1Q2021 Financial Results Briefing Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Daily Dispatch

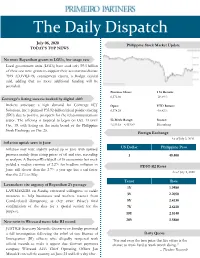

The Daily Dispatch July 06, 2020 Feb. 2, 2017 Philippine Stock Market Update TODAY’S TOP NEWS No more Bayanihan grants to LGUs, low usage rate Local government units (LGUs) have used only P5.5 billion of their one-time grants to support their coronavirus disease 2019 (COVID-19) containment efforts, a Budget official said, adding that no more additional funding will be provided. Previous Close: 1 Yr Return: 6,372.66 -20.58% Converge’s listing success backed by digital shift Brokers anticipate a high demand for Converge ICT Open: YTD Return: Solutions, Inc.’s planned P35.92-billion initial public offering 6,378.29 -18.82% (IPO) due to positive prospects for the telecommunications sector. The offering is targeted to begin on Oct. 13 until 52-Week Range: Source: Oct. 19, with listing on the main board of the Philippine 4,039.15 - 8,419.59 Bloomberg Stock Exchange on Oct. 26. Foreign Exchange As of July 3, 2020 Inflation uptick seen in June US Dollar Philippine Peso Inflation may have slightly picked up in June with upward pressure mainly from rising prices of oil and rice, according 1 49.400 to analysts. A BusinessWorld poll of 16 economists last week yielded a median estimate of 2.2% for headline inflation in PDST-R2 Rates June, still slower than the 2.7% a year ago but a tad faster As of July 3, 2020 than the 2.1% in May. Tenor Rate Lawmakers cite urgency of Bayanihan 2’s passage 1Y 1.9480 LAWMAKERS on Sunday reiterated willingness to tackle measures to help businesses and workers recover from 3Y 2.2050 Covid-related disruptions, as they await Palace’s final 5Y 2.4230 confirmation of the date for a special session for the 7Y 2.6410 purpose. -

(Access Network-Fiber) ADN Telecom Limited Bangladesh CTO ADN

Job Title Company Country Deputy General Manager (Access ADN Telecom Limited Bangladesh Network-Fiber) CTO ADN Telecom Limited Bangladesh Director of Customer Relations ASI Silica Machinery United States Engineering ManagerEngineering Manager Asian Vision Cable Philippines COO Asian Vision Cable Philippines Research and Testing Engineer Asian Vision Cable Holdings Inc Philippines IT/MIS Manager Asian Vision Cable Holdings Inc Philippines Network Engineer Asian Vision Cable Holdings Inc Philippines Business Development Representative AVSystem Poland Business Development Manager AVSystem Poland International Sales Director AVSystem Poland CEO AVSystem Poland President, Americas AVSystem United States Network Manager Batangas CATV Inc Philippines Engineer Binangonan Cable Tv Corp. Philippines Engineer Binangonan Cable Tv Corp. Philippines Sales Director APAC/LATAM BKtel Communications GmbH Germany BKtel Representative for South East Asia BKtel Communications GmbH Germany Assistant Manager - Network Operations Cable Link & Holdings Corp. Philippines & Engineering Vice President for Operations Cable Link & Holdings Corp. Philippines Manager - Network Operations & Cable Link & Holdings Corp. Philippines Engineering Head - Network Planning & Design Cable Link & Holdings Corp. Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines AVP Solutions Engineering Calix United States Sales Manager Camozzi Technopolymers Srl Italy Chief Executive Officer Celcom Timur (Sabah) -

Philippine Broadband Market Report

ICT MONITORING OVERVIEW This special report will give readers a view of the evolu&on of PHILIPPINE the broadband market in the Philippines -revenue, market share per provider, latest ini&a&ves, analyst outlook of the poten&al development and more about PH broadband BROADBAND market in the next few years. MARKET REPORT KEY PROVIDERS COVERED • Converge ICT • Eastern • Globe • PLDT • PT&T • Radius • RISE • Sky Cable • Source KEY INDICATORS COVERED Subscrip&ons (Historical quarterly figures covering the past 3 years + 5-year forecast): • Total broadband subscrip&ons • Total broadband subscrip"ons – market share by technology: xDSL, cable, FTTH/FTTB, fixed wireless access, mobile broadband, satellite) • Total broadband subscrip"ons – market share by provider • Total Business broadband subscrip&ons • Business broadband subscrip"ons – market share by technology: xDSL, cable, FTTH/FTTB, fixed wireless access, mobile broadband, satellite) • Business broadband subscrip"ons – market share by provider • Total Residen&al broadband subscrip&ons • Residen"al broadband subscrip"ons – market share by technology: xDSL, cable, FTTH/FTTB, fixed wireless access, mobile broadband, satellite) • Total Residen"al broadband subscrip"ons – market share by provider • Total broadband penetra&on rate (including breakdown by technology: xDSL, cable, FTTH/FTTB, fixed wireless access, mobile broadband, satellite) • Total broadband penetra"on rate – by provider • Business broadband penetra&on rate (including breakdown by technology: xDSL, cable, FTTH/FTTB, fixed wireless access, -

NOW Corp Prospectus June 21, 2018

of of SUBJECT TO COMPLETION PRELIMINARY PROSPECTUS STRICTLY CONFIDENTIAL nary Prospectus constitute an offer to sell or the solicitation here such offer or sale is not permitted. is not oroffer sale such here notice. notice. The Offer Shares may not be sold nor may an offer to buy be NOW Corporation (A corporation duly incorporated under the laws of the Republic of the Philippines) Primary Offer of 5,000,000 Redeemable Convertible Cumulative Non-Participating Non-Voting Peso- denominated Preferred ―A‖ Shares with an Oversubscription Option of Subscriptions to 5,000,000 Preferred ―A‖ Shares, with 25,000,000 underlying Common Shares and an additional 25,000,000 Common Shares upon the exercise of the Oversubscription Option, which Common Shares shall be issued upon conversion of the Preferred ―A‖ Shares at a conversion price of ₱20.00 per share, or a conversion ratio of 5 Common Shares for every 1 Preferred ―A‖ Share, at an Initial Dividend Rate of [7.5544% to 8.3044%]1 per annum and an Offer Price of ₱100.00 per share to be listed and traded on the Main Board of the Philippine Stock Exchange, Inc. and 10,000,000 Detachable Subscription Warrants to be issued free of charge, with 10,000,000 underlying Common Shares, with an Oversubscription Option of Subscriptions to 10,000,000 Detachable Subscription Warrants and 10,000,000 underlying Common Shares to be listed and traded on the Main Board of the Philippine Stock Exchange, Inc. Unicapital, Inc. Issue Manager, Bookrunner and Underwriter The date of this Preliminary Prospectus is [June __, 2018]. -

Sec Form – I-Acgr Integrated Annual Corporate Governance Report

SEC FORM – I-ACGR INTEGRATED ANNUAL CORPORATE GOVERNANCE REPORT 1. For the fiscal year ended: December 31, 2020 2. SEC Identification Number: CS200716094 3. BIR Tax Identification No. 006-895-049 4. Exact name of issuer as specified in its charter CONVERGE ICT SOLUTIONS, INC. 5. Metro Manila, Philippines 6. (SEC Use Only) Province, Country or other jurisdiction of Industry Classification Code: incorporation or organization 7. New Street Bldg., Mc Arthur Highway, Balibago, Angeles City, Pampanga 2009 Address of principal office Postal Code 8. (02) 8667-0888 Issuer's telephone number, including area code 9. N/A Former name, former address, and former fiscal year, if changed since last report. INTEGRATED ANNUAL CORPORATE GOVERNANCE REPORT COMPLIANT/ ADDITIONAL INFORMATION EXPLANATION NON- COMPLIANT The Board’s Governance Responsibilities Principle 1: The company should be headed by a competent, working board to foster the long- term success of the corporation, and to sustain its competitiveness and profitability in a manner consistent with its corporate objectives and the long- term best interests of its shareholders and other stakeholders. Recommendation 1.1 1. Board is composed of directors with The Board of Directors is composed collective working knowledge, experience of highly skilled and capable or expertise that is relevant to the individuals, having expertise and company’s industry/sector. competencies in multiple industries 2. Board has an appropriate mix of that enable them to respond to the competence and expertise. needs of the organization and act for Compliant 3. Directors remain qualified for their positions the best interest of the company. individually and collectively to enable them to fulfill their roles and responsibilities References: and respond to the needs of the SEC Annual Report 17A Pages (56-57) organization. -

Cnvrg Fy2020

C OV ER SH E ET SEC Registration Number C S 2 0 0 7 1 6 0 9 4 Company Name C O N V E R G E I N F O R M A T I O N A N D C O M M U N I C A T I O N S T E C H N O L O G Y S O L U T I O N S , I N C . Principal Office (No./Street/Barangay/City/Town/Province) N E W S T R E E T B U I L D I N G M C A R T H U R H I G H W A Y B A L I B A G O A N G E L E S C I T Y P A M P A N G A Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A C O M P A N Y I N F O R M A T I O N Company's Email Address Company's Telephone Number/s Mobile Number converge [email protected] - 09175774586 Annual Meeting Fiscal Year Month/Day Month/Day Last Friday of May of Each Year Dec -31 C O N T A C T P E R S O N I N F O R M A T I O N The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number OWEN OCAMPO okdocam po @converge ict.com - 09 328912603 CONTACT PERSON's ADDRESS Reliance IT Center Bldg., Annex 1, No. -

![Board of Directors [Excerpt from Prospectus]](https://docslib.b-cdn.net/cover/9213/board-of-directors-excerpt-from-prospectus-1679213.webp)

Board of Directors [Excerpt from Prospectus]

BOARD OF DIRECTORS [EXCERPT FROM PROSPECTUS] The following table sets forth our Board of Directors: Name Position Citizenship Dennis Anthony H. Uy CEO, Founder & Executive Director Filipino Maria Grace Y. Uy President, Chief Resources Officer, Founder & Executive Filipino Director Jose Pamintuan de Jesus Chairman, Independent Non-Executive Director Filipino Amando M. Tetangco, Jr. Independent Non-Executive Director Filipino Roman Felipe S. Reyes Independent Non-Executive Director Filipino Francisco Ed. Lim Non-Executive Director Filipino Saurabh N. Agarwal Non-Executive Director Indian The following states the business experience of our incumbent directors for the last five years: Mr. Dennis Anthony H. Uy, aged 54, co-founded Converge with Ms. Maria Grace Y. Uy in 2007 and currently serves as our CEO and Executive Director. Mr. Uy launched his first business while still in university. He founded Comclark, the controlling shareholder of Converge, in Pampanga in 1996 and remains the CEO and President of Comclark. Mr. Uy also serves on the boards of several companies in the technology, media, power, and real estate sectors, including the Uy family’s holding companies and Comclark, and actively participating Founding member and leader of Asia Pacific FTTH Council. Mr. Uy holds a Bachelor of Science degree in Electrical Engineering from the Holy Angels University, Pampanga. Ms. Maria Grace Y. Uy, aged 52, co-founded Converge with Mr. Dennis Anthony H. Uy in 2007 and currently serves as our President, Chief Resources Officer and Executive Director. Prior to that, she served as the Accounting Manager of IBM Philippines from 1990 to 1997 and Vice President for Finance in Savers Mall Group of Companies from 1997 to 2000. -

4Q/FY2020 Financial and Operating Results Briefing #Experiencebetter Legal Disclaimer

4Q/FY2020 Financial and Operating Results Briefing #ExperienceBetter Legal Disclaimer These materials have been prepared exclusively for information and disclosure purposes only. This does not constitute any offer to sell securities. These may contain forward-looking statements and information that are, by their nature, subject to significant risks, uncertainties, and assumptions. Many factors could make or cause the actual results, performance or achievements of CNVRG to be materially different from those expressed or implied in this release, including, but not limited to, changes in general economic, political, governmental and business conditions in the Philippines and globally, as may be applicable; changes in interest rates; changes in inflation rates; changes in exchange rates; the level and speed of network construction generally; changes in raw materials and energy prices, changes in business strategies; and various other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. CNVRG disclaims any obligation or undertaking to update or revise the information contained in these materials and releases. This communication is not intended to be provided to, and may not be used by, any person or entity in any jurisdiction where the provision or use thereof would be contrary to applicable laws, rules, or regulations. All rights reserved. • 2 2 Today’s Speakers Dennis Anthony Uy Grace Yao Uy Matthias Vukovich Chief Executive Officer, Co-Founder President, Co-Founder Chief Financial Office Advisor Jesus Romero Benjamin Azada Chief Operating Officer Chief Strategy Officer • 3 3 4 5 4Q/FY2020 Results Key Takeaways Rapid growth continues in 4Q2020 with 81% YoY revenue growth and 88% ✓ YoY EBITDA growth (vs. -

Converge Deploys 3Rd Core Network Backbone Node for Better Customer Internet Experience

Converge Deploys 3rd Core Network Backbone Node for Better Customer Internet Experience Manila, Philippines, January 6, 2021 – Converge ICT Solutions, Inc. (PSE: CNVRG), the country’s biggest pure end-to-end fiber internet service provider, is making its fiber network fully redundant with the deployment of its third Core node to further improve its customers’ internet experience. “We’ve always said that we are all about our customers’ online experience. This is one of the best examples of how we intend to back it up. Our main advantage is the quality of our high-speed fiber connectivity,” said Converge CEO Dennis Anthony Uy. He noted that a third core backbone node will enable a robust and redundant traffic routing in the network, making it more fault tolerant. Previously, the main network backbone of Converge are connected to two core nodes located in Metro Manila and Pampanga. With the completion of a third Core network backbone node last December, the Converge end-to-end pure fiber network becomes stronger and more resilient with a more efficient network traffic distribution and better ability to address outages. "Our expansion efforts are running at an unprecedented pace. And we know that network capabilities need to be more so we can serve everyone as best as we could,” Mr. Uy pointed out. Aside from the third Core backbone node, Converge has implemented several network and connectivity enhancement initiatives. It has recently deployed 34 broadband remote access server systems (BRAS) throughout Luzon. These systems help enhance customer internet experience as it increases reliability and decreases latency. -

3.4 Philippines Telecommunications

3.4 Philippines Telecommunications Telecommunications Regulations Existing Humanitarian Telecoms Systems Internet Service Providers (ISPs) Mobile Network Operators (MNOs) The Philippines has an advanced mobile market when compared to other similar countries. The Philippine Long-Distance Telephone Company (PLDT) and Globe Telecom are the two major telecommunication carriers in the country. The current Philippine cellular infrastructure is Global System for Mobile Communications (GSM). 4G service was made available in 2010, access to 4G services are above 70% for both all over the country with more than 80% in the main town. SMART (PLDT) and Globe launched long-term evolution (LTE) networks in 2012.PLDT has an existing digital fibre optic, and a digital microwave radio system connecting the entire country. Globe Telecom has fibre optic cables and was the first to offer Worldwide Interoperability for Microwave Access (WiMax). The bulk of the fixed services are in urban areas. In contrast, the fixed line market in the Philippines remains underdeveloped and fixed line penetration continues to show stagnant growth. A major reason for this is due to the dominance of the mobile segment and the rapid expansion of the mobile broadband segment. PLDT has continued to be the Philippines’ dominant fixed- line provider. However, in recent years, Globe Telecom has been pushing hard to overhaul the incumbent and now is the leading mobile provider in term of overall subscribers. It’s very easy buying a mobile number in the Philippines, you can choose between prepaid and post-pay contracts. The main mobile service providers in the country are Smart and Globe and you can get information on rates, contract types, fees and offers by visiting operator’s websites. -

Indonesian Towers Philippine Fixed Broadband

TMT M&A NEWSLETTER 3Q2019 INDONESIAN TOWERS Indosat Ooredoo to find investors for 3,000 towers Stefano Sorrentino, Adriano Giaquinta, Chin San Ng PHILIPPINE FIXED BROADBAND Converge ICT to connect 13 million homes to the Internet INDONESIAN TOWERS Indonesian-based telecom operator Some potential investors have already Indosat Ooredoo plans to sell ~3,000 expressed interest. As of August 2019, of its tower assets. The operator set Protelindo, the largest independent the average price for one tower unit in tower company in Indonesia (Exhibit 1), the range of USD 100 to 200 thousand, and Telkomsel, a state-owned telco, are depending on the tower location and the rumored to be interested in the towers. rental period, as well as other aspects. Indosat Ooredoo had previously com- Protelindo is well positioned to pur- pleted the sale and leaseback of 2,500 chase 3,000 additional towers thanks telecommunications towers to Tower to its balance sheet strength. In 2Q Bersama for a reported USD 519 million 2019, Protelindo reported a net debt in August 2012, i.e. slightly over USD 200 to annualized EBITDA ratio of 2.1x, i.e. thousand per tower. Today, Indosat Oore- well below its industry peers (STP’s doo is looking to raise USD 2 billion for its 4.5x and TBIG’s 5.2x). This might allow upcoming 4G CAPEX investments. The Protelindo to pursue inorganic growth operator is in the process of expanding by raising additional debt. A recent DBS its 4G network across Indonesia over the research paper shows that if Protelindo next 3 years, and this would encompass were to fund this transaction solely the addition of 18,000 4G base stations through debt, assuming that it would by the end of 2019. -

Philippines in View Cc

PHILIPPINES IN VIEW 2021 Table of Contents Chapter 1: Overall TV Market Environment ........................................................................ 2 Chapter 2: Online Curated Content (OCC) Market Environment ....................................... 13 Chapter 3: Traditional Pay TV Market Environment ......................................................... 45 Chapter 4: Piracy in the Philippines: Piracy and Unauthorized Distribution for Online and Traditional TV .................................................................................................................. 97 Chapter 5: Regulatory Environment for Digital Content ........................................................ 102 References ..................................................................................................................... 113 Annex A: Top TV Programs ............................................................................................. 121 Annex B: Glossary of Acronyms ...................................................................................... 125 1 Chapter 1: Overall TV Market Environment The disruptions to the Philippine television (TV) industry over recent years are many and the most recent of them, the 2019 coronavirus pandemic (COVID-19), has not made things easier. In June 2020, the World Economic Forum cited the myriad ways the pandemic has affected the media industry from content creators to distributors, saying that while consumer demand for content has skyrocketed due to lockdowns and the prevalence of remote