PEUGEOT SA (“Company”) Shares

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Catalogooilfilterskyfil.Pdf

oil filter SKO-2-2017 SKO-2-2018 OF. 9018 OF. 8806 CHEV. ASTRA 2.2 LTS. 4 LTS. 02/04 CHEV. ASTRA 1.8 LTS. 4 CIL. 00/01 MALIBU 2.2 LTS. 4 CIL. 04/08 CHEVROLET SKO-2-2020 SKO-2-2021 OF. 2518 OF. 10246 CHEV. SPARK 1.2 LTS. 4 CIL. 11/15 CHEV. ASTRA 1.8 LTS. 4 CIL. 07/08 CRUZE 1.8 LTS. 4 CIL. 11/15 SKA-L-2005 SKO-L-2006 OF. 3675 OF. 2933 CHEV. SIERRA V6 CHEV. ASTRA 2.4 LTS. 4 CIL. 04 SKO-L-2007 SKA-L-2008 OF. 3506 OF. 3387 CHEV. COLORADO 2.9 LTS. 4 CIL. 08/12 CHEV. CHEVY 1.6 LTS. 4 CIL. 01/12 CHEYENNE 5.3 LTS. 8V 03/07 CAVALIER 2.2 LTS. 4 CIL. 95/05 1 oil filter CHEVROLET SKO-L-2009 SKO-L-2010 OF. 05 CHEV. CAPTIVA SPORT 2.4 LTS. 4 CIL. 11/15 CHEV. SUBURBAN 7.4 LTS. 8V 92/95 ZAFIRA 2.2 LTS. 4 CIL. 02/07 SILVERADO 3500 HEAVY DUTY 5.7 LTS. 8V 03/05 CHRYSLER SKO-D-2033 SKO-D-2037 OF. 16 OF. 10060 CHRYS. GRAND VOYAGER 3.3 LTS. 6V 99/02 CHRYS. NITRO 4.0 LTS. 6V 09/11 RAM SRT-10 P-UP 8.3 LTS. 10V 04/06 JOURNEY 3.5 LTS. 6V 09/10 SKO-D-2038 SKO-D-2039 OF. 11665 OF. 3614 CHRYS. DURANGO 3.6 LTS. 6V 11/16 CHRYS. NEON 2.4 LTS. 4 CIL. 04/06 GRAND CARAVAN 3.6 LTS. -

New PEUGEOT PARTNER Mastering the Impossible

PRESS PACK 26th June 2018 New PEUGEOT PARTNER Mastering the impossible Why not combine practicality with pleasure, feel that delight every time you drive, why not optimise your time, guarantee your safety and feel sure that your vehicle is rugged enough to withstand any test … this is exactly what new PEUGEOT PARTNER provides to all professional clients in the LCV segment. New PEUGEOT PARTNER, which includes the PEUGEOT i-Cockpit® as standard, an unprecedented move in this vehicle segment, offers a new driving experience and a setting that is conducive to productivity. PEUGEOT is revolutionising the LCV segment with a relevant, dynamic and generous market offering, the perfect balance between convenience and drivability - the Brand's hallmark. With its dynamic design, New PEUGEOT PARTNER is not only practical and elegant - it features an unparalleled range of driving aids that, to date, have only been seen on the latest saloon vehicle generations. Two major original innovations are featured for the first time: Overload Alert and Surround Rear Vision, which provides blind angle camera vision. New PEUGEOT PARTNER offers a stimulating, stress-free mobile office; the dimensions are perfectly in line with the market segment, it is exceedingly comfortable and the payload area is even more practical and versatile than ever. No matter what your profession, you will find the right configuration to enable you to work effectively: just look at the Grip version, which meets a need for ruggedness in all circumstance or the Asphalt version for those of you who do not count the time spent behind the wheel. New PEUGEOT PARTNER is at the heart of the entrepreneur mentality; it boosts your capacity to deliver results and makes it possible to go far beyond what might have previously seemed impossible. -

Peugeot 2008 Suv | Specification Sheet

PEUGEOT 2008 SUV | SPECIFICATION SHEET ACTIVE 1.6 HDi ALLURE 1.6 HDi ACTIVE 1.2 PureTech ALLURE 1.2 PureTech GT LINE 1.2 PureTech MODEL Manual Manual Manual Auto Auto 1 2 3 4 5 ENGINE Power (kW @ r/min) 68 @ 4000 68 @ 4000 81 @ 5500 81 @ 5500 81 @ 5500 Torque (Nm @ r/min) 230 @ 1750 230 @ 1750 205 @ 1500 205 @ 1500 205 @ 1500 Cubic Capacity 1560 1560 1199 1199 1199 Cylinders 4 4 3 3 3 Transmission Manual Manual Manual Auto Auto Gears 5-speed manual 5-speed manual 5-speed manual 6-speed auto 6-speed auto Fuel tank capacity (liters) 50 50 50 50 50 Fuel Type Diesel Diesel Unleaded Unleaded Unleaded PERFORMANCE Consumption Urban 4.7 4.7 6.6 6.6 6.6 Consumption Rural 3.6 3.6 4.4 4.4 4.4 Consumption Combined 4.0 4.0 5.2 5.2 5.2 CO2 Emissions (g C02/Km) 103 103 121 121 121 0 to 100 km/h in (s) 11.5 11.5 10.3 10.3 10.3 Top Speed 181 181 188 188 188 DIMENSIONS Boot Space (litres) min / max (with seats folded down) 410 / 1400 410 / 1400 410 / 1400 410 / 1400 410 / 1400 Length (mm) 4159 4159 4159 4159 4159 Height (mm) 1,556 1,556 1,556 1,556 1,556 Width with mirrors (mm) 2,004 2,004 2,004 2,004 2,004 Ground Clearance (mm) 165 165 165 165 165 Wheelbase (mm) 2,538 2,538 2,538 2,538 2,538 WHEELS & TYRES Alloy wheels 16'' 17'' 16'' 17'' 17'' Spare Wheel S S S S S Tyre Pressure Sensor S S S S S EXTERIOR FEATURES Colour Coded Mirrors S S S S - Perla Black Mirrors - - - - S Colour Coded Door Handles S S S S S Electric and Heated Mirrors S S S S S Electric Folding Mirrors S S S S S Roof Bars S S S S S LIGHTING Two-tone Black and Chrome Headlights S S S S -

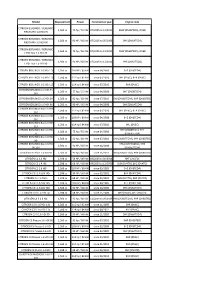

Model Displacement Power Construction Year Engine Code

Model Displacement Power Construction year Engine code CITROËN BERLINGO / BERLINGO 1,560 cc 75 hp / 55 kW 07/2005 to 12/2011 9HW (DV6BTED4), DV6B FIRST MPV 1.6 HDI 75 CITROËN BERLINGO / BERLINGO 1,560 cc 90 HP / 66 kW 07/2005 to 05/2008 9HX (DV6ATED4) FIRST MPV 1.6 HDI 90 CITROËN BERLINGO / BERLINGO 1,560 cc 75 hp / 55 kW 07/2005 to 12/2011 9HW (DV6BTED4), DV6B FIRST Box 1.6 HDI 75 CITROËN BERLINGO / BERLINGO 1,560 cc 90 HP / 66 kW 07/2005 to 12/2011 9HX (DV6ATED4) FIRST Box 1.6 HDI 90 CITROËN BERLINGO 1.6 HDi 110 1,560 cc 109 HP / 80 kW since 04/2008 9HZ (DV6TED4) CITROËN BERLINGO 1.6 HDi 110 1,560 cc 112 hp / 82 kW since 07/2010 9HL (DV6C), 9HR (DV6C) CITROËN BERLINGO 1.6 HDi 115 1,560 cc 114 hp / 84 kW since 07/2010 9HR (DV6C) CITROËN BERLINGO 1.6 HDi 75 1,560 cc 75 hp / 55 kW since 04/2008 9HT (DV6BTED4) 16V CITROËN BERLINGO 1.6 HDi 90 1,560 cc 92 hp / 68 kW since 07/2010 9HJ (DV6DTEDM), 9HP (DV6DTED) CITROËN BERLINGO 1.6 HDi 90 1,560 cc 90 HP / 66 kW since 04/2008 9HX (DV6ATED4) CITROËN BERLINGO Box 1.6 HDi 1,560 cc 112 hp / 82 kW since 07/2010 9HL (DV6C), 9HR (DV6C) 110 CITROËN BERLINGO Box 1.6 HDi 1,560 cc 109 HP / 80 kW since 04/2008 9HZ (DV6TED4) 110 CITROËN BERLINGO Box 1.6 HDi 1,560 cc 114 hp / 84 kW since 07/2010 9HL (DV6C) 115 CITROËN BERLINGO Box 1.6 HDi 9HT (DV6BTED4), 9HT 1,560 cc 75 hp / 55 kW since 04/2008 75 (DV6BUTED4) CITROËN BERLINGO Box 1.6 HDi 1,560 cc 92 hp / 68 kW since 07/2010 9HJ (DV6DTEDM), 9HP (DV6DTED) 90 CITROËN BERLINGO Box 1.6 HDi 9HS (DV6TED4BU), 9HX 1,560 cc 90 HP / 66 kW since 04/2008 90 16V (DV6AUTED4) -

PEUGEOT 108 Top Range : Equipment

PEUGEOT 108 top range : equipment PEUGEOT Car Range Pricing Guide Pricing Valid from 1st November 2019 A PEUGEOT For EVERY Occasion Hatchbacks Page 4 Page 9 Page 17 108 208 Compact, chic and full of character. If you're looking for a 308 fun way to get around town, the 108 will be right up your Behind its neat and compact appearance, this car is The PEUGEOT 308 is a real show-stopper, with a street. bursting with energy and ambition – just like you. stunning design, superior technology and ultra-efficient engines. SUVs Page 13 Page 23 Page 28 2008 SUV 3008 SUV 5008 SUV A strong visual signature ensures the 2008 SUV The PEUGEOT 3008 SUV unveils its strength and Enter a new dimension with PEUGEOT 5008 SUV,offering commands road presence and offers a distinctive air of character. Featuring a sleek design,this distinct SUV cutting edge technology and the flexibility offered by adventure. combines robustness with elegance. seven individual seats Fastback Estate Page 39 Page 40 Page 17 All-new 508 All-new 508 SW 308 SW Discover the all-new PEUGEOT 508: the radical Fastback Discover the all-new Peugeot 508 SW: the premium estate The 308 SW, is the ultimate family car. with a bold look , offering advanced technology for an car with uncompromising design, combining the comfort Feel good behind the wheel, its attention to detail and outstanding driving experience. of a tourer. cavernous 660 litre boot set it apart from its rivals. MPVs Cabrio Page 4 Page 33 Page 44 108 TOP! All-new Rifter This 5-door cabrio, comes with a retractable electric fabric Traveller Featuring great levels of comfort, outstanding modularity roof and wind deflector so that you can enjoy that Distinctive design, expert PEUGEOT handling, elegance and intelligent storage solutions, all-new Rifter is the “outdoor” experience throughout the year. -

CP Revenue Q1 2010

Communiqu é de presse April 21, 2010 First-Quarter 2010 Revenue up 27.5% to €14.0 Billion First-Quarter 2010 Highlights • Consolidated revenue up 27.5% compared with Q1-2009 (22.8% like-for-like) • Automotive Division revenue up 22.4% compared with Q1-2009 • Share of the European car and light commercial vehicle market increased to 14.6% from 13.5% in Q1-2009 • Successful performance by the new Citroën C3, Peugeot 3008 and Peugeot 5008 • Signs of an upturn in the European light commercial vehicle market (up 6%), where the Group strengthened its leadership with a 22.7% share • Sustained recovery at Faurecia, with revenue up 32.2% like-for-like and 59.5% including the acquisition of Emcon % change (in millions of euros) Q1 2009 Q1 2010 % change like-for-like Automotive Division 8,678 10,619 +22.4% +22.4% Faurecia* 2,008 3,202 +59.5% +32.2% Gefco 664 842 +26.7% +26.7% Banque PSA Finance 462 457 -1.1% -1.1% Other businesses and intersegment (839) (1,135) eliminations PSA Peugeot Citroën 10,973 13,986 +27.5% +22.8% *Since 1 January 2010, Faurecia has consolidated Emcon, which contributed €553 million in revenue for the period Outlook for 2010 In Europe, the Group still expects automotive markets to contract by around 9% over the year. Its market share should continue to increase compared with 2009, led by the full-year impact of models introduced in recent months and those currently being launched, such as the Citroën DS3 and the Peugeot RCZ. -

Sébastien Loeb På Väg Till Toppen I Peugeot 208 T16 Pikes Peak!

Sébastien Loeb på väg till toppen i Peugeot 208 T16 Pikes Peak! Den niofaldiga rallyvärldsmästaren Sébastien Loeb ställs nu inför sin nästa stora utmaning, när han i samarbete med Peugeot Sport deltar i Pikes Peak International Hill Climb den 30 juni, i en specialdesignad Peugeot 208 T16. Det legendariska loppet i Pikes Peak i Colorado är världens högst belägna lopp och det är första gången det franska teamet återvänder till detta klassiska lopp sedan de historiska segrarna 1988 och 1989. Ari Vatanens seger i en 405 T16 1989 har senare hyllats i den prisbelönta filmen ”Climb Dance”, där han visar prov på sin dödsföraktande stil på vägen uppför berget. Pikes Peak: ett legendariskt lopp Pikes Peak International Race är det näst äldsta amerikanska motorloppet och startade redan 1916. Idag deltar mer än 150 förare i loppet som även kallas ”Race to the Clouds”. Starten går på 2 865 meter höjd och under den 20 km långa sträckan är det inte mindre än 156 hisnande kurvor som ska klaras av innan vinnaren når toppen på 4 301 meter. Under åren har sträckan gradvis asfalterats och 2012 genomfördes det första loppet helt på asfalt. Det ledde till ett nytt världsrekord genom Rhys Millen (Hyundai Genesis Coupé) på tiden 9’46’’164, det vill säga dubbelt så snabbt som när loppet gick av stapeln 1916! Loppet består av 20 klasser och innefattar förutom bilar även motorcyklar och tyngre lastbilar. Sébastien Loebs 208 T16 Pikes Peak deltar i kategorin ”Unlimited”. Alla detaljer om bilen har inte avslöjats ännu, men bilderna på bilen offentliggörs nu på webben. -

Press Release

Press release Paris, 23 October 2013 Third-Quarter 2013 Consolidated Revenues On-going implementation of the turnaround plan Within a European market in process of stabilisation at a low level, the third quarter of 2013 for the group PSA Peugeot Citroën was impacted by the pricing policy, the interruption in Citroën C3 production and pressure on market shares in Europe. In addition, the Group was affected by a sharp deterioration of exchange rates. In this challenging environment, the Group continued to implement its turnaround plan, with: The successful launches of the new Peugeot 308 and Citroën Grand C4 Picasso during the 3rd quarter, following those of the first-half (Peugeot 2008, 208 GTi and XY, 301 and the new Citroën C4 Picasso, C4 L, C-Elysée and DS3 Cabrio) Further progress in the globalisation strategy. Sales outside Europe accounted for 42% of total volumes at the end of September, with strong performance in China where sales were up 28%. However, the Brazilian and Russian markets remained under pressure, compounded by exchange rate variations Progress in the industrial and commercial restructuring plan covering 8,000 job positions in France is in line with objectives, with 6,650 applications submitted for an internal or external placement by end of September. The “New Social Contract”, which is in advanced stage of negotiation, will complete this restructuring plan, which aims to support the Group’s competitiveness of its French manufacturing base Implementation of the Alliance with GM: o first results of the Joint Purchase -

Driving Resistances of Light-Duty Vehicles in Europe

WHITE PAPER DECEMBER 2016 DRIVING RESISTANCES OF LIGHT- DUTY VEHICLES IN EUROPE: PRESENT SITUATION, TRENDS, AND SCENARIOS FOR 2025 Jörg Kühlwein www.theicct.org [email protected] BEIJING | BERLIN | BRUSSELS | SAN FRANCISCO | WASHINGTON International Council on Clean Transportation Europe Neue Promenade 6, 10178 Berlin +49 (30) 847129-102 [email protected] | www.theicct.org | @TheICCT © 2016 International Council on Clean Transportation TABLE OF CONTENTS Executive summary ...................................................................................................................II Abbreviations ........................................................................................................................... IV 1. Introduction ...........................................................................................................................1 1.1 Physical principles of the driving resistances ....................................................................... 2 1.2 Coastdown runs – differences between EU and U.S. ........................................................ 5 1.3 Sensitivities of driving resistance variations on CO2 emissions ..................................... 6 1.4 Vehicle segments ............................................................................................................................. 8 2. Evaluated data sets ..............................................................................................................9 2.1 ICCT internal database ................................................................................................................. -

The Pugilist September 2013

the pugilist September 2013 Magazine of the Peugeot Car Club of NSW Inc Peugeot’s 208 GTi arrives in Australia Group chat: Drivers and groupies chat at the Peugeot display at the recent Shannons Sydney Classic. Old-fashioned country service Your Peugeot diesel specialist I We keep a large range of new and used Peugeots I Authorised Peugeot Dealership TAMWORTH CITY PRESTIGE, 1-5 Jewry Street, Tamworth 2340 Telephone (02) 6766 5008 Fax (02) 6766 8243 Mike Woods, Sales Manager Lucas Holloway, Sales Consultant 0428 490 823 0437 771 534 [email protected] [email protected] OUR ARMIDALE SERVICE CENTRE, 91 Markham Street, Armidale 2350 02 6774 9777 Ari Vatanen, embraced by his son Max. ing his son in action are in a way too close. I think that the wise thing behind the wheel. is you try to set back, stand back a little bit. He Ari is a very Max Vatanen has his own life. He is not Ari Vatanen, he is made his FIA Max Vatanen. And of course, his name gives European Rally him a certain pressure but it also gives him many Championship on opportunities.” worried manlast month’s Geko Max Vatanen finished 37th overall and 20th Now I know how Mrs Vatanen felt, says Ypres Rally, where in the ERC 2WD Championship classification in legend Ari he received words of encouragement from his Belgium driving a Renault Twingo R2 on what Legendary rally driver Ari Vatanen has spoken famous father Ari Vatanen, the 1981 world was his first event on asphalt. He’s targeting fur- about the emotions he experiences when watch- champion. -

061A MERCEDES-BENZ Passenger

061A MERCEDES-BENZ passenger PICTURE S/N PART # PART NAME APPLICATION SALES REGIONS COMBINATION SWITCH with MERCEDES VITO BUS (638) (1996/02 - 2003/07) 0015404945 A0015404945 LE01-06141-1 parking, rear wiper MERCEDES VITO BOX (638) (1997/03 - 2003/07) US Poland Germany 12+10 pins 组合开关带停车灯、后雨刮 MERCEDES V-CLASS (638/2) (1996/02 - 2003/07) MERCEDES SPRINTER 2-T PLATFORM/CHASSIS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BOX (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BUS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T BUS (903) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T PLATFORM/CHASSIS (903) (1995/01 - 2006/05) COMBINATION SWITCH without 0015404745 A0015404745 MERCEDES SPRINTER 3-T BOX (903) (1995/01 - 2006/05) Mexico US Canada Netherlands LE01-06141-2 parking, rear wiper MERCEDES SPRINTER 4-T BOX (904) (1996/02 - 2006/05) 12+10 pins Germany UK 组合开关不带停车灯、后雨刮 MERCEDES SPRINTER 4-T PLATFORM/CHASSIS (904) (1996/02 - 2006/05) MERCEDES SPRINTER 5-T PLATFORM/CHASSIS (905) (2001/04 - 2006/05) DODGE SPRINTER 2500 2003-2006 DODGE SPRINTER 3500 2003-2006 FREIGHTLINER SPRINTER 2500 2002-2006 FREIGHTLINER SPRINTER 3500 2002-2006 MERCEDES SPRINTER 2-T PLATFORM/CHASSIS (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 2-T BOX (901, 902) (1995/01 - 2006/05) MERCEDES SPRINTER 3-T PLATFORM/CHASSIS (903) (1995/01 - 2006/05) 9015400145 A9015400145 COMBINATION SWITCH without MERCEDES SPRINTER 3-T BOX (903) (1995/01 - 5103539AA 5103539AB parking, rear wiper, with 2 wires 2006/05) LE01-06141-2A 5103539AC SW5289 1S7754 Germany 组合开关不带停车灯、后雨刮, -

Annual Report 2019

Contents Corporate Profile 2 Corporate Information 4 Our Products 6 Business Overview 13 Financial Highlights 32 CEO’s Statement 33 Management Discussion and Analysis 36 Directors and Senior Management 48 Directors’ Report 56 Corporate Governance Report 74 Independent Auditor’s Report 86 Consolidated Balance Sheet 92 Consolidated Income Statement 94 Consolidated Statement of Comprehensive Income 95 Consolidated Statement of Changes in Equity 96 Consolidated Statement of Cash Flows 97 Notes to the Consolidated Financial Statements 98 Five Years’ Financial Summary 168 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2019 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, as well as advanced driver assistance systems (ADAS) and automated driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage our design, development and manufacturing strengths in advanced steering and driveline systems that provide differentiated and value-added solutions to our customers. We develop solutions that enable a new era of safety and performance for traditional and varying levels of ADAS/AD. Overall, we are making driving safer, more fuel-efficient and fun for today’s world and an automated future. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship.