Paynow and Thailand's Promptpay Complete the World's First Faster

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

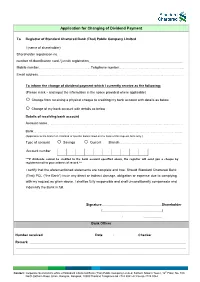

Application for Changing of Dividend Payment

Application for Changing of Dividend Payment To Registrar of Standard Chartered Bank (Thai) Public Company Limited I (name of shareholder) Shareholder registration no. number of identification card / juristic registration Mobile number………………………………………………….……….....Telephone number…………………..……………………………………….……………….. Email address……………………………………………………………………………………………………………….……………………………………………………………… To inform the change of dividend payment which I currently receive as the following: (Please mark and input the information in the space provided where applicable) Change from receiving a physical cheque to crediting my bank account with details as below Change of my bank account with details as below Details of receiving bank account Account name………………………………………………………………………………………………………………………………………………………..…….….. Bank………………………………………………………………………………………………………………………………………………………..……………………….... (Applicable to the branch in Thailand of specific banks listed on the back of this request form only.) Type of account Savings Current Branch…………………………………………………….……………………. Account number ***If dividends cannot be credited to the bank account specified above, the registrar will send you a cheque by registered mail to your address of record.*** I certify that the aforementioned statements are complete and true. Should Standard Chartered Bank (Thai) PCL (“the Bank”) incur any direct or indirect damage, obligation or expense due to complying with my request as given above. I shall be fully responsible and shall unconditionally compensate and indemnify the Bank in full. Signature Shareholder ( ) / / Bank Officer Number received Date / / Checker Remark Contact: Corporate Secretariat’s office of Standard Chartered Bank (Thai) Public Company Limited, Sathorn Nakorn Tower, 12th Floor, No. 100 North Sathorn Road, Silom, Bangrak, Bangkok, 10500 Thailand Telephone 66 2724 8041-42 Fax 66 2724 8044 Documents to be submitted for changing of dividend payment (All photocopies must be certified as true) For Individual Person 1. -

Notice of Additional Acquisition of Subsidiaries' Shares in Thailand

Notice of Additional Acquisition of Subsidiaries' Shares in Thailand TOKYO, February 28, 2020 -- Ajinomoto Co., Inc. (“Ajinomoto Co.”) has agreed with KASIKORNBANK PUBLIC COMPANY LIMITED ("KBANK") and The Siam Commercial Bank Public Company Limited ("SCB") to acquire all the shares of AJINOMOTO CO., (Thailand) LTD. (“Ajinomoto Thailand”), owned by KBANK and SCB, following the resolution regarding the execution of share purchase and sale agreement with THANACHART SPV2 CO., Ltd. announced on January 31 2020. Today Ajinomoto Co. has resolved to enter into a share purchase and sale agreement with KBANK and SCB, respectively. 1. Reasons for Additional Acquisition of Shares Ajinomoto Thailand, established in 1960, is a consolidated subsidiary in which Ajinomoto Co. owns an 88.52% stake. It manufactures and sells seasonings, food products and other products in Thailand. Ajinomoto Co. set out "to consider increasing net income by increasing the ratio interest of consolidated subsidiaries" in the 2017-2019 (for 2020) Medium-Term Management Plan, and set out the basic policy of "concentrating all management resources for the purpose of solving food and health issues" in the "ASV Management of the Ajinomoto Group, Vision for 2030 and Medium-Term Management Plan for 2020-2025", released on February 19, 2020. Ajinomoto Co. will focus further management resources on solving food and health issues by raising the shareholding ratio of Ajinomoto Thailand, which is the mainstay of the consumer food business. Ajinomoto Co. also expects that the additional acquisition of such shares will contribute to the improvement of its ROE and EPS. Ajinomoto Co. will continue to strengthen our ability to generate cash flow and improve capital efficiency to increase shareholder value and transform our business structure into one capable of sustainable growth. -

Ar 18 Eng.Pdf

Our Vision: THE MOST ADMIRED BANK DIGITAL CONVENIENCE FOR EASIER LIVING Using advanced biometric technology for identity verification, the SCB EASY app lets new customers open a savings account by themselves anytime, anywhere. DIGITAL CONVENIENCE FOR EASIER LIVING Using advanced biometric technology for identity verification, the SCB EASY app lets new customers open a savings account by themselves anytime, anywhere. SMART DIGITAL LENDING FOR EVERYONE SCB EASY uses big data analytics to broaden customer access to personal loans and allow instant approval. SMART DIGITAL LENDING FOR EVERYONE SCB EASY uses big data analytics to broaden customer access to personal loans and allow instant approval. DIGITAL SOLUTIONS FOR THAI SMEs SCB brings street vendors into the “Industry 4.0” era. Our Total Business Solutions provides money management services for food cart franchisors and franchisees. DIGITAL SOLUTIONS FOR THAI SMEs SCB brings street vendors into the “Industry 4.0” era. Our Total Business Solutions provides money management services for food cart franchisors and franchisees. FINANCIAL LITERACY FOR ‘NEXT GEN’ THAIS “Keb Hom”, is an AI-based app that offers a model savings plan. This friendly yet powerful software helps young people learn financial discipline. FINANCIAL LITERACY FOR ‘NEXT GEN’ THAIS “Keb Hom”, is an AI-based app that offers a model savings plan. This friendly yet powerful software helps young people learn financial discipline. GOOD GOVERNANCE FOR A BETTER SOCIETY SCB emphasizes good corporate governance so that the Bank and society can both grow sustainably. It requires sound management, transparent processes and fairness. GOOD GOVERNANCE FOR A BETTER SOCIETY SCB emphasizes good corporate governance so that the Bank and society can both grow sustainably. -

Ssb3: Debit Card Updates / / / / /

SSB3: DEBIT CARD UPDATES If only Part A or B is completed, please send to: DBS Bank Ltd – Credit Ops, 2 Changi Business Park Crescent, #07-03, DBS Asia Hub, S486029. If only Part C is completed, please send to: DBS Bank Ltd – Account Services, Simpang Bedok Post Office, PO Box 215, Singapore 914808, unless otherwise stated. If Part A, B and C are completed, please send to: DBS Bank Ltd – Credit Ops, 2 Changi Business Park Crescent, #07-03, DBS Asia Hub. Name: IC/ Passport No.*: Existing Debit Card (“Card”) No.: PART A: Instruction for POSB Multitude, Takashimaya Debit, Capita Debit, DBS SUTD, DBS NUSSU, HomeTeamNS-PAssion-POSB or SAFRA DBS Debit Card ☐ Lost (Please call Lost Card No. at 18001111111 immediately to report loss of your Card.) ☐ Non-receipt ☐ Damaged / Faulty Card* (Existing PIN to be used with the new Card issued.) Replace Card due to: ☐ Change of name embossed on the Card to: (Max 19 characters. Existing PIN to be used with the new Card issued.) ☐ Retained at ATM. Location: Change of Language Choice: ☐ English ☐ Selection at ATM PART B: Instruction for POSB GO! Debit MasterCard, PAssion POSB Debit Card, DBS Visa Debit, DBS UnionPay Debit, DBS Treasures Visa Debit, DBS Treasures Private Client Visa Debit or DBS Private Banking Visa Debit Card ☐ Lost (Please call Lost Card No. at 18001111111 immediately to report loss of your Card.) ☐ Non-receipt Replace Card due to: ☐ Damaged / Faulty Card (New Card and PIN will be sent in two separate mailers) Note: A $5 Debit Card replacement fee ☐ Change of name embossed on the Card to: is applicable for Lost Card (Max 19 characters) ☐ Retained at ATM. -

Bank Announcement

BANK ANNOUNCEMENT Citibank, N.A., Bangkok Branch Detail concerning interest rates, service charges, fees and other expenses in the use of credit cards Effective from Sep 15, 2015 1. Interest, penalty, fee and other service charges Interest Maximum 20.00 % per annum Credit line usage fee ………-……..% per annum Penalty for overdue payment ………-……..% per annum Fees or other service charges ………-……..% per annum Commencing date for interest calculation From [ X ] date of payment to store [ ] date of summary of total transactions [ ] Due date for payment - Interest for revolving credit will be calculated starting from the posting date as indicated on the monthly statement. - Interest for cash advance will be calculated starting from the withdrawal date to the date on which Citibank has received payment in full. 2. Minimum installment payment rate 10% of the total amount as per the monthly statement, or minimum payment of Baht 200 whichever is higher (The minimum payment 200 Baht is not applied to transaction from PayLite, PayLite Conversion On Phone/ Online, or Cash Advance On Phone/ Online programs, that required monthly minimum payment is 10% of outstanding balance as of statement cycle date). 3. Cash withdrawal fee 3 % of the amount of cash withdrawn (Cash Advance withdrawal amount shall vary with customer's payment history to be up to 100% of credit line) 4. Interest-free repayment period if paying when due Maximum payment period up to 45 - 55 days from statement billing cycle (Fully paying on due for retail spending) (Maximum payment period up to 55 days for Citibank Visa / Master and Citibank Rewards (Limited Edition)) 5. -

2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management

Coaition Greenwich 2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management Q1 2021 Greenwich Associates presents the overall and regional lists of 2021 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Asian Large Corporate Cash Management and the winners of the 2021 Greenwich Excellence Awards in several important categories. Greenwich Share and Quality Leaders — 2021 Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Banking Market Penetration Asian Large Corporate Banking Quality Bank Market Penetration Statistical Rank Bank HSBC ANZ Bank Standard Chartered Bank Citi DBS ANZ Bank T BNP Paribas T Asian Large Corporate Cash Management Market Penetration Asian Large Corporate Cash Management Quality Bank Market Penetration Statistical Rank Bank HSBC J.P. Morgan Citi Standard Chartered Bank DBS BNP Paribas Note: Market Penetration is the proportion of companies interviewed that consider each bank an important provider of: corporate banking services; corporate cash management services. Based on 840 respondents for large corporate banking and 1,073 for large corporate cash management. Share Leaders are based on Top 5 leading banks including ties. Quality Leaders are cited in alphabetical order including ties. Source: Greenwich Associates 2020 Asian Large Corporate Banking and Asian Large Corporate Cash Management Studies © 2021 GREENWICH ASSOCIATES Greenwich Share and Quality Leaders — 2021 Large Corporate Banking by Asian Markets Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Market Banking Market Penetration Penetration Statistical Rank Asian Large Corporate Banking Quality China (161) China (161) Bank of China ANZ Bank ICBC BNP Paribas China Construction Bank T China CITIC Bank Agricultural Bank of China T HSBC Mizuho Bank Hong Kong (91) Hong Kong (91) HSBC ANZ Bank Bank of China Standard Chartered Bank T DBS T India (198) India (198) State Bank of India Axis Bank HDFC T J.P. -

For the Year Ended 31 December 2019 Siam Commercial Bank

Annual Registration Statement (Form 56-1) For the Year Ended 31 December 2019 Siam Commercial Bank Public Company Limited The Siam Commercial Bank Public Company Limited 9 Ratchadapisek Road, Jatujak, Bangkok 10900 Thailand Tel. +66 2 544-1000 Website: www.scb.co.th Siam Commercial Bank Public Company Limited Annual Registration Statement (Form 56-1) Ended 31 December 2019 Contents PART 1 COMPANY'S BUSINESS 1. Policy and Business Overview ......................................................................................................... 1 2. Nature of Business Performance ...................................................................................................... 4 3. Risk Factors .................................................................................................................................... 18 4. Business Assets ............................................................................................................................. 37 5. Legal Dispute .................................................................................................................................. 44 6. General Information ........................................................................................................................ 45 PART 2 MANAGEMENT AND CORPORATE GOVERNANCE 7. Securities and Shareholders .......................................................................................................... 49 8. Organization Structure ................................................................................................................... -

Summary of Details of the Bank of Thailand Savings Bonds, B.E. 2551, Issue 1 1. Maturity 4 Years 7 Years Will Be Based on a 4-Ye

Summary of Details of the Bank of Thailand Savings Bonds, B.E. 2551, Issue 1 1. Maturity 4 Years 7 Years 2. Interest rate Will be based on a 4-year government Will be based on a 7-year government bond (coupon) bond yield plus spread of no more than yield plus spread of no more than 15% of 15% of the yield the yield The BOT will announce the interest rates on 15 February 2008 via websites of the BOT and the selling agents 3. Total issuance 50,000 Million Baht. 4. Minimum purchase 50,000 Baht/person with additional purchase in multiples of 10,000 Baht. 5. Eligible buyers in Individuals with Thai nationality, Thai residents, and non-profit public organizations. primary market 6. Subscription period 18 – 26 February 2008 7. Payment due date Cashier and personal cheques: within the cheque-clearing hours on 25 February 2008 Cash and direct debits: by closing time on 26 February 2008 8. Issue date 27 February 2008 ( the date on which interest calculation begins) 9. Interest payment Semi-annually, with equal installments, on 27 February and 27 August of every year until maturity. 10. Maturity date 27 February 2012 27 February 2015 11. Tax payment The interest is taxable in accordance with the rate announced in the Revenue Code each time interest is paid. Individuals have an option whether to include this interest in their annual income tax calculation. 12. Usage of BOT Bond holders are able to use BOT savings bonds as collaterals for government Savings Bonds as agencies, for instance, court bails or electricity guarantees. -

Community Development Councils Contents | 01

ANNUAL REPORT FY2014 COMMUNITY DEVELOPMENT COUNCILS CONTENTS | 01 MISSION Foreword 02 To Build a Caring and Cohesive Community where we Assist the Needy, Bond the People and Connect the Community. 04 Offi ce of the Mayors 08 Overview of Community Development Councils ASSIST THE NEEDY To help the less fortunate through local assistance 12 Towards a Caring and Cohesive Community schemes and programmes 29 Financial Information BOND THE PEOPLE 30 Governing Council To bond the community through projects and programmes so 31 List of Council Members as to bring members of the community closer to one another CONNECT THE COMMUNITY To develop strategic partnerships with corporate and community partners to better serve our residents CONTENTS 02 | FOREWORD FOREWORD | 03 FOREWORD From Chairman, Mayors’ Committee This has been an interesting year for the Offi ce of the Mayors. As we complement the work of MSF, the Offi ce of the Mayors will In June 2014, we welcomed two new Mayors, Ms Low Yen also step up efforts to help the lower-middle income; getting the Ling, South West District Mayor, and Ms Denise Phua, Central more able to help the less able; promoting both community and Singapore District Mayor; and thanked two former Mayors, corporate social responsibility. Dr Amy Khor, and Mr Sam Tan for helping to build strong communities in their districts. Their good work and legacies The challenges are huge. As our population ages, this means will always be remembered in the hearts of their communities. that there will be many more elderly who require our attention - to I would like to take this opportunity to also thank Dr Amy Khor promote active ageing; to befriend seniors who are lonely; and to for chairing the Mayors’ Committee since 2011. -

SCB) Rating: BUY Fair Price: Bt130.0 Close Price: Bt109.5

Company Update Thursday, September 23, 2021 I V Global Securities Public Company Limited Siam Commercial Bank Plc (SCB) Rating: BUY Fair price: Bt130.0 Close price: Bt109.5 Transforming to a holding company, SCB X Pcl Company Information Event: SCB’s board of directors has proposed that shareholders consider and Ticker: SCB TB approve the SCB Financial Business Group Restructuring Plan, ahead of the Sector: Financials scheduled extraordinary general meeting of shareholders on 15 Nov 2021. The Shares outstanding (m): 3,395.63 Market capitalization (Btm): 371,821.78 key message is to get approval for the share swap of SCB with the new Trading vol/day (‘000 shares): 13,568.34 company, SCB X Public Co. (SCBX). The transaction would only be successful if Free float (%): 76.61 at least 90% of the total number of voting rights are swapped. The share swap Beta: 1.26 ratio is at one (SCB) for one (SCBX). If it succeeds, SCB would be delisted and SCB X would be listed instead with a similar market capitalization value. Restructuring rationale. SCBX would be positioned as a holding company Major Shareholders while SCB would become a subsidiary of SCBX. There would be three business His Majesty King Maha Vajiralongkorn groups under SCBX: Bodindradebayavarangkun 23.38% Vayupak Fund I 23.12% a) The core banking services (i.e., SCB banking business, asset management, Thai NVDR 8.91% insurance and Julius Baer b) Consumer finance and digital financial services with several subsidiaries, Auto X, Alpha X, Card X and SCB Securities c) Digital platform and technology services; SCB10X, CPG-SCB VC Fund, Consensus Bloomberg AISCB JV, SCB Abacus, Digital Ventures, Purple Ventures, Token X, Monix, 2021F EPS (Bt): 9.73 SCB Tech X, and Data X Target price (Bt): 119.58 In the early years of restructuring, core banking services would contribute 85- Price Performance 90% of SCBX’s consolidated earnings. -

The Economic Crisis and Financial Sector Restructuring in Thailand

The Economic Crisis and Financial Sector Restructuring in Thailand Masahiro Kawai and Ken-ichi Takayasu Masahiro Kawai is Chief Economist, East Asia and Pacific, World Bank. Ken-ichi Takayasu is Senior Economist, Center for Pacific Business Studies, Sakura Institute of Research, Tokyo, Japan. 38 A STUDY OF FINANCIAL MARKETS Introduction ○○○○○○○○○ • Resolve nonviable and problem financial inst- itutions. The economic crisis in Thailand was triggered by • Strengthen the financial sector structure. the baht devaluation in July 1997 and aggravated by • Enhance the regulatory and supervisory regime. the underlying weaknesses of the country’s financial Most of the reform efforts in 1997-1999 focused ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ system and corporate sector. Prior to the crisis, on the first objective, including resolving the assets Thailand had embarked on a comprehensive liberal- and liabilities of the 56 closed finance companies, ization of domestic financial markets and capital restructuring and recapitalizing troubled commercial account transactions. As a result, financial institutions banks, and resolving bank nonperforming loans began to enjoy a more liberal economic environment, (NPLs). including increased business opportunities with the In addition to financial system reform, Thailand corporate and household sectors as well as favorable also focused on corporate sector reform in order to funding terms from domestic and foreign sources. resolve serious corporate debt overhang and to create However, Thailand’s financial system was not a robust corporate sector, thereby helping restore sufficiently sound or resilient to cope with problems financial system health. The reform strategy included created by large inflows of deposits and foreign funds (i) accelerating corporate debt restructuring, (ii) as well as the subsequent expansion of domestic strengthening corporate insolvency procedures, and credit. -

Corporate Governance

Corporate Governance Corporate Governance Report 2019 091 Internal Control and Risk Management 12 Related Party Transactions 10 Nomination, Compensation and Corporate Governance Committee Report 12 Report of the Executive Committee 1 Report of the Technology Committee 1 THE SIAM COMMERCIAL BANK PUBLIC COMPANY LIMITED 091 Corporate Governance Report for 2019 The Board of Directors of the Siam Commercial Bank The Bank was listed on the World Index • PCL (“the Bank” or “SCB”) recognizes the importance and the Emerging Markets Index of the Dow Jones of corporate governance (CG) and is determined to Sustainability Indices 2019, ranked 8th globally in ensure that SCB’s business governance is efficient, the banking sector. transparent, and fair to all stakeholders in order to bolster the trust of all stakeholders — shareholders, The Bank achieved the top level “Excellent” • customers, employees, business partners, debtors, rating in the 2019 CG assessment of Thai Listed society and regulators — and strengthen the Bank’s Companies by the Thai Institute of Directors competitiveness with ethics and social responsibility Association (IOD), marking its 15th consecutive year to achieve sustainable growth both for the Bank and for this recognition since 2005. society at large. The Board believes that adherence to good corporate governance will lead to the Bank’s The Bank was rated as “Outstanding” (score • success in continually enhancing its internal practices range of 98-100) in the Thai Investors Association’s and processes to meet the corporate