Philippines Infrastructure.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Philippine Notice to Mariners July 2021 Edition

PHILIPPINE NOTICES TO MARINERS Edition No.: 07 31 July 2021 Notices Nos.: 045 to 049 CONTENTS I Index of Charts Affected II Notices to Mariners III Corrections to Nautical Publications IV Navigational Warnings V Publication Notices Prepared by the Maritime Affairs Division Produced by the Hydrography Branch Published by the Department of Environment and Natural Resources NATIONAL MAPPING AND RESOURCE INFORMATION AUTHORITY Notices to Mariners – Philippine edition are now on- line at http:// www.namria.gov.ph/download.php#publications Subscription may be requested thru e-mail at [email protected] THE PHILIPPINE NOTICES TO MARINERS is the monthly publication produced by the Hydrography Branch of the National Mapping and Resource Information Authority (NAMRIA). It contains the recent charts correction data, updates to nautical publications, and other information that is vital for the safety of navigation on Philippine waters. Copies in digital format may be obtained by sending a request through e-mail address: [email protected] or by downloading at the NAMRIA website: www.namria.gov.ph/download.php. Masters of vessels and other concerned are requested to advance any report of dangers to navigation and other information affecting Philippine Charts and Coast Pilots which may come to their attention to the Director, Hydrography Branch. If such information warrants urgent attention like for instance the non- existence of aids to navigation or failure of light beacons or similar structure or discovery of new shoals, all concerned are requested to contact NAMRIA directly through the following portals: Mail: NAMRIA-Hydrography Branch, 421 Barraca St., San Nicolas, 1010 Manila, Philippines E-mail: [email protected] Fax: (+632) 8242-2090 The Hydrographic Note form at the back-cover page of this publication must be used in reporting information on dangers to navigation, lighted aids, and other features that should be included in the nautical charts. -

•19 SEP26 All H3

EIGHTEENTH CONGRESS OF THE ) REPUBLIC OF THE PHILIPPINES ) ofll;r fri'. rrtnrp First Regular Session ) •19 SEP 26 All H3 SENATE P.S. Res. No. 1 4 6 Introduced by SI .N ATOR LEILA M. DE LIMA RESOLUTION DIRECT TNG THE APPROPRIAT E SENAT E COMMITTEE TO CONDUCT AN INQUIRY, IN AID OF LEGISLATION, ON THE MEMORANDUM OF AGREEMENT BETWEEN THE ARMED FORCES OF THE PHILIPPINES AND DITO TELECOMMUNITY, GRANTING THE LATTER PERMIT TO INSTALL TELECOMMUNICATION FACILITIES AND EQUIPMENT INSIDE MILITARY CAMPS AND INSTALLATIONS, WHICH EXPOSES THE COUNT RY TO RISKS OF ESPIONAGE AND POTENTIALLY ENDANGERS OUR NATIONAI. SECURITY 1 WHEREAS, on o8 July 2019, the country’s third major telecommunications 2 player Mislatel Consortium announced that it has been renamed as Dito 3 Telecommunity. The consortium consists of three (3) companies, namely: Udenna 4 Corporation, Chelsea Logistics, and China Telecommunication Company (China 5 Telecom). Both Udenna Corporation and Chelsea Logistics are Filipino corporations 6 headed by Dennis Uy, who has reportedly close ties with President Rodrigo Duterte;1 7 WHEREAS, the transfer of Mislatel Consortium’s owmership to Dito 8 Telecommunity gives Udenna Corporation 35% control of the venture, and Chelsea 9 Logistics Corporation 25% share. China-owned and operated China Telecom secures 10 the remaining 40%2. While this set-up ostensibly respects the constitutional limit for 11 foreign investment and capitalization, it appears, however, that China Telecom has 1 Rivas, R. (03 January 2019) Dennis Uy's growing empire (and debt). Retrieved from; https://www.rappler.com/newsbreak/in-depth/219039-dennis-uy-growing-business-empire-debt-year- opener-2019 <last visited on 23 September 2019> 2 De Guzman, L. -

Read the Airport Policy Brief Here

AUTHOR Maria Cherry Lyn S. Rodolfo is a member of the Export Development Council Networking Committee on Transport and Logistics. Editor: : John D. Forbes Cover Concept & Layout : Christina Maria D. Tuguigui Coordinators : Jannica Anne H. Gaisano, John Vincent C. Pimentel, and Froland M. Tajale Sponsors : The American Chamber of Commerce of the Philippines Australian New Zealand Chamber of Commerce of the Philippines Canadian Chamber of Commerce of the Philippines, Inc. Coalitions for Change, a partnership of the Australian Embassy and The Asia Foundation European Chamber of Commerce of the Philippines Financial Executives Institute of the Philippines Foundation for Economic Freedom The Japanese Chamber of Commerce and Industry of the Philippines, Inc. Korean Chamber of Commerce Philippines Makati Business Club Management Association of the Philippines Philippine Association of Multinational Companies Regional Headquarters, Incorporated Philippine Chamber of Commerce and Industries The Philippine Exporters Confederation, Inc. Semiconductor and Electronics Industries in the Philippines Foundation, Inc. Tourism Congress of the Philippines US-ASEAN Business Council, Inc. AIR TRANSPORT INFRASTRUCTURE: A POLICY BRIEF Contents I. Introduction .............................. 1 II. Air Transport, Economic Growth, and Performance .............................. 1 III. Regional Developments .............................. 3 IV. Philippine Air Transport Infrastructure .............................. 7 A. Demand and Supply Situation ............................. -

The Daily Dispatch

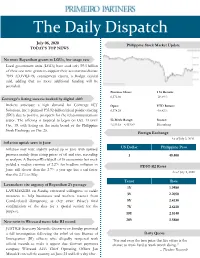

The Daily Dispatch July 06, 2020 Feb. 2, 2017 Philippine Stock Market Update TODAY’S TOP NEWS No more Bayanihan grants to LGUs, low usage rate Local government units (LGUs) have used only P5.5 billion of their one-time grants to support their coronavirus disease 2019 (COVID-19) containment efforts, a Budget official said, adding that no more additional funding will be provided. Previous Close: 1 Yr Return: 6,372.66 -20.58% Converge’s listing success backed by digital shift Brokers anticipate a high demand for Converge ICT Open: YTD Return: Solutions, Inc.’s planned P35.92-billion initial public offering 6,378.29 -18.82% (IPO) due to positive prospects for the telecommunications sector. The offering is targeted to begin on Oct. 13 until 52-Week Range: Source: Oct. 19, with listing on the main board of the Philippine 4,039.15 - 8,419.59 Bloomberg Stock Exchange on Oct. 26. Foreign Exchange As of July 3, 2020 Inflation uptick seen in June US Dollar Philippine Peso Inflation may have slightly picked up in June with upward pressure mainly from rising prices of oil and rice, according 1 49.400 to analysts. A BusinessWorld poll of 16 economists last week yielded a median estimate of 2.2% for headline inflation in PDST-R2 Rates June, still slower than the 2.7% a year ago but a tad faster As of July 3, 2020 than the 2.1% in May. Tenor Rate Lawmakers cite urgency of Bayanihan 2’s passage 1Y 1.9480 LAWMAKERS on Sunday reiterated willingness to tackle measures to help businesses and workers recover from 3Y 2.2050 Covid-related disruptions, as they await Palace’s final 5Y 2.4230 confirmation of the date for a special session for the 7Y 2.6410 purpose. -

DOTC Project Pipeline 29 September 2014, Singapore

Public-Private Partnerships DOTC Project Pipeline 29 September 2014, Singapore Rene K. Limcaoco Undersecretary for Planning and Project Development Department of Transportation and Communications Key Performance Indicators 1. Reduce transport cost by 8.5% – Increase urban mass transport ridership from 1.2M to 2.2M (2016) – Development of intermodal facilities 2. Lessen logistics costs from 23% to 15% – Improve transport linkages and efficiency 3. Airport infra for 10M foreign and 56M domestic tourists – Identify and develop key airport tourism destinations to improve market access and connectivity 4. Reduce transport-related accidents – Impose standards and operating procedures TRANSPORT DEVELOPMENT PLAN Awarded and for Implementation With On-going Studies • Automatic Fare Collection System • North-South Railway • Mactan-Cebu Int’l Airport • Mass Transit System Loop • LRT 1 Cavite Extension • Manila Bay-Pasig River Ferry System • MRT 7 (unsolicited; for implementation) • Integrated Transport System – South • Clark International Airport EO&M Under Procurement • LRT Line 1 Dasmariñas Extension • Integrated Transport System – Southwest • C-5 BRT • Integrated Transport System – South • LRT 2 Operations/Maintenance For Procurement of Transaction Advisors • NAIA Development For Rollout • Manila East Mass Transit System • New Bohol Airport Expansion, O&M • R1-R10 Link Mass Transit System • Laguindingan Airport EO&M • Road Transport IT Infrastructure Project Phase II • Central Spine RoRo For Approval of Relevant Government Bodies • MRT Line 3 -

(Access Network-Fiber) ADN Telecom Limited Bangladesh CTO ADN

Job Title Company Country Deputy General Manager (Access ADN Telecom Limited Bangladesh Network-Fiber) CTO ADN Telecom Limited Bangladesh Director of Customer Relations ASI Silica Machinery United States Engineering ManagerEngineering Manager Asian Vision Cable Philippines COO Asian Vision Cable Philippines Research and Testing Engineer Asian Vision Cable Holdings Inc Philippines IT/MIS Manager Asian Vision Cable Holdings Inc Philippines Network Engineer Asian Vision Cable Holdings Inc Philippines Business Development Representative AVSystem Poland Business Development Manager AVSystem Poland International Sales Director AVSystem Poland CEO AVSystem Poland President, Americas AVSystem United States Network Manager Batangas CATV Inc Philippines Engineer Binangonan Cable Tv Corp. Philippines Engineer Binangonan Cable Tv Corp. Philippines Sales Director APAC/LATAM BKtel Communications GmbH Germany BKtel Representative for South East Asia BKtel Communications GmbH Germany Assistant Manager - Network Operations Cable Link & Holdings Corp. Philippines & Engineering Vice President for Operations Cable Link & Holdings Corp. Philippines Manager - Network Operations & Cable Link & Holdings Corp. Philippines Engineering Head - Network Planning & Design Cable Link & Holdings Corp. Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines Technical Engineer Cabletronics Cable Systems Inc Philippines AVP Solutions Engineering Calix United States Sales Manager Camozzi Technopolymers Srl Italy Chief Executive Officer Celcom Timur (Sabah) -

Download (PCC-Issues-Paper-2020-01-The

PCC Issues Paper No. 01, Series of 2020 PAPER ISSUES The State of Competition in the Air Transport Industry: A Scoping Exercise Gilberto M. Llanto and Ma. Cherry Lyn Rodolfo The State of Competition in the Air Transport Industry: A Scoping Exercise The State of Competition in the Air Transport Industry: A Scoping Exercise I. INTRODUCTION policies which relate to (i) the opening up Gilberto M. Llanto and Ma. Cherry Lyn Rodolfo1 of regional airports to international flights, This study reviews the state of competition (ii) reciprocity as to whether it hinders in the domestic air transport industry, penetration of regional airports by foreign Published by: specifically focusing on the airline carriers; and (iii) the overall air transport passenger business. In reviewing the policy objective of the government, will Philippine Competition Commission business and economic landscape of remain unaddressed. Despite this limitation, 25/F Vertis North Corporate Center 1 the industry, it considers factors such as the report tries to provide a substantial North Avenue, Quezon City 1105 the market structure of the domestic air analysis of the present situation of the transport industry, the economic incentives2 industry and the competition-related that motivate the airline companies to issues faced by the industry, the public and behave in a certain way, and the regulations3 government. affecting the industry. The study turns to Williamson’s (1975) idea that organizations After a brief introduction, Section 2 presents review organizational costs and configures an overview of the air transport industry a governance structure that minimizes costs and uses an aviation services market value and maximizes revenues subject to the chain as a neat frame for understanding how constraints of extant policy and regulatory several entities collaborate and coordinate PCC Issues Papers aim to examine the structure, conduct, and performance of framework. -

1Q2021 Financial Results Briefing Presentation

Meeting Reminders • Please mute your microphones during the presentation. • Questions will be entertained during the Q&A portion. You may send your questions through the Zoom Chat feature. Please introduce yourself along with your affiliated company/research house. • The session will be recorded. 2 Today’s Speakers Mr. Dennis Anthony H. Uy Ms. Grace Y. Uy CEO and Co-Founder President and Co-Founder Mr. Matthias Vukovich Mr. Jesus C. Romero Mr. Benjamin B. Azada Chief Financial Office Advisor Chief Operations Officer Chief Strategy Officer 1Q2021 Results Key Takeaways Maintained industry-leading trifecta in 1Q2021 (vs. 1Q2020) with ✓ 83.6% revenue growth, 55.0% EBITDA margin and 23.1% ROIC Continued strong EBITDA growth in 1Q2021 with 101.6% YoY growth ✓ (vs. 1Q2020) 500k new ports and 182k gross residential subscribers added in ✓ 1Q2021. Converge captured 48% of Fixed Broadband Net Adds Improved our residential blended ARPU from P1,284 in 1Q2020 to ✓ P1,390 during 1Q2021 Residential business delivered 110% YoY revenue growth in 1Q2021, ✓ driven by strong subscriber additions and slightly improved ARPU ✓ Enterprise business grew 2% YoY in 1Q2021 6 Added ~500k FTTH Ports during 1Q2021 Extensive and Fast-growing Network Homes Passed (MM) (1)(2)(3) 13% 25% 14% 28% 55% More than 7.1MM homes passed as of March 2021, almost 190 350 128 331 15.1 ✓ double from March 2020 ~2x 7.1 6.2 0.8 ~28% household coverage nationwide as of December 2020 3.2 0.8 3.6 ✓ (~50% in Luzon) 0.8 5.3 0.8 2.4 2.8 6.3 (6) 2019 2020 1Q2020 1Q2021 2021E 2025E Targeting 55% household coverage (~15MM homes passed) by FTTH Homes Passed HFC Homes Passed ✓ 2025 Monthly Addition Run-rate (‘000s) (4) Household Coverage (5) (for last month in the period) Number of Ports (MM) (1)(2) 100 177 66 165 ~4.0MM ports as of March 2021, 82% increase from March 7.5-8.0 ✓ 2020. -

Comprehensive Capacity Development Project for the Bangsamoro Sector Report 2-3: Air Transport

Comprehensive capacity development project for the Bangsamoro Sector Report 2-3: Air Transport Comprehensive Capacity Development Project for the Bangsamoro Development Plan for the Bangsamoro Final Report Sector Report 2-3: Air Transport Comprehensive capacity development project for the Bangsamoro Sector Report 2-3: Air Transport Comprehensive capacity development project for the Bangsamoro Sector Report 2-3: Air Transport Table of Contents Chapter 1 Introduction ...................................................................................................................... 3-1 1.1 Airports in Mindanao ............................................................................................................ 3-1 1.2 Classification of Airports in the Philippines ......................................................................... 3-1 1.3 Airports in Bangsamoro ........................................................................................................ 3-2 1.4 Overview of Airports in Bangsamoro ................................................................................... 3-2 1.4.1 Cotabato airport ............................................................................................................... 3-2 1.4.2 Jolo airport ....................................................................................................................... 3-3 1.4.3 Sanga-Sanga Airport ........................................................................................................ 3-3 1.4.4 Cagayan De Sulu -

![BICOL)INTERNATIONAL)AIRPORT) )DEVELOPMENT)PROJECT) Package)2A! Construction)Of)Landside)Facilities) (Site)Development)And)Other)Buildings)) [REBID]! ! ) ) ) ) ) )](https://docslib.b-cdn.net/cover/4637/bicol-international-airport-development-project-package-2a-construction-of-landside-facilities-site-development-and-other-buildings-rebid-1324637.webp)

BICOL)INTERNATIONAL)AIRPORT) )DEVELOPMENT)PROJECT) Package)2A! Construction)Of)Landside)Facilities) (Site)Development)And)Other)Buildings)) [REBID]! ! ) ) ) ) ) )

! ! Government!of!the!Republic!of!the!Philippines! Department)of)Transportation)and)Communications) ) ) ) ) PHILIPPINE)BIDDING)DOCUMENTS) ) ) ) ) ) PROCUREMENT)OF) INFRASTRUCTURE)PROJECTS) ) BICOL)INTERNATIONAL)AIRPORT) )DEVELOPMENT)PROJECT) Package)2A! Construction)of)Landside)Facilities) (Site)Development)and)Other)Buildings)) [REBID]! ! ) ) ) ) ) ) TABLE)OF)CONTENTS) ! SECTION)I.)INVITATION)TO)BID))..........................................................................................)3! SECTION)II.)INSTRUCTIONS)TO)BIDDERS))........................................................................)7! SECTION)III.)BID)DATA)SHEET)).........................................................................................)30! SECTION)IV.)GENERAL)CONDITIONS)OF)CONTRACT))...................................................)36! SECTION)V.)SPECIAL)CONDITIONS)OF)CONTRACT))......................................................)63! SECTION)VI.)SPECIFICATIONS)).........................................................................................)67! SECTION)VII.)DRAWINGS))..................................................................................................)68! SECTION)VIII.)BILL)OF)QUANTITIES))................................................................................)69! SECTION)IX.)BIDDING)FORMS))..........................................................................................)76! 2 Section)I.)Invitation)to)Bid) ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 3! ! DEPARTMENT OF TRANSPORTATION AND COMMUNICATIONS ! -

Study on Airport Ownership and Management and the Ground Handling Market in Selected Non-European Union (EU) Countries

Study on airport DG MOVE, European ownership and Commission management and the ground handling market in selected non-EU countries Final Report Our ref: 22907301 June 2016 Client ref: MOVE/E1/SER/2015- 247-3 Study on airport DG MOVE, European ownership and Commission management and the ground handling market in selected non-EU countries Final Report Our ref: 22907301 June 2016 Client ref: MOVE/E1/SER/2015- 247-3 Prepared by: Prepared for: Steer Davies Gleave DG MOVE, European Commission 28-32 Upper Ground DM 28 - 0/110 London SE1 9PD Avenue de Bourget, 1 B-1049 Brussels (Evere) Belgium +44 20 7910 5000 www.steerdaviesgleave.com Steer Davies Gleave has prepared this material for DG MOVE, European Commission. This material may only be used within the context and scope for which Steer Davies Gleave has prepared it and may not be relied upon in part or whole by any third party or be used for any other purpose. Any person choosing to use any part of this material without the express and written permission of Steer Davies Gleave shall be deemed to confirm their agreement to indemnify Steer Davies Gleave for all loss or damage resulting therefrom. Steer Davies Gleave has prepared this material using professional practices and procedures using information available to it at the time and as such any new information could alter the validity of the results and conclusions made. The information and views set out in this report are those of the authors and do not necessarily reflect the official opinion of the European Commission. -

CAGAYAN VALLEY: the Philippine’S Prime Cereal Producer and Northern Gateway

CAGAYAN VALLEY: The Philippine’s Prime Cereal Producer and Northern Gateway REGIONAL DEVELOPMENT COUNCIL 2 Tuguegarao City June 2010 Regional Development Agenda 2010-2020 Cagayan Valley: The Philippine’s Prime Cereal Producer and Northern Gateway Notes on the Cover: 1. Port Irene, courtesy of the Cagayan Economic Zone Authority 2. Sierra Madre, courtesy of Conservation 1 International Philippines 6 2 3. Magat Dam, courtesy of the Department 7 of Tourism RO2 5 3 4. Rice Harvest 4 5. Cagayan River, courtesy of the Department of Tourism RO2 6. Callao Caves, courtesy of the Department of Tourism RO2 7. Rafflesia leonardi, photo taken by Dr. Julie Barcelona PREFACE The Regional Development Agenda (RDA) CY 2010-2020 was formulated to guide the next Regional Development Council 2 in the crafting of the successor Regional Development Plan. The document has undergone a series of consultation participated in by line agencies, local government units, NGOs and HEIs. The Cagayan Valley RDA is among the legacies of the officials and members of the Regional Development Council 2 (RDC2) CY 2007-2010 under the able leadership of his Eminence Bishop Ramon B. Villena. As such, the document will provide the next Council with a starting document that would guide them in formulation of the successor Regional Development Plan. The RDA takes off from existing planning documents such as the Regional Development Plan CY 2004-2010, the Regional Physical Framework Plan, the Regional Investments Priority Plan, and the Regional Action Agenda for Productivity and Quality. The RDA articulates the region’s highest priorities and the essential ingredients needed to achieve the desired development scenario.