Au Optronics Corp. and Subsidiaries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Representative Legal Matters Mark W.C

Representative Legal Matters Mark W.C. Tu Represented KKR in relation to its proposed buyout of Yageo Corporation. Represented Advanced Semiconductor Engineering Inc. in its acquisition of 100 percent shares of PowerASE Technology by way of tender offer and merger. Represented Morgan Stanley, the financial advisor to Polaris Securities Corporation, in relation to its share swap with Yuanta Financial Holding Company. Represented MediaTek Inc. for acquisition of 100 percent of outstanding shares of Ralink Technology Corporation by way of a share swap. Represented Chimei Optoelectronics Corporation in relation to its merger with Innolux Corporation. Represented Morgan Stanley, the financial advisor to Taiwan International Securities Corporation (TISC), in relation to the sale of all issued and outstanding shares of TISC to Capital Securities Corporation by way of a tender offer followed by a merger. Represented E.Sun Commercial Bank in its general business and asset assumption from Chu Nan Co-operative Credit Association. Represented Prime View International Co., Ltd. in relation to its acquisition of E. Ink Corporation by way of a share exchange. Represented Morgan Stanley Private Equity in its acquisition of a stake in CTCI Corporation. Representing WIN Semiconductors Corporation in relation to its issuance of global depositary receipts. Represented E.Sun Financial Holding Company. in relation to its issuance of global depositary receipts. Represented Cathay Financial Holding Company in relation to its issuance of European convertible bonds. Represented Chunghwa Telecom Co., Ltd. in relation to its Form 20-F filing submitted to the U.S. Securities and Exchange Commission. Represented Pegatron Corporation in relation to its issuance of European convertible bonds. -

Taiwan's Top 50 Corporates

Title Page 1 TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATES We provide: A variety of Chinese and English rating credit Our address: https://rrs.taiwanratings.com.tw rating information. Real-time credit rating news. Credit rating results and credit reports on rated corporations and financial institutions. Commentaries and house views on various industrial sectors. Rating definitions and criteria. Rating performance and default information. S&P commentaries on the Greater China region. Multi-media broadcast services. Topics and content from Investor outreach meetings. RRS contains comprehensive research and analysis on both local and international corporations as well as the markets in which they operate. The site has significant reference value for market practitioners and academic institutions who wish to have an insight on the default probability of Taiwanese corporations. (as of June 30, 2015) Chinese English Rating News 3,440 3,406 Rating Reports 2,006 2,145 TRC Local Analysis 462 458 S&P Greater China Region Analysis 76 77 Contact Us Iris Chu; (886) 2 8722-5870; [email protected] TAIWAN RATINGS CORP. | TAIWAN'S TOP 50 CORPORATESJenny Wu (886) 2 872-5873; [email protected] We warmly welcome you to our latest study of Taiwan's top 50 corporates, covering the island's largest corporations by revenue in 2014. Our survey of Taiwan's top corporates includes an assessment of the 14 industry sectors in which these companies operate, to inform our views on which sectors are most vulnerable to the current global (especially for China) economic environment, as well as the rising strength of China's domestic supply chain. -

This Version of Au Optronics Corp's Form 20-F, As

NOTE: THIS VERSION OF AU OPTRONICS CORP’S FORM 20-F, AS FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) ON HTML FORMAT ON MAY 3, 2011, HAS BEEN CONVERTED FROM HTML BACK TO MICROSOFT WORD. PLEASE VISIT THE SEC’S WEBSITE AT www.sec.gov FOR THE FILED VERSION OF AU OPTRONICS CORP’S FORM 2O-F, INCLUDING THE EXHIBITS. WorldReginfo - b24d0578-faa5-4ed6-8a00-edfe430d82e2 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ________________ to ________________ OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ________________ Commission file number: 001-31335 (Exact name of Registrant as specified in its charter) AU OPTRONICS CORP. TAIWAN, REPUBLIC OF CHINA (Translation of Registrant’s name into English) (Jurisdiction of incorporation or organization) 1 LI-HSIN ROAD 2 HSINCHU SCIENCE PARK HSINCHU, TAIWAN REPUBLIC OF CHINA (Address of principal executive offices) Andy Yang 1 Li-Hsin Road 2 Hsinchu Science Park Hsinchu, Taiwan Republic of China Telephone No.: +886-3-500-8800 Facsimile No.: +886-3-564-3370 Email: [email protected] (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. -

Albert Shih ASSOCIATE

Albert Shih ASSOCIATE Litigation Palo Alto [email protected] 650-849-3022 FOCUS AREAS EXPERIENCE Albert Shih is an associate in the Palo Alto office of Wilson Sonsini Goodrich & Rosati, Litigation where his practice focuses on intellectual property litigation and counseling. He has litigated Patent Litigation more than 25 patent cases before federal district courts, the International Trade Commission, and Judicial Arbitration and Mediation Services, including a $31 million judgment obtained for his client in the field of telecommunication protocol. He also regularly advises clients on company intellectual property strategy, technology transactions, licensing negotiation, FRAND-rate setting for standard-essential patents, and patent prosecution matters. Prior to law school, Albert was a design engineer at Intel, where he taught courses at Intel University on chipset design. His field experience and knowledge allow him to understand and appreciate the unique business and technical perspective associated with leaders and innovators in the field of mobile telecommunication protocol, baseband processor, liquid crystal display, semiconductor fabrication, digital signal processors, digital receivers and tuners, image sensors, Internet security software, and various digital and analog circuit designs. Educated in Taiwan and Singapore in his early years, Albert is fluent in Mandarin Chinese. CREDENTIALS Education J.D., Loyola Law School, Los Angeles B.S., Electrical Engineering, University of Michigan, Ann Arbor Associations and Memberships Member, American Bar Association, Intellectual Property Section Member, American Intellectual Property Law Association Member, Asia Pacific Intellectual Property Association Member, International Trade Commission Trial Lawyer Association Honors Named to the 2015-2018 editions of the "Rising Stars" list published by Northern California Super Lawyers Admissions State Bar of California U.S. -

Managing Electronic Manufacturing Service (EMS) – Terry Gou and the Making of Foxconn

Kindai Management Review Vol. 4, 2016 (ISSN: 2186-6961) Managing Electronic Manufacturing Service (EMS) – Terry Gou and the Making of Foxconn Ho-Don Yan Feng Chia University, Taiwan Abstract To explain how Foxconn has become the global number one provider of electronic manufacturing service (EMS), this paper incorporates three main driving forces—entrepreneurship, strategic management, and leadership—to study how they contribute towards opportunity discovery, capa- bility accumulation, and firm transformation. By dividing the growth path of Foxconn into four stages, including initiation, expansion, maturity, and diversification, we examine how at each stage these three driving forces help in the making of Foxconn. We conclude that high and fast growth is no guarantee for firm endurance. The limitation of expansion in the EMS industry and impend- ing succession problem pose challenges for the longevity of Foxconn. Keywords: strategic management, dynamic capability, entrepreneurship, leadership, mergers and acquisitions, competitive advantage equipment manufacturing (OEM) (Hobday, 2001), INTRODUCTION one of the forms of EMS. Many small and medium The making of Foxconn Group (known as Hon Hai sized enterprises (SMEs) in Taiwan have succeeded in Taiwan) is associated with the prevalence of in collaborating with MNCs to improve their pro- electronics manufacturing service (EMS), which is ductivity and to benefit from fast growth (Krywulak used by firms that design, test, manufacture, dis- and Kukushkin, 2009). tribute, and provide repair services for electronics With a humble start at making plastic TV knobs components and assemblies for global brands of in 1974, Foxconn transformed itself in the 1990s multinational corporations (MNCs) (Lüthje, 2002; into producing connectors and entered the personal Zhai et al., 2007). -

Taiwan's Outward Foreign Direct Investment

Taiwan’s Outward Foreign Direct Investment (OFDI) into the European Union Qualitative Report EIAS Report October 2018 Policy Analysis Qualitative Report 1 Table of Contents ACKNOWLEDGEMENTS ....................................................................................................................................3 LIST OF ABBREVIATIONS ..................................................................................................................................4 1 - INTRODUCTION ........................................................................................................................................ 5 2 - BARRIERS TO TRADE AND INVESTMENT .................................................................................................... 5 2.1 - LINGUISTIC AND CULTURAL BARRIERS.................................................................................................... 6 2.2 - LABOUR LAW AND LABOUR RELATIONS.................................................................................................. 6 2.3 - KNOWLEDGE OF INVESTMENT INCENTIVES............................................................................................. 6 2.4 - BUREAUCRACY AND VISAS...................................................................................................................... 7 2.5 - LACK OF REGULATORY CONVERGENCE.................................................................................................... 7 3 - BILATERAL AGREEMENTS OF TAIWAN ....................................................................................................... -

UNITED STATES INTERNATIONAL TRADE COMMISSION Washington, D.C

UNITED STATES INTERNATIONAL TRADE COMMISSION Washington, D.C. In the Matter of CERTAIN LIQUID CRYSTAL DISPLAY DEVICES, INCLUDING MONITORS, TELEVISIONS, MODULES, AND COMPONENTS THEREOF Investigation Nos. 337-TA-741/749 COMMISSION DETERMINATION NOT TO REVIEW AN INITIAL DETERMINATION TERMINATING THE INVESTIGATION AS TO U.S. PATENT NO. 6,121,941; TERMINATION OF INVESTIGATION AGENCY: U.S. International Trade Commission. ACTION: Notice. SUMMARY: Notice is hereby given that the U.S. International Trade Commission has determined not to review initial determinations ("ID") (Order No. 31) granting ajoint motion to terminate the above-captioned investigation with respect to U.S. Patent No. 6,121,941. The investigation is terminated in its entirety. FOR FURTHER INFORMATION CONTACT: Jia Chen, Office ofthe General Counsel, U.S. International Trade Commission, 500 E Street, S.W., Washington, D.C. 20436, telephone (202) 708-4737. Copies of non-confidential documents filed in connection with this investigation are or will be available for inspection during official business hours (8:45 a.m. to 5:15 p.m.) in the Office ofthe Secretary, U.S. International Trade Commission, 500 E Street, S.W., Washington, D.C. 20436, telephone (202) 205-2000. General information concerning the Commission may also be obtained by accessing its Internet server at http://www, usitc. gov. The public record for this investigation may be viewed on the Commission's electronic docket (EDIS) at http://edis. usitc. gov. Hearing-impaired persons are advised that information on this matter can be obtained by contacting the Commission's TDD terminal on (202) 205-1810. SUPPLEMENTARY INFORMATION: The Commission instituted Inv. -

2005 Annual Report(PDF/2823KB)

Information updated to 2006.04.20 48 2005 Annual Report Key figures Unit: NT$ million Year 2001 2002 2003 2004 2005 Sales Revenue 58,820 93,229 108,699 147,770 124,407 Net Income 3,031 7,400 7,500 7,619 (5,226) Net Margin (%) 5 8 7 5 (4) Retroactively Adjusted Earnings Per Share (NT$/share) 1.32 3.08 3.03 3.10 (2.12) Net Asset Value 28,141 41,278 45,462 49,078 44,431 Note: All financials are non-consolidated figures (Taiwan parent company level) 48 2005 Annual Report Message To Our Shareholders Our Shareholders To Message Dear Esteemed BenQ Shareholders, BenQ announced in June 2005 it will acquire Siemens AG’s mobile handset business (Siemens MD) in an acquisition that successfully propelled BenQ onto the global stage as a renowned brand. Following the closing of the acquisition, we began our first step in Q4 of 2005 when the Company incurred a net loss of 5.2 billion NT$ in 2005, translating to a loss of 2.12 NT$ per share on revenue of NT$ 162.3 billion on consolidated basis. Since fourth quarter 2005, we have worked seamlessly with our Germany-based co-workers and re-enforced managerial resources in areas where BenQ has a strong comparative advantage. In a truly complementary merger of mobile handset assets without breaking our stride, we introduced twelve breathtaking new handsets in Q1 of 2006. Since October, the Company has undertaken restructuring initiatives to cut costs, to accelerate time-to-market for new products, and to restore customer confidence. -

China's Labor Question

Christoph Scherrer (Ed.) China’s Labor Question Rainer Hampp Verlag München, Mering 2011 Bibliographic information published by the Deutsche Nationalbibliothek Deutsche Nationalbibliothek lists this publication in the Deutsche Nationalbibliografie; detailed bibliographic data are available in the Internet at http://dnb.d-nb.de. ISBN 978-3-86618-387-2 Picture on cover: Workers are seen inside a Foxconn factory in the township of Longhua in the southern Guangdong province May 26, 2010 (reproduced by permission of REUTERS/Bobby Yip) First published in 2011 © 2011 Rainer Hampp Verlag München, Mering Marktplatz 5 86415 Mering, Germany www.Hampp-Verlag.de All rights preserved. No part of this publication may be reprinted or reproduced or util- ized in any form or by any electronic, mechanical, or other means, now known or hereaf- ter invented, including photocopying and recording, or in any information storage or re- trieval system, without permission in writing from the publisher. In case of complaints please contact Rainer Hampp Verlag. TABLE OF CONTENTS Acknowledgements............................................................................................................. vi Notes on Contributors........................................................................................................ vii Introduction: The many Challenges of Chinese Labor Relations..................................1 Christoph Scherrer Part I: The Basic Setting 1. Perspectives on High Growth and Rising Inequality .......................................................7 -

This Version of Au Optronics Corp's Form 20-F, As

NOTE: THIS VERSION OF AU OPTRONICS CORP’S FORM 20-F, AS FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) ON HTML FORMAT ON MARCH 21, 2016, HAS BEEN CONVERTED FROM HTML BACK TO MICROSOFT WORD. PLEASE VISIT THE SEC’S WEBSITE AT www.sec.gov FOR THE FILED VERSION OF AU OPTRONICS CORP’S FORM 2O-F, INCLUDING THE EXHIBITS. WorldReginfo - abec82fc-d68f-4cd7-bd57-1c650be1bbc6 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2015 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-31335 (Exact name of Registrant as specified in its charter) AU OPTRONICS CORP. TAIWAN, REPUBLIC OF CHINA (Translation of Registrant’s name into English) (Jurisdiction of incorporation or organization) 1 LI-HSIN ROAD 2 HSINCHU SCIENCE PARK HSINCHU, TAIWAN REPUBLIC OF CHINA (Address of principal executive offices) Benjamin Tseng Chief Financial Officer 1 Li-Hsin Road 2 Hsinchu Science Park Hsinchu, Taiwan Republic of China Telephone No.: +886-3-500-8800 Facsimile No.: +886-3-564-3370 Email: [email protected] (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. -

2019 Public Supplier List

2019 Public Supplier List The list of suppliers includes original design manufacturers (ODMs), final assembly, and direct material suppliers. The volume and nature of business conducted with suppliers shifts as business needs change. This list represents a snapshot covering at least 95% of Dell’s spend during fiscal year 2020. Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Compal 58 First Avenue, Alienware Notebook Final Assembly and/ Compal YES Comprehensive Free Trade Latitude Notebook or Original Design Zone, Kunshan, Jiangsu, Latitude Tablet Manufacturers People’s Republic Of China Mobile Precision Notebook XPS Notebook Poweredge Server Compal 8 Nandong Road, Pingzhen IoT Desktop Final Assembly and/ Compal YES District, Taoyuan, Taiwan IoT Embedded PC or Original Design Latitude Notebook Manufacturers Latitude Tablet Mobile Precision Notebook Compal 88, Sec. 1, Zongbao Inspiron Notebook Final Assembly and/ Compal YES Avenue, Chengdu Hi-tech Vostro Notebook or Original Design Comprehensive Bonded Zone, Manufacturers Shuangliu County, Chengdu, Sichuan, People’s Republic of China Public Supplier List 2019 | Published November 2020 | 01 of 40 Corporate Profile Address Dell Products / Supplier Type Sustainability Site GRI Procurement Category Dell 2366-2388 Jinshang Road, Alienware Desktop Final Assembly and/ Dell YES Information Guangdian, Inspiron Desktop or Original Design Xiamen, Fujian, People’s Optiplex All in One Manufacturers Republic of China Optiplex Desktop Precision Desktop -

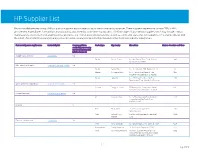

HP Supplier List

HP Supplier List Below is an alphabetized listing of HP production suppliers and information about their sustainability practices. These suppliers represent more than 95% of HP’s procurement expenditures for materials, manufacturing, and assembly at the time of publication. This list includes final assembly suppliers, which may include contract manufacturers, electronic manufacturing service providers, and original design manufacturers, as well as commodity and component suppliers. HP is sharing this list with the intent of promoting transparency and progress in raising social and environmental standards in the electronics industry supply chain. Final assembly parent supplier name Sustainability link Company publishes Product type City, Country Site address Number of workers on HP lines sustainability report using the Global Reporting (GRI) Initiative framework AU Optronics Corporation Sustainability Yes Display Suzhou, China No. 398, Suhong Zhong Road, Suzhou 890 Industrial Park, 215021 BOE Technology Group Co. Corporate Social Responsibility Yes Display Beijing, China No.118 Jinghaiyilu, BDA, Beijing, 100176 50 Display Chongqing, China No. 7, Yunhan Road, Shuitu Hi Tech 950 Industrial Park, Beibei District, 400700 Display Hefei, China No.2177, Great East Road, Xin Zhan 150 Development Zone, Hefei, An Hui Province Cheng Uei Precision Industry Co. Corporate Responsibility Yes Scanner Dongguan, China FIT Industry Park, Yinhe Industrial Area, 1013 Qingxi, Dongguan Guangdong Province Compal Electronics Sustainable Development Yes PC Kunshan,