Chicago Tribune News: Viewers Mad About CNBC's Cramer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2012 Pfister Hotel | 424 E

4th Annual Investment Conference ALL prOceedS benefit financial literacy education for area youth through Make A Difference – Wisconsin 1:30 – 2:30 pm Registration | 2:30 – 5:00 pm Program | 5:00 pm Networking Reception Wednesday, May 9th 2012 Pfister Hotel | 424 E. Wisconsin Avenue | Milwaukee What investment insights will drive your decisions in 2012? The speaker lineup for the 4th annual Make A Difference-Wisconsin Investment Conference promises another terrific afternoon for both the professional and individual investor. Modeled after Wall Street Week and the popular Ira Sohn Investment Research Conference in New York City, another must-hear panel is prepared to deliver top investment ideas and perspectives. Seating is limited and will sell out quickly, so don’t delay. Register today! Keynote speaker – James S. Chanos Jim Chanos, founder and managing partner of Kynikos Associates LP, New York, headlines this year’s conference. Throughout his investment career, Jim has identified and sold short the shares of numerous well-known corporate financial disasters. His celebrated short-sale of Enron shares was dubbed by Barron’s as “the market call of the decade, if not the past fifty years.” The media has noted his prescience in alerting finance ministers and others about the global financial crisis well before it occurred. His views are regularly covered by news organizations worldwide. Jim opened Kynikos Associates LP, the world’s largest exclusive short selling investment firm, after beginning his Wall Street career with Paine Webber, Gilford Securities, and Deutsche Bank. He also serves as chairman of the Coalition of Private Investment Companies. In that role, Jim has testified before Congress and provided comments to regulations proposed by the U.S. -

Cramer Investment Advice Warrants Caution

Cramer Investment Advice Warrants Caution By BRUCE MEYERSON AP Business Writer 866 words 30 May 2006 06:09 PM Associated Press Newswires APRS English (c) 2006. The Associated Press. All Rights Reserved. NEW YORK (AP) - One screams and throbs at the camera, while the other would address his viewers with the wooden calm of an English gentleman at tea time. Yet despite the Jekyll-and-Hyde differences between Jim Cramer and the late Louis Rukeyser, there's one notable similarity between their TV programs: any mention of a company could move its stock. This is a crucial fact for individual investors to understand because the stock market is a crafty place where the smart money loves to prey on predictable patterns like the instant bounce for stocks touted by Cramer on CNBC's "Mad Money" program. And when the pros win, the ordinary folk are bound to lose. Cramer fans needn't despair. Rather than swearing off the former hedge fund manager's advice, all that may be required is the poise and patience to wait a couple of weeks before putting your money where his mouth is, judging from a study into trading patterns after each airing of Mad Money on weekday nights. Cramer himself urges viewers to avoid the temptation to rush right in, especially during after-hours trading, though he doesn't see a need to hold off for weeks. Investors flock to Cramer's show for good reason. It's rare for average investors to have direct access to a professional stock picker with Cramer's vast knowledge and experience. -

Beyond Greed and Fear Financial Management Association Survey and Synthesis Series

Beyond Greed and Fear Financial Management Association Survey and Synthesis Series The Search for Value: Measuring the Company's Cost of Capital Michael C. Ehrhardt Managing Pension Plans: A Comprehensive Guide to Improving Plan Performance Dennis E. Logue and Jack S. Rader Efficient Asset Management: A Practical Guide to Stock Portfolio Optimization and Asset Allocation Richard O. Michaud Real Options: Managing Strategic Investment in an Uncertain World Martha Amram and Nalin Kulatilaka Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing Hersh Shefrin Dividend Policy: Its Impact on Form Value Ronald C. Lease, Kose John, Avner Kalay, Uri Loewenstein, and Oded H. Sarig Value Based Management: The Corporate Response to Shareholder Revolution John D. Martin and J. William Petty Debt Management: A Practitioner's Guide John D. Finnerty and Douglas R. Emery Real Estate Investment Trusts: Structure, Performance, and Investment Opportunities Su Han Chan, John Erickson, and Ko Wang Trading and Exchanges: Market Microstructure for Practitioners Larry Harris Beyond Greed and Fear Understanding Behavioral Finance and the Psychology of Investing Hersh Shefrin 2002 198 Madison Avenue, New York, New York 10016 Oxford University Press is a department of the University of Oxford It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide in Oxford New York Auckland Bangkok Buenos Aires Cape Town Chennai Dar es Salaam Delhi Hong Kong Istanbul Karachi Kolkata Kuala Lumpur Madrid Melbourne Mexico City Mumbai Nairobi São Paulo Shanghai Taipei Tokyo Toronto Oxford is a registered trade mark of Oxford University Press in the UK and in certain other countries Copyright © 2002 by Oxford University Press, Inc. -

How Women Approach Investing

HOW WOMEN APPROACH INVESTING Liz Ann Sonders, chief investment strategist at Charles Schwab, says women know who they are as investors -- for example, whether they’re aggressive or risk-averse. By JANET BODNAR February 1, 2018 Kiplinger's Personal Finance Among her many career accomplishments (including appearing on the cover of Kiplinger’s), Liz Ann Sonders, currently the chief investment strategist at Charles Schwab, was a regular panelist on PBS’s Wall Street Week With Louis Rukeyser. Before she made her first appearance in 1997, Rukeyser asked whether her parents were in the financial industry. No, she replied. “Then get them to understand what you’re talking about,” he said. No piece of advice has influenced her more. “I try to write and speak in a way that people can understand,” says Sonders, 53. In that spirit, she recently came to Washington, D.C., to address a gathering of women. I spoke with her to get her perspective on the role of women in finance (and her latest market outlook). What’s it like to be a high-powered woman in the financial industry? Being female is a huge positive. I can see how it might be a problem if you wanted to be the CEO of a company like J.P. Morgan, for example. But I don’t have many glass-ceiling bruises on my head. Doing what I do, there’s an advantage to not being a middle-aged guy. How did you get started in the business? It was a fluke. I graduated with a double major in political science and economics and went to live with my grandfather in Brooklyn while I looked for a job in New York City. -

Detroit Tues, July 29, 1975 from Detroit News 2 WJBK-CBS * 4 WWJ-NBC * 7 WXYZ-ABC * 9 CBET-CBC

Retro: Detroit Tues, July 29, 1975 from Detroit News 2 WJBK-CBS * 4 WWJ-NBC * 7 WXYZ-ABC * 9 CBET-CBC (and some CTV) * 20 WXON-Ind * 50 WKBD-Ind * 56 WTVS-PBS [The News didn't list TVO, Global or CBEFT] Morning 6:05 7 News 6:19 2 Town & Country Almanac 6:25 7 TV College 6:30 2 Summer Semester 4 Classroom 56 Varieties of Man & Society 6:55 7 Take Kerr 7:00 2 News (Frank Mankiewicz) 4 Today (Barbara Walters/Jim Hartz; Today in Detroit at 7:25 and 8:25) 7 AM America (Bill Beutel) 56 Instructional TV 7:30 9 Cartoon Playhouse 8:00 2 Captain Kangaroo 9 Uncle Bobby 8:30 9 Bozo's Big Top 9:00 2 New Price is Right 4 Concentration 7 Rita Bell "Miracle of the Bells" (pt 2) 9:30 2 Tattletales 4 Jackpot 9 Mr. Piper 50 Jack LaLanne 9:55 4 Carol Duvall 10:00 2 Spin-Off 4 Celebrity Sweepstakes 9 Mon Ami 50 Detroit Today 56 Sesame Street 10:15 9 Friendly Giant 10:30 2 Gambit 4 Wheel of Fortune 7 AM Detroit 9 Mr. Dressup 50 Not for Women Only 11:00 2 Phil Donahue 4 High Rollers 9 Take 30 from Ottawa 50 New Zoo Revue 56 Electric Company 11:30 4 Hollywood Squares 7 Brady Bunch 9 Family Court 50 Bugs Bunny 56 Villa Alegre Afternoon Noon 2 News (Vic Caputo/Beverly Payne) 4 Magnificent Marble Machine 7 Showoffs 9 Galloping Gourmet 50 Underdog 56 Mister Rogers' Neighborhood 12:30 2 Search for Tomorrow 4 News (Robert Blair) 7 All My Children 9 That Girl! 50 Lucy 56 Erica-Theonie 1:00 2 Love of Life (with local news at 1:25) 4 What's My Line? 7 Ryan's Hope 9 Showtime "The Last Chance" 50 Bill Kennedy "Hell's Kitchen" 56 Antiques VIII 1:30 2 As the World Turns 4 -

59Th Annual Distinguished Service Award Harvey P. Eisen, BS BA

59th Annual Distinguished Service Award Harvey P. Eisen, BS BA '64 Chairman, CEO and Director, Wright Investors' Service Holdings, Inc. Chairman and Managing Partner; Bedford Oak Advisers, LLC Chairman and Director, GP Strategies Harvey P. Eisen is Chairman, CEO and Director of Wright Investors’ Service Holdings, Inc. (WISH), formerly National Patent Development Corporation. He has also served as Chairman of Bedford Oak Advisors, LLC, an investment partnership since 1998, and Chairman and Director of GP Strategies since 2004. He was previously Senior Vice President of Travelers, Inc. and held various executive positions with Primerica, SunAmerica Corp., and Integrated Resources Asset Management. Mr. Eisen was president and portfolio manager of Eisen Capital Management for 10 years. He began his career as an analyst with Stifel, Nicolaus & Co. and Wertheim. Mr. Eisen has served on the Strategic Development Board for the Trulaske College of Business, University of Missouri since 1995 where he established the first accredited course on the Warren Buffett Principles of Investing. He also serves on the Zanvyl Krieger School of Arts and Sciences Advisory Board for Johns Hopkins University and is a member of the Carey Business School Board of Overseers and the Hopkins Parents Council. Mr. Eisen is widely recognized as one of the country’s leading portfolio managers. With over three decades of investment experience, he is often consulted by the national media for his expert views on all phases of the investment marketplace and is frequently quoted in The Wall Street Journal, The New York Times, Pension World, U.S. News & World Report, Financial World and Business Week, among others. -

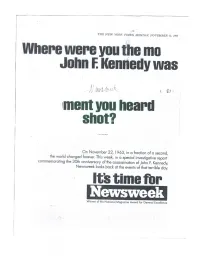

Its Time For

THE NEW YORK TIMES, MONDAY, NOVEMBER 15, 1993 Where were you the mo John F. Kennedy was tur1/1!:-i z Iment you heard shot? b011,3,111. On November 22, 1963, in a fraction of a second, the world changed forever. This week, in a special investigative report commemorating the 30th anniversary of the assassination of John F. Kennedy, Newsweek looks back at the events of that terrible day. Its time for Newsweek. Winner of the National Magazine Award for General Excellence Newsweek Ir HO' 71:171 "_, .‘" It's Nut Whet YOu Think was in my third year of college, and I was walking with my friend, Alan Placa, now Monsignor Placa. Someone came up to us and said that President Kennedy had been shot. At first, we thought it was a joke or a wild report. Then, some- one else said it to us. We went to a radio nearby where we heard the news report. Then we went to I remember the day well. I was at my car and put on the radio We the office when I heard. I ran out sat in the car for over one hour just of my office into the hall - I wanted listening in shock because we io call out the news to everyone. I didn't wont to leave until they started to cry; I couldn't get the announced it, that he was actually words out, Everyone stayed con- dead " gregated in the halls for some Rudolph Giuliani time. We all wanted to be together Mayor Elect, City of New York with each other in our sorrow.' Ed Meyer Chairman/President and Chief Executive Officer Grey Advertising was leaving the Beverly Hills Post Office. -

Anthony Scaramucci, Founder of Skybridge Capital, Added to Illustrious List of Individuals to Be Honored by NIAF at New York Gala on March 22

MEDIA ALERT – MEDIA ALERT – MEDIA ALERT – MEDIA ALERT – MEDIA ALERT CONTACT: RGI events + public relations o.202.738.4713 / m.703.785.7380 [email protected] UPDATED - March 14, 2017: Anthony Scaramucci, Founder of SkyBridge Capital, added to illustrious list of individuals to be honored by NIAF at New York Gala on March 22. Mr. Scaramucci is a successful businessman and former host of the television program, Wall Street Week. A frequent contributor to the FOX NEWS Channel, he served on the Presidential Transition Team Executive Committee following the 2016 election. He is currently under consideration for a position installing him as Advisor to President Donald Trump. Official Press Release can be found below - ANNOUNCING: The NATIONAL ITALIAN AMERICAN FOUNDATION to honor best and brightest in business, sports, entertainment, politics at New York Gala The National Italian American Foundation will hosts it’s yearly New York Gala, honoring New York State Superintendent of DFS, Maria T. Vullo; Founder, SkyBridge Capital, Anthony Scaramucci; Chairman, Jackson Lewis P.C., Vincent A. Cino, Cooking with Nonna host, Rossella Rago and others at Cipriani, 42nd Street, March 22, 2017. FOR IMMEDIATE RELEASE: New York, NY and Washington, D.C. The National Italian American Foundation (NIAF) will host its annual New York Gala at Cipriani 42nd Street on March 22, 2017. This distinguished event, held at this world-famous, historical, New York City venue will highlight the very best in Italian food, beverage and cultural experiences – along with celebrate some of the most notable and impactful luminaries of the Italian American community. NIAF is the largest and most faithful representative of over 25 million Italian Americans living in the United States. -

I Am a Little Wounded, but I Am Not Slain; I Will Lay Me Down and Bleed a While

2021 2020 I am a little wounded, but I am not slain; I will lay me down and bleed a while. Then I’ll rise up and fight again. ~ John Dryden On March 13, 2020, I sat down at the Starbucks It was more than just a year of a global pandemic, of on 47th Street right off of Sixth Avenue, across unimaginable government shutdowns, of breakneck- the street from NewsCorp’s headquarters speed economic contraction, of unprecedented (where Fox Business is located). I had two hours vaccine development, of skyrocketing national to work on my weekly Dividend Café before my debt, and of social and political polarization. And scheduled taping of Wall Street Week with while I tirelessly talk of the paradigmatic changes Maria Bartiromo (that taping, by the way, was playing out in the U.S. economy due to the the last “in studio” appearance I did in 2020). I entrenchment of Federal Reserve interventions, began typing that quote above as the “Quote it was more than just a year of aggressive of the Week” that I do in every issue of the monetary policy force. Your list of what stands Dividend Café. out about 2020 could include a lot of things, and It had been a horrid, brutal week in the market (in we will cover many of them in this paper. the 2020 Recap below I will provide meticulous But for investors, I am quite certain that it was, detail of that week and the couple weeks that above all else, a year in which the behavioral followed). -

Maggie-Mahar-Bull-A-History-Of-The

BULL! Ba history of the boom and bust, 1982–2004 maggie mahar To Raymond, who believes that everything is possible — Contents — Acknowledgments vii Prologue Henry Blodget xiii Introduction Chapter 1—The Market’s Cycles 3 Chapter 2—The People’s Market 17 Beginnings (1961–89) Chapter 3—The Stage Is Set 35 (1961–81) Chapter 4—The Curtain Rises 48 (1982–87) Chapter 5—Black Monday (1987–89) 61 iv Contents The Cast Assembles (1990–95) Chapter 6—The Gurus 81 Chapter 7—The Individual Investor 102 Chapter 8—Behind the Scenes, 123 in Washington The Media, Momentum, and Mutual Funds (1995–96) Chapter 9—The Media: CNBC Lays 153 Down the Rhythm Chapter 10—The Information Bomb 175 Chapter 11—AOL: A Case Study 193 Chapter 12—Mutual Funds: 203 Momentum versus Value Chapter 13—The Mutual Fund 217 Manager: Career Risk versus Investment Risk The New Economy (1996–98) Chapter 14—Abby Cohen Goes to 239 Washington; Alan Greenspan Gives a Speech Chapter 15—The Miracle of 254 Productivity The Final Run-Up (1998–2000) Chapter 16—“Fully Deluded 269 Earnings” Contents v Chapter 17—Following the Herd: 288 Dow 10,000 Chapter 18—The Last Bear Is Gored 304 Chapter 19—Insiders Sell; 317 the Water Rises A Final Accounting Chapter 20—Winners, Losers, and Scapegoats 333 (2000–03) Chapter 21—Looking Ahead: What 353 Financial Cycles Mean for the 21st-Century Investor Epilogue (2004–05) 387 Notes 397 Appendix 473 Index 481 about the author credits cover copyright about the publisher — Acknowledgments — More than a hundred people contributed to this book, sharing their expe- riences, their insights, and their knowledge. -

Students Put Real Money on the Line in National Competition University of Dayton

University of Dayton eCommons News Releases Marketing and Communications 1-30-2002 Bad Year, High Hopes: Students Put Real Money on the Line in National Competition University of Dayton Follow this and additional works at: https://ecommons.udayton.edu/news_rls Recommended Citation University of Dayton, "Bad Year, High Hopes: Students Put Real Money on the Line in National Competition" (2002). News Releases. 10238. https://ecommons.udayton.edu/news_rls/10238 This News Article is brought to you for free and open access by the Marketing and Communications at eCommons. It has been accepted for inclusion in News Releases by an authorized administrator of eCommons. For more information, please contact [email protected], [email protected]. \rJ A( 1' Jan. 30, 2002 Contact: Teri Rizvi [email protected] DAYTON NEWS RELEASE BAD YEAR, HIGH HOPES: STUDENTS PUT REAL MONEY ON THE LINE IN NATIONAL COMPETITION DAYTON, Ohio- Last year's national champs will be back to defend their titles as the best young stockbrokers in the nation. Against the backdrop of a horrible bear market, finance students from 56 business schools around the country and Canada are traveling to the University of Dayton Feb. 21-22 to learn from some of the nation's top investment strategists. More than half will compete in the second annual nationwide student portfolio management competition. The 300 participants will be treated to a luncheon keynote speech via satellite from CNBC anchor Maria Bartiromo on Feb. 21. The winning teams, announced at a luncheon on Feb. 22, will open the Nasdaq MarketSite in Times Square on April15 and are expected to be part of CNBC's "Squawk Box" program on April16. -

Joel Stern Biographical Information for Columbia University Website

Joel Stern Profile Joel Stern has been associated with approximately twenty graduate schools of business around the world. He has taught a Special Topics elective called the Theory and Policy of Modern Finance at Carnegie Mellon University for the past ten years, the University of Chicago for the past three years, at Columbia University since 1976 (with a brief three-year hiatus in the mid-1980s), and at the University of Cape Town in South Africa as a visiting professor since 2003 and this appointment runs five years. In addition, he teaches at the graduate school at Old Dominion University (Norfolk, Virginia) and at the Interdisciplinary Center in Herzliya, Israel. In the past, he has taught at Michigan, the William E. Simon School at the University of Rochester, the London Business School, the Australian Graduate School of Management, the Indian School of Business in Hyderabad, India, the Anderson School at UCLA and the University of Witswatersrand in Johannesburg, South Africa among others. He is the author of two books and the co-author of six others, all in financial economics. He has been a financial policy columnist for the Financial Times of London for four years and his articles have also appeared on the editorial page of The Wall Street Journal. For two years, he was a guest columnist for The Sunday Times of London, and for seventeen years, he was a rotating panelist on the national television program “Wall Street Week with Louis Rukeyser” and he has served on the boards of six firms and two charitable foundations. He is a member of the Council of The University of Chicago Graduate School of Business and he has been a member of the Executive Advisory Committee of the William E.