SARS,Lies and the Stock Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dalian Refrigeration Co., Ltd. 2011 Annual Report

Dalian Refrigeration Co., Ltd. 2011 Annual Report Dalian Refrigeration Co., Ltd. 2011 Annual Report CONTENTS §1 Important Notes⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯ 2 §2 Company Profile⋯⋯⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 2 §3 Summary of Accounting Data and Business Data⋯⋯ ⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 4 §4 Changes in Share Capital and Particulars about Shareholders⋯⋯⋯ ⋯⋯⋯ ⋯⋯ 6 §5 Directors, Supervisors, Senior Staff Members and Employees of the Company⋯⋯ 9 §6 The Administrative System of the Company⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 13 §7 The Internal Control of the Company⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯ 15 §8 Brief Introduction to the Shareholders General Meeting⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 16 §9 Report of the Board of Directors⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 17 §10 Report of the Supervisory Board⋯⋯⋯⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯ 29 §11 Significant Events⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 31 §12 Financial Report⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 37 §13 Contents of Reference Documents⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 95 1 Dalian Refrigeration Co., Ltd. 2011 Annual Report §1 Important Notes 1.1 The directors and the Board of Directors, the supervisors and the Supervisory Board, and Senior staff members of Dalian Refrigeration Co., Ltd. (hereinafter referred to as the Company) hereby confirm that there are not any important omissions, fictitious statements or serious misleading carried in this report, and shall take all responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents. 1.2 The financial report has been audited by ZON ZUN Certified Public Accounts Office Ltd. who has presented unqualified opinion audit report. 1.3 Chairman of the Board of Directors of the Company Mr. Zhang He, Financial Majordomo and the head of Accounting Department Ms. Xu Junrao hereby confirm that the financial report of the annual report is true and complete. 1.4 This report is written respectively in Chinese and in English. -

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

China: Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/28/2017 GAIN Report Number: GAIN0036 China - Peoples Republic of Retail Foods Increasing Change and Competition but Strong Growth Presents Plenty of Opportunities for U.S. Food Exports Approved By: Christopher Bielecki Prepared By: USDA China Staff Report Highlights: China remains one of the most dynamic retail markets in the world, and offers great opportunities for U.S. food exporters. Exporters should be aware of several new trends that are changing China’s retail landscape. Imported food consumption growth is shifting from China’s major coastal metropolitan areas (e.g., Shanghai; Beijing) to dozens of emerging market cities. China is also experimenting with new retail models, such as 24-hour unstaffed convenience stores and expanded mobile payment platforms. E-commerce sales continue to grow, but major e-commerce retailers are competing for shrinking numbers of new consumers. We caution U.S. exporters not to consider China as a single retail market. Over the past 10 years, the Chinese middle-class has grown larger and more diverse, and China has become a collection of 1 niche markets separated by geography, culture, cuisine, demographics, and commercial trends. Competition for these markets has become fierce. Shanghai and the surrounding region continues to lead national retail trends, however Beijing and Guangzhou are also important centers of retail innovation. Chengdu and Shenyang are two key cities leading China’s economic expansion into international trade and commerce. -

Harvest Funds (Hong Kong) Etf (An Umbrella Unit Trust Established in Hong Kong)

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2016 TO 30TH JUNE 2016 www.harvestglobal.com.hk HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 29 Statement of Movements in Investment Portfolio (Unaudited) 30 – 75 Performance Record (Unaudited) 76 Underlying Index Constituent Stocks Disclosure (Unaudited) 77 Report on Investment Overweight (Unaudited) 78 Management and Administration 79 - 81 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2016): Harvest MSCI China A Index ETF 1H-2016 (without dividend reinvested) MSCI China A Index2 -17.61% Harvest MSCI China A Index ETF NAV-to-NAV3 (RMB Counter) -17.60% Harvest MSCI China A Index ETF Market-to-Market4 (RMB Counter) -19.54% Harvest MSCI China A Index ETF NAV-to-NAV3 (HKD Counter) -18.51% Harvest MSCI China A Index ETF Market-to-Market4 (HKD Counter) -20.82% Source: Harvest Global Investments Limited, Bloomberg. 1 Past performance figures shown are not indicative of the future performance of the Sub-Fund. -

An Overview of 30 Retail Locations in China Retail Sales in 2013

China City Profiles 2014 An Overview of 30 Retail Locations in China Retail sales in 2013 Y-o-y Growth (%) Beijing 8.7% Shanghai 8.2% Guangzhou 15.2% Chongqing 11.9% Tianjin 14.0% Shenzhen 10.6% Wuhan 13.0% Chengdu 13.1% Suzhou 11.5% Hangzhou 19.9% Nanjing 13.8% Shenyang 13.7% Qingdao 13.3% Changsha 14.1% Wuxi 12.9% Harbin 13.9% Fuzhou 18.7% Ningbo 13.2% Ji'nan 13.4% Zhengzhou 12.9% Xi'an 14.0% Dalian 13.6% Foshan 12.1% Changchun 13.3% Nantong 12.8% Kunming 14.0% Changzhou 13.7% Hefei 14.5% Xiamen 10.5% Zhuhai 13.4% 0 100 200 300 400 500 600 700 800 900 1,000 (RMB billion) Source: CEIC Disposable income in 2013 Y-o-y Growth (%) Shenzhen 9.6% Shanghai 9.1% Guangzhou 10.5% Ningbo 10.1% Xiamen 10.1% Suzhou 9.5% Beijing 10.6% Nanjing 9.8% Hangzhou 4.8% Wuxi 9.4% Foshan 10.0% Changzhou 10.0% Zhuhai 10.3% Ji'nan 9.5% Qingdao 9.6% Changsha 11.1% Xi'an 10.4% Tianjin 10.2% Fuzhou 9.7% Nantong 9.8% Dalian 9.8% Chengdu 10.2% Wuhan 10.2% Shenyang 9.6% Kunming 10.3% Hefei 10.4% Zhengzhou 5.2% Changchun 12.8% Chongqing 9.8% Harbin 12.0% 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 (RMB per annum) Source: CEIC 2 China City Profiles 2014 China Retail Profiles 2014 The China market presents a compelling opportunity for retailers. -

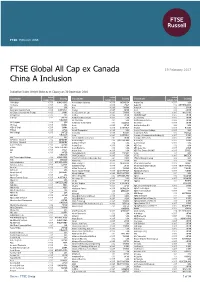

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

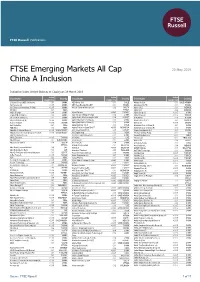

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C. -

China Dhgate Group Limited 中國敦煌網集團有限公司 (Incorporated in the Cayman Islands with Limited Liability)

The Stock Exchange of Hong Kong Limited and the Securities and Futures Commission take no responsibility for the contents of this Application Proof, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Application Proof. Application Proof China DHgate Group Limited 中國敦煌網集團有限公司 (Incorporated in the Cayman Islands with limited liability) WARNING The publication of this Application Proof is required by The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and the Securities and Futures Commission (the “Commission”) solely for the purpose of providing information to the public in Hong Kong. This Application Proof is in draft form. The information contained in it is incomplete and is subject to change which can be material. By viewing this document, you acknowledge, accept and agree with China DHgate Group Limited (the “Company”), its sponsor, advisers and members of the underwriting syndicate that: (a) this document is only for the purpose of providing information about the Company to the public in Hong Kong and not for any other purposes. No investment decision should be based on the information contained in this document; (b) the publication of this document or any supplemental, revised or replacement pages on the Stock Exchange’s website does not give rise to any obligation of the Company, its sponsor, advisers or members of the underwriting syndicate to proceed with an offering -

China Distribution & Trading

LI & FUNG RESEARCH CENTRE China Distribution & Trading Issue 89 August 2011 Department stores in China, 2011 IN THIS ISSUE: Overview . The total sales value of department stores in China was 249.8 billion I. Overview yuan in 2009; sales of select member enterprises of the China Commerce Association for General Merchandise registered 17.5% growth in 2010. II. Operation modes of Operation modes of department stores in China department stores in . Department stores operators in China generate revenue from (1) China commissions on concessionaire sales, (2) merchandise direct sales, (3) rental income from store tenants, (4) agency fee earned by serving as agents and (5) management fee etc. III. Competitive landscape . Commissions on concessionaire sales are the predominant source of income. IV. Challenges Competitive landscape . Compared with many mature markets, China’s department store sector is very fragmented. V. Recent developments . Domestic department store operators tend to focus on regional markets, while leading foreign department store operators have wider footprints. A growing number of department store operators look for opportunities in lower-tier cities. Challenges . Many department stores in China are poorly differentiated. Reliance on commissions from concessionaire sales is a major reason behind. Heavy initial capital outlays, lack of expertise in merchandising and long nurturing period for new brands are some common concerns Li & Fung Research Centre for operators to try out new operating models. Department stores are facing Increasing challenges from other retail 11/F, LiFung Tower formats such as shopping malls, professional stores, discount outlets and online retail stores. 868 Cheung Sha Wan Road, Kowloon, Hong Kong Recent developments Tel: (852) 2300 2399 . -

The Final Terms Relating to Each Issue of Regulation S Warrants Will Contain

The Final Terms relating to each issue of Regulation S Warrants will contain (without limitation) such of the following information as is applicable in respect of such Regulation S Warrants. All references to numbered conditions are to the terms and conditions of the Regulation S Warrants set out in Schedule 1 of the Agency Agreement (as defined in the Regulation S Warrant Conditions) and reproduced in the Base Prospectus and words and expressions defined in those terms and conditions shall have the same meaning in the applicable Regulation S Warrant Final Terms. MORGAN STANLEY ASIA PRODUCTS LIMITED (incorporated with limited liability in the Cayman Islands) Guaranteed by (incorporated in Delaware, U.S.A.) Warrant Programme The Warrants and the Guarantee have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the Securities Act), or the securities laws of any State in the United States. The Warrants and the Guarantee may not be offered, sold or delivered at any time, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons as such term is defined in Regulation S under the Securities Act. 100,000 American Style Regulation S Cash Settled Call Warrants due 9 December 2015 linked to a basket of local ordinary shares of listed on the Shanghai Stock Exchange (China Connect) This document constitutes the Final Terms relating to the issue of Regulation S Warrants described herein. This document constitutes final terms for the purposes of Article 5.4 of Directive 2003/71/EC, as amended (the Prospectus Directive). -

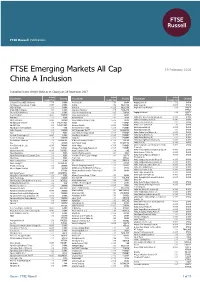

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 19 February 2018 China A Inclusion Indicative Index Weight Data as at Closing on 29 December 2017 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA Air China (H) 0.04 CHINA Angang Steel (H) 0.02 CHINA 361 Degrees International (P Chip) <0.005 CHINA AirAsia 0.02 MALAYSIA Angel Yeast (A) <0.005 CHINA 3SBio (P Chip) 0.04 CHINA AirAsia X <0.005 MALAYSIA Anglo American Platinum 0.03 SOUTH 51job ADR (N Shares) 0.01 CHINA Airports of Thailand 0.17 THAILAND AFRICA 58.com ADS (N Shares) 0.06 CHINA Airtac International Group 0.05 TAIWAN Anglogold Ashanti 0.08 SOUTH A.G.V. Products <0.005 TAIWAN Aisino Corporation (A) 0.01 CHINA AFRICA ABB India 0.02 INDIA Ajanta Pharma 0.01 INDIA Anhui Anke Biotechnology (Group) (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN Ajisen China Holdings (P Chip) <0.005 CHINA Anhui Chaodong Cement (A) <0.005 CHINA Aboitiz Equity Ventures 0.06 PHILIPPINES Akbank 0.1 TURKEY Anhui Conch Cement (A) 0.02 CHINA Aboitiz Power 0.02 PHILIPPINES Akcansa Cimento <0.005 TURKEY Anhui Conch Cement (H) 0.1 CHINA Abu Dhabi Commercial Bank 0.07 UAE Akenerji Elektrik Uretim <0.005 TURKEY Anhui Expressway (A) <0.005 CHINA AcBel Polytech 0.01 TAIWAN AKR Corporindo Tbk PT 0.01 INDONESIA Anhui Expressway (H) 0.01 CHINA ACC 0.02 INDIA Aksa Akrilik Ve Kimya Sanayii <0.005 TURKEY Anhui Golden Seed Winery (A) <0.005 CHINA Accelink Technologies (A) <0.005 CHINA Aksa Enerji Uretim AS <0.005 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA Accton Technology 0.03 TAIWAN Aksigorta <0.005 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA Ace Hardware Indonesia 0.01 INDONESIA Al Meera Consumer Goods Co. -

China City Profiles 2012 an Overview of 20 Retail Locations

China City Profiles 2012 An Overview of 20 Retail Locations joneslanglasalle.com.cn China Retail Profiles 2012 The China market presents a compelling opportunity for retailers. China’s retail sector has long been firmly underpinned by solid demand fundamentals–massive population, rapid urbanization and an emerging consumer class. Annual private consumption has tripled in the last decade, and China is on track to become the world’s second largest consumer market by 2015. China’s consumer class will more than double from 198 million people today to 500 million by 2022, if we define it as people earning over USD 5,000 per annum in constant 2005 dollars. It is never too late to enter the China market. China’s economic growth model is undergoing a shift from investment- led growth to consumption-led growth. It is widely recognized that government-led investment, while effective in the short term, is not the solution to long-term growth. With its massive accumulated household savings and low household debt levels, China’s domestic consumption offers immense headroom for growth. China’s leaders are acutely aware of the urgency to effect changes now and are more eager than ever before to tap its consumers for growth. Already, the government has set in motion a comprehensive range of pro-consumption policies to orchestrate a consumption boom. Broadly, the wide-ranging policies include wage increases, tax adjustments, strengthening of the social safety net, job creation, promotion of urbanization and affordable housing. While the traditional long-term demand drivers–urbanization, rising wealth and robust income growth–remain firmly intact, China’s retail story has just been given a structural boost.