Investor's Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

War and Insurgency in the Western Sahara

Visit our website for other free publication downloads http://www.StrategicStudiesInstitute.army.mil/ To rate this publication click here. STRATEGIC STUDIES INSTITUTE The Strategic Studies Institute (SSI) is part of the U.S. Army War College and is the strategic-level study agent for issues relat- ed to national security and military strategy with emphasis on geostrategic analysis. The mission of SSI is to use independent analysis to conduct strategic studies that develop policy recommendations on: • Strategy, planning, and policy for joint and combined employment of military forces; • Regional strategic appraisals; • The nature of land warfare; • Matters affecting the Army’s future; • The concepts, philosophy, and theory of strategy; and, • Other issues of importance to the leadership of the Army. Studies produced by civilian and military analysts concern topics having strategic implications for the Army, the Department of Defense, and the larger national security community. In addition to its studies, SSI publishes special reports on topics of special or immediate interest. These include edited proceedings of conferences and topically-oriented roundtables, expanded trip reports, and quick-reaction responses to senior Army leaders. The Institute provides a valuable analytical capability within the Army to address strategic and other issues in support of Army participation in national security policy formulation. Strategic Studies Institute and U.S. Army War College Press WAR AND INSURGENCY IN THE WESTERN SAHARA Geoffrey Jensen May 2013 The views expressed in this report are those of the authors and do not necessarily reflect the official policy or position of the Department of the Army, the Department of Defense, or the U.S. -

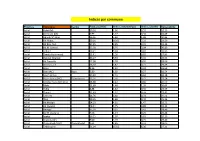

Indices Par Commune

Indices par commune Province Commune Centre Taux_pauvreté indice_volumétrique indice_séverité Vulnérabilité Azilal Azilal (M) 10,26 1,96 0,55 19,23 Azilal Demnate (M) 6,99 1,27 0,34 16,09 Azilal Agoudi N'Lkhair 26,36 5,84 1,88 30,84 Azilal Ait Abbas 50,01 16,62 7,33 23,59 Azilal Ait Bou Oulli 37,95 9,65 3,45 31,35 Azilal Ait M'Hamed 35,58 8,76 3,04 30,80 Azilal Tabant 19,21 3,24 0,81 33,95 Azilal Tamda Noumercid 15,41 2,90 0,82 27,83 Azilal Zaouiat Ahansal 35,27 9,33 3,45 28,53 Azilal Ait Taguella 17,08 3,28 0,95 28,09 Azilal Bni Hassane 16,10 2,87 0,77 29,55 Azilal Bzou 8,56 1,32 0,32 24,68 Azilal Bzou (AC) Bzou 5,80 1,02 0,27 16,54 Azilal Foum Jemaa 15,22 2,51 0,62 31,18 Azilal Foum Jemaa (AC) Foum Jemaa 13,26 2,56 0,72 22,54 Azilal Moulay Aissa Ben Driss 13,38 2,42 0,66 26,59 Azilal Rfala 21,69 4,46 1,35 30,64 Azilal Tabia 8,88 1,42 0,35 23,59 Azilal Tanant 11,63 2,12 0,59 23,41 Azilal Taounza 13,76 2,60 0,74 25,52 Azilal Tisqi 10,35 1,66 0,40 25,26 Azilal Ait Mazigh 24,23 4,91 1,47 33,72 Azilal Ait Ouqabli 18,31 3,25 0,88 33,12 Azilal Anergui 35,18 9,25 3,41 28,49 Azilal Bin El Ouidane 7,96 1,14 0,25 25,44 Azilal Isseksi 16,21 2,97 0,81 29,19 Azilal Ouaouizeght 9,00 1,19 0,25 29,46 Azilal Ouaouizeght (AC) Ouaouizeght 9,61 1,85 0,52 18,05 Azilal Tabaroucht 51,04 15,52 6,36 27,11 Province Commune Centre Taux_pauvreté indice_volumétrique indice_séverité Vulnérabilité Azilal Tagleft 27,66 6,89 2,44 26,89 Azilal Tiffert N'Ait Hamza 16,84 3,99 1,37 21,90 Azilal Tilougguite 24,10 5,32 1,70 30,13 Azilal Afourar 5,73 0,80 0,17 20,51 Azilal -

La Liste Des Jardins D'enfants Relevant Du Ministère De La Jeunesse Et Des Sports

la liste des Jardins d'Enfants relevant du Ministère de la Jeunesse et des Sports Délégation Etablissement Milieu Adresse Région : Rabat -Salé -Kenitra Rabat Alazhar Urbain Lotissement Alhaj Slimane n°15 C.Y.M Annahda Urbain Derb elfassi Rue joutiya n° 06 Souika Yaacoub eddar Urbain Rue 48 n° 1 Hay El Barid C.Y.M Provincial Urbain Avenue Sidi Mohamed Ben Abdellah C.Y.M Touarga Almichouar Said Touarga Urbain Almichouar Said Touarga Sale Tabrekte Urbain Hay Almazraä tabrekte Bettana Urbain Avenue Palestine Sale Achahbaa Urbain Avenue 2 Mars Rue Said Hajji Salé Alaayayda 1 Urbain Lgazzara Laayayda 1 Salé Alaayayda 2 Urbain Terrain Benaacher Alaayayda 2 Salé Skhirate Témara Almanzah Rural Commune Almanzah Sidi Yahya Rural Sidi Yahya zaër Ain Aaouda Urbain Eglise Ain Aaouda Annasr Urbain Hay Annasr Témara Hay Alfath Rural Hay Alfath skhirate Khémisset Provincial Urbain Avenue Idriss Elharti hay Essalam khémisset J.G Alaman Urbain Al hay alidari Khémisset Almahalli Urbain Rue Maarakate Badr Alkobra Khémisset Alamal Urbain Avenue la marche verte Tifelte Central « Almarkazi » Urbain N°66 rue almaazize hay alfarkh tifelte Albahraoui Rural - Arromani Rural Hay alamal Arromani Alghandour Rural Alghandour centre Alkanzara Rural Alkanzara centre Almaaziz Rural Almaaziz Alhay Alidari Ait Ikou Rural Ait Ikou centre Had Elbrachwa Rural Had Elbrachwa centre Ait Yadine Rural Ait Yadine centre Tiddasse Rural Tiddasse centre Khmisse Sidi Yahya Rural Commune Khmisse Sidi Yahya Oulmes Rural Oulmes centre Kénitra Alminaa Urbain Villa n°276 biir errami algharbiya -

4.3 Historique Du Developpement De L'irrigation Dans Le Souss Massa

GESTION DE LA DEMANDE EN EAU DANS LE BASSIN MEDITERRANEEN – EXEMPLE DU MAROC - CAS D’ETUDE DU SOUSS MASSA Rapport Principal Final PREAMBULE..........................................................................................................1 RESUME EXECUTIF ..............................................................................................3 1. POIDS DE LA DEMANDE EN EAU DANS LE SOUSS MASSA...................15 1.1 Analyse du bilan ressources besoins 17 1.1.1 Analyse de la demande 17 1.1.1.1 Demande en eau potable et industrielle 17 1.1.1.2 Demande agricole 18 1.1.1.3 Demande environnementale 25 1.1.2 Analyse de l’offre 28 1.1.2.1 Pluviométrie 28 1.1.2.2 Ressources de surface 30 1.1.2.3 Ressources souterraines 39 1.1.2.4 Qualité des eaux 52 1.1.2.5 Risque d’intrusion saline 57 1.2 Récapitulatif de l’équilibre offre / demande 60 2. SCENARIO « LAISSEZ-FAIRE »...................................................................64 3. SCENARIO TENDANCIEL.............................................................................67 4. HISTORIQUE DE L’IRRIGATION DANS LA REGION DU SOUSS ET DU MASSA ....................................................................................................75 4.1 Contexte, problématique 75 4.2 Les 4 stades de développement économique 76 4.3 Historique du développement de l’irrigation dans le Souss Massa 78 4.3.1 Agriculture traditionnelle avec des îlots d’irrigation 78 4.3.2 « Boom » du pompage dans le Souss à partir des années 1940 79 4.3.3 Premiers symptômes de surexploitation 82 4.3.4 Déclin et crises 83 4.4 Le Plan Maroc Vert comme issue ? 86 p:\chazot\800298_plan_bleu_afd_souss\2_production\rapport\3_rapport_principal_final\afd_rapport_principal_final_v8.doc Gestion de la demande en eau dans le bassin méditerranéen – Exemple du Maroc - Cas d’étude du Souss Massa 5. -

Accéder À L'inventaire (Pdf)

Archives de la Défense ARCHIVES DES DIRECTIONS ET CHEFFERIES DU GENIE REPERTOIRE NUMERIQUE SOUS-SERIE GR 5 V Archives du commandement et de la direction du génie du Maroc GR 5 V 1-51 Sous la direction du capitaine Valérie CANIART Chef de la section des archives techniques Mis à jour par Clotilde Sablon du Corail Chef de la division des archives techniques et de l’information géographique Vincennes, novembre 2010 INTRODUCTION Le S.H.A.T. a reçu au mois de mars 1989 les archives du Commandement et de la direction du Génie du Maroc ; elles provenaient de la caserne Bernadotte où elles étaient stockées à l'arrondissement des travaux du génie de Pau depuis une date indéterminée. Des portefeuilles renfermant des calques en mauvais état complétaient ce versement. Les documents conservés dans des chemises sans classement apparent n'avaient subi aucun tri préalable et étaient dans le plus grand désordre. L'examen de l'ensemble du fonds n'a pas permis de retrouver trace du cadre de classement propre aux archives du génie ; de plus, les documents recouvrent une période chronologique (1920-1960) durant laquelle l'organisation territoriale du service du génie au Maroc a constamment évolué : c'est ainsi qu'en 1924, il n'existait que deux directions, Casablanca et Fez, puis en 1935, s'ajouta celle de Meknès. Après la guerre, une restructuration vient encore bouleverser l'organisation existante ; une chefferie a pu ainsi dépendre successivement de plusieurs directions et les papiers d'une même affaire se trouvent ainsi dispersés dans différents dossiers. Aussi a-t-il parut plus cohérent d'adopter un classement par place qui permet de suivre l'évolution des problèmes domaniaux propres à une chefferie. -

Casing Only Date of Publication 10/12/2018

Validity date from COUNTRY Morocco 10/12/2018 00074 SECTION Treated stomachs, bladders and intestines: casing only Date of publication 10/12/2018 List in force Approval number Name City Regions Activities Remark Date of request B.1.2.13 TOUR HASSAN Rabat Rabat - Salé - Kénitra PP 37, O, P 31/01/2017 B.19.13.14 Boyauderie Marrakech Sellami MARRAKECH Marrakech - Safi PP 37, O 02/04/2014 B.19.19.13 BOYAUDERIE N'GUYER ABDERRAZZAK MARRAKECH Marrakech - Safi PP 37, C, O, P 31/01/2017 B.19.20.13 BOYAUDERIE SELLAMI MARRAKECH Marrakech - Safi PP P 31/01/2017 B.19.21.13 BOYAUDERIE MARRAKECH MARRAKECH Marrakech - Safi PP 37, O 31/01/2017 B.19.3.14 Boyauderie Marrakech boyaux naturels MARRAKECH Marrakech - Safi PP 37, C, O 11/06/2014 B.3.15.14 Boyauderie Zahra Témara Rabat - Salé - Kénitra PP 37, B, C, O, P, S 04/12/2014 B.34.1.13 BOYAUDERIE DE L'ATLAS Tanger Tanger - Tétouan - Al Hoceima PP 37, B, C, O, P 31/01/2017 B.34.2.13 BOYAUDERIE EL GHAZAL Tanger Tanger - Tétouan - Al Hoceima PP 37, O, P 31/01/2017 B.53.11.13 BOYAUDERIE ZEMAMRA El Jadida Grand Casablanca - Settat PP P 31/01/2017 B.53.12.13 BOYAUDERIE EL JADIDA El Jadida Grand Casablanca - Settat PP 37, O 31/01/2017 B.56.10.13 BOYAUDERIE CHAOUIA SETTAT Grand Casablanca - Settat PP 37, O, P 31/01/2017 B.56.2.13 Boyauderie 'La Casablançaise' SETTAT Grand Casablanca - Settat PP 37, O, P 09/03/2015 B.56.8.13 BOYAUDERIE ATLANTIQUE SETTAT Grand Casablanca - Settat PP 37, B, O, P 31/01/2017 B.56.9.13 BOYAUDERIE BAZI SETTAT Grand Casablanca - Settat PP 37, O, P 31/01/2017 1 / 2 List in force Approval -

Cadastre Des Autorisations TPV Page 1 De

Cadastre des autorisations TPV N° N° DATE DE ORIGINE BENEFICIAIRE AUTORISATIO CATEGORIE SERIE ITINERAIRE POINT DEPART POINT DESTINATION DOSSIER SEANCE CT D'AGREMENT N Casablanca - Beni Mellal et retour par Ben Ahmed - Kouribga - Oued Les Héritiers de feu FATHI Mohamed et FATHI Casablanca Beni Mellal 1 V 161 27/04/2006 Transaction 2 A Zem - Boujad Kasbah Tadla Rabia Boujad Casablanca Lundi : Boujaad - Casablanca 1- Oujda - Ahfir - Berkane - Saf Saf - Mellilia Mellilia 2- Oujda - Les Mines de Sidi Sidi Boubker 13 V Les Héritiers de feu MOUMEN Hadj Hmida 902 18/09/2003 Succession 2 A Oujda Boubker Saidia 3- Oujda La plage de Saidia Nador 4- Oujda - Nador 19 V MM. EL IDRISSI Omar et Driss 868 06/07/2005 Transaction 2 et 3 B Casablanca - Souks Casablanca 23 V M. EL HADAD Brahim Ben Mohamed 517 03/07/1974 Succession 2 et 3 A Safi - Souks Safi Mme. Khaddouj Bent Salah 2/24, SALEK Mina 26 V 8/24, et SALEK Jamal Eddine 2/24, EL 55 08/06/1983 Transaction 2 A Casablanca - Settat Casablanca Settat MOUTTAKI Bouchaib et Mustapha 12/24 29 V MM. Les Héritiers de feu EL KAICH Abdelkrim 173 16/02/1988 Succession 3 A Casablanca - Souks Casablanca Fès - Meknès Meknès - Mernissa Meknès - Ghafsai Aouicha Bent Mohamed - LAMBRABET née Fès 30 V 219 27/07/1995 Attribution 2 A Meknès - Sefrou Meknès LABBACI Fatiha et LABBACI Yamina Meknès Meknès - Taza Meknès - Tétouan Meknès - Oujda 31 V M. EL HILALI Abdelahak Ben Mohamed 136 19/09/1972 Attribution A Casablanca - Souks Casablanca 31 V M. -

Colossal Achievements and Know-How for Sustainable Development of Moroccan Agriculture

~\J)\ ~?_,JI ~4-- .. Il Institut National de la Recherche Agronomique INRA Colossal Achievements and know-how for Sustainable Development of Moroccan Agriculture \ Professeur Mohamed Badraoui f or nearly one century, INRA has been evolving in terms of organization and research strategy.lndeed, INRA has always managed to adapt its intervening structures, its research programs use tools and means specifie to the socio - economie environ ment prevailing at each phase of its history. Thanks to its research achievements, INRA is among the national institutions that have contributed significantly to the modernization of the Moroccan economy through basic knowledge produced and the technologies developed by its researchers. ln this regard, the regional dimension is a strategie priority. Thus, we are working to preserve client oriented research achievements and to consolidate regional anchorage. Our will is strongly expressed by the involvement of our partners, stakeholders and regional operators in orienting, monitoring and using research results. This is also the role ofThe Regional Councils of Agricultural Research which are important forums for holding debates and keeping information exchange. ln addition, communication and technology transfer is a key element of our vision. We are spa ring no effort to promote internai and external communication and improve information management. Nowadays, INRA has a solid basis to achieve defined objectives and, thereby, support the new Govern ment Agricultural Development Strategy "Green Morocco Plan:' Meanwhile, the opening up and partnership dimension is also a field for us to further strengthen collaboration at the national and international levels for better use of research results and for raising Research and Development to a level in harmony with public and private operators' needs. -

Report on the Kingdom of Morocco's Violations Of

REPORT ON THE KINGDOM OF MOROCCO’S VIOLATIONS OF ARTICLE 1 OF THE INTERNATIONAL COVENANT ON ECONOMIC, SOCIAL AND CULTURAL RIGHTS IN THE PARTS OF WESTERN SAHARA UNDER MOROCCAN OCCUPATION On the occasion of Morocco’s fourth periodic report on the implementation of the International Covenant on Economic, Social and Cultural Rights To the attention of the Committee on Economic, Social and Cultural Rights Submitted by Western Sahara Resource Watch to the Committee on 18 August 2015 Contact: Sara Eyckmans, International Coordinator, Western Sahara Resource Watch, [email protected] www.wsrw.org 1 Executive Summary 2015 marks forty years since the invasion and occupation of what has come to be regarded as Africa’s last colony, Western Sahara. A significant number of well-established human rights obligations apply in the three quarters of the territory that is under Moroccan occupation. International law contains clear prescriptions for the protection, political independence and advancement of the Saharawi people, who were the original inhabitants of Western Sahara, then Spanish Sahara, until they were abandoned by Spain in 1975. Foremost is the right of self-determination of non-self-governing peoples. The norms prescribed by the International Covenant on Economic, Social and Cultural Rights have been consistently violated in occupied Western Sahara. This submission for the Committee on Economic, Social and Cultural Rights has been prepared by Western Sahara Resource Watch, an international non-governmental organization, based in Brussels. It is intended to highlight the significant failure of Morocco as the occupying power or State with responsibility for the territory of Western Sahara and the Saharawi people to ensure even the most basic compliance with the International Covenant on Economic, Social and Cultural Rights. -

Direction Regionale Du Centre Nord

ROYAUME DU MAROC Office National de l’Électricité et de l’Eau Potable Branche Eau DIRECTION REGIONALE DU CENTRE NORD ________________________________ Projet de renforcement de la production et d’amélioration de la performance technique et commerciale de l’eau potable (PRPTC) Composante : Programme d’amélioration des performances techniques des centres de la Direction Régionale du Centre Nord PLAN D’ACQUISITION DES TERRAINS ET D’INDEMNISATION DES PERSONNES AFFECTEES PAR LE PROJET (PATI-PAP) FINANCEMENT BAD 15 Août 2021 RESUME EXECUTIF DU PATI-PAP 1. INTRODUCTION 1.1. CONTEXTE ET JUSTIFICATION DU PROJET 1.2. OBJECTIFS DU PATI-PAP 1.3. METHODOLOGIE D’ELABORATION DU PATI-PAP 2. DESCRIPTION DU PROJET ET DE LA ZONE CONCERNEE 2.1. Description du projet 2.2. Consistance du projet 2.2.1 Consistance des lots 2.2.2. Besoins en foncier 2.3. Présentation de la zone du projet 2.3.1 Présentation géographique 2.3.2. POPULATION ET DEMOGRAPHIE 2.3.3 Urbanisation 2.3.4 Armature urbaine 2.3.5. INFRASTRUCTURES DE BASE 2.3.6. SECTEURS PRODUCTIFS 2.3.7 CAPITAL IMMATERIEL 3. IMPACTS POTENTIELS DU PROJET 3.1. Impacts potentiels positifs 3.2. Impacts potentiels négatifs 3.3. Impacts cumulatifs et résiduels 4. RESPONSABLITES ORGANISATIONNELLES 4.1. Cadre organisationnel nationale 4.2. Responsabilités de la mise en œuvre du présent PATI-PAP 5. PARTICIPATION ET CONSULTATIONS PUBLIQUES 5.1. Participation communautaire/Consultations publiques déjà réalisées 5.2. Consultation des PAPs 5.3. Enquêtes administratives 6. INTEGRATION DES COMMUNAUTES D’ACCUEIL 7. ETUDES SOCIO –ECONOMIQUES : Recensement des personnes affectées par le projet 7.1. -

Ahwash Ntfrkhin’As a Case Study Sekkal Khadija Sidi Mohamed Ben Abdellah University, Faculty of Letters and Human Sciences, Sais-Fez, Morocco

SSRG International Journal of Humanities and Social Science (SSRG-IJHSS) – Volume 7 Issue 1–January 2020 An Ethnographic Approach to Women’s Identity Celebrating in Folklore: ‘Ahwash Ntfrkhin’as a Case Study Sekkal Khadija Sidi Mohamed Ben Abdellah University, Faculty of Letters and Human Sciences, Sais-Fez, Morocco Abstract as an academic discipline articulating its own content The paper is about the discourse used by women in and methodology. Being no longer perceived as ahwash (a folk dance in Sous, Morocco). It aims at something amateurish associated with ‘primitive’ documenting the way ahwash ntfrkhin, (girls’ cultures, folklore has come to stand a ahwash)articulates anempowering and often genuineincarnation of the thoughts, attitudes, values, challenging discourse via performance and lyrics. and beliefs of specific communities (Propp 1984: 38). Though there are many folkloric performances in Many researchers have depicted folklore as Sous, ahwash ntfrkhin stands as the epitome of all the gender-biased (Radner and Lanser 1987, Kowawole dances since it grants women the opportunity to enjoy 1998, Kousaleos 1999,Sadiqi 2003, Ennaji 2008, autonomy and freedom of expression and experience. Sekkal 2012).Women are commonly deprecated in Freedom of expression implies that women can folklore. And when accorded some consideration, it express freely and outwardly a particular feminine only fits their prevalent image as evils, victims, and world view. Yet, freedom of experience refers to the failures or their traditional role as docile mothers and fact that females experience themselves as active submissive housewives. Not with standing, such subjects during this performance. The study unfolds stereotypical conceptualization of women in folklore that women are successful in challenging male and the one-dimensional interpretation of its data dominion in ahwash ntfrkhin showing their solidarity should be revisited as folklore also serves as a scope and unity against any patriarchal domination and for subverting gender-biased discourse. -

Fao/Global Environment Facility Project Document

FAO/GLOBAL ENVIRONMENT FACILITY PROJECT DOCUMENT PROJECT TITLE:Conservation of biodiversity and mitigation of land degradation through adaptive management of agricultural heritage systems. PROJECT SYMBOL: GCP/MOR/045/GFF Recipient Country/ies: Morocco Resource Partner: GEF FAO project ID: 629911 GEF Project ID: 5481 EXECUTING PARTNER(S):National Institute for Agricultural Research (INRA), Ministry of Agriculture and Marine Fisheries (MAPM) Expected EOD (starting date): March 2015 Expected NTE (End date): December 2018 Contribution to FAO’s a. Strategic objective/Organizational Result: Strategic Framework1 SO2: OO1 b. Regional Result/Priority Area: Promote Sustainable Use and Management of Natural Resources2 c. Country Programming Framework Outcome: CPF- Priority area 1; Outcome 1.2: Small Scale Family Farming is improved and diversified in the context of Green Morocco Plan, Pillar II. CPF- Priority area 2; Outcome 2.4: The standard of living of vulnerable populations is improved. GEF Focal Area: Land Degradation; Biodiversity GEF Strategic Objectives: BD-2– Mainstreaming biodiversity in production landscapes/sectors LD-1– Ecosystem services in production landscapes (agriculture, rangeland) LD-3 – SLM in wider landscapes (integrated management) Environmental Impact Assessment Category (insert √): A B C √ Financing Plan: GEF allocation: USD 771 918 Co-financing: FAO USD 350 000 ADA – Green Morocco Plan (PMV), Pillar II USD 2 000 000 ANDZOA – Improvement of Agricultural Production in Oasis USD 4 000 000 1 For projects operated by country