Press Release Key Rating Drivers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sweet Jamaica a Pot Still and Three Distilleries Dutch

N. 27 | JULY 2020 SUPPLEMENT OF BARTALES LIQUID STORY / FAMILY JEWELS A POT STILL BAR STORY / PEGU AND THREE DISTILLERIES COLONIAL FLAVOUR HOT SPIRIT / TRELAWNY RUM HOT SPIRIT / INDIAN WHISKY SWEET JAMAICA MIXTURE FROM OVER THE SEAS BAR TOUR / DRINKING EUROPE FOCUS ON / THE TEARS TOP TEN NORTH WIND DUTCH COURAGE BAR EDITORIAL by Melania Guida TALES A TEAM EFFORT tarting 24 June, and seven years after the release of the first issue of Bar- Tales, the Chinese edition of our magazine is now online. This was a great challenge – an attempt at considering what until a few months ago was unthinkable. Another “younger brother”, following the Spanish edition of Sour “Best of Bartales”. With hindsight, and fingers crossed, we put our experience to good use while riding the long wave of this crisis. This is the real meaning of hard times: attempting to turn hardship to your advantage, turning a disadvantage into an opportunity and upping the ante. It’s a wager, of course, perhaps even a gamble and at such an uncertain time. But it’s in these game-changing moments, we told ourselves, and during the hardest, that we have to pull out all the stops. “When the going gets tough, the tough get going”, in the words of that genius, John Belushi. It’s a statement that’s made history. We’ve borrowed it too – don’t hold it against us, John – for the launch of our next adventure: the Mandarin edition. It’s not use denying that there’s a touch of tension and some light-headedness. -

Amrut Double Cask Single Malt Whisky 46% Abv Limited Release

AMRUT DOUBLE CASK SINGLE MALT WHISKY 46% ABV LIMITED RELEASE A Unique Marriage of Two Single Casks – Bourbon and PX Sherry Color: Medium amber, orange blossom honey. Nose: I can feel the PX cask dominating on the nose... Bitter chocolate, cherry coke and dried cranberries. Zante currants, damson plums and ripe Black Mission figs. Dusty and slightly ashy... A little of aged Slivovitz. Noses like a younger spirit than it is actually. Adding water lifted ex-bourbon barrel aromas up a notch. Vanilla, burnt sugar and grilled pineapple rings. Oak and maple syrup. Palate: Very dry... Ex-bourbon barrel takes the lead on the palate. Toasted new oak, allspice and ground cloves. A lot of young toasted wood and Middle Eastern spices. Cumin, cinnamon and cardamom. Some black garden soil, prunes and Christmas spice mix. Adding water works great: Nutmeg, cinnamon and freshly ground black pepper. Finish: Medium long with cinnamon and cloves mainly. Some white pepper and eucalyptus drops. Overall: Limited Amrut expressions are nothing but surprises... Right now when I was getting ready to taste a sherry dominated profile after what I got from the nose initially it hit me with a dry and spicy new craft bourbon palate instead. I know the label says "barrel" for the size of the ex-bourbon cask used for the vat but it taste so much like a small cask matured American bourbon. If you are a fan of craft bourbons with a lot of wood influence and spices you will absolutely fall in love with this Review by Bozzy Bokurt http://www.bozzy.org/2017/02/amrut-double-cask.html Exclusively Imported by Purple Valley Imports USA. -

Indian Whiskey Market

Indian whiskey market Continue TOKYO/MUMBAI - Japanese beverage maker Suntory Holdings will this week roll out a whisky brand that will be sold exclusively in India, the world's largest market, as it tries to gain a foothold on top distiller Diageo.The new brand, Oaksmith, will be mixed with imported bourbon and scotch. The product is classified as a foreign Indian-made liqueur that uses imported whiskey and is mixed in the country. Such products make up more than 90% of the Indian whisky market. Beam Suntory, an American subsidiary of a Japanese parent, has been selling whisky brand Teachers in India since 1994. Oaksmith will be its first product sold only in India. Suntory acquired American distiller Beam in 2014. Pune is the center of the Indian information technology industry and has a young population. It plans to roll out products in other areas later. Oaksmith will have two products targeting middle and upper income drinkers and will be priced at up to 1,375 ($19) for a 750ml bottle in Maharashtra. By next year, Suntory hopes to sell 120,000 cases, rising to more than 1 million cases by 2022.India, once a British colony, is a huge whisky market that accounts for half of the world's demand. Suntory, the world's no 3 spirits manufacturer, faces stiff competition in India from rivals such as Uk's Diageo and France's Pernod Ricard. Both have local mixed import brands. In August, Diageo announced that it was increasing its stake in Indian distiller United Spirits to 55.2%. -

Before Johnny Walker Black Label and Chivas Regal Took the Indian

Before Johnny Walker Black Label and Chivas Regal took the Indian whisky market by storm there was a malt whisky being produced in India for quite some time, since 1855 in fact! Also this distillery is situated in the foothills of the Himalayas!! The brewing, distillation and maturation processes followed at the distillery are very similar to that of Scotch whisky. Yes I am referring to Mohan “Meakin’s Solan No 1”. The distillery is situated in Kasauli, a small town in Solan district in the state of Himachal Pradesh. So if you are one of those who believe that water plays a major role in the outcome of the distilled spirit then this location has perhaps some of the best streams of fresh water in the world. Pic. (1)Location of Solan district, 65 Kms from Chandigarh Now we are not talking about one of the multiple dubious whiskies produced in India, this one is a “legitimate” whisky even by Scottish standards! In fact this was considered the “only whisky” produced in India for a very long time, as this is a “Malt” whisky produced from barley unlike most other whiskies produced in India which use molasses. This distillery is well known for the “OLD MONK” rum, which most readers from the subcontinent will be familiar with. Till recently I had a misconception that it was a single malt whisky, which is what Wikipedia also states (have submitted a correction) but a little more research/ observation has shown me that this is a blended malt whisky. Pic. (2)Solan No 1 Bottle So why am I drinking this and writing about it? And most importantly what has Bangalore got to do with this?? Solan number 1 was one of the most popular whisky back in the 80’s and largely supplied its products to the defense services of India. -

Club Cocktails

CLUB COCKTAILS Using key Indian ingredients as their base, our cocktails reimagine drink recipes served in the elite clubs of India from the punch age of the 18th century to the golden age of cocktails of the 1930’s. Classic cocktails served on request. CLUB COCKTAILS CLUB COCKTAILS HOLY BASIL ROYALE 14.00 HOUSE MARTINI 14.00 Belvedere Vodka, Dry Vermouth, Holy Basil Vodka, Vermouth, Sparkling Lychee Olive Brine Pappadum Floral, fresh and spritzy. Holy basil, or sweet basil, Our House Martini is made with six parts peppery is infused into vodka to release its fresh, green anise Polish vodka and one part dry vermouth. A crisp flavour. Served tall with tapioca pearls for texture. olive brine pappadum served on the side intensifies the savoury elements to the Martini. NON-ALCOHOLIC 7.00 Holy Basil & Sparkling Lychee SILVER SIP GIMLET 14.00 RUBY PUNCH 14.00 Hendricks Gin, Jasmine & Clary Sage Cordial Rum Blend, Hine Cognac, Port, Jaggery, Classically a mixture of gin and lime cordial, our house Clarified Milk, Darjeeling Tea gimlet swaps lime with jasmine flowers and silver needle white tea, sweetened with lime blossom honey. Clary sage A re-imagined Ruby Punch from the 1892 recipe, with and cucumber gin adds fresh herbaceous notes. the addition of milk that is clarified in its preparation, NON-ALCOHOLIC 6.00 giving a smooth texture to the punch. The ‘Champagne Aecorn Dry, Jasmine & Clary Sage Cordial of teas’, Darjeeling gives a light, floral flavour. CLUB COCKTAILS CLUB COCKTAILS PEACH BLOW FIZZ 14.00 CHIKKI CHIKKI 15.00 Tanqueray Gin, Frozen Yoghurt, Egg White, Green Mango, Soda Johnnie Walker Green Label, Distilled Peanut, Angostura Bitters Our Peach Blow Fizz contains no peach at all, but unripe fresh green mango and bergamot oil, shaken with frozen A savoury and rich Scotch old fashioned. -

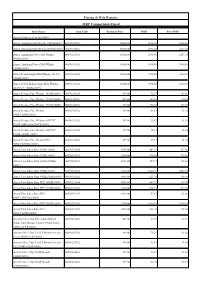

Pricing & Web Reports MRP Comparision Report

Pricing & Web Reports MRP Comparision Report Item Name Item Code Declared Price MRP Prev.MRP Amrut Distilleries Pvt Ltd (0009) Amrut Amalgam Malt Whisky 750ML(0009) 00090102901 15000.00 3894.68 3400.86 Amrut Amalgam Malt Whisky-500ML(0009) 00090102916 15000.00 2596.45 2267.24 Amrut Amalgam Peated Malt Whisky 00090103116 15000.00 2596.45 2267.24 500ML(0009) Amrut Amalgam Peated Malt Whisky 00090103101 15000.00 3894.68 3400.86 750ML(0009) Amrut Fusion Single Malt Whisky (42.8%) 00090103201 15000.00 3894.68 3400.86 750ML(0009) Amrut Peated Indian Single Malt Whisky- 00090103301 15000.00 3894.68 3400.86 42.8%V/V 750ML(0009) Amrut Prestige Fine Whisky 180 Ml (0009) 00090100304 499.00 70.27 63.10 Amrut Prestige Fine Whisky 375 Ml (0009) 00090100302 499.00 145.43 130.49 Amrut Prestige Fine Whisky 750 Ml (0009) 00090100301 499.00 290.85 260.98 Amrut Prestige Fine Whisky 00090100352 499.00 35.13 31.55 90MLx96Btls(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190352 499.00 35.13 31.55 PACK 90MLx96A PACK(0009) Amrut Prestige Fine Whisky-ASEPTIC 00090190304 499.00 70.27 63.10 PACK-180ML (0009) Amrut Prestige Fine Whisky-PET 00090102652 499.00 35.13 31.55 90MLx96P.Btls (0009) Amrut Two Indies Rum 180ML(0009) 00090301104 4554.00 467.51 397.00 Amrut Two Indies Rum 375ML(0009) 00090301102 3800.00 930.47 783.56 Amrut Two Indies Rum 60MLx150Btls 00090301107 4924.00 157.17 133.66 (0009) Amrut Two Indies Rum 750ML(0009) 00090301101 3800.00 1860.94 1567.14 Amrut Two Indies Rum 90MLx96Btls(0009) 00090301152 4554.00 233.76 198.50 Amrut Two Indies Rum-PET 180ML(0009) -

Amrut Distilleries Ltd

Amrut launch, Glasgow, August 2004 Biographies Mr NEELAKANTA RAO R JAGDALE Managing Director of Amrut Distilleries Ltd Mr Neelakanta Jagdale obtained a BSc from the Government Science College, Bangalore, India, in 1972 and joined his family business in the liquor division of Amrut Distilleries Ltd. His father, the late Mr Radhakrishna N Jagdale, had pioneered distilling and the manufacturing of alcoholic beverages and pharmaceuticals in Bangalore during the post Independence period after 1948. A science graduate, the late Mr Jagdale, had gained a reputation as an illustrious industrialist as he quickly established a prosperous business. Working with his father gave Mr Neelakanta Jagdale an indelible legacy of simplicity and zeal for hard work. When his father died in 1976, Mr Neelakanta Jagdale, his elder brother and brother-in-law took over the Jagdale Group, which then focused on alcoholic beverages and pharmaceuticals. Over the next 15 years, the family team added further divisions of engineering and food. Since a corporate re-organisation in the early 1990s, Mr Neelakanta Jagdale has been the full time Managing Director of Amrut Distilleries Ltd, and he, his brother and sister continue to sit on the boards of each other’s companies. In the past decade, Mr Neelakanta Jagdale has added two more divisions: Software Development & Back Office Processing and Sports Nutrition & Sports Infrastructure. He is Managing Director of both divisions, which are already contributing well to the overall revenues of the group. Mr Neelakanta Jagdale has a wide knowledge of the distilling industry and is a blender with wide experience gained over the past three decades. -

Annual Summer Release Unique Offerings

ANNUAL SUMMER RELEASE UNIQUE OFFERINGS Old Rip Van Winkle Old Rip Van Winkle 10 yr. 107 Proof $15 Van Winkle Special Reserve 12 yr. $18 Van Winkle Family Reserve 13 yr. Rye $28 Pappy Van Winkle's Family Reserve 15 yr. $35 Pappy Van Winkle's Family Reserve 20 yr. $45 Pappy Van Winkle's Family Reserve 23 yr. $80 Antique Collection William Larue Weller $25 Eagle Rare 17 yr. $25 Thomas H. Handy Sazerac $25 Sazerac Rye 18 yr. $25 George T. Stagg $25 R 101 RESERVE 101 NOT YOWHISKEYUR DADDY’S WHISKEY LIST BAR Our whiskey list has taken years to curate. We have whiskies from all over the world as well as some very rare selections that make our establishment special. These whiskies are in red on the list and are subject to availability. Our whiskey list is broken down by distillery, but also by country, state and region to help better educate our guests. MADE IN THE U.S.A. TEXAS O Tennessee P BALCONES DISTILLERY ∙ WACO, TX GEORGE DICKEL DISTILLERY ∙ Baby Blue Corn Whiskey $8 TULLAHOMA, TN Brimstone $8 Tennessee Sour Mash Whiskey $7 Single Malt Whiskey $12 Barrel Select Tennessee Sour Mash Whiskey $10 GARRISON BROTHERS DISTILLERY ∙ HYE, TX Tennessee Rye $7 Texas Straight Bourbon Fall 2014 Release $14 JACK DANIEL’S DISTILLERY ∙ Cowboy Bourbon Second Release $35 LYNCHBURG, TN Tennessee Sour Mash Whiskey #12 $6.75 HERMAN MARSHALL DISTILLERY ∙ GARLAND, TX Gentleman Jack Tennessee Bourbon $9 Sour Mash Whiskey $8.75 Rye $9 Single Barrel Tennessee Temptress Single Malt Whiskey $14 Sour Mash Whiskey $10 RANGER CREEK BREWERY & DISTILLERY ∙ ORPHAN BARREL ∙ TULLAHOMA, TN SAN ANTONIO, TX Gifted Horse American Whiskey $14 36 Texas Bourbon $13 . -

Addendum Regarding: the 2016 Certified Specialist of Spirits Study Guide, As Published by the Society of Wine Educators Note

Addendum regarding: The 2016 Certified Specialist of Spirits Study Guide, as published by the Society of Wine Educators Note: This document outlines the substantive changes to the 2016 CSS Study Guide as compared to the 2015 version of the Study Guide. All page numbers reference the 2015 version. These items will not appear on Exams based on the 2015 SG. Page 9 – the following was added to the information under the “Fermentation” heading: Fermentation may also create small amounts of other alcohols, such as methanol (methyl alcohol) and a range of compounds collectively referred to as fusel oils which contain small amounts of amyl alcohol, n-propyl, and isobutyl alcohols. Page 17 – the following information was added to the section on Filtration: Many spirits undergo a process known as chill filtration. Chill filtration removes components common to many spirits that can cause a spirit to appear hazy or dull. Matured spirits in particular are likely to require chill filtration. To carry out this process, the spirit is chilled, which causes a haze to form that can then be removed. With all types of filtration, care must be taken to avoid filtering out desirable components that contribute to body and flavor along with those that are unwanted. Page 18 – the following information was added under the “bottling strength” heading: Most spirits are bottled at 37 to 43% alcohol by volume. Page 31 - the chart on the top-selling vodka brands has been updated to reflect 2015 statistics as follows (highlighted entries have changed): Top Selling Vodka Brands Rank Brand 1 Smirnoff 2 Absolut 3 Green Mark 4 Grey Goose 5 Skyy 6 Stolichnaya 7 Finlandia 8 Russian Standard 9 Cîroc 10 Ketel One 11 Sobieski 12 Eristoff Source: Drinks International (2015) Page 46 - the information pertaining to the PGI status of Plymouth gin was deleted, as the PGI was not submitted for renewal and has expired. -

How Indian Whisky Is Conquering The

MAKE LOCAL, GO GLOBAL: HOW CONFERENCES INDIAN WHISKY IS CONQUERING Ashok THE INTERNATIONAL Chokalingam MARKETPLACE 11 12 Established in 1948 in Bangalore, Southern India, Amrut Distilleries produces whisky, grape A unique production brandy, rum, gin and vodka at its local distillery. But as the company’s head of international sales process and marketing Ashok Chokalingam explained, So what really makes Amrut special? Amrut Amrut has also been successful in creating one of Distillery uses ex-bourbon casks, new American the most iconic single malt brands in the world. white oak casks, ex-sherry butts and former Port ‘pipes’ for maturation. All Amrut single malt Ashok Chokalingam described how his family’s whisky brands are unchilfi ltered and none are business became the fi rst distillery in India coloured artifi cially. to go global with a single malt whisky. Amrut single malt was befi ttingly launched in Glasgow, The distillery is located 300 ft above sea level in Scotland on August 24, 2004. The Amrut Fusion Bangalore where the temperature in summer brand was voted the third best whisky in the (April –June) can reach up to 39°C and fall to 20°C world by the Whisky Bible in 2010. Between whilst winter temperatures (October –February) these two landmark moments, the journey was range from 30°C at the top end to 17 °C at the extremely challenging as the brand not only had bottom. There is also an average diff erence to meet all the international requirements from of 6°C between the warehouse and ambient raw materials to fi nished product, it also became temperature. -

Based Centralized Software for Spirit Operation in KSBCL

Dear Retail / Bulk Buyer, Dear Sir, Subject: Implementation of Integrated web - based centralized software for Spirit operation in KSBCL. We are going to implement the new software for our Spirit Depot Operations with effect from 01- 04-2017. This software will have many new features, which will simplify the work both at our Depot as well as to the Spirit Buyers. One of the important features of this software is to provide online payment facility to spirit Buyers. Buyer can remit money to KSBC L through the following 2 Modes. A. E_Payments B. NEFT/RTGS A) For making epayment, the buyer should have account with internet banking facility in any one of these Banks. Viz AXIS Bank, Bank of India, Canara Bank, Corporation Bank, ICICI Bank, Syndicate Bank, State bank of India, State Bank of Mysore, Vijaya Bank. We will be allotting 5 digit code to each buyer, with the help of this code one can make the remittances . We enclose a step - by - step document to use this facility. Apart from SMS received from your Bank, you will be receiving additional SMS from KSBCL confirming the receipt of money. B) Buyers can also remit the funds, through NEFT / RTGS from any of their Bank account to the following account of KSBCL. Bank Name: HDFC Bank Account Number: 855500XXXXX (Where XXXXX is code allotted to the Buyer) IFSC Code: HDFC0000240 The amount remitted through both the above mode will be reflecting immediately in your specific account maintained by KSBCL for further operations. DEPOT MANAGER PARTY BUYER- List of Party-name with Party Code PARTY Beneficiary Acct IFSC NUMBER CODE Categor Number 81001 A.P. -

The Millionaires' Club

The definiTive ranking of The world's million-case spiriTs brands June 2012 The definiTive ranking of The world's million-case spiriTs brands 2012 The The June 2012 drinksint.com 3 welcome to the club here are clubs for ladies, for gentlemen, the gentry and the socially sedentary. Clubs where handshakes, back-slaps and ridiculous blazers Tmaintain a cosy elitism. The Millionaires’ Club is not one of these clubs. Here we favour meritocracy over cronyism – if a spirits or liqueur brand sells a million 9-litre cases it’s in, if it doesn’t, it’s out. This year the revolving door has welcomed more brands than it has ejected, with membership now numbering 181. We have a slew of novice Millionaires – affirmation to burgeoning brands that if you get the proposition and market right, the million-case mark is eminently achievable. contents Of the newcomers to Millionaire status there’s La leADer voDkA Martiniquaise’s Poliakov vodka, which inched its way past the Hamish Smith plays secretary 3 Lowdown on Europe’s favourite 23 million-case mark, presumably in the very last knockings of 2011. Then you have Cîroc which, through P Diddy’s notoriety mArket overvIew rum & cAchAçA and Diageo’s know-how, managed to pole-vault nearly 50 of its By Euromonitor International 5 Latin America’s heavyweights 29 competitors to debut at 133. The global analysts at Euromonitor International have also Full lIStIng cognAc & brAnDy unearthed some new names. There are those that have quietly All 181 Millionaire brands 9 The little and large grape spirits 30 amassed sales but been shy up to now about opening their ledgers.