Philippines in View Cc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kagawaran Ng Edukasyon Tanggapan Ng Pangalawang Kalihim

Republika ng Pilipinas Kagawaran ng Edukasyon Tanggapan ng Pangalawang Kalihim OUA MEMO 00-0121-0030 12 January 2021 For: Information and Communications Technology Service- Educational Technology Unit (ICTS-EdTech) Subject: PRIORITY TASKS FOR FIRST QUARTER OF 2021 As discussed during the meeting held last 07 January 2021, the Office of the Undersecretary for Administration (OUA) is reiterating the following directives to the Information and Communications Technology Service–Educational Technology Unit (ICTS-EdTech). 1. Double the Number of DepEd Commons Users With unique users currently at around 8 Million plus, ICTS-EdTech is tasked to double the figure to reach out to about 16 million learners with access to the internet. Use of the platform must be expanded to accommodate the planned improvements for this year. Innovations on materials uploaded or to be uploaded must be made interesting and attractive in the same manner that they were made in March and April 2020. 2. Capacitate All Public School Teachers on Use of Educational Platforms/Channels and Available Technologies With DepEd adopting distance and blended learning, it has become more essential that all Public School Teachers be trained in the use of various technologies, and promote DepEd’s various learning channels (DepEd TV, DepEd Commons, DepEd Learning Management System, DepEd Radio, DepEd TV Facebook, DepEd TV YouTube, DepEd Mobile App, etc.). ICTS-EdTech must conduct regular relevant and appropriate trainings for ALL public school teachers monthly. They should be equipped with appropriate knowledge and skills in using and blending all available DepEd technologies. The 400,000 plus teachers reached out by ICTS-EdTech last March-April must be expanded to cover all 900,00 plus teachers, not just in one webinar but in several continuous regular online trainings. -

Philippine Notice to Mariners July 2021 Edition

PHILIPPINE NOTICES TO MARINERS Edition No.: 07 31 July 2021 Notices Nos.: 045 to 049 CONTENTS I Index of Charts Affected II Notices to Mariners III Corrections to Nautical Publications IV Navigational Warnings V Publication Notices Prepared by the Maritime Affairs Division Produced by the Hydrography Branch Published by the Department of Environment and Natural Resources NATIONAL MAPPING AND RESOURCE INFORMATION AUTHORITY Notices to Mariners – Philippine edition are now on- line at http:// www.namria.gov.ph/download.php#publications Subscription may be requested thru e-mail at [email protected] THE PHILIPPINE NOTICES TO MARINERS is the monthly publication produced by the Hydrography Branch of the National Mapping and Resource Information Authority (NAMRIA). It contains the recent charts correction data, updates to nautical publications, and other information that is vital for the safety of navigation on Philippine waters. Copies in digital format may be obtained by sending a request through e-mail address: [email protected] or by downloading at the NAMRIA website: www.namria.gov.ph/download.php. Masters of vessels and other concerned are requested to advance any report of dangers to navigation and other information affecting Philippine Charts and Coast Pilots which may come to their attention to the Director, Hydrography Branch. If such information warrants urgent attention like for instance the non- existence of aids to navigation or failure of light beacons or similar structure or discovery of new shoals, all concerned are requested to contact NAMRIA directly through the following portals: Mail: NAMRIA-Hydrography Branch, 421 Barraca St., San Nicolas, 1010 Manila, Philippines E-mail: [email protected] Fax: (+632) 8242-2090 The Hydrographic Note form at the back-cover page of this publication must be used in reporting information on dangers to navigation, lighted aids, and other features that should be included in the nautical charts. -

•19 SEP26 All H3

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) ofll;r fri'. rrtnrp First Regular Session ) •19 SEP 26 All H3 SENATE P.S. Res. No. 1 4 6 Introduced by SI .N ATOR LEILA M. DE LIMA RESOLUTION DIRECT TNG THE APPROPRIAT E SENAT E COMMITTEE TO CONDUCT AN INQUIRY, IN AID OF LEGISLATION, ON THE MEMORANDUM OF AGREEMENT BETWEEN THE ARMED FORCES OF THE PHILIPPINES AND DITO TELECOMMUNITY, GRANTING THE LATTER PERMIT TO INSTALL TELECOMMUNICATION FACILITIES AND EQUIPMENT INSIDE MILITARY CAMPS AND INSTALLATIONS, WHICH EXPOSES THE COUNT RY TO RISKS OF ESPIONAGE AND POTENTIALLY ENDANGERS OUR NATIONAI. SECURITY 1 WHEREAS, on o8 July 2019, the country’s third major telecommunications 2 player Mislatel Consortium announced that it has been renamed as Dito 3 Telecommunity. The consortium consists of three (3) companies, namely: Udenna 4 Corporation, Chelsea Logistics, and China Telecommunication Company (China 5 Telecom). Both Udenna Corporation and Chelsea Logistics are Filipino corporations 6 headed by Dennis Uy, who has reportedly close ties with President Rodrigo Duterte;1 7 WHEREAS, the transfer of Mislatel Consortium’s owmership to Dito 8 Telecommunity gives Udenna Corporation 35% control of the venture, and Chelsea 9 Logistics Corporation 25% share. China-owned and operated China Telecom secures 10 the remaining 40%2. While this set-up ostensibly respects the constitutional limit for 11 foreign investment and capitalization, it appears, however, that China Telecom has 1 Rivas, R. (03 January 2019) Dennis Uy's growing empire (and debt). Retrieved from; https://www.rappler.com/newsbreak/in-depth/219039-dennis-uy-growing-business-empire-debt-year- opener-2019 <last visited on 23 September 2019> 2 De Guzman, L. -

KTX: a Success Story Amidst Lockdown, Shutdown Story on Page 4

MARCH 2021 A monthly publication of the Lopez group of companies www.lopezlink.ph http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph Economic impact assessment KTX: A success story amidst lockdown, shutdown Story on page 4 Golden Arrows for The Grove LPZ, ABS-CBN opens up & First Gen …page 3 …page 7 ‘Justice’ is served …page 8 2 Lopezlink March 2021 BIZ NEWS BIZ NEWS Lopezlink March 2021 3 ‘Full steam ahead’ SKY Fiber offers leveled up speeds Exec Movements Three Lopez companies bag Golden Arrow awards EDC launches Green Bond at the same affordable rates FPH greenlights Framework on its 45th anniversary NEW and existing SKY Fiber By Dolly Pasia-Ramos By Frances Ariola subscribers can quickly enhance their productivity and lifestyle appointment Bond Shelf Registration of up and evaluation of the projects, when they maximize SKY Fi- to P15 billion, and the offer and the management of the pro- ber’s leveled up fiber-fast home issuance of an initial tranche of ceeds of the Green Bonds, and internet subscription plans that of Mayol as VP up to P3 billion with an over- subsequent reporting. are even more affordably priced LPZ VP-legal and compliance officer Atty. Maria Amina Amado and risk subscription option of up to P2 Sustainalytics has reviewed than before. THE board of directors management head Carla Paras-Sison billion fixed rate bonds, subject to and issued a Second-Party A P999 monthly fee can now of First Philippine Hold- the approval of the Securities and Opinion on EDC’s Green Bond get subscribers up to 20 Mbps, ings Corporation (FPH) on Exchange Commission (SEC), to Framework. -

The Daily Dispatch

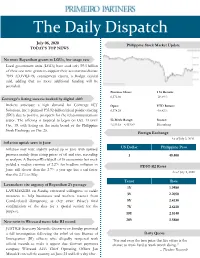

The Daily Dispatch July 06, 2020 Feb. 2, 2017 Philippine Stock Market Update TODAY’S TOP NEWS No more Bayanihan grants to LGUs, low usage rate Local government units (LGUs) have used only P5.5 billion of their one-time grants to support their coronavirus disease 2019 (COVID-19) containment efforts, a Budget official said, adding that no more additional funding will be provided. Previous Close: 1 Yr Return: 6,372.66 -20.58% Converge’s listing success backed by digital shift Brokers anticipate a high demand for Converge ICT Open: YTD Return: Solutions, Inc.’s planned P35.92-billion initial public offering 6,378.29 -18.82% (IPO) due to positive prospects for the telecommunications sector. The offering is targeted to begin on Oct. 13 until 52-Week Range: Source: Oct. 19, with listing on the main board of the Philippine 4,039.15 - 8,419.59 Bloomberg Stock Exchange on Oct. 26. Foreign Exchange As of July 3, 2020 Inflation uptick seen in June US Dollar Philippine Peso Inflation may have slightly picked up in June with upward pressure mainly from rising prices of oil and rice, according 1 49.400 to analysts. A BusinessWorld poll of 16 economists last week yielded a median estimate of 2.2% for headline inflation in PDST-R2 Rates June, still slower than the 2.7% a year ago but a tad faster As of July 3, 2020 than the 2.1% in May. Tenor Rate Lawmakers cite urgency of Bayanihan 2’s passage 1Y 1.9480 LAWMAKERS on Sunday reiterated willingness to tackle measures to help businesses and workers recover from 3Y 2.2050 Covid-related disruptions, as they await Palace’s final 5Y 2.4230 confirmation of the date for a special session for the 7Y 2.6410 purpose. -

1 Angel Locsin Prays for Her Basher You Can Look but Not Touch How

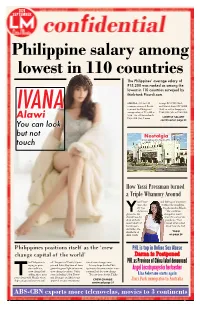

2020 SEPTEMBER Philippine salary among lowest in 110 countries The Philippines’ average salary of P15,200 was ranked as among the Do every act of your life as if it were your last. lowest in 110 countries surveyed by Marcus Aurelius think-tank Picordi.com. MANILA - Of the 110 bourg’s P198,500 (2nd), countries reviewed, Picodi. and United States’ P174,000 com said the Philippines’ (3rd), as well as Singapore’s IVANA average salary of P15,200 is P168,900 (5th) at P168,900, 95th – far-off Switzerland’s Alawi P296,200 (1st), Luxem- LOWEST SALARY continued on page 24 You can look but not Nostalgia Manila Metropolitan Theatre 1931 touch How Yassi Pressman turned a Triple Whammy Around assi Press- and feelings of uncertain- man , the ty when the lockdown 25-year- was declared in March. Yold actress “The world has glowed as she changed so much shared how she since the start of the dealt with the pandemic,” Yassi recent death of mused when asked her 90-year- about how she had old father, the YASSI shutdown of on page 26 ABS-CBN Philippines positions itself as the ‘crew PHL is top in Online Sex Abuse change capital of the world’ Darna is Postponed he Philippines is off. The ports of Panila, Capin- tional crew changes soon. PHL as Province of China label denounced trying to posi- pin and Subic Bay have all been It is my hope for the Phil- tion itself as a given the green light to become ippines to become a major inter- Angel Locsin prays for her basher crew change hub, crew change locations. -

Remote Control Preset Codes (AVR-A110) AVR

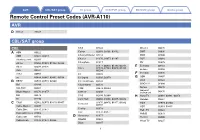

AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Remote Control Preset Codes (AVR-A110) AVR D Denon 73347 CBL/SAT group CBL CCS 03322 Director 00476 A ABN 03322 Celrun 02959, 03196, 03442 DMT 03036 ADB 01927, 02254 Channel Master 03118 DSD 03340 Alcatel-Lucent 02901 Charter 01376, 01877, 02187 DST 03389 Amino 01602, 01481, 01822, 02482 Chunghwa 01917 DV 02979 Arion 03034, 03336 01877, 00858, 01982, 02345, E Echostar 03452 Cisco 02378, 02563, 03028, 03265, Arris 02187 03294 Entone 02302 AT&T 00858 CJ 03322 F Freebox 01976 au 03444, 03445, 03485, 03534 CJ Digital 02693, 02979 G GBN 03407 B BBTV 02516, 02518, 02980 CJ HelloVision 03322 GCS 03322 Bell 01998 ClubInternet 02132 GDCATV 02980 BIG.BOX 03465 CMB 02979, 03389 Gehua 00476 General Bright House 01376, 01877 CMBTV 03498 Instrument 00476 BSI 02979 CNS 02350, 02980 H Hana TV 02681, 02881, 02959 BT 02294 Com Hem 00660, 01666, 02015, 02832 Handan 03524 C C&M 02962, 02979, 03319, 03407 01376, 00476, 01877, 01982, HCN 02979, 03340 Comcast 02187 Cable Magico 03035 HDT 02959, 03465 Coship 03318 Cable One 01376, 01877 Hello TV 03322 Cox 01376, 01877 Cable&Wireless 01068 HelloD 02979 Daeryung 01877 Cablecom 01582 D Hi-DTV 03500 DASAN 02683 Cablevision 01376, 01877, 03336 Hikari TV 03237 Digeo 02187 1 AVR CBL/SAT group TV group VCR/PVR group BD/DVD group Audio group Homecast 02977, 02979, 03389 02692, 02979, 03196, 03340, 01982, 02703, 02752, 03474, L LG 03389, 03406, 03407, 03500 Panasonic 03475 Huawei 01991 LG U+ 02682, 03196 Philips 01582, 02174, 02294 00660, 01981, 01983, -

Corporate Sustainability

OCTOBER 2015 www.lopezlink.ph Who will be the winners of the Lopez Achievement Awards and the first-ever Unsung Hero Award? Find out on October 15. Be part of the biggest gathering of Lopez Group employees at FPIP on October 17! http://www.facebook.com/lopezlinkonline www.twitter.com/lopezlinkph See details on page 5. SOME months ago, a change occurred that sharp-eyed readers might have spotted in the pages of LopezLink: the adoption of the term “CS,” for corporate sustain- ability, in lieu of CSR or corporate social responsibil- ity. Turn to page 6 The new green buzz: Corporate sustainability AMML Coco scores honored by anew with ‘Ang Christmas in …page 12 PMA …page 3 Probinsyano’…page 4 October Lopezlink October 2015 Biz News Biz News Lopezlink October 2015 EDC signs EPC contract for Dispatch from Japan power plant of Bacman 3 project Philippine embassy, Filcom organize PH Festival The weekend festival fea- ENERGY Development Cor- tured a parade, street dancing poration (EDC) has signed competition, band perfor- a design and equipment sup- mances and guest appearances ply contract with Hyundai by Manila-based celebrities. Engineering Co., Ltd. and a There were also booths offering construction services contract OML (4th from left) with (l-r) Usec. Alexander Pama of the Office of Civil Defense, Felix Icochea of Peru’s National Philippine culinary delights. with Galing Power & Energy Institute of Civil Defense, Nicholas Barker of Emergency Management Australia and Asec. Raymund Liboro of the With the assistance of the Construction Co. Inc., both Department of Science and Technology (Photo courtesy of www.apec2015gallery.com) tourism, trade and industry, dated September 15, 2015, for and agriculture attaché offices the engineering, procurement OML bats for DRR as national, regional of the embassy, companies from and construction of its 31-MW Manila and other regions put up Bacman 3 geothermal power Amb. -

Ed 303 318 Author Title Institution Report No Pub

DOCUMENT RESUME ED 303 318 SE 050 265 AUTHOR Druger, Marvin, Ed. TITLE Science for the Fun of It. A Guide to Informal Science Education. INSTITUTION National Science Teachers Association, Washington, D.C. REPORT NO ISBN-0-87355-074-9 PUB DATE 88 NOTE 137p.; Photographs may not reproduce well. AVAILABLE FROMNational Science Teachers Association, 1742 Connecticut Avenue, NW, Washington, DC 20009 ($15.00, 10% discount on 10 or more). PUB TYPE Collected Works - General (020) -- Books (010) -- Guides - Non-Classroom Use (055) EDRS PRICE MF01 Plus Postage. PC Not Available from EDRS. DESCRIPTORS Educational Facilities; Educational Innovation; Educational Media; Educational Opportunities; Educational Television; *Elementary School Science; Elementary Secondary Education; *Mass Media; *Museums; *Nonformal Education; Periodicals; Program Descriptions; Science Education; *Secondary School Science; *Zoos ABSTRACT School provides only a small part of a child's total education. This book focuses on science learning outside of the classroom. It consists of a collection of articles written by people who are involved with sevaral types of informal science education. The value of informal science education extends beyond the mere acquisition of knowledge. Attitudes toward science can be greatly influenced by science experiences outside of the classroom. The intent of this book is to highlight some of the many out-of-school opportunities which exist including zoos, museums, television, magazines and books, and a variety of creative programs and projects. The 19 articles in this volume are organized into four major sections entitled: (1) "Strategies"; (2) "The Media"; (3) "Museums and Zoos"; and (4) "Projects, Coop2titions, and Family Activities." A bibliography of 32 references on these topies is included. -

Pt.BI ISHTAR ~IKAIBKRS

ASCAP "S 2006 DART CLADI Pt.BI ISHTAR ~IKAIBKRS WiD AFFILIATED FOREIG& SOCIETIKS 3 OLC&IE I OF III P U B L I S H E R .357 PUBLISHING (A) S1DE UP MUSIC $$ FAR BEYOND ENTERTAINMENT $3.34 CHANGE OF THE BEAST ? DAT I SMELL MUS1C 'NANA PUDDIN PUBL1SHING A & N MUSIC CORP A & R MUSIC CO A A B A C A B PUBLISH1NG A A KLYC 4 A A P PUBLISHING A AL1KE PUBLiSHING A ALIKES MUSIC PUBLISHING A AND F DOGZ MUSIC A AND G NEALS PUBLiSHER A AND L MUS1C A AND S MUSICAL WORKS AB& LMUSIC A B A D MUZIC PUBLISHING A B ARPEGGIO MUSIC ABCG I ABCGMUSIC A B GREER PUBLISH1NG A B REAL MUSIC PUBLISHING A B U MUSIC A B WILLIS MUS1C A BAGLEY SONG COMPANY A BALLISTIC MUSIC A BETTER HISTORY PUBLISH1NG A BETTER PUBL1SHING COMPANY A BETTER TOMORROM A BIG ATT1TUDE INC A BIG F-YOU TO THE RHYTHM A BILL DOUGLAS MUSIC A BIRD AND A BEAR PUBLISHING A BLACK CLAN 1NC A BLONDE THING PUBLISHING A BOCK PUBLISHING A BOMBINATION MUSIC A BOY AND HIS DOG A BOY NAMED HO A BRICK CALLED ALCOHOL MUSIC A BROOKLYN PROJECT A BROS A BUBBA RAMEY MUSIC A BURNABLE PUBLISHING COMPANY A C DYENASTY ENT A CARPENTER'S SON A CAT NAMED TUNA PUBLISHING A CHUNKA MUSIC A CIRCLE OF FIFTHS MUSIC A CLAIRE MlKE MUSIC A CORDIS MUSIC A CREATI VE CHYLD ' PUB L I SHING A CREATIVE RHYTHM A CROM FLIES MUSIC INC A .CURSIVE MEMDR1ZZLE A D D RECORDiNGS A D G MUSICAL PUBLISHING INC A D HEALTHFUL LIFESTYLES A D SIMPSON OWN A D SMITH PUBLISHING P U B L I S H E R A D TERROBLE ENT1RETY A D TUTUNARU PUBLISHING A DAISY IN A JELLYGLASS A DAY XN DECEMBER A DAY XN PARIS MUSIC A DAY W1TH KAELEY CLAIRE A DELTA PACIFIC PRODUCTION A DENO -

(Access Network-Fiber) ADN Telecom Limited Bangladesh CTO ADN

Job Title Company Country Deputy General Manager (Access ADN Telecom Limited Bangladesh Network-Fiber) CTO ADN Telecom Limited Bangladesh Director of Customer Relations ASI Silica Machinery United States Engineering ManagerEngineering Manager Asian Vision Cable Philippines COO Asian Vision Cable Philippines Research and Testing Engineer Asian Vision Cable Holdings Inc Philippines IT/MIS Manager Asian Vision Cable Holdings Inc Philippines Network Engineer Asian Vision Cable Holdings Inc Philippines Business Development Representative AVSystem Poland Business Development Manager AVSystem Poland International Sales Director AVSystem Poland CEO AVSystem Poland President, Americas AVSystem United States Network Manager Batangas CATV Inc Philippines Engineer Binangonan Cable Tv Corp. Philippines Engineer Binangonan Cable Tv Corp. Philippines Sales Director APAC/LATAM BKtel Communications GmbH Germany BKtel Representative for South East Asia BKtel Communications GmbH Germany Assistant Manager - Network Operations Cable Link & Holdings Corp. Philippines & Engineering Vice President for Operations Cable Link & Holdings Corp. Philippines Manager - Network Operations & Cable Link & Holdings Corp. Philippines Engineering Head - Network Planning & Design Cable Link & Holdings Corp. Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines AVP Solutions Engineering Calix United States Sales Manager Camozzi Technopolymers Srl Italy Chief Executive Officer Celcom Timur (Sabah) -

COVER SHEET for AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A

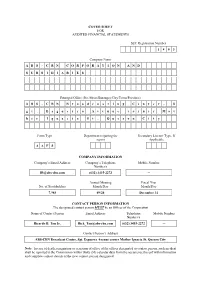

COVER SHEET FOR AUDITED FINANCIAL STATEMENTS SEC Registration Number 1 8 0 3 Company Name A B S - C B N C O R P O R A T I O N A N D S U B S I D I A R I E S Principal Office (No./Street/Barangay/City/Town/Province) A B S - C B N B r o a d c a s t i n g C e n t e r , S g t . E s g u e r r a A v e n u e c o r n e r M o t h e r I g n a c i a S t . Q u e z o n C i t y Form Type Department requiring the Secondary License Type, If report Applicable A A F S COMPANY INFORMATION Company’s Email Address Company’s Telephone Mobile Number Number/s [email protected] (632) 3415-2272 ─ Annual Meeting Fiscal Year No. of Stockholders Month/Day Month/Day 7,985 09/24 December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Mobile Number Number/s Ricardo B. Tan Jr. [email protected] (632) 3415-2272 ─ Contact Person’s Address ABS-CBN Broadcast Center, Sgt. Esguerra Avenue corner Mother Ignacia St. Quezon City Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.