Board of Directors and Group Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8 November 2007

3i Group plc 6 November 2008 Half-year results for the six months to 30 September 2008 Resilient performance in the face of challenging markets For the six months to 30 September 2008 2007 Business activity Investment £668m £1,234m Realisation proceeds £597m £1,044m Returns Realised profits on disposal of investments £190m £337m Gross portfolio return on opening portfolio value (1.3)% 14.3% Net portfolio return £(128)m £453m Total return £(182)m £512m Total return on opening shareholders’ funds (4.5)% 12.0% Interim dividend per ordinary share 6.3p 6.1p Portfolio and assets under management Own balance sheet £5,934m £5,130m External funds £4,019m £3.053m £9,953m £8,183m Net asset value per share (diluted) £10.19 £10.07 Commentary • Highly selective approach to new investment • Broadly balanced investment and realisations during the period • 32% growth in external funds since September 2007 3i’s Chief Executive, Philip Yea, commented: "The credit and stock markets have deteriorated since late September and the outlook for the global economy continues to weaken. Despite a resilient first six months of the year, we would expect a more challenging second half as the squeeze in credit markets persists, the economic slowdown affects portfolio earnings and M&A markets remain subdued. In such an environment our focus is on managing the portfolio, maintaining liquidity, remaining highly selective with investment and controlling costs. 3i's sector expertise, active partnership approach and close engagement with the strategy of the portfolio companies -

Investor Lunch, New York – 3 March 2006

Investor lunch, New York – 3 March 2006 1 3i team Philip Yea Simon Ball Jonathan Russell Michael Queen Jo Taylor Chris Rowlands Group Chief Executive Group Finance Director Managing Partner Managing Partner Managing Partner Head of Group Markets Buyouts Growth Capital Venture Capital Patrick Dunne Anil Ahuja Gustav Bard Graeme Sword Guy Zarzavatdjian Group Communications Managing Director, India Managing Director, Director, Oil and Gas Managing Director, Director Nordic Region France 2 Investor lunch, New York – 3 March 2006 Contents • Introduction to 3i • The private equity market • Interim results to 30 September 2005 • Investor relations • Closing remarks 3 Investor lunch, New York – 3 March 2006 Introduction to 3i 3i at a glance • A world leader in private equity and venture capital • Established 1945; IPO on London Stock Exchange 1994 (IPO at 272p) • Market capitalisation £5.0bn (as at 31 January 2006) • 3i has invested over £15bn in over 14,000 businesses • Portfolio value £4.4bn, in 1,285 businesses (as at 30 September 2005) • Network of teams located in 14 countries in Europe, Asia and the US • 3i also manages and advises third party funds totalling £1.8bn (as at 30 September 2005) • Member of the MSCI Europe, FTSE100, Eurotop 300 and DJ Stoxx indices 4 Investor lunch, New York – 3 March 2006 Introduction to 3i Our Board • Chairman Baroness Hogg • Six independent non-executive directors − Oliver Stocken (Deputy Chairman; Senior Independent Director) − Dr Peter Mihatsch − Christine Morin-Postel − Danny Rosenkranz − Sir Robert Smith -

Close Brothers Group Plc Annual Report 2006

(1,1) -1- 836858_cover.indd 2/10/06 3:32:35 pm Close Brothers Group plc Annual Report 2006 836858_cover.indd 1 22/10/06/10/06 33:32:35:32:35 ppmm (1,1) -2- 836858_cover.indd 2/10/06 3:32:16 pm 303 Close Brothers is an independent merchant bank and is amongst the top 200 listed companies in the UK. Our goal is to deliver consistent, long term growth in profi t and dividends. We strive to achieve this through our core strategy of specialisation and diversifi cation across a range of fi nancial services and, in particular, by: • focusing on higher margin activities • managing business risk whilst maintaining a healthy return on capital • attracting and supporting management teams of the highest calibre • fostering entrepreneurialism, independent thinking and a willingness to innovate • placing the highest importance on quality, professionalism and integrity in everything we do. 8836858_cover.indd36858_cover.indd 2 2/10/06 3:32:16 pm Close Brothers Group plc Annual Report 2006 1 Our Results at a Glance Profit £157m +21% Financial Highlights 2005 2006 Profit before goodwill and taxation £129m £157m +21% Earnings per share before goodwill 62.0p 74.1p +19% Profit before taxation £112m £157m +41% Earnings per share 49.8p 74.1p +49% Dividends per share 28.5p 32.5p +14% Shareholders’ funds £578m £662m +15% Total assets £4.8bn £4.8bn Operational Highlights • Asset Management profit up 21% to £38 million. FuM up 16% to £8.2 billion. • Corporate Finance record profit of £17 million. • Securities profit up 34% to £48 million. -

3I Group Plc Announces £1.075 Billion Total Return, Investment up 42% and 25% Growth in Assets Under Management

10 May 2007 3i Group plc announces £1.075 billion total return, investment up 42% and 25% growth in assets under management Preliminary results for the year to 31 March 2007 2007 2006 Investment activity Investment £1,576m £1,110m Realisation proceeds £2,438m £2,207m Returns Realised profits on disposal of investments £830m £576m Gross portfolio return on opening portfolio value 34.0% 24.4% Total return £1,075m £831m Total return on opening shareholders’ funds 26.8% 22.5% Final dividend 10.3p 9.7p Portfolio and assets under management Own balance sheet £4,362m £4,139m Third-party funds £2,772m £1,573m £7,134m £5,712m Net asset value per share (diluted) 932p 739p Highlights • A total return of £1,075 million representing a return of 26.8% on opening shareholders’ funds • Investment increased by 42% to £1,576 million • Total assets under management increased by 25% over the year, from £5,712 million to £7,134 million • Realisation proceeds on the sale of assets of £2,438 million generating realised profits of £830 million • Final dividend of 10.3p, making a total ordinary dividend for the year of 16.1p, up 5.9% • Board confirms the return of £800 million to shareholders through a bonus issue of B shares Baroness Hogg, Chairman of 3i Group plc, said: “This has been an exceptional year for 3i. The Group has delivered a high return on shareholders’ funds and a strong cash flow and, most importantly of all, has taken important steps to develop the business for the longer term.” 1 3i’s Chief Executive, Philip Yea, said: “We continue to see good investment opportunities in our chosen areas, albeit that pricing remains high. -

S/1 Records of Hill Samuel & Company

Lloyds TSB Group Archives: Catalogue S/1 Records of Hill Samuel & Company Level: Fonds S/1/a Establishment Level: Series S/1/a/1 Memorandum and articles of association of Hill 1969 Samuel and Company Level: Item S/1/a/2 Memorandum and articles of association of Hill 1969 Samuel Group. Includes copy of certificate of name change from Hill Samuel and Company to Hill Samuel Group Level: Item S/1/b Operation Level: Series S/1/b/1 Minutes of general meetings of Hill Samuel 1920-1978 Group (M.Samuel and Company until March1965; Hill Samuel and Company April 1965 - March 1969) (signed, indexed). Enclosed are papers relating to the proposed merger with Philip Hill, Higginson and Erlangers (1965). Level: Item S/1/b/2 Minutes of meetings of Board of Directors (M. 1965-1970 Samuel and Company record, January - March 1965; Hill Samuel and Company record, April 1965 - March 1969; Hill Samuel Group record, March 1969 - 1970) (indexed and signed). Level: Item S/1/b/3 Minutes of meetings of Board of Directors and 1970-1975 Committee of the Board of Directors (indexed, signed). Level: Item Lloyds TSB Group Archives: Catalogue S/1/b/4 Minutes of meetings of Board of Directors and 1975-1978 Committee of Board of Directors (indexed, signed). Level: Item S/1/b/5 Minutes of meetings of Board of Directors; 1979-1982 Committee of the Board of Directors; Group Chief Executive's Committee; Chairman's Committee; Emoluments Committee; Audit Committee; annual general meetings (indexed, signed). Level: Item S/1/b/6 Minutes of meetings of Committee of the Board 1983-1986 of Directors; Group Chief Executive's Committee; and Emoluments Committee (signed). -

Compulsory Publication in Accordance with Section 14

NON-BINDING ENGLISH TRANSLATION Mandatory publication pursuant to sections 34, 14 paras. 2 and 3 of the German Securities Acqui- sition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – WpÜG) Shareholders of Kabel Deutschland Holding AG, in particular those who have their place of residence, seat (Sitz) or place of habitual abode outside the Federal Republic of Germany should pay particular attention to the information contained in Section 1 “General infor- mation and notes for shareholders”, Section 6.8 “Possible parallel acquisitions” and Sec- tion 11.9 “Note to holders of American Depositary Receipts” of this Offer Document. OFFER DOCUMENT VOLUNTARY PUBLIC TAKEOVER OFFER (Cash Offer) by Vodafone Vierte Verwaltungsgesellschaft mbH (whose change of legal form into a German stock corporation under the company name Vodafone Vierte Verwaltungs AG has been resolved upon) Ferdinand-Braun-Platz 1, 40549 Düsseldorf, Germany to the shareholders of Kabel Deutschland Holding AG Betastraße 6 – 8, 85774 Unterföhring, Germany to acquire all no-par value bearer shares of Kabel Deutschland Holding AG for a cash consideration of EUR 84.50 per Kabel Deutschland Holding AG share In addition, the shareholders of Kabel Deutschland Holding AG shall benefit from the dividend for the financial year ending on 31 March 2013 in the amount of EUR 2.50 per Kabel Deutschland Holding AG share as proposed by Kabel Deutschland Holding AG. If the settlement of the Takeover Offer occurs prior to the day on which Kabel Deutschland Holding AG’s general meeting resolving on the distribution of profits for the financial year ending on 31 March 2013 is held, the cash con- sideration will be increased by EUR 2.50 per Kabel Deutschland Holding AG share to EUR 87.00 per Kabel Deutschland Holding AG share. -

Private Equity

House of Commons Treasury Committee Private equity Tenth Report of Session 2006–07 Volume II Oral and written evidence Ordered by The House of Commons to be printed 24 July 2007 HC 567–II Published on 22 August 2007 by authority of the House of Commons London: The Stationery Office Limited £21·50 The Treasury Committee The Treasury Committee is appointed by the House of Commons to examine the expenditure, administration and policy of HM Treasury and its associated public bodies. Current membership Rt Hon John McFall MP (Labour, West Dunbartonshire) (Chairman) Mr Graham Brady MP (Conservative, Altrincham and Sale West) Mr Colin Breed MP (Liberal Democrat, South East Cornwall) Jim Cousins MP (Labour, Newcastle upon Tyne Central) Mr Philip Dunne (Conservative, Ludlow) Angela Eagle MP (Labour, Wallasey) Mr Michael Fallon MP (Conservative, Sevenoaks) (Chairman, Sub-Committee) Ms Sally Keeble MP (Labour, Northampton North) Mr Andrew Love MP (Labour, Edmonton) Mr George Mudie MP (Labour, Leeds East) Mr Siôn Simon MP, (Labour, Birmingham, Erdington) John Thurso MP (Liberal Democrat, Caithness, Sutherland and Easter Ross) Mr Mark Todd MP (Labour, South Derbyshire) Peter Viggers MP (Conservative, Gosport) The following members were also members of the Committee during the inquiry: Mr David Gauke MP (Conservative, South West Hertfordshire), Kerry McCarthy MP (Labour, Bristol East), and Mr Brooks Newmark MP (Conservative, Braintree) Powers The committee is one of the departmental select committees, the powers of which are set out in House of Commons Standing Orders, principally in SO No 152. These are available on the Internet via www.parliament.uk. Publications The Reports and evidence of the Committee are published by The Stationery Office by Order of the House. -

LLOYDS BANK Plc

PROSPECTUS Dated 30 March 2017 LLOYDS BANK plc (incorporated in England with limited liability with registered number 2065) £35,000,000,000 Euro Medium Term Note Programme This Prospectus (the “Prospectus”) is issued in connection with the Programme (as defined below). Save where otherwise specified in the applicable Final Terms, any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”), Lloyds Bank plc (the “Bank” or “Lloyds Bank”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue Euro Medium Term Notes (the “Notes”). The aggregate nominal amount of Notes outstanding will not at any time exceed £35,000,000,000 (or the equivalent in other currencies), subject to increase as provided herein. Notes to be issued under the Programme may comprise (i) unsubordinated Notes (“Senior Notes”) and (ii) Notes which are subordinated as described herein and have terms capable of qualifying as Tier 2 Capital (as defined below) (the “Dated Subordinated Notes”). The term “Tier 2 Capital” has the meaning given to it from time to time by the laws, regulations, requirements, guidelines and policies relating to capital adequacy then in effect in the United Kingdom. Application has been made to the Financial Conduct Authority (the “FCA”) under Part VI of the Financial Services and Markets Act 2000 (the “UK Listing Authority”) for Notes issued under the Programme for the period of twelve months from the date of this Prospectus to be admitted to the Official List of the UK Listing Authority (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for such Notes to be admitted to trading on the London Stock Exchange’s Regulated Market (the “Market”). -

Vodafone Group Plc 2011 Review of the Year and Notice of Annual General Meeting

Vodafone Group Plc 2011 Review of the Year and Notice of Annual General Meeting This document is important and requires your immediate attention. If you are in any doubt as to the action to be taken, you should consult your stockbroker, bank manager, solicitor, accountant or other professional adviser authorised under the Financial Services and Markets Act 2000 if you are resident in the United Kingdom or, if not, another appropriately authorised independent adviser. If you have sold or otherwise transferred all of your shares in Vodafone Group You can visit our online Annual Report at: Plc, please forward this document together with any accompanying Form of Proxy at once to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission www.vodafone.com/investor to the purchaser or transferee. If you have sold or otherwise transferred only part of your holding of shares, you should retain these documents. This Review of the Year and Notice of Annual General Meeting does not constitute a summary of the Vodafone Group Plc Annual Report for the year ended 31 March 2011 (the “Annual Report”) and should not be relied upon as a substitute for reading the full Annual Report. The Annual Report is available on Vodafone’s website at www.vodafone.com/investor or can be obtained by contacting Vodafone’s Registrars whose details are on page 12. Delivering a more valuable Vodafone Group highlights for the 2011 financial year £45.9bn £11.8bn £7.0bn 370.9m 8.90p Revenue Adjusted operating profit Free cash flow Mobile customers Total dividends 3.2% growth 3.1% growth 2.7% decrease 14.5% growth 7.1% growth Improved results: sustained revenue growth Good progress on strategic delivery and strong cash generation ■ Strong performance in key revenue growth areas: ■ Group revenue increased 3.2% to £45.9 billion; full year Data +26.4%(*), Emerging Markets +11.8%(1)(*), organic service revenue growth +2.1%(*) with a strong Fixed +5.2%(*), Europe Enterprise +0.5%(*). -

2005 Annual Report on Form 20-F

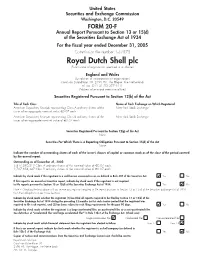

United States Securities and Exchange Commission Washington, D.C. 20549 FORM 20-F Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2005 Commission file number 1-32575 Royal Dutch Shell plc (Exact name of registrant as specified in its charter) England and Wales (Jurisdiction of incorporation or organisation) Carel van Bylandtlaan 30, 2596 HR, The Hague, The Netherlands tel. no: (011 31 70) 377 9111 (Address of principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act Title of Each Class Name of Each Exchange on Which Registered American Depositary Receipts representing Class A ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value €0.07 each American Depositary Receipts representing Class B ordinary shares of the New York Stock Exchange issuer of an aggregate nominal value of €0.07 each Securities Registered Pursuant to Section 12(g) of the Act None Securities For Which There is a Reporting Obligation Pursuant to Section 15(d) of the Act None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Outstanding as of December 31, 2005: 3,817,240,213 Class A ordinary shares of the nominal value of €0.07 each. 2,707,858,347 Class B ordinary shares of the nominal value of €0.07 each. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

130516 Ncdofst FACWI.Qxd

MONDRIAN May 16, 2013 INVESTMENT PARTNERS LIMITED Representing Mondrian: ELIZABETH A. DESMOND, CFA DIRECTOR, CHIEF INVESTMENT OFFICER P RESENTATION TO: INTERNATIONAL EQUITIES MONDRIAN INVESTMENT PARTNERS LIMITED NORTH CAROLINA PATRICIA M. KAROLYI, CFA DEPARTMENT OF STATE EXECUTIVE VICE PRESIDENT MONDRIAN INVESTMENT PARTNERS (U.S.), INC. TREASURER M ONDRIAN F OCUSED A LL C OUNTRIES W ORLD E X -US EQUITY A GENDA 1ORGANIZATION 2INVESTMENT PHILOSOPHY 3YEAR PERFORMANCE 4QUARTER PERFORMANCE 5INVESTMENT STRATEGY ANY OTHER BUSINESS Mondrian Investment Partners Limited Mondrian Investment Partners (U.S.), Inc. Fifth Floor Two Commerce Square 10 Gresham Street 2001 Market Street, Suite 3810 London EC2V 7JD Philadelphia, PA 19103 Telephone 020 7477 7000 Telephone (215) 825-4500 Mondrian Investment Partners Limited is authorised and regulated by the Financial Conduct Authority www.mondrian.com BIOGRAPHIES MONDRIAN INVESTMENT PARTNERS Elizabeth A. Desmond, CFA DIRECTOR, CHIEF INVESTMENT OFFICER INTERNATIONAL EQUITIES MONDRIAN INVESTMENT PARTNERS LIMITED LONDON Ms. Desmond is a graduate of Wellesley College and the Masters Program in East Asian Studies at Stanford University. After working for the Japanese government for two years, she began her investment career as a Pacific Basin investment manager with Shearson Lehman Global Asset Management. Prior to joining Mondrian in 1991, she was a Pacific Basin Equity Analyst and Senior Portfolio Manager at Hill Samuel Investment Advisers Ltd. Ms. Desmond is a CFA Charterholder, and a member of the CFA Institute and the CFA Society of the UK. Patricia M. Karolyi, CFA EXECUTIVE VICE PRESIDENT MONDRIAN INVESTMENT PARTNERS (U.S.), INC. PHILADELPHIA Ms. Karolyi is a graduate of Villanova University, where she earned an MBA, and Temple University, where she earned a Bachelor of Science degree. -

The People Who Matter Your Vote on European Private Equity’S Most Influential

olympic opportunitiEs > vEndor financing > partEch’s parting RealDeals 14 august 2008 For Europe’s private equity professional » E u r o p E The people who matter Your vote on European private equity’s most influential www.rEaldEals.Eu.com 20 MOST influential A tumultuous 12 months on from the onset of the credit crunch, we asked 500 of the industry’s biggest hitters to name the most powerful people in European private equity. 1: GUY HANDS (8) Guy Hands, chief executive of Terra Firma, The man who holds the future of embattled is embroiled in the most highly publicised music business EMI in his hands has shot to the private equity deal of recent times. But while top of the 20 most influential list this year as he all about him appear to doubt, he has remained attempts to drag the company’s creative prima committed to bringing uncompromising donnas into economic reality in the full glare of leveraged buyout efficiency to the extravagant the public spotlight. muso world. Despite frequent spats with pop idols – Robbie Williams’ manager accused Hands of running the business like a plantation owner – and a string of celebrity departures, including the Rolling Stones and Radiohead, as well as the painful fall-out of 2,000 job losses and the impact of the credit crunch on the deal itself, this unlikely rock and roll legend has managed to swing a company, hitherto spouting losses, into profit over recent months. There is still a long way to go before Hands can be declared a hit, of course, but what is clear is that the impact of the £3.2bn (¤4bn) deal will spread way beyond EMI’s walls.