The Impact of Urban Rail Transit on Commercial Property Value: New Evidence from Wuhan, China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Operator's Story Case Study: Guangzhou's Story

Railway and Transport Strategy Centre The Operator’s Story Case Study: Guangzhou’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from Guangzhou Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in Guangzhou, China. These notes are based upon 3 meetings on the 11th March 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece. Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. This mini case study does not attempt to provide a comprehensive picture of Guangzhou Metropolitan Corporation (GMC), but rather focuses on specific topics of interest to The Operators’ Story project. The research team thank GMC and its staff for their kind participation in this project. Comments are not attributed to specific individuals, as agreed with the interviewees and GMC. List of interviewees Meetings include the following GMC members: Mr. -

International Student Guide

Contents CHAPTER I PREPARATIONS BEFORE COMING TO CHINA 1. VISA APPLICATION (1) Introduction to the Student Visa.......................................................................2 (2) Requirements for Visa Application..................................................................2 2. WHAT TO BRING (1) Materials Required for Registration.................................................................2 (2) Other Recommended Items.............................................................................3 3. BANKING INFORMATION AND CURRENCY OPERATIONS (1) Introduction to Chinese Currency....................................................................4 (2) Foreign Currency Exchange Sites and Convertible Currencies................4 (3) Withdrawal Limits of Bank Accounts................................................................5 (4) Wire Transfer Services........................................................................................5 4. ACCOMMODATION (1) Check-in Time......................................................................................................5 (2) On-Campus Accommodation....................................................................5 (3) Off-Campus Accommodation and Nearby Hotels.......................................8 (4) Questions and Answers about Accommodation (Q&A).............................9 CHAPTER II HOW TO GET TO TIANJIN UNIVERSITY 5. HOW TO ARRIVE................................................................................................12 (1). How to Get to Weijin -

Sediment Provenance Discrimination in Northern Okinawa Trough During the Last 24 Ka and Paleoenvironmental Implication: Rare Earth Elements Evidence

JOURNAL OF RARE EARTHS, Vol. 30, No. 11, Nov. 2012, P. 1184 Sediment provenance discrimination in northern Okinawa Trough during the last 24 ka and paleoenvironmental implication: rare earth elements evidence XU Zhaokai (徐兆凯)1, LI Tiegang (李铁刚)1, CHANG Fengming (常凤鸣)1, CHOI Jinyong2, LIM Dhongil3, 4 XU Fangjian (徐方建) (1. Key Laboratory of Marine Geology and Environment, Institute of Oceanology, Chinese Academy of Sciences, Qingdao 266071, China; 2. Department of Oceanography, Kunsan National University, Kunsan 573-701, Korea; 3. South Sea Institute, Korea Ocean Research and Development Institute, Geoje 656-830, Korea; 4. School of Geo- sciences, China University of Petroleum, Qingdao 266555, China) Received 28 February 2012; revised 28 September 2012 Abstract: Rare earth elements (REE) compositions and discriminant function were successfully used to examine high resolution sediment source changes in the northern Okinawa Trough over the last 24.1 ka, especially for the influence from the Yellow River and the Tsushima Warm Current (TWC) that has not been well solved. Variations of these parameters were clearly divided into three distinct depositional units. During Interval 1 (24.1–16.0 ka BP), the paleo-Yellow River and the paleo-Yangtze River mouths were situated near the studied area and could have played major roles in the sedimentation therein. In Interval 2 (16.0–7.3 ka BP), these river mouths gradually retreated with global sea-level rise, leading to less fluvial inputs from them to the northern Okinawa Trough. Meanwhile, formation of the TWC could carry some sediment loads of Taiwan to the studied core, especially during its late phase (8.0–7.3 ka BP). -

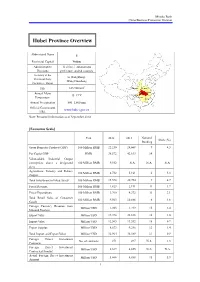

Hubei Province Overview

Mizuho Bank China Business Promotion Division Hubei Province Overview Abbreviated Name E Provincial Capital Wuhan Administrative 12 cities, 1 autonomous Divisions prefecture, and 64 counties Secretary of the Li Hongzhong; Provincial Party Wang Guosheng Committee; Mayor 2 Size 185,900 km Shaanxi Henan Annual Mean Hubei Anhui 15–17°C Chongqing Temperature Hunan Jiangxi Annual Precipitation 800–1,600 mm Official Government www.hubei.gov.cn URL Note: Personnel information as of September 2014 [Economic Scale] Unit 2012 2013 National Share (%) Ranking Gross Domestic Product (GDP) 100 Million RMB 22,250 24,668 9 4.3 Per Capita GDP RMB 38,572 42,613 14 - Value-added Industrial Output (enterprises above a designated 100 Million RMB 9,552 N.A. N.A. N.A. size) Agriculture, Forestry and Fishery 100 Million RMB 4,732 5,161 6 5.3 Output Total Investment in Fixed Assets 100 Million RMB 15,578 20,754 9 4.7 Fiscal Revenue 100 Million RMB 1,823 2,191 11 1.7 Fiscal Expenditure 100 Million RMB 3,760 4,372 11 3.1 Total Retail Sales of Consumer 100 Million RMB 9,563 10,886 6 4.6 Goods Foreign Currency Revenue from Million USD 1,203 1,219 15 2.4 Inbound Tourism Export Value Million USD 19,398 22,838 16 1.0 Import Value Million USD 12,565 13,552 18 0.7 Export Surplus Million USD 6,833 9,286 12 1.4 Total Import and Export Value Million USD 31,964 36,389 17 0.9 Foreign Direct Investment No. -

Final Program

5th IFAC Conference on Engine and Powertrain Control, Simulation and Modeling Final Program Sept. 20-22, 2018, Changchun, China Copyright and Reprint Permission: This material is permitted for personal use. For any other copying, reprint, republication or redistribution permission, please contact IFAC Secretariat, Schlossplatz 12, 2361 Laxenburg, AUSTRIA. All rights reserved. Copyright©2018 by IFAC. Contents Welcome Message ............................................................................................................ 1 Organizing Committee ...................................................................................................... 2 Program Committee .......................................................................................................... 6 General Information .......................................................................................................... 8 Venue, Date and Transportation .................................................................................... 10 Conference Floor Plan .................................................................................................... 13 Social Events ................................................................................................................... 15 Plenary Lectures ............................................................................................................. 20 Academic-industrial Panel Discussion ......................................................................... 27 Pre-conference Workshops -

China Clean Energy Study Tour for Urban Infrastructure Development

China Clean Energy Study Tour for Urban Infrastructure Development BUSINESS ROUNDTABLE Tuesday, August 13, 2019 Hyatt Centric Fisherman’s Wharf Hotel • San Francisco, CA CONNECT WITH USTDA AGENDA China Urban Infrastructure Development Business Roundtable for U.S. Industry Hosted by the U.S. Trade and Development Agency (USTDA) Tuesday, August 13, 2019 ____________________________________________________________________ 9:30 - 10:00 a.m. Registration - Banquet AB 9:55 - 10:00 a.m. Administrative Remarks – KEA 10:00 - 10:10 a.m. Welcome and USTDA Overview by Ms. Alissa Lee - Country Manager for East Asia and the Indo-Pacific - USTDA 10:10 - 10:20 a.m. Comments by Mr. Douglas Wallace - Director, U.S. Department of Commerce Export Assistance Center, San Francisco 10:20 - 10:30 a.m. Introduction of U.S.-China Energy Cooperation Program (ECP) Ms. Lucinda Liu - Senior Program Manager, ECP Beijing 10:30 a.m. - 11:45 a.m. Delegate Presentations 10:30 - 10:45 a.m. Presentation by Professor ZHAO Gang - Director, Chinese Academy of Science and Technology for Development 10:45 - 11:00 a.m. Presentation by Mr. YAN Zhe - General Manager, Beijing Public Transport Tram Corporation 11:00 - 11:15 a.m. Presentation by Mr. LI Zhongwen - Head of Safety Department, Shenzhen Metro 11:15 - 11:30 a.m. Tea/Coffee Break 11:30 - 11:45 a.m. Presentation by Ms. WANG Jianxin - Deputy General Manager, Tianjin Metro Operation Corporation 11:45 a.m. - 12:00 p.m. Presentation by Mr. WANG Changyu - Director of General Engineer's Office, Wuhan Metro Group 12:00 - 12:15 p.m. -

Changchun Taoist Temple

Line 1: Changchun Taoist temple Changchun Taoist temple, one of the most famous Taoist temples in China, located in wuhan, hubei province, is the only existing Taoist temple in this area. It was listed as a national key Taoist temple by the state council in 1983. The Taoist temple is located in the south of shuangfeng mountain in wuhan city. It is said that laozi, the ancestor of Taoism, once stayed here. Taoist architecture appeared here as early as the 3rd century BC. During the yuan dynasty, qiu chuji, a famous representative of quanzhen school, came here to practice and preach, which further expanded its scale. Because qiu chuji was called changchun real person, the Taoist temple was called changchun view. Since its establishment, the influence of changchun outlook has been constantly expanding, and it was further expanded in the Ming and qing dynasties to form its current scale. It sits in the south, built according to the mountain, the main building is the gate, lingguan dian, taiqing dian, three emperor dian, etc., compact layout, large scale. Next to the building of qizhen temple, there is a hall of merit and virtue, with an astronomical panorama inlaid on the wall. It was completed by the famous Taoist priest Lilian in the 1930s, which has a high reference value for the study of ancient astronomy. Now, changchun view is not only the local center of Taoist activities, but also a scenic tourist resort, every year many visitors and believers come to worship. Guiyuan Buddhist Temple Guiyuan Buddhist Temple is located at the west end of cuiwei street in hanyang, hubei province, China. -

Wuhan Sanyang Road Yangtze River Tunnel

Wuhan Sanyang Road Yangtze River Tunnel CHINA Presented by : Sun Feng Miami, USA 18th November 2019 Contents 1. Overview of the project 2. Why choose road tunnel and metro co-construction 3. Overall design of the tunnel 4. Project difficulties and solutions 5. Engineering photos Miami, USA 18th November 2019 1. Overview of the Project BEI JING WU HAN Sanyang Road Yangtze River Tunnel located in Wuhan, China Miami, USA 18th November 2019 1. Overview of the Project • Sanyang Road Yangtze River Tunnel connects the core areas of Hankou and Sanyang Road Wuchang. Yangtze River HAN KOU Tunnel • This tunnel is the world’s first Road- Metro shield tunnel. WU CHANG • This tunnel can meet the huge number of people and vehicles across the Yangtze River. Tunnel Location Miami, USA 18th November 2019 A Ramp C Ramp E Ramp B Ramp D Ramp San Yang Road Station F Ramp G Ramp Xu Jia Peng Station H Ramp ◆ Main tunnel(road) total length 4660 meters. ◆ There are 4 ramp tunnels on both sides of the Yangtze River connecting with urban roads. The total length of the eight ramp tunnels is 2680m. ◆ Station of the Metro Line 7 and the tunnel are located below the road tunnel. Miami, USA 18th November 2019 1. Overview of the Project ⚫ Project Start Time: 14, February 2014 ; ⚫ Project Completion Time :1,October 2018; ⚫ Total investment: RMB 7.39 billion($ 1.05 billion) ⚫ Owners :Wuhan Metro Group Co.,Ltd Miami, USA 18th November 2019 1. Overview of the Project Overall design • China Railway SIYUAN Survey and Design Group Co.,Ltd • Hubei Provincial Communications Planning -

Remote Sensing

remote sensing Article An Approach of Identifying and Extracting Urban Commercial Areas Using the Nighttime Lights Satellite Imagery Xuzhe Duan , Qingwu Hu * , Pengcheng Zhao , Shaohua Wang and Mingyao Ai School of Remote Sensing and Information Engineering, Wuhan University, Wuhan 430070, China; [email protected] (X.D.); [email protected] (P.Z.); [email protected] (S.W.); [email protected] (M.A.) * Correspondence: [email protected] Received: 7 February 2020; Accepted: 21 March 2020; Published: 23 March 2020 Abstract: Urban commercial areas can reflect the spatial distribution of business activities. However, the scope of urban commercial areas cannot be easily detected by traditional methods because of difficulties in data collection. Considering the positive correlation between business scale and nighttime lighting, this paper proposes a method of urban commercial areas detection based on nighttime lights satellite imagery. First, an imagery preprocess model is proposed to correct imageries and improve efficiency of cluster analysis. Then, an exploratory spatial data analysis and hotspots clustering method is employed to detect commercial areas by geographic distribution metric with urban commercial hotspots. Furthermore, four imageries of Wuhan City and Shenyang City are selected as an example for urban commercial areas detection experiments. Finally, a comparison is made to find out the time and space factors that affect the detection results of the commercial areas. By comparing the results with the existing map data, we are convinced that the nighttime lights satellite imagery can effectively detect the urban commercial areas. The time of image acquisition and the vegetation coverage in the area are two important factors affecting the detection effect. -

Leading New ICT Building a Smart Urban Rail

Leading New ICT Building A Smart Urban Rail 2017 HUAWEI TECHNOLOGIES CO., LTD. Bantian, Longgang District Shenzhen518129, P. R. China Tel:+86-755-28780808 Huawei Digital Urban Rail Solution Digital Urban Rail Solution LTE-M Solution 04 Next-Generation DCS Solution 10 Urban Rail Cloud Solution 15 Huawei Digital Urban Rail Solution Huawei Digital Urban Rail Solution Huawei LTE-M Solution for Urban Rail Huawei and Alstom the Completed World’s Huawei Digital Urban Rail LTE-M Solution First CBTC over LTE Live Pilot On June 29th, 2015, Huawei and Alstom, one of the world’s leading energy solutions and transport companies, announced the successful completion of the world’s first live pilot test of 4G LTE multi-services based on Communications- based Train Control (CBTC), a railway signalling system based on wireless ground-to-train CBTC PIS CCTV Dispatching communication. The successful pilot, which CURRENT STATUS IN URBAN RAIL covered the unified multi-service capabilities TV Wall ATS Server Terminal In recent years, public Wi-Fi access points have become a OCC of several systems including CBTC, Passenger popular commodity in urban areas. Due to the explosive growth Information System (PIS), and closed-circuit in use of multimedia devices like smart phones, tablets and NMS LTE CN television (CCTV), marks a major step forward in notebooks, the demand on services of these devices in crowded the LTE commercialization of CBTC services. Line/Station Section/Depot Station places such as metro stations has dramatically increased. Huge BBU numbers of Wi-Fi devices on the platforms and in the trains RRU create chances of interference with Wi-Fi networks, which TAU TAU Alstom is the world’s first train manufacturer to integrate LTE 4G into its signalling system solution, the Urbalis Fluence CBTC Train AR IPC PIS AP TCMS solution, which greatly improves the suitability of eLTE, providing a converged ground-to-train wireless communication network Terminal When the CBTC system uses Wi-Fi technology to implement for metro operations. -

Use Style: Paper Title

2019 4th International Conference on Education and Social Development (ICESD 2019) ISBN: 978-1-60595-621-3 Wuhan Subway Economic Development in the Perspective of "Innovation, Coordination, Green, Open, Sharing" Concept 1,a 2,b, Fang WANG and Xiao-sheng LEI * 1Hubei University of Traditional Chinese Medicine, Wuhan, Hubei, China 2Hubei University of Traditional Chinese Medicine, Wuhan, Hubei, China [email protected], [email protected] *Corresponding author Keywords: Development Concept, Wuhan, Subway Economy. Abstract. Since the 18th congress of the communist party of China, the "innovation, coordination, green, open and shared" development concept has been a profound change in the overall situation of China's development. In this context, the Wuhan Metro has developed rapidly, This paper analyzes the current situation, characteristics and influence of the development of subway economy in Wuhan from the perspective of development concept, and puts forward some suggestions for the future development of subway economy. Introduction For a long time, China has faced problems such as uneven, inadequate, uncoordinated and unsustainable development, and it has already faced the "ceiling dilemma". In recent years, China is facing the downward pressure of the economy. In order to change the development mode and solve the development problems, the 18th National Congress put forward five development concepts of “innovation, coordination, green, openness and sharing”, which have important guidance for the future development of social economy. Xiong'an New District is an innovative, coordinated, green ecological, open and co-constructed shared future urban model. Wuhan, following the glory of history, is becoming a reactivated city, and it must follow this development philosophy. -

Development of High-Speed Rail in the People's Republic of China

ADBI Working Paper Series DEVELOPMENT OF HIGH-SPEED RAIL IN THE PEOPLE’S REPUBLIC OF CHINA Pan Haixiao and Gao Ya No. 959 May 2019 Asian Development Bank Institute Pan Haixiao is a professor at the Department of Urban Planning of Tongji University. Gao Ya is a PhD candidate at the Department of Urban Planning of Tongji University. The views expressed in this paper are the views of the author and do not necessarily reflect the views or policies of ADBI, ADB, its Board of Directors, or the governments they represent. ADBI does not guarantee the accuracy of the data included in this paper and accepts no responsibility for any consequences of their use. Terminology used may not necessarily be consistent with ADB official terms. Working papers are subject to formal revision and correction before they are finalized and considered published. The Working Paper series is a continuation of the formerly named Discussion Paper series; the numbering of the papers continued without interruption or change. ADBI’s working papers reflect initial ideas on a topic and are posted online for discussion. Some working papers may develop into other forms of publication. Suggested citation: Haixiao, P. and G. Ya. 2019. Development of High-Speed Rail in the People’s Republic of China. ADBI Working Paper 959. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/development-high-speed-rail-prc Please contact the authors for information about this paper. Email: [email protected] Asian Development Bank Institute Kasumigaseki Building, 8th Floor 3-2-5 Kasumigaseki, Chiyoda-ku Tokyo 100-6008, Japan Tel: +81-3-3593-5500 Fax: +81-3-3593-5571 URL: www.adbi.org E-mail: [email protected] © 2019 Asian Development Bank Institute ADBI Working Paper 959 Haixiao and Ya Abstract High-speed rail (HSR) construction is continuing at a rapid pace in the People’s Republic of China (PRC) to improve rail’s competitiveness in the passenger market and facilitate inter-city accessibility.