Ar 18 Eng.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

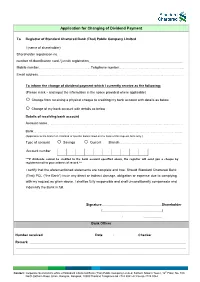

Application for Changing of Dividend Payment

Application for Changing of Dividend Payment To Registrar of Standard Chartered Bank (Thai) Public Company Limited I (name of shareholder) Shareholder registration no. number of identification card / juristic registration Mobile number………………………………………………….……….....Telephone number…………………..……………………………………….……………….. Email address……………………………………………………………………………………………………………….……………………………………………………………… To inform the change of dividend payment which I currently receive as the following: (Please mark and input the information in the space provided where applicable) Change from receiving a physical cheque to crediting my bank account with details as below Change of my bank account with details as below Details of receiving bank account Account name………………………………………………………………………………………………………………………………………………………..…….….. Bank………………………………………………………………………………………………………………………………………………………..……………………….... (Applicable to the branch in Thailand of specific banks listed on the back of this request form only.) Type of account Savings Current Branch…………………………………………………….……………………. Account number ***If dividends cannot be credited to the bank account specified above, the registrar will send you a cheque by registered mail to your address of record.*** I certify that the aforementioned statements are complete and true. Should Standard Chartered Bank (Thai) PCL (“the Bank”) incur any direct or indirect damage, obligation or expense due to complying with my request as given above. I shall be fully responsible and shall unconditionally compensate and indemnify the Bank in full. Signature Shareholder ( ) / / Bank Officer Number received Date / / Checker Remark Contact: Corporate Secretariat’s office of Standard Chartered Bank (Thai) Public Company Limited, Sathorn Nakorn Tower, 12th Floor, No. 100 North Sathorn Road, Silom, Bangrak, Bangkok, 10500 Thailand Telephone 66 2724 8041-42 Fax 66 2724 8044 Documents to be submitted for changing of dividend payment (All photocopies must be certified as true) For Individual Person 1. -

Notice of Additional Acquisition of Subsidiaries' Shares in Thailand

Notice of Additional Acquisition of Subsidiaries' Shares in Thailand TOKYO, February 28, 2020 -- Ajinomoto Co., Inc. (“Ajinomoto Co.”) has agreed with KASIKORNBANK PUBLIC COMPANY LIMITED ("KBANK") and The Siam Commercial Bank Public Company Limited ("SCB") to acquire all the shares of AJINOMOTO CO., (Thailand) LTD. (“Ajinomoto Thailand”), owned by KBANK and SCB, following the resolution regarding the execution of share purchase and sale agreement with THANACHART SPV2 CO., Ltd. announced on January 31 2020. Today Ajinomoto Co. has resolved to enter into a share purchase and sale agreement with KBANK and SCB, respectively. 1. Reasons for Additional Acquisition of Shares Ajinomoto Thailand, established in 1960, is a consolidated subsidiary in which Ajinomoto Co. owns an 88.52% stake. It manufactures and sells seasonings, food products and other products in Thailand. Ajinomoto Co. set out "to consider increasing net income by increasing the ratio interest of consolidated subsidiaries" in the 2017-2019 (for 2020) Medium-Term Management Plan, and set out the basic policy of "concentrating all management resources for the purpose of solving food and health issues" in the "ASV Management of the Ajinomoto Group, Vision for 2030 and Medium-Term Management Plan for 2020-2025", released on February 19, 2020. Ajinomoto Co. will focus further management resources on solving food and health issues by raising the shareholding ratio of Ajinomoto Thailand, which is the mainstay of the consumer food business. Ajinomoto Co. also expects that the additional acquisition of such shares will contribute to the improvement of its ROE and EPS. Ajinomoto Co. will continue to strengthen our ability to generate cash flow and improve capital efficiency to increase shareholder value and transform our business structure into one capable of sustainable growth. -

Bank Announcement

BANK ANNOUNCEMENT Citibank, N.A., Bangkok Branch Detail concerning interest rates, service charges, fees and other expenses in the use of credit cards Effective from Sep 15, 2015 1. Interest, penalty, fee and other service charges Interest Maximum 20.00 % per annum Credit line usage fee ………-……..% per annum Penalty for overdue payment ………-……..% per annum Fees or other service charges ………-……..% per annum Commencing date for interest calculation From [ X ] date of payment to store [ ] date of summary of total transactions [ ] Due date for payment - Interest for revolving credit will be calculated starting from the posting date as indicated on the monthly statement. - Interest for cash advance will be calculated starting from the withdrawal date to the date on which Citibank has received payment in full. 2. Minimum installment payment rate 10% of the total amount as per the monthly statement, or minimum payment of Baht 200 whichever is higher (The minimum payment 200 Baht is not applied to transaction from PayLite, PayLite Conversion On Phone/ Online, or Cash Advance On Phone/ Online programs, that required monthly minimum payment is 10% of outstanding balance as of statement cycle date). 3. Cash withdrawal fee 3 % of the amount of cash withdrawn (Cash Advance withdrawal amount shall vary with customer's payment history to be up to 100% of credit line) 4. Interest-free repayment period if paying when due Maximum payment period up to 45 - 55 days from statement billing cycle (Fully paying on due for retail spending) (Maximum payment period up to 55 days for Citibank Visa / Master and Citibank Rewards (Limited Edition)) 5. -

2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management

Coaition Greenwich 2021 Greenwich Leaders: Asian Large Corporate Banking and Cash Management Q1 2021 Greenwich Associates presents the overall and regional lists of 2021 Greenwich Share and Quality Leaders in Asian Large Corporate Banking and Asian Large Corporate Cash Management and the winners of the 2021 Greenwich Excellence Awards in several important categories. Greenwich Share and Quality Leaders — 2021 Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Banking Market Penetration Asian Large Corporate Banking Quality Bank Market Penetration Statistical Rank Bank HSBC ANZ Bank Standard Chartered Bank Citi DBS ANZ Bank T BNP Paribas T Asian Large Corporate Cash Management Market Penetration Asian Large Corporate Cash Management Quality Bank Market Penetration Statistical Rank Bank HSBC J.P. Morgan Citi Standard Chartered Bank DBS BNP Paribas Note: Market Penetration is the proportion of companies interviewed that consider each bank an important provider of: corporate banking services; corporate cash management services. Based on 840 respondents for large corporate banking and 1,073 for large corporate cash management. Share Leaders are based on Top 5 leading banks including ties. Quality Leaders are cited in alphabetical order including ties. Source: Greenwich Associates 2020 Asian Large Corporate Banking and Asian Large Corporate Cash Management Studies © 2021 GREENWICH ASSOCIATES Greenwich Share and Quality Leaders — 2021 Large Corporate Banking by Asian Markets Greenwich Greenwich Share Leader Quality Leader 202 1 202 1 Asian Large Corporate Market Banking Market Penetration Penetration Statistical Rank Asian Large Corporate Banking Quality China (161) China (161) Bank of China ANZ Bank ICBC BNP Paribas China Construction Bank T China CITIC Bank Agricultural Bank of China T HSBC Mizuho Bank Hong Kong (91) Hong Kong (91) HSBC ANZ Bank Bank of China Standard Chartered Bank T DBS T India (198) India (198) State Bank of India Axis Bank HDFC T J.P. -

For the Year Ended 31 December 2019 Siam Commercial Bank

Annual Registration Statement (Form 56-1) For the Year Ended 31 December 2019 Siam Commercial Bank Public Company Limited The Siam Commercial Bank Public Company Limited 9 Ratchadapisek Road, Jatujak, Bangkok 10900 Thailand Tel. +66 2 544-1000 Website: www.scb.co.th Siam Commercial Bank Public Company Limited Annual Registration Statement (Form 56-1) Ended 31 December 2019 Contents PART 1 COMPANY'S BUSINESS 1. Policy and Business Overview ......................................................................................................... 1 2. Nature of Business Performance ...................................................................................................... 4 3. Risk Factors .................................................................................................................................... 18 4. Business Assets ............................................................................................................................. 37 5. Legal Dispute .................................................................................................................................. 44 6. General Information ........................................................................................................................ 45 PART 2 MANAGEMENT AND CORPORATE GOVERNANCE 7. Securities and Shareholders .......................................................................................................... 49 8. Organization Structure ................................................................................................................... -

Summary of Details of the Bank of Thailand Savings Bonds, B.E. 2551, Issue 1 1. Maturity 4 Years 7 Years Will Be Based on a 4-Ye

Summary of Details of the Bank of Thailand Savings Bonds, B.E. 2551, Issue 1 1. Maturity 4 Years 7 Years 2. Interest rate Will be based on a 4-year government Will be based on a 7-year government bond (coupon) bond yield plus spread of no more than yield plus spread of no more than 15% of 15% of the yield the yield The BOT will announce the interest rates on 15 February 2008 via websites of the BOT and the selling agents 3. Total issuance 50,000 Million Baht. 4. Minimum purchase 50,000 Baht/person with additional purchase in multiples of 10,000 Baht. 5. Eligible buyers in Individuals with Thai nationality, Thai residents, and non-profit public organizations. primary market 6. Subscription period 18 – 26 February 2008 7. Payment due date Cashier and personal cheques: within the cheque-clearing hours on 25 February 2008 Cash and direct debits: by closing time on 26 February 2008 8. Issue date 27 February 2008 ( the date on which interest calculation begins) 9. Interest payment Semi-annually, with equal installments, on 27 February and 27 August of every year until maturity. 10. Maturity date 27 February 2012 27 February 2015 11. Tax payment The interest is taxable in accordance with the rate announced in the Revenue Code each time interest is paid. Individuals have an option whether to include this interest in their annual income tax calculation. 12. Usage of BOT Bond holders are able to use BOT savings bonds as collaterals for government Savings Bonds as agencies, for instance, court bails or electricity guarantees. -

SCB) Rating: BUY Fair Price: Bt130.0 Close Price: Bt109.5

Company Update Thursday, September 23, 2021 I V Global Securities Public Company Limited Siam Commercial Bank Plc (SCB) Rating: BUY Fair price: Bt130.0 Close price: Bt109.5 Transforming to a holding company, SCB X Pcl Company Information Event: SCB’s board of directors has proposed that shareholders consider and Ticker: SCB TB approve the SCB Financial Business Group Restructuring Plan, ahead of the Sector: Financials scheduled extraordinary general meeting of shareholders on 15 Nov 2021. The Shares outstanding (m): 3,395.63 Market capitalization (Btm): 371,821.78 key message is to get approval for the share swap of SCB with the new Trading vol/day (‘000 shares): 13,568.34 company, SCB X Public Co. (SCBX). The transaction would only be successful if Free float (%): 76.61 at least 90% of the total number of voting rights are swapped. The share swap Beta: 1.26 ratio is at one (SCB) for one (SCBX). If it succeeds, SCB would be delisted and SCB X would be listed instead with a similar market capitalization value. Restructuring rationale. SCBX would be positioned as a holding company Major Shareholders while SCB would become a subsidiary of SCBX. There would be three business His Majesty King Maha Vajiralongkorn groups under SCBX: Bodindradebayavarangkun 23.38% Vayupak Fund I 23.12% a) The core banking services (i.e., SCB banking business, asset management, Thai NVDR 8.91% insurance and Julius Baer b) Consumer finance and digital financial services with several subsidiaries, Auto X, Alpha X, Card X and SCB Securities c) Digital platform and technology services; SCB10X, CPG-SCB VC Fund, Consensus Bloomberg AISCB JV, SCB Abacus, Digital Ventures, Purple Ventures, Token X, Monix, 2021F EPS (Bt): 9.73 SCB Tech X, and Data X Target price (Bt): 119.58 In the early years of restructuring, core banking services would contribute 85- Price Performance 90% of SCBX’s consolidated earnings. -

The Economic Crisis and Financial Sector Restructuring in Thailand

The Economic Crisis and Financial Sector Restructuring in Thailand Masahiro Kawai and Ken-ichi Takayasu Masahiro Kawai is Chief Economist, East Asia and Pacific, World Bank. Ken-ichi Takayasu is Senior Economist, Center for Pacific Business Studies, Sakura Institute of Research, Tokyo, Japan. 38 A STUDY OF FINANCIAL MARKETS Introduction ○○○○○○○○○ • Resolve nonviable and problem financial inst- itutions. The economic crisis in Thailand was triggered by • Strengthen the financial sector structure. the baht devaluation in July 1997 and aggravated by • Enhance the regulatory and supervisory regime. the underlying weaknesses of the country’s financial Most of the reform efforts in 1997-1999 focused ○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○○ system and corporate sector. Prior to the crisis, on the first objective, including resolving the assets Thailand had embarked on a comprehensive liberal- and liabilities of the 56 closed finance companies, ization of domestic financial markets and capital restructuring and recapitalizing troubled commercial account transactions. As a result, financial institutions banks, and resolving bank nonperforming loans began to enjoy a more liberal economic environment, (NPLs). including increased business opportunities with the In addition to financial system reform, Thailand corporate and household sectors as well as favorable also focused on corporate sector reform in order to funding terms from domestic and foreign sources. resolve serious corporate debt overhang and to create However, Thailand’s financial system was not a robust corporate sector, thereby helping restore sufficiently sound or resilient to cope with problems financial system health. The reform strategy included created by large inflows of deposits and foreign funds (i) accelerating corporate debt restructuring, (ii) as well as the subsequent expansion of domestic strengthening corporate insolvency procedures, and credit. -

Corporate Governance

Corporate Governance Corporate Governance Report 2019 091 Internal Control and Risk Management 12 Related Party Transactions 10 Nomination, Compensation and Corporate Governance Committee Report 12 Report of the Executive Committee 1 Report of the Technology Committee 1 THE SIAM COMMERCIAL BANK PUBLIC COMPANY LIMITED 091 Corporate Governance Report for 2019 The Board of Directors of the Siam Commercial Bank The Bank was listed on the World Index • PCL (“the Bank” or “SCB”) recognizes the importance and the Emerging Markets Index of the Dow Jones of corporate governance (CG) and is determined to Sustainability Indices 2019, ranked 8th globally in ensure that SCB’s business governance is efficient, the banking sector. transparent, and fair to all stakeholders in order to bolster the trust of all stakeholders — shareholders, The Bank achieved the top level “Excellent” • customers, employees, business partners, debtors, rating in the 2019 CG assessment of Thai Listed society and regulators — and strengthen the Bank’s Companies by the Thai Institute of Directors competitiveness with ethics and social responsibility Association (IOD), marking its 15th consecutive year to achieve sustainable growth both for the Bank and for this recognition since 2005. society at large. The Board believes that adherence to good corporate governance will lead to the Bank’s The Bank was rated as “Outstanding” (score • success in continually enhancing its internal practices range of 98-100) in the Thai Investors Association’s and processes to meet the corporate -

Collateral Deposit & Payment by Bill Payment Service at the Bank No

Collateral Deposit & Payment by Bill Payment Service at the Bank For your convenience, the “Bill Payment of Goods and Services” currently available at 9 banks: Bangkok Bank, Krung Thai Bank, Krungsri, Kasikorn Bank, CIMB, Siam Commercial Bank, TMB, Thanachart Bank, and UOB can be used to deposit collateral and make payments to us. You can use it by (1) payment over the counter at a bank branch, (2) via their ATM, Auto Telephone Banking, or (3) their Internet or Mobile Banking. 1) Bill payment over the counter at a bank branch. Complete and submit a pay-in slip provided by us along with your payment at the bank. You can download the form from our website www.poems.in.th under: Download >> Form >> Pay-in Slip. For BBL, KTB, Krungsri, Kasikorn, SCB, TBank, and UOB you can also use the Bill Payment Slip provided by the bank. 2) Bill payment via ATM or Automatic Telephone Banking. In general, you need to look for the Bill Payment Service menu. Use the correct company code with your bank, payment reference 1, and 2 codes from the tables below. Please refer to or download the User’s Guide from each bank from our website www.poems.in.th under: Learning Center >> Investors Guide >> Bill Payment User Guide. Bill Payment Recipient Company Code for Payment at a Bank Branch, ATM, Internet, and Mobile Banking Bill Payment Channel (Service Code, Comp Code, BP Code) No. Banks Payment at a Bank Branch / Internet Banking & ATM Mobile Banking 1 TMB Bank Comp Code: 0914 Comp Code: 0504 2 Bangkok Bank Comp Code: 50234 / Service Code: PST 3 Kasikorn Bank Comp Code: 33826 4 Krung Thai Bank Comp Code: 5346 5 Krungsri Comp Code: 24155 6 CIMB Thai Comp Code: PST / Service Code: PST034 7 Siam Commercial Bank Comp Code: 0016 8 Thanachart Bank Com Code: C100 / Service Code : 3145 9 UOB BP Code: 3300 *For TMB, our Comp Code is different at the bank branch (0914) and at the ATM (0504) Payment Reference 1 is your 5 digit trading account number with us. -

Details on Interest Rate, Service Charges, and Penalty Related to Personal Loan Business Under Supervision No

United Overseas Bank (Thai) Public Company Limited would like to supercede the Bank Announcement # 033/2019 dated December 19, 2019 which effective from January 1, 2020 with the revised interest rates and conditions as follows:- United Overseas Bank (Thai) Public Company Limited Details on Interest Rate, Service Charges, and Penalty related to Personal Loan Business under Supervision No. 020/2020 Effective Date: August 1, 2020 1 Interest, Service Charges, and Penalty UOB Cash Plus UOB I-Cash 1.1 Normal Interest Rate Maximum 25% per annum Ceiling Interest Rate and Default Rate (Per annum) 25% The different rate between the approved rate and ceiling interest rate multiplied by outstanding balance 1.2 Prepayment Fee within the first year N/A and the number of day counting from the date of the first draw down until prepayment date, divided by 365 1.3 Arrangement Fee N/A N/A 2 Expense Paid to Government Agencies 0.05% of credit limit 0.05% of credit limit 2.1 Stamp Duty 3 Expense Paid to External Parties 3.1 Payment Service Fee4 Payment Channel6 Serivce charges per Transaction Serivce charges per Transaction Bangkok and Greater Upcountry Province Bangkok and Greater Upcountry Province At Counter of United Overseas Bank (Thai) Free Free Free Free Mailing Cheque Free Free Free Free At UOB ATM / UOB Direct Debit Free Free Free Free UOB Cyber Banking (www.uob.co.th) Free Free Free Free Pay at Post THB 10 / every THB 50,000 N/A At Counter Service (Cash only and not more than THB 30,000/ THB 15 THB 20 THB 15 THB 20 Bank of Ayudhaya - At Counter -

Sustainability Report 2018

Vision The Most Admired Bank Table of Content Message from the Board of Directors 04 About This Report 10 SCB at a Glance 16 Sustainability at SCB 20 To be... The Most Sustainable Return Company 26 To be... The Most Preferred Partner 36 To be... The Most Caring Employer 52 To be... The Most Responsible Corporate Citizen 76 To be... The Most Prudent Bank 100 Awards and Recognitions 123 Sustainability Performance 124 GRI Content Index 132 Independent Assurance 136 004 SUSTAINABILITY REPORT 2018 Message from the Board of Directors Dr. Vichit Suraphongchai Mr. Anand Panyarachun Mr. Arthid Nanthawithaya Director and Chairman of the Board Director and Chairman of the Executive Committee Chief Executive Officer THE SIAM COMMERCIAL BANK PUBLIC COMPANY LIMITED 005 The year 2018 was still a challenging year for the Bank For more than two years, the Bank has undergone which must operate in an environment that was a major organisational reform under SCB continuously and rapidly changing. Although the Thai Transformation with a focus on customer centricity to economy grew at a reasonable pace, the second increase the Bank resilience in the face of emerging half of the year was fraught with challenges from disruptions. Through the Transformation programme, global economic slowdown and vulnerability from the Bank focuses on developing digital and data the US-China trade war. Moreover, technological analytics capabilities to best enhance its service disruption and shift in customer behaviour to quality as well as forming strategic partnerships emphasise convenience and financial solutions for across different industries to develop platforms and new lifestyles have forever altered the landscape ecosystems that can deliver personalised product for the banking industry.