Priscilla De Oliveria

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bibliography

BIbLIOGRAPHY 2016 AFI Annual Report. (2017). Alliance for Financial Inclusion. Retrieved July 31, 2017, from https://www.afi-global.org/sites/default/files/publica- tions/2017-05/2016%20AFI%20Annual%20Report.pdf. A Law of the Abolition of Currencies in a Small Denomination and Rounding off a Fraction, July 15, 1953, Law No.60 (Shōgakutsūka no seiri oyobi shiharaikin no hasūkeisan ni kansuru hōritsu). Retrieved April 11, 2017, from https:// web.archive.org/web/20020628033108/http://www.shugiin.go.jp/itdb_ housei.nsf/html/houritsu/01619530715060.htm. About PBC. (2018, August 21). The People’s Bank of China. Retrieved August 21, 2018, from http://www.pbc.gov.cn/english/130712/index.html. About Us. Alliance for Financial Inclusion. Retrieved July 31, 2017, from https:// www.afi-global.org/about-us. AFI Official Members. Alliance for Financial Inclusion. Retrieved July 31, 2017, from https://www.afi-global.org/sites/default/files/inlinefiles/AFI%20 Official%20Members_8%20February%202018.pdf. Ahamed, L. (2009). Lords of Finance: The Bankers Who Broke the World. London: Penguin Books. Alderman, L., Kanter, J., Yardley, J., Ewing, J., Kitsantonis, N., Daley, S., Russell, K., Higgins, A., & Eavis, P. (2016, June 17). Explaining Greece’s Debt Crisis. The New York Times. Retrieved January 28, 2018, from https://www.nytimes. com/interactive/2016/business/international/greece-debt-crisis-euro.html. Alesina, A. (1988). Macroeconomics and Politics (S. Fischer, Ed.). NBER Macroeconomics Annual, 3, 13–62. Alesina, A. (1989). Politics and Business Cycles in Industrial Democracies. Economic Policy, 4(8), 57–98. © The Author(s) 2018 355 R. Ray Chaudhuri, Central Bank Independence, Regulations, and Monetary Policy, https://doi.org/10.1057/978-1-137-58912-5 356 BIBLIOGRAPHY Alesina, A., & Grilli, V. -

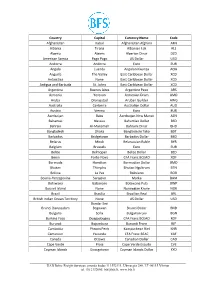

June 2021 Indices Des Prix De Détail Relatif Aux Dépenses De La Vie Courante Des Fonctionnaires De L'onu New York = 100, Date D'indice = Juin 2021

Price indices Indices des prix Retail price indices relating to living expenditures of United Nations Officials New York City = 100, Index date = June 2021 Indices des prix de détail relatif aux dépenses de la vie courante des fonctionnaires de l'ONU New York = 100, Date d'indice = Juin 2021 National currency per US $ Index - Indice Monnaie nationale du $ E.U. Excluding Country or Area Duty Station housing 2 Pays ou Zone Villes-postes Per US$ 1 Currency Total Non compris 1 Cours du $E-U Monnaie l'habitation 2 Afghanistan Kabul 78.070 Afghani 86 93 Albania - Albanie Tirana 98.480 Lek 78 82 Algeria - Algérie Algiers 132.977 Algerian dinar 80 85 Angola Luanda 643.121 Kwanza 84 93 Argentina - Argentine Buenos Aires 94.517 Argentine peso 81 84 Armenia - Arménie Yerevan 518.300 Dram 75 80 Australia - Australie Sydney 1.291 Australian dollar 82 88 Austria - Autriche Vienna 0.820 Euro 91 100 Azerbaijan - Azerbaïdjan Baku 1.695 Azerbaijan manat 81 87 Bahamas Nassau 1.000 Bahamian dollar 100 96 Bahrain - Bahreïn Manama 0.377 Bahraini dinar 83 86 Bangladesh Dhaka 84.735 Taka 81 89 Barbados - Barbade Bridgetown 2.000 Barbados dollar 90 95 Belarus - Bélarus Minsk 2.524 New Belarusian ruble 85 91 Belgium - Belgique Brussels 0.820 Euro 84 92 Belize Belmopan 2.000 Belize dollar 76 80 Benin - Bénin Cotonou 537.714 CFA franc 83 92 Bhutan - Bhoutan Thimpu 72.580 Ngultrum 77 83 Bolivia (Plurinational State of) - Bolivie (État plurinational de) La Paz 6.848 Boliviano 73 80 Bosnia and Herzegovina - Bosnie-Herzégovine Sarajevo 1.603 Convertible mark 73 79 Botswana Gaborone 10.582 Pula 75 83 Brazil - Brésil Brasilia 5.295 Real 71 82 British Virgin Islands - Îles Vierges britanniques Road Town 1.000 US dollar 87 93 Bulgaria - Bulgarie Sofia 1.603 Lev 70 85 Burkina Faso Ouagadougou 537.714 CFA franc 80 87 Burundi Bujumbura 1,953.863 Burundi franc 82 90 Cabo Verde - Cap-Vert Praia 90.389 CV escudo 79 87 Cambodia - Cambodge Phnom Penh 4,098.000 Riel 82 88 Cameroon - Cameroun Yaounde 537.714 CFA franc 83 91 Canada Montreal 1.208 Canadian dollar 91 96 Central African Rep. -

147 Chapter 5 South Africa's Experience with Inflation: A

147 CHAPTER 5 SOUTH AFRICA’S EXPERIENCE WITH INFLATION: A CENTRAL BANK PERSPECTIVE 5.1 Introduction Although a country’s experience with inflation can be reviewed from different perspectives (e.g. the government, the statistical agency responsible for recording inflation, producers, consumers or savers), this chapter reviews South Africa’s experience with inflation from the perspective of the SA Reserve Bank. The SA Reserve Bank was chosen because this study focuses on inflation from a monetary perspective. Reliable inflation data for South Africa are published as far back as 192153, co-inciding with the establishment of the SA Reserve Bank, although rudimentary data on price levels are available as far back as 1895. South Africa’s problems with accelerating inflation since the 1970s are well documented (see for instance De Kock, 1981; De Kock, 1984; Republiek van Suid-Afrika, 1985; Rupert, 1974a; Rupert, 1974b; or Stals, 1989), but various parts (or regions) of what constitutes today the Republic of South Africa have experienced problems with inflation, rising prices or currency depreciation well before 1921. The first example of early inflation in South Africa was caused by currency depreciation. At the time of the second British annexation of the Cape in 1806, the Dutch riksdaalder (“riksdollar”) served as the major local currency in circulation. During the tenure of Caledon, Governor of the Cape Colony from 1807 to 1811, and Cradock, Governor from 1811 to 1814, riksdollar notes in circulation were increased by nearly 50 per cent (Engelbrecht, 1987: 29). As could be expected under circumstances of increasing currency in circulation, the value of the riksdollar in comparison to the British pound sterling and in terms of its purchasing power declined from 4 shillings in 1806 to 1 shilling and 5½ pennies in 1825 (or 53 Tables A1 to C1 in Appendices A to C highlight South Africa’s experience with inflation, as measured by changes in the CPI since 1921. -

Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu

Global Wire is an available payment method for the currencies listed below. This list is subject to change at any time. Currency Codes COP Colombian Peso KWD Kuwaiti Dinar RON Romanian Leu ALL Albanian Lek KMF Comoros Franc KGS Kyrgyzstan Som RUB Russian Ruble DZD Algerian Dinar CDF Congolese Franc LAK Laos Kip RWF Rwandan Franc AMD Armenian Dram CRC Costa Rican Colon LSL Lesotho Malati WST Samoan Tala AOA Angola Kwanza HRK Croatian Kuna LBP Lebanese Pound STD Sao Tomean Dobra AUD Australian Dollar CZK Czech Koruna LT L Lithuanian Litas SAR Saudi Riyal AWG Arubian Florin DKK Danish Krone MKD Macedonia Denar RSD Serbian Dinar AZN Azerbaijan Manat DJF Djibouti Franc MOP Macau Pataca SCR Seychelles Rupee BSD Bahamian Dollar DOP Dominican Peso MGA Madagascar Ariary SLL Sierra Leonean Leone BHD Bahraini Dinar XCD Eastern Caribbean Dollar MWK Malawi Kwacha SGD Singapore Dollar BDT Bangladesh Taka EGP Egyptian Pound MVR Maldives Rufi yaa SBD Solomon Islands Dollar BBD Barbados Dollar EUR EMU Euro MRO Mauritanian Olguiya ZAR South African Rand BYR Belarus Ruble ERN Eritrea Nakfa MUR Mauritius Rupee SRD Suriname Dollar BZD Belize Dollar ETB Ethiopia Birr MXN Mexican Peso SEK Swedish Krona BMD Bermudian Dollar FJD Fiji Dollar MDL Maldavian Lieu SZL Swaziland Lilangeni BTN Bhutan Ngultram GMD Gambian Dalasi MNT Mongolian Tugrik CHF Swiss Franc BOB Bolivian Boliviano GEL Georgian Lari MAD Moroccan Dirham LKR Sri Lankan Rupee BAM Bosnia & Herzagovina GHS Ghanian Cedi MZN Mozambique Metical TWD Taiwan New Dollar BWP Botswana Pula GTQ Guatemalan Quetzal -

SUSTAINABLE ENERGY 2013 Report of the Arab Forum for Environment and Development

2013 Report of the Arab Forum for Environment and Development ARA ARAB ENVIRONMENT 6 SUSTAINABLE ENERGY 2013 Report of the Arab Forum for Environment and Development B ENVIRONMENT ARAB ENVIRONMENT 6 Sustainable Energy is the sixth in the series of annual reports produced by the Arab Forum for Environment and Arab Forum for Environment and Development (AFED) on the state of Arab Development (AFED) is a regional SUSTAINABLE ENERGY environment. The report highlights the need for more efficient management of not-for-profit, non-governmental, the energy sector, in view of enhancing its contribution to sustainable membership-based organization PROSPECTS, CHALLENGES, OPPORTUNITIES development in the Arab region. headquartered in Beirut, Lebanon, with the status of international The AFED 2013 report aims at: presenting a situational analysis of the current organization. Since 2007, AFED EDITED BY: state of energy in the Arab region, shedding light on major challenges, has been a public forum for IBRAHIM ABDEL GELIL discussing different policy options and, ultimately, recommending alternative influential eco-advocates. During courses of action to help facilitate the transition to a sustainable energy future. five years, it has become a major MOHAMED EL-ASHRY To achieve its goals, the AFED 2013 report addresses the following issues: oil dynamic player in the global NAJIB SAAB and beyond, natural gas as a transition fuel to cleaner energy, renewable energy environmental arena. 6 prospects, the nuclear option, energy efficiency, the energy-water-food nexus, The flagship contribution of AFED ENERGY SUSTAINABLE mitigation options of climate change, resilience of the energy sector to climate is an annual report written and risk, and the role of the private sector in financing sustainable energy. -

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

Table 2. Morocco: Selected Macroeconomic Indicators, 2016-2022

Document of The World Bank Group FOR OFFICIAL USE ONLY Public Disclosure Authorized Report No. 131039-MA INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT INTERNATIONAL FINANCE CORPORATION MULTILATERAL INVESTMENT GUARANTEE AGENCY Public Disclosure Authorized COUNTRY PARTNERSHIP FRAMEWORK FOR THE KINGDOM OF MOROCCO FOR THE PERIOD FY19–FY24 January 18, 2019 Public Disclosure Authorized Maghreb Country Management Unit Middle East and North Africa International Finance Corporation Multilateral Investment Guarantee Agency Public Disclosure Authorized This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without World Bank Group authorization. The date of the last Performance and Learning Review was May 24, 2017 (Report No. 105894 – MA) CURRENCY EQUIVALENTS (Exchange Rate Effective January 15, 2019) Currency Unit=Moroccan Dirham (MAD) MAD 1.00=US$ 0.11 Kingdom of Morocco GOVERNMENT FISCAL YEAR January 1 – December 31 ABBREVIATIONS AND ACRONYMS Comité Régional de l’Environnement des Agence Française de Développement AfD CREA Affaires (Regional Committee for (French Agency of Development) Business Environment) AfDB African Development Bank CSO Civil Society Organization ALMP Active Labor Market Policies CSP Concentrated Solar Plant Cash Transfer Program for Widows and AMC Asset Management Company DAAM Orphans Deep and Comprehensive Free Trade AMMC Morocco’s Capital Market Agency DCFTA Agreement ANAPEC National Employment Agency -

This PDF Is a Selection from an Out-Of-Print Volume from the National Bureau of Economic Research

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The International Gold Standard Reinterpreted, 1914-1934 Volume Author/Editor: William Adams Brown, Jr. Volume Publisher: NBER Volume ISBN: 0-87014-036-1 Volume URL: http://www.nber.org/books/brow40-1 Publication Date: 1940 Chapter Title: Book IV, Part I: The Nature of the Disintegration Chapter Author: William Adams Brown, Jr. Chapter URL: http://www.nber.org/chapters/c5948 Chapter pages in book: (p. 1050 - 1069) Disintegration the of Xature The I Disintegration, FOUR BOOK CHAPTER 29 The Major Characteristics of the Period following September 1931 TheGold Standard (Amendment) Act of September 21, ended the brief history of the gold bullion standard in Great Britain. It inaugurated a period during which the pound sterling declined in terms of the dollar, the franc, and all other currencies which, through the mechanism of the international gold standard or otherwise, were kept in an un- changed and stable relation to these two currencies and to one another. The Concept of the Breakup of the Nucleus as opposed to the Concept of the Depreciation of Sterling This situation is simply described by saying that the pound sterling depreciated 'in terms of gold,' or still more simply that it 'depreciated.' In the use of these terms, which might be applied equally to the currencies of Peru, Spain, or Aus- tralia, there is a danger to clear thinking, not because they do not accurately describe the surface facts, but because they carry certain implications. To say that sterling has depre- ciated in terms of gold implies that nothing very serious has happened to gold as an international monetary standard, and that the international gold standard system continues to operate as before, with only the loss of one of its members. -

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL Lek Algeria MC / VI DZA DZ Algerian dinar Argentina MC / VI ARG AR Argentine peso Australia MC / VI AUS AU Australian dollar -Christmas Is. -Cocos (Keeling) Is. -Heard and McDonald Is. -Kiribati -Nauru -Norfolk Is. -Tuvalu Christmas Island MC CXR CX Australian dollar Cocos (Keeling) Islands MC CCK CC Australian dollar Heard and McDonald Islands MC HMD HM Australian dollar Kiribati MC KIR KI Australian dollar Nauru MC NRU NR Australian dollar Norfolk Island MC NFK NF Australian dollar Tuvalu MC TUV TV Australian dollar Bahamas MC / VI BHS BS Bahamian dollar Bahrain MC / VI BHR BH Bahraini dinar Bangladesh MC / VI BGD BD Taka Armenia VI ARM AM Armenian Dram Barbados MC / VI BRB BB Barbados dollar Bermuda MC / VI BMU BM Bermudian dollar Bolivia, MC / VI BOL BO Boliviano Plurinational State of Botswana MC / VI BWA BW Pula Belize MC / VI BLZ BZ Belize dollar Solomon Islands MC / VI SLB SB Solomon Islands dollar Brunei Darussalam MC / VI BRN BN Brunei dollar Myanmar MC / VI MMR MM Myanmar kyat (effective 1 November 2012) Burundi MC / VI BDI BI Burundi franc Cambodia MC / VI KHM KH Riel Canada MC / VI CAN CA Canadian dollar Cape Verde MC / VI CPV CV Cape Verde escudo Cayman Islands MC / VI CYM KY Cayman Islands dollar Sri Lanka MC / VI LKA LK Sri Lanka rupee Chile MC / VI CHL CL Chilean peso China VI CHN CN Colombia MC / VI COL CO Colombian peso Comoros MC / VI COM KM Comoro franc Costa Rica MC / VI CRI CR Costa Rican colony Croatia MC / VI HRV HR Kuna Cuba VI Czech Republic MC / VI CZE CZ Koruna Denmark MC / VI DNK DK Danish krone Faeroe Is. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

CURRENCY BOARD FINANCIAL STATEMENTS Currency Board Working Paper

SAE./No.22/December 2014 Studies in Applied Economics CURRENCY BOARD FINANCIAL STATEMENTS Currency Board Working Paper Nicholas Krus and Kurt Schuler Johns Hopkins Institute for Applied Economics, Global Health, and Study of Business Enterprise & Center for Financial Stability Currency Board Financial Statements First version, December 2014 By Nicholas Krus and Kurt Schuler Paper and accompanying spreadsheets copyright 2014 by Nicholas Krus and Kurt Schuler. All rights reserved. Spreadsheets previously issued by other researchers are used by permission. About the series The Studies in Applied Economics of the Institute for Applied Economics, Global Health and the Study of Business Enterprise are under the general direction of Professor Steve H. Hanke, co-director of the Institute ([email protected]). This study is one in a series on currency boards for the Institute’s Currency Board Project. The series will fill gaps in the history, statistics, and scholarship of currency boards. This study is issued jointly with the Center for Financial Stability. The main summary data series will eventually be available in the Center’s Historical Financial Statistics data set. About the authors Nicholas Krus ([email protected]) is an Associate Analyst at Warner Music Group in New York. He has a bachelor’s degree in economics from The Johns Hopkins University in Baltimore, where he also worked as a research assistant at the Institute for Applied Economics and the Study of Business Enterprise and did most of his research for this paper. Kurt Schuler ([email protected]) is Senior Fellow in Financial History at the Center for Financial Stability in New York.