The Imf: the Second Coming?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic Commission for Latin America Annual Report

E/3857/Rev.2 E/CN.12/AC.57/15/Rev.2 ECONOMIC COMMISSION FOR LATIN AMERICA ANNUAL REPORT (18 May 1963 - 14 February 1964) ECONOMIC AND SOCIAL COUNCIL OFFICIAL RECORDS : THIRTY-SEVENTH SESSION SUPPLEMENT No. 4 UNITED NATIONS ECONOMIC COMMISSION FOR LATIN AMEBICA ANNUAL REPORT (18 May 1963 - 14 February 1964) ECONOMIC AND SOCIAL COUNCIL OFFICIAL RECORDS : THIRTY-SEVENTH SESSION SUPPLEMENT No. 4 UNITED NATIONS New York, 1964 NOTE Symbols of United Nations documents are composed of capital letters combined with figures. Mention of such a symbol indicates a reference to a United Nations document. E/3857/Rev.2 E/CN.12/AC.57/15/Rev.2 CONTENTS Paragraphs Page Abbreviations V Introduction 1 1 Part I. WORK OF THE COMMISSION SINCE THE TENTH SESSION . 2 - 275 1 General background 2 - 22 1 A. ACTIVITIES OF SUBSIDIARY BODIES • 23 - 66 6 Central American Economic Co-operation Committee . 24 - 66 6 B. OTHER ACTIVITIES ..... 67 - 246 14 Meetings and seminars . 68 - 85 14 Economic Development and Research Division . 86 - 102 18 Social Affairs Division . 103 - 127 22 Industrial Development Division . 128 - 148 26 Trade Policy Division . 149 - 163 30 Joint ECLA/FAO Agriculture Division . i64 - 175 33 Natural Resources and Energy Programme . 176 - 188 35 Transport Programme . 189 - 193 37 Statistical Division . 194 - 207 39 Mexico Office . 208 - 2i4 41 Washington Office • 215 - 216 42 Joint ECLA/BNDE Centre for Economic Development . 217 - 225 42 Technical Assistance . 226 - 235 44 United Nations Special Fund . 236 - 237 45 United Nations Headquarters and regional economic commissions . 238 - 246 46 c. RELATIONS WITH SPECIALIZED AGENCIES AND OTHER ORGANIZATIONS . -

![[ 1988 ] Part 7 Chapter 9 International Monetary Fund (IMF)](https://docslib.b-cdn.net/cover/6610/1988-part-7-chapter-9-international-monetary-fund-imf-1746610.webp)

[ 1988 ] Part 7 Chapter 9 International Monetary Fund (IMF)

International Monetary Fund 945 Chapter IX International Monetary Fund (IMF) The International Monetary Fund (IMF), a forum adjustment. The facilities and policies through in which its member States discuss global mone- which it provided such support differed, depend- tary issues and related economic matters, aims to ing on the nature of the macro-economic and assist them to develop sound policies and so en- structural problems to be addressed and the gender a stable international economic and finan- terms and degree of conditionality attached to cial environment. The Fund provides members them. with advice on economic and financial policies, Stand-by arrangements, typically covering lends money to members that are undertaking eco- periods of one or two years, focus on specific nomic reforms to overcome balance-of-payments macro-economic policies, such as exchange rate difficulties and makes available to them informa- and interest policies, aimed at overcoming tion and technical assistance. balance-of-payments difficulties. Extended ar- Each member contributes to IMF’s pool of rangements, which support medium-term pro- financial resources an amount of money, called a grammes generally running for three years, are quota subscription, roughly proportional to its available to overcome more intractable balance- standing in the world economy. As at December of-payment difficulties, attributable to structural 1988, aggregate quotas, measured in special draw- as well as macro-economic problems. ing rights (SDRs)-the Fund’s unit of account- In September, the Interim Committee of the amounted to SDR 90 billion ($130 billion). The Board of Governors on the International Mone- amount a member has contributed determines its tary System, a 22-member advisory body repre- voting power and how much it can borrow from senting the same constituencies as in the Fund’s the Fund. -

Executive Boards in International Organizations: Lessons for Strengthening IMF Governance

BP/08/08 Executive Boards in International Organizations: Lessons for Strengthening IMF Governance Leonardo Martinez-Diaz Global Economy and Development Program The Brookings Institution Address. 700 19th Street, N.W., Washington D.C. 20431, U.S.A. Telephone. +1 202 623 7312 Fax. +1 202 623 9990 Email. [email protected] Website. www.ieo-imf.org 2 © 2008 International Monetary Fund BP/08/08 IEO Background Paper Independent Evaluation Office of the International Monetary Fund Executive Boards in International Organizations: Lessons for Strengthening IMF Governance Prepared by Leonardo Martinez-Diaz Political Economy Fellow The Brookings Institution Revised May 2008 Abstract To identify ways to strengthen the IMF’s Executive Board in its various functions, this paper compares and contrasts that governing body with the executive boards of eleven other intergovernmental organizations (IGOs). The paper identifies four key roles that IGO executive boards are expected to play—those of political counterweight, performance police, democratic forum, and strategic thinker—and assesses how well the boards of the eleven organizations are equipped to play these roles. The exercise allows us to identify three “models” of governance, each with different strengths and weaknesses. The paper concludes that the twin crises of relevance and legitimacy that the IMF is currently facing are closely related to the Fund’s adherence to a particular model of governance. This model gives major shareholders close control via the Executive Board over the use of the financial resources they provide, but this control is maintained at the expense of the Board’s capacity to act as strategic thinker, performance police, and democratic forum. -

1980 UN Yearbook

International Civil Aviation Organization 1313 Alexandre Kafka (Brazil) José Gabriel-Pena (Dominican Republic) Brazil. Colombia. Dominican Republic. Ecua- dor, Guyana, Haiti, Panama, Suriname, Trin- idad and Tobago Morteza Abdollahi (Iran) Omar Kabbaj (Morocco) Afghanistan, Algeria, Ghana, ha”. Morocco, Oman, Tunisia Zhang Zicun (China) Tal Qianding (China) Chins Juan Carlos Iarezza (Argentina) Raul Salazar (Peru) Argentina, Bolivia, Chile. Paraguay, Peru. Uru- guay Samuel Nana-Sinkam (United Republic of Abderrahmane Alfidja (Niger) Benin, Cape Verde. Central African Republic. Cameroon) Chad, Comoros, Congo, Djibouti, Equatorial Guinea, Gabon, Guinea-Bissau, Ivory Coast, Madagascar, Mali. Mauritania, Mau- ritius, Niger. Sac Tome and Principe, Sene- gal, Togo, United Republic of Cameroon, Upper Volta, Zaire NOTE: Democratic Kampuchea, Egypt, Rwanda and South Africa did not participate In the 1980 regular election of Executive Directors. Annex III. PRINCIPAL OFFICERS AND OFFICES OF THE INTERNATIONAL MONETARY FUND (As at 31 December 1980) PRINCIPAL OFFICERS Managing Director: J. de Larosière. Director, Legal Department: George Nicoletopoulos. Deputy Managing Director: William B. Dale. Director, Middle Eastern Department: A. Shakour Shaalan. Counsellor: Walter O. Habermeier.a Director, Research Department: William C. Hood. Economic Counsellor: William C. Hood.a Secretary, Secretary's Department: Leo Van Houtven. Counsellor: L. A. Whittome.a Treasurer. Treasurer’s Department: Walter O. Habermeier. Director: Adjustment Studies: Charles F. Schwartz. Director, Western Hemisphere Department: E. Walter Robichek. Director, Administration Department: Roland Tenconl. Director, Office of External Relations: Azizali F. Mohammed. Director, African Department: J. B. Zulu. Director, Bureau of Language Services: Bernardo T. Rutgers. Director. Asian Department: Tun Thin. Director, Bureau of Statistics: Werner Dannemann. Director, Central Banking Department: P. -

Relations Between Brazil and Philippines: an Overview Ministry of External Relations

RELATIONS BETWEEN BRAZIL AND PHILIPPINES: AN OVERVIEW MINISTRY OF EXTERNAL RELATIONS Foreign Minister Ambassador Celso Amorim Secretary General Ambassador Antonio de Aguiar Patriota ALEXANDRE DE GUSMÃO FOUNDATION President Ambassador Jeronimo Moscardo The Alexandre de Gusmão Foundation (Funag) was established in 1971. It is a public foundation linked to the Ministry of External Relations whose goal is to provide civil society with information concerning the international scenario and aspects of the Brazilian diplomatic agenda. The Foundations mission is to foster awareness of the domestic public opinion with regard to international relations issues and Brazilian foreign policy. Ministry of External Relations Esplanada dos Ministérios, Bloco H Anexo II, Térreo 70170-900 Brasília, DF Telephones: (61) 3411-6033/6034/6847 Fax: (61) 3411-9125 Site: www.funag.gov.br JOSÉ CARLOS BRANDI A LEIXO Relations between Brazil and Philippines: an overview Translated by Susan Casement Sergio Ferrez and José Carlos Brandi Aleixo Brasília, 2010 Copyright © by José Carlos Brandi Aleixo Fundação Alexandre de Gusmão Ministério das Relações Exteriores Esplanada dos Ministérios, Bloco H Anexo II, Térreo 70170-900 Brasília DF Telefones: (61) 3411-6033/6034 Fax: (61) 3411-9125 Site: www.funag.gov.br E-mail: [email protected] Capa: Antonio Saura - Cabeza - 1986 Técnica mixta sobre cartón - 26,8 x 22,9 cm Equipe Técnica: Maria Marta Cezar Lopes Cíntia Rejane Sousa Araújo Gonçalves Erika Silva Nascimento Fernanda Leal Wanderley Henrique da Silveira Sardinha Pinto Filho Juliana Corrêa de Freitas Translated from the Original: Relações entre Brasil e Filipinas: uma visão abrangente by Susan Casement, Sergio Ferrez and the Author. Revised by: Sergio Ferrez, Teresita Barsana and the Author. -

Sustaining the International Economic System: Issues for U.S

ESSAYS IN INTERNATIONAL FINANCE No. 121, June 1977 SUSTAINING THE INTERNATIONAL " ECONOMIC SYSTEM: ISSUES FOR U.S. POLICY MARINA v. N. WHITMAN INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey This is the one hundred and twenty-first number in the series ESSAYS IN INTERNATIONAL FINANCE, published from time to time by the International Finance Section of the Department of Economics of Princeton University. The author, Marina v. N. Whitman,is Distinguished Pub- lic Service Professor of Economics at the University of Pitts- burgh. She has served as a member of the Price Commission and of the Council of Economic Advisers. In addition to articles in various professional journals, she is the author of GOVERNMENT RISK SHARING IN FOREIGN INVESTMENT (1965) and of two Studies and one Special Paper in the series pub- lished by the International Finance Section. The Section sponsors the essays in this series but takes no further responsibility for the opiniono expressed in them. The writers are free to develop their topics as they wish. PETER B. ICENEN, Director International Finance Section ESSAYS IN INTERNATIONAL FINANCE No. 121, June 1977 SUSTAINING THE INTERNATIONAL ECONOMIC SYSTEM: ISSUES FOR U.S. POLICY MARINA v. N. WHITMAN INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey Copyright © 1977, by International Finance Section Department of Economics, Princeton University Library of Congress Cataloging in Publication Data Whitman, Marina von Neumann. Sustaining the international economic system. (Essays in international finance; no. 121 ISSN 0071-142X) Includes bibliographical references. 1. International economic relations. 2. United States—Foreign economic relations. -

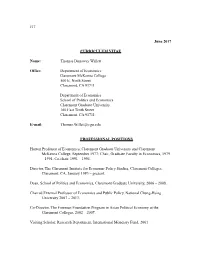

J17 June 2017 CURRICULUM VITAE Name: Thomas Dunaway Willett

J17 June 2017 CURRICULUM VITAE Name: Thomas Dunaway Willett Office: Department of Economics Claremont McKenna College 500 E. Ninth Street Claremont, CA 91711 Department of Economics School of Politics and Economics Claremont Graduate University 160 East Tenth Street Claremont, CA 91711 E-mail: [email protected] PROFESSIONAL POSITIONS Horton Professor of Economics, Claremont Graduate University and Claremont McKenna College, September 1977; Chair, Graduate Faculty in Economics, 1979 – 1991, Co-chair, 1991 – 1994. Director, The Claremont Institute for Economic Policy Studies, Claremont Colleges, Claremont, CA, January 1983 – present. Dean, School of Politics and Economics, Claremont Graduate University, 2006 – 2008. Chaired External Professor of Economics and Public Policy, National Chung-Hsing University 2007 – 2013. Co-Director, The Freeman Foundation Program in Asian Political Economy at the Claremont Colleges, 2002 – 2007. Visiting Scholar, Research Department, International Monetary Fund, 2001. Director, July 1990 to December 1991, The Lowe Institute of Political Economy, Claremont McKenna College; Associate Director, December 1991 – August 1996. Adjunct Scholar, American Enterprise Institute for Public Policy Research, 1977-1987. Director of Research and Senior Advisor for International Economic Affairs; Director of International Monetary Research, U.S. Treasury, July 1975 – August 1977. Adjunct Lecturer, School of Advanced International Studies, Johns Hopkins University, 1976. Deputy Assistant Secretary of the Treasury for International Affairs - Research, December 1972 – July 1975. Professor, Associate Professor of Economics and Public Affairs, Graduate School of Business and Public Administration, Cornell University, 1970 – 1972. Senior Consultant to the Deputy Assistant Secretary for Research, Office of the Assistant Secretary for International Affairs, Department of the Treasury, 1970 – 1972. Adjunct Associate Professor of International Economics, Fletcher School of Law and Diplomacy, Fall semester, 1970. -

The Evolution of the International Monetary Fund

ESSAYS IN INTERNATIONAL FINANCE No. 135, December 1979 THE EVOLUTION OF THE INTERNATIONAL MONETARY FUND FRANK A. SOUTHARD, JR. INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey This is the one hundred and thirty-fifth number in the series ESSAYS IN INTERNATIONAL FINANCE, published from time to time by the International Finance Section of the Department of Economics of Princeton University. The author, Frank A. Southard, Jr., was Professor of Eco- nomics at Cornell University and held positions as Director of the Office of International Finance in the Treasury De- partment, Deputy Director of Research in the Board of Governors of the Federal Reserve System, and U.S. Execu- tive Director and subsequently Deputy Managing Director of the International Monetary Fund. He is the author of books and articles in the field of international finance, in- cluding FOREIGN EXCHANGE PRACTICE AND POLICY and THE FINANCES OF EUROPEAN LIBERATION. The Section sponsors the Essays in this series but takes no further responsibility for the opinions expressed in them. The writers are free to develop their topics as they wish. PETER B. KENEN, Director International Finance Section ESSAYS IN INTERNATIONAL FINANCE No. 135, December 1979 THE EVOLUTION OF THE INTERNATIONAL MONETARY FUND FRANK A. SOUTHARD, JR. INTERNATIONAL FINANCE SECTION DEPARTMENT OF ECONOMICS PRINCETON UNIVERSITY Princeton, New Jersey V" INTERNATIONAL FINANCE SECTION EDITORIAL STAFF Peter B. Kenen, Director Ellen Seiler, Editor Susan Ciotti, Editorial Aide Kaeti Isaila, Subscriptions and Orders Library of Congress Cataloging in Publication Data Southard, Frank Allan, 1907- The evolution of the International Monetary Fund. (Essays in international finance; no. -

Accounting for the Role of Epistemic Communities in Developing Brazilian Statistics from the 1930S to 1980S

Accounting for the role of epistemic communities in developing Brazilian statistics from the 1930s to 1980s Fickle Formulas Working Paper 07-2020. Roberto Barbosa de Andrade Aragão University of Amsterdam November 2020 1 Accounting for the role of epistemic communities in developing Brazilian statistics from the 1930s to 1980s Roberto Barbosa de Andrade Aragao University of Amsterdam [email protected] Last update: November 2020 ABSTRACT. This paper studies three moments in the emergence of Brazilian statistics: first, the creation of the Brazilian Official Statistical Office in the 1930s; second the first economic indicators produced by the FGV in the 1940s; and finally, the transference of economic statistics production to the IBGE in the 1980s. I found that epistemic communities played an important role in creating and developing Brazilian economic statistics. More interestingly, access to knowledge from outside Brazil through migrants, conferences, and technical partnerships were important conduits for these changes to take place. Furthermore, understanding the reasons for the construction of Brazilian gauges explains the kind of relationship Brazilian society has with its statistics and the degree of independence its statistical offices enjoy. Word count: Keywords. political economy of statistics; epistemic communities; sociology of quantification How GDP Traveled to China: the unpaved road to harmonization www.fickleformulas.org 2 Introduction1 Economic indicators play a crucial role in the decision-making process of modern societies. From the evaluation of government performance to the equitability of the latest salary increase, numbers expressed in economic indicators such as GDP and inflation receive wide attention and are deemed to shape how people perceive the reality around them (Lewis-Beck & Stegmaier, 2000; Soroka, Stecula & Wlezien, 2015). -

Alexandre Kafka

II Alexandre Kafka Brasília 2019 História Contada do Banco Central do Brasil II Alexandre Kafka Ficha Catalográfica elaborada pela Biblioteca do Banco Central do Brasil – v. 2 Banco Central do Brasil Alexandre Kafka / Banco Central do Brasil – Brasília : Banco Central do Brasil, 2019. 206 p. ; 23 cm – (Coleção História Contada do Banco Central do Brasil; v. 2) I. Banco Central do Brasil – História. II. Entrevista. III. Kafka, Alexandre. IV. Título. V. Coleção. CDU 336.711(81)(091) Apresentação (edição atual) O Banco Central do Brasil tem mais de 50 anos. A realização de entrevistas orais com personalidades que contribuíram para a sua construção faz parte da memória dessa Instituição, que tão intimamente se vincula à trajetória econômica do país. Essas entrevistas são apresentadas nesta Coleção História Contada do Banco Central do Brasil, que complementa iniciativas anteriores. É um privilégio poder apresentar esta Coleção. As entrevistas realizadas permitem não apenas um passeio pela história, mas também vivenciar as crises, os conflitos, as escolhas realizadas e as opiniões daqueles que deram um período de suas vidas pela construção do Brasil. Ao mesmo tempo, constituem material complementar às fontes históricas tradicionais. O conjunto de depoimentos demonstra claramente o processo de construção do Banco Central como instituição de Estado, persistente no cumprimento de sua missão. A preocupação com a edificação de uma organização com perfil técnico perpassa a todos os entrevistados. Ao mesmo tempo em que erguiam a estrutura, buscavam adotar as medidas de política econômica necessárias ao atingimento de sua missão. É evidente, também, a continuidade de projetos entre as diversas gestões, viabilizando construções que transcendem os mandatos de seus dirigentes. -

![[ 1992 ] Part 7 Chapter 9 International Monetary Fund (IMF)](https://docslib.b-cdn.net/cover/4747/1992-part-7-chapter-9-international-monetary-fund-imf-6604747.webp)

[ 1992 ] Part 7 Chapter 9 International Monetary Fund (IMF)

1140 Intergovernmental organizations Chapter IX International Monetary Fund (IMF) During 1992, the International Monetary Fund according to IMF policy. Access to the Fund’s (IMF) increased its assistance to the formerly cen- general resources under the enlarged. access policy trally planned economies in transition to market- had been subject to annual limits of 90 or 110 per based systems and focused on initiatives to im- cent of quota, three-year limits of 270 or 330 per prove prospects for the world economy. cent of quota and cumulative limits of 400 or 440 IMF provided the machinery for, and promoted, per cent of quota. Once borrowed resources were international monetary cooperation through sur- fully used, ordinary resources were substituted to veillance of the exchange-rate policies of its mem- meet commitments. The substitution was applica- ber States. Surveillance was carried out through ble until 30 September 1992. In November, the consultations analysing the economic and finan- Ninth General Review of Quotas took effect, in- cial conditions of IMF members and regular dis- creasing the amount of IMF quotas to 144.8 bil- cussions on the world economic outlook. lion special drawing rights (SDRs) from SDR 97.4 IMF operates on a fiscal year; fiscal year 1992 billion. covered the period from 1 May 1991 to 30 April The structural adjustment facility (SAF), 1992. launched in 1986,a provided balance-of-payments As at 31 December 1992, IMF membership assistance on concessional terms to support stood at 175, with the admission of Armenia, Azer- medium-term macroeconomic adjustment and baijan, Belarus, Croatia, Estonia, Georgia, structural reform in low-income countries facing Kazakhstan, Kyrgyzstan, Latvia, Lithuania, the protracted balance-of-payments problems. -

The Minerva Program

THE MINERVA PROGRAM The Theory and Operation of a Modern National Economy The Minerva Program is a sixteen-week economics training program especially designed for Brazilian government officials. The Program’s objective is to give the participants anaccurate, though concise, summary of modern market economics. The program emphasizes the importance of good public administration and of responsible, ethical public servants. The following modules and topics comprise the core of the Minerva Program: • Principles of Microeconomics • Principles of Macroeconomics • International Trade Theory • Hemispheric Trade Integration • The Role of the Financial System • The Role of Government • Latin American Social Trends • Issues in Development • Intellectual Property Rights • The Institutions Necessary for a Liberal Economy • Policies for Sustained Brazilian Economic Growth The basic economic modules are led by professors from the George Washington University. Special topic modules are addressed by distinguished speakers from the University as well as from the multilateral agencies and the business sector. The following are some of the speakers who have participated in the Minerva Program: Dr. Uri Dadush, World Bank - Trends in the Global Economy; Dr. Sebastian Edwards, World Bank - Latin American Economic Policy Trends; Dr. David Fleischer, University of Brasília - Corruption, Governability and Brazilian Political Reform; Dr. Paul Holden, World Bank - Unshackling the Private Sector; Dr. Alexandre Kafka, IMF - Policies for Sustained Brazilian Growth; Dr. Paulo Leme, Goldman-Sachs - Private Sector View of Government Decisions; Dr. Claudio de Moura Castro, IDB - Social Trends in Latin America; Dr. John Page, World Bank - The ‘Asian Tigers’ Experience; Dr. Carlos Primo Braga, World Bank - Policies for Sustained Brazilian Growth; Dr. Carmen Reinhart, IMF - Capital Movements; Dr.