Reflect Reconciliation Action Plan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agpasa, Brendon

29 January 2021 The Hon Paul Fletcher MP PO Box 6022 House of Representatives Parliament House Canberra ACT 2600 CHRIS (BRENDON) AGPASA SUBMISSION TO THE 2021-22 PRE-BUDGET SUBMISSIONS Dear Minister Fletcher, I write to request assistance had appropriate for media diversity to support digital radio and TV rollouts will continue in the federal funding, Brendon Agpasa was a student, radio listener and TV viewer. Paul Fletcher MP and the Morrison Government is supporting the media diversity including digital radio rollout, transition of community television to an online operating model, digital TV rollout, radio and TV services through regional media and subscription TV rollout we’re rolled out for new media landscape and it’s yours to towards a digital future of radio and TV broadcasting. We looking up for an expansion of digital radio rollout has been given consideration, the new digital spectrum to test a trial DRM30 and DRM+ with existing analogue (AM/FM) radio services, shortwave radio and end of spectrum (VHF NAS licences) will be adopted Digital Radio Mondiale services in Australia for the future plans. The radio stations Sydney’s 2GB, Melbourne’s 3AW, Brisbane’s Nova 106.9, Adelaide’s Mix 102.3, Perth’s Nova 93.7, Hit FM and Triple M ranks number 1 at ratings survey 8 in December 2020. Recently in December 2020, Nova Entertainment had launched it’s new DAB+ stations in each market, such as Nova Throwbacks, Nova 90s, Nova Noughties, Nova 10s, Smooth 80s and Smooth 90s to bring you the freshest hits, throwbacks and old classics all day everyday at Nova and Smooth FM. -

OAKS BRISBANE WOOLLOONGABBA SUITES RECEPTION – DIAL ‘9’ RECREATIONAL FACILITIES Upon Departure

GUEST SERVICES DIRECTORY OAKS BRISBANE WOOLLOONGABBA SUITES RECEPTION – DIAL ‘9’ RECREATIONAL FACILITIES upon departure. If keys are not returned, a replacement fee of International Calls: Dial 8 + 0011 + country code, area code (if Welcome to Oaks Brisbane Woolloongabba Suites. Our friendly The swimming pool, spas, BBQ facilities and steam room are $300 will be imposed. Outside of reception hours please place applicable), then the telephone number. reception team is here to help make your stay more memorable. located on the rooftop (Level R). Open from 6am to 10pm daily. your keys in the Express Check-Out box at reception. Strictly no glass is to be taken into the pool area. Children must be supervised by an adult at all times. Please ensure that you clean the MOVIES / TELEVISION RESTAURANTS HOTEL SERVICES BBQ plate and facilities after use. Additional towels are available A selection of local free-to-air and Foxtel channels is available. We recommend the following restaurants where you can charge from reception (charges apply). Please see reception for gym Please use the ‘Source’ button on your television remote to navigate back to your room. Please contact reception for a menu or further ACCOUNT SETTLEMENT facilities, just a short walk from the property. between Foxtel, free-to-air channels and the DVD player. information; a 10% surcharge applies to all meal charge-backs. Payment can be made by cash, credit card or EFTPOS upon or prior to departure. Company charges or cheque payments will 100 CH 9 500/501 Fox Sports News TRANSPORTATION COFFEE NATURE only be accepted by prior arrangement. -

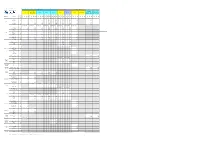

SI Allocations

Free TV Australia DTTB SI Register Transport Stream Service Information for Television Market Area All values are hexadecimal Issue 15 Date: October 2020 Western Australia Tasmania Northern Territory Remote Remote Queensland, Mandurah (Turner NSW, Vic, SA, Tas Perth Bunbury Albany Remote Hobart Launceston Darwin Alice Springs Northern Territory Hill) (See Note 3) (See Notes 1 and 2) (See notes 1 and 2) LCN Broadcaster Service Name SID SID SID SID SID SID SID SID SID SID SID NID NID NID NID NID NID NID NID NID NID NID TSID TSID TSID TSID TSID TSID TSID TSID TSID TSID TSID ONID ONID ONID ONID ONID ONID ONID ONID ONID ONID (dec) ONID 3201 3239 0261 1010 3256 0263 1010 3256 0263 1010 3256 0263 1010 3256 0263 1010 325B 0271 1010 3257 0273 1010 325C 0281 1010 325B 0283 ABC1 2 02E1 02E1 02E1 02E1 02E1 0271 0291 0281 02F1 ABC News 24 24 02E0 02E0 02E0 02E0 02E0 0270 0290 0280 02F0 ABC ABC1 21 02E3 02E3 02E3 02E3 02E3 0273 0293 0283 02F3 ABC2 / ABC4 22 02E2 02E2 02E2 02E2 02E2 0272 0292 0282 02F2 ABC3 23 02E4 02E4 02E4 02E4 02E4 0274 0294 0284 02F4 ABC Dig Music 200 02E6 02E6 02E6 02E6 02E6 0276 0296 0286 02F6 ABC Jazz 201 02E7 02E7 02E7 02E7 02E7 0277 0297 0287 02F7 3202 3202 0320 3202 3202 03A0 3202 3202 03A0 3202 3202 03A0 3202 3202 03A0 3202 3202 0380 3202 3202 0380 3202 3202 0360 SBS ONE 3 0321 03A1 03A1 03A1 03A1 0381 0381 0361 SBS ONE HD 30 0325 03A5 03A5 03A5 03A5 0385 0385 0365 SBS VICELAND HD 31 0326 03A6 03A6 03A6 03A6 0386 0386 0366 SBS World Movies 32 0327 03A7 03A7 03A7 03A7 0387 0387 0367 SBS Food 33 0323 03A3 03A3 03A3 03A3 0383 -

Stream Name Category Name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---TNT-SAT ---|EU| FRANCE TNTSAT TF1 SD |EU|

stream_name category_name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---------- TNT-SAT ---------- |EU| FRANCE TNTSAT TF1 SD |EU| FRANCE TNTSAT TF1 HD |EU| FRANCE TNTSAT TF1 FULL HD |EU| FRANCE TNTSAT TF1 FULL HD 1 |EU| FRANCE TNTSAT FRANCE 2 SD |EU| FRANCE TNTSAT FRANCE 2 HD |EU| FRANCE TNTSAT FRANCE 2 FULL HD |EU| FRANCE TNTSAT FRANCE 3 SD |EU| FRANCE TNTSAT FRANCE 3 HD |EU| FRANCE TNTSAT FRANCE 3 FULL HD |EU| FRANCE TNTSAT FRANCE 4 SD |EU| FRANCE TNTSAT FRANCE 4 HD |EU| FRANCE TNTSAT FRANCE 4 FULL HD |EU| FRANCE TNTSAT FRANCE 5 SD |EU| FRANCE TNTSAT FRANCE 5 HD |EU| FRANCE TNTSAT FRANCE 5 FULL HD |EU| FRANCE TNTSAT FRANCE O SD |EU| FRANCE TNTSAT FRANCE O HD |EU| FRANCE TNTSAT FRANCE O FULL HD |EU| FRANCE TNTSAT M6 SD |EU| FRANCE TNTSAT M6 HD |EU| FRANCE TNTSAT M6 FHD |EU| FRANCE TNTSAT PARIS PREMIERE |EU| FRANCE TNTSAT PARIS PREMIERE FULL HD |EU| FRANCE TNTSAT TMC SD |EU| FRANCE TNTSAT TMC HD |EU| FRANCE TNTSAT TMC FULL HD |EU| FRANCE TNTSAT TMC 1 FULL HD |EU| FRANCE TNTSAT 6TER SD |EU| FRANCE TNTSAT 6TER HD |EU| FRANCE TNTSAT 6TER FULL HD |EU| FRANCE TNTSAT CHERIE 25 SD |EU| FRANCE TNTSAT CHERIE 25 |EU| FRANCE TNTSAT CHERIE 25 FULL HD |EU| FRANCE TNTSAT ARTE SD |EU| FRANCE TNTSAT ARTE FR |EU| FRANCE TNTSAT RMC STORY |EU| FRANCE TNTSAT RMC STORY SD |EU| FRANCE TNTSAT ---------- Information ---------- |EU| FRANCE TNTSAT TV5 |EU| FRANCE TNTSAT TV5 MONDE FBS HD |EU| FRANCE TNTSAT CNEWS SD |EU| FRANCE TNTSAT CNEWS |EU| FRANCE TNTSAT CNEWS HD |EU| FRANCE TNTSAT France 24 |EU| FRANCE TNTSAT FRANCE INFO SD |EU| FRANCE TNTSAT FRANCE INFO HD -

Auditor's Independence Declaration

ASX RELEASE 18 August 2021 Appendix 4E for the year ended 30 June 2021 Results for Announcement to the Market Key Financial Information $'000 up/down % movement Revenue from ordinary activities 528,649 Down 2.1% Net profit from ordinary activities after tax (including significant items) 48,096 Up 91.6% Net profit from ordinary activities after tax (excluding significant items) 48,096 Up 40.7% Franked Amount amount Tax rate for Dividend Information per per share franking share cents credit cents Interim FY2021 dividend per share - - - Final FY2021 dividend per share 5.00 5.00 30% The dividend reinvestment plan has been suspended and will not apply to the final FY2021 dividend. Final FY2021 Dividend Dates Ex-dividend date 1 September 2021 Record date 2 September 2021 Payment date 1 October 2021 30 Jun 21 30 Jun 20 Net Tangible Assets Per Security $(0.47) $(0.77)1 Additional Appendix 4E disclosure requirements can be found in the directors’ report, financial statements and notes to the financial statements contained in the Southern Cross Austereo Financial Report for the year ended 30 June 2021. This report is based on the consolidated Financial Report for the year ended 30 June 2021 which has been reviewed by PricewaterhouseCoopers with the Independent Auditor's Review Report included in the Financial Report. For personal use only 1 On 6 November 2020, the Group announced completion of the one for ten share consolidation approved by shareholders at the AGM on 30 October 2020. The comparative has been adjusted accordingly. Southern Cross Media Group Limited Level 2, 257 Clarendon Street, South Melbourne VIC 3205 ABN 91 116 024 536 Southern Cross Media Group Limited ASX release Approved for release by the Board of directors. -

Sydney Program Guide

6/4/2021 prtten04.networkten.com.au:7778/pls/DWHPROD/Program_Reports.Dsp_SHAKE_Guide?psStartDate=20-Jun-21&psEndDate=26-Ju… SYDNEY PROGRAM GUIDE Sunday 20th June 2021 06:00 am Totally Wild CC C Get inspired by all-access stories from the wild side of life! 06:30 am Top Wing (Rpt) G Penny's Polar Bear Rescue / Shirley Squirrely Flies Away Penny saves the day when a stranded polar-bear family floats into the water near Big Swirl Island. Team Top Wing saves Shirley Squirrely when her giant flying machine nearly crashes into the ocean. 07:00 am Blue's Clues & You! (Rpt) G Spooky Costume Party With Blue It's a spooky Halloween at the Blue's Clues house - Blue's dressed up as a fish, but Magenta can't decide what to wear! We play Blue's Clues to figure out what costume Magenta should wear. 07:30 am Paw Patrol (Rpt) G Pups Save Big Hairy / Pups Save A Flying Kitty The pups need to lure a big ape onto the PAW Patroller so they can return him to the jungle. A bird-watching adventure gets tricky for Marshall and Cap'n Turbot when they spot a kitten stuck in a tree 07:56 am Shake Takes 08:00 am Paw Patrol (Rpt) G Pups Party With Bats / Pups Save Sensei Yumi Bats are drawn from their cave by DJ Rubble's new dance track.A windstorm interrupts Marshall's Pup-Fu training with Sensei Yumi, allowing him to use his Marshall arts skills in real life. -

SI Allocations

Free TV Australia DTTB SI Register Transport Stream Service Information for Television Market Area All values are hexadecimal Issue 13 Date: September 2019 Western Australia Tasmania Northern Territory Remote Remote Queensland, Mandurah (Turner NSW, Vic, SA, Tas Perth Bunbury Albany Remote Hobart Launceston Darwin Alice Springs Northern Territory Hill) (See Note 3) (See Notes 1 and 2) (See notes 1 and 2) LCN Broadcaster Service Name SID SID SID SID SID SID SID SID SID SID SID NID NID NID NID NID NID NID NID NID NID NID TSID TSID TSID TSID TSID TSID TSID TSID TSID TSID TSID ONID ONID ONID ONID ONID ONID ONID ONID ONID ONID (dec) ONID 3201 3239 0261 1010 3256 0263 1010 3256 0263 1010 3256 0263 1010 3256 0263 1010 325B 0271 1010 3257 0273 1010 325C 0281 1010 325B 0283 ABC1 2 02E1 02E1 02E1 02E1 02E1 0271 0291 0281 02F1 ABC News 24 24 02E0 02E0 02E0 02E0 02E0 0270 0290 0280 02F0 ABC1 21 02E3 02E3 02E3 02E3 02E3 0273 0293 0283 02F3 ABC ABC2 / ABC4 22 02E2 02E2 02E2 02E2 02E2 0272 0292 0282 02F2 ABC3 23 02E4 02E4 02E4 02E4 02E4 0274 0294 0284 02F4 ABC Dig Music 200 02E6 02E6 02E6 02E6 02E6 0276 0296 0286 02F6 ABC Jazz 201 02E7 02E7 02E7 02E7 02E7 0277 0297 0287 02F7 3202 3202 0320 3202 3202 03A0 3202 3202 03A0 3202 3202 03A0 3202 3202 03A0 3202 3202 0380 3202 3202 0380 3202 3202 0360 SBS ONE 3 0321 03A1 03A1 03A1 03A1 0381 0381 0361 SBS ONE HD 30 0325 03A5 03A5 03A5 03A5 0385 0385 0365 SBS VICELAND HD 31 0326 03A6 03A6 03A6 03A6 0386 0386 0366 SBS World Movies 32 0327 03A7 03A7 03A7 03A7 0387 0387 0367 SBS Food 33 0323 03A3 03A3 03A3 03A3 0383 -

ASX RELEASE Appendix 4E for the Year Ended 30 June 2021

ASX RELEASE 18 August 2021 Appendix 4E for the year ended 30 June 2021 Results for Announcement to the Market Key Financial Information $'000 up/down % movement Revenue from ordinary activities 528,649 Down 2.1% Net profit from ordinary activities after tax (including significant items) 48,096 Up 91.6% Net profit from ordinary activities after tax (excluding significant items) 48,096 Up 40.7% Franked Amount amount Tax rate for Dividend Information per per share franking share cents credit cents Interim FY2021 dividend per share - - - Final FY2021 dividend per share 5.00 5.00 30% The dividend reinvestment plan has been suspended and will not apply to the final FY2021 dividend. Final FY2021 Dividend Dates Ex-dividend date 1 September 2021 Record date 2 September 2021 Payment date 1 October 2021 30 Jun 21 30 Jun 20 Net Tangible Assets Per Security $(0.47) $(0.77)1 Additional Appendix 4E disclosure requirements can be found in the directors’ report, financial statements and notes to the financial statements contained in the Southern Cross Austereo Financial Report for the year ended 30 June 2021. This report is based on the consolidated Financial Report for the year ended 30 June 2021 which has been reviewed by PricewaterhouseCoopers with the Independent Auditor's Review Report included in the Financial Report. 1 On 6 November 2020, the Group announced completion of the one for ten share consolidation approved by shareholders at the AGM on 30 October 2020. The comparative has been adjusted accordingly. Southern Cross Media Group Limited Level 2, 257 Clarendon Street, South Melbourne VIC 3205 ABN 91 116 024 536 Southern Cross Media Group Limited ASX release Approved for release by the Board of directors. -

Shake Shack Inc. (SHAK) Is an American-Born Premium Fast- Company Data

THE FINAL PAGE OF THIS REPORT CONTAINS A DETAILED DISCLAIMER The content and opinions in this report are written by university students from the CityU Student Research & Investment Club, and thus are for reference only. Investors are fully responsible for their investment decisions. CityU Student Research & Investment Club is not responsible for any direct or indirect loss resulting from investments referenced to this report. The opinions in this report constitute the opinion of the CityU Student Research & Investment Club and do not constitute the opinion of the City University of Hong Kong nor any governing or student body or department under the University. Rating HOLD October 14th, 2019 Price (10/19/2019 USD) 88.49 Target price (USD) 77.85 Americas % down from Price on 10/19/2019 12.02% Equity Research Market cap. (USD, b) 03.30 Restaurants Enterprise Value (USD b) 03.24 Stock ratings are relative to the coverage universe in each analyst's or each team's respective sector. Target price is for SHAKE SHACK INCORPORATED (SHAK:NYSE) 12 months. Research Analysts: Our analysis on ‘Shake Shack’ (from hereupon referred to as “Shake Shack”, Murtaza Salman Abedin “Shack” or “SHAK”) is Discounted Cash Flow valuation-driven. Shake +852 59858568 [email protected] Shack is a growing brand with rapidly rising potential, however being a small company it still faces various growth-oriented challenges. Our Daria Yong-Tong Yip [email protected] Valuation gives SHAK a fair share value of USD 77.85 (HOLD) and this Samya Malhotra has been calculated through a DCF valuation of the 5-Year forecast period [email protected] ranging from 2019E to 2023E. -

ASX RELEASE Affiliation with Network 10 from 1 July 2021

ASX RELEASE 25 June 2021 Affiliation with Network 10 from 1 July 2021 Southern Cross Media Group Limited (ASX: SXL) (SCA) today announced it has reached agreement with Network 10 to broadcast channels 10, 10 Bold, 10 Peach and 10 Shake in the three aggregated markets of regional Queensland, Southern NSW and regional Victoria for two years commencing 1 July 2021. A copy of a joint media release is attached. The agreement with Network 10 follows constructive and collaborative discussions with Network 10 over the past three months during which the respective sales, technical, and operations teams have worked closely to ensure there will be a seamless transition to Network 10 programming on 1 July 2021. SCA’s sales teams have consistently generated excellent revenue outcomes for its partners. Over the five year period of the Nine affiliation, SCA’s sales power ratio (converting ratings to revenue) in the three aggregated markets improved by nine percentage points from 1.03 in 1H FY17 to 1.12 in 1H FY211. With Network 10’s suite of highly successful programs including MasterChef Australia, Australian Survivor, The Bachelor Australia, The Masked Singer, The Project and live A-League, Westfield W- League, Socceroos, Matildas and FFA Cup matches, SCA looks forward to continuing its superior sales performance to generate strong commercial returns for both SCA and Network 10. Television revenue booked to date for the first quarter of FY22 is in line with SCA’s internal forecasts and is currently pacing ahead of the same time in the current financial year, which was affected by COVID-19. -

Viacomcbs Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For fiscal year ended December 31, 2019 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-09553 ViacomCBS Inc. (Exact name of registrant as specified in its charter) Delaware 04-2949533 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 1515 Broadway New York, New York 10036 (212) 258-6000 (Address, including zip code, and telephone numbers, including area code, of registrant’s principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act: Trading Name of Each Exchange on Title of Each Class Symbols Which Registered Class A Common Stock, $0.001 par value VIACA The Nasdaq Stock Market LLC Class B Common Stock, $0.001 par value VIAC The Nasdaq Stock Market LLC Securities Registered Pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act of 1933). Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Agpasa, Brendon

A proposal for Australian Digital Radio and TV rollout By Chris Brendon Agpasa’s Pre-Budget Submission 2021-22 Digital Radio data services Digital Radio stations Widescreen Audio Extra Channels Electronic Program Guide Video Program Guides Radio channels on TV – ABC and SBS stations Digital TV channels New national community TV service in metro, regional and remote areas A new metropolitan and regional free-to-air TV channel in Melbourne, Adelaide, Perth, Sydney, Brisbane and regional Australia that is a community focused national broadcaster aiming to reflect Australia's multicultural diversity and provide an alternative local view platform, UHF channel 32 digital in metro areas, as well as UHF channel 35 digital in regional areas. We bring you the best content from community TV in Australia and other content in overseas Channel 44 (metro areas) Channel 46 (regional areas) This will be transitioned from C31, C44 and WTV in metro areas as well as Bushvision in regional areas to become a new statewide versions of national community TV service in the near future. An realignment of regional TV stations in Australia – Nine to SCA, 10 to WIN The renewal of regional TV affiliates in affected areas The extended multi-year affiliation deals with Nine to Southern Cross Austereo's Nine Regional stations, Mildura Digital Television, Tasmanian Digital Television, West Digital Television, WIN SA's Nine SA and WIN Griffith's Nine Griffith, as well as WIN Television was an affiliation deal with Network 10 were renewed from July 1 2021, as well as new home of their multi-channels 9Life and 9Rush to join Nine’s regional affiliates and then, 10 Shake joins WIN Television channels.