What You Need to Know About the SBD

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Solomon Islands

SOLOMON ISLANDS STAFF REPORT FOR THE 2016 ARTICLE IV CONSULTATION AND FIFTH AND SIXTH REVIEWS UNDER THE EXTENDED CREDIT FACILITY ARRANGEMENT—INFORMATIONAL ANNEX March 8, 2016 Prepared By Asia and Pacific Department (In consultation with other departments) CONTENTS FUND RELATIONS ________________________________________________________________________ 2 SUPPORT FROM THE PACIFIC FINANCIAL TECHNICAL ASSISTANCE CENTRE ________ 6 RELATIONS WITH THE WORLD BANK GROUP __________________________________________ 8 RELATIONS WITH THE ASIAN DEVELOPMENT BANK ________________________________ 10 STATISTICAL ISSUES ____________________________________________________________________ 12 MAIN WEBSITES OF DATA _____________________________________________________________ 14 ©International Monetary Fund. Not for Redistribution SOLOMON ISLANDS FUND RELATIONS (As of January 31, 2016) Membership Status: Joined September 22, 1978; Article VIII General Resources Account: SDR Percent of Million Quota Quota 10.40 100.00 Fund holdings of currency 9.85 94.73 Reserve position in the 0.55 5.29 Fund SDR Department: SDR Million Percent of Allocation Net cumulative allocation 9.91 100.00 Holdings 8.23 83.07 Outstanding Purchases and Loans: SDR Million Percent Quota SDR Million Percent of Quota ECF Arrangements 0.74 7.14 SCF Arrangements 10.40 100.00 Latest Financial Arrangements: Type Approval Expiration Amount Approved Amount Drawn Date Date (SDR Mission) (SDR Million) ECF 12/7/2012 3/31/2016 1.04 0.74 SCF 12/6/2011 12/5/2012 5.20 0.00 SCF 6/2/2010 12/1/2011 12.48 12.48 Projected Payments to Fund1: (SDR Million; based on existing use of resources and present holdings of SDRs): …..Forthcoming 2016 2017 2018 2019 2020 Principal 2.77 2.77 2.46 1.46 0.13 Charges/Interest 0.00 0.01 0.01 0.01 0.00 Total 277 2.79 2.46 1.47 0.14 1 When a member has overdue financial obligations outstanding for more than three months, the amount of such arrears will be shown in this section. -

This PDF Is a Selection from an Out-Of-Print Volume from the National Bureau of Economic Research

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: The International Gold Standard Reinterpreted, 1914-1934 Volume Author/Editor: William Adams Brown, Jr. Volume Publisher: NBER Volume ISBN: 0-87014-036-1 Volume URL: http://www.nber.org/books/brow40-1 Publication Date: 1940 Chapter Title: Book III, Part V: The Impact of the World Economic Depression on the International Gold Standard, 1929-1931 Chapter Author: William Adams Brown, Jr. Chapter URL: http://www.nber.org/chapters/c5947 Chapter pages in book: (p. 808 - 1047) PART V The Impact of the World Economic Depression on the International Gold Standard, 1929-1931 S CHAPTER 22 The International Distribution of Credit under the Impact of World-wide Deflationary Forces For about twelve months after the critical decisions of June 1927 the international effects of generally easy money were among the most fundamental causes of a world-wide upswing in business.1 Though prices in gold standard countries were falling gradually, increasing productivity would probably have forced them much lower had it not been for the ex- pansion of credit. There was an upward pressure in many price groups. Profits from security and real estate speculation stimulated demand for many commodities. Low interest rates made it easy to finance valorization schemes and price arrangements and promoted the issue of foreign loans, par.. ticularly in the United States. Foreign loans in turn helped to maintain prices in many debtor countries and also pre- vented the growth of tariffs from checking the expansion of international trade.2 The continued extension of interna- tional credit was a dam that was holding back the onrushing torrent of economic readjustment. -

World Bank Document

Document of The World Bank FOR OMCIAL USE ONLY Public Disclosure Authorized R1uutNo. P-3687-Snr- RERPO- AND REWOIUIKNDkON OF TME PRSIEn OF THEl Public Disclosure Authorized I,FNTONL D EL, ASSOCIATION TO TME EXECUTIVE DIRECTORS m A PROPSED XD& C3REDIT 3N AN AMONT EBUIV TO SDR 3.3 MILLION Public Disclosure Authorized TO SOL9ON ISLANDS FOR A RURAL SERVICES PROJECT November 14, 1983 Public Disclosure Authorized bsbcmmet Ihas iatdc dEggbetI ma hbe m..i by retip -a ely in Oh pefama of IIeoftial dum kg =my ne ethewise be dbdched W &_WM Bk mberdz.do CURRENCYEQUIVALENTS Calendar 1982 July 1983 Solomon Islands Solomon Islands Currency Unit dollar (SI$) dollar (SI$) $1.00 SI$1.03 ST$1.20 SI$1.00 US$0.971 US$0.830 The Solomon Islands Dollar was introduced in 1977. The exchange rate is determined on the basis of a weighted basket of currencies of the major trading partners of the Solomon Tslands. ABBREVIATIONS ADB - Asian Development Bank ADAB - Australian Development Assistance Bureau AIU - Agriculture Information Unit DBSI - Development Bank of Solomon Islands FTC - Farmer Training Center IFAD - International Fund for Agricultural Development HHAND - Ministry of Home Affairs and National Development KATI - National Agricultural Training Institute rIU - Project Implementation Unit RDC - Rural Development Center UNDP - United Nations Development Program FISCAL YEAR January 1 - December 31 FOR OFFICIAL USE ONLY SOLOMONISLANDS RURALSERVICES PROJECT Credit and Project Summary Borrower: The Solomon Islands Amount: SDR 3.3 million (US$3.5million) Terms: Standard IDA terms. Project Description: The project would expand and improve the country's agricul- tural support services in the areas of research,education, training and extensionservices, and foster developmentof rural enterprises. -

Christopher Kent: the Resources Boom and the Australian Dollar

Christopher Kent: The resources boom and the Australian dollar Address by Mr Christopher Kent, Assistant Governor (Economic) of the Reserve Bank of Australia, to the Committee for Economic Development of Australia (CEDA) Economic and Political Overview, Sydney, 14 February 2014. * * * I thank Jonathan Hambur, Daniel Rees and Michelle Wright for assistance in preparing these remarks. I would like to thank CEDA for the invitation to speak here today. I thought I would take the opportunity to talk to you about the implications of the resources boom for the Australian dollar. The past decade saw the Australian dollar appreciate by around 50 per cent in trade- weighted terms (Graph 1).1 The appreciation was an important means by which the economy was able to adjust to the historic increase in commodity prices and the unprecedented investment boom in the resources sector.2 Even though there was a significant increase in incomes and domestic demand over a number of years, average inflation over the past decade has remained within the target. Also, growth has generally not been too far from trend. This is all the more significant in light of the substantial swings in the macroeconomy that were all too common during earlier commodity booms.3 The high nominal exchange rate helped to facilitate the reallocation of labour and capital across industries. While this has made conditions difficult in some industries, the appreciation, in combination with a relatively flexible labour market and low and stable inflation expectations, meant that high demand for labour in the resources sector did not spill over to a broad-based increase in wage inflation.4 So the high level of the exchange rate was helpful for the economy as a whole. -

The Drs. Joanne and Edward Dauer Collection of World Banknotes

DALLAS | THE DRS. JOANNE JOANNE DRS. THE DAUER AND EDWARD COLLECTION OF BANKNOTESWORLD WORLD PAPER MONEY PAPER WORLD APRIL 24, 2020 WORLD PAPER MONEY AUCTION #4020 | THE DRS. JOANNE AND EDWARD DAUER COLLECTION OF WORLD BANKNOTES | APRIL 24, 2020 | DALLAS Front Cover Lots: 26088, 26115, 26193, 26006, 26051 Inside Front Cover Lots: 26066, 26075, 26190, 26177, 26068 Inside Back Cover Lots: 26143, 26162, 26083, 26148, 26125 Back Cover Lots: 26191, 26129, 26185, 26181, 26108 Heritage Signature® Auction #4020 World Paper Money The Drs. Joanne and Edward Dauer Collection of World Banknotes April 24, 2020 | Dallas FLOOR Signature® Session PRELIMINARY LOT VIEWING (Floor, Telephone, HERITAGELive!®, Internet, Fax, and Mail) By appointment only. Contact Jose Berumen at 214-409-1299 Heritage Auctions, Dallas • 1st Floor Auction Room or [email protected] (All times subject to change) 3500 Maple Avenue • Dallas, TX 75219 Heritage Auctions, Dallas • 17th Floor 3500 Maple Avenue • Dallas, TX 75219 Session Friday, April 24 • 2:00 PM CT • Lots 26001–26197 Monday, April 6 – Friday, April 10 • 9:00 AM – 5:00 PM CT LOT VIEWING Heritage Auctions, Dallas • 17th Floor LOT SETTLEMENT AND PICK-UP 3500 Maple Avenue • Dallas, TX 75219 Available weekdays 9:00 AM – 5:00 PM CT starting Monday, April 27, by appointment only. Please contact Client Services Tuesday, April 21 • 12:00 PM – 5:00 PM CT at 866-835-3243 to schedule an appointment. Wednesday, April 22 – Friday, April 24 9:00 AM – 5:00 PM CT Lots are sold at an approximate rate of 125 lots per hour, but it is not uncommon to sell 100 lots or 175 lots in any given hour. -

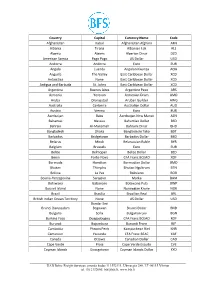

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL

Country Scheme Alpha 3 Alpha 2 Currency Albania MC / VI ALB AL Lek Algeria MC / VI DZA DZ Algerian dinar Argentina MC / VI ARG AR Argentine peso Australia MC / VI AUS AU Australian dollar -Christmas Is. -Cocos (Keeling) Is. -Heard and McDonald Is. -Kiribati -Nauru -Norfolk Is. -Tuvalu Christmas Island MC CXR CX Australian dollar Cocos (Keeling) Islands MC CCK CC Australian dollar Heard and McDonald Islands MC HMD HM Australian dollar Kiribati MC KIR KI Australian dollar Nauru MC NRU NR Australian dollar Norfolk Island MC NFK NF Australian dollar Tuvalu MC TUV TV Australian dollar Bahamas MC / VI BHS BS Bahamian dollar Bahrain MC / VI BHR BH Bahraini dinar Bangladesh MC / VI BGD BD Taka Armenia VI ARM AM Armenian Dram Barbados MC / VI BRB BB Barbados dollar Bermuda MC / VI BMU BM Bermudian dollar Bolivia, MC / VI BOL BO Boliviano Plurinational State of Botswana MC / VI BWA BW Pula Belize MC / VI BLZ BZ Belize dollar Solomon Islands MC / VI SLB SB Solomon Islands dollar Brunei Darussalam MC / VI BRN BN Brunei dollar Myanmar MC / VI MMR MM Myanmar kyat (effective 1 November 2012) Burundi MC / VI BDI BI Burundi franc Cambodia MC / VI KHM KH Riel Canada MC / VI CAN CA Canadian dollar Cape Verde MC / VI CPV CV Cape Verde escudo Cayman Islands MC / VI CYM KY Cayman Islands dollar Sri Lanka MC / VI LKA LK Sri Lanka rupee Chile MC / VI CHL CL Chilean peso China VI CHN CN Colombia MC / VI COL CO Colombian peso Comoros MC / VI COM KM Comoro franc Costa Rica MC / VI CRI CR Costa Rican colony Croatia MC / VI HRV HR Kuna Cuba VI Czech Republic MC / VI CZE CZ Koruna Denmark MC / VI DNK DK Danish krone Faeroe Is. -

Currency Exchange Rates

Pacific Data Hub .Stat metadata Currency exchange rates Data description Title Currency exchange rates Description Number of U.S. Dollars per of domestic currency unit for currencies used in Pacific Island Countries and Territories. Monthly and yearly values for end-of-period and period-average exchange rates since 1950 are based on data from IMF International Financial Statistics. Data identification Identifier SPC:DF_CURRENCIES(2.0) URL https://stats.pacificdata.org/vis?locale=en&facet=6nQpoAP&constraints[0]=6nQpoAP%2C0%7CEconomy%23ECO%23&start=0 &dataflow[datasourceId]=SPC2&dataflow[dataflowId]=DF_CURRENCIES&dataflow[agencyId]=SPC&dataflow[version]=2.0 Data source Monthly and yearly currency exchange rates are collected from IMF International Financial Statistics, using the SDMX API. Exchange rates are domestic currency per U.S. Dollar for currencies used by Pacific Island Countries and Territories : Australian Dollar, CFP Franc, Fiji Dollar, Kina, New Zealand Dollar, Pa’anga, Solomon Islands Dollar, Tala and Vatu. End of period rates and period average rates are collected. The call to IMF API used to collect the data is : http://dataservices.imf.org/REST/SDMX_XML.svc/CompactData/IFS/A+M.FJ+NC+PG+SB+TO+VU+WS+AU+NZ.ENDA_XDC_USD_RATE+ENDE_XD C_USD_RATE?startPeriod=1950&endPeriod=2050 Data processing Data values are rounded to 4 decimal places. Quarterly values are calculated from monthly values: end of perdiod value of the last month of the quarter is used for end of period rate, average of average monthly rates is used for period average rate. Reference area ISO3166-1 alpha 2 codes are recoded to ISO 4217 currency codes this way : Temporal coverage First period 1950 Last period Current month-1 Data scheduling Frequency Monthly and yearly Timeliness Data is refreshed at the beginning of each month, timeliness of data for individual currencies has not been assessed. -

WM/Refinitiv Closing Spot Rates

The WM/Refinitiv Closing Spot Rates The WM/Refinitiv Closing Exchange Rates are available on Eikon via monitor pages or RICs. To access the index page, type WMRSPOT01 and <Return> For access to the RICs, please use the following generic codes :- USDxxxFIXz=WM Use M for mid rate or omit for bid / ask rates Use USD, EUR, GBP or CHF xxx can be any of the following currencies :- Albania Lek ALL Austrian Schilling ATS Belarus Ruble BYN Belgian Franc BEF Bosnia Herzegovina Mark BAM Bulgarian Lev BGN Croatian Kuna HRK Cyprus Pound CYP Czech Koruna CZK Danish Krone DKK Estonian Kroon EEK Ecu XEU Euro EUR Finnish Markka FIM French Franc FRF Deutsche Mark DEM Greek Drachma GRD Hungarian Forint HUF Iceland Krona ISK Irish Punt IEP Italian Lira ITL Latvian Lat LVL Lithuanian Litas LTL Luxembourg Franc LUF Macedonia Denar MKD Maltese Lira MTL Moldova Leu MDL Dutch Guilder NLG Norwegian Krone NOK Polish Zloty PLN Portugese Escudo PTE Romanian Leu RON Russian Rouble RUB Slovakian Koruna SKK Slovenian Tolar SIT Spanish Peseta ESP Sterling GBP Swedish Krona SEK Swiss Franc CHF New Turkish Lira TRY Ukraine Hryvnia UAH Serbian Dinar RSD Special Drawing Rights XDR Algerian Dinar DZD Angola Kwanza AOA Bahrain Dinar BHD Botswana Pula BWP Burundi Franc BIF Central African Franc XAF Comoros Franc KMF Congo Democratic Rep. Franc CDF Cote D’Ivorie Franc XOF Egyptian Pound EGP Ethiopia Birr ETB Gambian Dalasi GMD Ghana Cedi GHS Guinea Franc GNF Israeli Shekel ILS Jordanian Dinar JOD Kenyan Schilling KES Kuwaiti Dinar KWD Lebanese Pound LBP Lesotho Loti LSL Malagasy -

International Currency Codes

Country Capital Currency Name Code Afghanistan Kabul Afghanistan Afghani AFN Albania Tirana Albanian Lek ALL Algeria Algiers Algerian Dinar DZD American Samoa Pago Pago US Dollar USD Andorra Andorra Euro EUR Angola Luanda Angolan Kwanza AOA Anguilla The Valley East Caribbean Dollar XCD Antarctica None East Caribbean Dollar XCD Antigua and Barbuda St. Johns East Caribbean Dollar XCD Argentina Buenos Aires Argentine Peso ARS Armenia Yerevan Armenian Dram AMD Aruba Oranjestad Aruban Guilder AWG Australia Canberra Australian Dollar AUD Austria Vienna Euro EUR Azerbaijan Baku Azerbaijan New Manat AZN Bahamas Nassau Bahamian Dollar BSD Bahrain Al-Manamah Bahraini Dinar BHD Bangladesh Dhaka Bangladeshi Taka BDT Barbados Bridgetown Barbados Dollar BBD Belarus Minsk Belarussian Ruble BYR Belgium Brussels Euro EUR Belize Belmopan Belize Dollar BZD Benin Porto-Novo CFA Franc BCEAO XOF Bermuda Hamilton Bermudian Dollar BMD Bhutan Thimphu Bhutan Ngultrum BTN Bolivia La Paz Boliviano BOB Bosnia-Herzegovina Sarajevo Marka BAM Botswana Gaborone Botswana Pula BWP Bouvet Island None Norwegian Krone NOK Brazil Brasilia Brazilian Real BRL British Indian Ocean Territory None US Dollar USD Bandar Seri Brunei Darussalam Begawan Brunei Dollar BND Bulgaria Sofia Bulgarian Lev BGN Burkina Faso Ouagadougou CFA Franc BCEAO XOF Burundi Bujumbura Burundi Franc BIF Cambodia Phnom Penh Kampuchean Riel KHR Cameroon Yaounde CFA Franc BEAC XAF Canada Ottawa Canadian Dollar CAD Cape Verde Praia Cape Verde Escudo CVE Cayman Islands Georgetown Cayman Islands Dollar KYD _____________________________________________________________________________________________ -

St Tri B 1960 5

~ .., ,."\ \ ~ ) ~ .·• ·• ~ ~. IL 1 -., ' ST/TRI/B.l960/ 5 NON-SELF-GOVERNING TERRITORIES Summaries of information transmitted to the Secretary-General for 1959 Pacific Territories: American Samoa Cook Islands Fiji Gilbert and Ellice Islands Guam Netherlands New Guinea New Hebrides Niue Island Papua Pitcairn Island Solomon Islands Tokelau Islands UNITED NATIONS SUMMARIES OF INFORMATION FOR 1959 Territories by Administering Member responsible for transmitting information Au$tralia United Kingdom (continued) Cocoa (Keeling) Islands Malta Papua Mauritius New Hebrides France (condominium, France) North Borneo New Hebrides , Northern Rhodesia (condominium, Uni~ed Kingdom) Nyasaland Pitcairn Island Netherlands st. Helena Netherlands New Guinea Sarawak Seychelles New Zealand Sierra Leone Singapore Cook Islands Solomon Islands Niue Island Swaziland Tokelau Islands Uganda The West lndies: United Kingdom Antigua Aden Barbados Bahamas Dominica Basutoland Grenada Bechuanaland Jamaica Bermuda Montserrat British Gulana st. Kitts-Nevis-Anguilla British Honduras st. Lucia British Virgin Islands st. Vincent Brunei Trinidad and Tobago Falkland Islands Zanzibar Fiji Gambia Gibraltar United States of America Gilbert and Elllce Islands American Samoa Hong Kong Guam Kenya United states Virgin Islands NON-SELF-GOVERNING TERRITORIES Summaries of information transmitted to the Secretary-General for 1959 Pacific Territories: American Samoa Cook Islands Fiji Gilbert and Ellice Islands Guam Netherlands New Guinea New Hebrides Niue Island Papua Pitcairn Island Solomon Islands Tokelau Islands UNITED NATIONS New York, 1961 NOTE The following symbols are used: Three dots (••• ) data not available Dash (- ) magnitude nil or negligible Slash 1948/1949 crop or financial year Hyphen 1948-1949 annual average STJTRI/B.l960/5 l INFORMATION FROM NON-SELF-GOVERNING TERRITORIES Pacific Territorie~/ In accordance with the provisions of ALticle 73 e of the Charter the . -

CURRENCY BOARD FINANCIAL STATEMENTS Currency Board Working Paper

SAE./No.22/December 2014 Studies in Applied Economics CURRENCY BOARD FINANCIAL STATEMENTS Currency Board Working Paper Nicholas Krus and Kurt Schuler Johns Hopkins Institute for Applied Economics, Global Health, and Study of Business Enterprise & Center for Financial Stability Currency Board Financial Statements First version, December 2014 By Nicholas Krus and Kurt Schuler Paper and accompanying spreadsheets copyright 2014 by Nicholas Krus and Kurt Schuler. All rights reserved. Spreadsheets previously issued by other researchers are used by permission. About the series The Studies in Applied Economics of the Institute for Applied Economics, Global Health and the Study of Business Enterprise are under the general direction of Professor Steve H. Hanke, co-director of the Institute ([email protected]). This study is one in a series on currency boards for the Institute’s Currency Board Project. The series will fill gaps in the history, statistics, and scholarship of currency boards. This study is issued jointly with the Center for Financial Stability. The main summary data series will eventually be available in the Center’s Historical Financial Statistics data set. About the authors Nicholas Krus ([email protected]) is an Associate Analyst at Warner Music Group in New York. He has a bachelor’s degree in economics from The Johns Hopkins University in Baltimore, where he also worked as a research assistant at the Institute for Applied Economics and the Study of Business Enterprise and did most of his research for this paper. Kurt Schuler ([email protected]) is Senior Fellow in Financial History at the Center for Financial Stability in New York. -

Fear of Sudden Stops: Lessons from Australia and Chile

Fear of Sudden Stops: Lessons from Australia and Chile Ricardo J. Caballero Kevin Cowan Jonathan Kearns∗ March 2, 2004 Abstract Latin American economies are exposed to substantial external vulnerability. Domestic im- balances and terms of trade shocks are often exacerbated by sudden financial distress. In this paper we explore ways of overcoming external vulnerability drawing lessons from a detailed com- parison of the response of Chile and Australia to recent external shocks and from Australia’s historical experience. We argue that in order to understand sudden stops and the mechanisms to smooth them, it is useful to highlight and then draw a distinction between two dimensions of investors confidence: country-trust and currency-trust. While these two dimensions are interre- lated, there are important distinctions. Lack of country-trust is a more fundamental and serious problem behind sudden stops. But lack of currency-trust may both be a source of country-trust problems as well as weaken a country’s ability to deal with sudden stops. We discuss steps to improve along these two dimensions of investors’ confidence in the medium run, and policies to reduce the impact of country-trust and currency-trust weaknesses in the short run. ∗Respectively: MIT and NBER; IADB; Reserve Bank of Australia. This paper is a revised version of the paper prepared for the Financial Dedollarization: Policy Options conference at the Inter-American Development Bank, 1-2 December 2003. The views expressed in this paper are those of the authors and should not be attributed to the IADB, the Reserve Bank or any other institution with which they are affiliated.