China Distribution & Trading

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dalian Refrigeration Co., Ltd. 2011 Annual Report

Dalian Refrigeration Co., Ltd. 2011 Annual Report Dalian Refrigeration Co., Ltd. 2011 Annual Report CONTENTS §1 Important Notes⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯ 2 §2 Company Profile⋯⋯⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 2 §3 Summary of Accounting Data and Business Data⋯⋯ ⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 4 §4 Changes in Share Capital and Particulars about Shareholders⋯⋯⋯ ⋯⋯⋯ ⋯⋯ 6 §5 Directors, Supervisors, Senior Staff Members and Employees of the Company⋯⋯ 9 §6 The Administrative System of the Company⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 13 §7 The Internal Control of the Company⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯ 15 §8 Brief Introduction to the Shareholders General Meeting⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 16 §9 Report of the Board of Directors⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 17 §10 Report of the Supervisory Board⋯⋯⋯⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯ 29 §11 Significant Events⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 31 §12 Financial Report⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 37 §13 Contents of Reference Documents⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 95 1 Dalian Refrigeration Co., Ltd. 2011 Annual Report §1 Important Notes 1.1 The directors and the Board of Directors, the supervisors and the Supervisory Board, and Senior staff members of Dalian Refrigeration Co., Ltd. (hereinafter referred to as the Company) hereby confirm that there are not any important omissions, fictitious statements or serious misleading carried in this report, and shall take all responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents. 1.2 The financial report has been audited by ZON ZUN Certified Public Accounts Office Ltd. who has presented unqualified opinion audit report. 1.3 Chairman of the Board of Directors of the Company Mr. Zhang He, Financial Majordomo and the head of Accounting Department Ms. Xu Junrao hereby confirm that the financial report of the annual report is true and complete. 1.4 This report is written respectively in Chinese and in English. -

Maoye International Holdings Limited 茂業國際控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 848)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Maoye International Holdings Limited 茂業國際控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 848) INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2018 HIGHLIGHTS • Total sales proceeds and rental income were RMB7,878.3 million, representing an increase of 1.3% compared to the corresponding period in the last year • Same-store sales proceeds and rental income were RMB7,847.5 million, representing an increase of 1.0% compared to the corresponding period in the last year • Total operating revenue was RMB3,802.5 million, representing an increase of 6.2% compared to the corresponding period in the last year • The net profit was RMB509.2 million, representing a decrease of 15.7% compared to the corresponding period in the last year • Without taking into account the effect of non-operating gains and losses, the net profit was RMB497.5 million, representing an increase of 330.2% compared to the corresponding period in the last year • Basic earnings per share for the period was RMB7.4 cents, the Board does not recommend the payment of interim dividend for the six months ended 30 June 2018 INTERIM RESULTS The board (the “Board”) of directors (the “Directors”) of Maoye International Holdings Limited (the “Company”) announces the unaudited consolidated interim results of the Company and its subsidiaries (the “Group”) for the six months ended 30 June 2018. -

STOXX Hong Kong All Shares 180 Last Updated: 01.04.2015

STOXX Hong Kong All Shares 180 Last Updated: 01.04.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 92.5 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 70.6 2 3 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 64.3 3 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 61.8 4 4 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 52.5 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 40.9 6 6 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 30.3 7 7 HK0013000119 6448068 0013.HK 644806 Hutchison Whampoa Ltd. HK HKD Y 26.2 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 25.3 9 16 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 25.2 10 10 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 25.0 11 9 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 21.7 12 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 20.9 13 12 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.9 14 13 HK0004000045 6435576 0004.HK 643557 Wharf (Holdings) Ltd. HK HKD Y 19.7 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.9 16 15 CNE100000205 B0B8Z29 3328.HK CN0054 Bank of Communications Co 'H' CN HKD Y 17.6 17 17 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Charles Zhang

In a little over 35 years China’s economy has been transformed Week in China from an inefficient backwater to the second largest in the world. If you want to understand how that happened, you need to understand the people who helped reshape the Chinese business landscape. china’s tycoons China’s Tycoons is a book about highly successful Chinese profiles of entrepreneurs. In 150 easy-to- digest profiles, we tell their stories: where they came from, how they started, the big break that earned them their first millions, and why they came to dominate their industries and make billions. These are tales of entrepreneurship, risk-taking and hard work that differ greatly from anything you’ll top business have read before. 150 leaders fourth Edition Week in China “THIS IS STILL THE ASIAN CENTURY AND CHINA IS STILL THE KEY PLAYER.” Peter Wong – Deputy Chairman and Chief Executive, Asia-Pacific, HSBC Does your bank really understand China Growth? With over 150 years of on-the-ground experience, HSBC has the depth of knowledge and expertise to help your business realise the opportunity. Tap into China’s potential at www.hsbc.com/rmb Issued by HSBC Holdings plc. Cyan 611469_6006571 HSBC 280.00 x 170.00 mm Magenta Yellow HSBC RMB Press Ads 280.00 x 170.00 mm Black xpath_unresolved Tom Fryer 16/06/2016 18:41 [email protected] ${Market} ${Revision Number} 0 Title Page.qxp_Layout 1 13/9/16 6:36 pm Page 1 china’s tycoons profiles of 150top business leaders fourth Edition Week in China 0 Welcome Note.FIN.qxp_Layout 1 13/9/16 3:10 pm Page 2 Week in China China’s Tycoons Foreword By Stuart Gulliver, Group Chief Executive, HSBC Holdings alking around the streets of Chengdu on a balmy evening in the mid-1980s, it quickly became apparent that the people of this city had an energy and drive Wthat jarred with the West’s perception of work and life in China. -

VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Form N-Q

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2018-09-28 | Period of Report: 2018-07-31 SEC Accession No. 0000932471-18-007167 (HTML Version on secdatabase.com) FILER VANGUARD INTERNATIONAL EQUITY INDEX FUNDS Mailing Address Business Address PO BOX 2600 PO BOX 2600 CIK:857489| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1031 V26 V26 Type: N-Q | Act: 40 | File No.: 811-05972 | Film No.: 181093806 VALLEY FORGE PA 19482 VALLEY FORGE PA 19482 6106691000 Copyright © 2018 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT COMPANY Investment Company Act file number: 811-05972 Name of Registrant: VANGUARD INTERNATIONAL EQUITY FUNDS Address of Registrant: P.O. Box 2600 Valley Forge, PA 19482 Name and address of agent for service: Anne E. Robinson, Esquire P.O. Box 876 Valley Forge, PA 19482 Date of fiscal year end: October 31 Date of reporting period: July 31, 2018 Item 1: Schedule of Investments Vanguard Pacific Stock Index Fund Schedule of Investments (unaudited) As of July 31, 2018 Market Value Shares ($000) Common Stocks (99.6%)1 Australia (16.6%) Commonwealth Bank of Australia 1,856,264 103,370 BHP Billiton Ltd. 3,386,626 88,447 Westpac Banking Corp. 3,610,167 79,036 CSL Ltd. 475,901 69,628 Australia & New Zealand Banking Group Ltd. -

China: Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/28/2017 GAIN Report Number: GAIN0036 China - Peoples Republic of Retail Foods Increasing Change and Competition but Strong Growth Presents Plenty of Opportunities for U.S. Food Exports Approved By: Christopher Bielecki Prepared By: USDA China Staff Report Highlights: China remains one of the most dynamic retail markets in the world, and offers great opportunities for U.S. food exporters. Exporters should be aware of several new trends that are changing China’s retail landscape. Imported food consumption growth is shifting from China’s major coastal metropolitan areas (e.g., Shanghai; Beijing) to dozens of emerging market cities. China is also experimenting with new retail models, such as 24-hour unstaffed convenience stores and expanded mobile payment platforms. E-commerce sales continue to grow, but major e-commerce retailers are competing for shrinking numbers of new consumers. We caution U.S. exporters not to consider China as a single retail market. Over the past 10 years, the Chinese middle-class has grown larger and more diverse, and China has become a collection of 1 niche markets separated by geography, culture, cuisine, demographics, and commercial trends. Competition for these markets has become fierce. Shanghai and the surrounding region continues to lead national retail trends, however Beijing and Guangzhou are also important centers of retail innovation. Chengdu and Shenyang are two key cities leading China’s economic expansion into international trade and commerce. -

Harvest Funds (Hong Kong) Etf (An Umbrella Unit Trust Established in Hong Kong)

HARVEST FUNDS (HONG KONG) ETF (AN UMBRELLA UNIT TRUST ESTABLISHED IN HONG KONG) HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) SEMI-ANNUAL REPORT 1ST JANUARY 2016 TO 30TH JUNE 2016 www.harvestglobal.com.hk HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) CONTENTS PAGE Report of the Manager to the Unitholders 1 - 2 Statement of Financial Position (Unaudited) 3 Statement of Comprehensive Income (Unaudited) 4 Statement of Changes in Net Assets Attributable to Unitholders (Unaudited) 5 Statement of Cash Flows (Unaudited) 6 Investment Portfolio (Unaudited) 7 – 29 Statement of Movements in Investment Portfolio (Unaudited) 30 – 75 Performance Record (Unaudited) 76 Underlying Index Constituent Stocks Disclosure (Unaudited) 77 Report on Investment Overweight (Unaudited) 78 Management and Administration 79 - 81 RESTRICTED HARVEST MSCI CHINA A INDEX ETF (A SUB-FUND OF THE HARVEST FUNDS (HONG KONG) ETF) REPORT OF THE MANAGER TO THE UNITHOLDERS Fund Performance A summary of the performance of the Sub-Fund1 is given below (as at 30 June 2016): Harvest MSCI China A Index ETF 1H-2016 (without dividend reinvested) MSCI China A Index2 -17.61% Harvest MSCI China A Index ETF NAV-to-NAV3 (RMB Counter) -17.60% Harvest MSCI China A Index ETF Market-to-Market4 (RMB Counter) -19.54% Harvest MSCI China A Index ETF NAV-to-NAV3 (HKD Counter) -18.51% Harvest MSCI China A Index ETF Market-to-Market4 (HKD Counter) -20.82% Source: Harvest Global Investments Limited, Bloomberg. 1 Past performance figures shown are not indicative of the future performance of the Sub-Fund. -

An Overview of 30 Retail Locations in China Retail Sales in 2013

China City Profiles 2014 An Overview of 30 Retail Locations in China Retail sales in 2013 Y-o-y Growth (%) Beijing 8.7% Shanghai 8.2% Guangzhou 15.2% Chongqing 11.9% Tianjin 14.0% Shenzhen 10.6% Wuhan 13.0% Chengdu 13.1% Suzhou 11.5% Hangzhou 19.9% Nanjing 13.8% Shenyang 13.7% Qingdao 13.3% Changsha 14.1% Wuxi 12.9% Harbin 13.9% Fuzhou 18.7% Ningbo 13.2% Ji'nan 13.4% Zhengzhou 12.9% Xi'an 14.0% Dalian 13.6% Foshan 12.1% Changchun 13.3% Nantong 12.8% Kunming 14.0% Changzhou 13.7% Hefei 14.5% Xiamen 10.5% Zhuhai 13.4% 0 100 200 300 400 500 600 700 800 900 1,000 (RMB billion) Source: CEIC Disposable income in 2013 Y-o-y Growth (%) Shenzhen 9.6% Shanghai 9.1% Guangzhou 10.5% Ningbo 10.1% Xiamen 10.1% Suzhou 9.5% Beijing 10.6% Nanjing 9.8% Hangzhou 4.8% Wuxi 9.4% Foshan 10.0% Changzhou 10.0% Zhuhai 10.3% Ji'nan 9.5% Qingdao 9.6% Changsha 11.1% Xi'an 10.4% Tianjin 10.2% Fuzhou 9.7% Nantong 9.8% Dalian 9.8% Chengdu 10.2% Wuhan 10.2% Shenyang 9.6% Kunming 10.3% Hefei 10.4% Zhengzhou 5.2% Changchun 12.8% Chongqing 9.8% Harbin 12.0% 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 (RMB per annum) Source: CEIC 2 China City Profiles 2014 China Retail Profiles 2014 The China market presents a compelling opportunity for retailers. -

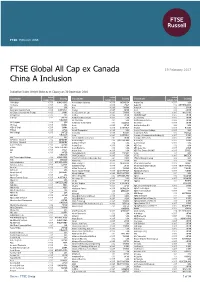

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

INTERIM REPORT 2020 Corporate Information (Continued)

(Incorporated in the Cayman Islands with limited liability) Stock Code: 1638 * For identification purposes only CONTENTS 2 Corporate Information 4 Chairman’s Statement 10 Management Discussion and Analysis 18 Project Portfolio 40 Disclosure of Interests 54 Independent Review Report 55 Condensed Consolidated Statement of Profit or Loss and Other Comprehensive Income 57 Condensed Consolidated Statement of Financial Position 59 Condensed Consolidated Statement of Changes in Equity 60 Condensed Consolidated Statement of Cash Flows 62 Notes to the Condensed Consolidated Financial Information 121 Other Information CORPORATE INFORMATION DIRECTORS REGISTERED OFFICE Executive Directors Cricket Square Mr. KWOK Ying Shing (Chairman) Hutchins Drive Mr. SUN Yuenan (Vice Chairman) PO Box 2681 Mr. MAI Fan Grand Cayman, KY1-1111 Mr. LI Haiming Cayman Islands Mr. KWOK Hiu Kwan Non-Executive Director HEADQUARTERS IN THE PRC Ms. CHEN Shaohuan Room 3306, Kerry Center Ren Min Nan Road Independent Non-Executive Directors Luohu Mr. RAO Yong Shenzhen Mr. ZHANG Yizhao China Mr. LIU Xuesheng PRINCIPAL PLACE OF BUSINESS IN AUDIT COMMITTEE HONG KONG Mr. RAO Yong (Chairman) 30/F, The Center Mr. ZHANG Yizhao 99 Queen’s Road Central Ms. CHEN Shaohuan Central Hong Kong REMUNERATION COMMITTEE Mr. ZHANG Yizhao (Chairman) PRINCIPAL SHARE REGISTRAR AND Mr. RAO Yong TRANSFER OFFICE Mr. KWOK Ying Shing Royal Bank of Canada Trust Company (Cayman) Limited 4th Floor, Royal Bank House 24 Shedden Road NOMINATION COMMITTEE George Town Mr. KWOK Ying Shing (Chairman) Grand Cayman, KY1-1110 Mr. RAO Yong Cayman Islands Mr. ZHANG Yizhao HONG KONG SHARE REGISTRAR AUTHORISED REPRESENTATIVES Computershare Hong Kong Investor Services Limited Mr. SUN Yuenan Mr. -

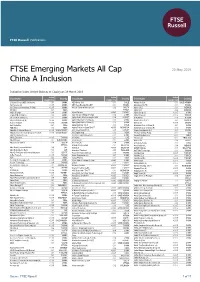

FTSE Emerging Markets All Cap China a Inclusion

FTSE Russell Publications FTSE Emerging Markets All Cap 20 May 2019 China A Inclusion Indicative Index Weight Data as at Closing on 29 March 2019 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 21Vianet Group (ADS) (N Shares) 0.01 CHINA AES Gener S.A. 0.01 CHILE Almarai Co Ltd 0.01 SAUDI ARABIA 360 Security (A) <0.005 CHINA AES Tiete Energia SA UNIT 0.01 BRAZIL Alpargatas SA PN 0.01 BRAZIL 361 Degrees International (P Chip) <0.005 CHINA African Rainbow Minerals Ltd 0.02 SOUTH Alpek S.A.B. 0.01 MEXICO 3M India 0.01 INDIA AFRICA Alpha Bank 0.04 GREECE 3SBio (P Chip) 0.04 CHINA Afyon Cimento <0.005 TURKEY Alpha Group (A) <0.005 CHINA 51job ADR (N Shares) 0.03 CHINA Agile Group Holdings (P Chip) 0.04 CHINA Alpha Networks <0.005 TAIWAN 58.com ADS (N Shares) 0.12 CHINA Agility Public Warehousing Co KSC 0.04 KUWAIT ALROSA ao 0.06 RUSSIA 5I5j Holding Group (A) <0.005 CHINA Agricultural Bank of China (A) 0.06 CHINA Alsea S.A.B. de C.V. 0.02 MEXICO A.G.V. Products <0.005 TAIWAN Agricultural Bank of China (H) 0.26 CHINA Altek Corp <0.005 TAIWAN Aarti Industries 0.01 INDIA Aguas Andinas S.A. A 0.03 CHILE Aluminum Corp of China (A) 0.01 CHINA ABB India 0.02 INDIA Agung Podomoro Land Tbk PT <0.005 INDONESIA Aluminum Corp of China (H) 0.03 CHINA Abdullah Al Othaim Markets <0.005 SAUDI ARABIA Ahli United Bank B.S.C.