Wealth Management Products and Issuing Banks' Risk in China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China and Its “Long March” Toward a Modern Banking System

China and Its “Long March” Toward a Modern Banking System Ting Zhong (on Prof. Joseph Norton’s behalf) I. Introduction China, the ancient oriental empire, opened its door to the outside world in the first half of the nineteenth century. Modern banking was introduced at that time to satisfy the financial needs of increasing trade business between China and the western world. So till now China has had long experience with the banking system. But influenced by several severe social transitions in the past two centuries, China’s modern banking system experienced different development directions and is now still at a premature stage. For the recent 25 years, recognizing the need to merge into the global system and to sustain its domestic development, China has conducted comprehensive reforms in its banking sector to adopt a modern banking system consistent with evolving and heightening international prudential, operational, and anti-money laundering and anti-terrorism financing standards, along with the liberalization and openness aims engendered by the move toward a robust “socialist market economy” on a sustainable basis and the embrace of the WTO requirements. The reforms already conducted in the banking sector are extensive in scope and have received impressive achievements. But China still faces numerous challenges in accomplishing its goal. Besides, as an emerging economic power with the inevitable evolution of the Chinese Yuan into a major international currency but at the same time still being a developing country facing a lot of disparities and development needs, China encounters a more complex situation to balance the conflicting functions of its banking sector when designing the reform schemes. -

Xiamen International Bank Co., Ltd. 2018 Annual Report

Xiamen International Bank Co., Ltd. 2018 Annual Report 厦门国际银行股份有限公司 2018 年年度报告 Important Notice The Bank's Board of Directors, Board of Supervisors, directors, supervisors, and senior management hereby declare that this report does not contain any false records, misleading statements or material omissions, and they assume joint and individual responsibilities on the authenticity, accuracy and completeness of the information herein. The financial figures and indicators contained in this annual report compiled in accordance with China Accounting Standards, unless otherwise specified, are consolidated figures calculated based on domestic and overseas data in terms of RMB. Official auditor of the Bank, KPMG Hua Zhen LLP (special general partnership), conducted an audit on the 2018 Financial Statements of XIB compiled in accordance with China Accounting Standards, and issued a standard unqualified audit report. The Bank’s Chairman Mr. Weng Ruotong, Head of Accounting Affairs Ms. Tsoi Lai Ha, and Head of Accounting Department Mr. Zheng Bingzhang, hereby ensure the authenticity, accuracy and completeness of the financial report contained in this annual report. Notes on Major Risks: No major risks that can be predicted have been found by the Bank. During its operation, the key risks faced by the Bank include credit risks, market risks, operation risks, liquidity risks, compliance risks, country risks, information technology risks, and reputation risks, etc. The Bank has taken measures to effectively manage and control the various kinds of operational risks. For relevant information, please refer to Chapter 2, Discussion and Analysis of Business Conditions. Forward-looking Risk Statement: This Report involves several forward-looking statements about the financial position, operation performance and business development of the Bank, such as “will”, “may”, “strive”, “endeavor”, “plan to”, “goal” and other similar words used herein. -

Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 6138)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 6138) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of Harbin Bank Co., Ltd. (the “Bank”) is pleased to announce the audited annual results of the Bank and its subsidiaries (the “Group”) for the year ended 31 December 2019. This results announcement, containing the full text of the 2019 Annual Report of the Bank, complies with the relevant content requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of annual results. The annual financial statements of the Group for the year ended 31 December 2019 have been audited by Ernst & Young in accordance with International Standard on Review Engagements. Such annual results have also been reviewed by the Board and the Audit Committee of the Bank. Unless otherwise stated, financial data of the Group are presented in Renminbi. This results announcement is published on the websites of the Bank (www.hrbb.com.cn) and HKExnews (www.hkexnews.hk). The printed version of the 2019 Annual Report of the Bank will be dispatched to the holders of H shares of the Bank and available for viewing on the above websites in April 2020. -

December 2019 Trade Bulletin.Pdf

December 5, 2019 Highlights of This Month’s Edition Bilateral trade: The U.S. goods trade deficit with China totaled $31.3 billion in October 2019, down 27.5 percent year-on-year—the largest decrease in the bilateral goods deficit in more than three years. Policy trends in China’s economy: Beijing doubles down on industrial policy to steer the economy as negotiations with the United States continue; Harbin Bank becomes the fourth Chinese regional bank to get government backing; three city commercial banks issued perpetual bonds in November 2019, becoming the first subnational banks to raise capital this way since the State Council cleared the instrument for use in December 2018; MSCI finalized the expansion of the weighting assigned to Chinese A-shares in two of its widely followed indexes; Alibaba, China’s largest e-commerce firm, reported record Singles’ Day revenue, but sales growth continued to slow amid economic headwinds and increased competition from rival firms. In focus – Chinese telecom operators launch 5G services: China’s three major telecom operators officially launched 5G networks on November 1, 2019; 5G services are planned in 57 Chinese cities by the end of 2019 compared to 34 cities currently in the United States. Contents Bilateral Trade ............................................................................................................................................................2 U.S.-China Trade Deficit Sees Largest Reduction in More Than Three Years ......................................................2 -

HARBIN BANK CO., LTD. (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) Stock Code: 6138

HARBIN BANK CO., LTD. (A joint stock company incorporated in the People’s Republic of China with limited liability) Stock Code: 6138 2020 INTERIM REPORT Harbin Bank Co., Ltd. Contents Interim Report 2020 Definitions 2 Company Profile 3 Summary of Accounting Data and Financial Indicators 7 Management Discussion and Analysis 9 Changes in Share Capital and Information on Shareholders 73 Directors, Supervisors, Senior Management and Employees 78 Important Events 84 Organisation Chart 90 Financial Statements 91 Documents for Inspection 188 The Company holds the Finance Permit No. B0306H223010001 approved by the China Banking and Insurance Regulatory Commission and has obtained the Business License (Unified Social Credit Code: 912301001275921118) approved by the Market Supervision and Administration Bureau of Harbin. The Company is not an authorised institution within the meaning of the Hong Kong Banking Ordinance (Chapter 155 of the Laws of Hong Kong), not subject to the supervision of the Hong Kong Monetary Authority, and not authorised to carry on banking/deposit-taking business in Hong Kong. Denitions In this report, unless the context otherwise requires, the following terms shall have the meanings set out below. “Articles of Association” the Articles of Association of Harbin Bank Co., Ltd. “Board” or “Board of Directors” the board of directors of the Company “Board of Supervisors” the board of supervisors of the Company “CBIRC”/”CBRC” the China Banking and Insurance Regulatory Commission/China Banking Regulatory Commission (before 17 March -

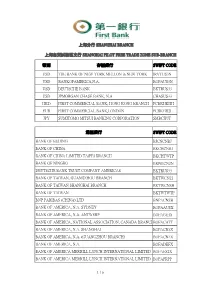

1 / 6 幣別 存匯銀行 Swift Code Usd the Bank of New York

上海分行 SHANGHAI BRANCH 上海自貿試驗區支行 SHANGHAI PILOT FREE TRADE ZONE SUB-BRANCH 幣別 存匯銀行 SWIFT CODE USD THE BANK OF NEW YORK MELLON in NEW YORK IRVTUS3N USD BANK OF AMERICA, N.A. BOFAUS3N USD DEUTSCHE BANK BKTRUS33 USD JPMORGAN CHASE BANK, N.A CHASUS33 HKD FIRST COMMERCIAL BANK, HONG KONG BRANCH FCBKHKHH EUR FIRST COMMERCIAL BANK,LONDON FCBKGB2L JPY SUMITOMO MITSUI BANKING CORPORATION SMBCJPJT 通匯銀行 SWIFT CODE BANK OF BEIJING BJCNCNBJ BANK OF CHINA BKCHCNBJ BANK OF CHINA LIMITED TAIPEI BRANCH BKCHTWTP BANK OF NINGBO BKNBCN2N DEUTSCHE BANK TRUST COMPANY AMERICAS BKTRUS33 BANK OF TAIWAN, GUANGZHOU BRANCH BKTWCN22 BANK OF TAIWAN SHANGHAI BRANCH BKTWCNSH BANK OF TAIWAN BKTWTWTP BNP PARIBAS (CHINA) LTD BNPACNSH BANK OF AMERICA, N.A. SYDNEY BOFAAUSX BANK OF AMERICA, N.A. ANTWERP BOFABE3X BANK OF AMERICA, NATIONAL ASSOCIATION, CANADA BRANCHBOFACATT BANK OF AMERICA, N.A. SHANGHAI BOFACN3X BANK OF AMERICA, N.A. (GUANGZHOU BRANCH) BOFACN4X BANK OF AMERICA, N.A. BOFADEFX BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED BOFAES2X BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED BOFAFRPP 1 / 6 通匯銀行 SWIFT CODE BANK OF AMERICA, N.A. LONDON BOFAGB22 BANK OF AMERICA, N.A. ATHENS BOFAGR2X BANK OF AMERICA, N.A. HONG KONG BOFAHKHX BANK OF AMERICA, N.A. JAKARTA BRANCH BOFAID2X BANK OF AMERICA, N.A. MUMBAI BOFAIN4X BANK OF AMERICA, N.A. BOFAIT2X BANK OF AMERICA, TOKYO BOFAJPJX BANK OF AMERICA, N.A. SEOUL BRANCH BOFAKR2X BANK OF AMERICA, MALAYSIA BERHAD BOFAMY2X BANK OF AMERICA, N.A. AMSTERDAM BOFANLNX BANK OF AMERICA, N.A. MANILA BOFAPH2X BANK OF AMERICA, N.A. SINGAPORE BOFASG2X BANK OF AMERICA (SINGAPORE) LTD. -

Environmental, Social and Governance Report 2016 Environmental, Social and Governance Report

Shengjing Bank Co., Ltd. Shengjing Bank Co., Ltd.* (A joint stock company incorporated in the People's Republic of China with limited liability) Stock Code: 02066 * 2016 Environmental, Social and Governance Report 2016 Environmental, Social and Governance Report Report and Governance Social Environmental, 2016 CONTENTS About This Report 2 Message from the Board of Directors 4 I. About Us 6 1.1 Company Profile 6 1.2 Honours and Awards 8 1.3 KPIs 11 II. Social Responsibility Concepts and Management 12 2.1 Social Responsibility Concepts 12 2.2 Social Responsibility Management and Practices 12 2.3 Social Responsibility Communication 13 2.4 Analysis of Material Issues 15 III. Governance Enhancement and Risk Prevention 16 3.1 Corporate Governance Improvement 16 3.2 Risk Management Enhancement 18 3.3 Sound and Compliance-based Operation 20 IV. Serving the Economy and Benefiting People’s 24 Livelihoods 4.1 Supporting Economic Revitalisation of Northeast 24 China 4.2 Serving Beijing-Tianjin-Hebei Integration 25 4.3 Supporting small and micro businesses 26 4.4 Enhancing Agriculture-related Development 27 4.5 Promoting the Development of Livelihood- 29 related Finance V. Green Development and Environmental Protection 32 5.1 Implementing Green Credit 32 5.2 Promoting Green Services 33 5.3 Advocating Green Operation 35 VI. Reciprocating the Society and Achieving a 37 Harmonious and Win-win Result 6.1 Improve the Service Quality 37 6.2 Safeguarding Customers’ Rights and Interests 41 6.3 Contributing to Staff’s Development 44 6.4 Commitment to Social Benefits 55 Prospect for 2017 57 Independent Limited Assurance Report 59 ESG Indicator Index 62 Feedback from Readers 65 * Shengjing Bank Co., Ltd. -

Banking Newsletter

September 2017 Banking Newsletter Review and Outlook of China’s Banking Industry for the First Half of 2017 www.pwccn.com Editorial Team Editor-in-Chief:Vivian Ma Deputy Editor-in-Chief:Haiping Tang, Carly Guan Members of the editorial team: Cynthia Chen, Jeff Deng, Carly Guan, Tina Lu, Haiping Tang (in alphabetical order of last names) Advisory Board Jimmy Leung, Margarita Ho, Richard Zhu, David Wu, Yuqing Guo, Jianping Wang, William Yung, Mary Wong, Michael Hu, James Tam, Raymond Poon About this newsletter The Banking Newsletter, PwC’s analysis of China’s listed banks and the wider industry, is now in its 32nd edition. Over the past one year there have been several IPOs for small-and-medium-sized banks, increasing the universe of listed banks in China. This analysis covers 39 A-share and/or H-share listed banks that have released their 2017 first half results. Those banks are categorized into four groups as defined by the China Banking Regulatory Commission (CBRC): Large Commercial Joint-Stock Commercial City Commercial Banks Rural Commercial Banks Banks (6) Banks (9) (16) (8) Industrial and Commercial Chongqing Rural Commercial Bank Bank of China (ICBC) China Industrial Bank (CIB) Bank of Beijing (Beijing) (CQRCB) China Construction Bank China Merchants Bank (CMB) Bank of Shanghai (Shanghai) (CCB) Guangzhou Rural Commercial Bank SPD Bank (SPDB) Bank of Hangzhou (Hangzhou) Agricultural Bank of China (GZRCB) (ABC) China Minsheng Bank Corporation Bank of Jiangsu (Jiangsu) (CMBC) Jiutai Rural Commercial Bank Bank of China (BOC) Bank of -

The Architecture of Harbin's First Banking Institutions. Fujiadian District

IOP Conference Series: Materials Science and Engineering PAPER • OPEN ACCESS The Architecture of Harbin’s First Banking Institutions. Fujiadian District To cite this article: M E Bazilevich and A A Kim 2021 IOP Conf. Ser.: Mater. Sci. Eng. 1079 022045 View the article online for updates and enhancements. This content was downloaded from IP address 170.106.202.226 on 24/09/2021 at 23:56 International Science and Technology Conference (FarEastСon 2020) IOP Publishing IOP Conf. Series: Materials Science and Engineering 1079 (2021) 022045 doi:10.1088/1757-899X/1079/2/022045 The Architecture of Harbin’s First Banking Institutions. Fujiadian District M E Bazilevich1,a and A A Kim1,b 1Department of Architecture and Urbanistics, Institute of Architecture and Design, Pacific National University, 136, Tihookeanskaya St., Khabarovsk, 680035, Russia E-mail: [email protected], [email protected] Abstract. The article is devoted to the architecture of the first banking institutions of one of the largest historic districts of Harbin: Fujiadian (now Daowai). A brief historical overview of the history of formation and development of the district is given. The buildings of banking institutions that have been preserved on its territory have been identified. As a result, the main directions of development of this layer of Harbin architecture, associated with the spread of “Chinese Baroque” and strict Neoclassicism in the architecture of the city, were determined. The architectural features of particular bank buildings are considered and their importance in the formation of the historical and architectural environment of Harbin is shown. 1. Introduction The history of Harbin is closely related to the construction of the China-East Railway (CER). -

Banknotes Week Ended 14 March 2014

NEWSLETTER FINANCIAL SERVICES Banknotes Week ended 14 March 2014 Title KPMG China’s weekly banking news summary This publication is a summary of publicly reported information, the accuracy of which has not been verified by KPMG. Final results for the year ended 31 December 2013 In the news Chong Hing Bank China CITIC Bank – Net profit after tax rose 2.6% to HKD 557 million. China Minsheng Bank – Net interest income rose 21.2% to HKD 1.01 billion, while the net interest margin increased 16 basis points to 1.26%. Chong Hing Bank – Net fee and commission income rose 10.9% to HKD 210 million. Harbin Bank – The basic earnings per share increased 2.6% to HKD 1.28. Mizuho Bank – Tier 1 capital ratio increased to 10.82% at the end of 2013. People’s Bank of China – A final dividend of HKD 0.33 per share was proposed for 2013. Ping An Bank Qingdao Rural Commercial Bank China Minsheng Bank signs agreement with China Taiping – China Minsheng Ta Chong Bank Banking Corp., Ltd has signed a partnership agreement with China Taiping UBS Insurance Group Co., Ltd to promote the development of the insurance agency and pension insurance business, among others. Harbin Bank approved to list on HKSE – The Hong Kong Stock Exchange has granted listing approval to China-based Harbin Bank for its USD 1 billion initial public offering. Mizuho Bank opens sub-branch in Shanghai Free-trade Zone – Mizuho Bank (China), Limited has opened a sub-branch in the Shanghai Free-trade Zone. Ping An sells RMB 9 billion worth of bonds – Shenzhen-based Ping An Bank has issued RMB 9 billion worth of 10-year RMB-denominated bonds, with an interest rate of 6.8 percent. -

BANK of NINGBO CO., LTD. 2020 Annual Report

BANK OF NINGBO CO., LTD. (Stock Code: 002142) 2020 Annual Report Full Text of 2020 Annual Report of Bank of Ningbo Co., Ltd. Chapter One Important Notes, Content and Interpretation The Board of Directors, Board of Supervisors, directors, supervisors and senior management of the Company ensure the authenticity, accuracy and completeness of contents, and guarantee no frauds, misleading statements or major omissions in this report. They are willing to burden any individual and joint legal responsibilities. The 6th meeting of the 7th Board of Directors of the Company deliberated on and approved the text and abstract of 2020 Annual Report. 13 directors in person out of the total of 13 required directors attended the meeting, and part of supervisors attended as a nonvoting delegates. The Chairman of the Company, Mr. Lu Huayu, the President, Mr. Luo Mengbo, the person in charge of accounting, Mr. Zhuang Lingjun, and the general manager of financial department, Ms. Sun Hongbo hereby declare to guarantee the authenticity, accuracy and completeness of financial statements in the annual report. Financial data and indicators included in this annual report are following the criteria of Chinese Accounting Standard for Business Enterprises. Unless otherwise stated, all data in the consolidated financial statements of Bank of Ningbo Co., Ltd. and its holding subsidiary, Maxwealth Fund Management Co., Ltd., its wholly-owned subsidiaries, Maxwealth Financial Leasing Co., Ltd. and Ningyin Finance Co., Ltd., are subject to the unit of RMB. Ernst & Young Hua Ming LLP audited the 2020 Financial Statements of the Company in accordance with domestic accounting principles and published unqualified opinion. -

Knowledge Work on Credit Growth in Microfinance and Rural Finance

Consultant’s Report Project Number: SC 102911 April 2014 The People’s Republic of China: Knowledge Work on Credit Growth in Microfinance and Rural Finance Prepared by David Lucock For Asian Development Bank This consultant’s report does not necessarily reflect the views of ADB or the Government concerned, and ADB and the Government cannot be held liable for its contents. (For project preparatory technical assistance: All the views expressed herein may not be incorporated into the proposed project’s design. TABLE OF CONTENTS page no. EXECUTIVE SUMMARY I. INTRODUCTION 1 II. OUTLINE AND DESCRIPTION OF FINANCIAL INSTITUTIONS 1 A. Outline of the Banking Sector 1 B. Rural and Micro Financial Services 2 C. Regulated Rural and Micro Banking Institutions 5 1. Agricultural Development Bank of China 5 2. Agricultural Bank of China 6 3. Rural Credit Cooperatives 7 4. Rural Mutual Fund Cooperatives 8 5. Postal Savings Bank of China 9 6. Village or Township Banks 10 7. Loan Companies 15 D. Non-Banking (Shadow Banking) Institutions 15 1. Description of and Concerns over Shadow Banking 15 2. Microcredit Companies 17 3. Credit Guarantee Companies 22 4. Microfinance Institutions – Poverty Alleviation Focus 24 III. POLICY, REGULATION, SUPERVISION AND CONTROLS 24 IV. DEMOGRAPHICS OF FINANCIAL SERVICES 27 1. Provincial Comparisons 27 2. Comparison of Urban and Rural Incomes and Expenditures 28 3. Analysis of County Level Loans and Deposits 31 4. Household Surveys of Financial Service Access 34 V. OPPORTUNITIES AND CONSTRAINTS IN RURAL AND MICRO FINANCIAL SYSTEMS 37 A. The Cooperative Financial Institutions 38 B. Commercial Bank Rural Service Outlets 40 C.