Blackrock Investment Stewardship Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fidelity® Emerging Markets Index Fund

Quarterly Holdings Report for Fidelity® Emerging Markets Index Fund January 31, 2021 EMX-QTLY-0321 1.929351.109 Schedule of Investments January 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 92.5% Shares Value Shares Value Argentina – 0.0% Lojas Americanas SA rights 2/4/21 (b) 4,427 $ 3,722 Telecom Argentina SA Class B sponsored ADR (a) 48,935 $ 317,099 Lojas Renner SA 444,459 3,368,738 YPF SA Class D sponsored ADR (b) 99,119 361,784 Magazine Luiza SA 1,634,124 7,547,303 Multiplan Empreendimentos Imobiliarios SA 156,958 608,164 TOTAL ARGENTINA 678,883 Natura & Co. Holding SA 499,390 4,477,844 Notre Dame Intermedica Participacoes SA 289,718 5,003,902 Bailiwick of Jersey – 0.1% Petrobras Distribuidora SA 421,700 1,792,730 Polymetal International PLC 131,532 2,850,845 Petroleo Brasileiro SA ‑ Petrobras (ON) 2,103,697 10,508,104 Raia Drogasil SA 602,000 2,741,865 Bermuda – 0.7% Rumo SA (b) 724,700 2,688,783 Alibaba Health Information Technology Ltd. (b) 2,256,000 7,070,686 Sul America SA unit 165,877 1,209,956 Alibaba Pictures Group Ltd. (b) 6,760,000 854,455 Suzano Papel e Celulose SA (b) 418,317 4,744,045 Beijing Enterprises Water Group Ltd. 2,816,000 1,147,720 Telefonica Brasil SA 250,600 2,070,242 Brilliance China Automotive Holdings Ltd. 1,692,000 1,331,209 TIM SA 475,200 1,155,127 China Gas Holdings Ltd. 1,461,000 5,163,177 Totvs SA 274,600 1,425,346 China Resource Gas Group Ltd. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

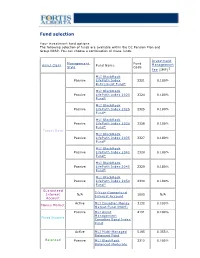

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

NP Key Contacts.Pdf

IGP Network Partners: Key Contacts Region: Americas Country / Territory IGP Network Partner IGP Contact Email Type IGP Regional Coordinator Mr. Michael Spincemaille [email protected] Argentina SMG LIFE Mr. Nicolas Passet [email protected] Partner Brazil MAPFRE Vida S.A. Ms. Débora Nunes Santos [email protected] Partner Canada Manulife Financial Corporation Mr. Kajan Ramanathan [email protected] Partner Chile MAPFRE Chile Ms. Nathalie Gonzalez [email protected] Partner Colombia MAPFRE Colombia Ms. Ingrid Olarte Pérez [email protected] Partner Costa Rica MAPFRE Costa Rica Mr. Armando Sevilla [email protected] Partner Dominican Republic (Life) MAPFRE BHD Mrs. Alejandra Quirico [email protected] Partner Dominican Republic (Health) MAPFRE Salud ARS, S. A. Mr. Christian Wazar [email protected] Partner Ecuador MAPFRE Atlas * Mr. Carlos Zambrano [email protected] Correspondent El Salvador MAPFRE Seguros El Salvador S.A. Mr. Daniel Acosta González [email protected] Partner French Guiana Refer to France - - Partner Guadeloupe Refer to France - - Partner Guatemala MAPFRE Guatemala Mr. Luis Pedro Chavarría [email protected] Partner Honduras MAPFRE Honduras Mr. Carlos Ordoñez [email protected] Partner Martinique Refer to France - - Partner Mexico Seguros Monterrey New York Life Ms. Paola De Uriarte [email protected] Partner Nicaragua MAPFRE Nicaragua Mr. Dany Lanuza Flores [email protected] Partner Panama MAPFRE Panama Mr. Manuel Rodriguez [email protected] Partner Paraguay MAPFRE Paraguay Mr. Sergio Alvarenga [email protected] Partner Peru MAPFRE Peru Mr. Ramón Acuña Huerta [email protected] Partner Saint Martin Refer to France - - Partner Saint Barthélemy Refer to France - - Partner Saint Pierre & Miquelon Refer to France - - Partner United States Prudential Insurance Company of America Mr. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Consolidated Financial Statements at 31 December 2019 Azimut Holding S.P.A

Consolidated financial statements at 31 december 2019 Azimut Holding S.p.A. WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b Consolidated financial statements at 31 december 2019 Azimut Holding S.p.A. WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b 4 Gruppo Azimut Contents Company bodies 7 Azimut Group's structure 8 Main indicators 10 Management report 13 Baseline scenario 15 Significant events of the year 19 Azimut Group's financial performance for 2018 25 Key balance sheet figures 28 Information about main Azimut Group companies 33 Main risks and uncertainties 37 Related-party transactions 41 Organisational structure and corporate governance 41 Human resources 42 Research and development 42 Significant events after the reporting date 42 Business outlook 43 Consolidated non-financial statement 43 Consolidated financial statements 81 Consolidated balance sheet 83 Consolidated income statement 85 Consolidated statement of comprehensive income 87 Consolidated statement of changes in shareholders' equity 88 Consolidated cash flow statement 92 Notes to the consolidated financial statements 95 Part A - Accounting policies 96 Part B - Notes to the consolidated balance sheet 141 Part C - Notes to the consolidated income statement 177 Part D - Other information 189 Certification of the consolidated financial statements 201 WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b 5 WorldReginfo - 2fb9419d-ea85-43fb-8cd1-f65f2f544c5b 6 Gruppo -

Terms of Reference

Terms of Reference Brazil ESG Practices Working Group Introduction The goal of the ESG Practices Working Group is to promote discussions through cooperation between companies and investors, seeking to share experiences with transparency. We believe that through these debates and Group member collaboration we can change corporate practices regarding ESG issues, and increase investidor interest and knowledge in integrating ESG issues in their investment analysis and monitoring. The ESG Practices Working Group is the result of the merger of the “ESG Engagement” and “ESG Integration” working groups in 2016. Goals The ESG Practices Working Group collects and analyzes Brazilian companies’ KPIs, focusing on future engagements and improved ESG transparency and disclosure. The Working Group’s objectives are to help companies report on their ESG indicators with greater quality and assertiveness, and to strengthen the relationship between analysts and companies. The project's stages are as follows: • A survey of the KPIs disclosed by the companies (public data) • Consolidation of the most relevant KPIs for decision making • Sending a letter to initiate the engagement with the surveyed companies • Engagement meetings with the surveyed companies • Preparation of a document based on the Working Group’s experience History In 2015, the Engagement Working Group analyzed the food and beverage industry, and surveyed the following companies: Ambev, BRF, JBS, Marfrig, Minerva, Cosan, and São Martinho. In 2016, following the merger, all members of the ESG Practices Group were involved in the project, which continued to analyze the KPIs of the Utilities sector (Energy). For 2017, the goal is to publish a white paper of the food and beverage industry, and to hold engagement meetings with companies in the energy sector. -

Part VII Transfers Pursuant to the UK Financial Services and Markets Act 2000

PART VII TRANSFERS EFFECTED PURSUANT TO THE UK FINANCIAL SERVICES AND MARKETS ACT 2000 www.sidley.com/partvii Sidley Austin LLP, London is able to provide legal advice in relation to insurance business transfer schemes under Part VII of the UK Financial Services and Markets Act 2000 (“FSMA”). This service extends to advising upon the applicability of FSMA to particular transfers (including transfers involving insurance business domiciled outside the UK), advising parties to transfers as well as those affected by them including reinsurers, liaising with the FSA and policyholders, and obtaining sanction of the transfer in the English High Court. For more information on Part VII transfers, please contact: Martin Membery at [email protected] or telephone + 44 (0) 20 7360 3614. If you would like details of a Part VII transfer added to this website, please email Martin Membery at the address above. Disclaimer for Part VII Transfers Web Page The information contained in the following tables contained in this webpage (the “Information”) has been collated by Sidley Austin LLP, London (together with Sidley Austin LLP, the “Firm”) using publicly-available sources. The Information is not intended to be, and does not constitute, legal advice. The posting of the Information onto the Firm's website is not intended by the Firm as an offer to provide legal advice or any other services to any person accessing the Firm's website; nor does it constitute an offer by the Firm to enter into any contractual relationship. The accessing of the Information by any person will not give rise to any lawyer-client relationship, or any contractual relationship, between that person and the Firm. -

Airtel Africa Plc Results for the Nine-Month Period Ended 31 December 2020 29 January 2021

Airtel Africa plc Results for the nine-month period ended 31 December 2020 29 January 2021 Another quarter of double-digit growth, with continued improvement in revenue growth and EBITDA profitability Highlights • Reported revenue increased by 13.8% to $2,870m with Q3’21 reported revenue growth of 19.5%. • Constant currency underlying revenue growth was 18.6%, with Q3’21 growth of 22.8%. Growth for the nine months was recorded across all regions: Nigeria up 21.6%, East Africa up 23.4% and Francophone Africa up 8.0%; and across all services, with voice revenue up 10.4%, data up 31.1% and mobile money up 34.2%. • Underlying EBITDA for the nine months was $1,297m, up 16% in reported currency while constant currency underlying EBITDA growth was 22.5%. • Underlying EBITDA margin for the nine months was 45.5%, up by 118 bps (up 144 bps in constant currency). Q3’21 underlying EBITDA margin was 46.9%. • Operating profit increased by 21.8% to $800m in reported currency, and by 29.9% in constant currency. • Free cash flow was $466m, up 20% compared to the same period last year. • Basic EPS was 5.5 cents, down 36.5%, largely due to prior year exceptional items and a one-off derivative gain. Excluding these, basic EPS rose by 19.8%. EPS before exceptional items was 5.0 cents. • Customer base up 11.0% to 118.9 million, with increased penetration across mobile data (customer base up 23.5%) and mobile money services (customer base up 29.0%). -

Itraxx Asia Ex-Japan Series 30 Final Membership List

iTraxx Asia ex-Japan Series 30 Final Membership List 13th September 2018 iTraxx Asian ex-Japan Series 30 Contents iTraxx Asia ex-Japan Series 30 Final Membership List ............................................................................................ 3 iTraxx Asia ex-Japan Series 30 Final vs. Series 29 ................................................................................................... 4 iTraxx Asia ex-Japan Series 30 Coupon and Recovery Rate ................................................................................... 4 Copyright © 2018, Markit Group Limited. All rights reserved. www.ihsmarkit.com 2 iTraxx Asian ex-Japan Series 30 iTraxx Asia ex-Japan Series 30 Final Membership List Markit Ticker Markit Long Name ALIBGRO Alibaba Group Holding Limited BCHINL BANK OF CHINA LIMITED BNKIND Bank of India CAPLSP CAPITALAND LIMITED CHINDEAC China Development Bank CNOOC CNOOC LIMITED DBSSP-DBSBank DBS BANK LTD. GSCO GS Caltex Corporation HUWHY Hutchison Whampoa Limited HYNMTR Hyundai Motor Company ICICIB ICICI Bank Limited ICBCHN INDUSTRIAL AND COMMERCIAL BANK OF CHINA LIMITED INDKOR Industrial Bank of Korea KEBHA KEB Hana Bank THAI Kingdom of Thailand CITNAT Kookmin Bank KORELE Korea Electric Power Corporation KOREAT KT Corporation MALAYS Malaysia OCBC OVERSEA-CHINESE BANKING CORPORATION LIMITED CHINA People's Republic of China PETROL PETROLIAM NASIONAL BERHAD (PETRONAS) POHANG POSCO RELIND RELIANCE INDUSTRIES LIMITED INDON Republic of Indonesia KOREA Republic of Korea PHILIP Republic of the Philippines STSP SINGAPORE TELECOMMUNICATIONS LIMITED SKM SK Telecom Co., Ltd. SBIIN-StateBkIn State Bank of India SUNHUN-Prop SUN HUNG KAI PROPERTIES LIMITED SWIRE Swire Pacific Limited TELMAL TELEKOM MALAYSIA BERHAD TENCHOL Tencent Holdings Limited EIBC THE EXPORT-IMPORT BANK OF CHINA EIBKOR The Export-Import Bank of Korea HKLAND-Co THE HONGKONG LAND COMPANY, LIMITED KDB The Korea Development Bank UOBSP UNITED OVERSEAS BANK LIMITED CMBKKO Woori Bank Copyright © 2018, Markit Group Limited. -

(As a Report for Fiscal Year Ended March 31, 2012)[PDF:3.9MB

DAICEL CORPORATION ANNUAL REPORT 2012 LAYING THE GROUND FOR THE FUTURE ANNUAL REPORT 2012 Year ended March 31, 2012 The report was printed with attention to minimizing environmental impact by using a waterless printing method, ink manufactured from vegetable oil, and paper certified by the Forest Stewardship CouncilTM. The cover and contents of this annual report are printed using ink that contains less than 1% of Volatile Organic Compounds (VOCs). BUSINESS DEVELOPMENT FLOWCHART MAJOR APPLICATIONS OF DAICEL GROUP PRODUCTS World’s No.1 Japan’s No.1 Civil engineering and Sales share (Daicel estimate) Production capacity share (Daicel estimate) oil drilling / CMC Photographic Nonflammable Cellulose Acetate tow CELLULOSIC LCDs / TAC Cigarette filters / film applications acetate DERIVATIVES Acetate tow, Cellulose acetate C1 Chemistry Japan’s No.1 Automotive paints / World’s No.1 Production capacity share (Daicel estimate) Caprolactone and Sales share (Daicel estimate) Petrochemical products such as ORGANIC Acetic acid acetic acid produced Polyester fibers / special epoxy resins Pharmaceutical products by the methanol CHEMICALS Acetic acid development / carbonylation process Chiral columns Celluloid Nitrocellulose POM Asia’s No.1 POM Asia’s No.1 / Packaging and Polyacetal Production capacity share LCP World’s No.1 films for snacks and Acetate resin Polyamide PLASTICS (Daicel estimate) Production capacity share (Daicel estimate) pocket warmers / plastics SAN/ABS 12 resin AND FILMS Auto parts / Office equipment and Packaging films electronic components