use exceeding that ● Do not change, convert or adjust the cooling scope is considered to be contrary to the air intake area to the blower. intended purpose. The manufacturer will The manufacturer shall not be held respon- not assume responsibility for any damage sible for any damage which results from resulting therefrom. The risks involved are such work. to be borne solely by the user. ● When carrying out maintenance/repair op- ● Use in accordance with the intended pur- erations on the engine, the use of DEUTZ pose also implies compliance with the con- original parts is prescribed. These are spe- ditions laid down by the manufacturer for cially designed for your engine and guaran- operation, maintenance and servicing. The tee perfect operation. engine should only be operated by person- Non-compliance results in the expiry of the nel trained in its use and the hazards in- warranty! volved. -

DWS Equity Funds Semiannual Reports 2010/2011

DWS Investment GmbH DWS Equity Funds Semiannual Reports 2010/2011 ■ DWS Deutschland ■ DWS Investa ■ DWS Aktien Strategie Deutschland ■ DWS European Opportunities ■ DWS Intervest ■ DWS Akkumula : The DWS/DB Group is the largest German mutual fund company according to assets under management. Source: BVI. As of: March 31, 2011. 4/2011 DWS Deutschland DWS Investa DWS Aktien Strategie Deutschland DWS European Opportunities DWS Intervest DWS Akkumula Contents Semiannual reports 2010/2011 for the period from October 1, 2010, through March 31, 2011 (in accordance with article 44 (2) of the German Investment Act (InvG)) TOP 50 Europa 00 General information 2 Semiannual reports 2010 DWS Deutschland 4 DWS Investa 10 2011 DWS Aktien Strategie Deutschland 16 DWS European Opportunities 22 DWS Intervest 28 DWS Akkumula 36 1 General information Performance ing benchmarks – if available – are also b) any taxes that may arise in connec- The investment return, or performance, presented in the report. All financial tion with administrative and custodial of a mutual fund investment is meas - data in this publication is as of costs; ured by the change in value of the March 31, 2011. c) the costs of asserting and enforcing fund’s units. The net asset values per the legal claims of the investment unit (= redemption prices) with the addi- Sales prospectuses fund. tion of intervening distributions, which The sole binding basis for a purchase are, for example, reinvested free of are the current versions of the simpli- The details of the fee structure are set charge within the scope of investment fied and the detailed sales prospec - forth in the current detailed sales accounts at DWS, are used as the basis tuses, which are available from DWS, prospectus. -

Designated Sponsor Erfordernis D 20210526

Aktien der Liquiditätskategorie A* gültig ab 26. Mai 2021 ISIN Instrument XLM Umsatz AT0000A0E9W5 S+T AG O.N. 35.97 4,280,782.85 DE0005089031 UTD.INTERNET AG NA 16.07 7,772,202.57 DE0005111702 ZOOPLUS AG 51.91 4,208,078.51 DE0005140008 DEUTSCHE BANK AG NA O.N. 5.40 111,925,300.01 DE0005158703 BECHTLE AG O.N. 14.58 12,440,739.68 DE0005190003 BAY.MOTOREN WERKE AG ST 3.92 116,673,048.94 DE0005190037 BAY.MOTOREN WERKE VZO 28.08 5,185,694.74 DE0005200000 BEIERSDORF AG O.N. 6.23 32,370,380.77 DE0005313704 CARL ZEISS MEDITEC AG 16.63 13,469,738.82 DE0005408116 AAREAL BANK AG 25.45 5,802,419.24 DE0005408884 LEONI AG NA O.N. 73.50 3,114,435.16 DE0005419105 CANCOM SE O.N. 25.16 5,547,456.62 DE0005439004 CONTINENTAL AG O.N. 7.21 58,481,792.62 DE0005470306 CTS EVENTIM KGAA 21.36 7,096,059.32 DE0005470405 LANXESS AG 12.23 15,402,539.66 DE0005493365 HYPOPORT SE NA O.N. 60.33 3,344,480.07 DE0005545503 1+1 DRILLISCH AG O.N. 27.93 4,681,191.15 DE0005550636 DRAEGERWERK VZO O.N. 50.73 3,327,527.09 DE0005552004 DEUTSCHE POST AG NA O.N. 3.95 119,438,574.31 DE0005557508 DT.TELEKOM AG NA 3.70 154,511,909.75 DE0005565204 DUERR AG O.N. 22.09 7,100,402.33 DE0005659700 ECKERT+ZIEGLER AG O.N. 44.12 3,806,078.02 DE0005664809 EVOTEC SE INH O.N. -

FACTSHEET - AS of 28-Sep-2021 Solactive Mittelstand & Midcap Deutschland Index (TRN)

FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) DESCRIPTION The Index reflects the net total return performance of 70 medium/smaller capitalisation companies incorporated in Germany. Weights are based on free float market capitalisation and are increased if significant holdings in a company can be attributed to currentmgmtor company founders. HISTORICAL PERFORMANCE 350 300 250 200 150 100 50 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive Mittelstand & MidCap Deutschland Index (TRN) CHARACTERISTICS ISIN / WKN DE000SLA1MN9 / SLA1MN Base Value / Base Date 100 Points / 19.09.2008 Bloomberg / Reuters MTTLSTRN Index / .MTTLSTRN Last Price 342.52 Index Calculator Solactive AG Dividends Included (Performance Index) Index Type Equity Calculation 08:00am to 06:00pm (CET), every 15 seconds Index Currency EUR History Available daily back to 19.09.2008 Index Members 70 FACTSHEET - AS OF 28-Sep-2021 Solactive Mittelstand & MidCap Deutschland Index (TRN) STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -3.69% 3.12% 7.26% 27.72% 12.73% 242.52% Performance (p.a.) - - - - - 9.91% Volatility (p.a.) 13.05% 12.12% 12.48% 13.60% 12.90% 21.43% High 357.49 357.49 357.49 357.49 357.49 357.49 Low 342.52 329.86 315.93 251.01 305.77 52.12 Sharpe Ratio -2.77 1.14 1.27 2.11 1.40 0.49 Max. Drawdown -4.19% -4.19% -4.19% -9.62% -5.56% -47.88% VaR 95 \ 99 -21.5% \ -35.8% -34.5% \ -64.0% CVaR 95 \ 99 -31.5% \ -46.8% -53.5% \ -89.0% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE -

Bekanntmachung Freiverkehr (Open Market)

Bekanntmachung Freiverkehr (Open Market) Aussetzung und Einstellung der Preisfeststellung von Strukturierten Produkten: Wegen Eintretens des Knockout-Ereignisses wird die Preisfeststellung an der Frankfurter Wertpapierbörse für folgende Strukturierte Produkte ausgesetzt und mit folgendem Datum eingestellt: ISIN Emittent Basiswert Letzter Handelstag 1 DE000PD0GSJ7 BNP Paribas Em.-u.Handelsg.mbH Rheinmetall AG 17.12.2020 2 DE000PD0JR31 BNP Paribas Em.-u.Handelsg.mbH Dürr AG 18.12.2020 3 DE000PD0NC81 BNP Paribas Em.-u.Handelsg.mbH Brent Crude Futures 18.12.2020 4 DE000PD0ND23 BNP Paribas Em.-u.Handelsg.mbH Brent Crude Futures 18.12.2020 5 DE000PD0NFU7 BNP Paribas Em.-u.Handelsg.mbH Crude Oil Futures 18.12.2020 6 DE000PD0NGM2 BNP Paribas Em.-u.Handelsg.mbH Crude Oil Futures 18.12.2020 7 DE000PD0PTB3 BNP Paribas Em.-u.Handelsg.mbH RBOB Gasoline Futures (Physica 18.12.2020 8 DE000PD0TSM4 BNP Paribas Em.-u.Handelsg.mbH NIKE Inc. 18.12.2020 9 DE000PD0X4D5 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 10 DE000PD0X4E3 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 11 DE000PD0XHL1 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 12 DE000PD0XHM9 BNP Paribas Em.-u.Handelsg.mbH Tesla Inc. 18.12.2020 13 DE000PD0Y3X4 BNP Paribas Em.-u.Handelsg.mbH Nasdaq-100 18.12.2020 14 DE000PD0Y3Y2 BNP Paribas Em.-u.Handelsg.mbH Nasdaq-100 18.12.2020 15 DE000PF132E0 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 16 DE000PF13AG2 BNP Paribas Em.-u.Handelsg.mbH Adyen N.V. 18.12.2020 17 DE000PF141J0 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 18 DE000PF155F8 BNP Paribas Em.-u.Handelsg.mbH United Internet AG 18.12.2020 19 DE000PF155R3 BNP Paribas Em.-u.Handelsg.mbH Wacker Chemie AG 17.12.2020 20 DE000PF185E8 BNP Paribas Em.-u.Handelsg.mbH Palo Alto Networks Inc.