Ports and Logistics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Economic Gateway for the Nation

Adani Ports and Special Economic Zone Limited An Economic Gateway for the Nation Thinking big Doing better Everyone has a philosophy or a set of rules they work by. Ours is Thinking big, Doing better. Over the course of 25 years, we discovered that starting a large scale business has served not only us, but also the nation. This in turn has affected millions of lives, making them simpler and better. This is why we think big, so we can do better. Each action we take ripples throughout the society and benefits people in ways we never even dreamt of. Adani Ports and Special Economic Zone Limited is an undisputed leader in the Indian port sector. 1 Adani Ports and Special Economic Zone APSEZ provides seamlessly integrated Exceptional features of APSEZ services across three verticals, i.e. Ports Ports, Logistics and SEZ • Deep water, all-weather, direct berthing • One stop solution for business facilities • Pan-India presence • Large scale mechanisation • Largest integrated infrastructure company • Connectivity to national highway and • Dedicated, committed and passionate rail networks team to provide superior services • Scope for major expansion at our ports • Technology driven system and processes • Operational benchmarks comparable to the best in the world 2 3 Strategic Advantages at Adani Kila - Raipur Patli Kishangarh Mundra Tuna Dahej Dhamra Hazira Vizag Ports Mormugao Terminals ICDs Kattupalli Ennore Vizhinjam Adani Ports: Pioneer on multiple fronts • Single window interface system for • Specialised infrastructure evolved customers that -

AIIM LAW Brochure 2019 A4 Fi

Adani Institute of Infrastructure Management (AIIM) Post-Graduate Diploma in Management (Law) AICTE-approved 2-year Full-time Program 'Legal & regulatory' expertise in infrastructure management Adani Institute of Infrastructure Management (AIIM) Pioneering Institute of Infrastructure in the Country Adani Institute of Infrastructure Management (AIIM) was founded in 2009 by the promoters of the Adani Group with a vision to establish an institution of excellence that provides world- class education and training to young professionals to shoulder managerial responsibilities in the infrastructure sector. AIIM is India's pioneering institute exclusively focused on research, education and training in the field of infrastructure management. It aims to create a pool of nation-builders and future business leaders. AIIM is an institute of excellence offering specially-designed programs with a curriculum aligned to the needs and aspiration of the infrastructure industry. At AIIM, students are groomed into becoming trained professionals who wish to take managerial and leadership positions in the infrastructure sector, with a unique blend of strong conceptual, analytical, and decision-making abilities. The students are provided with a perfect learning environment for intellectual stimulation and professional growth through interactions with highly-acclaimed faculty and distinguished industry captains. AIIM offers 2 flagship programs: • PGDM (Infrastructure Management) • PGDM (Law) A host of customized short-term Management Development Programs (MDPs) and industry- specific Executive Programs in Management are also part of the AIIM offerings. Our Well-wishers “PGDM (Law) by AIIM is a unique initiative to develop infrastructure 'legal and regulatory' practitioners. We will advise, train and mentor the students and be a part of creating an eco-system for infrastructure 'legal and regulatory' education.” Shri Vikram Nankani, Shri Cyril Shroff, Shri Amit Kapur, Sr. -

Adani Petronet (Dahej) Port Pvt

ADANI PETRONET (DAHEJ) PORT PVT. LTD INTEGRATED MANAGEMENT SYSTEM FORMATS MANUAL 0BMAR/F/003 1BADANI PETRONET DAHEJ PORT – PORT INFORMATION BOOK ADANI PETRONET (DAHEJ) PORT PVT. LTD PORT & TERMINAL INFORMATION BOOK WELCOMES THE MASTER, OFFICERS & CREW OF MV ________________________ Revised dated: 20-12-17 Reviewed By : Capt Vijesh Parasar Issue No : 00 Issued on : 01/07/2016 Approved By : Capt Ashish Singhal Revision No : 01 Page No. : 1 of 12 ADANI PETRONET (DAHEJ) PORT PVT. LTD INTEGRATED MANAGEMENT SYSTEM FORMATS MANUAL TABLE OF CONTENTS INTRODUCTION LETTER .........................................................................................................3 STANDARD MESSAGE – INBOUND VESSEL ..........................................................................4 PORT AND TERMINAL INFORMATION……………………………………………………………………………………………..........................................5 • Port Detail • Weather • VTMS Services at Gulf of Khambhat • Adani Dahej Port Anchorage instructions • Pilot Boarding ground and picking up pilot • Mooring Arrangements • Vessel equipments & mooring winches • Tidal information • Adani Dahej Port at berth Instructions • Security • Services at APDPPL • Charts • Dry cargo handling • Safety • Pollution • Emergency • Website link • Mooring Pattern • Dahej Port Reviewed By : Capt Vijesh Parasar Issue No : 01 Issued on : 01/07/2016 Approved By : Capt Ashish Singhal Revision No : 01 Page No. : 2 of 12 ADANI PETRONET (DAHEJ) PORT PVT. LTD INTEGRATED MANAGEMENT SYSTEM FORMATS MANUAL Dear Captain, We welcome you and crew to Adani Petronet(Dahej) Port Pvt.Ltd A. For your information and compliance, we enclose the following documents. a. Condition of Use Document b. Safety & Pollution Prevention Requirements. c. General Information B. Please note that “CONDITION OF USE” letter is a legal document and is to be filled up, signed, stamped and delivered to the pilot before commencement of Pilotage. The following documents are to be completed and handed over to the Pilot. -

“Adani Ports and Special Economic Zone Limited FY20 Earnings Conference Call” May 06, 2020

“Adani Ports and Special Economic Zone Limited FY20 Earnings Conference Call” May 06, 2020 MANAGEMENT: MR. ADANI – CHIEF EXECUTIVE OFFICER, ADANI PORTS AND SEZ LIMITED MR. DEEPAK MAHESHWARI – CHIEF FINANCIAL OFFICER AND HEAD OF STRATEGY, ADANI PORTS AND SEZ LIMITED MR. JEET ADANI – VICE PRESIDENT, ADANI GROUP MODERATOR: MR. ADITYA MONGIA – KOTAK SECURITIES LIMITED Page 1 of 25 Adani Ports and Special Economic Zone Limited May 06, 2020 Moderator: Ladies and gentlemen, good day. And welcome to the Adani Ports and SEZ FY20 Earnings Conference Call, hosted by Kotak Securities Limited. As a reminder, all participant lines will be in the listen-only mode. And there will be an opportunity for you to ask questions after the presentation concludes. Should you need assistance during the conference call, please signal an operator by pressing ‘*’ then ‘0’ on your touchtone phone. I would now like to hand the conference over to Mr. Aditya Mongia from Kotak Securities Limited. Thank you and over to you, sir. Aditya Mongia: Thank you, Lizann. Thank you to everybody here on the call to cover FY20 Adani Ports and SEZ call. From the management side we have Mr. Adani – the CEO; and Mr. Deepak Maheshwari – the CFO and Head of Strategy; Mr. Robbie Singh – Group CFO; and Mr. Jeet Adani – VP, Adani Group, as well as other members of the management team. At the onset, I would want to, first of all, congratulate Adani Ports for a fairly good performance, both in volumes as well as on the balance sheet. And would also want to thank them for the increased amount of disclosures which are now there as part of the presentation. -

Integrated Information Management for Operational Excellence

Integrated Information Management for Operational Excellence Presented by Vijendra Pancholi Agenda About Adani Group Need And Solution Mercury(Port Information System) Advantage and Benefits of system 2 Contents Sections About Adani Group Overview Mercury Overview Advantages / Benefits 3 The Adani Group Leading Business Conglomerate with interest in diversified sectors... Resources Logistics Energy Sourcing hydrocarbons from Owning a large network of ports, Leading player in around the world to fuel India’s railways, ships and operate various private sector power generation growth facilities around our ports Resources Logistics Energy • Gas Distribution • Coal Mining • Multi Modal Logistics • Power • Oil & Gas Exploration •Ports • Bunkering • Coal Trading • Special Economic Zones • Grain Silos & Fruits • Edible Oil 4 The Adani Group Adani Group has 3 listed companies…. Adani Enterprises Limited Adani Power Limited Adani Ports & SEZ Limited (AEL) (APL) (APSEZ) 5 Adani Ports Infrastructure Helping India build Port Capacity………………. • Adani initially started its first port at Mundra location. Later on it has aggressively added new Indian & Overseas ports to its portfolio. • Adani Ports is targeting to achieve the mammoth figure of 200 million MT per annum Indian cargo handling by 2020 • In the last fin year Adani Ports (India) handled over 100 Million MT of cargo 6 Adani Ports Infrastructure Helping India build Port Capacity………………. Year of Operations Planned Indian Ports & Terminals Location Existing Capacity (expected) Capacity Adani Mundra Port Mundra, Gujarat 1998 165 240 Adani Petronet (Dahej) Port Pvt. Ltd. Dahej, Gujarat 2010 20 20 Adani Abbot Point Terminal Pty Ltd Australia 2011 50 100 Adani Hazira Port Private Ltd. Hazira, Gujarat 2012 25 75 Adani Murmugoa Coal Terminal Pvt. -

Adani Corporate Catalogue

Adani Group Corporate Brochur Adani Group Adani Corporate House Shantigram, S G Highway Ahmedabad 382 421 Gujarat, India e | January 2020 Contact us: [email protected] [email protected] Adani Group Corporate Brochure www.adani.com Growth, the way it is meant to be. Growth, to us, isn't about the businesses we're involved in. Growth is about the real impact we can create. It's about the lives we can touch, the communities we can nourish, the future we can inspire. With our sheer size of operations, we have been able to reach out to the remotest of geographies with ease. Be it power transmission or solar energy generation or agri logistics, we go for large scale execution that benefits millions of Indians. We are proud of this quality of our operations, which we have consciously extended beyond our businesses, to impact healthcare, education, employment generation, and creation of sustainable livelihood for the communities that deserve them. It is the belief that growth can lead to goodness, which inspires us and drives us. Not India’s largest inte grated conglomerate, India’s largest goodness creators. A quick glance Adani group's performance for the financial year 18-19. Our diversified businesses have been working round the clock to meet our core objective, that is of Nation Building. Racing ahead of others can surely reserve the apex seat, but how far will it take us Revenue Assets is a question that keeps surfacing in our retrospection. We believe that $13 Billion $31.2 Billion the Adani Group is not in the business of Resource, Logistics, Energy and Agri, Ebitda Workforce rather it strives to transform lives by means of creating opportunities for employment and a sustainable livelihood $3.3 Billion 16,000+ using our business as the medium to attain these goals of goodness. -

Mundra Port and Special Economic Zone Ltd

MUNDRA PORT AND SPECIAL ECONOMIC ZONE LTD. December 23, 2011 BSE Code: 532921 NSE Code: MUNDRAPORT Reuters Code: MPSE.NS Bloomberg Code: MSEZ:IN Mundra Port and Special Economic Zone Ltd (MPSEZ) is engaged in the Market Data business of developing and operating the largest private port in India, the Rating ACCUMULATE Mundra Port. It is also engaged in developing other port based related infrastructure facilities, including multi product Special Economic Zone. With a CMP (`) 125 Target (`) capacity to handle million tonnes of cargoes ranging from Bulk cargo like coal, 162 fertilizer, petroleum products to container cargo and automobiles, MPSEZ has Potential Upside ~30% marked a record handling of 1.23 million TEU’s in FY11. The company is also is Duration Long Term 52 week H/L (`) 169.7/115.2 in the process of setting up coal import terminal at Vishakhapatnam. All time High (`) 249 Decline from 52WH (%) 26.4 Investor’s Rationale Rise from 52WL (%) 13.6 Beta 0.84 During Q2FY12, MPSEZ reported an impressive revenue growth of 50% Mkt. Cap (` mn) 251,784 (y-o-y) at `6.2 billion backed by significant volume growth in dry cargo, bulk and Enterprise Val (` mn) 287,347 liquid cargo. Going further, we expect MPSEZ’s superior infrastructure and Fiscal Year Ended natural advantages to drive its rapid pace of growth with strong volumes FY10A FY11A FY12E FY13E improvement. With the overall growth in line with its plan, MPSEZ is expected to Revenue (`mn) 14,955 20,001 26,001 35,101 mark significant revenue growth of 25-30% in FY12E. -

Lpg Import Jetty at Dahej, Gujarat

LPG IMPORT JETTY AT DAHEJ, GUJARAT PRE - FEASIBILITY REPORT JUNE 5, 2021 HINDUSTAN PETROLEUM CORPORATION LIMITED MUMBAI PFR for the proposed construction of LPG Import Jetty with dispatch station and Onshore pipeline to Vadadora at Dahej village, Bharuch District, Gujarat. Table of Contents EXECUTIVE SUMMARY .................................................................................................................... 4 1 INTRODUCTION ....................................................................................................................... 5 1.1 Identification of Project & Proponent .............................................................................. 5 1.2 Description & Nature of the Project ................................................................................. 6 1.3 Need for the Project ......................................................................................................... 7 1.4 Demand-Supply Gap ......................................................................................................... 7 1.5 Imports vs Indigenous Production .................................................................................... 8 1.6 Employment Generation due to the Project .................................................................... 8 1.7 Codes and Standards ........................................................................................................ 8 2 PROJECT DESCRIPTION ........................................................................................................ -

Chemicals and Petrochemicals Sector Profile Indian Chemicals and Petrochemicals Industry: Quick Facts

Chemicals and Petrochemicals Sector Profile Indian Chemicals and Petrochemicals Industry: Quick Facts Turnover of the th 6th largest in the US$ 92 Bn industry in India 6 world by turnover Share in Gross Value 2.2% Share in global output 7.1% Added within national manufacturing sector 7th largest importer 17th largest exporter of th of chemicals in the th 7 17 chemicals in the world world US$ 14.4 th Cumulative FDI 8th 8 highest cumulative FDI Bn attracted by the sector* earning sector for India 2 Snapshot of Gujarat’s chemicals and petrochemicals industry Gujarat accounts for 62 % of India’s petrochemical production, 30% India’s first 4 refining of other chemicals World’s largest operational complexes with Petroleum, Chemicals production & 40% grassroots combined capacity refinery in and Petrochemicals of 102 MMTPA of chemical Investment Region providing Jamnagar (PCPIR) exports (organic feedstock and inorganic) India’s first Presence of more than 4,400 industrial 6500 chemicals & • 50% share in chemical port in units that petrochemicals are exports of Dahej Inorganic manufacture being produced chemicals and Chemicals chemical products • 39% share in exports of Organic Chemicals Source: Annual Survey of Industries 2014-15; Chemicals & Petrochemicals Statistics at a glance: 2017, Ministry of Chemicals & Fertilizers, Department of Chemicals & Petrochemicals, 3 Government of India Growth drivers for Gujarat’s chemicals and petrochemicals industry Manufacturing sector contributing over 30% to State GDP. Strong manufacturing sector leads to continued high demand for chemicals, petrochemicals and intermediates Presence of manufacturing units across the chemicals and petrochemicals value chain helps optimize supply chains and logistics costs Demand from the urban consumer: 43% of Gujarat’s population resides in urban areas, Gujarat is a major producer of crops such as wheat, fueling demand for consumer chemicals, plastics, rice, groundnut, bajra, castor, cotton and mango paints, cosmetics etc. -

Press Release Adani Ports and Special Economic Zone Limited

Press Release Adani Ports and Special Economic Zone Limited January 15, 2020 Ratings Amount Facilities Ratings1 Rating Action (Rs. crore) Non-Convertible Debentures CARE AA+; Stable 750.00 Reaffirmed (Proposed) – I [Double A Plus; Outlook: Stable] Non-Convertible Debentures CARE AA+; Stable 40.00 Reaffirmed Issue – II * [Double A Plus; Outlook: Stable] 790.00 Total (Rupees Seven Hundred and Ninety Crore Only) Details of instruments/facilities in Annexure-1 *backed by the escrow of entire receivables of Indian Oil Corporation Ltd for the single point mooring (SPM) facility of APSEZ; ‘Structured Obligation’ (SO) removed in September 2019 pursuant to SEBI circular dated June 13, 2019 Detailed Rationale & Key Rating Drivers The rating assigned to the proposed non-convertible debenture (NCD) issue of Adani Ports and Special Economic Zone Limited (APSEZ) continues to factor in its strong operating efficiency and competitive position as manifested by significant market share in cargo handled across all ports of India, diversified cargo mix with increasing share of container volumes, geographically diverse port assets for longer concession period supported by large marine fleet and logistics assets, long- term contracts with customers and flexibility in determining tariff at seven ports including its landlord Mundra port. Rating also factors growth in cargo volumes during FY19 (refers to the period April 1 to March 31) and H1FY20 (refers to the period from April 01 to September 30) despite slowdown in Exim trade. Rating continues to take into account healthy profitability, demonstrated execution capabilities of APSEZ in the port sector and strong financial flexibility as well as liquidity. The rating assigned to NCD-II continues to take into account of escrow of entire receivables of Indian Oil Corporation Ltd (rated CARE AAA; Stable) for the single point mooring (SPM) facility and maintenance of funded debt service reserve account (DSRA). -

Ports and Logistics

Serial Number: Name of Investor: adani Ports and Logistics Adani Ports and Special Economic Zone Limited Public limited company incorporated under the Companies Act, 1956 with Corporate Identification Number L63090GJ1998PLC034182 Date of Incorporation: 26th May, 1998 Registered Office: Adani House, Mithakhali Six Roads, Navrangpura, Ahmedabad 380 009 Contact person: Mr. Kamlesh Bhagia Email: [email protected] Tel: +91-79-2555 5555; Fax: +91-79-2555 5500; Website: www.adaniports.com INFORMATION MEMORANDUM FOR THE ISSUE OF DEBENTURES ON A PRIVATE PLACEMENT BASIS ISSUE OF 15000 RATED, LISTED, SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE OF RS. 10,00,000/- EACH, AGGREGATING RS. 1500 CRORES ON A PRIVATE PLACEMENT BASIS (THE “ISSUE”) BY ADANI PORTS AND SPECIAL ECONOMIC ZONE LIMITED (THE “ISSUER” OR THE “COMPANY”). This Private Placement Offer Letter (hereinafter referred to as the “Information Memorandum”) is prepared in conformity with Securities and Exchange Board of India (Issue and Listing of Debt Securities) Regulations, 2008 issued vide Circular No. LAD-NRO/GN/2008/13/127878 dated June 06, 2008, as amended by the Securities and Exchange Board of India (Issue and Listing of Debt Securities (Amendment) Regulations, 2012 issued vide Circular No. LAD-NRO/GN/2012-13/19/5392 dated October 12, 2012 and CIR/IMD/DF/18/2013 dated October 29, 2013), Securities and Exchange Board of India Issue and Listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No. LAD-NRO/GN/2013-14/43/207 dated January 31, 2014 and Securities and Exchange Board of India Issue and Listing of Debt Securities (Amendment) Regulations, 2014 issued vide Circular No. -

Rating Rationale

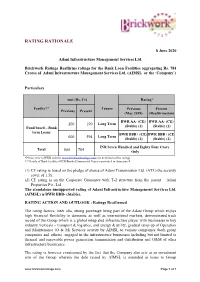

RATING RATIONALE 8 June 2020 Adani Infrastructure Management Services Ltd. Brickwork Ratings Reaffirms ratings for the Bank Loan Facilities aggregating Rs. 784 Crores of Adani Infrastructure Management Services Ltd. (AIMSL or the ‘Company’) Particulars Amt (Rs. Cr) Rating* Facility** Tenure Previous Present Previous Present (May 2019) (Reaffirmation) BWR AA- (CE) BWR AA- (CE) 200 190 Long Term Fund based – Bank (Stable) (1) (Stable) (1) term Loans BWR BBB+ (CE) BWR BBB+ (CE 600 594 Long Term (Stable) (2) (Stable) (2) INR Seven Hundred and Eighty Four Crore Total 800 784 Only *Please refer to BWR website www.brickworkratings.com/ for definition of the ratings ** Details of Bank facilities/NCD/Bonds/Commercial Paper is provided in Annexure-I (1) CE rating is based on the pledge of shares of Adani Transmission Ltd. (ATL) the security cover of 1.5x. (2) CE rating is on the Corporate Guarantee with T-2 structure from the parent – Adani Properties Pvt. Ltd. The standalone unsupported rating of Adani Infrastructure Management Services Ltd. (AIMSL) is BWR BBB- (Stable). RATING ACTION AND OUTLOOK : Ratings Reaffirmed The rating factors, inter alia, strong parentage being part of the Adani Group which enjoys high financial flexibility in domestic as well as international markets, demonstrated track record of the Group which is a global integrated infrastructure player with businesses in key industry verticals – transport & logistics, and energy & utility, gradual ramp-up of Operation and Maintenance (O & M) Services activity by AIMSL to various companies (both group companies and others) engaged in the infrastructure businesses including but not limited to thermal and renewable power generation, transmission and distribution and O&M of other infrastructure businesses.