ASX Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FEATURE the Use of Prefabrication and Modular Building Techniques In

FEATURE The images in this story are from AE Smith’s installation of a prefabricated module into the Lady Cilento Children’s Hospital (LCCH). Image: AE Smith. to implement, think again. As our three proponents of prefabricated and modular building techniques explain, the devil Fabricating is in the detail. We spoke to AE Smith national BIM operations manager Mark Jacobson, M.AIRAH, Warwick Stannus, M.AIRAH, group engineering manager for A.G. the future Coombs; and Nick Stavroulakis, M.AIRAH, mechanical project engineer, The use of prefabrication and modular building techniques associate for Wood & Grieve Engineers. in the HVAC industry is growing, and for good reason. As well Ecolibrium: Is the use of as leading to more accurate assembly, the process typically prefabrication in Australia reduces costs and risk. Sean McGowan spoke to some leading becoming more common, and why? proponents about the planning behind this evolving process. WS: The use of prefabrication in Australia is continuing to grow; however, we still have some way to go to catch up Though slower to adopt prefabricated projects – from commercial office to the levels of adoption seen in North building techniques than our buildings and residential accommodation America and the UK. Notwithstanding international counterparts in North to data centres and healthcare facilities. the relatively slow take-up to date, offsite America, Europe and Asia, the Australian For instance, projects such as the fabrication is starting to play a major construction industry is now making Queensland Children’s Hospital role in the delivery of healthcare projects rapid ground. energy plant (as featured in Ecolibrium, around the country. -

Only Connect’ - Social, Economic and Environmental Benefits

REFERENCES ESSAY: ‘Only Connect’ - Social, Economic and Environmental Benefits Kate Clark ABS (Australian Bureau of Statistics), 2002. Australian Social Trends 2002: Housing and lifestyle, home renovation, Cat. No. 4102.0. Downloaded 20th August 2011 from: http://www.abs.gov.au/AUSSTATS/[email protected]/0/062C1F689E72A59CCA2570EC000B922D?opendocument ABS (Australian Bureau of Statistics), 2003. Construction and the Environment. Feature article Year Book Australia 2003. Downloaded 20th August 2011 from: http://www.abs.gov.au/ausstats/[email protected]/Previousproducts/1301.0Feature%20Article282003?opendocument &tabname=Summary&prodno=1301.0&issue=2003&num=&view= ABS (Australian Bureau of Statistics), 2004. Information Paper: Measuring Social Capital — An Australian Framework and Indicators, Cat. No. 1378.0, Canberra, p. 14. ABS (Australian Bureau of Statistics), 2006. Voluntary Work, Australia, Cat. No. 4441.0. Downloaded 20th August 2011 from: http://www.abs.gov.au/ausstats/[email protected]/mf/4441.0 ABS (Australian Bureau of Statistics), 2009. Museums – Australia 2007-2008. Cat.No.8560.0 ABS (Australian Bureau of Statistics), 2010. 'Museums', Arts and Culture in Australia: A Statistical Overview. ABS 4172.0 Downloaded 20th August 2011 from: http://www.abs.gov.au/ausstats/[email protected]/Latestproducts/A1F92A2C5B46EAAECA2577C00013B79A?opendocu ment AE Smith, 2011. '5 Star NABERS Rating for Sydney – Proving You Can Teach an Old Building New Tricks', AE Smith. Downloaded from: http://www.aesmith.com.au/5StarNABERSRatingforSydneyProvingYouCanTeachanOldBuildingNewTricks Allen Consulting Group, 2005. Valuing the Priceless: The Value of Historic Heritage in Australia. Research Report 2 for the Heritage Chairs and Officials of Australia and New Zealand. Anwar McHenry, J., 2009. ‘A place for the arts in rural revitalisation and the social wellbeing of Australian Rural communities’. -

Capability Snapshot

AE Smith Construction Single Source Solution Wherever some form of fluid or gas needs to be Being partner of first choice means transported by duct or pipework within a facility, recognising you’re in the business of AE Smith’s engineering skill, technical business, not air conditioning or mechanical experience and practical know-how is required. services. AE Smith has the size, scope and AE Smith is your partner of first choice for the experience to keep you focused on what’s The stakes for choosing the right design, construction and installation of all types important to your business while we take AE Smith is a BRW Top 500 Private Company delivering of air conditioning and mechanical services. care of the rest. Examples include: partner for your air conditioning, commercial and industrial solutions around Australia and New Zealand for: > Essential Safety Measures mechanical services, environmental AE Smith Service > Fire Protection Maintenance > Cooling Tower and Water Treatment controls and energy services couldn’t Air Conditioning & Mechanical Services Reduce your facility’s owning and operating > Refrigerant Management be higher. Environmental Controls & Building Technologies costs by improving environmental conditions. > Electrical Services AE Smith is your partner of first choice for the > Sub-contractor & Supplier Management Sustainability & Energy Services total protection of your facility’s air conditioning Worldwide, 30-40% of all primary and mechanical services. This includes: Established in 1898, today AE Smith is the largest -

CIBSE at 30 Australia & New Zealand

The Australia and New Zealand Region of the Chartered Institution of Building Services Engineers was established in 1987, reaching its 30 th Anniversary in 2017. The CIBSE Heritage Group has produced this electronic story recording the early history of building engineering services in Australia and New Zealand and its development in the 30 years of the CIBSE Region. Front Cover: Deutsche Bank, Sydney, 2005 (Haden) Back Cover: Acrylic Model of the Sydney Opera House, 1973 C IBSE AUSTRALIA AND NEW ZEALAND I n 1987, there were some 200 members of CIBSE working in Australia, which led to the proposal to create an Australian CIBSE Region. It was believed that the Institution’s Charter would be better served if the Region ha d a seat on Council, enhancing the recognition and professional standing of Building Services Engineers in Australia. The first Committee of the Australian CIBSE Region was created in Sydney in May 1987 when John Tyerman was elected Chairman. State Chapt ers were created: New South Wales and Australia Capital Territory (ACT); Queensland; South Australia and Northern Territory (NT); Victoria; and Western Australia. The aims of the Committee included providing an active programme of technical meetings and se minars within the Chapters and encouraging networking among members. In 1989, the 2 nd CIBSE Australian Conference Building for the 21 st Century was held in Sydney, and in 1991, CIBSE CEng was recognised as qualifying for membership of the Institute of Eng ineering Australia as Chartered Professional Engineer (CPEng). In 1992, New Zealand was inaugurated as the 6 th Chapter of the Australian CIBSE Region. -

Final Minutes

FINAL MINUTES 5 November 2014 FINAL MINUTES WEDNESDAY 5 NOVEMBER 2014 Table of Contents Folio Date Particulars 35215 05.11.2014 Ordinary Meeting Minutes 35258 08.09.2014 - 05.10.2014 Community and Client Services Monthly Review for the Period 8 September to 5 October 2014 35296 31.10.2014 Economic Development Monthly Review - October 2014 35304 14.10.2014 Minutes - Fields of Dreams Advisory Committee 35306 07.10.2014 Minutes - Natural Environment Advisory Committee 35308 13.10.2014 Minutes - Sustainable Futures Advisory Committee Declaration of Perceived Conflict of Interest Item 9.5 - Cr Casey MIN/05.11.2011 FOLIO 35214 FINAL MINUTES WEDNESDAY 5 NOVEMBER 2014 ORDINARY MEETING MINUTES 1. ATTENDANCE: Her Worship the Mayor, Cr D T Comerford (Chairperson), Crs K J Casey, C J Bonanno, L G Bonaventura, F A Gilbert, A N Jones, G J Martin, T A Morgan, D J Perkins, P F Steindl, and R D Walker were in attendance at the commencement of the meeting. Also present was Mr B Omundson (Chief Executive Officer) and Mrs M Iliffe (Minute Secretary). The meeting commenced at 10.04 am. 2. OPENING PRAYER: Pastor Reno Klashorst led those present in Prayer. 3. ABSENT ON COUNCIL BUSINESS: Nil 4. APOLOGIES: Nil 5. CONDOLENCES: Council expressed their condolences on the passing of Mrs Sue Whitehead to her husband John and their family. Sue was an active member of the Road Accident Awareness Group (RAAG) and worked tireless to improve the conditions for her community. MIN/05.11.2011 FOLIO 35215 FINAL MINUTES WEDNESDAY 5 NOVEMBER 2014 6. CONFIRMATION OF MINUTES: 6.1 ORDINARY MEETING MINUTES - 22 OCTOBER 2014 THAT the Ordinary Meeting Minutes held on 22 October 2014 be confirmed. -

Uni-Span Put Safety and Productivity on the Leading Edge

UNI-SPAN PUT SAFETY AND PRODUCTIVITY ON THE LEADING EDGE Andy Barker – OneForm, Project Foreman. uilding a leading edge hospital on a site the size of around 28 football fields, with a peak workforce estimated at 2,300 workers means Bovis Lend Lease need superior safety solutions. The new $1.55 billion, 750-bed system’s ability to turn thru’ 90 degrees as well as incorporate plywood tertiary Gold Coast University Hospital (GCUH), which commenced infill’s and rips sets it apart from its competitors.” construction this year and is due for completion late 2012 is such a massive development, it will be serviced by its own entirely separate Central Energy Uni-span Formwork Solutions also provided the formwork design for the Plant (CEP). slabs at the CEP. Using their in-house engineering application software, Grafsystem, they provided designs, material lists and load calculations for Being independent from the vicissitudes of main grid energy supplies is various elements of the project. a crucial element of the GCUH achieving best practice, and matching aspirations of excellence in patient care with excellence in design and “The engineering back up, on the products in particular, provided our construction. The CEP facility will client with the necessary comfort they needed to accept the formwork CLEANING UP THE UNI deliver all the energy requirements solution being offered; and the support to the site has been very good,” olution Cleaning Services knows that attention to detail is one of As well as providing high quality service, Solution Cleaning for the GCUH and house all the said Daren King, engineer for Oneform. -

We Believe There Is a Better Way

We believe there is a better way... Technical and Engineering Services mechanical services building construction onsite power and energy efficiency building services www.aesmith.com.au About us Our customers AE Smith deliver technical and engineering service solutions We deliver comprehensive solutions all over Australia all over Australia. to a client list that includes educational institutions, buildings, stadia, mining companies, shopping centres, hydraulics, plumbing, refrigeration, construction, maintenance, entertainment venues, senior living facilities and more. building controls and electronic security. We provide clients a single point of contact and offer tailored, Our locations Our people Our award winning team of over 750 employees is comprised of specialist engineers and technicians, who are managers, estimators, draftspeople, site personnel and service specialists. Safety culture Fundamental to the success of AE Smith is the promotion of a safe, healthy and secure workplace for our employees Our belief We believe there is a better way… A better way, created by a passionate team dedicated to delivering you a valued solution every time. We care about people’s welfare, believe in the power of relationships and do what we say we are going to do. AE Smith delivers insightful solutions in technical and engineering services across Australia including mechanical, Our values Safety We work safely all the time Integrity We act ethically and professionally Teamwork We always help and collaborate with one another Relationships We look for and foster good working relationships Communication We communicate openly and honestly Initiative We encourage and nurture new ideas Recognition We acknowledge outstanding performance and celebrate success Our service solution AE Smith can offer end-to-end services for every client. -

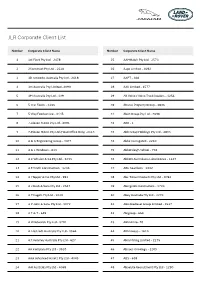

JLR Corporate Client List

JLR Corporate Client List Number Corporate Client Name Number Corporate Client Name 1 1st Fleet Pty Ltd - 2478 25 AAMHatch Pty Ltd - 2573 2 2Construct Pty Ltd - 2620 26 Aapc Limited - 4092 3 3D networks Australia Pty Ltd - 2618 27 AAPT - 468 4 3m Australia Pty Limited -4090 28 AAV Limited - 1577 5 3M Australia Pty Ltd - 139 29 AB Volvo / Volvo Truck Dealers - 1256 6 5 Star Foods - 3166 30 Abacus Property Group - 3036 7 5 Way Foodservice - 3145 31 Abah Group Pty Ltd - 2698 8 7-eleven Stores Pty Ltd - 4091 32 ABB - 1 9 7-Eleven Stores Pty Ltd (Head Office Only) -2113 33 Abb Group Holdings Pty Ltd - 4093 10 A & G Engineering Group - 3473 34 Abbe Corrugated - 2210 11 A & L Windows - 613 35 Abbotsleigh School - 702 12 A C Whalan & Co Pty Ltd - 3233 36 Abbott Australasia Laboratories - 1247 13 A E Smith Construction - 1236 37 ABC Seamless - 1002 14 A I Topper & Co. Pty Ltd - 991 38 Abc Tissue Products Pty Ltd - 4094 15 A J Bush & Sons Pty Ltd - 2647 39 Abergeldie Contractors - 1724 16 A P Eagers Pty Ltd - 3020 40 Abey Australia Pty Ltd - 3270 17 A P John & Sons Pty Ltd - 1072 41 ABG Biodiesel Group Limited - 1537 18 A T & T - 649 42 Abigroup - 650 19 A W Edwards Pty Ltd - 3701 43 ABN Amro -70 20 A. Hartrodt Australia Pty Ltd - 3564 44 ABN Group - 1610 21 A.T. Kearney Australia Pty Ltd - 627 45 Abra Mining Limited - 2275 22 AA Company Pty Ltd - 3510 46 Abraxis Oncology - 2209 23 AAA Advanced Assets Pty Ltd - 4045 47 ABS - 638 24 AAI Australia Pty Ltd - 4068 48 Absolute Recruitment Pty Ltd - 1290 JLR Corporate Client List Number Corporate Client -

Downer in Queensland Downer in Queensland

Downer in Queensland Downer in Queensland Downer employs more than 53,000 people 53,000 across more than 300 sites 300 primarily in Australia and New Zealand but also in the Asia-Pacific region, South America and Africa. Through the Keolis Downer joint venture, we have operated the Gold Coast light rail since its launch in 2014. 2 About us At Downer, our customers are at the heart of everything we do. Our Purpose is to create and sustain the modern environment by building trusted relationships with our customers. Our Promise is to work closely with our customers to help them succeed, using world leading insights and solutions. Downer designs, builds and sustains assets, infrastructure and facilities and we are the leading provider of integrated services in Australia and New Zealand. With a history dating back over 150 years, Downer is listed on the Australian Securities Exchange and New Zealand Stock Exchange as Downer EDI Limited (DOW). We are an ASX 100 company that also owns 88 per cent of Spotless Group Holdings Limited (SPO). Our expertise We aim to employ the best people and bring thought leadership to each stage of the asset We support our customers through the full life lifecycle as we support our customers to plan, of their assets – from initial feasibility and design create and sustain. through to production and operations and eventual decommissioning. We build strong relationships of trust with our customers, truly understanding and predicting their needs and bringing them world leading insights and solutions. Our business is -

Australian Gun Club

. - 'I SMITH'S . ;;i '>i ? SPORTS STORE , i8.. .!G@ Mick Smith (Prop.) 773 George Street, Sydney ~ CLAY - Phones: MA 7693 BA 2192 I - 1 Mail Order Specialists International Trapshooting Rep. Australia's Largest Range of Spare Parts 1 303-25 Hi Power Lee Enfield ........... 525 0 0 303-25 Hi Power Lee Enfield De Luxe ....... €27 10 0 303-210 Hi Power Lee Enfield De Luxe ........... £32 10 0 303-25 M17 Action ...................... £26 0 0 303-25 MI7 De Luae ....................... $33 10 0 .222 Sako ...... "... -.... .................. €53 10 0 ,222 B.S.4. ................................ C51 10 0 .22 ~irnetBRNO ............ .-... .... E4B 0 0 .22 BRNO LU- ........... .-... ...... e3i 10 o 250-3000 F.N. Mauser ............... ....- £61 10 0 270 F.N. Mauser ........................... .S67 10 0. Breda 12 gauge, Ventilated Rib ................ €72 10 0 Breda 12 gauge, Ventilated Rib, Magnum ...... €88 0 0 Browning Automatic, Lightweight, Reeessed Rib 667 10 0 Browning Automatic, Ventilated Rib ............ £68 0 0 magnum Cartridges, 3" ................ .+... El 13 4 per Alphamm 3" Cartridges ................. £1 18 4 per Wholesale and Retail - I.C.I. Cartridge Dlstrlbutor. Look! Pree-180 page Catalogue now available ........ HARRIS-WILLIAMG PREBS PTY. LTD.. I3-ls CWLIWIND STREET. MELBOUWSE WELT OFFICIAL JOURNAL OF THE AUSTRALIAN , CLAY PIGEON TRAP SHOOTING ASSOCIATION AUSTRALIAN CLAY PIGEON SHOOTING NEWS AUSTRALIAN CLAY PIGEON SHOOTING NEWS Atrstralian Clay Pigeon Trup Shooting Associalior~ Patrons: His Excellency Lient.-General Sir John Lavarack, K.B.E., C.M.G., D.S.O., Governor of Queensland; Sir W. Lennon Raws, C.B.E.; Lieut.- Ammo Andy says General Sir W. Bridgeford, K.B.E., C.B., C.B.E., M.C.; Essington Lewis, C.H.; .. -

Company Profile Who Are We?

Company Profile Who are we? Fans Direct is a wholly Australian owned company whose history stretches back over 20 years in the HVAC industry. Our ancestry includes proud names such as Ziehl-ebm fans and motors along with NuAire UK. Our goal is to deliver unparalleled service, product innovation, competitive pricing, and quality products that meet the needs of our customers. Personalised, face to face service delivered by an experienced team and listening to our customers are foundations of a company philosophy that has seen the business grow into a world class enterprise. What do we do? From our modern office and factory complex located in Melbourne or from any of our 14 sales outlets around Australia and New Zealand, we service the ventilation equipment needs of customers in industries ranging from HVAC through to mining, manufacturing and materials processing. In virtually any situation where air or other gases need to be moved, we have a fan and the expertise to get the job done to specification, without fuss and to budget. Why should you use us? Clients have told us that what they want are “fans that meet specification delivered on time at the quoted price”, followed by “easy access to people who know what they’re talking about and can solve problems quickly”. At Fans Direct we have put more resources into ‘on the road’ staff than most companies in our industry which means a known and trusted face is never far away to solve even the most complicated problem. Fans Direct has always been proud of its reputation for the quality and accuracy of its test information and product data. -

16 August 2018 Company Announcements Office ASX Limited Exchange Centre Level 4, 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam

Downer EDI Limited ABN 97 003 872 848 Triniti Business Campus 39 Delhi Road North Ryde NSW 2113 1800 DOWNER www.downergroup.com 16 August 2018 Company Announcements Office ASX Limited Exchange Centre Level 4, 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam Please find attached the following documents: 1. Appendix 4E – results for announcement to the market for the year ended 30 June 2018; 2. 2018 Annual Report; 3. Market release dated 16 August 2018; 4. Investor Presentation; and 5. Appendix 4G – Key to Disclosures Corporate Governance Principles and Recommendations. Yours sincerely, Downer EDI Limited Peter Tompkins Company Secretary Page 1 of 1 Results for announcement to the market for the year ended 30 June 2018 Appendix 4E 2018 2017 % $'m $'m change Revenue from ordinary activities 12,016.6 7,267.1 Other income 14.3 20.3 Total revenue and other income from ordinary activities 12,030.9 7,287.4 65.1% Total revenue including joint ventures and other income 12,620.2 7,812.3 61.5% Earnings before interest and tax 204.8 277.8 (26.3%) Earnings before interest and tax and amortisation of acquired intangible assets (EBITA) 271.5 285.2 (4.8%) Profit from ordinary activities after tax attributable to members of the parent entity 71.4 181.5 (60.7%) Profit from ordinary activities after tax before amortisation of acquired intangible assets (NPATA) 117.9 186.6 (36.8%) 2018 2017 % cents cents change Basic earnings per share 10.7 35.8 (70.1%) Diluted earnings per share(i) 10.7 35.0 (69.4%) Net tangible asset backing per ordinary share(ii) 26.0 93.4 (72.2%) (i) At 30 June 2018, the ROADS are deemed anti-dilutive and consequently, diluted EPS remained at 10.7 cents per share.