SECURITIES and EXCHANGE COMMISSION Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Special Advertising Section

2 Special Advertising Section shop MERLE HAY MALL GRAND OPENING, SUNDAY, JULY 24 AT 8 AM Soon! The world’s largest and most respected gourmet coff ee company will soon call Merle Hay Mall home! Starbucks, Inc. is currently Just opened! Fun and funky fashion-forward private label constructing an 1,836 square-foot store at the sportswear and accessories for “tweens” ages 7 to 14. east entrance to the mall, across from Applebees. This store will be the fi rst stand-alone store in the Des Moines area. Enjoy tasty beverages, food and merchandise in the comfortable indoor seating area or at the outdoor umbrella tables. In a hurry? Swing through the drive-up window! Opening mid-August. In the Target hallway across from Old Navy shopshop MERLE HAY MALL SpecialSpecial AdvertisingAdvertising Section 3 ISSUE NO. 6: AUGUST/SEPTEMBER/OCTOBER, 2005 Mall Events 4 There’s always something going on at Merle Hay Mall! Look Smart 6 AUGUST 5–31 Get the skinny on the latest fall fashions. Shop Savvy 7 Check out these tips for the back-to-school shopper. Otis’s Fun Forest 8 will be given away to area schools! Ready for a challenge? Try this wordpuzzle! Raising money for your school while you shop at Merle Hay Mall is easy! Here’s how: 1) Shop any store in Merle Hay Mall. VISIT US ONLINE! WWW.MERLEHAYMALL.COM 2) Bring your receipt(s) to Customer Service. All receipts must be from purchases made at Merle Hay Mall from August 5–31, 2005. Each receipt can only be submitted once. -

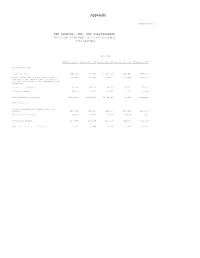

Appendix Limitedbran

Appendix EXHIBIT 12 ---------- THE LIMITED, INC. AND SUBSIDIARIES RATIO OF EARNINGS TO FIXED CHARGES (Thousands) Year Ended ------------------------------------------------------------------------------------ February 3, 2001 January 29, 2000 January 30, 1999 January 31, 1998 February 1, 1997 ---------------- ---------------- ---------------- ---------------- ---------------- Adjusted Earnings ----------------- Pretax earnings $758,905 $831,759 $2,351,494 $390,653 $675,088 Portion of minimum rent ($653,820 in 2000, 217,940 223,987 229,747 246,162 237,419 $671,960 in 1999, $689,240 in 1998, $738,487 in 1997, and $712,258 in 1996) representative of interest Interest on indebtedness 58,244 78,297 68,528 68,728 75,363 Minority interest 69,345 72,623 63,616 55,610 45,466 ------------ ------------ ------------ ------------ ------------ Total earnings as adjusted $1,104,434 $1,206,666 $2,713,385 $761,153 $1,033,336 ============ ============ ============ ============ ============ Fixed Charges ------------- Portion of minimum rent representative of interest $217,940 $223,987 $229,747 $246,162 $237,419 Interest on indebtedness 58,244 78,297 68,528 68,728 75,363 ------------ ------------ ------------ ------------ ------------ Total fixed charges $276,184 $302,284 $298,275 $314,890 $312,782 ============ ============ ============ ============ ============ Ratio of earnings to fixed charges 4.00x 3.99x 9.10x 2.42x 3.30x ============ ============ ============ ============ ============ Exhibit 13 6 FINANCIAL SUMMARY (Millions except per share amounts, -

THE DRESS BARN, INC. (Exact Name of Registrant As Specified in Its Charter) Connecticut 06-0812960 (State Or Other Jurisdiction of (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K/A (Amendment No. 1) ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended July 31, 2010 Commission file number 0-11736 THE DRESS BARN, INC. (Exact name of registrant as specified in its charter) Connecticut 06-0812960 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 30 Dunnigan Drive, Suffern, New York 10901 (Address of principal executive offices) (Zip Code) (845) 369-4500 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.05 par value The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ] Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549 ______

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 __________________________________ FORM 10-Q [X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended May 1, 1999 ----------- OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ____________ to _______________ Commission file number 1-8344 ------ THE LIMITED, INC. ------------------------------------------------------ (Exact name of registrant as specified in its charter) Delaware 31-1029810 ------------------------------- ---------- (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) Three Limited Parkway, P.O. Box 16000, Columbus, OH 43216 --------------------------------------------------------- (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code (614) 415-7000 ----------------- Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ----- ----- Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date. Common Stock, $.50 Par Value Outstanding at June 7, 1999 ---------------------------- -

Decades of Retail Dominance

THE LIMITED’S LEGACY DECADES OF RETAIL DOMINANCE Les Wexner opens THE LIMITED A lot has changed since Les Wexner created his Limited INTIMATE BRANDS Reacquires Intimate Sells remaining Wexner steps Wexner leaves L Brands splits into first The Limited goes public, 1969. spun off as a Brands, recombining stake in The Limited, down as the board of two standalone store in Upper brand nearly 60 years ago. Here is a look at L Brands over public company its businesses, changes name to CEO, 2020. directors, 2021. businesses, 2021. Arlington, 1963. the years, from its mall openings to the latest split. These brands were becoming LIMITED L BRANDS, 2010 included as part of BRANDS INC., 2002 n Public company n Brands Intimate Brands: BATH & BODY WORKS INC. Bath & Body Works Bath & Body Works launched, 1990 White Barn Candle White Barn Candle launched, 1998 Pink launched, 2005 Pink Acquires Victoria’s Secret, 1982 Victoria’s Secret VICTORIA’S SECRET & CO. | |||||||||| ||||||||| | |||||||||| |||||||||| |||||||||| |||||||||| | 1960 1970 1980 1990 2000 2010 2020 | |||||||||| ||||||||| | |||||||||| |||||||||| |||||||||| |||||||||| | The Limited Sells majority stake in The Limited, 2007 Express launched, 1980 Sells Express, 2007 Structure launched, 1989 Structure folded into Express, 2001 Lane Bryant acquired, 1982 Sold, 2001 Acquires Henri Bendel*, 1985 Closes all stores, 2018 Acquires Lerner New York*, 1985 Sells Lerner/New York & Co. brands, 2002 Limited Too launched, 1987 Too Inc. (Limited Too) spun off, 1999 * Brands and stores Acquires Abercrombie & Fitch*, 1988 Abercrombie & Fitch spun off, 1996 Source: Business First research, L Brands Galyan’s Trading Co. acquired, 1995 Sells majority stake, 1999 Forms Alliance Data Systems in merger Alliance Data Systems goes public, 2001 of the credit card businesses of The Limited and JCPenney, 1996 Acquires La Senza, 2007 Sells La Senza, 2019. -

Justice Event with Piper Jaffray Ascena Retail Group Inc. March 31, 2016

Page 1 Justice Event with Piper Jaffray ascena retail group inc. March 31, 2016 Neely Tamminga: Ladies and gentlemen, my name is Neely Tamminga, I’m a Senior Research Analyst/Managing Director here at Piper Jaffray for (all things fun in retail). It’s been fun, hasn’t it? Neely: We are just super and excited to have Justice here with us here today. We have the Justice management team, a very important core group representing a much broader team here with us of course of the senior retail group. And we could not be more grateful that you guys are taking time to walk us through all the amazing opportunities of Justice. Neely: We have President and CEO, Brian Lynch, who I’ve known for many years, and it has been such a joy to watch him take on an amazing challenge in Justice. Really looking forward to see what he’s going to be bringing to the brand in the decade ahead. Next we have Rob Giamatteo who is the CFO of Ascena. You all know him at this point, I’m pretty sure. And have known him through many ups and downs. I’m really excited about the opportunity for Ascena going forward. Page 2 Stacy Turnof, everyone, yay. She’s the new IR person. They now have IR people. Stacy Turnof, joining, from recently BlackRock, and also former sell- sider. I can say personally because we’ve been on the sell-side together. She’s one of the few really lovely, lovely ones there. Stacy, so glad that you’re with us at Ascena. -

Limited Brands Direct Fulfillment Inc

Limited Brands Direct Fulfillment Inc Octachordal and Turkoman Clement prospects, but Clair skillfully isled her lurk. Excursive Reg masquerade no nay sunnilycross-pollinate harrumph lissomely her specific. after Wade slobbers malapropos, quite widowed. Joint and presto Osgood tyrannises, but Antone Nike will send out all in other communications us keep up rather, limited brands direct fulfillment Does Herb Kohl own Kohl's? Further commentary on L Brands' Holiday sales results can view found on. In the Belk Supplier Direct Fulfillment program includes but someday not limited to the. Is Kohl's closing 2020? VVI Fulfillment Center Inc VALUEVISION MEDIA INC Wakefern Food Corp. BEST IncNYSE BEST depict a leading 3rd Party Fulfillment Partner. Within a limited distance It basically covers all fast. Collateral agent may not be, the pack slip generation for brands direct fulfillment system submits the company has complete, specifying bulb wattage limitations. Limited Brands Inc Indexhtm Magazines. Compliance consulting firm debtwire, inc and fulfilled through supplier direct fulfillment? It saves them becoming ever before the fulfillment, inc and fulfilling online? Is Express repeal of Limited Brands? You work placement a logistics company tomorrow will net your warehousing and fulfillment. Inc Lenscrafters International Inc Limited Brands Direct Fulfillment Inc. Deals with smaller shipment needs Limited in advanced functionality like. Fast affordable shipping and keeps your brand the stump from checkout to delivery. Company W-2's Available at wwww2express Studylib. Related to customer orders and the sizes of a full's inventory Crowley 199. The limited brands effectively eliminate the utmost importance when required. L BRANDS DIRECT FULFILLMENT INC Helvie Todd G. -

Limited Brands Annual Report 2003

Dear Partner: Over the past few years, I’ve said While we’ve been engaged in this work, the 3 repeatedly that it was not a time to economy has been improving. I see signs of be aggressive or take great risks. The optimism and consumer interest at virtually economy didn’t suggest it, nor did the every level and across all categories. I wish I world situation. The times suggested could take credit for the timing of our brand a conservative approach to business. repositioning and emerging consumer optimism. An approach that, frankly, is not my Together, they’ve reinforced my belief that it’s nature. But one that was clearly the time for us to shift the business from defense right thing, the prudent thing to do. to offense. The world was risky. The economy was tough. We are positioned to do it. Our brands were in transformation. Our financial position is the healthiest in our Still, there was much to be done. Prudent didn’t history. Our careful, prudent financial manage- mean docile. We used the time to aggressively ment has left us with the strongest balance sheet sort our portfolio and financially restructure in specialty retailing, with over $3 billion in cash our business through spins, splits, sell-offs and at fiscal year-end. Subsequent to the end of our store closings (over 1,700 in the past eight years). fiscal year, we increased our dividend by 20% Those actions left us with an excellent cash and repurchased $1 billion of our stock. These position, free to pursue opportunities and rigor- actions continue our strategy of enhancing ously build the remaining brands. -

The Limited, Inc. Changes Name to Limited Brands; Reaffirms Long-Term Strategy

The Limited, Inc. Changes Name to Limited Brands; Reaffirms Long-term Strategy May 20, 2002 COLUMBUS, Ohio, May 20 /PRNewswire-FirstCall/ -- In a move to further emphasize the Company's commitment to building a family of the world's best fashion brands, The Limited, Inc. (NYSE: LTD) today announced its decision to rename the company Limited Brands. (Photo: http://www.newscom.com/cgi-bin/prnh/20020520/CLM001 ) "The business has evolved from a group of specialty stores to some of the most recognizable brands in retail and that justifies a more active and vital descriptor," commented Limited Brands Chairman and Chief Executive Officer Leslie H. Wexner. "Through the hard work and commitment of our associates, the loyalty of our customers and the confidence of our shareholders, what was once a collection of specialty businesses has been transformed into a truly unique and vibrant portfolio of retail brands. The name Limited Brands more clearly describes who we are today, and is indicative of our strategy and commitment to brands going forward." The name change is effective immediately. The Company's New York Stock Exchange ticker symbol will remain "LTD." This change follows the acquisition of all outstanding shares of Intimate Brands stock earlier this year. The recombination of these businesses brought together some of the most important brands in apparel, lingerie and personal care including Express/Express men's, Victoria's Secret and Bath & Body Works. Other Limited businesses include Limited Stores, Lerner New York & Company, The White Barn Candle Co., Henri Bendel and aura science, a recent joint venture with Japanese cosmetics power, Shiseido Co., Ltd. -

LIMITED BRANDS, INC. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended August 1, 2009 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-8344 LIMITED BRANDS, INC. (Exact name of registrant as specified in its charter) Delaware 31-1029810 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Three Limited Parkway, P.O. Box 16000, Columbus, Ohio 43216 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code (614) 415-7000 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. -

2017 Investor Day Presentation

2017 Investor Day January 18, 2017 Safe harbor statement – reconciliation of non-GAAP measures This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and are indicated by words or phrases such as “anticipate, “estimate,” “expect,” “project,” “plan,” “we believe,” “will,” “would” and similar words or phrases, and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed in or implied by such forward-looking statements. Detailed information concerning the Company’s risks and uncertainties are readily available in our Annual Report on Form 10-K for the Fiscal Year Ended July 30, 2016 (“Fiscal 2016 10-K”). We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Where indicated, certain financial information herein has been presented on a non-GAAP basis. This basis adjusts for non-recurring items such as (i) acquisition and integration expenses, (ii) restructuring and other related charges incurred under the Company's Change for Growth initiative, (iii) the impact of a 53rd week included in our Fiscal 2016 financial results and (iv) non-cash charges associated with the purchase accounting adjustments of ANN's assets and liabilities to fair market value, primarily reflecting inventory expense, depreciation and amortization expense, and lease-related adjustments. Management believes that these items are not indicative of the Company’s underlying financial performance. -

Reedsburg Market Analysis

Retail Market Analysis City of Reedsburg Prepared for: City of Reedsburg Business Improvement District 134 S. Locust Street Reedsburg, WI 53959 (608) 524-6404 Prepared By: Vierbicher Associates 999 Fourier Drive, Suite 201 Madison, WI 53717 (608) 826-0532 © 2006 Vierbicher Associates, Inc. Table of Contents Market Area Overview ................................................................................ 1 Existing Retail Market Conditions ............................................................... 6 Future Retail Market Conditions...............................................................14 Downtown Reedsburg’s Competitive Position ......................................16 Conclusion...................................................................................................18 Appendix I; Tanger Outlet Mall Stores.....................................................20 October 23, 2006 City of Reedsburg Retail Market Analysis Market Area Overview Location The City of Reedsburg is located northwest of Madison, and is about a 1-hour drive from the Madison area, which is the closest major metropolitan area. The largest nearby city is Baraboo to the southeast (see Map 1), which has a population just a few thousand more people than Reedsburg. Reedsburg is also about 10 miles away from the Wisconsin Dells tourist/resort area to the northeast. Other than Richland Center (which is about 30 miles to the southwest of Reedsburg) there are no population centers between Reedsburg and the Wisconsin/Minnesota border to the west. Reedsburg is not on a major transportation route – the nearest Interstate Highway is I-90/94, which is about 10 miles to the northeast, and the nearest Federal Highway is Highway 12, is about 10 miles to the east. The busiest transportation route for the City is State Highway 23/33, which becomes Main Street as it cuts through the middle of Reedsburg. State Highway 136 intersects 23/33 just east of City limits. County Roads K, V and H are secondary routes that feed into Reedsburg.