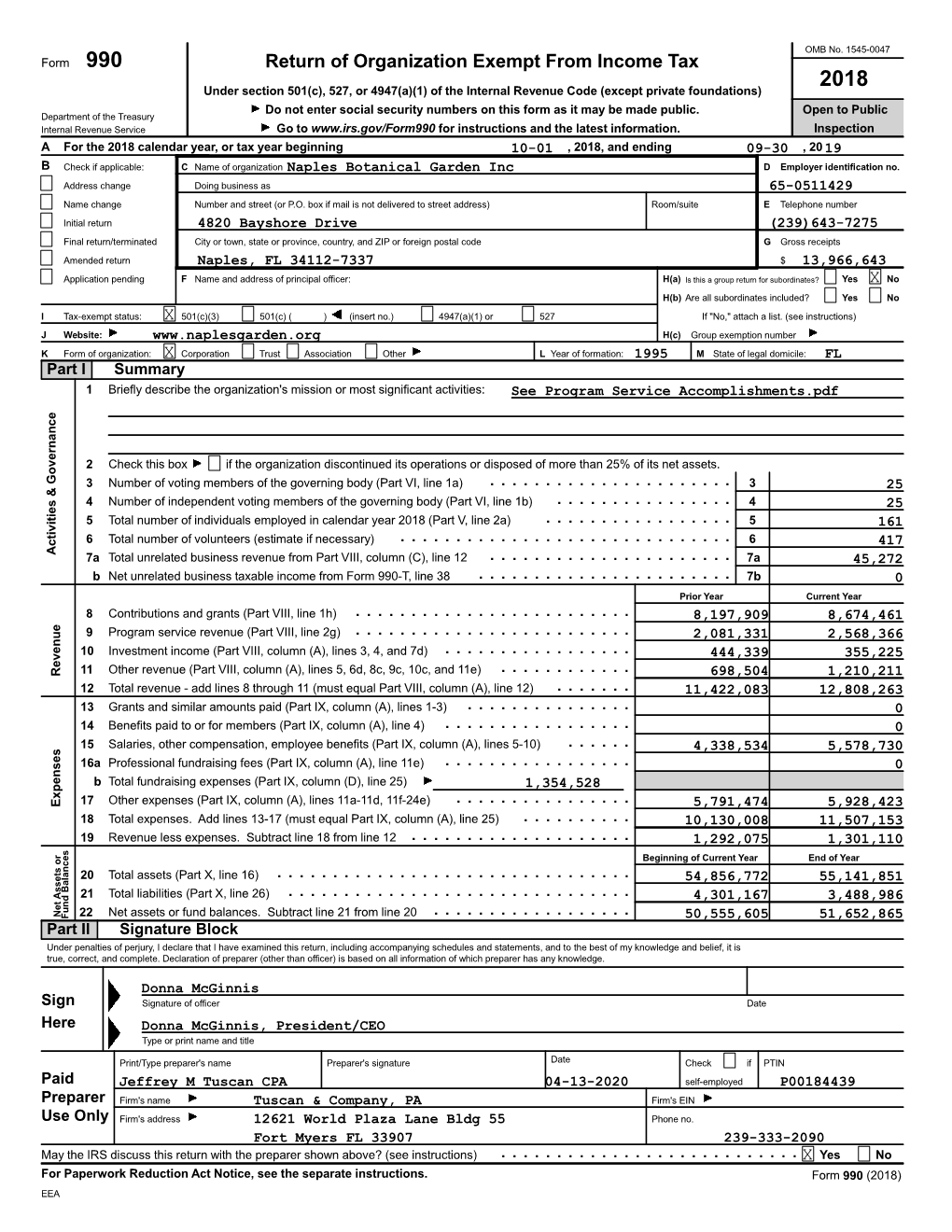

2018 IRS Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research Article the Impact of Urban Transit Systems on Property Values: a Model and Some Evidences from the City of Naples

Hindawi Journal of Advanced Transportation Volume 2018, Article ID 1767149, 22 pages https://doi.org/10.1155/2018/1767149 Research Article The Impact of Urban Transit Systems on Property Values: A Model and Some Evidences from the City of Naples Mariano Gallo Dipartimento di Ingegneria, Universita` del Sannio, Piazza Roma 21, 82100 Benevento, Italy Correspondence should be addressed to Mariano Gallo; [email protected] Received 9 October 2017; Revised 30 January 2018; Accepted 21 February 2018; Published 5 April 2018 Academic Editor: David F. Llorca Copyright © 2018 Mariano Gallo. Tis is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. A hedonic model for estimating the efects of transit systems on real estate values is specifed and calibrated for the city of Naples. Te model is used to estimate the external benefts concerning property values which may be attributed to the Naples metro at the present time and in two future scenarios. Te results show that only high-frequency metro lines have appreciable efects on real estate values, while low-frequency metro lines and bus lines produce no signifcant impacts. Our results show that the impacts on real estate values of the metro system in Naples are signifcant, with corresponding external benefts estimated at about 7.2 billion euros or about 8.5% of the total value of real estate assets. 1. Introduction lower environmental impacts produced by less use of private cars, investments in transit systems, especially in railways Urban transit systems play a fundamental role for the social and metros, may generate an appreciable increase in property and economic development of large urban areas, as well as values in the zones served; this beneft should be explicitly signifcantly afecting the quality of life in such areas. -

Freezing in Naples Underground

THE ARTIFICIAL GROUND FREEZING TECHNIQUE APPLICATION FOR THE NAPLES UNDERGROUND Giuseppe Colombo a Construction Supervisor of Naples underground, MM c Technicalb Director MM S.p.A., via del Vecchio Polit Abstract e Technicald DirectorStudio Icotekne, di progettazione Vico II S. Nicola Lunardi, all piazza S. Marco 1, The extension of the Naples Technical underground Director between Rocksoil Pia S.p.A., piazza S. Marc Direzionale by using bored tunnelling methods through the Neapo Cassania to unusually high heads of water for projects of th , Pietro Lunardi natural water table. Given the extreme difficulty of injecting the mater problem of waterproofing it during construction was by employing artificial ground freezing (office (AGF) district) metho on Line 1 includes 5 stations. T The main characteristics of this ground treatment a d with the main problems and solutions adopted during , Vittorio Manassero aspects of this experience which constitutes one of Italy, of the application of AGF technology. b , Bruno Cavagna e c S.p.A., Naples, Giovanna e a Dogana 9,ecnico Naples 8, Milan ion azi Sta o led To is type due to the presence of the Milan zza Dante and the o 1, Milan ial surrounding thelitan excavation, yellow tuff, the were subject he stations, driven partly St taz Stazione M zio solved for four of the stations un n Università ic e ds. ip Sta io zione Du e omo re presented in the text along the major the project examples, and theat leastsignificant in S t G ta a z r io iibb n a e Centro lldd i - 1 - 1. -

Humane Society Return

OMB No. 1545-0047 Form 990 Return of Organization Exempt From Income Tax 2018 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Open to Public Department of the Treasury G Do not enter social security numbers on this form as it may be made public. Internal Revenue Service G Go to www.irs.gov/Form990 for instructions and the latest information. Inspection A For the 2018 calendar year, or tax year beginning , 2018, and ending , B Check if applicable: C D Employer identification number Address change Humane Society of Collier County, Inc. 59-1033966 Name change 370 Airport-Pulling Road N. E Telephone number Initial return Naples, FL 34104 239-643-1880 Final return/terminated Amended return G Gross receipts $ 5,122,242. Is this a group return for subordinates? Application pending F Name and address of principal officer: Sarah Baeckler Davis H(a) Yes X No H(b) Are all subordinates included? Yes No Same As C Above If "No," attach a list. (see instructions) I Tax-exempt status: X 501(c)(3) 501(c) ()H (insert no.) 4947(a)(1) or 527 J Website: G hsnaples.org H(c) Group exemption number G K Form of organization: X Corporation Trust Association OtherG L Year of formation: 1960 M State of legal domicile: FL Part I Summary 1 Briefly describe the organization's mission or most significant activities:To provide shelter and adoption services for pets while promoting responsible pet ownership. 2 Check this box G if the organization discontinued its operations or disposed of more than 25% of its net assets. -

I I I I Mmmmmmm I I I I Mmmmmmmmmmm Mmmmmmmmmm Mmmmmmmmm M

Exempt Organization Business Income Tax Return OMB No. 1545-0687 Form 990-T (and proxy tax under section 6033(e)) For calendarI year 2017 or other tax year beginning , 2017, and ending , 20 . À¾µ» Department of the Treasury Go to www.irs.gov/Form990T for instructions and the latest information. I Open to Public Inspection for Internal Revenue Service Do not enter SSN numbers on this form as it may be made public if your organization is a 501(c)(3). 501(c)(3) Organizations Only A Check box if Name of organization ( Check box if name changed and see instructions.) D Employer identification number (Employees' trust, see instructions.) address changed INSTITUTE OF ELECTRICAL AND ELECTRONICS B Exempt under section ENGINEERS, INC. X 501(C )( 3 ) Print Number, street, and room or suite no. If a P.O. box, see instructions. 13-1656633 or 408(e) 220(e) E Unrelated business activity codes Type (See instructions.) 408A 530(a) 445 HOES LANE 529(a) City or town, state or province, country, and ZIP or foreign postal code C Book value of all assets PISCATAWAY, NJ 08854 541800 541200 at end of year I F Group exemption number I(See instructions.) 657,496,877. G Check organization typeX 501(c)I corporation 501(c) trust 401(a) trust Other trust H Describe the organization's primary unrelated business activity. ADVERTISING INCOME FROM PERIODICALS.m m m m m m m I During the tax year, was the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group? I YesX No If "Yes," enter the name and identifying number of the parent corporation. -

Rete Metropolitana Napoli 1.Pdf

aversa piedimonte matese benevento caserta caserta formia frattamaggiore casoria cancello afragola acerra casalnuovo di napoli botteghelle volla poggioreale centro direzionale underground and railways map madonnelle argine palasport salvator gianturco rosa villa gianturco visconti formia vesuvio barra de meis duomo san ponticelli giovanni porta nolana san s. maria giovanni del pozzo bartolo longo licola quarto quarto torregaveta centro san pietrarsa giorgio cavalli di bronzo bellavista portici ercolano pompei castellammare sorrento pompei salerno pozzuoli capolinea autobus edenlandia bus terminal kennedy linea 1 ANM linea 2 Trenitalia collegamento marittimo torregaveta agnano line 1 line 2 sea transfer pozzuoli gerolomini linea 6 ANM parcheggio metrocampania nordest EAV parking line 6 metrocampania nordest line bagnoli ospedale cappuccini dazio funicolari ANM hospital funicolars linea circumvesuviana EAV circumvesuviana railway museo stazione museum station linea circumflegrea EAV castello stazione dell’arte circumflegrea railway castle art station linea cumana EAV università stazione in costruzione cumana railway university station under construction stadio scale mobili rete ferroviaria Trenitalia stadium escalators regional and national railway network mostra d’oltremare nodi di interscambio collegamento aeroporto interchange station airport transfer ostello internazionale Porto - Stazione Centrale - Aeroporto hostelling international APERTURA CHIUSURA PUOI ACQUISTARE I BIGLIETTI PRESSO I open closed DISTRIBUTORI AUTOMATICI O NEI RIVENDITORI -

PRESS RELEASE in a Augur Tion of New Station Naples-Garibaldi by Dominique Perrault

PRESS RELEASE IN A AUGUR TION OF NEW STATION Naples-GARIBALDI BY DOMINIQUE perraULT © DPA / Adagp After two achievements in the north of Italy – the NH-Fieramilano Hotel in the northwest of Milan delivered in 2008 and the redesigning of the Piazza Gramsci (2004), central place of Cinisello Balsamo, city located a few kilometres from the Milan capital-, Dominique Perrault makes his mark in the southern provinces of the peninsula, benefiting from the upcoming arrival of a metro station to orchestrate the –in-depth- transforma- tion of a major public space in the heart of Naples: The Piazza Garibaldi. After a striking proposition made on the occasion of the international architecture competition for the creation of the future TGV Napoli station - Afragola (Treno Alta Velocita) in 2003 - the architect of the Grande Bibliothèque is entrusted, from 2004, by the Metropolitana di Napoli with the studies for the redesigning of the Piazza Garibaldi, but also the realisation of the eponym subway station on the new line 1. It’s an effervescent scene where the Neapolitan intensity explodes, and where more than 50 millions of people pass by every year. The Piazza Garibaldi on which watches over- face to the central station - the statue of the man called “the hero of the Two Worlds” gathers in a happy chaos the historic heart of Naples and the new business district set up on the former warehouses of the City: the Centro Direzionale. This square is a link of almost 6 hectares. It relies on a heterogeneous built heritage, and until now it was used as a huge available space serving the intermodality and the moving, without properly qualifying the public space to host the urban practices, and only offers to the residents, travellers and walkers, few spaces dedicated to the ramble and the relaxation. -

2017 Sustainability Profile

(Translation from the Italian original which remains the definitive version) 2017 Sustainability profile 2017 consolidated non-financial statement G4-1 Dear readers, Here is our sustainability profile, our calling card that presents our group’s daily commitment to save the environment, protect our workers, innovate and dialogue with our stakeholders. We are aware that the construction sector has always been a driving force for the economy and the generation of well-being. We “construct” with great responsibility as we know the potential impacts our activities can have on the surrounding area. The world is looking to a new social, economic and environmental development model. Two important testimonies are the United Nations’ approval of the Agenda for Sustainable Development and the related goals to be achieved by 2030 and the circular economy as a proactive answer to the crisis of the linear economic system. Though there are still political, economic and social barriers to fully reaching these ambitious goals, Astaldi is ready to embrace this challenge as we are certain that sustainability will play an ever more significant role in construction in coming years. This sector has always been tied to the ability of its players to manage and convert certain global challenges, including urbanisation, climate change and the increasingly pressing shortage of material, energy and water resources, into potential opportunities, including new market share. By integrating sustainability into our business, we get a better insight into our industry, thus boosting our ability to grasp new market challenges. We have no doubt that competition between top international players will continue to heighten and a pivotal factor will lie in each company’s ability to thoroughly diversify its products, drive ahead on innovation and draw in the expert and talented people needed to execute large technologically-advanced projects. -

INVITATION to BID CITY of NAPLES PURCHASING DIVISION CITY HALL, 735 8TH STREET SOUTH NAPLES, FL 34102 Cover Sheet PH: 239-213-7100 FX: 239-213-7105

INVITATION TO BID CITY OF NAPLES PURCHASING DIVISION CITY HALL, 735 8TH STREET SOUTH NAPLES, FL 34102 Cover Sheet PH: 239-213-7100 FX: 239-213-7105 NOTIFICATION TITLE SOLICITATION OPENING DATE & TIME: DATE: Fleischmann Park Baseball Fence and NUMBER: Net Replacement 05/01/2017 04/05/17 17-019 2:00 PM PRE-BID CONFERENCE DATE, TIME AND LOCATION Non-mandatory Pre-Bid Meeting April 14, 2017; 10:00 AM local time at Fleischmann Park, 1600 Fleischmann Blvd., Naples FL 34102 LEGAL NAME OF PARTNERSHIP, CORPORATION OR INDIVIDUAL: MAILING ADDRESS: CITY-STATE-ZIP: PH: EMAIL: FX: WEB ADDRESS: AUTHORIZED SIGNATURE DATE PRINTED NAME/TITLE I certify that this bid is made without prior understanding, agreement, or connection with any corporation, firm, or person submitting a bid for the same materials, supplies, or equipment and is in all respects fair and without collusion or fraud. I agree to abide by all conditions of this bid and certify that I am authorized to sign this bid for the bidder. In submitting a bid to the City of Naples the bidder offers and agrees that if the bid is accepted, the bidder will convey, sell, assign or transfer to the City of Naples all rights, title, and interest in and to all causes of action it may now or hereafter acquire under the Anti-trust laws of the United States and the State of FL for price fixing relating to the particular commodities or services purchased or acquired by the City of Naples. At the City's discretion, such assignment shall be made and become effective at the time the City tenders final payment to the bidder. -

Nessun Titolo Diapositiva

STATIONS, RAILWAYS, URBAN PLANNING AND MOBILITY POLICIES. THE CASE STUDY OF NAPLES AND CAMPANIA Prof. Ing. Ennio Cascetta Dipartimento di Ingegneria dei Trasporti “L. Tocchetti” Università degli Studi di Napoli Federico II Event 1 Bologna October, 2012 Place. SEP / 2012 OUTLINE • THE CONTEXT • RAILWAYS IN NAPLES AND CAMPANIA BEFORE THE YEAR 2000 • OBJECTIVES AND STRATEGIES OF THE PROJECT • THE METRO SYSTEM IN NAPLES AND CAMPANIA 2000-2012 • THE VALUE OF BEAUTY 2 1 RAILWAYS IN NAPLES AND CAMPANIA BEFORE THE YEAR 2000 The metropolitan area of Naples TheE. metropolitanCascetta areas centred around Naples with 3.5 millions inhabitants3 3 hasBologna one October, with 2012 the highest residential density in the world (1900 inh./kmq) RAILWAYS IN NAPLES AND CAMPANIA BEFORE THE YEAR 2000 Metropolitan areas in the world: population and residential densities Luz (Large Urban Zone Metropolitan): population and residential densities 6000,0 5 .16 9 5000,0 4000,0 3000,0 2 .6 0 7 1.9 0 3 2000,0 1.6 0 2 1.4 16 1.0 8 5 1.0 7 7 1.0 2 3 9 6 9 9 6 7 1000,0 9 18 6 9 1 6 7 0 6 5 5 6 2 0 590 460 444 284 278 0,0 Milan Wien Tokyo Lisbon Rome Madrid Berlin Praga Istanbul Naples Lond on Ath ens Brussels New Yo rk Bud apest BarcelonaVarsavia Munchen Copenh agen Paris (LUZ as Ile de Fr) Population (inh/10.000) Residential Densities (inh./kmq) E. Cascetta 4 Bologna October, 2012 Font: Eurostat LUZ: an area with a significant share of the resident commute into the city 2 OUTLINE • THE CONTEXT • RAILWAYS IN NAPLES AND CAMPANIA BEFORE THE YEAR 2000 • OBJECTIVES AND STRATEGIES OF THE PROJECT • THE METRO SYSTEM IN NAPLES AND CAMPANIA 2000-2012 • THE VALUE OF BEAUTY 5 RAILWAYS IN NAPLES AND CAMPANIA BEFORE THE YEAR 2000 The railway history in Campania 3 october 1839: • Opening of the Naples-Portici line 7.250 km long with the king Ferdinand II •The Vesuvius locomotive 1839: line Naples-Portici, first railway E. -

International Society for Soil Mechanics and Geotechnical Engineering

INTERNATIONAL SOCIETY FOR SOIL MECHANICS AND GEOTECHNICAL ENGINEERING This paper was downloaded from the Online Library of the International Society for Soil Mechanics and Geotechnical Engineering (ISSMGE). The library is available here: https://www.issmge.org/publications/online-library This is an open-access database that archives thousands of papers published under the Auspices of the ISSMGE and maintained by the Innovation and Development Committee of ISSMGE. Geotechnical Aspects of Underground Construction in Soft Ground – Viggiani (ed) © 2012 Taylor & Francis Group, London, ISBN 978-0-415-68367-8 Modelling and monitoring of a urban underground excavation A. Cantone Department of Civil Engineering, II University of Naples, Italy R. Fico Structural & Geotechnical Designer Collaborator, Naples, Italy F. Cavuoto Structural & Geotechnical Designer, Naples, Italy A. Mandolini Department of Civil Engineering, II University of Naples, Italy ABSTRACT: The highly urbanization of the area where Montesanto Station (Naples, Italy) is located and the need to guarantee the transportation service to travellers during the works gave birth to the plan of the combined use of 3D numerical analyses and the real time monitoring of significant parameters (displacements, strain, stresses and temperature) to confirm the set of design criteria assumed and calibrate the design parameters affecting the problem faced. The 3D analyses simulated the step by step excavation predicting the stress-strain behaviour; hence the comparison of the analytical predictions with the corresponding values derived through the monitoring (238 points being monitored) allowed to calibrate the model as the excavation advanced, thus refining the analysis itself and improving the safety level. 1 INTRODUCTION adopted, an intensive monitoring activity was planned under the supervision of the Civil The Montesanto Station of Cumana Railway Line, Engineering Department (DIC) of the Second owned by S.E.P.S.A. -

No.12 December 2009 Inter City Railway Society Founded 1973

Tracks the monthly magazine of the Inter City Railway Society websites: icrs.org.uk & icrs.fotopic.net Aggregates Industries 59002 ‘Alan J Day’ with the 6V18 Hither Green - Whatley empty boxes passes southbound through Willesden Junction High Level with a freightliner on line behind (see page 6 in November issue) and showing the early stages of platform lengthening on the left 13 October 2009 Volume 37 No.12 December 2009 Inter City Railway Society founded 1973 The content of the magazine is the copyright of the Society No part of this magazine may be reproduced without prior permission of the copyright holder President: Simon Mutten (01603 715701) Coppercoin, 12 Blofield Corner Rd, Blofield, Norwich, Norfolk NR13 4RT Chairman: Carl Watson - [email protected] 14, Partridge Gardens, Waterlooville, Hampshire PO8 9XG Secretary: Gary Mutten - [email protected] (01953 600445) 1 Corner Cottage, Silfield St. Silfield, Wymondham, Norfolk NR18 9NS Treasurer: Gary Mutten - [email protected] details as above Membership Secretary: Trevor Roots - [email protected] (01466 760724) Mill of Botary, Cairnie, Huntly, Aberdeenshire AB54 4UD Editorial Manager: Trevor Roots - [email protected] details as above Website Manager: Mark Richards - [email protected] (01908 520028) 7 Parkside, Furzton, Milton Keynes, Bucks. MK4 1BX Editorial Team: Sightings: James Holloway - [email protected] (0121 744 2351) 246 Longmore Road, Shirley, Solihull B90 3ES News: John Barton - [email protected] (0121 770 2205) 46, Arbor Way, Chelmsley Wood, Birmingham B37 7LD Wagons & Trams: Martin Hall - [email protected] (0115 930 2775) 5 Sunninghill Close, West Hallam, Ilkeston, Derbyshire DE7 6LS All Our Yesterdays: Alan Gilmour - [email protected] 24 Norfolk Street, Lowestoft, Suffolk NR32 2HJ Europe (website): Robert Brown - [email protected] (01909 591504) 32 Spitalfields, Blyth, Worksop, Notts. -

From TGV to Inoui SNCF Looks to the Future As New High-Speed Lines Open

July 2017 I Volume 57 Issue 7 www.railjournal.com | @railjournal IRJInternational Railway Journal From TGV to inOui SNCF looks to the future as new high-speed lines open Race to the north Binding the Baltic Britain poised to begin Trilateral consensus builds construction on HS2 behind Rail Baltica Contents Contact us July 2017 Volume 57 issue 7 Editorial offices News Post 46 Killigrew Street 4 This month Falmouth Cornwall, TR11 3PP 6 News headlines UK 12 Transit Tel +44 1326 313945 14 Financial Fax +44 1326 211576 Web www.railjournal.com 16 Technology news: UITP summit 18 Technology news: IAF track show Editor-in-Chief 20 Analysis David Briginshaw 18 [email protected] Associate Editor France Keith Barrow [email protected] 22 Will France say “oui” to inOui? Features Editor SNCF relaunches TGV as inOui in bold move to revitalise Kevin Smith an iconic brand [email protected] 28 Reconnecting Paris Features & News Reporter Dan Templeton France’s ambitious Grand Paris metro project starts to [email protected] take shape Market Researcher 32 Developing the new TGV, brick by brick Jonny Dearden 28 Alstom begins development of its next-generation [email protected] Sales Executive high-speed train Chloe Pickering [email protected] High-speed Production Manager 36 HS2 poised for start of construction Sue Morant [email protected] Preliminary works are underway on Britain’s second high-speed rail project Advertising sales offices 40 Rail Baltica gathers momentum Post 19 John De Mierre House Bridge Road Creating a standard-gauge