ANNUAL REPORT Management Philosophy and Policy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oshiage Yoshikatsu URL

Sumida ☎ 03-3829-6468 Oshiage Yoshikatsu URL http://www.hotpepper.jp/strJ000104266/ 5-10-2 Narihira, Sumida-ku 12 Mon.- Sun. 9 3 6 and Holidays 17:00 – 24:00 (Closing time: 22:30) Lunch only on Sundays and Holidays 11:30 – 14:00 (Open for dinner on Sundays and Holidays by reservation only) Irregular 4 min. walk from Oshiage Station Exit B1 on each line Signature menu とうきょう "Tsubaki," a snack set brimming Green Monjayaki (Ashitabaスカイツリー駅 Monja served with baguettes) with Tokyo ingredients OshiageOshiage Available Year-round Available Year-round Edo Tokyo vegetables, Tokyo milk, fi shes Yanagikubo wheat (Higashikurume), fl our (Ome), cabbages Ingredients Ingredients 北十間川 from Tokyo Islands, Sakura eggs, soybeans (produced in Tokyo), Ashitaba (from Tokyo Islands), ★ used used (from Hinode and Ome), TOKYO X Pork TOKYO X Pork sausage, Oshima butter (Izu Oshima Island) *Regarding seasoning, we use Tokyo produced seasonings in general, including Hingya salt. Tokyo Shamo Chicken Restaurant Sumida ☎ 03-6658-8208 Nezu Torihana〈Ryogoku Edo NOREN〉 URL http://www.tokyoshamo.com/ 1-3-20 Yokoami, Sumida-ku 12 9 3 6 Lunch 11:00 – 14:00 Dinner 17:00 – 21:30 Mondays (Tuesday if Monday is a holiday) Edo NOREN can be accessed directly via JR Ryogoku Station West Exit. Signature menu Tokyo Shamo Chicken Tokyo Shamo Chicken Course Meal Oyakodon Available Year-round Available Year-round ★ Ingredients Ingredients Tokyo Shamo Chicken Tokyo Shamo Chicken RyogokuRyogoku used used *Business hours and days when restaurants are closed may change. Please check the latest information on the store’s website, etc. 30 ☎ 03-3637-1533 Koto Kameido Masumoto Honten URL https://masumoto.co.jp/ 4-18-9 Kameido, Koto-ku 12 9 3 6 Mon-Fri 11:30 – 14:30/17:00 – 21:00 Weekends and Holidays 11:00 – 14:30/17:00 – 21:00 * Last Call: 19:30 Lunch last order: 14:00 Mondays or Tuesdays if a national holiday falls on Monday. -

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

Environmentally Friendly Railway-Car Technology 18 Environmentally Friendly Railway-Car Technology

Environmentally Friendly Railway-car Technology 18 Environmentally Friendly Railway-car Technology Katsutoshi Horihata OVERVIEW: As regards railway vehicles, it is becoming important to respond Hirofumi Sakamoto to the growing concerns for the global environment while satisfying the needs to provide comfort and shorten travel times. Aiming at manufacturing Hideo Kitabayashi train cars that take account of environmental concerns, Hitachi, Ltd. has Akihiro Ishikawa developed technologies for the high-speed “Shinkansen” — starting with East Japan Railway Company’s E954-type — that raise train speed while lowering noise pollution. Furthermore, as for commuter trains, beginning with the 10000 Series for the new Fukutoshin Line of Tokyo Metro Co., Ltd., we have further advanced “A-train” technology for “cleanly” manufacturing lightweight, but extremely rigid, carriage bodywork by utilizing large-scale molded materials and friction-stir welding, and improved carriage recycleability by unifying the various kinds of aluminum alloys conventionally used into one kind. At the same time, by avoiding use of plastic resin materials (such as PVC and fiber-reinforced plastics) as much as possible — in accordance with countermeasures against fire decreed by revised ministerial ordinances — we have strengthened countermeasures against fire and poisonous gas. INTRODUCTION and improving comfort, interactions along the railway IN recent times, as concern for the environment grows, line and care for the global environment are becoming railways have been gaining attention as public transport ever more important. systems with low energy consumption. Among many In accepting these requirements, much work to issues, in regard to the requirements concerning increase speed of railway vehicles while reducing their railway vehicles, on top of shortening of journey times energy consumption is being attempted by means of Fig. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Narita Airport Route(*PDF File)

1 of 2 Bus stop valid for Airport Limousine Bus Premium Coupon(Narita Airport route) required required Area Bus Stop Useable Area Bus Stop Useable number number Tokyo Station/Marunouchi North ○ 2 coupons The New Sanno Hotel ○ 2 coupons Mandarin Oriental Tokyo ○ 2 coupons The Prince Park Tower Tokyo ○ 2 coupons HOSHINOYA Tokyo/Otemachi Financial City Grand Cube ○ 2 coupons Tokyo Prince Hotel ○ 2 coupons AMAN TOKYO ○ 2 coupons Andaz Tokyo ○ 2 coupons Tokyo Station/Yaesu North(Tekko Building) ○ 2 coupons Conrad Tokyo ○ 2 coupons Tokyo Station/Yaesu South ○ 2 coupons Park Hotel Tokyo ○ 2 coupons Tokyo Station, Nihonbashi T-CAT(Tokyo City Air Terminal), Tokyo City Air Terminal(T-CAT) ○ 2 coupons The Royal Park Iconic Tokyo Shiodome ○ 2 coupons Century Southern Tower ○ 2 coupons Tennozu Isle(Dai-ichi Hotel Tokyo Seafort) ○ 2 coupons Hotel Sunroute Plaza Shinjuku ○ 2 coupons HOTEL THE CELESTINE TOKYO SHIBA ○ 2 coupons Hilton Tokyo ○ 2 coupons Shiba Park Hotel ○ 2 coupons Shinjuku Washington Hotel ○ 2 coupons Hotel InterContinental Tokyo Bay ○ 2 coupons Park Hyatt Tokyo ○ 2 coupons Hilton Tokyo Odaiba ○ 2 coupons Hyatt Regency Tokyo 2 coupons Grand Nikko Tokyo Daiba 2 coupons Shinjuku ○ ○ Keio Plaza Hotel ○ 2 coupons SOTETSU GRAND FRESA TOKYO-BAY ARIAKE ○ 2 coupons Shiba, Shiodome, Takeshiba, Rinkai Fukutoshin (Tokyo Water Front) Shinjuku Station/West ○ 2 coupons Tokyo Bay Ariake Washington Hotel ○ 2 coupons Shinjuku Expressway Bus Terminal ○ 2 coupons Terminal 3 ○ 2 coupons 【Early Morning Service】Shinjuku Expressway Bus Terminal ○ 2 coupons -

Transparency Report 2017 1

23.974Transparency mm Report 2017 2017 9 ______年 月 www.kpmg.com/jp/azsa © 2017 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Transparency Report 2017 1 1. Message from the Local Senior Partner As a member of the KPMG network,KPMG AZSA LLC shares a common Purpose-to Inspire Confidence,Empower Change–with member firms around the globe.Based on this Purpose,we aim to establish the reliability of information through auditing and accounting services and support the change of companies and society towards sustainable growth. KPMG AZSA's system of quality control is in line with the KPMG Audit Quality Framework applicable to KPMG network firms globally.This Transparency Report 2017 explains our quality control system in performing audit,based on the framework,and the systems of quality control for each of the key drivers and KPMG network arrangements.We also published AZSA Quality 2017 in September 2017 to address mainly our recent efforts regarding quality control that serves as the basis for KPMG AZSA’s Audit Quality,governance structure and policies of human resource development. 2. Network arrangements As a member firm of KPMG International,KPMG AZSA LLC provides clients with a consistent set of professional services globally through a network in 155 countries.KPMG network arrangements,including legal structure,responsibilities and obligations of member firm are described more detail in the following sections of this report. -

Tokyo Skytree

ENGLISH 英語 Let’s collect! TOKYO SKYTREE Tembo Galleria (Floor 445, 450) Visit Commemoration Stamp Tembo Galleria Floor 445-450 A sloped 110-meter “air walk” The height of TOKYO SKYTREE is★★★m from Floor 445 up to Floor 450. With audio eects that The tallest tower in the world, SKYTREE! How many meters high is it? change with the season and Let’s start to our journey and nd out the hidden answer with weather. Sorakara-chan and other ocial characters of TOKYO SKYTREE! e Tembo Ga ytre lleri Sk a yo Sorakara Point Commemorative Photography (Floor 445) ok TOKYO SKYTREE T “Sorakara-chan”, descended from the sky The highest point at 451.2 meters above the Memorial photo at the highest point of ① Traditional Techniques and ground. Visitors can enjoy seasonal limited the TOKYO SKYTREE! out of curiosity to TOKYO SKYTREE. events or other services. Opening hours 8:00-21:30 “Teppenpen”, a girl who has a weakness Forefront Technologies from Japan for fads and fashions. Floor 450 “Sukoburuburu”, an old dog bred in shitamachi, the Tokyo traditional town SKYTREE TERRACE TOURS (Outdoor guided tour) area. Three of them are looking forward to meeting visitors from all over the world here at SKYTREE! In addition to Tembo Deck and Tembo Galleria, a special new oor has been revealed. Enjoy the kyo Skytree T panoramic view seen To emb TOKYO SKYTREE Tembo Deck (Floor 350, 345, 340) ② o D through the SKYTREE’s Tembo Shuttle ec Floor 155 dynamic steel frameworks. (See-through elevator) k Feel the open-air breeze, SKYTREE® Post Floor 345 light and sounds of Tokyo. -

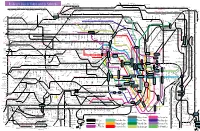

Railway Lines in Tokyo and Its Suburbs

Minami-Sakurai Hasuta Shin-Shiraoka Fujino-Ushijima Shimizu-Koen Railway Lines in Tokyo and its Suburbs Higashi-Omiya Shiraoka Kuki Kasukabe Kawama Nanakodai Yagisaki Obukuro Koshigaya Atago Noda-Shi Umesato Unga Edogawadai Hatsuisi Toyoshiki Fukiage Kita-Konosu JR Takasaki Line Okegawa Ageo Ichinowari Nanasato Iwatsuki Higashi-Iwatsuki Toyoharu Takesato Sengendai Kita-Koshigaya Minami-Koshigaya Owada Tobu-Noda Line Kita-Kogane Kashiwa Abiko Kumagaya Gyoda Konosu Kitamoto Kitaageo Tobu Nota Line Toro Omiya-Koen Tennodai Miyahara Higashi-Urawa Higashi-Kawaguchi JR Musashino Line Misato Minami-Nagareyama Urawa Shin-Koshigaya Minami- Kita- Saitama- JR Tohoku HonsenKita-Omiya Warabi Nishi-Kawaguchi Kawaguchi Kashiwa Kashiwa Hon-Kawagoe Matsudo Shin- Gamo Takenozuka Yoshikawa Shin-Misato Shintoshin Nishi-Arai Umejima Mabashi Minoridai Gotanno Yono Kita-Urawa Minami-Urawa Kita-Akabane Akabane Shinden Yatsuka Shin- Musashiranzan Higashi-Jujo Kita-Matsudo Shinrin-koenHigashi-MatsuyamaTakasaka Omiya Kashiwa Toride Yono Minami- Honmachi Yono- Matsubara-Danchi Shin-Itabashi Minami-FuruyaJR Kawagoe Line Musashishi-Urawa Kita-Toda Toda Toda-Koen Ukima-Funato Kosuge JR Saikyo Line Shimo Matsudo Kita-Sakado Kita- Shimura- Akabane-Iwabuchi Soka Masuo Ogawamachi Naka-Urawa Takashimadaira Shiden Matsudo- Yono Nishi-Takashimadaira Hasune Sanchome Itabashi-Honcho Oji Kita-senju Kami- Myogaku Sashiogi Nisshin Nishi-Urawa Daishimae Tobu Isesaki Line Kita-Ayase Kanamachi Hongo Shimura- Jujo Oji-Kamiya Oku Sakasai Yabashira Kawagoe Shingashi Fujimino Tsuruse -

Senkawa, Takamatsu, Chihaya, Kanamecho Ikebukuro Station's

Sunshine City is one of the largest multi-facility urban complex Ikebukuro Station is said to be one of the biggest railway terminals in Tokyo, Japan. in Japan. It consists of 5 buildings, including Sunshine It contains the JR Yamanote Line, the JR Saikyo Line, the Tobu Tojo Line, the Seibu Ikebukuro Ikebukuro Station’s 60, a landmark of Ikebukuro, at its center. It is made up of Line, Tokyo Metro Marunouchi Line, Yurakucho Line, Fukutoshin Line, etc., Sunshine City shops and restaurants, an aquarium, a planetarium, indoor Narita Express directly connects Ikebukuro Station and Narita International Airport. West Exit theme parks etc., A variety of fairs and events are held at It is a very convenient place for shopping and people can get whichever they might require Funsui-hiroba (the Fountain Plaza) in ALPA. because the station buildings and department stores are directly connected, such as Tobu Department Store, LUMINE, TOBU HOPE CENTER, Echika, Esola, etc., Jiyu Gakuen Myōnichi-kan Funsui-hiroba (the Fountain Plaza) In addition, various cultural events are held at Tokyo Metropolitan eater and Ikebukuro Nishiguchi Park on the west side of Ikebukuro Station. A ten-minute-walk from the West Exit will bring you to historic buildings such as Jiyu Gakuen Myōnichi-kan, a pioneering school of liberal education for Japan’s women and designed by Frank Lloyd Wright, Rikkyo University, the oldest Christianity University, and the Former Residence of Rampo Edogawa, a leading author of Japanese detective stories. J-WORLD TOKYO Sunshine City Rikkyo University and “Suzukake-no- michi” ©尾 田 栄 一 郎 / 集 英 社・フ ジ テ レ ビ・東 映 ア ニ メ ー シ ョ ン Pokémon Center MEGA TOKYO Tokyo Yosakoi Former Residence of Rampo Edogawa Konica Minolta Planetarium “Manten” Sunshine Aquarium Senkawa, Takamatsu, NAMJATOWN Chihaya, Kanamecho Tokyo Metropolitan Theater Ikebukuro Station’s Until about 1950, there were many ateliers around this area, and young painters and East Exit sculptors worked hard. -

TAITO-KAN Access

Tokyo Metropolitan Industrial trade center TAITO-KAN Access Kototoi-dori Ave. Kot o TAITO-KAN toi br id ge Asakusa Hanayashiki Nitenmon Gate Umamichi-dori St. Umamichi-dori Sumida River Sensoji Temple Edo-dori Ave. Nitenmon Marugoto Gate Nippon Tokyo Mizube Asakusa Cruising Line Sch. Water bus port Asakusa 2 Police Kokusai-dori Ave. box Denbouin-dori St. Tobu Line Asakusa Sta. Tsukuba Express Asakusa Nakamise Matsuya Asakusa EKIMISE Asakusa Sta. Public Hall Exit A1 Kaminarimon Tokyo Metro Ginza Line Gate Asakusa Sta. Exit 7 Police box Kaminarimon-dori St. Azuma-bash Asakusa Culture Tourist Information Center i bridge Tokyo Metropolitan Industrial Trade Center TAITO-KAN Toei Asakusa Line Asakusa Sta. 2-6-5 Hanakawado, Taito-ku, Exit A5 Tokyo, 111-0033 Asakusa-dori Ave. Komagata-bashi TEL:0 3 - 3844- 6190 bridge F A X:0 3 - 3843- 6707 ■ When coming by train: 370m from Asakusa Station. 5min on foot. Tokyo Metro Ginza Line Take Exit 7. Go up the stairs and leave through the left-side exit. Proceed to the right (Umamichi-dori). Located at Nitenmon Intersection. 370m from Asakusa Station. 5min on foot. Tobu Skytree Line Get off the escalator and leave through the right-side exit. Proceed to the right (Umamichi-dori). Located at Nitenmon Intersection. 500m from Asakusa Station. 8min on foot. Toei Asakusa Line Take Exit A5. Proceed to the left with the exit to your rear (Umamichi-dori). Located at Nitenmon Intersection. Directly in front after getting off at Nitenmon. Toei bus (Toei 08) Nippori Station ⇔ Kinshicho Station (Kusa 64) Asakusa Kaminarimon ⇔ Ikebukuro Station East Gate 700m from Asakusa Station. -

Tobu to Open Asakusa Tobu Hotel on Wednesday, July 22, 2020 Bookings Will Begin on the Tobu Hotel Management’S Website from Monday, February 10

January 29, 2020 A base for exploring Asakusa and the Tokyo Skytree Town® area Tobu to Open Asakusa Tobu Hotel on Wednesday, July 22, 2020 Bookings will begin on the Tobu Hotel Management’s website from Monday, February 10 Tobu Railway Co., Ltd. Tobu Hotel Management Co., Ltd. Tobu Hotel Management Co., Ltd. (Headquartered in Sumida-ku, Tokyo; President: Atsushi Shigeta), an affiliate of Tobu Railway Co., Ltd. (Headquartered in Sumida-ku, Tokyo; President: Yoshizumi Nezu), is preparing to open a hotel in front of Tobu Skytree Line Asakusa Station. The facilities and services of the hotel will be limited to those necessary for accommodations. Recently, Tobu Hotel Management has named the new hotel Asakusa Tobu Hotel and decided to open it on Wednesday, July 22, 2020. The new hotel is excellently located a one-minute walk from Asakusa Station on the Tobu Skytree Line and the Tokyo Metro Ginza subway line and three-minute walk from Asakusa Station on the Toei Asakusa subway line. It will address the diverse needs of guests from inside and outside the country by, for example, offering many four-person rooms. Asakusa Tobu Hotel will serve as a base for exploring Asakusa and the Tokyo Skytree Town area. The Tobu Group aims to integrate Asakusa and the Tokyo Skytree Town to create the No. 1 tourist destination in Tokyo. Tobu Railway will complete the construction of the Sumida River Walk footbridge spanning the Sumida River and connecting Asakusa with Tokyo Skytree Station this coming spring. TOKYO Mizumachi, a commercial complex underneath the elevated railway track, is also scheduled to open. -

Tobu Will Open Complex Under Elevated Railway Tracks

June 25, 2019 An attractive environment surrounded by a park and water terrace Tobu will Open Complex under Elevated Railway Tracks Connecting Asakusa with TOKYO SKYTREE TOWN in Spring 2020! Dining and service establishments with a hostel community open to the town Tobu Railway Co., Ltd. Wise Owl Co., Ltd. Tobu Railway is pleased to announce that in the spring of 2020 we will open a complex integrated with commercial and accommodation facilities linking the two major tourist destinations of Asakusa and TOKYO SKYTREE TOWN. The complex will be situated under the elevated railway tracks between Asakusa Station and TOKYO SKYTREE Station on the Tobu Skytree Line. The facility will be located under elevated railway tracks operated by Tobu Railway in an area surrounded by Sumida Park and the Kitajukken River Water Terrace, which have undergone improvements by Sumida Ward and the Tokyo Metropolitan Government. Combined with the newly constructed footbridge spanning the Sumida River, the facility will provide visitors with an enjoyable experience as they walk between Asakusa and TOKYO SKYTREE TOWN. Embracing the “Live to Trip” concept expressing the desire for neighborhood residents to spend time as though they were traveling while having tourists from other parts of Japan and overseas stay in the area as if they lived there, the facility will attract dining, shopping and experience-based establishments that allow users to take in the charm of this new downtown while strolling through the area. In terms of accommodation facilities, a new hostel will be open and operated by Wise Owl, which has experience operating two other hostels in Tokyo.