DB RREEF Trust Property Synopsis 2006 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(Westfield Kotara) Application for Individual Exemption

Application for Individual Exemption Westfield Kotara 10 July 2015 File: 2015.07.10 – EN Exemption Kotara – V4CP SCENTRE SHOPPING CENTRE MANAGEMENT PTY LTD ABN 55 000 712 710 Level 30, 85 Castlereagh Street, Sydney NSW 2000 Australia · GPO Box 4004 Sydney NSW 2001 Australia · T +61 (02) 9358 7000 · scentregroup.com Contents General Information Requirements ....................................................................................... 3 Particulars relating to the nature and scope of the proposed operations .............................. 6 Appendix A: Further Information ..........................................................................................10 Page 2 General Information Requirements 1. Legal Name Scentre Custodian Pty Limited ACN 098 698 652 as trustee for the VIC Shopping Centre Trust 2. Trading Name Westfield Kotara 3. Australian Company Number (ACN) 098 698 652 4. Registered Postal Address for Correspondence Scentre Group 85 Castlereagh Street Sydney NSW 2000 Or Scentre Group GPO Box 4004 Sydney NSW 2001 5. Nominated Contact Person Mark Gleeson National Facilities Manager T: 02 9028 8320 M: 0409 362 281 E: [email protected] 6. Why you are seeking an individual exemption, and why you believe that an exemption (rather than a retailer authorisation) is appropriate to your circumstances. Scentre Group is seeking an individual exemption for the retrofit of an existing private network to create an embedded network on a single site. The proposed on-selling activities are incidental to Scentre Group’s core business activity of managing the shopping centre. 7. The address of the site at which you intend to sell energy, including a map of the site and a brief description of this site and its current and future use/s. Westfield Kotara is located at the corner of Northcott Drive & Park Avenue, Kotara NSW 2009. -

DEXUS Property Group 2016 Performance Pack Introduction

DEXUS Property Group 2016 Performance Pack Introduction DEXUS considers corporate responsibility and sustainability an integral part of its daily business operations. Committed to understanding, monitoring and managing social, environmental and economic impact, DEXUS delivers these responsibilities through measurable actions and within corporate policies. DEXUS reports on its material issues in accordance with Global Reporting Initiative (GRI) G4 requirements. DEXUS sets measurable performance targets across its key stakeholder groups in line with its strategy, and drives ethical and responsible performance in all areas of its operations. DEXUS’s FY16 commitments are based on material issues which have the greatest impact on its stakeholders across its CR&S framework. The majority of its FY16 commitments have been achieved and/or progressed. The results relating to each stakeholder group are detailed in the 2016 DEXUS Annual Report supported by non-financial and operational data supplied in this 2016 Performance Pack. DEXUS's materiality assessment DEXUS continuously seeks to improve the information it reports on, including reviewing material issues to ensure relevance. In 2015, and previously in 2011, DEXUS formally developed its material issues through an extensive review process outlined below and DEXUS has conducted subsequent annual management reviews of its commitments in the intervening years of 2012 to 2014 and again in 2016 in line with its reporting disclosure. 2011 2012 2013 2014 2015 2016 Materiality Management Management Management Materiality Management Assessment Review Review Review Assessment Review DEXUS’s periodic materiality assessment encompasses an extensive review of DEXUS's materiality for reporting in 2015 facilitated by an independent specialist. The 2015 materiality assessment comprised a four stage process: 1. -

Escape Issue47 Number Food Build Your Own Breakfast

JamaicaBlue AUTUMN 2018 ESCAPE ISSUE47 NUMBER FOOD BUILD YOUR OWN BREAKFAST FITNESS UNDERSTANDING THE SCIENCE OF SLEEP TRAVEL A TASTE OF COSTA RICA JessicaRoweWOULDN'T CHANGE A THING TAKE ME HOME FITNESS, FASHION, HEALTH, NUTRITION, RECIPES AND MORE: JB LIFESTYLE PG 27 JB47-p01 Cover.indd 2 18/01/2018 23:50:49 JamaicaBlue 2018 AutumnIssue 47 FEATURES 12 COVER FEATURE p04 Jessica Rowe 14 FOOD Build your own breakfast 17 SPORT The Commonwealth Games 20 TRAVEL JAMAICA BLUE PTY LTD Beautiful Costa Rica ACN 059 236 387 22 FOOD Unit 215F1, Building 215 p14 The Entertainment Quarter A taste of chocolate p06 122 Lang Road 24 BEACON FOUNDATION Moore Park NSW 2021 PO Box 303 A pathway to success Double Bay NSW 1360 26 THE BARISTA SAYS... T 1800 622 338 Meet Jaydan Hancock of (Australia only) T 02 9302 2200 Jamaica Blue Harbour Town F 02 9302 2212 E [email protected] LIFESTYLE SECTION New Zealand Office 28 FINANCE T +64 9377 1901 Making the most of Amazon F +64 9377 1908 30 CAREER E [email protected] Pressing pause JAMAICA BLUE ESCAPE™ 32 HEALTH Editor The science of sleep Rachel Stuart 34 FITNESS Art Director The top 5 free apps Natalie Delarey p17 36 FASHION Nutrition Specialist Six great new autumn looks Sharon Natoli 40 BOOKS Welcome to the autumn Fashion Editor Autumn reads edition of Jamaica Blue Cheryl Tan 42 NUTRITION Escape. In this issue we chat Eating for good mental health to Australian TV veteran, Contributors Jessica Rowe, try our new John Burfitt 44 NUTRITION WITH Shane Conroy SHARON NATOLI 'build your own' breakfast Sarah Megginson You are when you eat menu, ready ourselves for the Gold Coast Thomas Mitchell 46 RECIPES Commonwealth Games, try on the Autumn never tasted so good latest fashions and more. -

The Manager Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street SYDNEY NSW 2000

27 February 2013 The Manager Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam WESTFIELD RETAIL TRUST (ASX: WRT) PROPERTY COMPENDIUM Please find attached the Property Compendium for Westfield Retail Trust. Yours faithfully WESTFIELD RETAIL TRUST Katherine Grace Company Secretary Encl. SHOPPING CENTRE OPERATIONAL PERFORMANCE REPORT 31 DECEMBER 2012 SHOPPING CENTRE OPERATIONAL PERFORMANCE REPORT OVERVIEW OF PORTFOLIO Westfield Retail Trust’s (the Trust) portfolio of shopping centres is geographically diverse, spread across five states and one territory in Australia and New Zealand. These centres are generally located near or in major metropolitan areas, are anchored by long-term tenancies with major retailers and incorporate a wide cross-section of specialty retailers and national chain store operators. The Trust’s shopping centre investments are undertaken through joint ventures and co-ownership arrangements, primarily with Westfield Group and major institutional investors. The following table sets out the Trust’s shopping centre portfolio as of December 31 2012. Australia New Zealand Total Centres 38 9 47 Retail Outlets 10,911 1,431 12,342 GLA (million square metres) 3.3 0.4 3.7 Asset Value (billion)1 A$12.2 NZ$1.3 A$13.3 1. Trust share of shopping centre assets excluding development projects and construction in progress of $144.4 million. Note: Exchange rate as of December 31 2012 was AUD/NZ 1.2613 Key operating statistics for the shopping centre portfolio (including part-owned shopping centres on a 100% basis) for the year ended December 31 2012, as applicable, include the following: − Comparable shopping centre net property income growth: 2.9% − Portfolio leased rate: >99.5% − Weighted average unexpired lease term: 7.1 years (anchor retailers 10.0 years, specialty retailers 3.5 years) − Total number of lease deals completed: 2,458 with an aggregate of 303,486 square metres As of December 31 2012, the Trust owned interests in 47 shopping centres in Australia and New Zealand. -

Designed for Students a Guide to Living and Studying in Adelaide

Designed for students A guide to living and studying in Adelaide A Welcome to Adelaide Adelaide is a multicultural, vibrant and friendly city and a beautiful place to live. We’ve created this guide to help you find your way around life in Adelaide. Settling In Health & Safety Things to know about Things to know about settling into your new health and safety, home in Adelaide, including how to see a including getting around, doctor and local hospitals. organising a phone, where to shop and more. Work Entertainment Things to know about Things to know about working while you study, how to have fun in your including getting a job, spare time, including how to get paid and local nightlife, weekend paying taxes. getaways and Adelaide’s best attractions. Welcome to Adelaide. Designed for life. Follow us We Chat At StudyAdelaide, we’re here to help you enjoy your time living and studying in Adelaide. Make sure you follow our social media channels for the latest offers and opportunities. Designed for Students A guide to living and studying in Adelaide 2 Table of Contents 04 Settling in 23 Health and safety 32 Work 39 Entertainment 3 Settling in Things to know about settling into your new home in Adelaide. 05 All about Adelaide 06 Arriving in Adelaide 07 Climate 08 Local language 09 Getting around 11 Accommodation 12 Setting up your new home 13 Staying connected 15 Money matters 17 Food and shopping 18 Cultural and student groups 19 Religion 20 City of Adelaide 21 Public holidays 2019 22 International Student Advisory Service 4 All about Adelaide Founded in 1836, Adelaide is the capital city of the • South Australia is more than twice the size of the state of South Australia. -

DEXUS Property Group 2014 Performance Pack Overview

DEXUS Property Group 2014 Performance Pack Overview In 2013 DEXUS Property Group detailed its FY14 commitments based on material issues which have the greatest impact on its stakeholders to ensure outcomes are aligned to the interest of investors, stakeholders and the wider community. DEXUS has delivered on the majority of its FY14 commitments and the results relating to each stakeholder group are detailed in the 2014 Annual Review supported by non-financial and operational data supplied in this Performance Pack. Materiality The Group uses the GRI Sustainability Reporting Guidelines (version 3.1) to set the 2014 Annual Review boundary in relation to material issues and key performance indicators reporting across stakeholder groups, including current and prospective investors, employees, tenants, customers, suppliers and the community. In 2014, the Group developed a plan to transition from GRI version 3.1 to its materiality-based G4 sustainability reporting guidelines for reporting in FY15. The plan involves four phases in which the Group will systematically: 1. Scan internal and external collateral and review existing and emerging material issues that are known to be or potentially relevant to the Group as identified by local and international best-practice peers, investment bodies, sustainability benchmarking tools and industry associations 2. Engage with a wide range of stakeholders to consult with them on existing and emerging material issues and gather feedback on current reporting disclosure 3. Conduct workshops and business forums with the Group’s employees to prioritise material issues based on their significance and likely impact to DEXUS and its stakeholders 4. Prepare to report in FY15 by reviewing the Group’s strategy and set targets against the developed list of material issues and proceed to collect and report against these issues The Group completed the review phase in FY14 and will continue its transitional work in preparation for reporting against GRI G4 in FY15. -

Presentation to 2008 Macquarie Emerging Leaders Conference

JB Hi-Fi Limited Macquarie Emerging Leaders Conference –May 2008 For personal use only AGENDA 1. Performance 2. Historical Performance 3. Trading Update 4. JB Model –CODB and EDLP 5. Dividends & Cashflow 6. Store Update 7. Investment Checklist Richard Murray CFO For personal use only 2 1. PERFORMANCE Strong performance for 6 months to 31 December 2007: HY08 Growth q Sales $988.5m 50.0% Û q Comparable store sales growth 18.8% (Aust: 19.6%, NZ: 0.4%) q EBIT Margin 6.6% +22 bps Û q NPAT $41.9m 60.2% Û q Earnings per share 40.0 cps 58.2% Û q Interim dividend - fully franked * 10.0 cps 100% Û For personal use only * paid 19 March 2008 3 2. HISTORICAL PERFORMANCE Strong growth in sales & earnings since MBI in July 2000 SALES HY08 EBIT HY08 NPAT HY08 +50% +55% +60% ~ 90-94m ~ 1.8b ~ 57-60m 65.5m 64.8m 1,282m +47% +55% +36% 41.9m 40.4m +60% +57% 989m 946m +50% 44.5m +36% +28% 25.8m 694m 34.7m +32% +54% +52% 19.5m 452m 22.8m +41% 61% 13.8m 356m +27% 16.7m +37% +60% 249m +43% 11.6m +44% 8.6m For personal use only 155m +61% 6.2m 5.7m +104% +39% 2.6m +138% 4 2001 2002 2003 2004 2005 2006 2007 2008F 2001 2002 2003 2004 2005 2006 2007 2008F 2001 2002 2003 2004 2005 2006 2007 2008F 3. TRADING UPDATE Trading Outlook FY08 • Since reporting in mid February, trading in February, March and April has been solid. -

2015 DEXUS Performance Pack

DEXUS Property Group 2015 Performance Pack Introduction DEXUS considers corporate responsibility and sustainability an integral part of its daily business operations. Committed to understanding, monitoring and managing social, environmental and economic impact, DEXUS delivers these responsibilities through measurable actions and within corporate policies. DEXUS sets measurable performance targets across its key stakeholder groups in line with its strategy, and drives ethical and responsible performance in all areas of its operations. DEXUS’s FY15 commitments are based on material issues which have the greatest impact on its stakeholders across its CR&S framework. The majority of its FY15 commitments have been achieved and the results relating to each stakeholder group are detailed in the 2015 DEXUS Annual Review supported by non-financial and operational data supplied in this 2015 Performance Pack. Materiality based G4 sustainability guidelines In FY15 DEXUS transitioned from the GRI Sustainability Reporting Guidelines (version 3.1) to the materiality based G4 sustainability guidelines which it used to define the 2015 DEXUS Annual Review content. The boundary relates to material issues and key performance indicators reporting across stakeholder groups, including current and prospective investors, employees, tenants, customers, suppliers and the community. The transition involved four stages in which the Group systematically undertook: 1. Identify: DEXUS researched existing and emerging material issues relevant to its business, as identified by: . Local and international best practice peers . Investment bodies . Sustainability benchmarking tools . Industry 2. Engage: DEXUS engaged with key stakeholders to identify issues that they considered important to the Group. These included prioritising issues relating to GRI G4 aspects as well as other issues identified by stakeholders. -

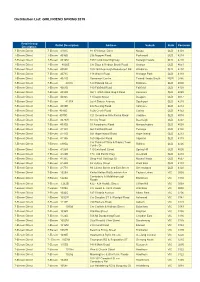

Distribution List: GIRLFRIEND SPRING 2019

Distribution List: GIRLFRIEND SPRING 2019 Retail Group Outlet Description Address Suburb State Postcode Description 7-Eleven Direct 7-Eleven 4101C 91-97 Noosa Drive Noosa QLD 4101 7-Eleven Direct 7-Eleven 4096B 236 Napper Road Parkwood QLD 4214 7-Eleven Direct 7-Eleven 4016M 1957 Gold Cast Highway Burleigh Heads QLD 4220 7-Eleven Direct 7-Eleven 4026E Cnr Days & Kedron Brook Road Grange QLD 4051 7-Eleven Direct 7-Eleven 4058E 159-163 Beenleigh-Beaudesert Rd Windaroo QLD 4207 7-Eleven Direct 7-Eleven 4073C 118 Waller Road Heritage Park QLD 4118 7-Eleven Direct 7-Eleven 4077D Homemart Centre Tweed Heads South NSW 2486 7-Eleven Direct 7-Eleven 4081C 120 Edward Street Brisbane QLD 4000 7-Eleven Direct 7-Eleven 4061D 180 Fairfield Road Fairfield QLD 4103 7-Eleven Direct 7-Eleven 4083D SH 1 2058-2062 Mogill Road Kenmore QLD 4069 7-Eleven Direct 7-Eleven 4086C 11 Depot Street Deagon QLD 4017 7-Eleven Direct 7-Eleven 4197A Lot 4 Slatyer Avenue Southport QLD 4215 7-Eleven Direct 7-Eleven 4089E 400 Nerang Road Ashmore QLD 4214 7-Eleven Direct 7-Eleven 4075D 1505 Creek Road Carina QLD 4152 7-Eleven Direct 7-Eleven 4079D 721 Seventree Mile Rocks Road Jindalee QLD 4074 7-Eleven Direct 7-Eleven 4078W 10 City Road Beenleigh QLD 4207 7-Eleven Direct 7-Eleven 4095D 53 Aerodrome Road Maroochydore QLD 4558 7-Eleven Direct 7-Eleven 4112H 563 Fairfield Road Yeronga QLD 4104 7-Eleven Direct 7-Eleven 4111D 341 Hope Island Road Hope Island QLD 4212 7-Eleven Direct 7-Eleven 4118b 169 Algester Road Algester QLD 4115 Cnr Robina P'Way & Robina Town 7-Eleven Direct -

2020 Property Compendium

2020 Property Compendium Creating extraordinary places, connecting 31 December 2020 and enriching communities Scentre Group Limited ABN 66 001 671 496 Creating extraordinary places, connecting and enriching communities Contents Portfolio Overview __________________________ 1 Westfield Knox, VIC _________________________ 28 Operating Performance _______________________ 3 Westfield Kotara, NSW _______________________ 29 Retailers and Lease Expiry Profile _______________ 4 Westfield Liverpool, NSW _____________________ 30 Portfolio Details _____________________________ 6 Westfield Manukau, NZ _______________________ 31 Scentre Group Property Profiles _______________ 7 Westfield Marion, SA ________________________ 32 Westfield Airport West, VIC ____________________ 8 Westfield Miranda, NSW ______________________ 33 Westfield Albany, NZ _________________________ 9 Westfield Mt Druitt, NSW _____________________ 34 Westfield Belconnen, ACT ____________________ 10 Westfield Newmarket, NZ _____________________ 35 Westfield Bondi Junction, NSW ________________ 11 Westfield North Lakes, QLD ___________________ 36 Westfield Booragoon, WA ____________________ 12 Westfield Parramatta, NSW ____________________ 37 Westfield Burwood, NSW _____________________ 13 Westfield Penrith, NSW _______________________ 38 Westfield Carindale, QLD _____________________ 14 Westfield Plenty Valley, VIC ___________________ 39 Westfield Carousel, WA ______________________ 15 Westfield Riccarton, NZ ______________________ 40 Westfield Chatswood, NSW ___________________ -

8-9 New Youth Programs Creating a Brighter Future

ISSUE NO. 1 WINTER 2016 Flourish Celebrating the people and programs of UnitingCare Wesley Port Adelaide 8-9 NEW YOUTH PROGRAMS CREATING A BRIGHTER FUTURE 5 7 10 12 14 IN THIS Old beds are Helping more Fun, food & Congratulations Winter campaign ISSUE: put to good people to laughter for to our newest launched to help use overseas access loans Chinese New Year Centenarians homeless “ We are privileged to support people to overcome life challenges.” CEO LIBBY CRAFT, 2016 Welcome elcome to Flourish, our We launch our annual winter new quarterly publication campaign, Hang it up for Poverty, Wshowcasing the amazing to help SA’s homeless and speak with work of our staff and volunteers – our Anti Poverty Team Leader about and the successes of those we our emergency assistance program work alongside. providing food and warmth to thousands of people in need each year. Our work makes an enormous difference to people in our community. In our aged care homes, we have had We join together as a team, take our Chinese New Year festivities bringing roles seriously and provide quality colour and laughter to our sites, and services to make a positive difference two of our residents celebrating their to people’s lives. We are proud of our 100th birthdays. organisation and what it represents. We also meet a family who is the We assist people to have a home, essence of why we do what we do. find employment, attend education, They arrived in Australia almost 20 and improve their health and years ago with nothing more than a wellbeing. -

PAS Group Transaction Support Deed of Company Arrangement

DocuSign Envelope ID: A0EA26CB-D4CC-470B-8E52-331407C08EDA PAS Group Transaction Support Deed of Company Arrangement Martin Francis Ford, Stephen Graham Longley and David Laurence McEvoy (Voluntary Administrators) and Martin Francis Ford, Stephen Graham Longley and David Laurence McEvoy (Deed Administrators) and The PAS Group Limited (Administrators Appointed) (ACN 169 477 463) (the Company) EXECUTION VERSION Ref: 011914080 DocuSign Envelope ID: A0EA26CB-D4CC-470B-8E52-331407C08EDA 1 CONTENTS Page no. 1 Purpose and Objects of this DOCA .................................................... 5 2 Conditional effect of this DOCA .......................................................... 5 2.1 Condition precedent................................................................................... 5 2.2 Obligation to satisfy conditions .................................................................. 6 2.3 Consequences of non-satisfaction of the condition precedent ................... 6 3 Operation ............................................................................................... 6 3.1 Commencement and termination ............................................................... 6 3.2 Interim effect .............................................................................................. 6 3.3 Previous operation of this DOCA preserved .............................................. 7 4 Parties bound by this DOCA ................................................................ 7 4.1 Parties bound by this DOCA .....................................................................