(Westfield Kotara) Application for Individual Exemption

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Customer Visits Grow to 548 Million

ASX Announcement 18 February 2020 FULL YEAR FUNDS FROM OPERATIONS OF 25.42c PER SECURITY UP 3.2% (PRO FORMA BASIS); ANNUAL CUSTOMER VISITS GROW TO 548 MILLION Scentre Group (ASX: SCG) today released its results for the 12 months to 31 December 2019, with Funds From Operations (“FFO”) of $1.345 billion, in line with forecast. On a per security basis FFO was 25.42 cents, up 0.7% or 3.2% on a pro forma basis adjusting for the transactions1 completed during 2019. Distribution for the 12-month period was 22.60 cents per security, up 2.0% and in line with forecast. Operating Earnings – the Group’s FFO excluding Project Income – was $1.287 billion for the 12-month period, up 1.0% per security or 3.6% on a pro forma basis. Scentre Group CEO Peter Allen said: “We are creating the places more people choose to come, more often, for longer. “Our strategic focus on the customer and curation of our offer to continually meet their changing expectations and preferences has delivered these pleasing results. “Our 42 Westfield Living Centres are each strategically located in highly urbanised areas with strong population growth and density. “The strength of our portfolio combined with our leading operating platform has seen annual customer visits grow to more than 548 million. This is an increase of more than 12 million visits. “We have seen strong demand continue from our retail and brand partners with portfolio occupancy at 99.3%. During the year we introduced 344 new brands and 279 existing brands grew their store network with us. -

DEXUS Property Group 2016 Performance Pack Introduction

DEXUS Property Group 2016 Performance Pack Introduction DEXUS considers corporate responsibility and sustainability an integral part of its daily business operations. Committed to understanding, monitoring and managing social, environmental and economic impact, DEXUS delivers these responsibilities through measurable actions and within corporate policies. DEXUS reports on its material issues in accordance with Global Reporting Initiative (GRI) G4 requirements. DEXUS sets measurable performance targets across its key stakeholder groups in line with its strategy, and drives ethical and responsible performance in all areas of its operations. DEXUS’s FY16 commitments are based on material issues which have the greatest impact on its stakeholders across its CR&S framework. The majority of its FY16 commitments have been achieved and/or progressed. The results relating to each stakeholder group are detailed in the 2016 DEXUS Annual Report supported by non-financial and operational data supplied in this 2016 Performance Pack. DEXUS's materiality assessment DEXUS continuously seeks to improve the information it reports on, including reviewing material issues to ensure relevance. In 2015, and previously in 2011, DEXUS formally developed its material issues through an extensive review process outlined below and DEXUS has conducted subsequent annual management reviews of its commitments in the intervening years of 2012 to 2014 and again in 2016 in line with its reporting disclosure. 2011 2012 2013 2014 2015 2016 Materiality Management Management Management Materiality Management Assessment Review Review Review Assessment Review DEXUS’s periodic materiality assessment encompasses an extensive review of DEXUS's materiality for reporting in 2015 facilitated by an independent specialist. The 2015 materiality assessment comprised a four stage process: 1. -

Public Competition Assessment

Public Competition Assessment 28 November 2013 Westfield Group and Westfield Retail Trust - proposed acquisition of Karrinyup Shopping Centre Introduction 1. On 5 September 2013, the Australian Competition and Consumer Commission (ACCC) announced its decision not to oppose the proposed acquisition of Karrinyup Shopping Centre (Karrinyup) by Westfield Group (Westfield) and Westfield Retail Trust (WRT) (proposed acquisition), subject to a section 87B undertaking (the undertaking) accepted by the ACCC on 4 September 2013. The ACCC decided that the proposed acquisition, in conjunction with the undertaking, would be unlikely to have the effect of substantially lessening competition in any market in contravention of section 50 of the Competition and Consumer Act 2010 (the Act). 2. The ACCC made its decision on the basis of the information provided by Westfield and WRT and information arising from its market inquiries. This Public Competition Assessment outlines the basis on which the ACCC reached its decision on the proposed acquisition, subject to confidentiality considerations. Public Competition Assessment 3. To provide an enhanced level of transparency and procedural fairness in its decision making process, the ACCC issues a Public Competition Assessment for all transaction proposals where: a proposed acquisition is opposed; a proposed acquisition is subject to enforceable undertakings; the merger parties seek such disclosure; or a proposed acquisition is not opposed but raises important issues that the ACCC considers should be made public. 4. This Public Competition Assessment has been issued because the ACCC’s decision not to oppose Westfield and WRT’s proposed acquisition of Karrinyup was subject to a court enforceable undertaking. 5. By issuing Public Competition Assessments, the ACCC aims to provide the public with a better understanding of the ACCC's analysis of various markets and the associated merger and competition issues. -

HUB Store List ▪ Victoria ▪ Queensland ▪ Western Australia ▪ Northern Territory New South Wales

▪ New South Wales ▪ Australian Capital Territory HUB store list ▪ Victoria ▪ Queensland ▪ Western Australia ▪ Northern Territory New South Wales Balmain Baulkham Hills Campbelltown Chatswood 279 Darling Street, Kiosk 10 Stockland Baulkham Hills, Shop L50 Campbelltown Mall, 340 Victoria Avenue, Balmain NSW 2041 Baulkham Hills NSW 2153 Campbelltown NSW 2170 Chatswood NSW 206 02 9555 8866 02 9688 6936 02 4626 2250 02 9884 8880 Mon-Sun: 8am-6pm Mon-Sun: 8am-7pm Mon-Sun: 8am-6:00pm Mon-Sun: 8am-8pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Bankstown Blacktown Castle Hill Chifley Plaza Kiosk KI113 Bankstown Centre, Shop 3033 Westpoint Shopping Shop 210A Castle Towers, Shop L1, F8/Chifley Plaza Bankstown NSW 2200 Centre, Blacktown NSW 2148 Castle Hill NSW 2154 Chifley Square, Sydney NSW 2000 02 9793 9688 02 9676 3260 02 9680 9886 02 9222 9618 Mon-Sun: 8am-6pm Mon-Sun: 8am-6:00pm Mon-Sun: 8am-7pm Mon-Fri: 9:30am-5pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Bass Hill Brookvale Casula Cranebrook Shop 19A Bass Hill Plaza, Kiosk 25K04 Warringah Mall Shop 30 Casula Mall, Shop 2 Cranebrook Village, Bass Hill NSW 2197 Brookvale NSW 2100 1 Ingham Drive, Casula NSW 2170 Cranebrook NSW 2749 02 9793 9688 02 9907 3077 02 9822 7543 02 9037 7066 Mon-Sun: 8am-6:30pm Mon-Sun: 8am-6pm Mon-Sun: 8am-8pm Mon-Sun: 9am-7pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 8am-9pm Thurs: 9am-9pm Sun: 10am-6pm Bateau Bay Cabramatta Central Shop 107 Bateau Bay Square, 23/ 101-103 John Street, Shop 2 815-825 George Street Bateau Bay NSW 2261 Cabramatta NSW 2166 Haymarket NSW 2000 02 4334 7755 02 9728 9600 02 9281 1258 Mon-Sun: 8am-6:00pm Mon-Sun: 8am-7:30pm Mon-Fri: 8am-10pm Thurs: 8am-9pm Sat-Sun: 8am-9:30pm Trading hours may vary during public holiday, please contact individual stores for details. -

Escape Issue47 Number Food Build Your Own Breakfast

JamaicaBlue AUTUMN 2018 ESCAPE ISSUE47 NUMBER FOOD BUILD YOUR OWN BREAKFAST FITNESS UNDERSTANDING THE SCIENCE OF SLEEP TRAVEL A TASTE OF COSTA RICA JessicaRoweWOULDN'T CHANGE A THING TAKE ME HOME FITNESS, FASHION, HEALTH, NUTRITION, RECIPES AND MORE: JB LIFESTYLE PG 27 JB47-p01 Cover.indd 2 18/01/2018 23:50:49 JamaicaBlue 2018 AutumnIssue 47 FEATURES 12 COVER FEATURE p04 Jessica Rowe 14 FOOD Build your own breakfast 17 SPORT The Commonwealth Games 20 TRAVEL JAMAICA BLUE PTY LTD Beautiful Costa Rica ACN 059 236 387 22 FOOD Unit 215F1, Building 215 p14 The Entertainment Quarter A taste of chocolate p06 122 Lang Road 24 BEACON FOUNDATION Moore Park NSW 2021 PO Box 303 A pathway to success Double Bay NSW 1360 26 THE BARISTA SAYS... T 1800 622 338 Meet Jaydan Hancock of (Australia only) T 02 9302 2200 Jamaica Blue Harbour Town F 02 9302 2212 E [email protected] LIFESTYLE SECTION New Zealand Office 28 FINANCE T +64 9377 1901 Making the most of Amazon F +64 9377 1908 30 CAREER E [email protected] Pressing pause JAMAICA BLUE ESCAPE™ 32 HEALTH Editor The science of sleep Rachel Stuart 34 FITNESS Art Director The top 5 free apps Natalie Delarey p17 36 FASHION Nutrition Specialist Six great new autumn looks Sharon Natoli 40 BOOKS Welcome to the autumn Fashion Editor Autumn reads edition of Jamaica Blue Cheryl Tan 42 NUTRITION Escape. In this issue we chat Eating for good mental health to Australian TV veteran, Contributors Jessica Rowe, try our new John Burfitt 44 NUTRITION WITH Shane Conroy SHARON NATOLI 'build your own' breakfast Sarah Megginson You are when you eat menu, ready ourselves for the Gold Coast Thomas Mitchell 46 RECIPES Commonwealth Games, try on the Autumn never tasted so good latest fashions and more. -

Smart Living Starts Here

Smart living starts here Smart living starts here This brand new development, neighbouring with Chisholm and Thornton, is your opportunity to invest in an architecturally designed estate, in the most accessible Hunter location. Chisholm Gardens has a range of dwellings to cater to the wide demographic of tenants and home buyers. With two and three bedroom villas & townhouses in single level adaptable or double storey, the variety suits most lifestyles; singles, couples, young families, downsizers, seniors and home owners who simply don’t want to worry about maintaining a large parcel of land. In close proximity to transportation and major education facilities in both Maitland & Newcastle as well as a childcare facilties just around the corner. Located opposite Homeworld, with SMSF option, you wont regret investing in this central thriving location. It’s an investment in smart living. Key Features 2 & 3 bedroom Villas 2.5 hp split-system air conditioner and townhouses Landscaped common areas, Single level adaptable designs gardens and BBQ areas Gourmet kitchen featuring Automatic panel-lift garage door modern stainless steel appliances Contemporary concrete patios, (cooktop, rangehood, dishwasher, driveways and footpaths fan-forced under-bench oven) and laminated cupboards Self Managed Super Fund suitable Home Styles Chisholm Gardens has a range of dwellings to cater Complete to the wide demographic of tenants and home buyers. Turn-Key Package The Acheron (TYPE A1) 3 Bedroom Villa Living 134.4m2 Portico 2.8m2 Garage 33.8m2 Dwelling size -

New South Wales

New South Wales Venue Location Suburb Bar Patron 2 Phillip St Sydney Westfield Kotara Kotara BEERHAUS 24 York St Sydney 108-110 Jonson St Byron Bay El Camino Cantina Manly Wharf Manly 18 Argyle St The Rocks 52 Mitchell Road Alexandria 118 Willoughby Rd Crows Nest ICC Sydney Darling Harbour Fratelli Fresh Entertainment Quarter Moore Park 11 Bridge St Sydney Westfield Sydney Sydney Munich Brauhaus 33 Playfair St The Rocks Rockpool Bar & Grill 66 Hunter St Sydney Rosetta Ristorante 118 Harrington St The Rocks 33 Cross Street Double Bay Sake Restaurant & Bar Manly Wharf Manly 12 Argyle Street The Rocks Spice Temple 10 Bligh St Sydney 108 Campbell Parade Bondi Beach Macarthur Square Shopping Centre Campbelltown Castle Towers Castle Hill Charlestown Square Charlestown Chatswood Central Chatswood Stockland Greenhills East Maitland Manly Wharf Manly Westfield Miranda Miranda The Bavarian Entertainment Quarter Moore Park Westfield Penrith Penrith Rouse Hill Town Centre Rouse Hill Stockland Shellharbour Shellharbour World Square Sydney Westfield Tuggerah Tuggerah Stockland Wetherill Park Wetherill Park Wollongong Central Wollongong The Cut Bar & Grill 16 Argyle St The Rocks Page 1 of 2 12 Shelley Street, Sydney, NSW 2000, Australia. ABN 92 108 952 085. Victoria Venue Location Suburb El Camino Cantina 222 Brunswick St Fitzroy Munich Brauhaus 45 South Wharf Promenade South Wharf Rockpool Bar & Grill Crown Melbourne Southbank Rosetta Trattoria Crown Melbourne Southbank 121 Flinders Lane Melbourne Sake Restaurant & Bar 100 St Kilda Rd Southbank Spice -

The Manager Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street SYDNEY NSW 2000

27 February 2013 The Manager Company Announcements Office ASX Limited Level 4, Exchange Centre 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam WESTFIELD RETAIL TRUST (ASX: WRT) PROPERTY COMPENDIUM Please find attached the Property Compendium for Westfield Retail Trust. Yours faithfully WESTFIELD RETAIL TRUST Katherine Grace Company Secretary Encl. SHOPPING CENTRE OPERATIONAL PERFORMANCE REPORT 31 DECEMBER 2012 SHOPPING CENTRE OPERATIONAL PERFORMANCE REPORT OVERVIEW OF PORTFOLIO Westfield Retail Trust’s (the Trust) portfolio of shopping centres is geographically diverse, spread across five states and one territory in Australia and New Zealand. These centres are generally located near or in major metropolitan areas, are anchored by long-term tenancies with major retailers and incorporate a wide cross-section of specialty retailers and national chain store operators. The Trust’s shopping centre investments are undertaken through joint ventures and co-ownership arrangements, primarily with Westfield Group and major institutional investors. The following table sets out the Trust’s shopping centre portfolio as of December 31 2012. Australia New Zealand Total Centres 38 9 47 Retail Outlets 10,911 1,431 12,342 GLA (million square metres) 3.3 0.4 3.7 Asset Value (billion)1 A$12.2 NZ$1.3 A$13.3 1. Trust share of shopping centre assets excluding development projects and construction in progress of $144.4 million. Note: Exchange rate as of December 31 2012 was AUD/NZ 1.2613 Key operating statistics for the shopping centre portfolio (including part-owned shopping centres on a 100% basis) for the year ended December 31 2012, as applicable, include the following: − Comparable shopping centre net property income growth: 2.9% − Portfolio leased rate: >99.5% − Weighted average unexpired lease term: 7.1 years (anchor retailers 10.0 years, specialty retailers 3.5 years) − Total number of lease deals completed: 2,458 with an aggregate of 303,486 square metres As of December 31 2012, the Trust owned interests in 47 shopping centres in Australia and New Zealand. -

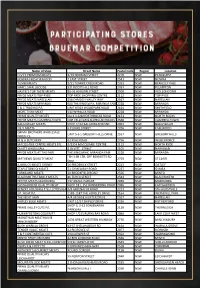

Participating Butcher

PARTICIPATING BUTCHER Name of Shop Street Name Postal Code Region Location ELVY'S PREMIUM MEATS 2/19 NORMAN STREET 2210 NSW PEAKHURST NOWRA FRESH SEAFOOD 2 EAST STREET 2541 NSW NOWRA TUMBI MEATS 2/11 TUMBIE CREEK ROAD 2261 NSW BERKELEY VALE NAREL SMALLGOODS 331 ROOTY HILL ROAD 2761 NSW PLUMPTON HASTIE'S TOP TASTE MEATS 89-91 AUBURN STREET 2500 NSW WOLLONGONG PRYDE MEATS TOP RYDE TOP RYDE SHOPPING CENTRE 2112 NSW TOP RYDE PRYDE MEATS NARELLAN 256 CAMDEN VALLEY WAY 2567 NSW NARELLAN PRYDE MEATS MIRANDA 600 THE KINGSWAY, MIRANDA FAIR 2228 NSW MIRANDA E & C TRADING P/L UNIT 8/323 WOODPARK ROAD 2164 NSW SMITHFIELD MORE THAN MEAT 130 WYRALLA ROAD 2228 NSW MIRANDA PRIME QUALITY MEATS Dock 4,328 NORTHROCKS ROAD 2151 NSW NORTH ROCKS PRYDE MEATS CAMPBELLTOWN CNR KELLICAR & NARELLAN ROADS 2560 NSW CAMPBELLTOWN BALGOWLAH MEATS SHOP 4/ 62 BALGOWLAHROAD 2093 NSW BALGOWLAH J & V MEATS 6 CLARKE STREET 2206 NSW EARLWOOD GRIMA BROTHERS WHOLESALE UNIT 5-6 1 GREGORY HILLS DRIVE 2557 NSW GREGORY HILLS PRODUCE M & A BUTCHERY 62 KING ROAD 2756 NSW WILBERFORCE MACQUARIE CENTRE MEATS P/L 3/3354 MACQUARIE CENTRE 2113 NSW NORTH RYDE DEVITT WHOLESALE 2 DEVITT STREET 2105 NSW NARABEEN PRYDE MEATS AT THE FAIR THE KINGSWAY, MIRANDA FAIR 2228 NSW MIRANDA "SH 3 SH CTR, OFF BENNETTS RD MATHEWS QUALITY MEAT 2759 NSW ST CLAIR (opp. JUMBUCK MEATS SYDNEY 16 FREDERICK STREET 2223 NSW OATLEY STAPLETONS Q-MEATS 71 GYMEA BAY ROAD 2227 NSW GYMEA FARMLAND MEATS 10 BROOKFIELD ROAD 2566 NSW MINTO BLACKSMITHS FAMILY MEATS 86 TUREA STREET 2581 NSW BLACKSMITHS PETERS MEATS MAROUBRA 737 ANZAC PARADE 2036 NSW MAROUBRA EASTGARDENS QUALITY MEAT SHOP 181, 152 BUNNERONG ROAD 2036 NSW EASTGARDENS BENZAT HOLDINGS T/as LLOYDS IGA 3/8 GREENACRE ROAD 2221 NSW STH HURSTVILLE J.P. -

NSW Retail Market Overview • July 2007

Research NSW Retail Market Overview • July 2007 Contents Market Indicators 2 Economic Overview 2 Sydney CBD Retail 3 Major & Super Regional 4 Regional Centres 5 Sub Regional Centres 6 Neighbourhood Centres 7 Bulky Goods Retailing 8 Deal Tracker 9 Outlook 10 Executive Summary • The NSW retail market comprises approximately 6.8 million sq m of retail space across 497 centres. The Sydney metropolitan area accommodates 64% of the state’s retail space with the remaining 36% located within regional NSW. • Growth in retail spending in NSW for the 12 months to May 2007 was 4.78%, up from 2.88% the previous year. Whilst this represents a strong increase on the previous years growth, it continues to lag the Australian total 5-year average of 5.93%. • Despite sluggish growth in the state economy and in retail spending, the NSW retail sector managed a healthy total return of 17.27% for the year to March 2007 (PCA/IPD), supported by low vacancy rates underpinning steady rental growth, a pick up in retail spending and yield compression on the back of strong investor demand across all retail asset classes. • Rental growth was experienced across all retail asset classes in the 12 months to July 2007. Sub-regional centres experienced the strongest growth with net rents increasing 4.2%. Bulky goods centres faired the worst with rents increasing just 1.8% over the period. Incentive levels remained tight across all retail asset classes. • A total of 302,000 sq m of new retail space is due to enter the market in 2007, before surging in 2008 when a further 593,000 sq m is due for completion. -

Designed for Students a Guide to Living and Studying in Adelaide

Designed for students A guide to living and studying in Adelaide A Welcome to Adelaide Adelaide is a multicultural, vibrant and friendly city and a beautiful place to live. We’ve created this guide to help you find your way around life in Adelaide. Settling In Health & Safety Things to know about Things to know about settling into your new health and safety, home in Adelaide, including how to see a including getting around, doctor and local hospitals. organising a phone, where to shop and more. Work Entertainment Things to know about Things to know about working while you study, how to have fun in your including getting a job, spare time, including how to get paid and local nightlife, weekend paying taxes. getaways and Adelaide’s best attractions. Welcome to Adelaide. Designed for life. Follow us We Chat At StudyAdelaide, we’re here to help you enjoy your time living and studying in Adelaide. Make sure you follow our social media channels for the latest offers and opportunities. Designed for Students A guide to living and studying in Adelaide 2 Table of Contents 04 Settling in 23 Health and safety 32 Work 39 Entertainment 3 Settling in Things to know about settling into your new home in Adelaide. 05 All about Adelaide 06 Arriving in Adelaide 07 Climate 08 Local language 09 Getting around 11 Accommodation 12 Setting up your new home 13 Staying connected 15 Money matters 17 Food and shopping 18 Cultural and student groups 19 Religion 20 City of Adelaide 21 Public holidays 2019 22 International Student Advisory Service 4 All about Adelaide Founded in 1836, Adelaide is the capital city of the • South Australia is more than twice the size of the state of South Australia. -

DEXUS Property Group 2014 Performance Pack Overview

DEXUS Property Group 2014 Performance Pack Overview In 2013 DEXUS Property Group detailed its FY14 commitments based on material issues which have the greatest impact on its stakeholders to ensure outcomes are aligned to the interest of investors, stakeholders and the wider community. DEXUS has delivered on the majority of its FY14 commitments and the results relating to each stakeholder group are detailed in the 2014 Annual Review supported by non-financial and operational data supplied in this Performance Pack. Materiality The Group uses the GRI Sustainability Reporting Guidelines (version 3.1) to set the 2014 Annual Review boundary in relation to material issues and key performance indicators reporting across stakeholder groups, including current and prospective investors, employees, tenants, customers, suppliers and the community. In 2014, the Group developed a plan to transition from GRI version 3.1 to its materiality-based G4 sustainability reporting guidelines for reporting in FY15. The plan involves four phases in which the Group will systematically: 1. Scan internal and external collateral and review existing and emerging material issues that are known to be or potentially relevant to the Group as identified by local and international best-practice peers, investment bodies, sustainability benchmarking tools and industry associations 2. Engage with a wide range of stakeholders to consult with them on existing and emerging material issues and gather feedback on current reporting disclosure 3. Conduct workshops and business forums with the Group’s employees to prioritise material issues based on their significance and likely impact to DEXUS and its stakeholders 4. Prepare to report in FY15 by reviewing the Group’s strategy and set targets against the developed list of material issues and proceed to collect and report against these issues The Group completed the review phase in FY14 and will continue its transitional work in preparation for reporting against GRI G4 in FY15.