United Way of Collier County, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

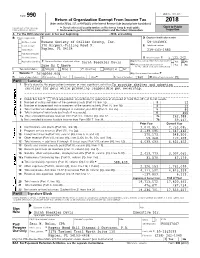

Humane Society Return

OMB No. 1545-0047 Form 990 Return of Organization Exempt From Income Tax 2018 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Open to Public Department of the Treasury G Do not enter social security numbers on this form as it may be made public. Internal Revenue Service G Go to www.irs.gov/Form990 for instructions and the latest information. Inspection A For the 2018 calendar year, or tax year beginning , 2018, and ending , B Check if applicable: C D Employer identification number Address change Humane Society of Collier County, Inc. 59-1033966 Name change 370 Airport-Pulling Road N. E Telephone number Initial return Naples, FL 34104 239-643-1880 Final return/terminated Amended return G Gross receipts $ 5,122,242. Is this a group return for subordinates? Application pending F Name and address of principal officer: Sarah Baeckler Davis H(a) Yes X No H(b) Are all subordinates included? Yes No Same As C Above If "No," attach a list. (see instructions) I Tax-exempt status: X 501(c)(3) 501(c) ()H (insert no.) 4947(a)(1) or 527 J Website: G hsnaples.org H(c) Group exemption number G K Form of organization: X Corporation Trust Association OtherG L Year of formation: 1960 M State of legal domicile: FL Part I Summary 1 Briefly describe the organization's mission or most significant activities:To provide shelter and adoption services for pets while promoting responsible pet ownership. 2 Check this box G if the organization discontinued its operations or disposed of more than 25% of its net assets. -

2017 Sustainability Profile

(Translation from the Italian original which remains the definitive version) 2017 Sustainability profile 2017 consolidated non-financial statement G4-1 Dear readers, Here is our sustainability profile, our calling card that presents our group’s daily commitment to save the environment, protect our workers, innovate and dialogue with our stakeholders. We are aware that the construction sector has always been a driving force for the economy and the generation of well-being. We “construct” with great responsibility as we know the potential impacts our activities can have on the surrounding area. The world is looking to a new social, economic and environmental development model. Two important testimonies are the United Nations’ approval of the Agenda for Sustainable Development and the related goals to be achieved by 2030 and the circular economy as a proactive answer to the crisis of the linear economic system. Though there are still political, economic and social barriers to fully reaching these ambitious goals, Astaldi is ready to embrace this challenge as we are certain that sustainability will play an ever more significant role in construction in coming years. This sector has always been tied to the ability of its players to manage and convert certain global challenges, including urbanisation, climate change and the increasingly pressing shortage of material, energy and water resources, into potential opportunities, including new market share. By integrating sustainability into our business, we get a better insight into our industry, thus boosting our ability to grasp new market challenges. We have no doubt that competition between top international players will continue to heighten and a pivotal factor will lie in each company’s ability to thoroughly diversify its products, drive ahead on innovation and draw in the expert and talented people needed to execute large technologically-advanced projects. -

INVITATION to BID CITY of NAPLES PURCHASING DIVISION CITY HALL, 735 8TH STREET SOUTH NAPLES, FL 34102 Cover Sheet PH: 239-213-7100 FX: 239-213-7105

INVITATION TO BID CITY OF NAPLES PURCHASING DIVISION CITY HALL, 735 8TH STREET SOUTH NAPLES, FL 34102 Cover Sheet PH: 239-213-7100 FX: 239-213-7105 NOTIFICATION TITLE SOLICITATION OPENING DATE & TIME: DATE: Fleischmann Park Baseball Fence and NUMBER: Net Replacement 05/01/2017 04/05/17 17-019 2:00 PM PRE-BID CONFERENCE DATE, TIME AND LOCATION Non-mandatory Pre-Bid Meeting April 14, 2017; 10:00 AM local time at Fleischmann Park, 1600 Fleischmann Blvd., Naples FL 34102 LEGAL NAME OF PARTNERSHIP, CORPORATION OR INDIVIDUAL: MAILING ADDRESS: CITY-STATE-ZIP: PH: EMAIL: FX: WEB ADDRESS: AUTHORIZED SIGNATURE DATE PRINTED NAME/TITLE I certify that this bid is made without prior understanding, agreement, or connection with any corporation, firm, or person submitting a bid for the same materials, supplies, or equipment and is in all respects fair and without collusion or fraud. I agree to abide by all conditions of this bid and certify that I am authorized to sign this bid for the bidder. In submitting a bid to the City of Naples the bidder offers and agrees that if the bid is accepted, the bidder will convey, sell, assign or transfer to the City of Naples all rights, title, and interest in and to all causes of action it may now or hereafter acquire under the Anti-trust laws of the United States and the State of FL for price fixing relating to the particular commodities or services purchased or acquired by the City of Naples. At the City's discretion, such assignment shall be made and become effective at the time the City tenders final payment to the bidder. -

No.12 December 2009 Inter City Railway Society Founded 1973

Tracks the monthly magazine of the Inter City Railway Society websites: icrs.org.uk & icrs.fotopic.net Aggregates Industries 59002 ‘Alan J Day’ with the 6V18 Hither Green - Whatley empty boxes passes southbound through Willesden Junction High Level with a freightliner on line behind (see page 6 in November issue) and showing the early stages of platform lengthening on the left 13 October 2009 Volume 37 No.12 December 2009 Inter City Railway Society founded 1973 The content of the magazine is the copyright of the Society No part of this magazine may be reproduced without prior permission of the copyright holder President: Simon Mutten (01603 715701) Coppercoin, 12 Blofield Corner Rd, Blofield, Norwich, Norfolk NR13 4RT Chairman: Carl Watson - [email protected] 14, Partridge Gardens, Waterlooville, Hampshire PO8 9XG Secretary: Gary Mutten - [email protected] (01953 600445) 1 Corner Cottage, Silfield St. Silfield, Wymondham, Norfolk NR18 9NS Treasurer: Gary Mutten - [email protected] details as above Membership Secretary: Trevor Roots - [email protected] (01466 760724) Mill of Botary, Cairnie, Huntly, Aberdeenshire AB54 4UD Editorial Manager: Trevor Roots - [email protected] details as above Website Manager: Mark Richards - [email protected] (01908 520028) 7 Parkside, Furzton, Milton Keynes, Bucks. MK4 1BX Editorial Team: Sightings: James Holloway - [email protected] (0121 744 2351) 246 Longmore Road, Shirley, Solihull B90 3ES News: John Barton - [email protected] (0121 770 2205) 46, Arbor Way, Chelmsley Wood, Birmingham B37 7LD Wagons & Trams: Martin Hall - [email protected] (0115 930 2775) 5 Sunninghill Close, West Hallam, Ilkeston, Derbyshire DE7 6LS All Our Yesterdays: Alan Gilmour - [email protected] 24 Norfolk Street, Lowestoft, Suffolk NR32 2HJ Europe (website): Robert Brown - [email protected] (01909 591504) 32 Spitalfields, Blyth, Worksop, Notts. -

METROS/U-BAHN Worldwide

METROS DER WELT/METROS OF THE WORLD STAND:31.12.2020/STATUS:31.12.2020 ّ :جمهورية مرص العرب ّية/ÄGYPTEN/EGYPT/DSCHUMHŪRIYYAT MISR AL-ʿARABIYYA :القاهرة/CAIRO/AL QAHIRAH ( حلوان)HELWAN-( المرج الجديد)LINE 1:NEW EL-MARG 25.12.2020 https://www.youtube.com/watch?v=jmr5zRlqvHY DAR EL-SALAM-SAAD ZAGHLOUL 11:29 (RECHTES SEITENFENSTER/RIGHT WINDOW!) Altamas Mahmud 06.11.2020 https://www.youtube.com/watch?v=P6xG3hZccyg EL-DEMERDASH-SADAT (LINKES SEITENFENSTER/LEFT WINDOW!) 12:29 Mahmoud Bassam ( المنيب)EL MONIB-( ش ربا)LINE 2:SHUBRA 24.11.2017 https://www.youtube.com/watch?v=-UCJA6bVKQ8 GIZA-FAYSAL (LINKES SEITENFENSTER/LEFT WINDOW!) 02:05 Bassem Nagm ( عتابا)ATTABA-( عدىل منصور)LINE 3:ADLY MANSOUR 21.08.2020 https://www.youtube.com/watch?v=t7m5Z9g39ro EL NOZHA-ADLY MANSOUR (FENSTERBLICKE/WINDOW VIEWS!) 03:49 Hesham Mohamed ALGERIEN/ALGERIA/AL-DSCHUMHŪRĪYA AL-DSCHAZĀ'IRĪYA AD-DĪMŪGRĀTĪYA ASCH- َ /TAGDUDA TAZZAYRIT TAMAGDAYT TAỴERFANT/ الجمهورية الجزائرية الديمقراطيةالشعبية/SCHA'BĪYA ⵜⴰⴳⴷⵓⴷⴰ ⵜⴰⵣⵣⴰⵢⵔⵉⵜ ⵜⴰⵎⴰⴳⴷⴰⵢⵜ ⵜⴰⵖⴻⵔⴼⴰⵏⵜ : /DZAYER TAMANEỴT/ دزاير/DZAYER/مدينة الجزائر/ALGIER/ALGIERS/MADĪNAT AL DSCHAZĀ'IR ⴷⵣⴰⵢⴻⵔ ⵜⴰⵎⴰⵏⴻⵖⵜ PLACE DE MARTYRS-( ع ني نعجة)AÏN NAÂDJA/( مركز الحراش)LINE:EL HARRACH CENTRE ( مكان دي مارت بز) 1 ARGENTINIEN/ARGENTINA/REPÚBLICA ARGENTINA: BUENOS AIRES: LINE:LINEA A:PLACA DE MAYO-SAN PEDRITO(SUBTE) 20.02.2011 https://www.youtube.com/watch?v=jfUmJPEcBd4 PIEDRAS-PLAZA DE MAYO 02:47 Joselitonotion 13.05.2020 https://www.youtube.com/watch?v=4lJAhBo6YlY RIO DE JANEIRO-PUAN 07:27 Así es BUENOS AIRES 4K 04.12.2014 https://www.youtube.com/watch?v=PoUNwMT2DoI -

Romania's Long Road Back from Austerity

THE INTERNATIONAL LIGHT RAIL MAGAZINE www.lrta.org www.tautonline.com MAY 2016 NO. 941 ROMANIA’S LONG ROAD BACK FROM AUSTERITY Systems Factfile: Trams’ dominant role in Lyon’s growth Glasgow awards driverless contract Brussels recoils from Metro attack China secures huge Chicago order ISSN 1460-8324 £4.25 Isle of Wight Medellín 05 Is LRT conversion Innovative solutions the right solution? and social betterment 9 771460 832043 AWARD SPONSORS London, 5 October 2016 ENTRIES OPEN NOW Best Customer Initiative; Best Environmental and Sustainability Initiative Employee/Team of the Year Manufacturer of the Year Most Improved System Operator of the Year Outstanding Engineering Achievement Award Project of the Year <EUR50m Project of the Year >EUR50m Significant Safety Initiative Supplier of the Year <EUR10m Supplier of the Year >EUR10m Technical Innovation of the Year (Rolling Stock) Technical Innovation of the Year (Infrastructure) Judges’ Special Award Vision of the Year For advanced booking and sponsorship details contact: Geoff Butler – t: +44 (0)1733 367610 – @ [email protected] Alison Sinclair – t: +44 (0)1733 367603 – @ [email protected] www.lightrailawards.com 169 CONTENTS The official journal of the Light Rail Transit Association MAY 2016 Vol. 79 No. 941 www.tautonline.com EDITORIAL 184 EDITOR Simon Johnston Tel: +44 (0)1733 367601 E-mail: [email protected] 13 Orton Enterprise Centre, Bakewell Road, Peterborough PE2 6XU, UK ASSOCIATE EDITOR Tony Streeter E-mail: [email protected] WORLDWIDE EDITOR Michael Taplin 172 Flat 1, 10 Hope Road, Shanklin, Isle of Wight PO37 6EA, UK. E-mail: [email protected] NEWS EDITOR John Symons 17 Whitmore Avenue, Werrington, Stoke-on-Trent, Staffs ST9 0LW, UK. -

Senza Titolo-2

Global & Local Vol. 13 No.2 Economic Review Volume 13 No. 2 2009 2009 Ennio Forte, Lucio Siviero, Lidia Carleo w From fare standardization to functional e unification of urban transport with reference i to the logistic functionality of service v e Pasquale Sarnacchiano, Antonello D’Ambra R Cumulative correspondence analysis as a tool for optimizing factor setting in public transport c i Tonio Di Battista, Tonino Sclocco m Sampling design for local public transport assessment o n Michele Gallo, Enrico Ciavolino o Multivariate statistical approaches for customer c satisfaction into the transportation sector E Michele Gallo, Antonello D’Ambra, Ida Camminatiello l The evaluation of passenger satisfaction in the a local public transport: a strategy for data analysis c o Cristina Bernini, Alessandro Lubisco L Modelling dynamic customer satisfaction in urban public transportation & l Pietro Rostirolla, Oriana Romano a Taxi service and sustainable mobility: a people b satisfaction survey o l Antonio Lucadamo, Luigi D’Ambra, Francesca Pagliara Multinomial logit models: multicollinearity and its G consequences on parameter estimation and on independence from irrelevant alternatives tests Luisa Scaccia DITION E Ramdom parameters logit models applied to public transport demand RACCE T TRACCE EDITION POLICY FOR THE SUBMISSION OF MANUSCRIPTS TO BE PUBLISHED IN THE GLOBAL & LOCAL ECONOMIC REVIEW 1. PRELIMINARY INSTRUCTIONS For a manuscript to be accepted for publication in the Review, authors are required to abide by the following publication rules. In particular, authors must state that: • the manuscript, or relevant parts of the manuscripts, was not previously pu- blished; • the manuscript is not simultaneously under review by any other journal; • the manuscript will be not submitted elsewhere before the final outcome of peer-reviewing process by the Scientific Board. -

2018 Naples Community Hospital

PUBLIC DISCLOSURE COPY ** PUBLIC DISCLOSURE COPY ** Return of Organization Exempt From Income Tax OMB No. 1545-0047 Form 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) 2017 Department of the Treasury | Do not enter social security numbers on this form as it may be made public. Open to Public Internal Revenue Service | Go to www.irs.gov/Form990 for instructions and the latest information. Inspection A For the 2017 calendar year, or tax year beginningOCT 1, 2017 and ending SEP 30, 2018 BCCheck if Name of organization D Employer identification number applicable: Address change NAPLES COMMUNITY HOSPITAL, INC. Name change Doing business as 59-0694358 Initial return Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number Final return/ P.O. BOX 413029 239-624-6338 termin- ated City or town, state or province, country, and ZIP or foreign postal code G Gross receipts $ 772,264,237. Amended return NAPLES, FL 34101-3029 H(a) Is this a group return Applica- tion F Name and address of principal officer: RICK WYLES for subordinates? ~~ Yes X No pending 350 SEVENTH STREET NORTH, NAPLES, FL 34102- H(b) Are all subordinates included? Yes No I Tax-exempt status: X 501(c)(3) 501(c) () § (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions) J Website: | WWW.NCHMD.ORG H(c) Group exemption number | K Form of organization: X Corporation Trust Association Other | LMYear of formation:1957 State of legal domicile: FL Part I Summary 1 Briefly describe the organization's mission or most significant activities: HELPING EVERYONE LIVE A LONGER, HAPPIER, AND HEALTHIER LIFE. -

2020 Form 990 and 990-T

EXTENDED TO MAY 17, 2021 Return of Organization Exempt From Income Tax OMB No. 1545-0047 Form 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) (Rev. January 2020) | Do not enter social security numbers on this form as it may be made public. 2019 Department of the Treasury Open to Public Internal Revenue Service | Go to www.irs.gov/Form990 for instructions and the latest information. Inspection A For the 2019 calendar year, or tax year beginning JUL 1, 2019 and ending JUN 30, 2020 B Check if C Name of organization D Employer identification number applicable: COMMUNITY FOUNDATION OF COLLIER Address change COUNTY, INC. Name change Doing business as 59-2396243 Initial return Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number Final return/ 1110 PINE RIDGE ROAD 200 239-649-5000 termin- ated City or town, state or province, country, and ZIP or foreign postal code G Gross receipts $ 112,817,103. Amended return NAPLES, FL 34108 H(a) Is this a group return Applica- tion F Name and address of principal officer: EILEEN CONNOLLY-KEESLER for subordinates? ~~ Yes X No pending 1110 PINE RIDGE ROAD, SUITE 200, NAPLES, FL H(b) Are all subordinates included? Yes No I Tax-exempt status: X 501(c)(3) 501(c) ( )§ (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions) J Website: | WWW.CFCOLLIER.ORG H(c) Group exemption number | K Form of organization: X Corporation Trust Association Other | L Year of formation: 1985 M State of legal domicile: FL Part I Summary 1 Briefly describe the organization's mission or most significant activities: WORKING WITH DONORS, WE INSPIRE IDEAS, IGNITE ACTION, AND MOBILIZE RESOURCES TO ADDRESS COMMUNITY 2 Check this box | if the organization discontinued its operations or disposed of more than 25% of its net assets. -

House Prices and Rents Variations Due to Transit Oriented Development Policies Francesca Pagliaraa

INTERNATIONAL JOURNAL OF REAL ESTATE AND LAND PLANNING VOL.1 (2018) eISSN 2623-4807 Available online at https://ejournals.lib.auth.gr/reland House prices and rents variations due to Transit Oriented Development policies Francesca Pagliaraa a Department of Civil, Architectural and Environmental Engineering, University of Naples Federico II, Via Claudio 21, 80125 Naples, Italy Abstract The concept of Transit Oriented Development (TOD) deals with the development of a mixed-use, compact, walkable neighborhood with the objective of encouraging residents to live near and use public transit. A TOD neighborhood is typically characterized by a transit station, public spaces and by a walkable street network connecting residential and commercial buildings to that station within a 800m radius. TOD is based on the contrast to the auto-dependent behaviour, which has characterized the development pattern in the United States since the Second World War, due to the growth of car use, highway expansion, and suburbanization. Studies on the impacts of transit rail on residential property values have provided interesting results in many urban contexts. However, for the case study of Italy, the literature is very poor with the exception of some experiences reported for the cities of Milan, Turin and Genoa, where the impacts of these initiatives have not really been quantified. The aim of this paper is to fill this gap, indeed through the case study of Naples, a city in the south of Italy, the impacts of metro stations on house prices and on rents have been analysed. The Campania Regional Metro System (RMS) project is considered one of the most ambitious examples of rail- based public transport policies currently implemented in Italy. -

2018 IRS Form

OMB No. 1545-0047 Form 990 Return of Organization Exempt From Income Tax 2018 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Do not enter social security numbers on this form as it may be made public. Open to Public Department of the Treasury Internal Revenue Service Go to www.irs.gov/Form990 for instructions and the latest information. Inspection A For the 2018 calendar year, or tax year beginning10-01 , 2018, and ending 09-30 , 20 19 B Check if applicable:C Name of organization Naples Botanical Garden Inc D Employer identification no. Address change Doing business as 65-0511429 Name change Number and street (or P.O. box if mail is not delivered to street address) Room/suiteE Telephone number Initial return 4820 Bayshore Drive (239)643-7275 Final return/terminated City or town, state or province, country, and ZIP or foreign postal codeG Gross receipts Amended return Naples, FL 34112-7337$ 13,966,643 Application pendingF Name and address of principal officer: H(a)Is this a group return for subordinates? YesX No H(b)Are all subordinates included? Yes No I Tax-exempt status:X 501(c)(3) 501(c) ( ) (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions) JWebsite: www.naplesgarden.org H(c) Group exemption number K Form of organization:X Corporation Trust Association OtherLM Year of formation:1995 State of legal domicile: FL Part I Summary 1 Briefly describe the organization's mission or most significant activities: See Program Service Accomplishments.pdf 2 Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets. -

Nov Itates PUBLISHED by the AMERICAN MUSEUM of NATURAL HISTORY CENTRAL PARK WEST at 79TH STREET, NEW YORK, N.Y

AMERICAN MUSEUM Nov itates PUBLISHED BY THE AMERICAN MUSEUM OF NATURAL HISTORY CENTRAL PARK WEST AT 79TH STREET, NEW YORK, N.Y. 10024 Number 2879, pp. 1-63 June 10, 1987 Type Specimens of Birds in the American Museum of Natural History Part 4. Passeriformes: Tyrannidae, Pipridae, Cotingidae, Oxyruncidae, Phytotomidae,l Pittidae, Philepittidae,1 Acanthisittidae, Menuridae, Atrichomithidae JAMES C. GREEN-WAY, JR.2 PREFACE This is the fourth part of Type Specimens of checked, and the final draft prepared by Mary Birds in the American Museum of Natural His- LeCroy and Richard Sloss. Wesley E. Lanyon care- tory. Taxonomically it does not immediately fol- fully read over the lengthy section on the Tyran- low the other two (Bulletin American Museum nidae, making many helpful comments, and Jay Natural History, 1973, vol. 150, art. 3; and 1978, Pitocchelli prepared the index. vol. 161, art. 1). Rather, it treats the same bird In this part of the list a total of 376 names of families covered in Peters' Check-list of Birds of types appear, of which 80 are synonyms. These the World, vol. 8 (Traylor, 1979). Unfortunately, are in addition to the 2157 names oftypes included Mr. Greenway's health has not permitted him to in Parts 1 and 2, which covered the nonpasserines. continue the list of type specimens at his earlier A number of addenda and corrigenda for Parts 1 rapid pace. However, manuscript for the subos- and 2 have come to our attention since the pub- cine birds treated here was in an advanced state. lication of Part 2 (Greenway, 1978, pp.