CP Revenue Q1 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Pugilist September 2013

the pugilist September 2013 Magazine of the Peugeot Car Club of NSW Inc Peugeot’s 208 GTi arrives in Australia Group chat: Drivers and groupies chat at the Peugeot display at the recent Shannons Sydney Classic. Old-fashioned country service Your Peugeot diesel specialist I We keep a large range of new and used Peugeots I Authorised Peugeot Dealership TAMWORTH CITY PRESTIGE, 1-5 Jewry Street, Tamworth 2340 Telephone (02) 6766 5008 Fax (02) 6766 8243 Mike Woods, Sales Manager Lucas Holloway, Sales Consultant 0428 490 823 0437 771 534 [email protected] [email protected] OUR ARMIDALE SERVICE CENTRE, 91 Markham Street, Armidale 2350 02 6774 9777 Ari Vatanen, embraced by his son Max. ing his son in action are in a way too close. I think that the wise thing behind the wheel. is you try to set back, stand back a little bit. He Ari is a very Max Vatanen has his own life. He is not Ari Vatanen, he is made his FIA Max Vatanen. And of course, his name gives European Rally him a certain pressure but it also gives him many Championship on opportunities.” worried manlast month’s Geko Max Vatanen finished 37th overall and 20th Now I know how Mrs Vatanen felt, says Ypres Rally, where in the ERC 2WD Championship classification in legend Ari he received words of encouragement from his Belgium driving a Renault Twingo R2 on what Legendary rally driver Ari Vatanen has spoken famous father Ari Vatanen, the 1981 world was his first event on asphalt. He’s targeting fur- about the emotions he experiences when watch- champion. -

061A MERCEDES-BENZ Passenger

061A MERCEDES-BENZ passenger PICTURE S/N PART # PART NAME APPLICATION SALES REGIONS COMBINATION SWITCH with MERCEDES VITO BUS (638) (1996/02 - 2003/07) 0015404945 A0015404945 LE01-06141-1 parking, rear wiper MERCEDES VITO BOX (638) (1997/03 - 2003/07) US Poland Germany 12+10 pins 组合开关带停车灯、后雨刮 MERCEDES V-CLASS (638/2) (1996/02 - 2003/07) MERCEDES SPRINTER 2-T PLATFORM/CHASSIS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BOX (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BUS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T BUS (903) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T PLATFORM/CHASSIS (903) (1995/01 - 2006/05) COMBINATION SWITCH without 0015404745 A0015404745 MERCEDES SPRINTER 3-T BOX (903) (1995/01 - 2006/05) Mexico US Canada Netherlands LE01-06141-2 parking, rear wiper MERCEDES SPRINTER 4-T BOX (904) (1996/02 - 2006/05) 12+10 pins Germany UK 组合开关不带停车灯、后雨刮 MERCEDES SPRINTER 4-T PLATFORM/CHASSIS (904) (1996/02 - 2006/05) MERCEDES SPRINTER 5-T PLATFORM/CHASSIS (905) (2001/04 - 2006/05) DODGE SPRINTER 2500 2003-2006 DODGE SPRINTER 3500 2003-2006 FREIGHTLINER SPRINTER 2500 2002-2006 FREIGHTLINER SPRINTER 3500 2002-2006 MERCEDES SPRINTER 2-T PLATFORM/CHASSIS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BOX (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T PLATFORM/CHASSIS (903) (1995/01 - 2006/05) 9015400145 A9015400145 COMBINATION SWITCH without MERCEDES SPRINTER 3-T BOX (903) (1995/01 - 5103539AA 5103539AB parking, rear wiper, with 2 wires 2006/05) LE01-06141-2A 5103539AC SW5289 1S7754 Germany 组合开关不带停车灯、后雨刮, -

2 0 1 4 C S R R E P O

2014 CSR REPORT 2014 CSR REPORT CORPORATE SOCIAL RESPONSIBILITY CONTENTS 1 5 A CSR PROGRAMME FULLY INDUSTRIAL ECOLOGY WITHIN THE INTEGRATED INTO THE GROUP’S GROUP’S MANUFACTURING PLANTS 161 STRATEGY 1 5.1. The group’s environmental protection policy 1.1. Message from the Chairman of the Managing Board 3 at manufacturing level: organisation and strategy 163 1.2. Group profi le 4 5.2. Energy and carbon footprint from manufacturing 168 1.3. CSR organisation, strategy and policies 12 5.3. Industrial waste and pollutants: managing impacts 1.4. Relations with stakeholders 33 on the environment and local residents 176 5.4. Waste and materials cycle 181 5.5. Managing the water cycle in facilities 188 2 5.6. Protecting natural environments and actions to promote biodiversity 192 A GROUP TREND-SETTER IN SUSTAINABLE MOBILITY 39 5.7. Scope and methodology of reporting 194 2.0. PSA Peugeot Citroën’s innovation system 41 2.1. Vehicle CO2 emission and fuel consumption 52 2.2. Air quality 62 6 2.3. Vehicle quality and safety 65 ETHICAL PRACTICES , ECONOMICS 2.4. Environmental impact of materials and end of life 74 AND CORPORATE GOVERNANCE 197 2.5. Provision of mobility services 83 6.1. Ethics in business relationships 199 2.6. Scope and methodology of reporting 86 6.2. Distribution of added value 206 6.3. Transparency and integrity of infl uence strategies and practices 209 3 6.4. Governance principles 213 HUMAN RESOURCES, 6.5. Integration of CSR into Governance 217 DRIVING CHANGE WITHIN 6.6. Scope and methodology of reporting 218 PSA PEUGEOT CITROËN 87 3.1. -

![[En]=> (LV-CAN200)](https://docslib.b-cdn.net/cover/8156/en-lv-can200-1458156.webp)

[En]=> (LV-CAN200)

[en]=> (LV-CAN200) year program № from Engine is working on CNG Front left door Front right door Rear right door Trunk cover Oil pressure / level Total mileage of the vehicle (dashboard) Total fuel consumption Fuel level (in percent) Fuel level (in liters) Engine temperature Vehicle speed Acceleration pedal position Total CNG consumption - (counted) CNG level (in percent) CNG level (in kilograms) Rear left door Engine cover (Hood) Vehicle mileage - (counted) Total fuel consumption - (counted) Engine speed (RPM) Total CNG use 1 ABARTH 124 SPIDER 2016 → 12259 2020-06-30 + + + + + + + + + + + + + 2 ABARTH 595 2016 → 12687 2019-05-30 + + + + + + + + + + + + + 3 ABARTH 695 2017 → 12687 2019-05-30 + + + + + + + + + + + + + 4 ACURA RDX 2010 → 11113 2017-09-01 + + + + + + + + + + + + + + + 5 ACURA RDX 2007 → 11113 2017-09-01 + + + + + + + + + + + + + + + 6 ACURA TL 2004 → 11167 2017-09-01 + + + + + + + + + + + 7 ACURA TLX 2015 → 12363 2019-05-19 + + + + + + + + + + + + + + + 8 ACURA TSX 2009 → 12578 2019-01-16 + + + + + + + + + + + + + + + 9 ACURA TSX 2004 → 11167 2017-09-01 + + + + + + + + + + + 10 ALFA ROMEO 159 2005 → 11128 2017-09-01 + + + + + + + + + + + + + 11 ALFA ROMEO BRERA 2008 → 11128 2017-09-01 + + + + + + + + + + + + + 12 ALFA ROMEO GIULIA 2017 → 12242 2019-05-22 + + + + + + + + + + + + + + 13 ALFA ROMEO GIULIETTA 2013 → 11127 2019-04-10 + + + + + + + + + + + + + 14 ALFA ROMEO GIULIETTA 2010 → 11127 2017-09-01 + + + + + + + + + + + + + 15 ALFA ROMEO GT 2005 → 11128 2017-09-01 + + + + + + + + + + + 16 ALFA ROMEO MITO 2014 → 11127 2017-09-01 -

Superscan Solo

SUPERSCAN SOLO - PEUGEOT / CITROEN APPSLICATIONS LIST JAN 2014 MODEL CATEGORY SYSTEM CITROEN BERLINGO ENGINE ELECTRONICS (PETROL/DIESEL) HDI_SID 801 (M49) CITROEN BERLINGO ENGINE ELECTRONICS (PETROL/DIESEL) LUCAS DCN2 CITROEN BERLINGO ENGINE ELECTRONICS (PETROL/DIESEL) LUCAS DCN2 (KWP2000) CITROEN BERLINGO ENGINE ELECTRONICS (PETROL/DIESEL) MOTRONIC ME 7.4.5 KWP CITROEN CITROEN BERLINGO 2 ABS / ABR ABS BOSCH 8 KWP CITROEN BERLINGO 2 ABS / ABR ABS BOSCH 8.1 KWP CITROEN CITROEN BERLINGO 2 ABS / ABR ESP BOSCH 5.7 CITROEN BERLINGO 2 ABS / ABR ESP BOSCH 8 KWP CITROEN BERLINGO 2 ABS / ABR ESP BOSCH 8.1 KWP CITROEN CITROEN BERLINGO 2 ADDITIONAL HEATING CITROEN ADDITIONAL HEATING CITROEN CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) BOSCH EDC16C34 KWP CITROEN CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) BOSCH EDC17C10 BR2 KWP CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) HDI_SID 801 KWP CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) J34P KWP CITROEN CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) MOTRONIC ME 7.4.5 KWP CITROEN CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) MOTRONIC ME 7.4.9 KWP CITROEN CITROEN BERLINGO 2 ENGINE ELECTRONICS (PETROL/DIESEL) SAGEM S2000 PM1 / PM2 CITROEN BERLINGO 2 MDS ‐ SERVICES MODULE MDS RASTREADOR KWP CITROEN BERLINGO B9 ABS / ABR ABS BOSCH 8.1 CAN CITROEN CITROEN BERLINGO B9 ABS / ABR ESP BOSCH 8.1 CAN CITROEN CITROEN BERLINGO B9 AIRBAG / PRETENSIONER AIRBAG AUTOLIV (B9‐A51‐A58‐A55) CITROEN BERLINGO B9 ANTI‐THEFT ALARM CAN ALARM CITROEN BERLINGO B9 ASR ‐ ANTI‐SLIP -

The Pugilist March 2014

the pugilist Magazine of the Peugeot Car Club March 2014 of NSW Inc n Peugeot’s 504: n HDi technology: a French war- are your diesel horse in Africa injectors OK? his South African Peugeot 404 is in wonderful condition but it’s more or less out to pasture beside the grazing zebras. It is part of the collection of a Peugeot dealer that members of the South Africa club inspected last Tyear. Spotters will notice the Lion badge in place of the usual shield. This indicates it is a locally built GL model equipped with the Peugeot 504 1,800cc engine and more recent than Australian versions. It’s part of a run of 4,997 units built between September 1974 and 1978. Photo: Ian Loubser. peugeot.com.au Old-fashioned country service Your Peugeot diesel specialist I We keep a large range of new and used Peugeots I Authorised Peugeot Dealership MOTION & EMOTION TAMWORTH CITY PRESTIGE, Cnr Jewry and Belmont streets, TAMWORTH 2340 Telephone (02) 6767 3777 Fax (02) 6767 3016 Mike Woods, Peugeot Brand Manager 0428 490 823 [email protected] Armidale Service Centre, 912 Markham St, Armidale 2350 02 6774 9777 Frosty to race a Peugeot V8 EIGNING Bathurst 1000 champion “The Voxx team emailed me and asked if I Jr and 57-year old veteran Chico Serra, whereas Mark Winterbottom is ready to swap his was interested” Winterbottom informed v8su- Indycar and sportscar racers Bruno Junquiera, RFord Performance Racing V8 Supercar percars.com. Rafa Matos and Oswaldo Negri will also be on for some South American samba when he jets “It’s an awesome looking series. -

EMBREAGEM NOVA Núm

EMBREAGEM NOVA Núm. Código Montadora Aplicação Original/SIMILAR Corsa Wind 1.0 - Super 1.0 16v Sedan 1.0 8/16v - GL 1.4 1994 a 2000 - Celta 1.4 8v MPF/flex após 2001 - Agile 1.4 6285 / N602-K CHEVROLET flex ano todos - Prisma 1.4 flex ano todos 190mm 14 estrias - 619 2174 00 MB Corsa GLS 1.6 - Sedan 1.6 8/16v - Pick - up 1.6 8/16v (todos) - 6563 / N602-AK CHEVROLET Tigra 1.6 (todos) 200mm 620 3027 00 Astra 2.0 16v 1999 a 2003 - Vectra 2.2 8/16v após 1999 - 9588 / N605-AC CHEVROLET Zafira 2.0 16v 1999 a 2004 - 228mm 14 estrias SEM 623 2425 09 ATUADOR Astra 1.8/2.0 8v 1999 à 2003 - Corsa e Pick - up 1.8 8v após 2002 gas./flexpower - Meriva 1.8 8/16v flexpower após 9587 / N605-AAC CHEVROLET 2003 - Montana 1.8 8v após 2004 flexpower - Zafira 2.0 8v 621 2424 09 1999 à 2001 flexpower - Vectra 2.0 8v 01/2004 à 10/2005 - 205mm 14 estrias SEM ATUADOR Monza - Kadett - Ipanema 1.8/2.0 Fase 2 (09/1986 à 6183 / N734-AK CHEVROLET 12/1992) - Monza 1.8 (álcool) Fase 1 até 09/1986 210mm - 622 2085 00 MB Monza - Kadett 1.8/2.0 após 12/1992 - Astra 2.0 importado 6257 / N734-AAK CHEVROLET até 96 - Vectra 2.0 8/16v até 1996 - 215mm 622 2086 00 6284 / N749-K CHEVROLET Opala - Caravan 4 e 6 cilindros após 11/1973 623 2177 00 Palio - Palio Weekend 1.6 16v - Siena 1.6 16v - Strada LX 1.6 6053 / N676-AAK FIAT 16v (todos) - Brava 1.6 8/ 16v ELX/ SX após 12/1999 620 3029 00 200mm - 20 estrias Palio - Weekend - Siena - Strada 1.0/1.3 Fire 8/16v gas 01/01 à 12/04 - 1.0 8v fire flex 01/05.. -

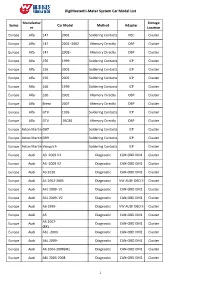

Digimasteriii-Meter System Car Model List

DigiMasterIII-Meter System Car Model List Manufactur Storage Series Car Model Method Adapter er Location Europe Alfa 147 2001 Soldering Contacts NEC Cluster Europe Alfa 147 2001–2002 Memory Directly OBP Cluster Europe Alfa 147 2002– Memory Directly OBP Cluster Europe Alfa 156 1999 Soldering Contacts ICP Cluster Europe Alfa 156 2001 Soldering Contacts ICP Cluster Europe Alfa 156 2002 Soldering Contacts ICP Cluster Europe Alfa 166 1999 Soldering Contacts ICP Cluster Europe Alfa 166 2002 Memory Directly OBP Cluster Europe Alfa Brera 2007 Memory Directly OBP Cluster Europe Alfa GTV 1995 Soldering Contacts ICP Cluster Europe Alfa GTV 93C86 Memory Directly OBP Cluster Europe Aston Martin DB7 Soldering Contacts ICP Cluster Europe Aston Martin DB9 Soldering Contacts ICP Cluster Europe Aston Martin Vanquich Soldering Contacts ICP Cluster Europe Audi A3 -2009 V1 Diagnostic CAN-OBD DM1 Cluster Europe Audi A3 -2009 V2 Diagnostic CAN-OBD DM1 Cluster Europe Audi A3 2010 Diagnostic CAN-OBD DM1 Cluster Europe Audi A4 2002-2005 Diagnostic VW AUDI OBD II Cluster Europe Audi A4L 2009- V1 Diagnostic CAN-OBD DM1 Cluster Europe Audi A4L 2009- V2 Diagnostic CAN-OBD DM1 Cluster Europe Audi A6 1999- Diagnostic VW AUDI OBD II Cluster Europe Audi A5 Diagnostic CAN-OBD DM1 Cluster A5 2007- Europe Audi Diagnostic CAN-OBD DM1 Cluster (8K) Europe Audi A6L -2009 Diagnostic CAN-OBD DM1 Cluster Europe Audi A6L 2009- Diagnostic CAN-OBD DM1 Cluster Europe Audi A6 2004-2008(4F) Diagnostic CAN-OBD DM1 Cluster Europe Audi A8L 2003-2008 Diagnostic CAN-OBD DM1 Cluster 1 DigiMasterIII-Meter -

INVESTOR UPDATE December, 2010

INVESTOR UPDATE December, 2010 Investor Relations James Palmer + 33 1 40 66 54 59 [email protected] Investor update – November 2010 1 This presentation may contain forward-looking statements. Such forward-looking statements do not constitute forecasts regarding the Company’s results or any other performance indicator, but rather trends or targets, as the case may be. These statements are by their nature subject to risks and uncertainties as described in the Company’s annual report available on its Internet website (www.psa-peugeot-citroen.com). These statements do not reflect future performance of the Company, which may materially differ. The Company does not undertake to provide updates of these statements. More comprehensive information about PSA Peugeot Citroën may be obtained on its Internet website (www.psa-peugeot-Citroën.com), under Regulated Information. Investor update – November 2010 2 Key highlights YTD 2010 • Operating and financial performance restored ► Market trends better than expected ► Market share growth in Europe, China, Latin America and Russia ► Profitability restored in H1, Expectations raised for H2 & 2010 ► Solid financial structure and active optimisation of debt • Progressing on our ambitions ► Building blocks in place in high growth markets to reach 50% sales by 2015 ► Products to support market share and pricing power ► Pioneering technologies to reduce CO 2 emissions ► New co-operations to support growth and generate development synergies ► Performance plan delivering operational excellence Investor update -

PEUGEOT SA (“Company”) Shares

This presentation does not constitute an offer to sell, or a solicitation of an offer to buy, PEUGEOT SA (“Company”) shares. This presentation may contain forward-looking statements. Such forward-looking statements do not constitute forecasts regarding the Company’s results or any other performance indicator, but rather trends or targets, as the case may be. These statements are by their nature subject to risks and uncertainties as described in the registration document filed with the French Autorité des Marchés Financiers (AMF). These statements do not reflect future performance of the Company, which may materially differ. The Company does not undertake to provide updates of these statements. More comprehensive information about PSA PEUGEOT CITROËN may be obtained on group website (www.psa-peugeot-citroen.com), under Regulated Information. First Half Results 2013 – July 31st, 2013 2 Agenda ▐ H1 2013 Highlights Philippe Varin ▐ Financial results Jean-Baptiste de Chatillon ▐ Strategic update Philippe Varin First Half Results 2013 – July 31st, 2013 3 H1 2013 HIGHLIGHTS Philippe Varin Chairman of the Managing Board H1 2013 Highlights Solid progress of turnaround plans ▐ Group Recurring Operating Income: -€65M in H1 2013, with -€510M on Automotive division ▐ Free Cash Flow: €203M excluding restructuring and exceptional ▐ Financial security strengthened at €11.8bn and State guarantee for Banque PSA Finance: approval granted by EU on July 30th ▐ Successful launches of Peugeot 2008, Peugeot 208 GTI and XY, Peugeot 301, new Citroën C4 Picasso, -

Approval Car Price Issued As of 30Th June 2018

APPROVAL CAR PRICE ISSUED AS OF 30TH JUNE 2018 DATE SHOWROOM PASSENGER MOTOR VEHICLES BRAND PASSENGER MOTOR VEHICLES MODEL /TYPE DATE ISSUED PRICE (SRP) EFFECTIVE EXPIRY AUDI AUDI A3 TFSI S-TRONIC (T. C. Y. MOTORS SDN BHD) AUDI A3 1.2L TFSI S-TRONIC AUTO SEDAN PETROL 13-Jan-18 31-Dec-17 30-Dec-18 $43,453.00 (MODEL CODE : 8VMBKG) AUDI A3 TFSI S-TRONIC SPORTBACK AUDI A3 1.2L TFSI S-TRONIC AUTO SPORTBACK PETROL 21-Sep-17 11-Sep-17 10-Sep-18 $46,803.00 AUDI A3 TFSI S-TRONIC SPORTBACK S-LINE AUDI A3 1.2L S-LINE TFSI S-TRONIC AUTO SPORTBACK PETROL 18-Oct-17 9-Oct-17 8-Oct-18 $52,036.00 AUDI A4 TFSI ULTRA S-TRONIC S-LINE BLACK STYLING AUDI A4 2.0L TFSI ULTRA S-TRONIC AUTO S-LINE BLACK STYLING SEDAN 13-Jan-18 31-Dec-17 30-Dec-18 $58,515.00 PETROL (MODEL CODE : 8W2BDG) AUDI A4 TFSI S-TRONIC AUDI A4 1.4L TFSI S-TRONIC AUTO SEDAN PETROL 13-Jan-18 31-Dec-17 30-Dec-18 $48,556.00 (MODEL CODE : 8W2BEG) AUDI A4 TFSI QUATTRO S-TRONIC AUDI A4 2.0L TFSI QUATTRO AWD S-TRONIC AUTO SEDAN PETROL 6-Nov-17 23-Oct-17 22-Oct-18 $71,830.00 AUDI A4 TFSI ULTRA S-TRONIC AUDI A4 2.0L TFSI ULTRA S-TRONIC AUTO SEDAN PETROL 7-Jun-18 15-Jun-18 14-Jun-19 $56,852.00 AUDI A5 TFSI QUATTRO S-TRONIC COUPE AUDI A5 2.0L TFSI QUATTRO S-TRONIC AUTO COUPE PETROL 24-Aug-17 14-Aug-17 13-Aug-18 $79,952.00 AUDI A5 TFSI QUATTRO S-TRONIC SPORTBACK AUDI A5 2.0L TFSI QUATTRO S-TRONIC AUTO SPORTBACK PETROL 24-Aug-17 14-Aug-17 13-Aug-18 $83,042.00 AUDI A8L AUDI A8L 3.0L TFSi QUATTRO TIPTRONIC AUTO SEDAN PETROL 10-Oct-17 16-Oct-17 15-Oct-18 $165,350.00 AUDI Q2 AUDI Q2 1.0L TFSi S-TRONIC AUTO -

Corporate Social Responsability Strategic Guidelines, Commitments and Indicators

CORPORATE SOCIAL RESPONSABILITY STRATEGIC GUIDELINES, COMMITMENTS AND INDICATORS CORPORATE SOCIAL RESPONSIBILITY 20 STRATEGIC GUIDELINES, 12 COMMITMENTS AND INDICATORS In addition to the Group’s 2012 Sustainable Development and Annual Report and website (www.annualreport.psa- peugeot-citroen.com), this document covers the economic, environmental, social, societal and governance aspects of the corporate social responsibility performance of PSA Peugeot Citroën companies. It covers the Group’s automotive and banking businesses. It is designed to provide a deeper understanding of the Group’s sustainable development challenges and impacts and explain more about its policies, programmes and 2012 accomplishments. Together, these publications make up PSA Peugeot Citroën’s sustainable development reporting for 2012 and are available on the corporate website, www.psa-peugeot-citroen.com. Global Reporting Initiative (GRI) Guidelines For the tenth straight year, the Group’s sustainable development reporting follows the Sustainability Reporting Guidelines issued by the Global Reporting Initiative, using the G3 version for the sixth year. According to the criteria recommended in the “G3 Guidelines, Application Levels”, the Group’s own assessment of its 2012 sustainable development reporting results in an A+ application level (the GRI application level check statement is available at the end of this report). Audit The information in this report complies with French legislation, notably Articles L. 225-102-1 and R. 225-105 of the French Commercial Code as amended by the Grenelle 2 Law, effective since 2012 and described in the Group’s Registration Document. The 42 topics addressed in the aforementioned Articles are indicated in this document with icons numbering G1 to G42, and a correspondence table at the end of this report indicates on what pages the information required by the Articles can be found.